What is Floating Production, Storage and Offloading Market Size?

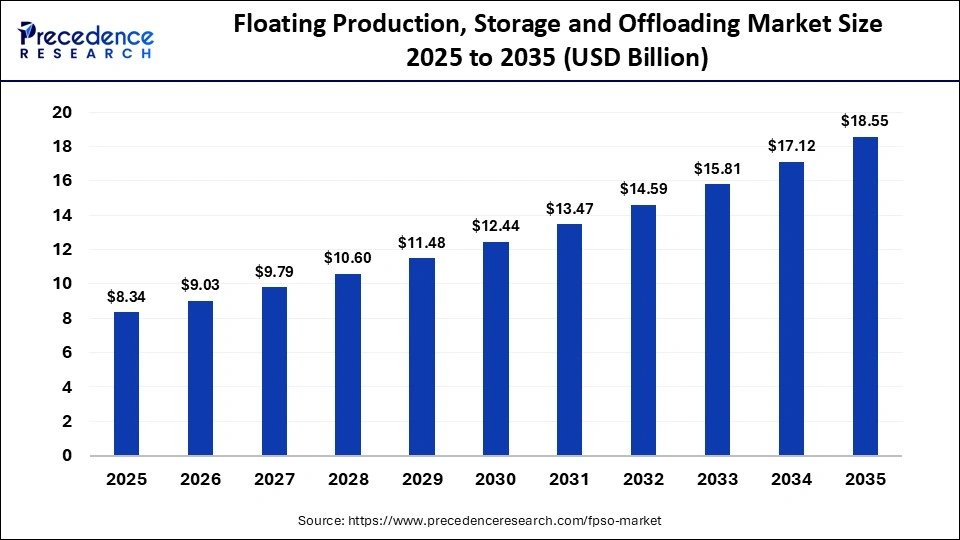

The global floating production, storage and offloading market size was calculated at USD 8.34 billion in 2025 and is predicted to increase from USD 9.03 billion in 2026 to approximately USD 18.55 billion by 2035, expanding at a CAGR of 8.32% from 2026 to 2035. The market is driven by the rapid shift toward deepwater exploration, high demand for cost-efficient offshore solutions, and advanced vessel technology driving major offshore investment.

Market Highlights

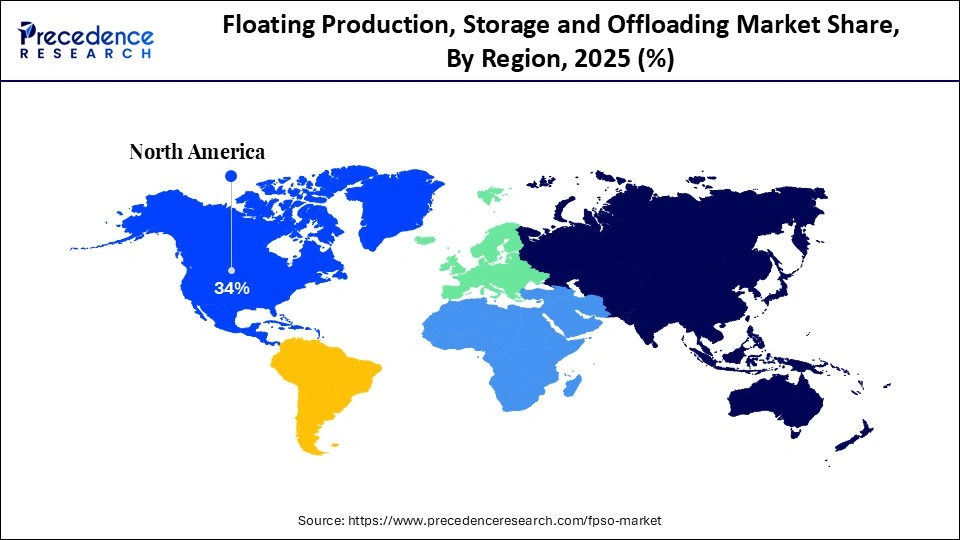

- South America dominated the market with a major share OF 41% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

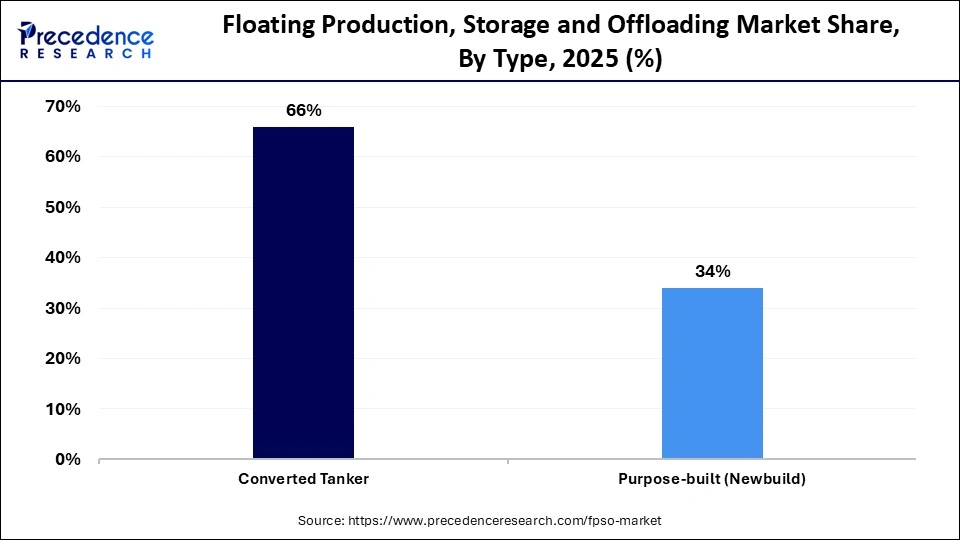

- By type, the converted tanker segment contributed the highest market share of 66% in 2025.

- By type, the purpose-built (newbuild) segment is expected to grow at a strong CAGR between 2026 and 2035.

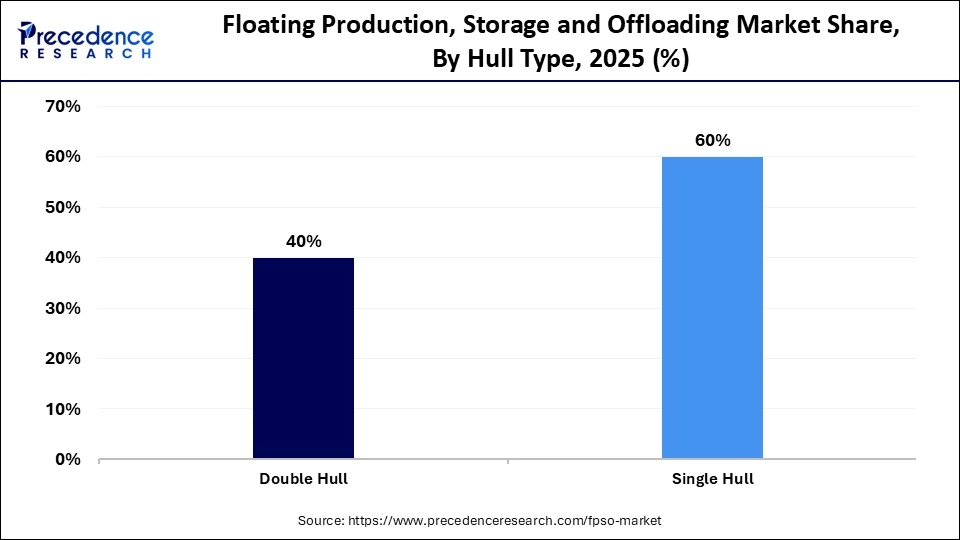

- By hull type, the single hull segment held a major market share of 60% in 2025.

- By hull type, the double hull segment is expected to expand at the fastest CAGR from 2026 to 2035.

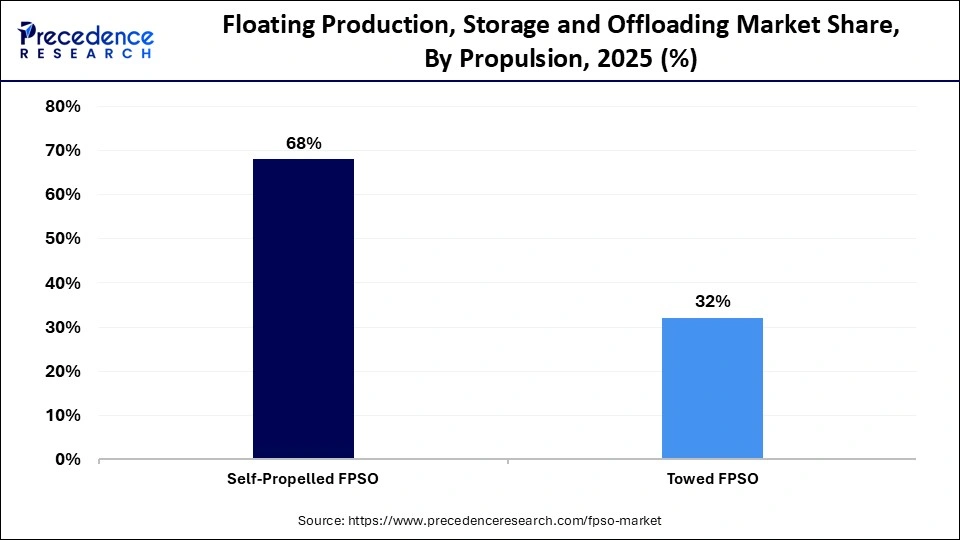

- By propulsion, the self-propelled FPSO segment generated the biggest market share of 68% in 2025.

- By propulsion, the towed FPSO segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By processing capability, the oil FPSO segment accounted for the largest market share of 75% in 2025.

- By processing capability, the hybrid (oil and gas) processing segment is projected to grow at a solid CAGR between 2026 and 2035.

What is the Floating Production, Storage and Offloading Market?

The floating production, storage and offloading market comprises specialized vessels used in offshore oil and gas, integrating production, storage, and processing into a single unit to support deepwater projects. A floating production, storage, and offloading (FPSO) vessel is used by the offshore oil and gas industry to produce, process, and store hydrocarbons directly from subsea fields, later offloading them to shuttle tankers. The market is driven by rising global energy demand, the need for cost-effective, relocatable infrastructure, and advancements in subsea technology.

Major Trends in the Floating Production, Storage and Offloading Market

- Integration of Green Technologies for Decarbonization: FPSOs are shifting toward sustainability by integrating renewable energy, such as electrification via floating wind platforms, to meet emissions targets.

- Immersive Digital Transformation and Intelligent Operations: The industry is adopting AI, IoT, and big data analytics for real-time monitoring and predictive maintenance, reducing equipment failures and enhancing operating efficiency.

- Adoption of Deepwater Projects: As shallow reserves deplete, investments are surging into complex deepwater exploration, reducing construction time and costs.

- Redeployment and Cost-Effective Solutions: To avoid the high capital expenditures of new builds, operators are increasingly refurbishing and redeploying existing FPSOs for developing marginal or newly discovered fields.

How is AI Transforming the Floating Production, Storage and Offloading Market?

Artificial intelligence (AI) is transforming the market by enabling predictive maintenance, real-time safety monitoring, and operational optimization through data from IoT sensors. AI algorithms analyze sensor data to forecast equipment failures before they occur, reducing unplanned downtime and maintenance costs. AI not only optimizes production processes and resource management, increasing overall asset utilization, but also assists in automating complex, high-risk tasks, reducing human intervention. AI enhances safety by detecting gas leaks, identifying degraded safety barriers, and monitoring hazardous areas to protect personnel and the environment.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.34 Billion |

| Market Size in 2026 | USD 9.03 Billion |

| Market Size by 2035 | USD 18.55 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.32% |

| Dominating Region | South America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type,Hull Type,Propulsion,Processing Capability, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

How Does the Converted Tanker Segment Dominate the Floating Production, Storage and Offloading Market?

The converted tanker segment dominated the market in 2025, primarily due to its cost-effectiveness, shorter conversion timelines, and the ability to repurpose existing, mature oil tanker hulls. Converted tankers are generally more economically viable, as they utilize existing infrastructure, which helps avoid the high capital investments and lengthy construction times associated with newly built vessels. The conversion of a tanker into an FPSO unit takes only a few months, compared to the years required for new builds. This makes converted tankers ideal for urgent, short-term projects and allows for efficient repurposing, facilitating faster project deployment.

The purpose-built (newbuild) segment is expected to experience the fastest growth during the forecast period. This growth is driven by the need for higher processing capacities and more robust structures that can manage complex, deepwater, and harsh-environment projects. As shallow-water resources deplete, operators are exploring deeper and more remote reserves. These fields require specialized, high-capacity vessels that typical converted tankers cannot accommodate. Newly built FPSOs also allow for full integration of the latest technologies, such as advanced mooring systems and enhanced safety features.

Hull Type Insights

What Made Single Hull the Leading Segment in the Floating Production, Storage and Offloading Market?

The single hull segment led the market with the largest share in 2025, primarily due to the single-hull FPSOs' lower capital investment, faster conversion times, and efficiency in shallow fields where they are suitable for specific environments. Single-hull FPSOs are preferred for shallow water, nearshore, and moderate-environment mature fields, where safety regulations are less stringent. Additionally, converted and redeployed units offer greater flexibility for short-cycle or marginal projects and represent a significant portion of the currently installed global fleet, thanks to their shorter construction timelines compared to new-built FPSOs.

The double hull segment is expected to grow at the fastest rate during the forecast period. This growth is mainly driven by stringent safety and environmental regulations, as well as superior risk management capabilities related to oil spills. Double-hull vessels provide enhanced protection against pollution, as their design includes a secondary containment layer in case the outer hull is breached. As FPSO operations expand into deeper and more complex waters, the structural integrity and stability of double-hull vessels become essential for handling tough conditions. They also offer greater longevity and lower maintenance costs, making them preferable for long-term production projects.

Propulsion Insights

Why Did the Self-Propelled FPSO Segment Dominate the Floating Production, Storage and Offloading Market?

The self-propelled FPSO segment dominated the market in 2025 due to its efficiency in deepwater and remote projects, as well as its performance in harsh environments. This is attributed to their superior mobility, reduced reliance on third-party tugs, and enhanced asset redeployment flexibility. Self-propelled units can travel independently to and from deepwater, remote locations without needing expensive tug support. They enable quick disconnection and sail-away during extreme weather, which is crucial for preventing significant damage costs and maximizing uptime while enhancing energy efficiency, reducing emissions, and lowering maintenance needs.

The towed FPSO segment is expected to expand at the fastest CAGR in the upcoming period, mainly due to its cost-efficiency and suitability for established, less complex, shallow-water fields. The segment is also driven by increased exploration of mature and nearshore fields. Towed FPSOs typically require a lower initial capital investment compared to self-propelled units, making them highly attractive for projects seeking to maximize returns. They are also ideal for long-term deployment in specific, static locations, aligning with the needs of many offshore, fixed-position production projects.

Processing Capability Insights

How Did the Oil FPSO Segment Lead the Floating Production, Storage and Offloading Market?

The oil FPSO segment led the global market in 2025, primarily due to its high throughput capacity, adaptability to deepwater, and critical role in bypassing expensive infrastructure. The shift toward offshore reserves is boosting demand for advanced FPSOs that offer both high-capacity oil separation and on-site crude storage. In remote areas, FPSOs eliminate the need for costly, fixed pipelines to shore, making them the preferred and more flexible option for offshore oil producers. Moreover, there is a focus on upgrading and redeploying existing oil FPSOs to reduce capital expenditure, allowing for faster and more economical development.

The hybrid (oil and gas) processing segment is expected to grow at the fastest CAGR over the forecast period. This is mainly due to stricter methane emission regulations, the demand for enhanced energy security, and the optimization of resources in deepwater developments. Hybrid units are designed to handle both oil and associated gas, allowing operators to monetize gas resources, aligning with stringent environmental, social, and governance mandates. The integration of modular topsides, advanced separation technologies, and digital monitoring allows hybrid units to be more efficient and flexible, reducing downtime with high processing capability.

Regional Insights

How Big is the South America Floating Production, Storage and Offloading Market Size?

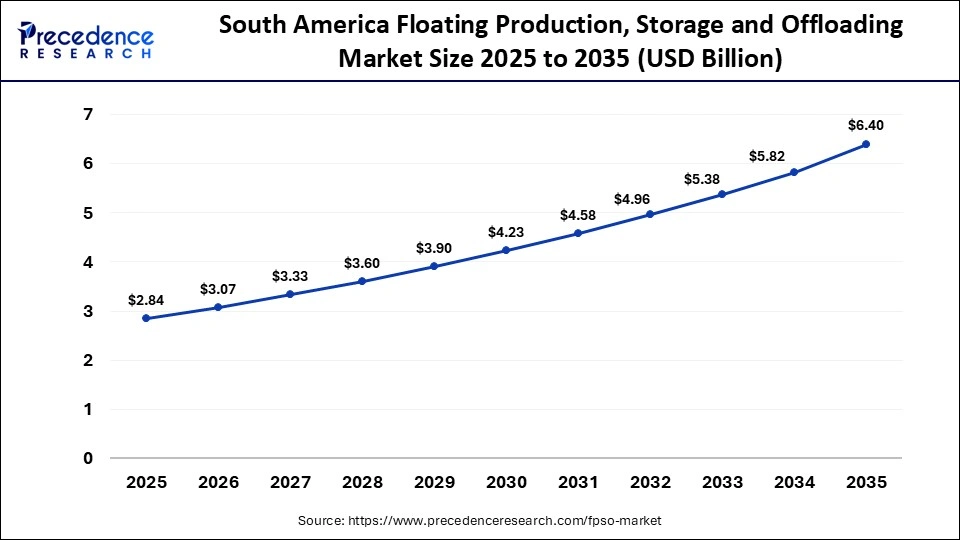

The South America floating production, storage and offloading market size is estimated at USD 2.84 billion in 2025 and is projected to reach approximately USD 6.40 billion by 2035, with a 8.46% CAGR from 2026 to 2035.

What Made South America the Dominant Region in the Floating Production, Storage and Offloading Market?

South America dominated the global market with a major revenue share in 2025. This is mainly due to its immense, high-quality ultra-deepwater oil reserves, particularly in the Santos and Campos basins, which require large, complex FPSO units to unlock their potential. Guyana has emerged as a premier hotspot, with ExxonMobil's aggressive development of the Stabroek block making it one of the most active regions for new FPSO deployments. The market favors FPSOs due to their ability to be converted from tankers, offering faster deployment and lower capital costs compared to fixed platforms, which is crucial for deepwater developments and encourages foreign partnerships and investment.

Brazil Floating Production, Storage and Offloading Market Trends

Brazil plays a dominant role within the region, mainly due to deepwater pre-salt fields like Búzios and Mero. Brazilian projects set industry benchmarks, utilizing large-capacity units to reduce per-barrel costs and optimize efficiency. Significant projects include Bacalhau and the deployment of FPSOs in the Santos and Campos basins. Additionally, there is a strong focus on low-emission designs, including hybrid power, flare gas minimization, and digital monitoring.

Why is Asia Pacific Considered the Fastest-Growing Region in the Floating Production, Storage and Offloading Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. This is mainly due to high energy demand, increased offshore exploration, and significant investments in marginal field development. Countries like Malaysia, Indonesia, and Australia are focusing on developing smaller, scattered offshore fields, where the mobility of FPSOs is more cost-effective. South Korea and China possess advanced shipbuilding and engineering capabilities, allowing them to lead in constructing both new-build and converted units. Rapid industrialization in developing economies, particularly China and India, has accelerated the need for stable energy.

India Floating Production, Storage and Offloading Market Trends

India stands out as an emerging market within the region, mainly because it is actively scaling up its offshore production capabilities in the Asia-Pacific region, contributing to the rising demand for floating production units. Increasing energy demand is driving the exploration and development of offshore oil reserves in India, fueling the need for FPSO technology. Furthermore, India is focusing on optimizing its aging and new offshore assets, requiring advanced FPSO solutions to enhance production efficiency.

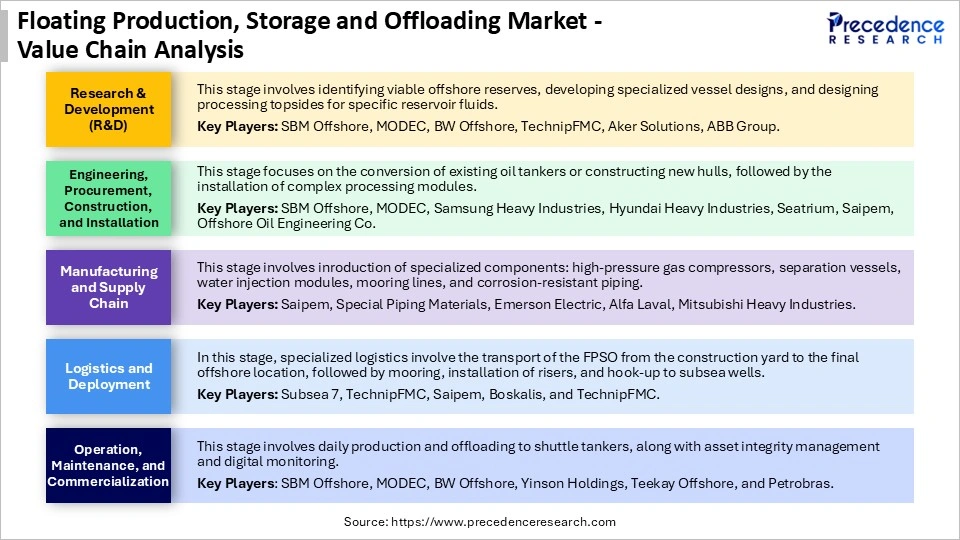

Floating Production, Storage and Offloading Market Value Chain Analysis

Who are the Major Players in the Global Floating Production, Storage and Offloading Market?

The major players in the floating production, storage and offloading market include SBM Offshore N.V., MODEC, Inc., BW Offshore Limited, Yinson Holdings Berhad, Bumi Armada Berhad, Bluewater Energy Services B.V., Teekay Corporation, Saipem S.p.A., PetroVietnam Technical Services Corporation, and MISC Berhad

Recent Developments

- In January 2026, Samsung Heavy Industries launched the hull of its second floating liquefied natural gas vessel, Coral Norte, for Eni at its Geoje Island yard. This 432-meter vessel, with a capacity of 3.6 million tonnes per annum, will be deployed in Mozambique's Rovuma basin upon completion in 2028, following a $7.2 billion investment decision by Eni. Coral Norte aims to double Mozambique's LNG output to 7 million tpa, positioning the country as Africa's third-largest LNG producer. (Source:https://www.upstreamonline.com)

- In April 2025, Exxon Mobil progressed on expanding its oil output in Guyana with the installation of its fourth FPSO, One Guyana, which has a capacity of 250,000 barrels per day. This vessel will help increase the consortium's total production capacity to approximately 940,000 barrels per day by the end of 2025, supporting development in the Stabroek Block. (Source:https://finance.yahoo.com)

Segments Covered in the Report

By Type

- Converted Tanker

- Purpose-built (Newbuild)

By Hull Type

- Double Hull

- Single Hull

By Propulsion

- Self-Propelled FPSO

- Towed FPSO

By Processing Capability

- Oil FPSO

- Gas FPSO

- Hybrid (Oil and Gas)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting