What is Flexible Printed Circuit Boards Market Size?

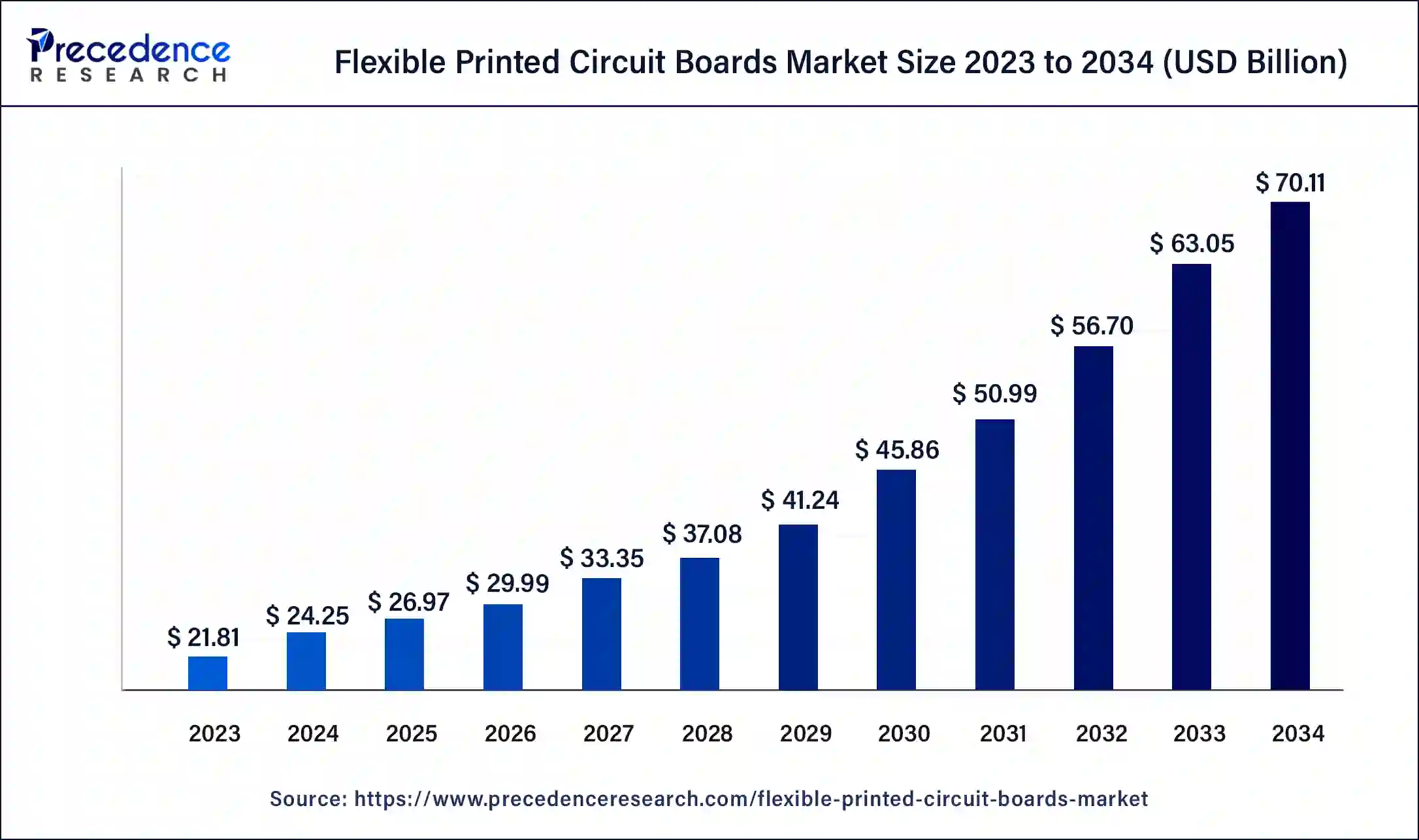

The global flexible printed circuit boards market size accounted for USD 26.97 billion in 2025 and is anticipated to reach around USD 76.69 billion by 2035, growing at a CAGR of 11.02% from 2026 to 2035.

Market Highlights

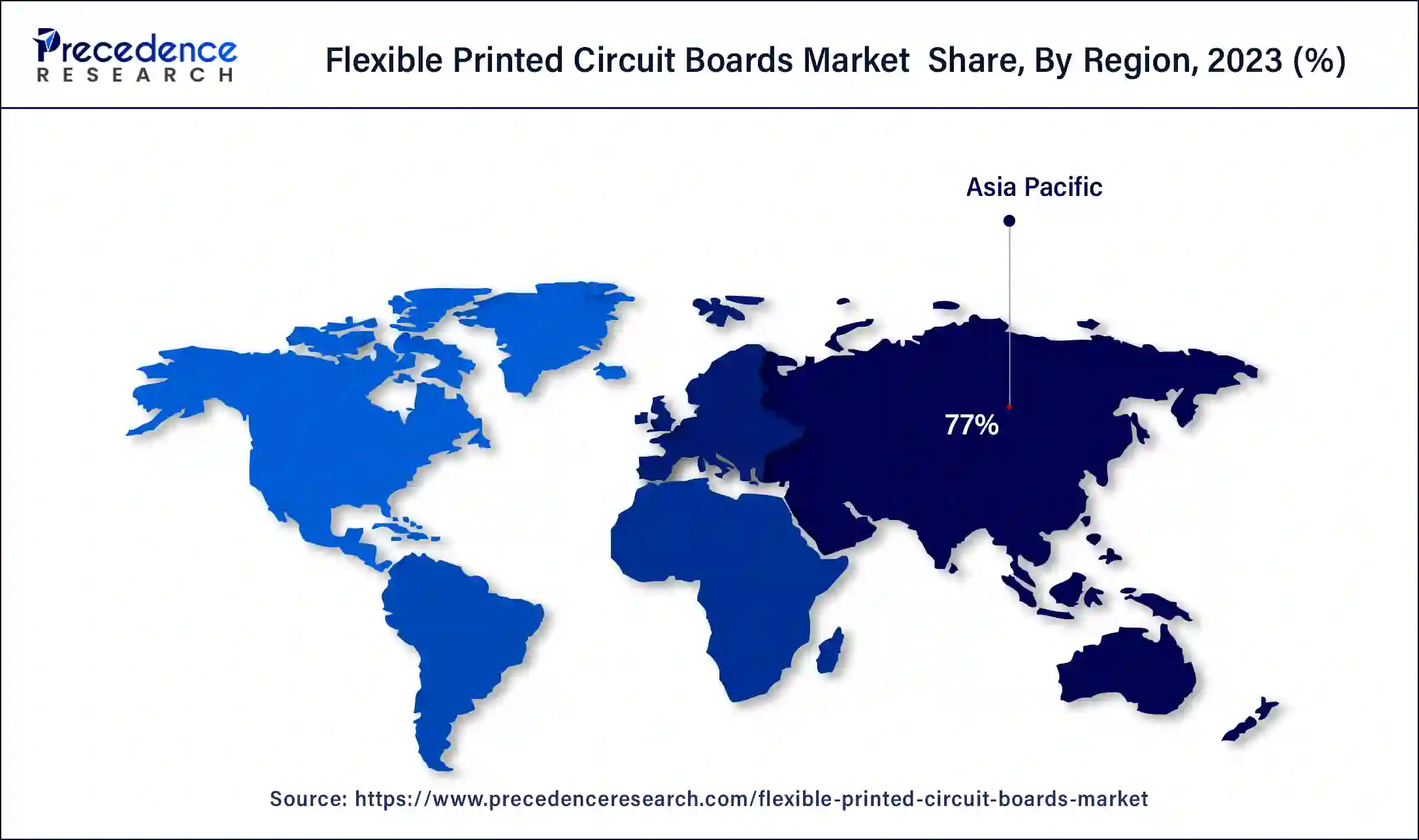

- Asia Pacific contributed more than 77% of revenue share in 2025.

- North America is estimated to expand the fastest CAGR between 2026 and 2035.

- By type, the double-sided PCB segment has held the largest market share of 45% in 2025.

- By type, the multilayer PCBs segment is anticipated to grow at a remarkable CAGR of 12% between 2026 and 2035.

- By end-use, the IT and telecom segment generated over 34% of revenue share in 2025.

- By end-use, the consumer electronics segment is expected to expand at the fastest CAGR over the projected period.

What are Flexible Printed Circuit Boards?

Flexible printed circuit boards (FPCBs) are a type of electronic interconnectivity solution known for their bendable and adaptable nature. Composed of flexible plastic materials such as polyimide, these boards provide a compact and lightweight alternative to traditional rigid circuit boards. FPCBs are ideal for applications where space constraints and complex geometries are a concern, allowing for efficient routing of connections in three-dimensional configurations.

Their flexibility allows them to seamlessly integrate into devices, reducing the need for bulky connectors and enhancing reliability by withstanding dynamic stresses. This makes FPCBs particularly valuable in industries like consumer electronics, automotive, and medical devices, where space-efficient and durable designs are essential. In summary, flexible printed circuit boards provide a cutting-edge solution for contemporary electronics, promoting creative design possibilities and improved functionality.

Flexible Printed Circuit Boards Market Growth Factors

- Rising Demand in Consumer Electronics: The increasing use of FPCBs in smartphones, wearables, and other consumer electronics drives market growth.

- Automotive Integration: FPCBs play a vital role in automotive electronics, benefiting from the growing complexity of in-vehicle systems.

- Medical Device Advancements: The healthcare sector's reliance on compact and reliable electronic devices boosts demand for FPCBs in medical applications.

- Internet of Things (IoT) Expansion: As IoT devices become more prevalent, FPCBs are essential for their compact design and versatile connectivity.

- Demand in Aerospace Applications: Lightweight and flexible circuits find extensive use in aerospace for space-saving and weight reduction purposes.

- Increased Automation: The trend towards automation in industries drives the need for flexible and space-efficient circuitry, promoting FPCB growth.

- Wearable Technology: The proliferation of wearable devices, from smartwatches to fitness trackers, contributes significantly to FPCB market expansion.

- Rapid Advancements in 5G Technology: FPCBs are crucial in the development of 5G-enabled devices, benefitting from the ongoing global rollout of 5G networks.

- Compact Design Trends: The preference for slim and lightweight electronic products fuels the demand for FPCBs in various applications.

- Emerging Artificial Intelligence (AI) Devices: AI-powered devices often require flexible and efficient circuitry, contributing to the FPCB market's growth.

- Renewable Energy Sector: FPCBs are utilized in solar panels and other renewable energy systems, aligning with the global focus on sustainable technologies.

- Advancements in Flexible Display Technologies: The growth of flexible display technologies, such as foldable screens, drives the demand for FPCBs.

- Enhanced Durability: FPCBs' ability to withstand mechanical stress and vibrations makes them attractive for rugged applications, including industrial equipment.

- Miniaturization in Electronics: The ongoing trend of miniaturization in electronic components benefits FPCBs due to their compact and flexible nature.

- Increased Investments in Research and Development: R&D efforts to improve FPCB materials and manufacturing processes contribute to market expansion.

- Global Connectivity Needs: The demand for devices that support global connectivity fosters growth in FPCBs for communication applications.

- Electric Vehicle (EV) Industry Growth: The expanding EV market relies on FPCBs for lightweight and reliable electronic components in electric vehicles.

- Supply Chain Resilience: The need for resilient supply chains in electronics manufacturing enhances the importance of FPCBs.

- Flexible Electronics Prototyping: FPCBs serve as a crucial component in the prototyping phase of flexible electronic devices, boosting market demand.

- Adoption in Military and Defense: The military and defense sector's increasing adoption of electronic systems propels the demand for FPCBs in these applications.

- Nitto Denko annual revenue for 2022 was $7.596B, a 6.14% increase from 2021. Nitto Denko annual revenue for 2021 was $7.156B, a 4.97% increase from 2020.

Market Outlook

- Industry Growth Overview: The flexible printed circuit boards market is experiencing significant growth as it provides mechanical support for electronic components so that a device can be mounted in an enclosure.

- Global Expansion: The market is experiencing significant worldwide expansion, driven by its widespread use in PC and peripheral products, automotive electronics, healthcare equipment, communication products, consumer electronics, and other fields. Asia Pacific is dominant in the market as there is advanced manufacturing and vigorous infrastructure.

- Major investors: Major investors in the market include established Japanese firms such as Nippon Mektron, Sumitomo Electric, and Fujikura Ltd, alongside Taiwanese giants like Zhen Ding Tech and Unimicron, US players like TTM Technologies, and Korean companies like bhflex

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 26.97 Billion |

| Market Size in 2026 | USD 29.99 Billion |

| Market Size by 2035 | USD 76.69 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 11.02% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By End Use, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Miniaturization trend and consumer electronics boom

The miniaturization trend and consumer electronics boom synergistically drive the surging market demand for flexible printed circuit boards. As electronic devices continue to evolve, there is an increasing emphasis on miniaturization, with consumers demanding smaller, more lightweight products. FPCBs play a pivotal role in meeting this demand, offering a flexible and compact solution for intricate circuitry in devices with limited space.

The consumer electronics boom, marked by the widespread adoption of smartphones, wearables, and other portable gadgets, significantly amplifies the demand for FPCBs. These boards enable the design of sleeker and more sophisticated electronic devices, aligning with the preferences of modern consumers. The interplay of the miniaturization trend and consumer electronics boom positions FPCBs as a critical enabler of innovation, fostering their integration into a broad spectrum of electronic applications and driving sustained growth in the FPCB market.

Restraint

Limited heat dissipation

Limited heat dissipation poses a significant restraint on the growth of the flexible printed circuit boards market. While FPCBs offer unparalleled flexibility and adaptability, their ability to dissipate heat is generally lower compared to rigid boards. In applications where efficient thermal management is crucial, such as high-performance computing or power electronics, the constraints on heat dissipation can impede the adoption of FPCBs.

Thermal limitations may lead to concerns over overheating, potentially compromising the performance and reliability of electronic systems. This restriction becomes particularly pronounced in industries that demand rigorous thermal control, limiting the applicability of FPCBs in certain critical applications. As electronic devices continue to push the boundaries of performance, addressing the challenge of limited heat dissipation becomes imperative for FPCBs to expand their market presence in diverse sectors and applications.

Opportunity

Wearable electronics

FPCBs are crucial for wearable healthcare devices that monitor vital signs, deliver therapies or aid in diagnostics. The healthcare wearable market's growth presents a substantial opportunity for FPCB manufacturers. The expanding market for wearable electronics, driven by consumer demand for smartwatches, fitness trackers, and other connected devices, creates a continuous demand for FPCBs. This growth provides opportunities for innovation and market expansion in the flexible printed circuit boards sector.

Segment Insights

Type Insights

In 2025, the double-sided PCB segment had the highest market share of 45% based on the type. Double-Sided PCBs in the flexible printed circuit boards market refer to circuits featuring conductive traces on both sides of the flexible substrate. These boards offer enhanced design flexibility and increased circuit density. The double-sided FPCB segment is witnessing a notable trend towards greater integration in compact electronic devices. The demand for thinner and more lightweight products is driving the adoption of double-sided FPCBs, enabling manufacturers to achieve higher functionality in limited space and contributing to the overall growth of the FPCB market.

The multilayer circuit segment is anticipated to expand at a significant CAGR of 12% during the projected period. Multilayer circuits are a type of flexible printed circuit board characterized by the stacking of multiple conductive layers separated by insulating substrates. These boards allow for intricate and dense circuit designs in a compact form factor. A growing trend in the FPCB market is the increasing adoption of multilayer configurations. This trend is driven by the need for enhanced functionality in compact electronic devices, such as smartphones and IoT devices, where multilayer FPCBs enable the integration of complex and sophisticated circuitry.

End-use Insights

According to the end-use, the IT and telecom segment has held 34% revenue share in 2025. The IT and Telecom segment in the flexible printed circuit boards market encompasses the use of these circuits in a range of devices such as smartphones, networking equipment, and communication devices. Trends in this segment include the increasing demand for FPCBs in 5G-enabled devices, where the boards provide compact and efficient connectivity solutions. Additionally, the trend towards miniaturization in IT and telecom equipment drives the adoption of FPCBs, allowing manufacturers to design sleeker and more feature-rich devices with flexible and space-efficient circuitry.

The consumer electronics segment is anticipated to expand fastest over the projected period. The consumer electronics segment in the flexible printed circuit boards market encompasses devices such as smartphones, tablets, wearables, and gaming consoles. A notable trend in this segment is the increasing demand for compact and lightweight designs, driving the adoption of FPCBs due to their flexibility and space-efficient attributes. As consumer preferences lean towards sleeker and more advanced electronic gadgets, FPCBs enable manufacturers to achieve innovative and intricate circuitry layouts, positioning them as a vital component in the evolution of consumer electronics.

Regional Insights

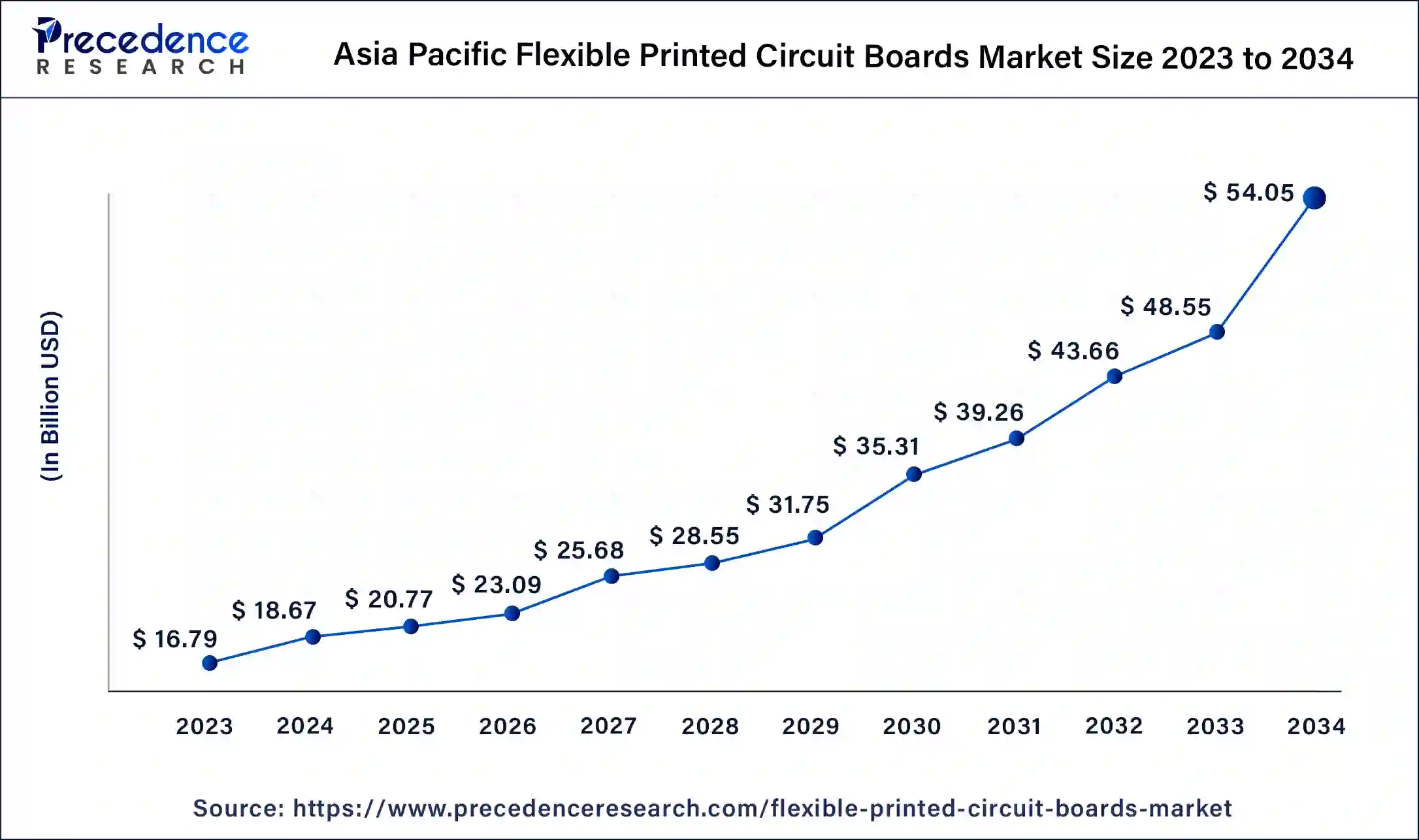

Asia Pacific Flexible Printed Circuit Boards Market Size and Growth 2026 to 2035

The Asia Pacific flexible printed circuit boards market size is valued at USD 20.77 billion in 2025 and is predicted to surpass around USD 59.14 billion by 2035, rising at a CAGR of 11.03% from 2026 to 2035.

Asia Pacific : Major hubs for consumer electronics

Asia-Pacific has held the largest revenue share 77% in 2025. Asia-Pacific dominates the flexible printed circuit boards market due to its robust electronics manufacturing ecosystem, led by countries like China, Japan, and South Korea. These nations are major hubs for consumer electronics production and assembly, driving the demand for FPCBs. The region's advanced technology infrastructure, skilled workforce, and favorable regulatory environment also contribute to its leadership in FPCB manufacturing. Additionally, the escalating adoption of smartphones, wearables, and other electronic devices in the region further amplifies the demand for flexible and lightweight circuit solutions, solidifying Asia-Pacific's significant market share.

North America is estimated to observe the fastest expansion. North America commands a significant share in the flexible printed circuit boards market due to the region's robust electronics industry, technological advancements, and early adoption of innovative technologies. The presence of key market players, substantial investment in research and development, and a high demand for flexible and compact electronic devices contribute to North America's dominance. Additionally, the region's emphasis on applications like automotive electronics, aerospace, and healthcare further propels the use of FPCBs, consolidating North America's leading position in the global market.

China Flexible Printed Circuit Boards Market Trends

China has evolved as a worldwide home for PCB prototype manufacturing due to its affordable solutions, skilled workforce, and advanced technology. Increasing investment in infrastructure, technology, and workforce advancement. Increasing household income in China has led to an increasing demand for electronic products, driving demand for printed circuit boards.

North America: Robust industrialization

U.S. Flexible Printed Circuit Boards Market Trends

In the United States, increasing military and aerospace applications, telecommunications, and initial computing technologies drive the demand for PCB manufacture. Major organizations such as IBM and HP spearheaded innovation, and the region's robust industrial base allowed rapid technological development. Manufacturers now produce wide with unique needs, like high-frequency substrates, flexible circuits, and HDI technology.

Europe: Increasing automotive manufacturin

Europe is experiencing significant growth in the market, as builders use FPCBs to rationalize production; they lower part counts and reduce assembly mistakes because they are simple to install in the tight, uneven spaces of a battery pack. Increasing spending in wearable health monitoring and implantable medical devices, such as bio-compatible FPCBs for heart monitors, drives regional expertise.

The UK Flexible Printed Circuit Boards Market Trends

UK companies drive in electronics design and provide specialized, high-performance services, focusing on quality over less-cost mass production. The UK's tech landscape emphasizes miniaturization, smart technologies (AI), and digital transformation, needful sophisticated FPCB designs.

Value Chain Analysis - Flexible Printed Circuit Boards Market

- Raw Material: Raw material used in flexible printed circuit boards primarily uses polyimide (PI) (Kapton) or polyester (PET) films as the base substrate, with copper foil for conductive traces, bonded by adhesives, and protected by cover films.

• Key Players: Interflex and Sumitomo Electric - Manufacturing Processes: The manufacturing of flexible printed circuit boards (FPCBs) is done in a specialized sequence designed to handle thin, bendable materials such as polyimide (PI) or polyester (PET).

• Key Players: Fujikura and Nitto Denko - Waste Management: It includes a multi-step process that includes extracting valuable materials, correctly handling hazardous substances, and ensuring that the final disposal is safe for the environment, like collection and sorting, mechanical shredding, chemical and physical separation, removal of hazardous substances, and many other steps.

• Key Players: Nippon Mektron and Zhen Ding Technology

SWOT Analysis - Flexible Printed Circuit Boards Market

Drivers:

• Flex PCBs combine durability and flexibility, offering up to 50% expense savings and reliable performance for compact electronics.

• Flexible PCBs folded or creased to fit into tiny or erratically shaped enclosures, allowing the design of ultra-compact devices such as wearables and hearing aids.

Restraints:

• Rigid-flex PCBs are more costly to manufacture than outdated rigid boards because of the complexity of the design, materials used, and manufacturing technology.

• Achieving good manufacturability in rigid-flex designs is problematic.

Opportunity:

• Flexible circuit boards are used in aerospace technology as they play a significant role in aerospace, driving everything from avionics to communication and navigation systems.

• Special materials such as liquid crystal polymers and nanomaterials make flexible PCBs stronger and last longer.

Threat:

• Rigid-flex PCBs may be unprotected to harsh environments in applications such as aerospace or automotive.

• Safeguarding that the elastic sections withstand repeated bending and flexing without mechanical failure is essential.

Flexible Printed Circuit Boards Market Companies

- Samsung Electro-Mechanics

- NOK Corporation

- Flex Ltd.

- Jabil Inc.

- Fujikura Ltd.

- Molex LLC

- Sumitomo Electric Industries, Ltd.

- Zhen Ding Technology Holding Limited

- Career Technology (MFG.) Co., Ltd.

- NewFlex Technology Co., Ltd.

- Nitto Denko Corporation

- Multek Corporation (a subsidiary of Flex Ltd.)

- Daeduck GDS Co., Ltd.

- Interflex Co., Ltd.

- Tripod Technology Corporation

Recent Developments

- In July 2025, OKI Circuit Technology, the OKI Group's printed circuit board (PCB) business company, developed rigid-flex PCBs with embedded copper coins. These coins provide enhanced heat dissipation for use in rockets and satellite-mounted equipment operating in vacuum environments. (https://www.oki.com)

- In December 2024, Elephantech began mass-producing SustainaCircuits, innovative printed circuit boards (PCBs) that lower copper usage by 70-80% using printing technology. It develops relatively niche single-sided flexible PCBs, which account for only about 2% of the market. (https://elephantech.com)

- In 2022, significant strides were made in the field of Printed Circuit Boards (PCBs), with hands-on training provided to a group comprising students, faculty members, and industrialists. This initiative, conducted under the Atal Incubation Centre-PEC Foundation (AIC-PECF) and Puducherry Technological University (PTU), aimed to empower participants in designing PCBs that assemble electronic components.

- In 2022, the year saw the initiation of the Rapid Prototyping and Micro Manufacturing Collaborative Project, marked by the inaugural use of a pick-and-place machine. This project aimed to facilitate the growth and diversification of start-up and scale-up businesses by streamlining the prototyping process.

- In a legislative development, Representatives Anna Eshoo (D-CA) and Blake Moore (R-UT) introduced the Supporting American Printed Circuit Boards Act of 2022. This proposed legislation sought to incentivize the purchase of domestically produced flexible printed circuit boards, encouraging industry investments in factories, equipment, workforce training, and research and development.

Segments Covered in the Report

By Type

- Single-Sided FPCBs

- Double-Sided FPCBs

- Multilayer FPCBs

- Rigid-Flex FPCBs

- Others

By End Use

- Consumer Electronics

- Automotive Electronics

- Industrial Electronics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting