Fortified Dairy Products Market Size and Forecast 2025 to 2034

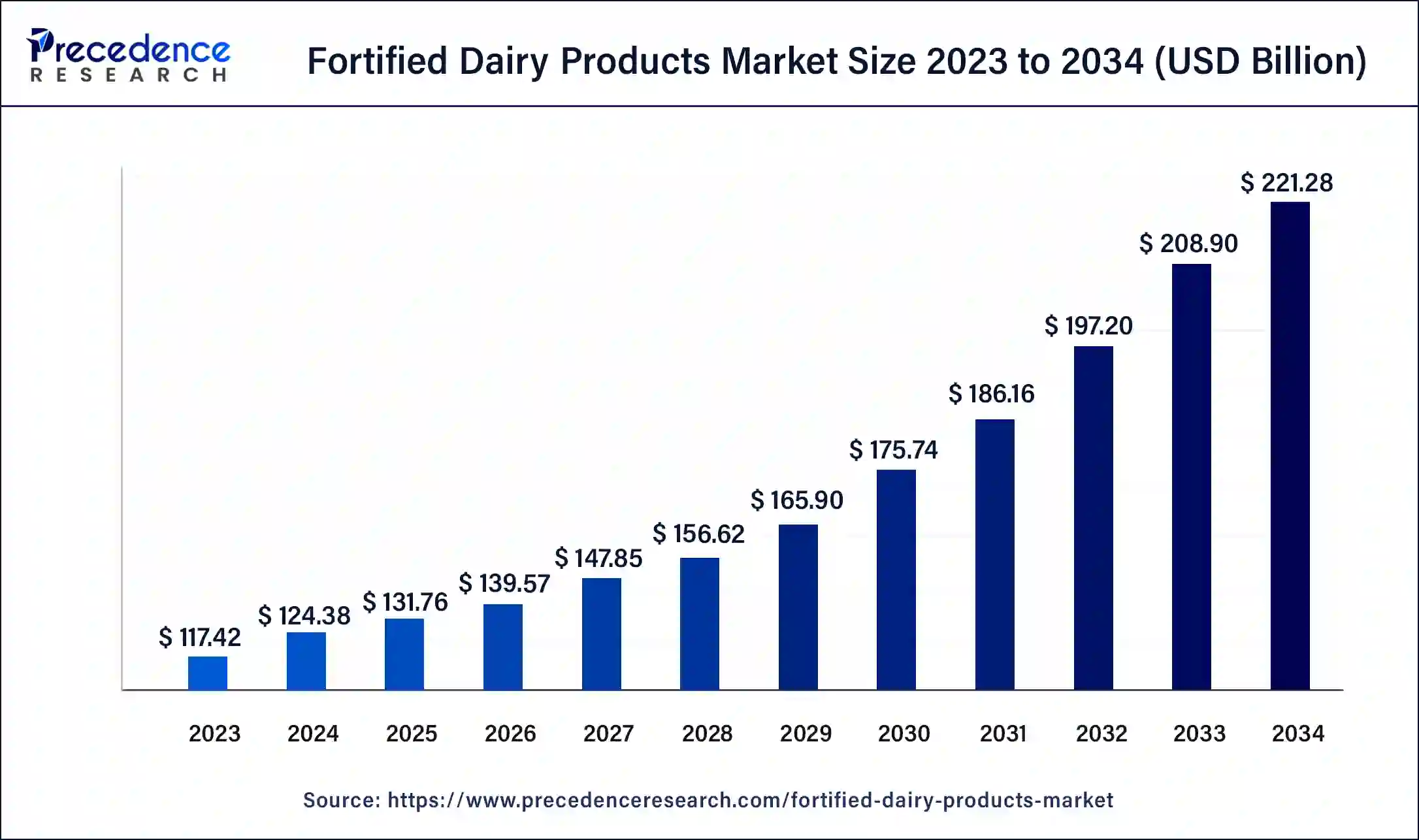

The global fortified dairy products market size was evaluated at USD 124.38 billion in 2024 and is anticipated to reach around USD 221.28 billion by 2034, growing at a CAGR of 5.93% over the forecast period 2025 to 2034. The growing health awareness and nutritional deficiencies are the key factors driving the fortified dairy products market growth.

Fortified Dairy Products Market Key Takeaways

- The global fortified dairy products market was valued at USD 124.38 billion in 2024.

- It is projected to reach USD 221.28 billion by 2034.

- The fortified dairy products market is expected to grow at a CAGR of 5.93% from 2025 to 2034.

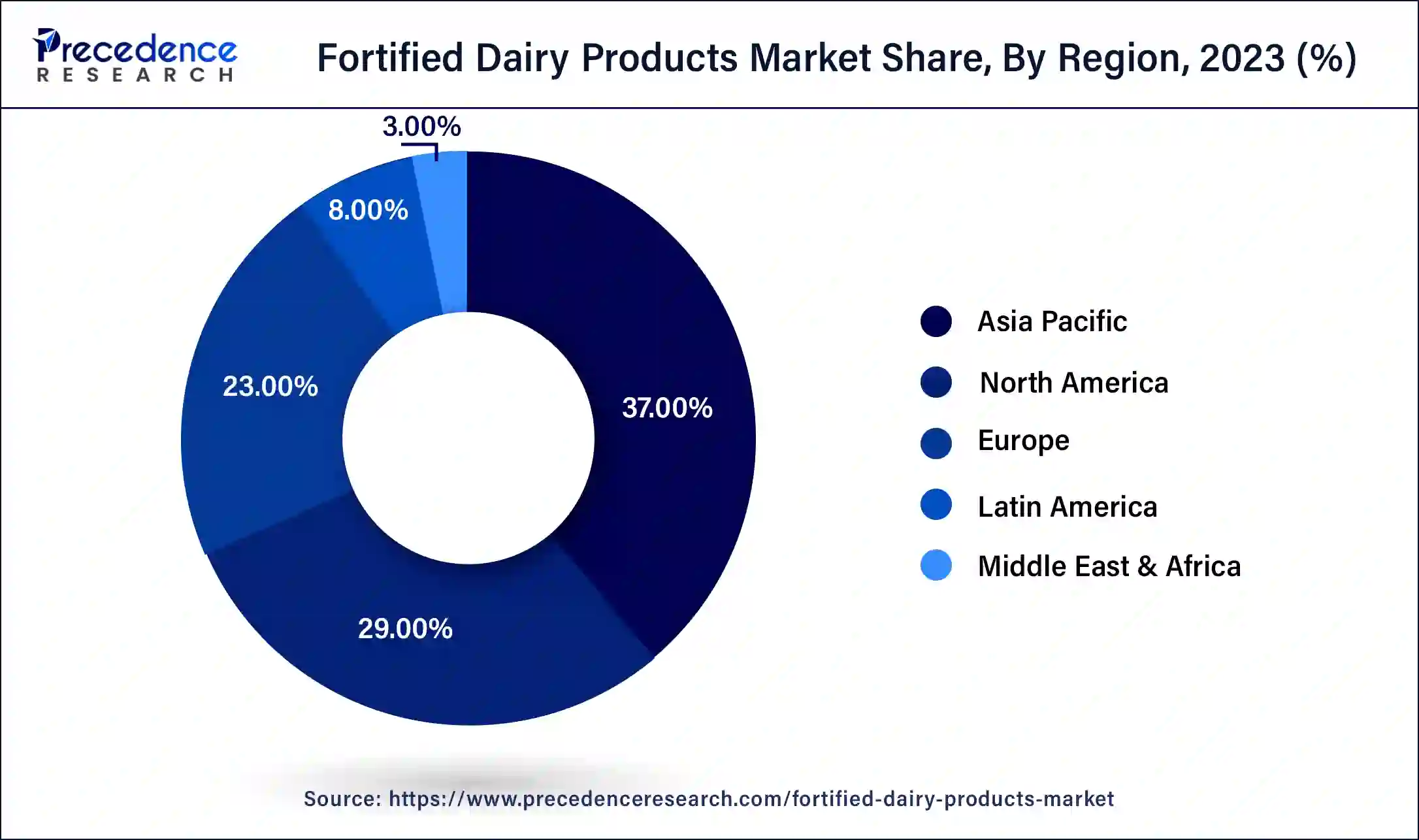

- Asia Pacific dominated the fortified dairy products market with the largest market share of 37% in 2024.

- By product, the milk segment generated the biggest market share of 42% in 2024.

- By product, the ice cream segment is anticipated to grow at the fastest CAGR of 6.82% over the forecast period.

- By ingredient, the vitamin segment captured more than 32% of market share in 2024.

- By ingredient, the protein segment is expected to grow at a remarkable CAGR of 6.92% during the forecast period.

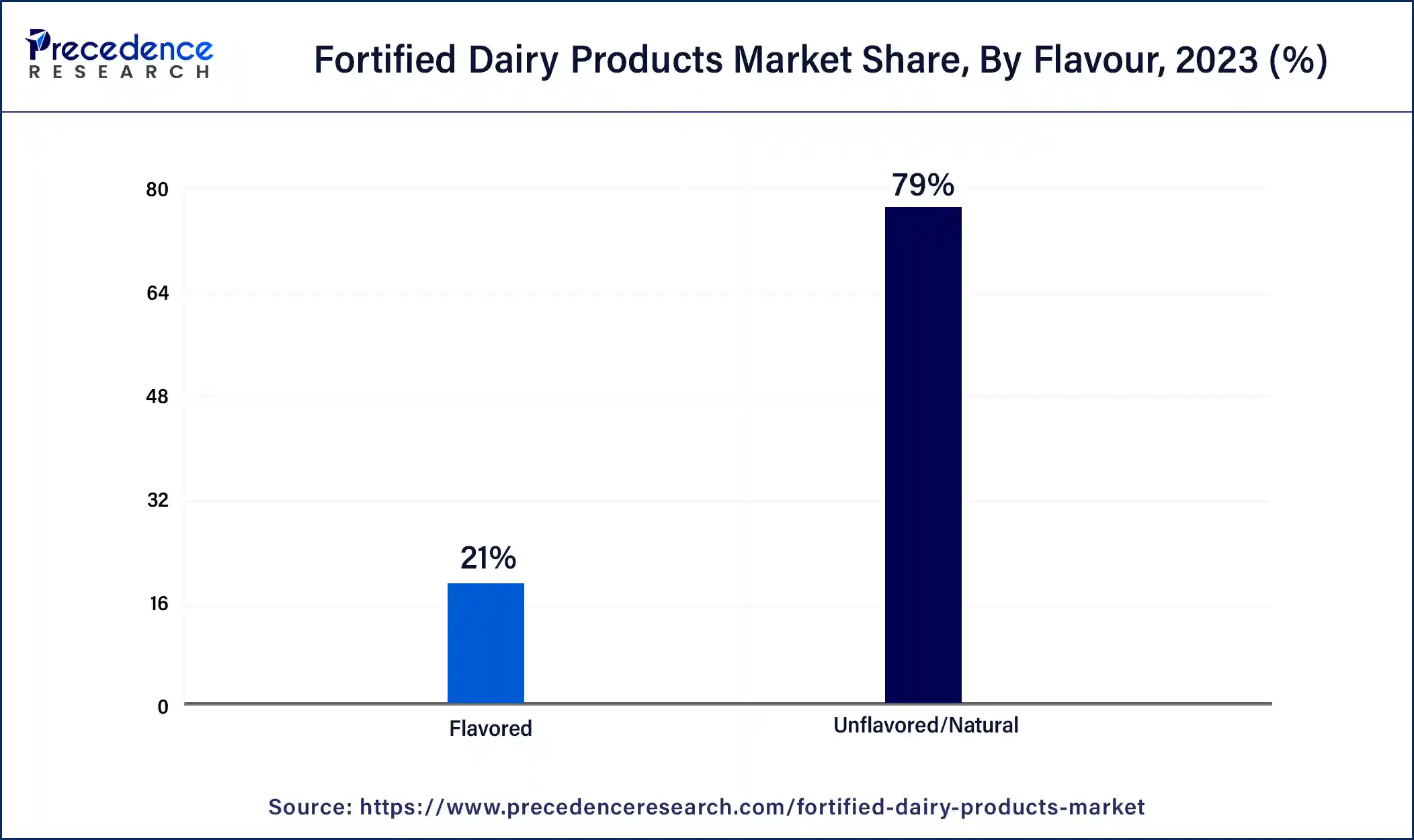

- By flavour, the unflavoured/natural segment contributed the highest market share of 79% in 2024.

- By flavour, the flavoured segment is expected to grow at the fastest rate in the market during the projected period.

- By distribution channel, the hypermarkets & supermarkets segment has recorded the major market share of 38% in 2024.

- By distribution channel, the online segment is registering a solid CAGR of 7.32% over the forecast period.

How is AI Changing the Fortified Dairy Products Market?

There are many applications of AI in the fortified dairy products market, including drones, robots, 3D printing, virtual reality, and artificial neural networks (ANN). The dairy industry utilizes AI robots for different applications to enhance effectiveness and reduce the production cost. Furthermore, as per certain researchers, productivity in the food industry can be increased by up to 25% by using robots instead of human chains. The application of AI in the dairy industry can change the whole dairy sector in upcoming years.

- In December 2023, eVerse.AI, which is a leading technology company operating in the Dairy, Agriculture, and Sustainability space, launched CowGPT. It is the world's first Generative AI application that was purpose-built for this space. Generative AI has been creating a lot of buzz in the industry for a year or so, and it has already started transforming several industries at a rapid pace.

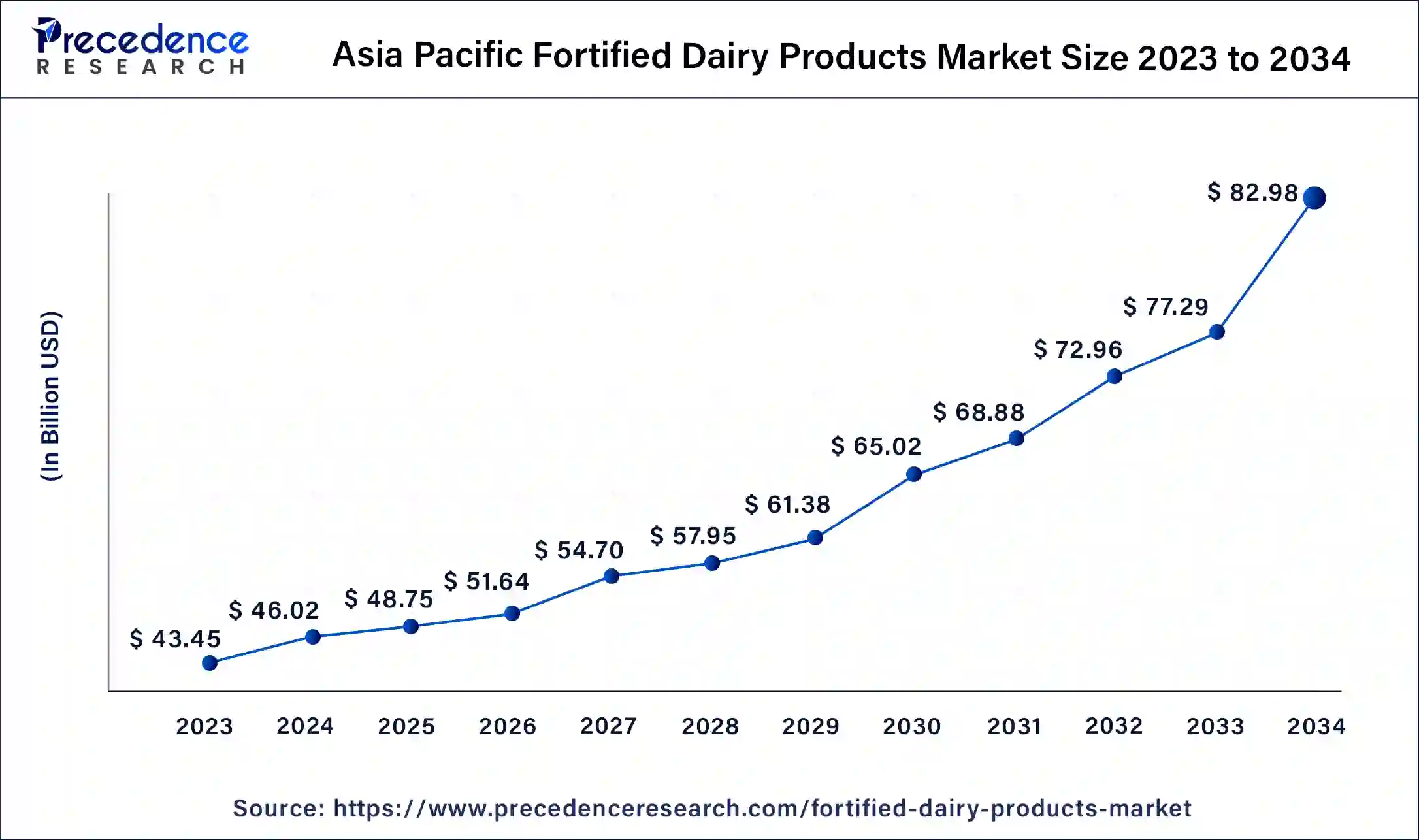

Asia Pacific Fortified Dairy Products Market Size and Growth 2025 to 2034

The Asia Pacific fortified dairy products market size was exhibited at USD 46.02 billion in 2024 and is projected to cross around USD 82.98 billion by 2034, poised to grow at a CAGR of 6.07% from 2025 to 2034.

Asia Pacific dominated the fortified dairy products market in 2024. The dominance of the region can be attributed to the rising concerns about nutrient deficiencies, particularly in developing nations, which are enabling consumers to seek out fortified methods for key vitamins and minerals. Furthermore, changing dietary patterns also leads to a higher consumption of dairy products. Advancements in product formulations and flavors can make fortified dairy more appealing.

- In November 2023, Nestlé announced the development of N3 milk in China, made from cow's milk with added prebiotic fibers and lower lactose content, resulting in over 15% fewer calories. Using proprietary technology, Nestlé has enhanced the milk's nutritional profile to support gut health.

Europe is expected to show the fastest growth in the fortified dairy products market over the studied period. This is because the European market benefits from efficient retail networks involving health food stores and supermarkets, which provide good access to an extensive range of fortified dairy products. Moreover, strict regulatory standards, along with diverse consumer preferences, make fortified dairy more appealing in the region.

Market Overview

Fortified dairy products are the kind of dairy products that are rich with micronutrients like minerals and vitamins that are lacking in consumers of different age groups. Because of its various applications and strong nutritional value milk is the most consumed dairy product across the globe. Many diseases can be cured by consuming fortified milk such as night blindness, anaemia, osteoporosis, and exophthalmia.

Top 10 Countries by Milk Production (2022)

| Country | Milk Production in Tonnes |

| India | 213,779,230 |

| United States | 102,747,320 |

| Pakistan | 62,557,950 |

| China | 39,914,930 |

| Brazil | 35,944,056 |

| Germany | 33,188,890 |

| Russia | 32,977,956 |

| France | 25,028,850 |

| Turkey | 21,563,492 |

| New Zealand | 21,051,000 |

Fortified Dairy Products Market Growth Factors

- The rise in purchasing power of the middle-class population can fuel market growth further.

- Technological advancements in the food and beverages industry are expected to boost market growth shortly.

- Increasing research and development activities can propel market growth over the forecast period.

- Growing awareness about malnourishment among kids will likely contribute to market expansion further.

- Growing modernization in the new products offered can contribute to the market expansion shortly.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 221.28 Billion |

| Market Size in 2025 | USD 131.76 Billion |

| Market Size in 2024 | USD 124.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.93% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Ingredient, Flavour, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Expansion of probiotic-fortified dairy products

The probiotic-fortified dairy products market is experiencing strong growth as the link between gut health and the normal well-being of an individual. Additionally, rising consumer interest in probiotics is fueled by scientific research underscoring the advantages of a healthy gut microbiome, which include better digestion, enhanced immunity, and potential mental health benefits. These advancements are making probiotic-fortified yogurts more appealing and effective.

- In March 2023, DFA launched its ‘first-ever' probiotics-fortified UHT milk as an affordable alternative to kefir, kombucha. Dairy Farmers of America (DFA) believes the product, developed alongside Good Culture, is the first lactose-free, long-life fluid milk on the U.S. market to combine the nutritional benefits of dairy with microbiome-boosting probiotics.

Restraint

High cost and lactose intolerance

The cost of fortified dairy products market products is generally higher than regular dairy products, which can be a significant challenge for the global market. Additionally, there is an increasing prevalence of lactose intolerance among young adults.

Opportunity

Rising demand for vitamin-fortified dairy products

The demand for vitamin-fortified dairy products is experiencing a notable surge in the fortified dairy products market as consumers become more aware of their nutritional intake. Vitamin fortification solves deficiencies common in a variety of populations. Furthermore, Fortified milk is a main product in this category, providing improved levels of these important vitamins.

- In June 2023, Karimnagar Dairy launched fortified milk with vitamins A and D. As per Food Safety and Standards Authority of India (FSSAI) standards, Karimnagar Dairy has fortified all its milk varieties with Vitamin A and D, an excellent way to get micronutrients and a great way to meet nutritional needs of all age groups.

Product Insights

The milk segment dominated the fortified dairy products market in 2024. The dominance of the segment can be attributed to the rising health consciousness among most consumers, along with the added nutritional benefits of fortified milk, such as minerals and vitamins. Moreover, Health issues like vitamin D deficiencies and osteoporosis are becoming more prevalent, enabling consumers to look for more safe dietary options.

The ice cream segment is anticipated to grow at the fastest rate in the fortified dairy products market over the forecast period. This is because consumers are seeking indulgent treats that provide nutritional benefits like minerals, vitamins, and probiotics, which is fueling the segment's growth further. Furthermore, Innovations in food technology can be able to make fortified ice cream by maintaining its original taste and texture.

- In June 2024, The Brooklyn Creamery launched a range of protein ice cream bars in its domestic market and the UAE, where it is leveraging its partnership with a quick-commerce platform to meet growing consumer demand for protein-rich desserts.

Ingredient Insights

The vitamin segment led the global fortified dairy products market 2024. The segment's growth can be linked to increasing consumer awareness about nutrition and health. Consumers are also seeking products that offer key health benefits, such as items fortified with vitamins A, B12, and D, which are necessary for bone health and immune function.

The protein segment is expected to grow at the fastest rate in the fortified dairy products market during the forecast period. This is due to increasing health awareness and the popularity of high-protein diets, such as paleo and keto, which are propelling consumers to find protein-enriched dairy products. Also, people are becoming more aware of protein's benefits for muscle growth and overall health management. Athletes and fitness freaks also seek protein-fortified dairy products for performance enhancement.

- In July 2024, Ripple Foods just launched ‘Shake Ups,' a new range of plant-based protein shakes for children and young people. The California-based vegan dairy company described its product as the ‘first and only' kids' protein shake designed to tackle hunger with 13g of pea protein and 3g of fiber per 12 oz carton. They are currently available in either ‘Chocolate' or ‘Viva Vanilla' flavors.

Flavor Insights

The unflavoured/natural segment dominated the fortified dairy products market in 2024. Unflavoured fortified dairy products give a versatile and pure base, which is needed for greater flexibility in meal preparation and cooking. Additionally, there is a growing demand for maintaining a natural diet, which enhances interest in dairy products with essential nutrients and natural flavors.

The flavoured segment is expected to grow at the fastest rate in the fortified dairy products market during the projected period. The growth of the segment can be linked to the rising consumer awareness regarding nutritional benefits and flavored taste experiences, boosting interest in products that combine key nutrients with various flavors. Furthermore, flavored fortified dairy products provide an efficient way to fuel nutrient intake without compromising on taste.

Distribution Channel Insights

The hypermarkets & supermarkets segment led the fortified dairy products market in 2024. The dominance of the segment is driven by the increasing foot traffic and wide reach of hypermarkets and supermarkets in urban cities. These stores often provide prominent marketing strategies that underscore the health benefits of fortified dairy products. These retail channels also offer a wide range of fortified dairy products, which makes it convenient for consumers to choose from and access various options.

The online segment will witness the fastest growth in the fortified dairy products market over the forecast period. This is because online shopping gives unparalleled convenience, allowing consumers to purchase and browse fortified dairy products from any location. However, the increase in subscription services, along with the direct-to-consumer models, further enhances customer convenience and loyalty.

Fortified Dairy Products Market Companies

- Dean Foods Company

- Nestle S.A

- BASF SE.

- China Modern Dairy Holdings Ltd.

- General Mills Inc.

- Arla Foods UK Plc.

- Danone

- CMMF Ltd.

- Fonterra Group Cooperative Ltd

- Bright Dairy & Foods Co.

Recent Developments

- In June 2024, Galaxy Foods, a Tanzanian producer of dairy and non-dairy products, introduced a new fortified yogurt branded ‘Kilimanjaro Fresh.' This yogurt is developed with the assistance of Arla Foods Ingredients for product innovation and incorporates value-enhancing ingredients supplied by Promaco.

- In January 2024, Yoplait launched Yoplait Protein, a dairy snack comprising 15g of protein and 3g of sugar per serving. The product combines ultra-filtered milk with traditional yogurt fermentation, ensuring a smooth texture without the sour taste often associated with high-protein yogurts.

- In May 2023, Aavin, a major state-run cooperative known for its large-scale production of pasteurized skimmed milk in India, launched a new fortified milk product in a purple sachet. Previously, Aavin offered its milk in green, orange, and blue sachets, each corresponding to different processing methods and price points.

Segments Covered in the Report

By Product

- Milk

- Yogurt

- Cheese

- Ice Cream

- Others

By Ingredient

- Vitamins

- Minerals

- Probiotics

- Omega-3 Fatty Acids

- Proteins

- Others

By Flavour

- Unflavored/Natural

- Flavored

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

References:

Fortified Dairy Products Market

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting