What is G. Fast Chipset Market Size?

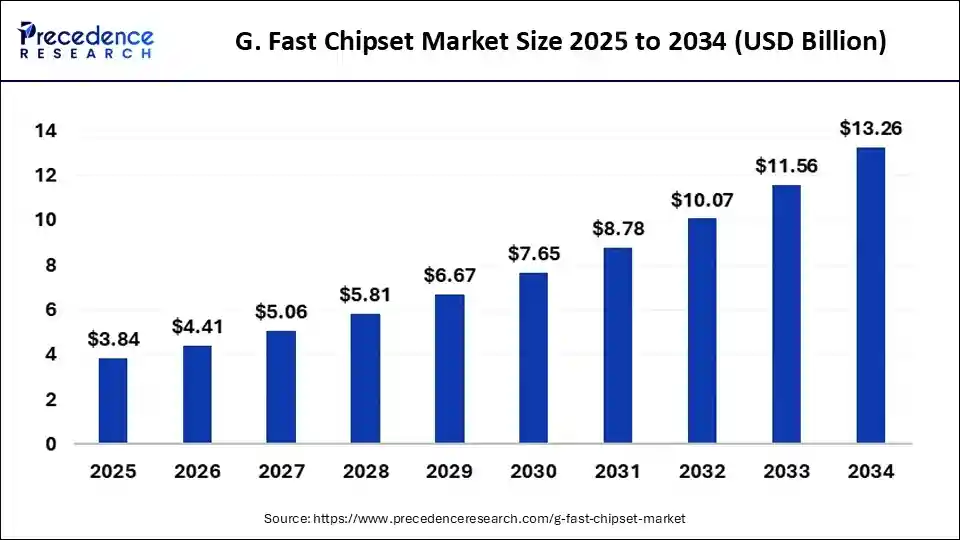

The global G. fast chipset market size is estimated at USD 3.84 billion in 2025 and is predicted to increase from USD 4.41 billion in 2026 to approximately USD 13.26 billion by 2034, expanding at a CAGR of 14.75% from 2025 to 2034. The rising proliferation of the Internet across the world is expected to boost the growth of the market during the forecast period.

Market Highlights

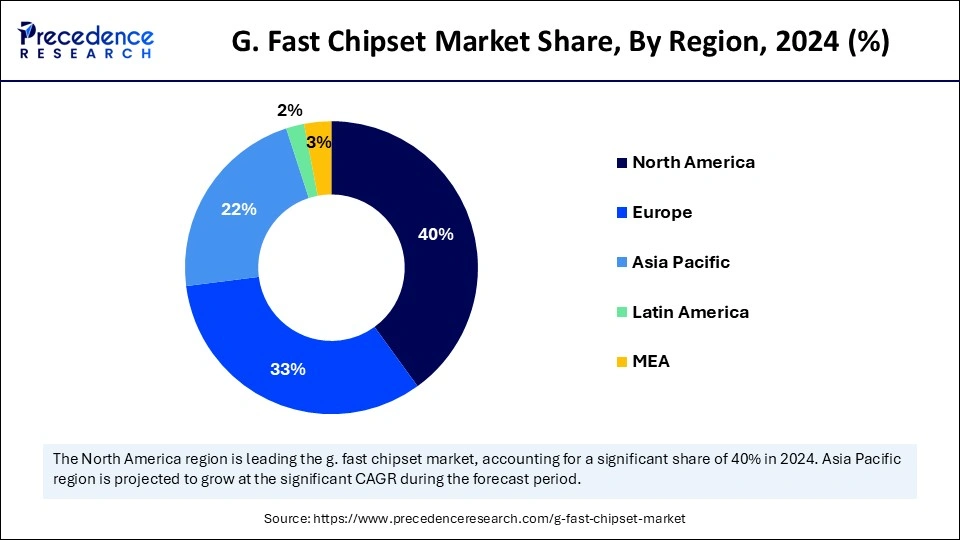

- North America led the G. fast chipset market with the largest market share of 40% in 2024.

- Asia Pacific is expected to expand at the fastest rate during the forecast period.

- By technology, the wireless solutions segment held a major market share in 2024.

- By technology, the fiber to the node segment is expected to grow at a notable CAGR during the projection period.

- By configuration, the integrated chipsets segment dominated the market in 2024.

- By configuration, the stand-alone chipsets segment is likely to witness significant CAGR between 2025 and 2034.

- By application, the broadband access segment contributed the biggest market share in 2024.

- By application, the smart home devices segment is projected to grow at a notable rate in the coming years.

- By end-use, the residential segment held the biggest market share in 2024.

- By end-use, the commercial segment is anticipated to observe significant growth over the studied period.

What are the Developments Strengthening the G. Fast Chipset?

G. fast technology is a next-generation broadband technology that utilizes the existing coaxial cable or copper infrastructure to deliver high Internet speeds reaching up to 1 Gbps. G. fast chipset market is witnessing significant growth because of the utilization of this technology, especially in areas that are not feasible for fiber-optic cables. The utilization of the g. fast technology with advanced chipsets helps broadband providers offer high-speed connectivity at shorter distances. The increasing demand for high-speed Internet worldwide is a key factor driving the growth of this market.

Governments worldwide are making efforts and putting forth initiatives to improve access to Internet services, which is propelling market growth. The requirement for reliable and fast Internet connectivity in residential and commercial spaces further supports market growth. With rising demand for online gaming and streaming services, the demand for high bandwidth and high-speed Internet is increasing. Consumers are seeking faster connections to adopt the more bandwidth-consuming services easily. The G. fast chipset technology is cost-effective because it can be integrated into the existing infrastructure without high initial investments. Advancements in technology and the rising adoption of smart devices, 5G, and IoT contribute to the growth of the market.

G. Fast Chipset Market Growth Factors

- The increasing penetration of Internet services in all corners of the world is a major factor boosting the growth of the market.

- The growing usage of the high-speed Internet is fueling the growth of the g. fast chipset market.

- The rising demand for smart home solutions and appliances further supports market expansion.

- With the rising usage of streaming services, online gaming, and social media platforms, the need for high bandwidth is increasing, propelling market growth.

- Advancements in technology like the Internet of Things (IoT), 5G, and wireless communication are driving the market's growth.

- Governments around the world are establishing policies that support the spread of the Internet, fueling the growth of this market.

G. Fast Chipset Market Outlook:

- Global Expansion: Rising data consumption, urbanization, and the progression of multi-gigabit applications, such as 8K streaming and VR, are transforming the overall development.

- Major Investor: A huge company, like Broadcom, Qualcomm, MediaTek, and Huawei, is actively investing in research, development, and mass-scale deployment of G.fast technology to strengthen broadband services.

- Startup Ecosystem: Movandi, a startup that designs and creates deep semiconductor technology, particularly components for 5G and beyond networks.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.84 Billion |

| Market Size in 2026 | USD 4.41 Billion |

| Market Size by 2034 | USD 13.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.75% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Configuration, Application, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

High Demand for IoT and Smart Devices

The increasing demand for the Internet of Things (IoT) and smart home appliances is one of the key factors driving the growth of the G. fast chipset market. With rapid urbanization, smart home solutions are gaining popularity. IoT and smart home appliances often require faster internet speed for their smooth functioning and reliability. This, in turn, boosts the demand for G. fast chipsets. According to a survey report, approximately 69.91 million households in the U.S. actively used smart home devices in 2024, an increase of 10.2% from than previous year. The G. fast technology offers seamless support for integrating devices like security systems, smart appliances, speakers, or TVs by enabling real-time data transmission and control. The smart city projects being undertaken, especially in emerging countries, are boosting the utilization of smart home appliances and IoT connectivity. As more and more consumers choose smart home appliances and applications along with IoT-enabled devices, the demand for G. fast chipsets increases.

Restraint

High Deployment Costs

The high deployment costs of installing G. fast infrastructure limit the growth of the G. fast chipset market. While this technology is cost-effective in the long run compared to fiber, the deployment and upgradation cost of G. fast infrastructure is significant. This can affect the small or medium-sized service providers that find it difficult to invest the amount in the initial deployment. Key players operating in the market must invest in research and development activities to find solutions to address this issue, which further widens the consumer base.

Opportunity

Emphasis on Sustainable Connectivity

There is an increased awareness among consumers and service providers, and government regulations to reduce environmental impact are ongoing worldwide. The emphasis on sustainable connectivity is expected to create lucrative growth opportunities in this market. The growing concerns related to energy consumption can be addressed by focusing on sustainable options that improve energy efficiency and power consumption without compromising performance. Developing practices that can help reduce the environmental impact, like integrating advanced technology, sustainable materials utilization, and minimizing waste, can help improve sustainability. Minimizing the infrastructure's carbon footprint further opens new growth avenues for this market.

Segment Insights

Technology Insights

The wireless solutions segment held a major share of the G. fast chipset market in 2024. The segment growth is driven by the increased demand for wireless connections. The flexibility and scalability of this technology helps in broadening the scope of applications in different environments. With the growing adoption of smart devices, the demand for wireless connectivity is increasing, further solidifying the segment's position in the market.

The fiber to the node segment is expected to grow at a notable rate during the projection period. The growth of the segment can be attributed to the growing need for robust connectivity, especially online connectivity. This technology provides support in modernization of communication infrastructure, which makes it a popular choice. The rising focus on modernizing or upgrading existing network infrastructure is expected to support this segment's growth.

Configuration Insights

The integrated chipset segment dominated the G. fast chipset market in 2024. The compact design and efficiency of these integrated chipsets make them an attractive choice for consumers. These chipsets are suitable for commercial as well as residential applications due to their unique features that enable high-speed broadband access. The rising demand for high-speed Internet bolstered the growth of the segment.

Meanwhile, the stand-alone chipsets segment is likely to witness significant growth. This is mainly due to the rising demand for high-speed broadband. These chipsets are known for their excellent scalability, flexibility, and high power, which makes them popular in the commercial sector. They enable high-speed broadband over existing copper lines.

Application Insights

The broadband access segment led the G. fast chipset market in 2024. The rise in the demand for high-speed Internet connectivity has bolstered the segment's growth. The need for high bandwidth and low latency has increased with the increased adoption of advanced technologies like IoT and 5G. Moreover, rapid digitalization is likely to continue the segment's growth trajectory.

Meanwhile, the smart home devices segment is projected to grow at a notable rate in the coming years. This is mainly due to the rising production and adoption of smart home devices due to the growing concerns about home security. The rise of smart city projects, along with the growing demand for smart devices to expand interconnectivity in home environments, will boost this segment's growth.

End-use Insights

The residential segment led the G. fast chipset market in 2024. This is mainly due to the rise in consumer demand for faster broadband services and connectivity. There is an increased popularity of digital lifestyle, bolstering the growth of this segment. Moreover, with the increased trend of smart homes, the adoption of advanced technologies has increased to support home automation, boosting the demand for high bandwidth. Integration of smart devices in home automation further bolstered the segment.

On the other hand, the commercial segment is anticipated to observe significant growth over the studied period. The rising need for high-speed and reliable Internet connections for various processes in the commercial sector is likely to support segmental growth. Businesses are constantly improving their network infrastructure to support business operations, boosting the demand for G. fast chipsets and contributing to the growth of the segment.

Regional Insights

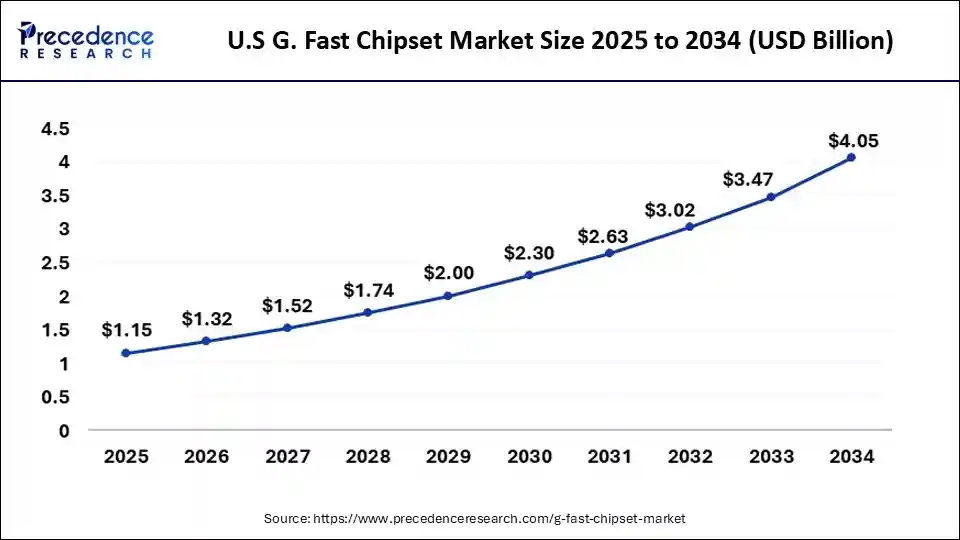

U.S. G. Fast Chipset Market Size and Growth 2025 to 2034

The U.S. G. fast chipset market size is exhibited at USD 1.15 billion in 2025 and is projected to be worth around USD 4.05 billion by 2034, growing at a CAGR of 14.89% from 2025 to 2034.

What Made North America Dominant in the Market in 2024?

North America held the dominant share of the G. fast chipset market in 2024. The market growth in the region is mainly driven by its developed network infrastructure. The widespread adoption of broadband technologies across North America further bolstered market growth. Increased investment in infrastructure development from the telecommunication and Internet service providers significantly boosted the regional market growth. The region is expected to continue its growth trajectory in the coming years. With the increasing utilization of Internet of Things devices and rising demand for smart home solutions, the demand for high-speed Internet is increasing. The rising integration of advanced technologies into private and public sectors is fueling the growth of this market.

Raised Demand for Advanced & Rapid Internet Connectivity: U.S. Market Trend

The U.S. plays a crucial role in the North American G. fast chipset market. There is a high demand for fast and reliable Internet connectivity. The easy availability and accessibility of the Internet across the country has boosted the need for G. fast chipsets. With the increasing adoption of streaming services, wearables, and online gaming, the consumer demand for high-performance and reliable Internet connections is increasing in the U.S., supporting market growth.

Substantial Government Support is Impacting the Asia Pacific

Asia Pacific is projected to witness the fastest growth during the forecast period. The rapid pace of urbanization, modernization, and digitalization in this region is boosting the growth of the G. fast chipset market. The increasing proliferation of the Internet is likely to support market growth in the region. Consumers are actively seeking reliable and high-speed connectivity. The growing focus on improving availability and accessibility to the Internet, especially in rural areas, is playing an important part in the growth of this market. Governments of various Asian countries are making efforts to improve and enhance digital connectivity, which further drives market growth.

Many smart city projects are ongoing that will utilize smart devices and advanced technologies, which will aid market growth. The rising number of Internet users further contributes to market expansion. In China, there is a high demand for copper telephone lines. The G. fast chipset can easily integrate into the existing copper infrastructure, expanding the market growth.

A Rise in the Number of Internet Users is Fueling Europe

Europe is expected to grow at a notable growth during the projection period. The European G. fast chipset market growth can be attributed to the increasing number of Internet users and the rising adoption of advanced technologies. The demand for high-speed Internet connectivity is also rising in the region. The UK can have a stronghold on the market. The rising government initiatives, like the Digital Infrastructure Investment Fund (DIIF) that aims to support digitalization and strengthen the existing infrastructure, drive market growth. Moreover, the increasing popularity of smart homes is expected to support market growth.

UK's Next-Gen Tech Surge: G. Fast Chipset Market Accelerates

The UK G. Fast chipset market is experiencing significant growth driven by the need for faster broadband. This expansion is crucial for powering modern digital services and high-speed connectivity, signalling a vibrant future for the nation's telecommunications infrastructure.

Promotion of Vendor Solutions is Assisting South America

In the coming era, South America will expand significantly, with rising novelty in vendor solutions. Such as Zyxel provides a complete portfolio of G.fast solutions, such as Distribution Point Units (DPUs) and Customer Premises Equipment (CPE), with an emphasis on ease of deployment and temperature-hardened designs favourable for various environments in South America.

Enhancement in Network & Infrastructure: Brazilian Market Trend

Day by day, the Brazilian mobile operators are rapidly boosting 5G standalone (SA) networks. In the case of 2024 development, Claro achieved download speeds of 10.4 Gbps during a 5.5G trial conducted with Huawei in Brasília. However, in January 2025, TIM Brasil joined with Nokia to boost its 5G network across 15 states, widening Nokia's AirScale portfolio, using ReefShark System-on-Chip technology to escalate coverage and capacity.

G. Fast Chipset Market: Value Chain Analysis

- Raw Material Procurement

This mainly encompasses the sourcing of diverse materials, such as silicon, dopants, metals, insulating, and dielectric materials.

Key Players: Marvell Technology, Ltd., Metanoia Communications, Inc., Sckipio Technologies SI Ltd, etc. - Assembly and Packaging (Back-end)

During designing and handling, firms are using advanced techniques, including flip-chip bonding and Ball Grid Array (BGA) packaging.

Key Players: ASE Group, Amkor Technology, Powertech Technology Inc., etc. - Lifecycle Support and Recycling

This usually covers product lifecycle policies of the equipment manufacturers (like HP, Dell, Western Digital) and local/national e-waste recycling programs.

Key Players: Eco Recycling Ltd., Attero Recycling, Cerebra Integrated Technologies, etc.

Key Players in G. Fast Chipset Market and Their Offerings

- Intel- It prominently facilitates through its Intel AnyWAN transceiver VRX618 and accompanying Intel AnyWAN SoCs.

- Texas Instruments- It emphasises offering analog and embedded processing chips that can be part of a larger communications system.

- MediaTek- A company that leverages chipsets for smartphones, tablets, smart home devices, and automotive solutions.

- Qualcomm- It mainly explored Vx686 (CPE) and the Velocity-5U (DPU).

- Infineon Technologies- A major leader provides its product portfolio, emphasizing mainly on power semiconductors (silicon, silicon carbide, and gallium nitride), microcontrollers, sensors, automotive Ethernet, and security solutions.

Recent Developments

- In March 2025, Qualcomm launched three new Snapdragon G series chips. These chips are specifically designed to power Android handled gaming devices.

- In August 2024, Google launched its Pixel 9 series with the new Tensor G4 chip. This chip is a custom processor that enhances performance and drives AI-powered features in Pixel 9 series.

Segments Covered in the Report

By Technology

- Fiber to the Node

- Fiber to the Curb

- Wireless Solutions

By Configuration

- Integrated Chipsets

- Stand-alone Chipsets

By Application

- Broadband Access

- Telecommunications

- Data Centers

- Smart Home Devices

By End-Use

- Residential

- Commercial

By Region

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting