Forestry Lubricants Market Size and Forecast 2025 to 2034

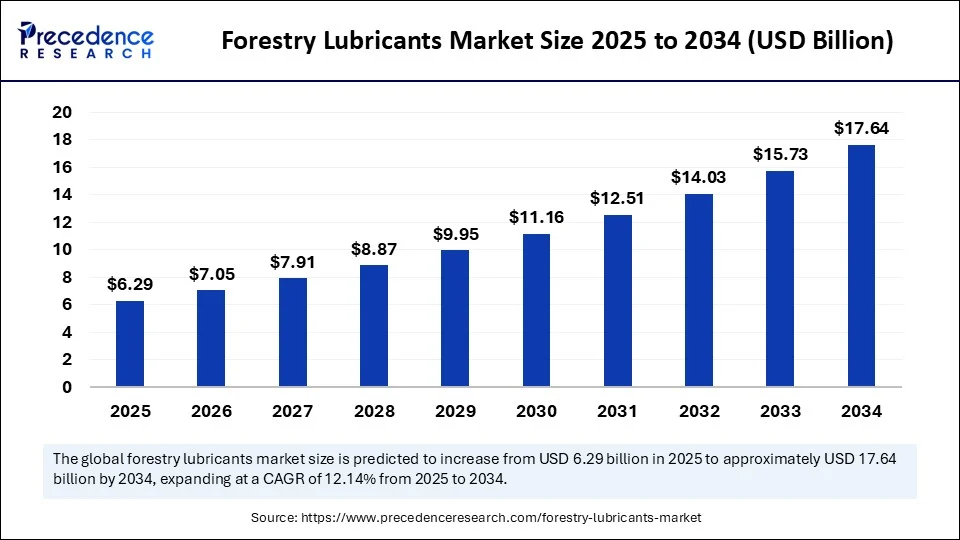

The global forestry lubricants market size accounted for USD 5.61 billion in 2024 and is predicted to increase from USD 6.29 billion in 2025 to approximately USD 17.64 billion by 2034, expanding at a CAGR of 12.14% from 2025 to 2034. The market is growing due to increasing demand for sustainable and biodegradable lubrication solutions in forestry machinery and equipment.

Forestry Lubricants MarketKey Takeaways

- In terms of revenue, the global forestry lubricants market was valued at USD 5.61 billion in 2024.

- It is projected to reach USD 17.64 billion by 2034.

- The market is expected to grow at a CAGR of 12.14% from 2025 to 2034.

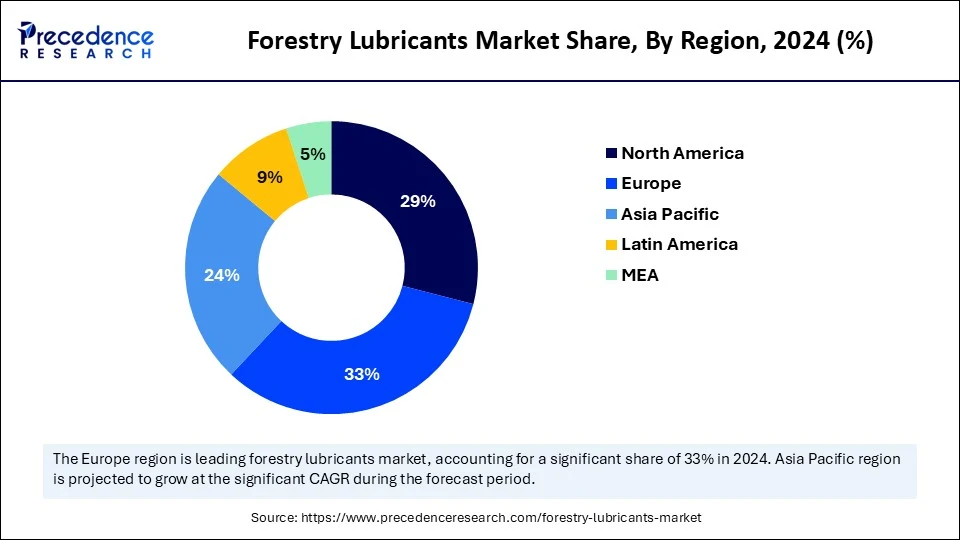

- Europe dominated the forestry lubricants market with the largest market share of 33% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the coming years.

- By product type, the hydraulic fluids segment held the biggest market share of 28% in 2024.

- By product type, the biodegradable lubricants segment is expected to grow at the fastest CAGR during the forecast period.

- By base oil type, the mineral oil-based segment generated the major market share of 52% in 2024.

- By base oil type, the bio-based oil segment is expected to grow at the fastest CAGR in during the forecast period.

- By machinery type, the harvesters segment captured the highest market share of 31% in 2024.

- By machinery type, the chainsaws segment is emerging as the fastest growing during the forecast period.

- By application, the hydraulic systems segment contributed the major market share of 34% in 2024.

- By application, the chains & bars segment is expected to grow at the fastest CAGR during the forecast period.

- By end-use, the logging contractors segment held the largest share of 37% in 2024.

- By end-use, the sawmill & processing plants segment is observed to grow at the fastest CAGR during the forecast period.

- By sales channel, the aftermarket segment generated the major market share of 61% in 2024.

- By sales channel, the online B2B platforms segment is likely to grow at the fastest CAGR between 2025 and 2034.

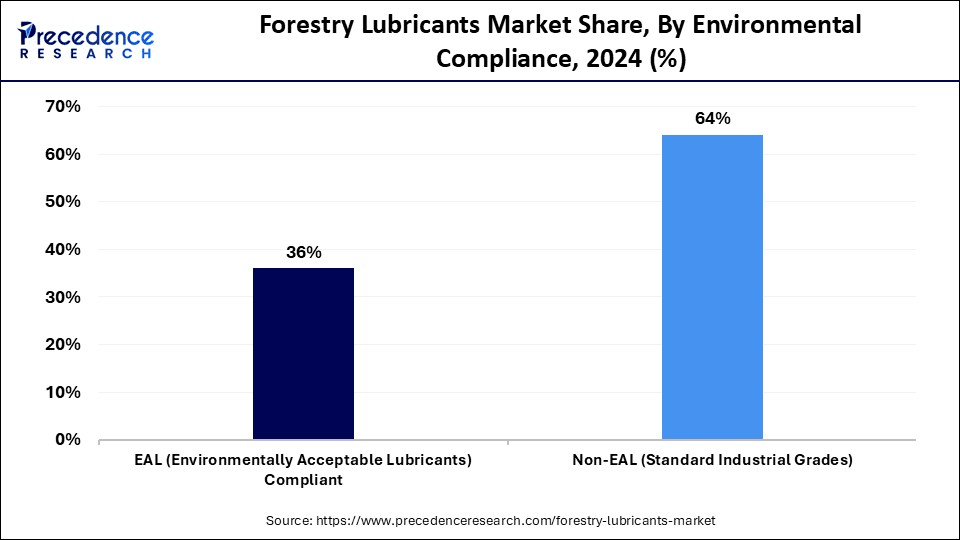

- By environmental compliance, the non-EAL segment accounted for significant market share of 64% in 2024.

- By environmental compliance, the EAL compliant segment is observed to grow at the fastest CAGR during the forecast period.

How is AI transforming the forestry lubricants market?

Artificial Intelligenceis revolutionizing the forestry lubricants market. AI optimizes lubricant formulations by analyzing large datasets to identify the best combination of base oil and additives. This enhances the performance of lubricants and significantly extends the lifespan of equipment. Moreover, AI reduces waste generation during manufacturing, enabling the proper usage of raw materials. AI also enhances the quality of lubricants. By using smart sensors and AI algorithms to monitor temperature, pressure, lubricant levels, and performance deterioration, operators can minimize downtime and reduce overuse by applying lubricants only when necessary. Furthermore, by predicting lubricant requirements based on usage trends, AI improves inventory control.

Europe Forestry Lubricants Market Size and Growth 2025 to 2034

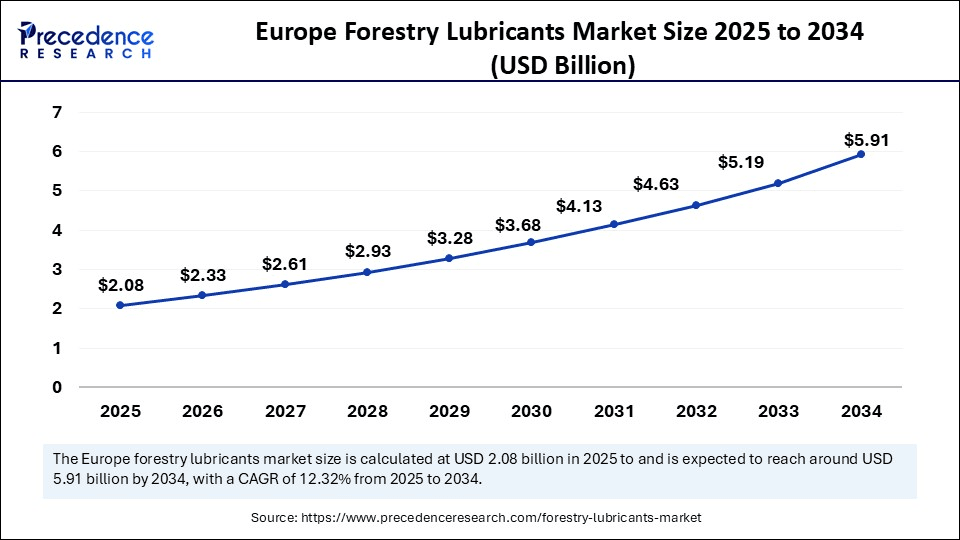

Europe forestry lubricants market size was exhibited at USD 1.85 billion in 2024 and is projected to be worth around USD 5.91 billion by 2034, growing at a CAGR of 12.32% from 2025 to 2034.

What made Europe the dominant region in the forestry lubricants market in 2024?

Europe dominated the market while holding the largest share in 2024 due to stringent environmental laws, extensive use of sustainable forestry methods, and high levels of mechanization. There is a strong focus on enhancing forestry equipment's performance, boosting the demand for forestry lubricants. The regional market is further strengthened by established distribution networks and government incentives. EAL-compliant lubricants have become the norm for forestry operations in Europe. The rapid expansion of the forestry industry and the rising demand for bio-based lubricants are ensuring the long-term growth of the market in the region.

Asia Pacific is the fastest-growing region. The growth of the market in the region is driven by rising timber demand, expanding commercial forestry, and increased investment in mechanized equipment. The region is witnessing rapid infrastructure development and reforestation initiatives, creating high demand for lubricants in the forestry sector. Low-cost labor and expanding exports also make forestry a high-growth sector here. As awareness of equipment maintenance grows, so does the demand for lubricants.

Market Overview

The forestry lubricants market comprises specialized lubricants designed to operate under extreme outdoor conditions in forestry machinery and equipment, including harvesters, forwarders, chainsaws, skidders, feller bunchers, loaders, and sawmills. These lubricants reduce friction, prevent corrosion, and extend equipment life across logging, wood processing, and reforestation activities. They include bio-based and mineral-based formulations tailored to withstand harsh environments, high loads, and environmental regulations specific to forestry operations.

Why is the demand for forestry lubricants increasing?

The demand for forestry lubricants is increasing globally due to the increasing usage of sophisticated, high-performing forestry equipment that needs efficient lubrication in harsh environments. In response to more stringent environmental laws and increased consciousness of sustainability, industries are moving toward eco-friendly and biodegradable lubricants that lessen their negative effects on the environment. Also, the need for specialized lubricants that improve equipment longevity and operational efficiency is being driven by the growth of commercial forestry activities and mechanized logging operations. The emphasis on lowering equipment downtime and enhancing fuel efficiency is driving the forestry lubricants market expansion even more.

Forestry Lubricants MarketGrowth Factors

- Mechanization of Forestry: Rising use of advanced forestry machinery boosts demand for durable, high-performance lubricants that reduce wear and maintenance in extreme conditions.

- Sustainability Trends: Growing environmental concerns are driving the shift toward biodegradable, eco-friendly lubricants that reduce soil and water pollution.

- Strict Regulations: Government mandates restricting petroleum-based lubricants in sensitive ecosystems are encouraging the adoption of green alternatives

- Timber Industry Growth: Expanding demand for timber, pulp, and paper is fueling forestry operations and increasing lubricant consumption.

- Lubricant Innovation: Technological advancements are improving the performance and longevity of bio-based lubricants, making them viable in harsh forestry environments.

- Emerging Market Expansion: Forestry activities in developing regions are growing, creating new demand for forestry-specific lubricant solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 17.64 Billion |

| Market Size in 2025 | USD 6.29 Billion |

| Market Size in 2024 | USD 5.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.14% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Base Oil Type, Machinery Type, Application, End-Use Segment, Sales Channel, Environmental Compliance, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Use of Mechanized Forestry Equipment

The increasing use of cutting-edge forestry equipment for harvesting, logging, and wood processing is fueling the demand for high-performance lubricants that guarantee dependable and effective operation in challenging outdoor environments. These devices frequently work in harsh, isolated locations, so consistent lubrication is crucial to avoiding equipment failure. Lubricants that can tolerate high pressure and temperature fluctuations are necessary for heavy-duty chainsaws, skidders, harvesters, and forwarders. Investments in automated and intelligent forestry technologies bolster this demand even more.

Focus on Equipment Longevity and Operational Efficiency

Lubricants that prolong equipment lifespan, minimize wear and tear, and save maintenance costs are becoming increasingly important to forestry companies, particularly in remote and difficult terrain. Lubricants are essential for minimizing overheating, corrosion, and friction, which guarantees that machinery runs as efficiently as possible. Long-drain interval lubricants provide financial benefits for equipment that is frequently exposed to harsh weather conditions and mechanical loads. Additionally, this lowers labor expenses related to regular replacements and maintenance.

Restraints

Limited Availability in Remote Forestry Locations

Forestry operations are typically located in remote and hard-to-access areas, where supply chains for specialty lubricants may be weak or inconsistent. Delays in lubricant supply can lower operational efficiency and interfere with machinery uptime. Adoption is also limited by the logistical difficulties of storing and transporting lubricants in severe weather. This is especially problematic in areas where infrastructure is lacking. The absence of regional distribution centers and qualified technical support staff increases costs and downtime. As a result, many operators would rather hoard or opt for readily available but ineffective substitutes.

Performance Limitations in Extreme Conditions

Certain bio-based lubricants might not work well in high-pressure or extremely hot environments where conventional lubricants have proven resilient. Eco-friendly options, stability, viscosity, and oxidation resistance can be put to the test by the severe mechanical loads that forestry equipment frequently experiences. Users might switch back to synthetic or mineral-based lubricants if these don't meet the durability requirements needed in the field. Some bio lubricants have shorter shelf lives, and water sensitivity continues to raise concerns. Environmental benefits notwithstanding, their adoption is still constrained by this performance scepticism.

Opportunities

Integration with Smart Forestry Equipment

The rise of automation, Internet of Things, and AI in forestry machinery is creating opportunities for advanced, high-performance lubricants. Advanced lubricants that work in tandem with sensors can notify operators about lubricant levels or replacement needs. This opens premium segments where digital integration and data-driven maintenance are key value additions.

Support from Green Certifications and Incentives

Forestry businesses that use eco-friendly lubricants can obtain green certifications such as ISO 14001, PEFC, or FSC. Their public image is enhanced, and their access to global forestry lubricants markets with eco-label requirements is increased thanks to these certifications. Furthermore, tax breaks and subsidies for sustainable inputs provided in some areas can increase lubricant sales among companies that care about the environment.

Product Type Insights

Why did the hydraulic fluids segment dominate the forestry lubricants market in 2024?

The hydraulic fluids segment dominated the forestry lubricants market with the largest share in 2024, as they play a vital part in driving heavy-duty forestry equipment like loaders, harvesters, and skidders. Because these machines move, lift, and cut using a hydraulic system's fluid reliability is crucial. Superior thermal stability, anti-wear qualities, and moisture resistance make hydraulic lubricants perfect for challenging and isolated forestry settings. They are the first option for reliable machine operation due to their high viscosity index and oxidation stability. Their extensive availability in the aftermarket and frequent maintenance requirements further reinforce their dominance.

The biodegradable lubricants segment is expected to grow at the fastest rate as sustainability gains prominence and environmental regulations become more stringent. These lubricants are perfect for use in forestry areas that are environmentally sensitive because they reduce contamination of the soil and water. Their use is growing in North America and Europe because of stringent eco-labeling regulations and increased demand for low-toxicity substitutes for commercial and public forestry operations.

Base Oil Type Insights

How does the mineral oil-based segment dominate the forestry lubricants market in 2024?

The mineral oil-based segment dominated the market while holding the largest share in 2024 due to the widespread availability, low cost, and demonstrated effectiveness of mineral oil-based lubricants. These lubricants are well known in the field and provide superior viscosity resistance to oxidation and shelf life in mild circumstances. Since they are affordable and work with older equipment, many forestry contractors still rely on them. The service technicians' familiarity with them, their established supply chain, and their local availability all contribute to their continued use. Additionally, they provide reasonable performance in less demanding circumstances, which is ideal for smaller or more cost-conscious operations.

The bio-based oil segment is likely to grow at the fastest CAGR in the coming years as it complements the worldwide movement toward sustainable practices. These oils have a lower environmental impact when equipment is operating because they are biodegradable and come from renewable sources like vegetables and animal fats. Adoption is anticipated to quicken as ongoing formulation improvements increase their load-bearing capacity and thermal stability. Government incentives and growing use in eco-certified forestry projects also contribute to segmental growth.

Machinery Type Insights

What made harvesters the dominant segment in the market in 2024?

The harvesters segment dominated the forestry lubricants market in 2024 due to their extensive use in automated logging and tree-cutting operations. These devices need constant lubrication for their engines, hydraulic systems, and saw attachments because they work nonstop in difficult environments. In comparison to other machines, they require more lubricants per unit due to their heavy-duty operations and complexity. Logging contractors place a high premium on preserving harvester efficiency because of their crucial role in contemporary forestry. Unplanned equipment downtime is decreased, and continuous operations are guaranteed with routine lubrication.

The chainsaws segment is expected to grow at the highest CAGR over the projection period. This is mainly due to the increasing use of chainsaws in activities such as tree felling, bucking, limbing, pruning, and harvesting of firewood. The demand for bar and chain oils is increasing, particularly in emerging markets, due to their affordability, portability, and expanding use in both commercial and personal forestry. Rural homes, fire departments, and independent contractors all frequently use chainsaws. Short oil life cycles and frequent lubrication requirements are the main causes of recurrent lubricant purchases.

Application Insights

Why did the hydraulic systems segment dominate the forestry lubricants market in 2024

The hydraulic systems segment dominated the market in 2024 because they are essential in the operation of several forestry machinery, such as arms, lifting equipment, and cutting tools. In these systems, effective lubrication guarantees seamless operation, minimizes energy losses, and lessens equipment wear because hydraulics are used by almost all large-scale forestry equipment. This application area continues to use the most lubricant. Failure of hydraulic fluids can result in significant equipment damage and downtime, necessitating planned maintenance and fluid replacement. As a result, OEM and aftermarket channels see consistent demand.

The chains & bars segment is likely to expand at the fastest CAGR during the forecast period because chainsaws and portable cutting tools are becoming increasingly popular. Regular lubrication is necessary for these parts to guarantee clean cuts, minimize friction, and stop chain wear. The quick rise of this market is also being aided by expansion in thinning operations, wildfire control, and residential forestry. High purchase frequency is the result of low volume per use and frequent replacement cycles. Manufacturers are also developing specialized formulas for chains to improve stickiness and temperature resistance.

End Use Insights

How does the logging contractors segment dominate the forestry lubricants market in 2024?

The logging contractors segment dominated the market in 2024 because they oversee extensive ongoing forestry operations that require substantial amounts of lubricants. They are large users of hydraulic oils, engine lubricants, and specialty fluids due to their fleets of large machinery and reliance on operational uptime. Long-term lubricant demand is also supported by their maintenance habits and purchasing power. Long-term supply agreements with lubricant suppliers and internal maintenance facilities are common. Their emphasis on machinery performance and cost effectiveness makes lubrication an essential component of their business operations.

The sawmills & processing plants segment is expected to grow at the highest CAGR in the coming years as both developed and emerging economies see an increase in value-added wood processing. These facilities use specialized equipment that needs industrial lubricants, such as sorters, conveyors, and Debarkers. Growth in this market is also being fueled by the push for domestic wood processing to reduce raw timber exports. Sawmill automation and longer workdays necessitate regulated lubrication for efficiency. There is an increasing need for plant-grade lubricants as processing becomes more regional.

Sales Channel Insights

What made aftermarket the dominant segment in the forestry lubricants market?

The aftermarket segment dominated the market because most forestry operators prefer purchasing lubricants separately from equipment purchases, frequent oil changes, field-based maintenance, and unplanned servicing drive demand through distributors, dealers, and service networks. The availability of a wide range of brands and formulations also favors aftermarket channels. Trusted relationships with local dealers and flexible order sizes make aftermarket channels convenient. Many buyers also benefit from promotional discounts and bundled service packages.

The online B2B platforms segment is likely to expand at the fastest rate over the projection period due to the rise of e-commerce. To order lubricants in bulk, compare prices, and ensure delivery on time, forestry companies are increasingly using e-commerce platforms. Additionally, online platforms make purchasing more efficient by giving small operators access to technical datasheets, certifications, and information. B2B platforms are using multilingual interfaces and mobile apps to reach a wider audience. AI-powered reordering platforms and subscription models are increasing supply chain predictability.

Environmental Compliance Insights

Why did the non-ELA segment dominate the market in 2024?

The non-EAL (standard industrial grades) dominated the forestry lubricants market in 2024, as non-EAL lubricants have been the norm in forestry operations for a long time and are still chosen in areas with lax environmental regulations. The cost of equipment compatibility and unpredictable field performance of the newer bio lubricants are the main reasons why many operators are reluctant to switch. Non-EAL oils have a comfort advantage due to their long shelf-life, widespread familiarity, and local availability. Retraining and processing modifications are also necessary when moving away from these, which shows the transitions.

The EAL (environmentally acceptable lubricants) complaint segment is expected to grow at the fastest rate, as international and regional policies increasingly demand environmentally safe alternatives. With regulatory bodies like the EPA and EU enforcing the use of biodegradable lubricants in sensitive zones, adoption is rising. Forestry certifications and sustainability mandates are further accelerating this trend. OEMs are also beginning to recommend EALs for new equipment lines, which supports growth, improves performance, and decreases cost gaps, thereby enhancing their market appeal.

Forestry Lubricants MarketCompanies

- Shell Plc

- ExxonMobil Corporation

- Chevron Corporation

- TotalEnergies SE

- BP Plc (Castrol)

- Fuchs Petrolub SE

- Klüber Lubrication

- Valvoline Inc.

- Petro-Canada Lubricants (HollyFrontier)

- Phillips 66 Lubricants

- Sinopec Lubricants

- Idemitsu Kosan Co., Ltd.

- Quaker Houghton

- Eni S.p.A.

- LUKOIL Lubricants Company

- Repsol S.A.

- Renewable Lubricants, Inc.

- PANOLIN AG

- RSC Bio Solutions

- ADDINOL Lube Oil GmbH

Recent Developments

- On 28 August 2024, EnviOn Oy launched Lube-En, a fully biodegradable synthetic lubricant for chainsaw and harvester use.

(Source: https://biomonitor.eu) - In July 2024, TYGRIS announced the launch of its ONOS line, the company's first-ever range of biodegradable lubricants. This innovative development marks a significant milestone in TYGRIS' commitment to sustainability and signifies a major leap forward for the industrial lubrication industry.(Source: https://industrial-now.net)

Segments Covered in the Report

By Product Type

- Engine Oils

- Hydraulic Fluids

- Chain Oils

- Transmission Fluids

- Gear Oils

- Greases

- Compressor Oils

- Biodegradable Lubricants

By Base Oil Type

- Mineral Oil-Based

- Synthetic Oil-Based

- Bio-Based Oil

By Machinery Type

- Harvesters

- Skidders

- Forwarders

- Feller Bunchers

- Chainsaws

- Loaders & Dozers

- Sawmill Machinery

By Application

- Engine Components

- Hydraulic Systems

- Chains & Bars

- Gear Assemblies

- Bearings & Joints

- Processing Units (Sawmills)

By End-Use Segment

- Logging Contractors

- Forest Product Manufacturers

- Timber Harvesting Companies

- Government Forestry Operations

- Sawmills & Processing Plants

By Sales Channel

- OEMs (Original Equipment Manufacturers)

- Aftermarket (Distributors & Retailers)

- Online B2B Platforms

- Direct Supply Contracts

By Environmental Compliance

- EAL (Environmentally Acceptable Lubricants) Compliant

- Non-EAL (Standard Industrial Grades)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting