What is the Feed Premixes Market Size?

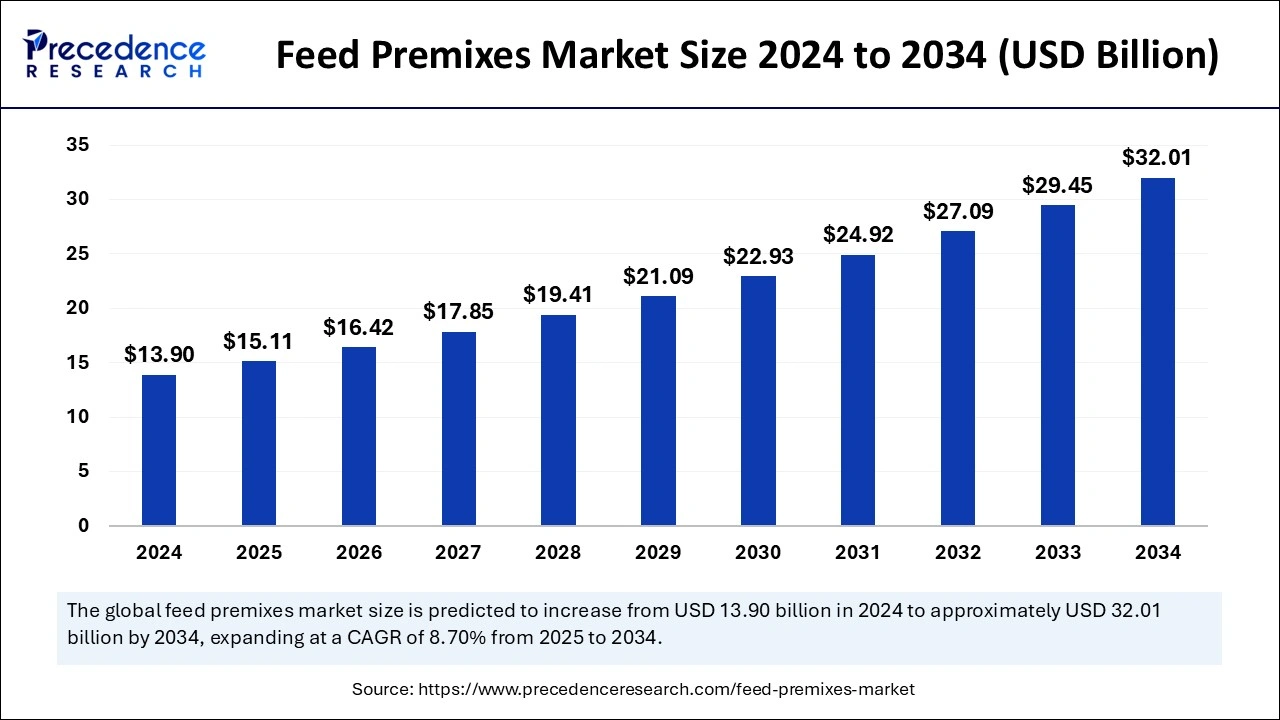

The global feed premixes market size is accounted at USD 15.11 billion in 2025 and predicted to increase from USD 16.42 billion in 2026 to approximately USD 32.01 billion by 2034, expanding at a CAGR of 8.70% from 2025 to 2034.

Feed Premixes Market Key Takeaways

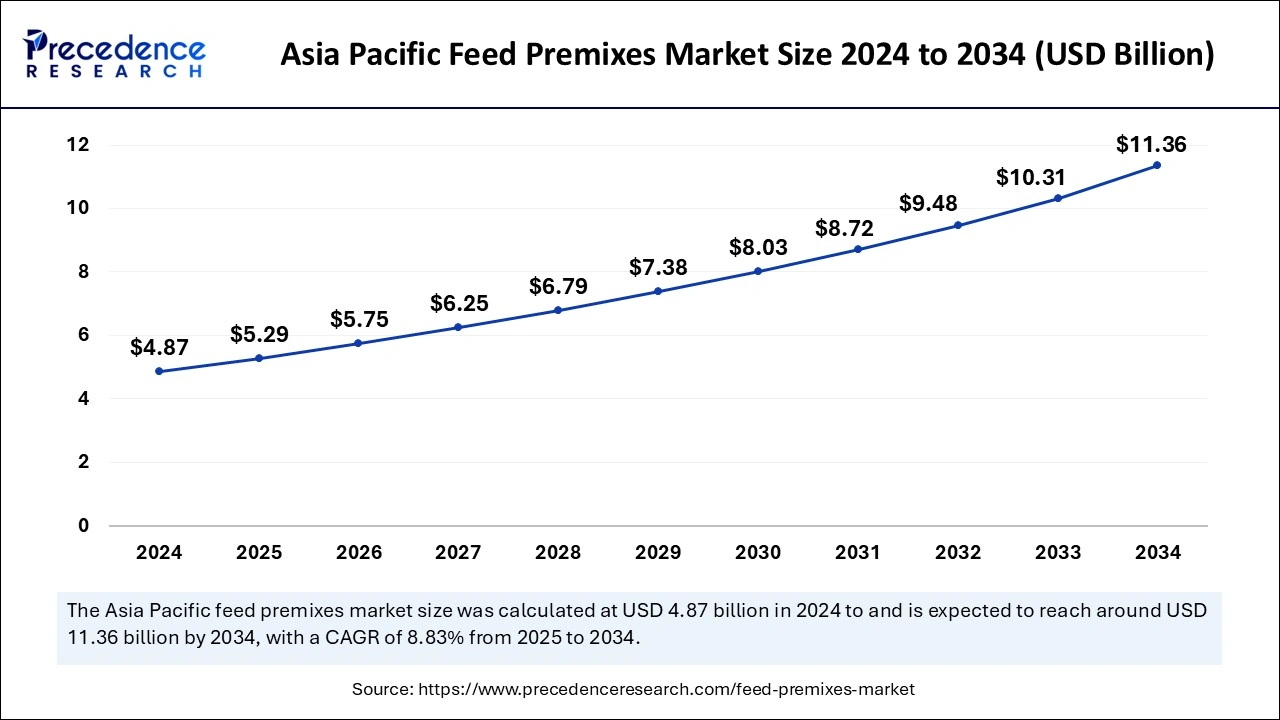

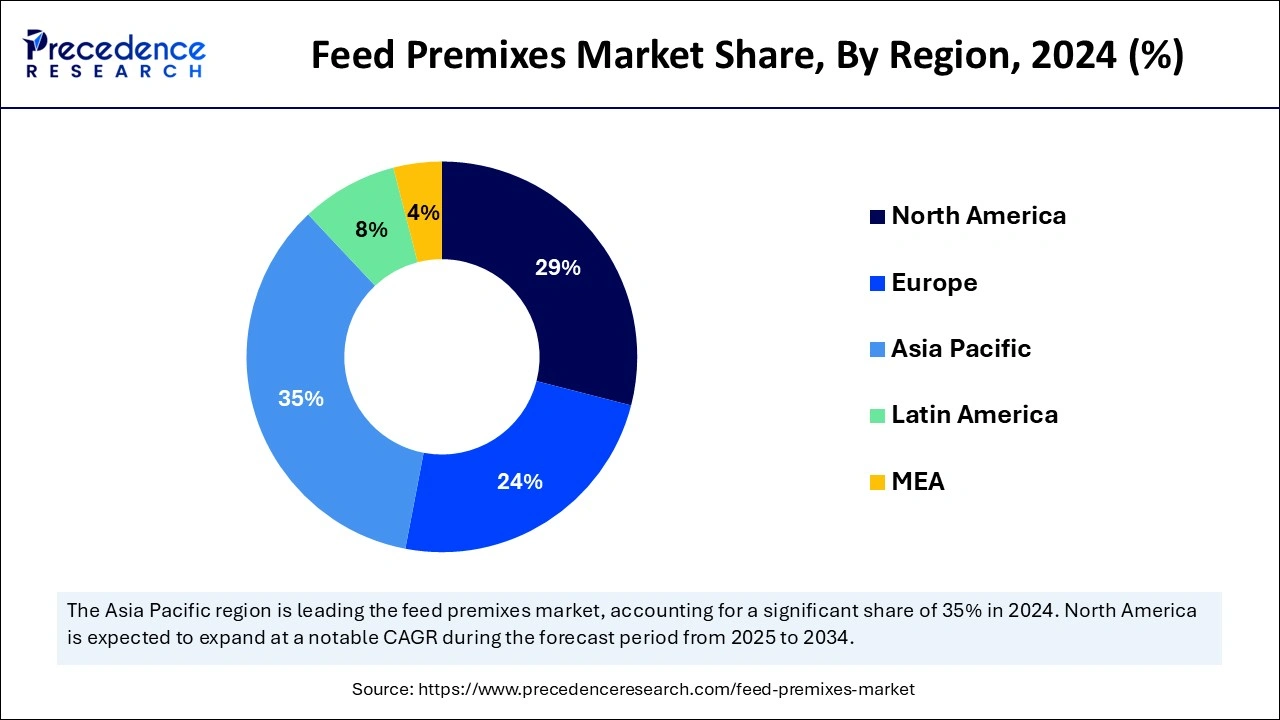

- Asia Pacific dominated the global feed premixes market with the largest market share of 35% in 2024.

- North America is expected to grow at the fastest rate in the market over the studied period.

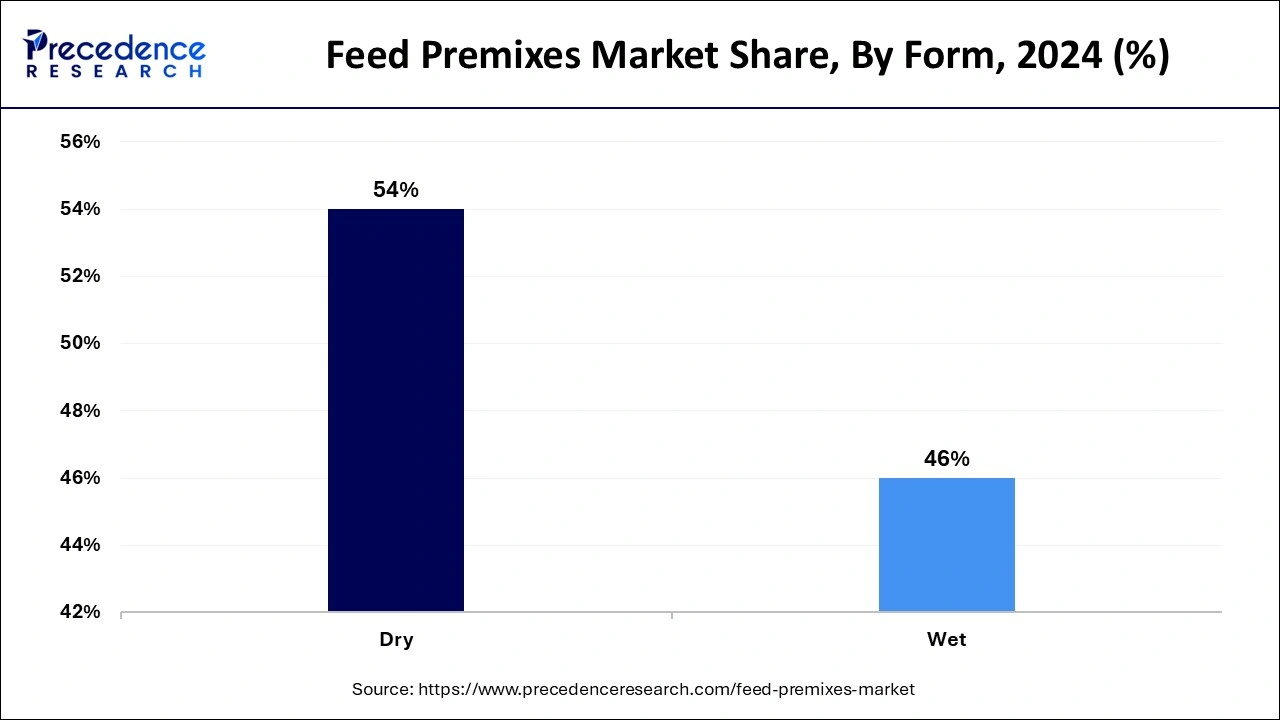

- By form, the dry segment has held a major market share of 54% in 2024.

- By form, the wet form segment is anticipated to grow at the fastest rate over the forecast period.

- By product, the amino acids segment accounted for the maximum market share of 44% in 2024.

- By product, the antioxidants segment is estimated to grow at the fastest rate over the forecast period.

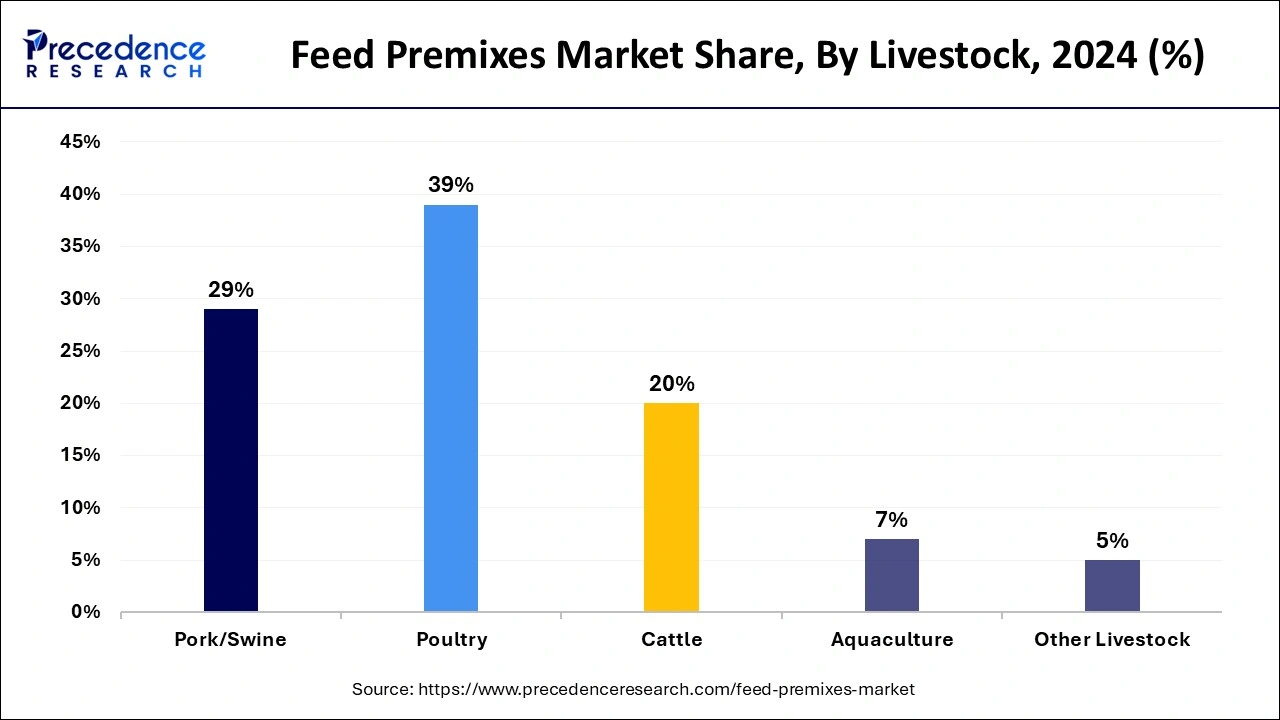

- By livestock, the poultry segment contributed the biggest market share of 39% in 2024.

- By livestock, the swine/pork segment is expected to grow at the fastest rate during the projected period.

Impact of Artificial Intelligence (AI) on the Feed Premixes Market

Artificial intelligence is substantially revolutionizing the feed premixes market by improving the precision and efficiency in feed formulation and production systems to facilitate the analysis of huge data sets to stimulate nutrient profiles, decrease waste, and enhance overall feed quality. Furthermore, AI-powered predictive analytics helps predict demands more precisely, helping manufacturers manage inventory.

- In November 2024, Zydus Wellness announced the launch of Nutralite Chef, an AI-powered food technology platform that provides personalized recipe suggestions and meal planning through WhatsApp and web interfaces. The platform aims to address meal planning challenges faced by urban consumers. The service integrates several AI technologies, including GPT-4xo and RAG.

Market Overview

Feed premixes are important elements of animal nutrition, offering a combination of micronutrients, decreasing the need to incorporate multiple ingredients, and simplifying feed formulation. These mixes optimize productivity, livestock health, and reproductive performance. Feed premixes are a blend of necessary micronutrients such as trace elements, vitamins, minerals, and other additives. The feed premixes market helps fulfill the specific nutritional demands of various animal species and production steps.

Feed Premixes Market Growth Factors

- Increasing demand for premixes from developing nations in the Asia Pacific and South America is expected to boost feed premixes market growth further.

- Strict regulations on food safety and quality can propel market growth soon.

- The increasing prevalence of pet food manufacturers, such as Diamond Pet Foods, will likely contribute to the market expansion over the forecast period.

Market key trends

The feed premix market is experiencing steady and sustainable growth, fuelled by the rising demand for enhanced animal nutrition and improved livestock productivity. One of the most prominent trends is the increasing shift toward customised and species-specific formulations, enabling precise delivery of nutrients tailored to poultry, ruminants, swine, and aquaculture. This trend is driven by growing awareness among livestock producers about the importance of balanced diets, leading to higher adoption of vitamin, mineral, amino acid, and enzyme premixes.

Additionally, natural and organic feed premixes are gaining popularity as producers respond to consumer demands for chemical-free meat, milk, and eggs. With rising concerns over antibiotic resistance and stringent global regulations, the industry is witnessing a movement towards antibiotic-free growth promoters and functional feed additives like probiotics, prebiotics, and essential oils. Technological innovation is also playing a pivotal role, as manufacturers are using microencapsulation and controlled-release technologies to improve bioavailability and stability of active ingredients.

Market Outlook

- Industry Growth Overview: The increasing prevalence of pet food manufacturers, such as Diamond Pet Foods, will likely contribute to the market expansion over the forecast period.

- Global Expansion: Asia Pacific is the largest and fastest-growing region, driven by its large livestock population, while North America is also a major market due to its advanced production systems and strong adoption of precision nutrition.

- Major investors: Some major companies and investors in the industry include Cargill, Archer Daniels Midland (ADM), Koninklijke DSM-Firmenich, Nutreco, BASF SE, and Alltech Inc., among others.

- Startup Ecosystem: Startups are focusing on niche opportunities, leveraging innovation to compete with established global players.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 32.01 Billion |

| Market Size in 2025 | USD 15.11 Billion |

| Market Size in 2026 | USD 16.42 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.70% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Product, Livestock, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Rapid growth in emerging markets

Ongoing and rapid economic growth at the country level optimizes the use of feed premixes in many markets. Emerging economies, especially in Asia Pacific, are witnessing smooth economic expansion, which leads to heavy investment in livestock farming. In addition, countries in this region are focusing on increasing animal production to meet the demand of the country and export markets. This surge further drives the demand for the feed premixes market.

- In May 2023, Aller Aqua launched a shrimp RAS feed line. Aller Aqua and VDS, a premix specialist, have launched a range of feed products that are specifically designed for use in shrimp RAS farms. These land-based systems are becoming increasingly popular in Europe, as they allow the production of high-quality, fresh shrimp products with short distances to market and, according to Aller Aqua.

Restraint

Animal disease outbreak

Outbreaks of animal disorders like African swine fever or avian influenza can substantially influence the livestock sector, decreasing the demand for the feed premixes market. However, this outbreak can disturb the supply chains, causing a shortage of essential raw materials and impacting feed premix production. Also, the cost of raw materials like minerals, vitamins, and amino acids can change rapidly due to climate change and geopolitical events.

Opportunity

Increasing adoption of animal-derived protein

The ongoing growth of the livestock industry to fulfill the increasing demand for animal-derived protein is impacting the feed premixes market positively. Also, the surge in the global population will requireprotein-rich food sources, which results in additional demand for feed premix. Furthermore, the increasing acceptance and requirement for protein foods across the globe are also creating market opportunities in the future.

- In February 2024, South Korea-based EASY BIO acquired a 100% stake in Devenish Nutrition LLC, a U.S. corporation specializing in feed additives, in a move to strengthen its feed additive and premix business in North America. Specifically, the former's U.S. subsidiary, EASY BIO USA, took over Devenish Nutrition from its parent company, Devenish Holdings Ltd., located in Northern Island.

Form Insights

The dry segment dominated the feed premixes market in 2024. The dominance of the segment can be attributed to factors like easy handling, convenience in storing, and manufacturing costs, which in turn result in a wide range of applications in the livestock industry. Additionally, the dry form is convenient to mix with animal food and offers longer self-life than the liquid form. Therefore, dry form is gaining traction and acceptability among market players.

The wet form segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the benefits of wet form for livestock applications. The main advantage of this form is equal distribution of nutrients in the feed, enabling improved homogeneity. Also, the wet form optimizes the accurate dosages for animals, thereby giving the owners liberty over the nutrient quality of their livestock.

Product Insights

The amino acids segment led the global feed premixes market in 2024. The dominance of the segment can be linked to the growing focus on stimulating animal diets to accomplish maximum nutritional value and growth efficiency. In addition, amino acids are the vital building blocks of proteins and play an important part in many physiological and growth mechanisms in animals. As a result, the requirement for amino acid feed premixes is increasing.

The antioxidants segment is estimated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by increasing the use of antioxidants such as vitamin C, selenium, vitamin E, and others in premix feeds, as they enhance animal health by neutralizing free radicals in their body. Moreover, the antioxidants also safeguard other vital components in the premixes from the oxidation process.

- In June 2024, Aquafeed company Skretting announced the launch of a new feed formulation concept, which aims to increase the precision and efficacy of its feeds whilst reducing unnecessary excess. By evaluating the total amino acid level that is effectively ingested by the fish and removing the unnecessary excess, the nutritional needs of fish can be met with increased precision and efficiency.

Livestock Insights

In 2024, the poultry segment dominated the feed premixes market by holding the largest share. The dominance of the segment is due to the surging global consumer demand for eggs and poultry meat, along with the need for cost-effective and efficient production. Furthermore, the rapid surge in poultry meat demand in emerging economies has impacted segment growth positively.

The swine/pork segment is expected to grow at the fastest rate during the projected period. The growth of the segment is because of rising industry emphasis on disease prevention among livestock coupled with the decrease in antibiotic use due to the incidence of fatal disorders among swine. These premixes also play a key role in enhancing the feed efficiency, carcass quality, and growth rates of swine.

Regional Insights

Asia Pacific Feed Premixes Market Size and Growth 2025 to 2034

Asia Pacific feed premixes market size is evaluated at USD 5.29 billion in 2025 and is projected to be worth around USD 11.36 billion by 2034, growing at a CAGR of 8.83% from 2025 to 2034.

Asia Pacific dominated the global feed premixes market in 2024. The dominance of the region can be attributed to the strong presence of an extensive livestock population in emerging economies like China, India, and Bangladesh. However, the region also boasts the presence of some top producers of animal food. Increasing disposable incomes and substantial economic growth in China make it the top consumer of premix feed in the region.

Asia-Pacific Strongholds of Livestock Diversity and Policy Backing

Asia-Pacific stands out as the dominant region in the global feed premix market, primarily due to its large and diverse livestock population, growing per capita meat consumption, and an increasing focus on improving farm productivity. Countries like China, India, Vietnam, Thailand, and Indonesia are leading contributors in this region. These nations have robust poultry, dairy, and aquaculture sectors, each of which relies heavily on nutritionally optimised feed.

Governments in this region have actively launched initiatives to boost animal health and food safety, recognising the critical role of feed in public health and food security. For example, India's National Livestock Mission promotes feed fortification and livestock management, while China's Five-Year Plan prioritises feed quality and sustainable animal farming. Vietnam and Thailand are focusing on agricultural modernisation, offering subsidies for feed improvement technologies, and encouraging public-private partnerships to scale production.

North America is expected to grow at the fastest rate in the feed premixes market over the studied period. The growth of the region can be credited to the huge number of pet owners and the high level of investment in animal nutrition. In North America, the U.S. led the market owing to advanced feed solutions and raised awareness of balanced animal diets. This region holds exponential growth ability in the near future.

- In September 2023, the U.S.-based agribusiness giant Cargill opened a new Provimi Premix plant in Giang ?i?n Industrial Park, ??ng Nai Province, Vietnam, to meet growing demand from livestock and aquaculture farmers.

North America: Pioneering Scientific Nutrition with Strategic Efficiency

In North America, the feed premix market is rapidly expanding, driven by a combination of technological leadership, intensive livestock farming, and stringent quality regulations. The region is known for its well-established animal nutrition industry, particularly in countries like the United States and Canada, where farm operators adopt precision feeding systems and advanced nutrient modelling.

Major contributing factors to the market's growth in North America include a strong focus on animal welfare, sustainable farming practices, and the demand for premium-quality animal-derived food products. The U.S. Department of Agriculture (USDA) and Canadian Food Inspection Agency (CFIA) both enforce strict feed safety standards, prompting manufacturers to prioritise high-purity ingredients and traceability in premix formulations.

China Feed Premixes Market Trends

In the Asia Pacific, China dominated the market owing to the increasing disposable incomes and substantial economic growth in China, making it the top consumer of premix feed in the region. China's Five-Year Plan prioritises feed quality and sustainable animal farming.

U.S. Feed Premixes Market Trends

In North America, the U.S. led the market. The U.S. Department of Agriculture (USDA) and Canadian Food Inspection Agency (CFIA) both enforce strict feed safety standards, prompting manufacturers to prioritise high-purity ingredients and traceability in premix formulations.

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be attributed to the increasing demand for high-quality animal-based protein along with the growing emphasis on animal health and productivity. Consumers in the region are also emphasizing the quality and safety of animal-derived products.

Germany Feed Premixes Market Trends

The growth of the market in Germany can be driven by growing focus on technological innovations, such as precision nutrition, coupled with the stringent regulatory standards supporting feed safety and animal welfare in the country.

Feed Premixes Market Value Chain Analysis

- Raw material sourcing

This stage involves sourcing an extensive range of ingredients, including vitamins (A, D, E, B), minerals, amino acids, and antioxidants. - Manufacturing and formulation

This stage includes micro-mixing of small-quantity ingredients, precise weighing, and macro-mixing with carriers to ensure a homogeneous product. - Distribution

Manufacturers can use distributors with established networks to supply products to retailers and feed mills. - End-user applications

The companies mix premixes with other ingredients like grains to create complete, balanced feed for various livestock.

Key Players' Offering

- Archer Daniels Midland (ADM): A full range of nutritional solutions, including amino acids, vitamins, minerals, and enzyme premixes, often marketed through its ADM Animal Nutrition division.

- Nutreco N.V.: Precision premixes and specialty feed products offered primarily under the Trouw Nutrition and Skretting (aquafeed) brands.

Feed Premixes Market Companies

- Cargill Inc.

- ADM

- DLG

- ForFramers

- Danish Agro

- BASF SE

- Land O'Lakes Inc.

- Godrej Agrovet Limited

- dsm-Firmenich

- InVivo Group

Latest Announcements by Market Leaders

- In September 2024, BASF SE's new leader announced a series of overhaul measures later this month, including plans for the future of its agricultural chemicals and coatings businesses, people with knowledge of the matter said.

- In July 2024, Godrej Agrovet's (GAVL) Oil Palm Plantation business (OPP) announced the inauguration of its first Samadhan Centre in Thanjavur, Tamil Nadu. A one-stop solution center that provides a comprehensive package of knowledge, inputs, tools, services, and solutions to oil palm farmers will be critical in enabling farmers to enhance their yields and improve their productivity.

Recent Updates on Feed Premix-2025

Precision nutrition redefines livestock feeding strategies

On 14 March 2025, the global market for feed premixes is changing quickly as precision nutrition becomes more popular in various animal farming industries. To maximize animal health, feed efficiency, and production results, farmers and producers are increasingly using species-specific lifecycle targeted premixes. In aquaculture and poultry, where customized nutrient delivery increases growth rates and reduces waste, the trend is particularly strong.

Sustainable formulations and traceability in focus

On 6 April 2025, as worries about antibiotic resistance and its effects on the environment grow, feed producers are repurposing premixes to add natural ingredients like probiotics, enzymes, and essential oils instead of antibiotic growth promoters. Digital tools for quality control and traceability are becoming commonplace, especially in areas like North America and the EU with stringent food safety laws.

Recent Developments

-

On 21 February 2025, DSM-Firmenich announced the U.S. launch of a next-generation vitamin and trace mineral premix solution designed to enhance gut health and immunity in poultry. This follows successful trials and strategic collaboration with leading poultry integrators across North America.

-

On 28 March 2025, ADM Animal Nutrition introduced Smart Trace, a cloud-connected system that tracks premix ingredients, sourcing, blending, and delivery. This platform enhances transparency for feed manufacturers and livestock producers, improving compliance with food chain traceability standards.

-

In March 2025, Nutreco partnered with a major Latin American distributor to expand the availability of its functional feed premixes, including products targeting heat stress and feed conversion optimization in swine and cattle.

-

Also in March 2025, Cargill launched a digital tool integrated with its premix portfolio to deliver real-time nutrient recommendations based on local feed resources and animal performance data. This move is expected to strengthen their precision nutrition offerings and boost customer retention globally.

- In March 2024, De Heus opened a new shrimp feed mill in Co Chien Industrial Zone, Vinh Long province, Vietnam. The establishment of the De Heus Vinh Long Shrimp Feed Mill underscores De Heus' commitment to long-term, strategic investments in the production of highly effective shrimp feed facilitated by a dedicated, state-of-the-art manufacturing facility.

- In October 2023, Cargill Incorporated and its partner Naturisa S.A collaborated with Skyvest EC Holding SA to establish a joint venture aimed at enlarging shrimp feed production in Ecuador.

Segments Covered in the Report

By Form

- Dry

- Wet

By Product

- Vitamins

- Amino Acids

- Antibiotics

- Antioxidants

- Other Products

By Livestock

- Pork/Swine

- Poultry

- Cattle

- Aquaculture

- Other Livestock

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting