What is the Fermentation Chemicals Market Size?

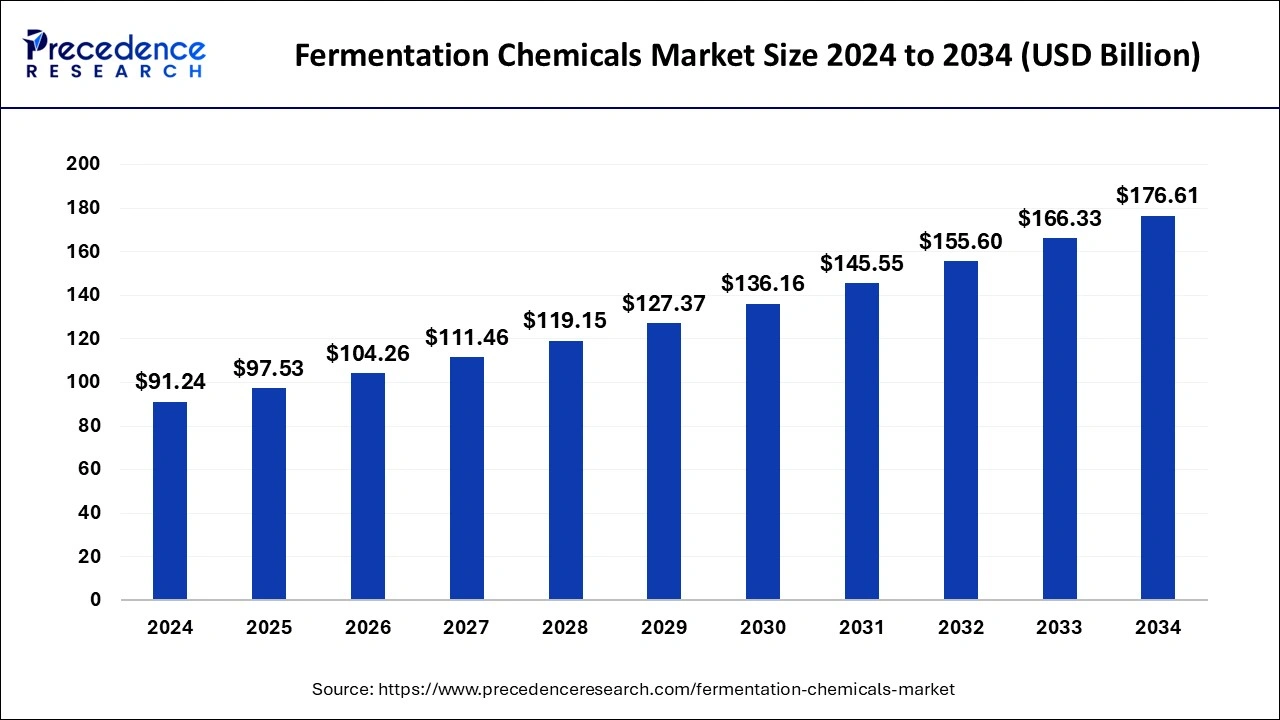

The global fermentation chemicals market size is valued at USD 97.53 billion in 2025 and is predicted to increase from USD 104.26 billion in 2026 to approximately USD 187.19 billion by 2035, expanding at a CAGR of 6.74% from 2026 to 2035.

Fermentation Chemicals Market Key Takeaways

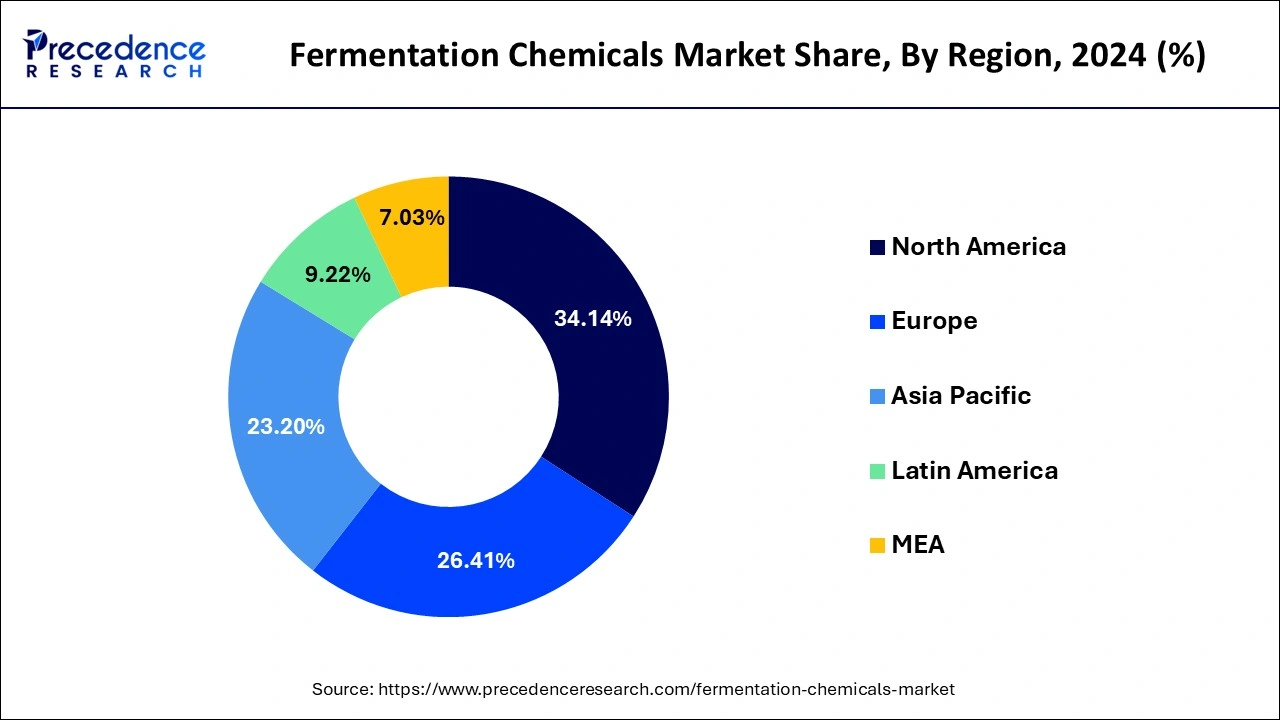

- North America led the global market with the highest market share of 34.14% in 2025.

- By product, the organic acid segment has held the largest market share in 2025.

- By application, the industrial segment captured the biggest revenue share of 42% in 2025.

Market Overview

Chemicals used in fermentation are essential for starting the chemical process. processing or acting as a catalyst It facilitates reaction speed in a reaction. As a result, it can reduce both the reaction's time and cost. The most crucial raw material in the ethanol sector is fermentation chemicals. Fermentations result in the manufacture of ethanol, a key component needed for the synthesis of alcohol and alcoholic beverages. As a result, the global market for fermentation chemicals is expanding due to the increase in demand for alcoholic drinks. Additionally, other sectors need fermentation chemicals to conduct their production processes, including the pharmaceutical, cosmetic, food, and beverage industries. Therefore, the fermentation chemicals industry is also driven by the expansion of these businesses across diverse geographic regions. Lactic acid cannot be used in the dairy business because of the high expense involved in the fermentation process. Additionally, the variability of the production process for ethanol, bacteria, and lactic acid also inhibits market expansion. Environmentally friendly fermentation chemicals would find use in industries like the conversion of biomass.

What is the Significance of AI in the Fermentation Chemicals Market?

The deployment of AI in the chemicals industry is an ongoing trend. In recent times, the fermentation chemicals brands have started integrating AI into their production centers to accelerate research & development, enhance product development, improve supply chain management, and optimize processes. Additionally, numerous AI platforms are designed to analyze demand forecasting and advance the quality check procedures in the chemicals sector. Thus, AI plays a significant role in positively shaping the fermentation chemicals market.

- In October 2025, Mstack launched Chemstack AI. Chemstack AI is an AI-based platform designed for improving the supply chains of chemicals.

(Source: https://agrospectrumindia.com)

Fermentation Chemicals Market Growth Factors

The main ingredients in fermentation chemicals are vegetable feedstocks like corn, sugar, and starch. Many end-use industries prefer these products in fermentation processes as a result of the lack of synthetic feedstock. To lessen reliance on petrochemicals, major businesses have moved their attention toward bio-based raw resources. The main factors influencing the transition toward bio-based chemicals are rising crude oil prices, the degradability of petrochemical-based goods and rising worries about carbon emissions. The multistep industrial fermentation process used to produce goods like bioplastics, biofuels, polymers, and composites is quite complex. In bioreactors or fermenters, the conversion is carried out using enzymes or microorganisms like yeast and algae that may have undergone genetic modification.

- The growing pharmaceutical industry.

- Flourishing food & beverage industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 104.26 Billion |

| Market Size in 2025 | USD 97.53 Billion |

| Market Size by 2035 | USD 187.19 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.74% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

- Increasing application in the meat production industry - Due to the expanding population and economies of developing countries, it is anticipated that the demand for meat will increase significantly on a global scale. Due to changing dietary preferences around the world, it is projected that meat consumption would rise in the future. Based on consumption, meat is divided into four groups: sheep, pork, poultry, beef, and veal. Pork and chicken make up the majority of the meat eaten in poor countries. Animal growing needs natural feedstock and amino acids. Amino acids increase the quantity and quality of meat. The demand for amino acids is expected to rise in the global meat market because they are one of the most important animal feed additives due to their nutritional value. With their help, animal muscle tissues can form. Since amino acids make it possible to utilize feedstock effectively, the market for fermentation chemicals is predicted to grow. Major players are focusing on increasing their ability to synthesize amino acids in order to meet the growing demand on a global scale.

- Growing pharmaceutical industry - It is projected that the pharmaceutical market in the U.S. will grow, particularly in the nation. Pharmaceutical companies are expected to carry out more research to produce novel medications by growing microorganisms. Strict regulations governing greenhouse gas (GHG) emissions from the chemical industry have been put in place by regulatory organizations including the U.S. Department of Energy and Environmental Protection Agency (EPA). Therefore, this led industry players to start focusing on using biological techniques for chemical synthesis.

Key Market Challenges

- Fluctuating costs of lactic acid fermentation - The cost of lactic acid fermentation restricts its use in the dairy industry. This aspect is projected to limit the market growth of fermentation chemicals throughout the forecast period.

Key Market Opportunities

- Rising cosmetic demand - A growing awareness among people about personal cleanliness and cosmetics has led to an enormous increase in demand for these products in recent years. Skin issues have increased as a result of environmental change, which has opened up a significant market opportunity for cosmetic applications. These fermented skin care products frequently contain fruits, herbs, and yeast, which have anti-inflammatory and other relaxing properties.

Product Insights

On the basis of product, the organic acid segment has held the largest market share in 2025. Acids having pKa values of 3 (carboxylic) or above are considered organic acids (phenolic). The industrial generation of organic acids is now possible because of developments in fermentation technology. Foods are frequently preserved by adding organic acids such as fumaric acid, tartaric acid, and lactic acid. A significant contributing cause to their usage as a preservative has been their ability to prevent bacterial development. Demand for organic acids in processed meat and foods is anticipated to increase as consumers become more aware of the value of products with longer shelf lives.

The use of enzymes in a variety of chemical and industrial processes is the main factor driving enzyme use. Detergents use enzymes as an active component. Enzymes are also used in the pre-treatment of biomass for the creation of biofuels. The demand for enzymes as a catalyst is anticipated to rise in response to growing concerns about the depletion of oil supplies and uncertain fuel prices.

Application Insights

On the basis of application, the industrial applications segment accounted largest market share in 2025. Fermentation chemicals are frequently employed in industrial settings. The adoption of green chemistry and several regulations for commercial and industrial purposes has led to higher penetration. Industrial fermentation is the process of producing goods like ethanol, citric acid, and acetic acid by using microorganisms like bacteria, fungi, and eukaryotic cells. It is generally accepted that food additives originating from various items, such as vitamins, preservatives, antioxidants, and colors, are superior to those obtained from chemicals.

Another application area where diverse fermentation chemicals are widely consumed is food and beverages. It is anticipated that the increasing population will have a direct impact on consumption. Dairy products including kefir, yogurt, sour cream, and cheeses, as well as vitamins, proteins, and carotenoids are among the food items that are traditionally generated through the fermentation process.

Regional Insights

U.S. Fermentation Chemicals Market Size and Growth 2026 to 2035

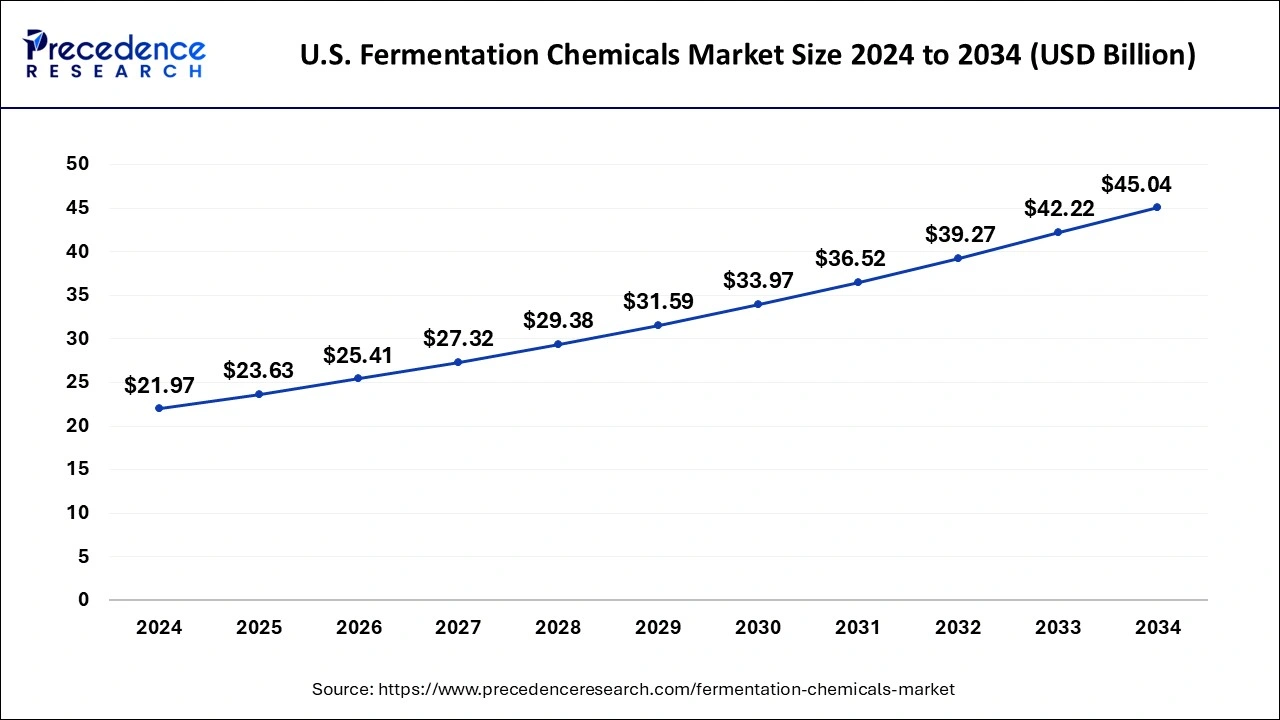

The U.S. fermentation chemicals market size is exhibited at USD 23.63 billion in 2025 and is projected to be worth around USD 47.95 billion by 2035, growing at a CAGR of 7.33% from 2026 to 2035.

How Does North America Generate the Highest Revenue of the Fermentation Chemicals Market?

On the basis of geography, the North America region contributed the highest revenue share in 2025. This is a result of the region's growing need for enzymes in a variety of applications involving paper, starch, and personal care. Growth in the business is expected to be greatly impacted by the rising demand for enzymes from a variety of industrial applications, including paper, personal care, and starch. By 2033, the North American fermentation chemical market might be worth more than 59.05 billion USD. Due to rising individual awareness of personal care and cleanliness, cosmetics and toiletries have seen enormous demand in recent years. Environmental change has increased skin and dermatological issues, which has opened up a significant market opportunity for cosmetic applications. These fermented skin care solutions frequently include herbs, yeast, and fruits that provide anti-inflammatory and other relaxing properties for the skin.

What Makes Asia Pacific the Fastest-Growing Region in the Fermentation Chemicals Market?

From 2026 to 2035, demand from the Asia Pacific region is anticipated to grow at a 6.5% CAGR. Over the course of the projection period, it is anticipated that the expansion of important end-use sectors including food and beverage, pharmaceuticals, and polymers, notably in China and India, will continue to be a major driver of the regional market. Over the projected period, it is anticipated that rising per-capita middle-class disposable income levels and expansion in the food and beverage sector in nations like China and India will boost regional demand.

What Drives the European Fermentation Chemicals Market?

The growing demand for fermentation chemicals from the food and beverage industry across numerous countries, such as Germany, Italy, Norway, the UK, France, and the Netherlands, is a major factor driving the market in Europe. Additionally, the presence of various market players such as DSM NV, Evonik Industries AG, and BASF SE is expected to propel the growth of the market in this region.

How is the Opportunistic Rise of Latin America in the Fermentation Chemicals Market?

Latin America is expected to grow at a significant rate in the market during the forecast period. The rising demand for organic acids from the pharmaceuticals industry in several nations, such as Brazil, Argentina, and Venezuela, is boosting the market expansion. Moreover, numerous government initiatives aimed at developing the chemicals industry are expected to drive the growth of the market in this region.

What Potentiates the Market in the Middle East & Africa?

The fermentation chemicals market in the Middle East & Africa is expected to grow at a lucrative rate during the forecast period. The rapid expansion of the chemicals industry in various countries, including the UAE, Saudi Arabia, Qatar, and South Africa, is boosting the market. Moreover, the rapid investment by market players for opening new production facilities is expected to foster the growth of the fermentation chemicals market in this region.

Value Chain Analysis

- Raw Materials

Raw materials used in the production of fermentation chemicals comprise sugars, starches, nitrogen sources, gases, and oils.

Key Companies: Gulshan Polycols, Aveve, and SPAC. - Quality Check

Quality control (QC) of fermentation chemicals is a comprehensive process involving a combination of chemical, physical, and microbiological testing methods.

Key Companies: SGS, Intertek, and HQTS. - Distribution Channel

The distribution channel of fermentation chemicals consists of direct enterprise sales, specialized distributors, e-commerce platforms, and retailers.

Key Companies: ADM, Cargill, Incorporated, and AB Enzymes.

Fermentation Chemicals Market Companies

- Novozymes A/S

- Ajinomoto Co., Inc.

- BASF SE

- ADM

- Cargill, Incorporated

- AB Enzymes

- DuPont

- DSM

- LANZATECH

- MicroBiopharm Japan Co., Ltd.

- Novasep, TCI Chemicals (India) Pvt. Ltd

- Biocon

- Evonik Industries AG

- Dow

- Lonza

- Amano Enzyme Inc.

- INVISTA

- Chr. Hansen Holding A/S

Recent Developments

- In May 2021 –A collaboration between LanzaTech and BASF aims to produce useful compounds from the carbon found in industrial off-gases. The partners have now made a significant breakthrough: using specialized bacteria, they were able to manufacture n-octanol at a laboratory scale from carbon monoxide and hydrogen, the major elements of emissions, such as those from the steel sector. Among other things, n-octanol is a crucial chemical used in cosmetics.

Segments Covered in the Report

By Product

- Organic Acid

- Amino acids

- Citric acids

- Lactic acids

- Others

- Enzymes

- Alcohol

- Others

By Application

- Food and Beverages

- Pharmaceuticals

- Plastic and Fibers

- Industrial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting