Open Gear Lubricants Market Size and Forecast 2025 to 2034

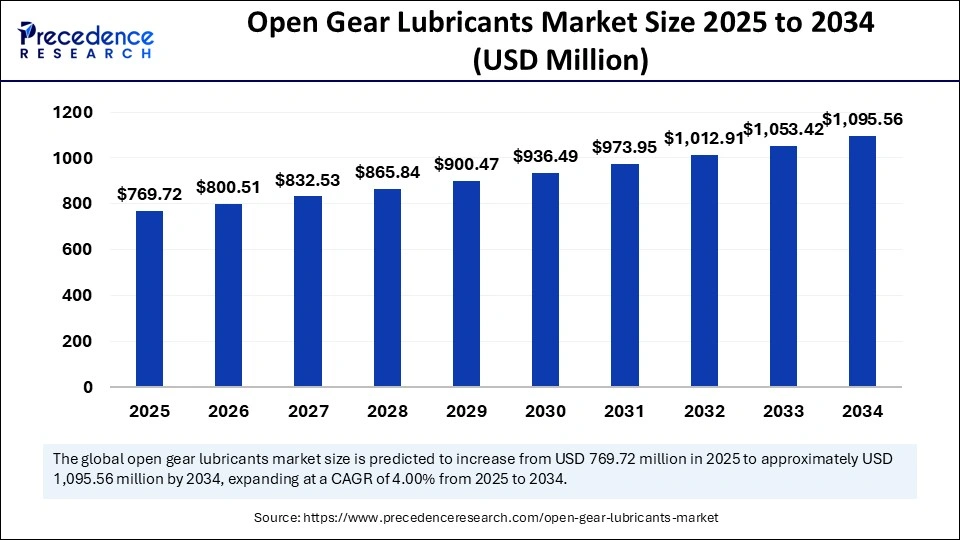

The global open gear lubricants market size accounted for USD 740.12 million in 2024 and is predicted to increase from USD 769.72 million in 2025 to approximately USD 1,095.56 million by 2034, expanding at a CAGR of 4.00% from 2025 to 2034. The increased demand for high-performance lubricants in various industries like mining, power generation, construction, and manufacturing is driving the global market. Rapid growth in infrastructure developments is driving demand for lubricants, leading to the expansion of the market.

Open Gear Lubricants Market Key Takeaways

- Asia Pacific dominated the global open gear lubricants market with the highest share in 2024.

- The Latin American market is estimated to grow at the fastest CAGR between 2025 and 2034.

- By base oil, the mineral oil segment accounted for the largest market share in 2024.

- By base oil, the synthetic oil segment is anticipated to witness the fastest growth over the forecast period.

- By end-use industry, the power generation segment captured the largest market share in 2024.

- By end-use industry, the mining segment is anticipated to show the fastest growth during the predicted timeframe.

Artificial Intelligence (AI) is Revolutionizing Open Gear Lubricant Developments and Performance

Implementation of Artificial Intelligence in the development of the open gear lubricants market is a significant approach in improving development and application. AI-enabled predictive maintenance helps industrial companies optimize lubricant use and helps to improve equipment lifespan. AI enables the development of more efficient and tailored lubricants by providing predictive analysis on formulation performance. AI helps to develop new lubricant formulations with enhanced properties, including environmental sustainability. The innovative digital twin can help with more accurate selection and optimization of lubricants according to equipment behaviour. AI is transforming the supply chain optimization field by offering streamlined production, distribution, and management, making it easier to meet increased industrial needs.

Market Overviews

The open gear lubricants market has experienced transformative growth due to increased demand for high-performance lubricants in industrial applications like cement, construction, mining, oil and gas, manufacturing, and automotive. The rising urbanization and infrastructure developments are increasing the adoption of open gear lubricants. Additionally, government initiatives in infrastructure development further enable access to high-performance and effective lubricants. Rapid urbanization and increasing population have led to high consumption of energy, contributing to expanding power generation projects and driving the adoption of open gear lubricants.

Rising availability of disposable income is contributing to the market expansion. Asia Pacific is a major player in market growth, driven by the region's rapid industrialization, urbanization, and infrastructure developments. The market is expected to witness significant innovative approaches in lubricant developments, driven by the rising demand for eco-friendly and more effective lubricants. Ongoing developments of high-performance lubricants for heavy-duty equipment are a major trend in market growth.

Open Gear Lubricants Market Growth Factors

- Industrial application: The rapid expansion of industries like automotive, construction, oil and gas, mining, and manufacturing is driving demand for open gear lubricants to enhance efficiency and cost-effectiveness.

- Demand for heavy-duty lubricants: Industries mostly use heavy machinery, which drives the need for heavy-duty lubricants to operate in extreme conditions and for gear protection.

- Environmental concern: The surge in sustainability has shifted demand for eco-friendly lubricants. Companies are investing heavily in biodegradable and low-toxicity lubricants, creating market competition.

- Government initiatives: Governments worldwide have increased investments in infrastructure developments, driving demand for high-performance lubricants in the open gear lubricants market.

- Advanced lubricant formulations: Technological advancements, such as advancements in lubricant formulations to improve compositions for better wear protection, increase load-bearing capacity, and lower friction, contribute to the rising adoption of lubricants in various industries.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,095.56 Million |

| Market Size in 2025 | USD 769.72 Million |

| Market Size in 2024 | USD 740.12 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.00% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Latin America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Base Oil, End-use Industry and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Industrial demand

The demand for open gear lubricants market is high in industrial applications, including mining, power generation, cement, steel, construction, and manufacturing sectors. The power generation industry uses open gear lubricants to optimize performance and durability. Heavy machinery used in the construction and mining sectors requires high-quality and high-performance lubricants to enhance efficiency, wear and tear resistance, and friction reduction, and efficiency. Similarly, other sectors drive the adoption of open gear lubricants to enhance the efficiency and lifespan of equipment. Growth in industrialization and infrastructure developments, fueled by government initiatives and investments, is driving the adoption of specialized industrial lubricants.

Restraint

Regulatory compliance

The regulatory compliance regarding the environmental impact of lubricants is increasing production costs. Manufacturers face complexity issues in formulation to meet regulatory standards. The regulatory demand for eco-friendly lubricants is hampering raw material supply chain management, leading to affected production and material availability. Stringent environmental regulations are pressuring manufacturers to reduce environmental impacts caused by lubricants, leading to increased development and production cost challenges for manufacturing companies. However, several industries are investing heavily in innovation and development of biodegradable and low-toxic lubricants, which will help to comply with environmental regulatory standards.

Opportunity

Surge in the development of eco-friendly lubricants

The rising concern of sustainability and environmental impacts has shifted toward demand for sustainable lubricants in the open gear lubricants market. Industries are the prior adopters of lubricants. Stringent regulatory requirements and investments in research and development encourage industries to adopt sustainable solutions. Industries are reflecting their commitment to net-zero emissions by adopting eco-friendly lubricants to minimize ecological impact and maintain equipment performance and quality. The ongoing surge of key vendors in the development of bio-based and synthetic lubricants provides a spectacular opportunity for market expansion.

Base Oil Insights

The mineral oil segment accounted for the largest open gear lubricants market share in 2024, driven by high availability and cost-effectiveness. Mineral oils are less expensive compared to other oils. Industries including automotive and power generation prefer mineral oils due to their advanced performance, such as low volatility, thermal stability, and high viscosity. Reliable and predictive performance of mineral oils makes them ideal for industrial applications.

The synthetic oil segment is anticipated to witness the fastest growth over the forecast period. Synthetic oils are highly adopted for industrial applications, including power generation, transportation, and manufacturing. Synthetic oil offers thermal stability, minimizes friction and wear, has a high viscosity index, and is biodegradable. Superior properties and environmental benefits have increased demand for synthetic oils.

- In March 2025, Shell Lubricants launched its Shell Advance Ultra with API SP, a newly upgraded full-synthetic lubricant. The premium motorcycle and scooter oil trusted by riders worldwide at the 2025 MotoGP in Thailand

End-Use Industry Insights

The power generation segment captured the largest open gear lubricants market share in 2024 due to increased demand for electricity globally. Lubricants maintain the performance and durability of gear systems in power plants and renewable energy systems. The shift toward renewable energy sources is driving the adoption of open gear lubricants. Power generation applications, especially in heavy-duty open gear system drives, demand high-performance lubricants with high load-bearing capacity, oxidation resistance, and long service life properties.

On the other hand, the mining segment is anticipated to show the fastest growth during the predicted timeframe. The demand for open gear lubricants is high in deep mining during high pressures and temperatures. The mining industry uses heavy machinery with open gearing, drives that require effective lubricants to ensure functioning, enhance resistance properties, reduce wear and tear, and improve lifespan. The rising mining operations in various regions have increased the adoption of high-performance lubricants.

Regional Insights

Expanding Industrial Infrastructure Fuelling the Asian Market

Asia Pacific is the hub for the construction and mining industries. Rapid growth of industries, including construction, machinery, cement, and mining production, is driving demand for open gear lubricants in Asia. Rapid industrialization and urbanization have led to increased demand for power generation. Additionally, rising infrastructure developments are expanding the adoption of open gear lubricants in the region. The demand for automotive is expected to be robust in the Asian open gear lubricants market in the forecast period.

China is a Major Player in the Open Gear Lubricant Market

China is the major player in the regional open gear lubricants market, growth driven by rapid infrastructure advancements, including power plants, mining, and construction projects. Stringent emission regulations in China have increased demand for high-performance lubricants. The robust automotive industry further contributes to high demand for lubricants to meet the requirements of modern vehicles. A growing economy is contributing to advancing manufacturing and the adoption of high-performance lubricants.

‘Make in India' Initiatives are Driving Demand for Open Gear Lubricants in India

Indian government initiatives like ‘Make in India' encourage the expansion of manufacturing industries. Expanding industrialization in the country is driving the adoption of open gear lubricants. Rapid urbanization, increased population, and infrastructure developments have increased power consumption and demand for mining and construction, driving the need for high-performance lubricants. The shift toward sustainability and efficient lubricants is contributing to market expansion.

- In May 2024, Klüber Lubrication, a global expert in specialty lubricants, announced an expansion of. Klüber India's manufacturing plant in Mysore is spread over 17,000 sq. m at present and produces world-class specialty lubricants, set to begin in 2027. The company has invested INR 142 crores to reiterate its commitment to "Make in India" by increasing domestic production.

Heavy Duty Manufacturing Industry in Latin America

The Latin American open gear lubricants market is estimated to grow at the fastest CAGR between 2025 and 2034, driven by increasing industrial activities. The strong presence of industries like mining, power generation, and manufacturing in the country is driving demand for open gear lubricants. Additionally, government initiatives in infrastructure development and industrialization support are fueling market expansion.

Brazil's Large Mining, Oil and Gas, and Infrastructure Sectors are Set to Boost the Market

Brazil is projected to contribute significant growth in the regional market due to increased demand for construction, automotive, and power generation. The presence of a significant mining industry in the country is driving demand for open gear lubricants. Additionally, high utilization of heavy-duty equipment in mines contributes to the need for high-performance lubricants.

Open Gear Lubricants Market Companies

- Kluber Lubrications

- Carl Bechem GmbH

- FUCHS SE

- Exxon Mobil Corporation

- Chevron Corporation

- BP P.L.C.

- CWS Industrials, Inc.

- Shell plc

- TotalEnergies SE

- Petron Corporation

- Specialty Lubricants Corporation

Recent Developments

- In January 2025, the FUCHS Group acquired Boss Lubricants GmbH and Co. KG, the German lubricants company, which develops, produces, and distributes lubricants that are used in medical technology, safety technology, metalworking, and mechanical engineering, among other things.

- In December 2024, Gear Energy Ltd. announced entering into an arrangement agreement under which a large publicly traded company will acquire Gear, including its heavy oil assets, for USD 110 million in cash. According to the agreement, Gear will transfer its Central Alberta assets, Southeast Saskatchewan assets, and Tucker Lake property to a newly formed entity.

- In November 2024, Valvoline Extended Protection Full Synthetic Gear Oil, the brand's first-ever super premium full synthetic gear oil, hit the market. Valvoline announced the new product offers four times better gear wear protection when compared to Valvoline Daily Protection Gear Oil.

- In April 2024, FUCHS SE acquired the LUBCON Group, a German-based manufacturer of high-performance specialty lubricants, including open gear lubricants, to expand FUCHS's product portfolio and global competitiveness in the specialty lubrication sector.

Segment Covered in the Report

By Base Oil

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

By End-use Industry

- Mining

- Cement

- Construction

- Power Generation

- Oil and Gas

- Marine

By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting