What is the Fusion Biopsy Market Size?

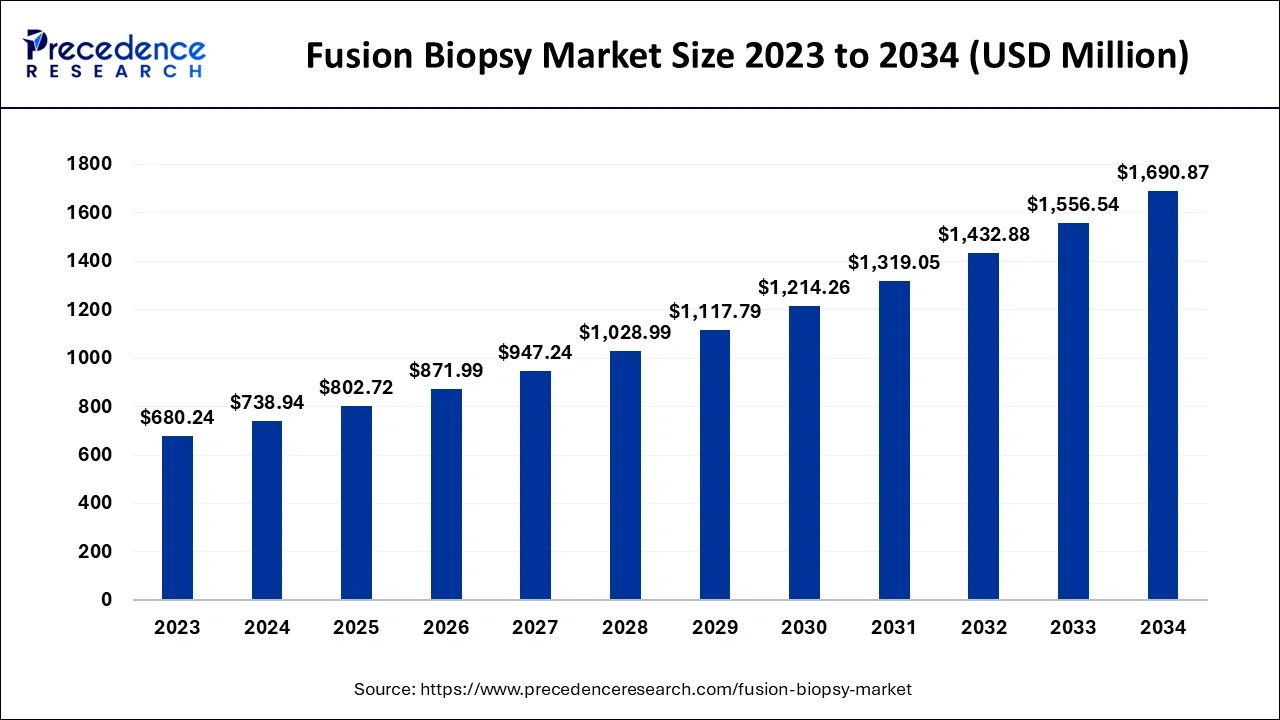

The global fusion biopsy market size was calculated at USD 356.8 million in 2025 and is anticipated to reach around USD 803.5 million by 2035, expanding at a CAGR of 8.6% from 2026 to 2035. The increasing incidence of prostate cancer worldwide is the key factor driving the fusion biopsy market growth. Advancements in molecular profiling, coupled with the development of technology, can fuel market growth further.

Fusion Biopsy Market Key Takeaways

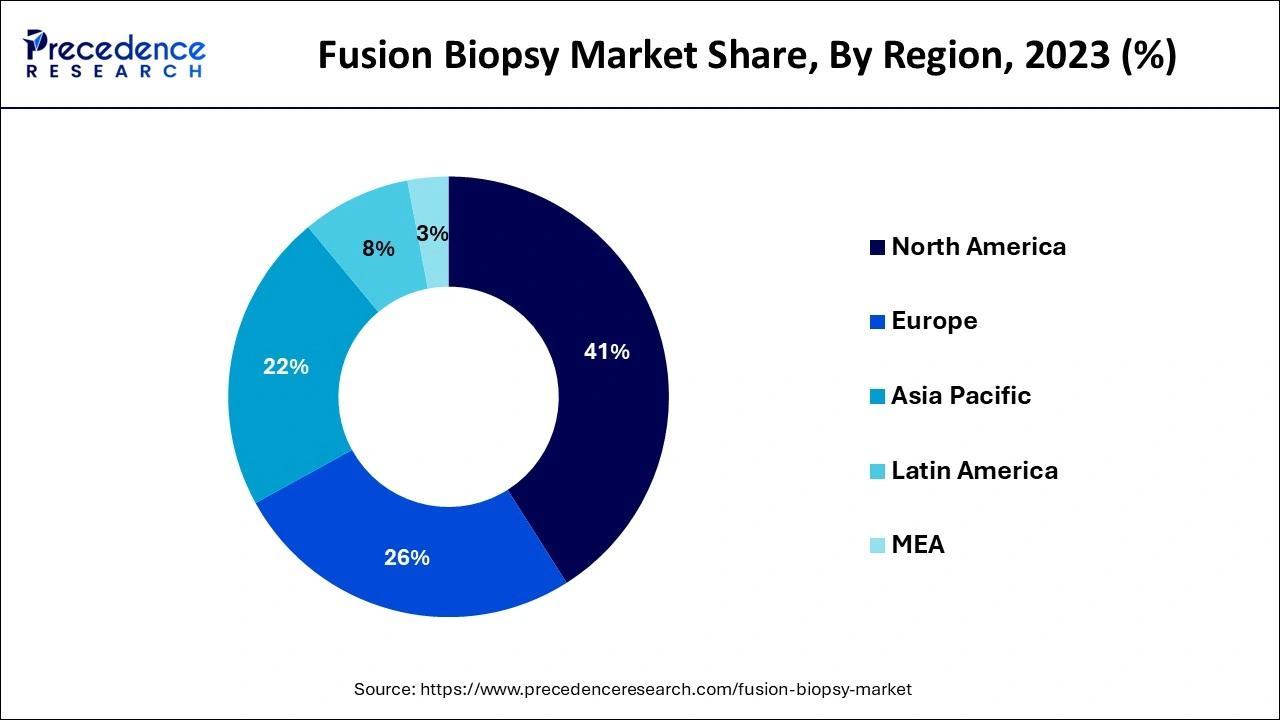

- North America dominated the global fusion biopsy Market with 41% of the market share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 22% between 2026 and 2035.

- By product type, the consumables and accessories segment generated the biggest market share in 2025.

- By product type, the software segment is expanding at the fastest CAGR between 2026 and 2035.

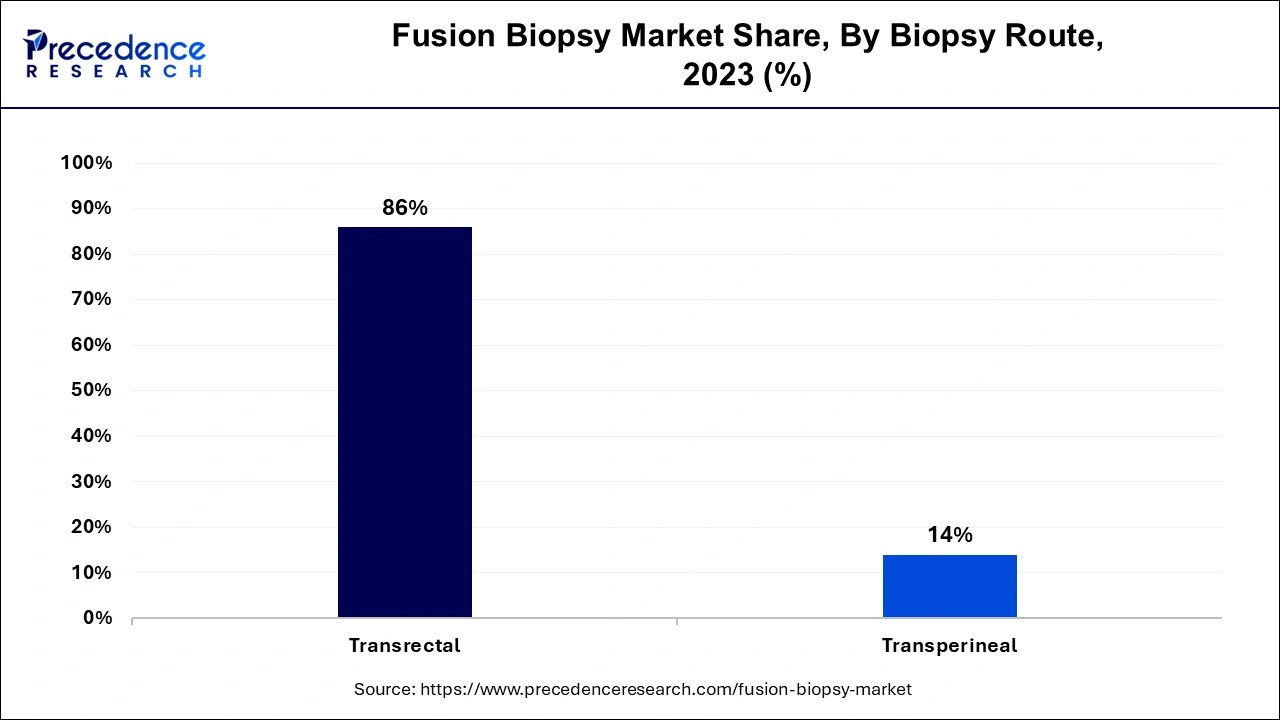

- By biopsy route, the transrectal (TRUS-MRI fusion) segment contributed the highest market share in 2025.

- By biopsy route, the transparent (TP-MRI fusion) segment is growing at a strong CAGR between 2026 and 2035.

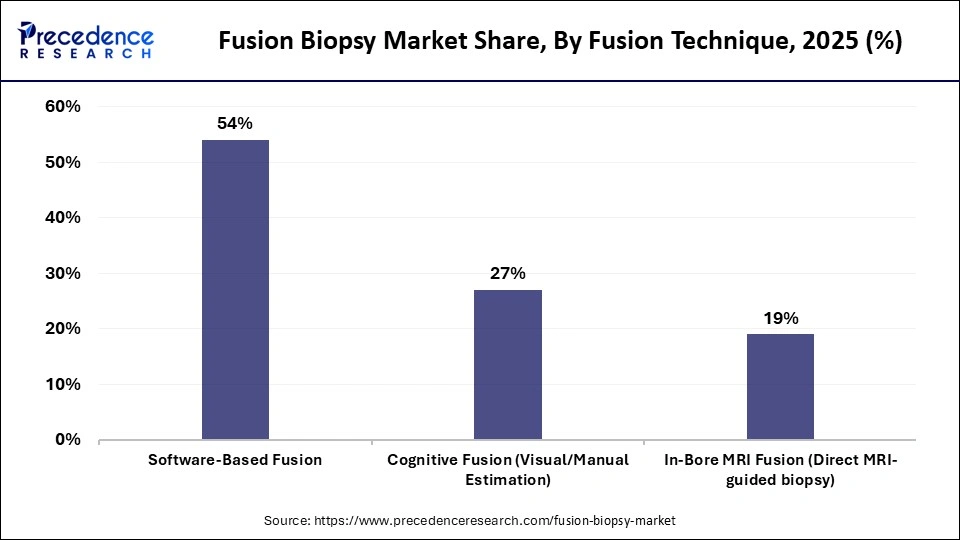

- By fusion technique, the software-based fusion segment held a major market share in 2025.

- By fusion technique, the In-bore MRI fusion segment is expected to expand at a notable CAGR from 2026 to 2035.

- By application, the prostate cancer diagnosis segment captured the highest market share of 41% in 2025.

- By application, the rental (kidney) lesion evaluation segment is poised to grow at a healthy CAGR between 2026 and 2035.

- By end user, the hospitals and tertiary care centers segment contributed to the highest market share in 2025.

- By end user, the ambulatory surgical centers (ASCs) segment is growing at a strong CAGR between 2026 and 2035.

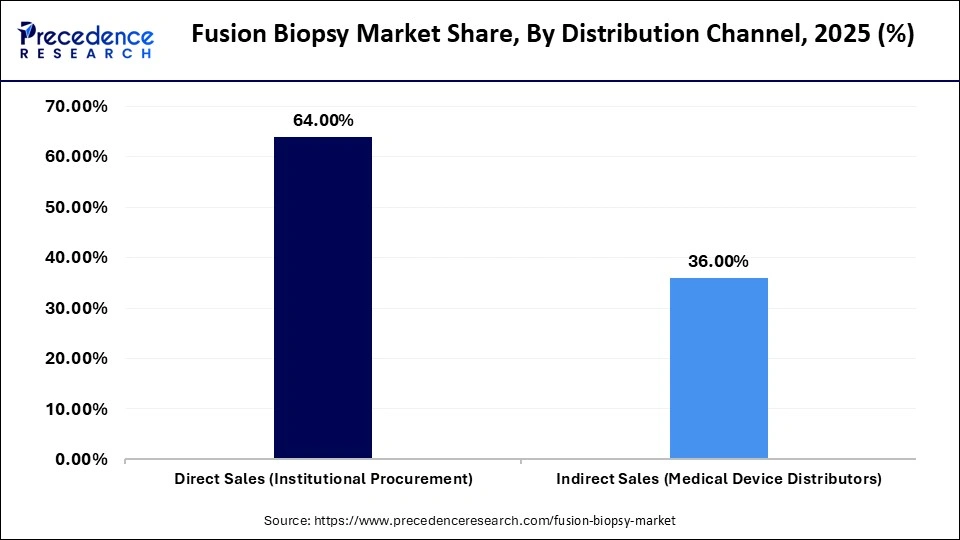

- By distribution channel, the direct sales segment held a major market share in 2025.

- By distribution channel, the indirect sales segment is expected to expand at a notable CAGR from 2026 to 2035.

Market Overview

The fusion biopsy market encompasses the diagnosis, treatment, and surgical procedures for detecting and curing cancer. This innovative diagnostic method offers physicians a complete picture of the targeted area by blending the insights from Country traditional magnetic resonance imaging and ultrasound imaging. This technology further reduces the chances of negative results by offering enhanced precision and imaging, which triggers more accurate tissue harvesting.

Role of Artificial Intelligence (AI) in the Fusion Biopsy Market

In the last few years innovations in artificial intelligence have opened new doors for the diagnosis and treatment of prostate cancer. The most substantial advancement in this area is the combination of fusion magnetic resonance technology with AI technology. Also, AI algorithms can use large sets of clinical data, MRI images, and histopathologic outcomes to recognize the pattern related to disease progression in the fusion biopsy market. Furthermore, the integration of fusion MRI-TB and AI seems promising for enhancing overall patient outcomes and transforming urologic oncology.

- In December 2024, UCLA Spinoff developed an AI tool that enhances the accuracy of prostate cancer diagnosis. The software, called Unfold AI, was developed by Avenda Health, a University of California Los Angeles (UCLA) spinoff company. Software processes imaging scans and clinical laboratory data to help oncologists and anatomic pathologists visualize a tumor's extent.

- In September 2024, Koelis, a global leader and innovator in prostate care, announced the collaboration and successful initial experience using the DeepHealth Prostate software to streamline the prostate MRI reading process and seamless fusion of MRI with Koelis Trinity 3D Ultrasound Platform for prostate fusion biopsy and treatment.

Fusion Biopsy Market Growth Factors

- Increasing demand for minimally invasive surgeries is expected to fuel fusion biopsy market growth shortly.

- Ongoing innovations in imaging technologies like ultrasound, MRI, and CT can propel market growth soon.

- The growing trend towards point-of-care diagnostics procedures will likely contribute to the market expansion further.

Market Key Trend

The fusion biopsy industry is undergoing a period of transformative growth, largely propelled by the need for more accurate, minimally invasive diagnostic techniques for prostate cancer. Medical professionals are increasingly turning to fusion biopsy over traditional random sampling, due to its ability to combine real-time ultrasound imaging with MRI data for precise tumour targeting. Another innovation driving market expansion is the integration of AI and machine learning algorithms into fusion biopsy platforms.

One of the prevailing trends reshaping this market is the increasing shift towards transperineally biopsy procedures. This technique is gaining traction over the conventional transrectal method, primarily because it poses a significantly lower risk of post-procedure infections and offers greater accuracy in accessing various parts of the prostate. The move towards safer, more effective approaches is enhancing patient outcomes and boosting market adoption. These technologies are proving invaluable in automating lesion detection, refining biopsy guidance, and reducing operator-dependent variability, resulting in faster, more reliable diagnoses.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 356.80 Million |

| Market Size in 2026 | USD 383.50 Million |

| Market Size in 2035 | USD 803.50 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.6% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Biopsy Route, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising use of Multi-Modality Imaging

There is a growing trend towards the utilization of multi-modality imaging (ultrasound, MRI, and CT) in the fusion biopsy market for more precise tumor detection. In addition, the use of point-of-care (POC) diagnostics is also escalating owing to the increasing use of fusion biopsy technologies in healthcare settings and outpatient clinics for rapid diagnosis and treatment.

- In October 2024, Boston Scientific Corporation announced the launch of AVVIGO™+ Multi-Modality Guidance System, a new intravascular ultrasound (IVUS) and fractional flow reserve (FFR) system with innovative software and hardware features designed to offer high-quality IVUS vessel imaging and physiology experience medical procedures.

Restraint

Limited reimbursement policies

Sufficient reimbursement policies in some areas may constrain the extensive adoption of fusion biopsy market procedures, as the cost is being borne by healthcare institutions or patients. Moreover, requirements for skilled personnel and technical complexities can impact market growth negatively as they can pose hurdles in the widespread adoption with limited access to skilled persons.

Opportunity

Increasing adoption of liquid biopsies

Liquid biopsies, assess cell-free nucleic acids in a blood vessel and provide a non-invasive solution to conventional tissue biopsies. Fusion biopsies can be carried out by using liquid biopsies, which enable the early detection of genomic alterations in tumor cells or cDNAs. Furthermore, the increasing adoption of liquid biopsies for the detection and control of cancer is anticipated to create future opportunities for the fusion biopsy market.

- In September 2024, Strand Life Sciences announced the launch of its Somatic Advantage 74 Liquid Biopsy (SA74 LB) Test. According to the company's statement, this test detects circulating tumor DNA in blood samples of cancer patients to offer a comprehensive analysis of 74 clinically relevant genes, offering invaluable insights for cancer treatment.

Segmental Analysis

By Product Type

What made the consumables and accessories segment dominate the fusion biopsy market?

The consumables and accessories segment dominates the fusion biopsy market because they are frequently used in all biopsy procedures, such as biopsy needles, disposable guides, grids, and tracking devices. Demand for these products is constantly driven by high procedure volumes in hospitals and diagnostic facilities, as well as stringent sterility and single-use regulations. Additionally, consumables are a vital part of the fusion biopsy system since they provide manufacturing with ongoing revenue streams.

The software segment is growing rapidly, driven by the growing use of AI-assisted lesion targeting, sophisticated image-fusion algorithms, and real-time navigation features. Demand for advanced fusion software platforms is rising as a result of increased focus on diagnostic precision, workflow effectiveness, and smooth MRI ultrasound integration. Cloud-based solutions integration with hospital IT systems and ongoing software updates all contribute to this segment's robust growth momentum.

By Biopsy Route

What made the transrectal (TRUS-MRI fusion) segment dominate the fusion biopsy market?

The transrectal (TRUS-MRI fusion) segment dominates the fusion biopsy market because of its availability in urology practices, long-standing clinical adoption, and procedural familiarity. This method is the preferred option for routine prostate cancer diagnosis because it requires shorter procedure times. Its dominant market position is further reinforced by established reimbursement frameworks and clinician comfort.

The transparent (TP-MRI fusion) segment is growing rapidly, driven by its enhanced access to anterior prostate lesions and decreased risk of infection. A move towards transperineal techniques is being encouraged by growing knowledge of the post biopsy complications linked to transrectal procedures. Growth is being accelerated by technological developments that streamline TP procedures and increase adoption in outpatient and ambulatory settings.

By Fusion Technique

Why did the software-based fusion segment dominate the fusion biopsy market?

Software-based fusion segment dominates the fusion biopsy market because they are affordable, adaptable, and compatible with conventional ultrasound systems. These systems are widely available in hospitals and diagnostic centers because they allow real-time alignment without requiring the availability of an MRI suite during the biopsy. Their robust market dominance is supported by their scalability and ease of integration into current clinical workflows.

In-bore MRI fusion (Direct MRI-guided biopsy) segment is growing rapidly, driven by its superior targeting accuracy and ability to directly visualize lesions during biopsy. This approach is increasingly preferred for complex or repeat biopsies where precision is critical. The growing availability of advanced MRI infrastructure and rising demand for highly accurate cancer detection are driving the rapid adoption of in-bore MRI fusion systems.

By Application

Why did the prostate cancer diagnosis segment dominate the fusion biopsy market?

The prostate cancer diagnosis (primary) segment dominates the fusion biopsy market. MRI-guided diagnostic pathways are becoming more widely used, and prostate cancer is becoming more common. Fusion biopsy reduces needle biopsies while greatly increasing clinically meaningful cancer detection. Its extensive use in primary prostate cancer diagnosis is still fueled by strong clinical validation and support from guidelines.

The renal (Kidney) lesion evaluation segment is growing rapidly, due to the fusion biopsy techniques becoming more popular outside of the prostate. The need for accurate minimally invasive biopsy techniques is growing due to the increased detection of small and complex renal masses using advanced imaging. Growth in this new application area is being accelerated by the expansion of clinical research and the technological adaptability of fusion platforms.

By End-User

What made hospitals and tertiary care centers dominate the fusion biopsy market?

The hospitals and tertiary care centers segment dominates the fusion biopsy market because of their high patient volume, sophisticated diagnostic infrastructure, and access to qualified professionals. These settings handle complex oncological cases and are usually early adopters of MRI fusion technology, which strengthens their dominant market share. Adoption in this market is further supported by a strong capital investment capacity.

The ambulatory surgical centers (ASCs) segment is growing rapidly, as more affordable diagnostic procedures become more prevalent in healthcare systems. ADCs can now efficiently perform high-precision biopsies thanks to advancements in minimally invasive procedures and compact fusion biopsy systems. Strong growth in this market is being driven by shorter hospital stays and advantageous reimbursement dynamics.

By Distribution Channel

Why did the direct sales segment dominate the fusion biopsy market?

The direct sales (Institutional Procurement) segment dominates the fusion biopsy market as hospitals and large healthcare institutions prefer procurement for high-value diagnostic equipment. This channel allows manufacturers to offer customized solutions, training, and long-term service contracts. Strong supplier institutions, relationships, and bundled offerings further strengthen the dominance of direct sales.

Indirect sales (Medical device distributors) are notably growing due to increasing geographic reach, providing localized support, and negotiating regulatory complexities, which are all critical tasks for distributors. This channel is steadily expanding due to the growing use of fusion biopsy systems in mid-sized hospitals and diagnostic facilities.

Regional Insights

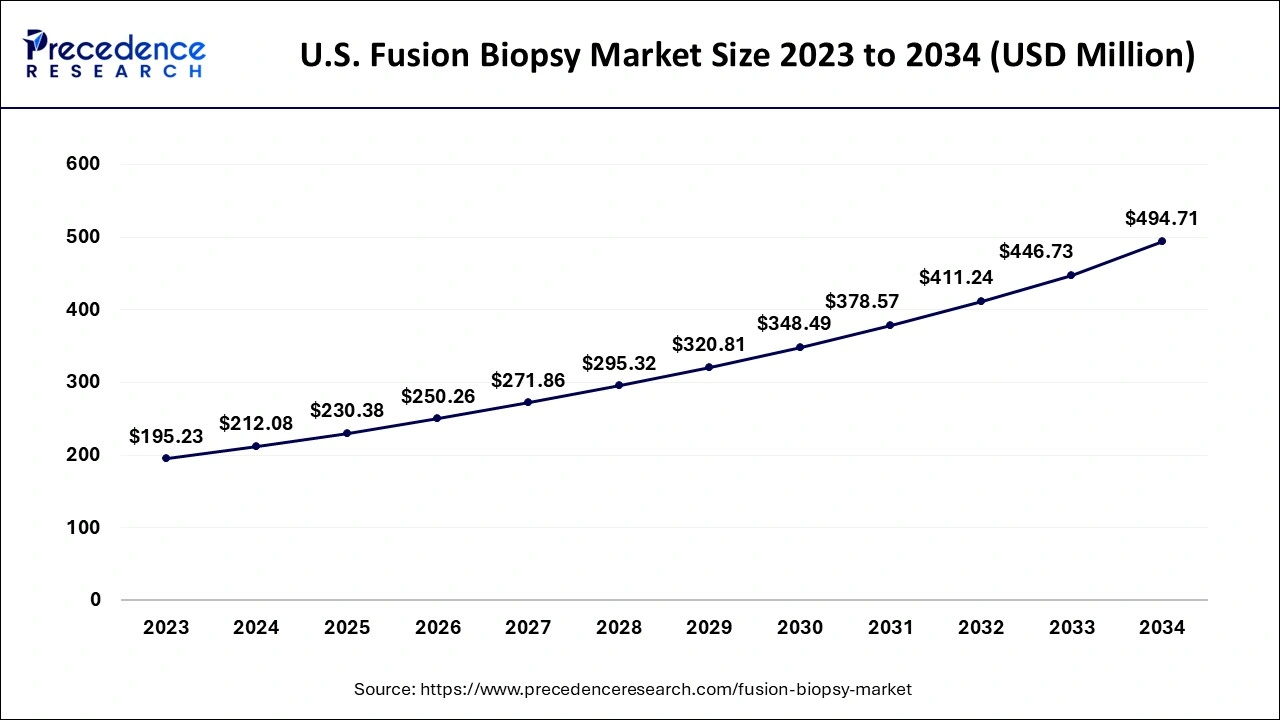

How Big is the U.S. Fusion Biopsy Market?

The U.S. fusion biopsy market size was valued at USD 128.2 million in 2025 and is expected to be worth nearly USD 258.7 million by 2035, growing at a CAGR of 7.4% from 2026 to 2035.

North America dominated the fusion biopsy market in 2025. The dominance of the region can be attributed to the increasing number of cancer cases along with the growing adoption of innovative diagnostic technologies. In North America, the U.S. led the market owing to the improved effectiveness and adoption of advanced cancer detection technologies. Furthermore, strong government support and developed healthcare infrastructure can support this market growth further.

North America remains the front-runner in the global fusion biopsy space. With a substantial market share secured, the region's leadership is anchored by a combination of robust healthcare systems, high rates of prostate cancer screening, and extensive insurance coverage for diagnostic procedures. In the United States, continued support from federal health agencies, including initiatives promoting early detection and improving diagnostic accuracy, has encouraged widespread adoption of fusion biopsy techniques. Additionally, the presence of top-tier medical device companies contributes to the region's innovation pipeline and market resilience.

- In February 2023, Exact Sciences received FDA approval for its Oncotype DX Breast Recurrence Score test, which predicts the risk of breast cancer recurrence and helps guide treatment decisions.

U.S. Fusion Biopsy Market Trends

The U.S. Region is dominating the market because of early adoption if MRI guided diagnostics, sophisticated healthcare infrastructure, and high prostate cancer screening rates. The region's leadership is further maintained by robust reimbursement support and ongoing technological innovation.

Asia Pacific region is expected to show the fastest growth over the studied period. The growth of the region can be credited to the rising awareness regarding protests against cancer in the region and advanced healthcare infrastructure in emerging countries such as China, India, and Japan. Furthermore, the surge in the aging population in countries like Japan and South Korea impacts market growth positively.

India Fusion Biopsy Market Trends

India is growing rapidly, fueled by the fast growth of sophisticated diagnostic infrastructure, the rising incidence of prostate cancer, and growing awareness of early cancer diagnosis. Access to MRI-guided biopsy procedures is increasing due to government initiatives to improve oncology care and the growing use of multiparametric MRI in urban hospitals. The adoption of fusion biopsy technologies is also being accelerated in major metropolitan areas by the growth of private hospitals, medical tourism, and affordable diagnostic services.

In Middle East and Africa, growth in the fusion biopsy market is being stimulated by broad healthcare reforms and rising public health awareness. Countries such as the UAE and Saudi Arabia are investing heavily in advanced diagnostic infrastructure as part of their national health strategies. Alongside the development of specialist cancer treatment centres, this has enabled wider deployment of fusion biopsy equipment, especially in urban regions. The increasing availability of MRI imaging and urology specialists is also helping accelerate the transition from conventional diagnostics to image-guided biopsy procedures.

UAE Fusion Biopsy Market Trends

The UAE is expanding rapidly due to the nation's emphasis on precision medicine and early cancer detection, as well as significant investments in cutting-edge healthcare infrastructure. Modern MRI facilities are becoming more widely available, and the market is expanding due to the growing need for minimally invasive diagnostic procedures. Fusion biopsy systems are also being adopted throughout the region due to the availability of well-equipped tertiary care hospitals favored reimbursement for advanced diagnostics, and an increase in medical tourism.

Fusion Biopsy Market Companies

- Eigen

- Koninklijke Philips N.V.

- Hitachi Ltd.

- MedCom

- ESAOTE SPA

- KOELIS

- Focal Healthcare

- BK Medical Holding Company, Inc.

- Exact Imaging

- Biobot Surgical Pte Ltd.

- UC-Care Medical Systems Ltd

Latest Announcement by Market Leaders

- In September 2024, Htachi Energy announced plans to invest an additional USD 155 million to expand its manufacturing capacity in North America. This involves a new distribution transformer factory in Reynosa, Mexico, and expansions to its transformer factory in South Boston, Virginia, and its high-voltage switchgear and breakers factory in Mount Pleasant, Pennsylvania.

- In September 2024, Koelis, SAS, a global leader and innovator in prostate care, announced the release of a new, compact 3D transducer for transperineal fusion biopsy and treatment. Koelis is now compatible with both the market-leading high-level disinfection systems.

Recent updates on fusion biopsy-2025

Rising prostate cancer incidence accelerates fusion biopsy adoption

- In March 2025, the market for fusion biopsy is expanding rapidly because of the increased prevalence of prostate cancer worldwide. When compared to conventional techniques, fusion biopsy, which combines MRI and ultrasound imaging, provides greater tumor localization accuracy. Urologists are increasingly favoring this minimally invasive method for accurate and early detection. Adoption is being accelerated, particularly in North America and Europe, by increased awareness, better reimbursement practices, and the need for targeted diagnostics.

Technological advancements improve diagnostic precision

- By April 2025, Advanced fusion biopsy platforms with robotic assistance, 3D navigation, and AI-guided imaging have become available. These developments are lowering false negatives and greatly increasing sampling accuracy. For usage in ambulatory surgical centers and outpatient clinics, businesses are concentrating on portable cloud-connected systems. Additionally, AI algorithms are being trained to identify high-grade tumors, which will enable more individualized treatment plans and better biopsy planning.

Recent Developments

- On 10 March 2025, a prominent market research firm emphasized the expanding adoption of fusion biopsy technologies in cancer diagnosis. The focus on combining MRI and ultrasound imaging to enhance the accuracy of prostate cancer detection has gained significant traction among healthcare providers globally. This advancement is expected to improve early diagnosis and treatment outcomes.

- On 15 January 2025, industry experts highlighted the increasing demand for advanced image-guided biopsy systems that offer superior precision over traditional biopsy methods. Training programs for clinicians are being expanded to ensure effective use of these sophisticated diagnostic tools, facilitating improved patient care.

- On 20 February 2025, companies announced the ongoing integration of artificial intelligence and machine learning into fusion biopsy devices. These developments aim to support clinicians by providing enhanced imaging interpretation, thereby improving diagnostic accuracy and reducing procedural risks.

- In October 2023, Medtronic unveiled the Hugo™ robotic-assisted biopsy platform which is the latest version of its Biopsy System. This state-of-the-art technology brings together advanced imaging and artificial intelligence (AI) in an attempt to increase precision and reduce procedure time.

- In June 2024, Hologic Inc. introduced the Affirm™ Prone Biopsy System, designed to offer superior imaging and patient comfort. This system is a breakthrough in ergonomic patterns together with better imaging abilities that help to facilitate breast biopsy accuracy.

- In March 2023, Biocept announced a partnership with Illumina to develop and commercialize next-generation sequencing-based liquid biopsy tests for cancer detection and monitoring.

- In January 2023, Guardant Health, Inc. announced a partnership with AstraZeneca to develop liquid biopsy tests for cancer diagnosis and treatment monitoring.

Segments Covered in the Report

By Product Type

- Equipment (Systems)

- MRI–Ultrasound Fusion Platforms

- Fusion-Enabled Ultrasound Systems

- Interventional MRI Systems

- Software

- Image Registration & Fusion Software

- AI-Driven Lesion Mapping & Segmentation Tools

- 3D Visualization & Navigation Software

- Post-Procedure Reporting & Analytics Platforms

- Consumables & Accessories

- Biopsy Needles & Guidance Kits

- Needle Guides & Templates (Grid-based / Freehand)

- Fiducial Markers & Target Sensors

- Disposable Probes & Sheaths

By Biopsy Route

- Transrectal (TRUS–MRI Fusion)

- Transperineal (TP–MRI Fusion)

- By Fusion Technique

- Software-Based Fusion

- Cognitive Fusion (Visual / Manual Estimation)

- In-Bore MRI Fusion (Direct MRI-Guided Biopsy)

By Application

- Prostate Cancer Diagnosis (Primary)

- Renal (Kidney) Lesion Evaluation

- Liver Tumor Targeting

- Active Surveillance Monitoring

- Focal Therapy Planning

By End-User

- Hospitals & Tertiary Care Centers

- Specialized Oncology Clinics

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers (ASCs)

- Academic & Research Institutions

By Distribution Channel

- Direct Sales (Institutional Procurement)

- Indirect Sales (Medical Device Distributors)

By Region

- North America

- U.S.

- Canada

- Europe

-

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting