What is the Multi-mode Chipset Market Size?

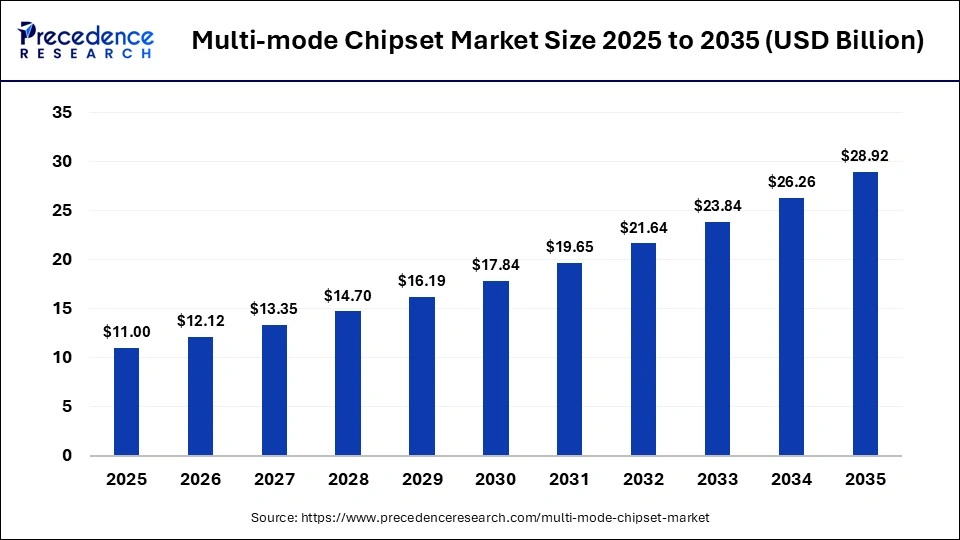

The global multi-mode chipset market size was calculated at USD 11.00 billion in 2025 and is predicted to increase from USD 12.12 billion in 2026 to approximately USD 28.92 billion by 2035, expanding at a CAGR of 10.15% from 2026 to 2035.This market is growing due to increasing demand for high-speed data transmission and bandwidth-intensive applications across data centers, telecom networks, and enterprise connectivity.

Market Highlights

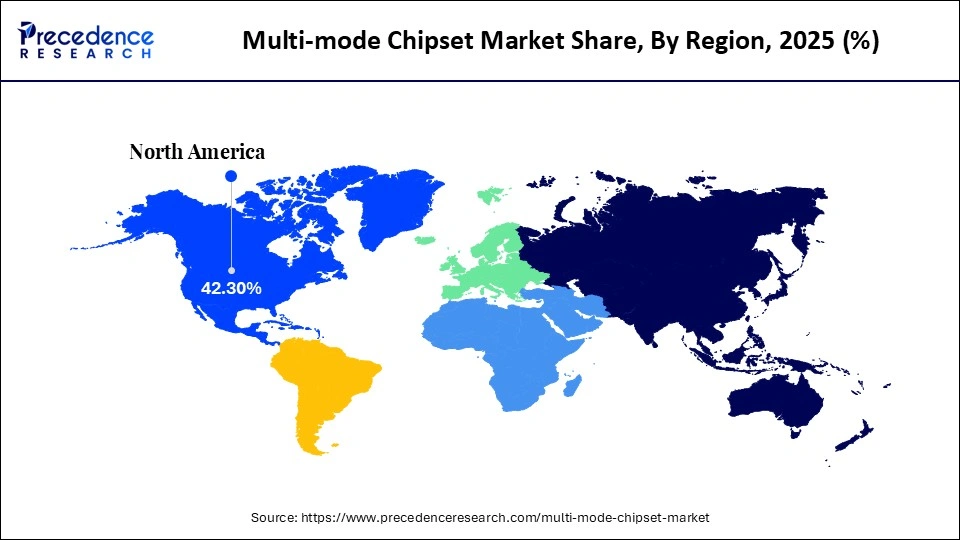

- Asia Pacific dominated the aircraft data management multi-mode chipset market with 42.3% of the market share in 2025.

- North America is expected to grow at the fastest CAGR of 10.8% between 2026 and 2035.

- By technological type, the 5G/4G/3G multi-mode segment contributed the highest market share of 42.3% in 2025.

- By technological type, the 5G/4G/3G+ satellite segment is growing at a strong CAGR of 9.6% between 2026 and 2035.

- By application/device, the smartphones segment held a major market share of 35.8% in 2025.

- By application/device, the automotive segment is expected to expand at a notable CAGR of 9.7% from 2026 to 2035.

- By end user/sector, the OEMs segment captured the highest market share of 38.7% in 2025.

- By end user/sector, the automotive Tier 1 segment is poised to grow at a healthy CAGR of 9.8% between 2026 and 2035.

- By communication generations, the 4G/LTE & 5G combined segment generated the biggest multi-mode chipset market share of 55.8% in 2025.

- By communication generations, the 5G/NR segment is expanding at the fastest CAGR of 10% between 2026 and 2035.

Why Is the Multi-mode Chipset Market Gaining Momentum?

The multi-mode chipset market is witnessing rapid growth driven by the growing need for short-range high-speed data transmission in enterprise networks and data centers. The need for effective optical connectivity solutions is growing due to rising data traffic and cloud adoption. Further boosting market adoption are developments in power efficiency and chipset integration. Additionally, market expansion is being supported by rising investments in hyperscale data centers and 5G infrastructure.

What is the Role of the Multi-Mode Chipset Market?

AI plays a crucial role in the market by accelerating chip design and development, optimizing performance (PPA), enabling intelligent, adaptive functionality in devices, and driving demand through new applications in smart everything, ultimately leading to faster time-to-market and more efficient, powerful chips for complex AI tasks.

Key Technological Shifts

- Rapid adoption of higher data rate standards (25G, 50G, and 100G+) to support growing bandwidth requirements in data center and enterprise networks.

- Advancements in silicon photonics and optical integration are enabling smaller, faster, and more energy-efficient multimode chipsets.

- Increasing focus on low-power and heat-efficient designs to reduce operational costs on high density networking environments.

Integration of AI-driven network optimization and signal processing to improve performance and reduce latency. - Development of compact and cost-effective transceiver chipsets to support scalable and short-reach optical communications.

Multi-Mode Chipset Market Trends

- Growing adoption of 400G and next-generation optical interconnects in hyperscale data centers.

- Rising focuses on energy-efficient and low-latency chipsets to reduce power consumption and operational costs.

- Increased integration of silicon photonics for compact, high-performance multimode solutions.

- Expansion of AI, cloud computing, and big data workloads is driving demand for faster short-reach connectivity.

- Shift toward cost-optimized, scalable transceiver designs to support rapid data center expansion.

Opportunities in the Multi-Mode Chipset Market

- Rapid expansion of edge data centers and hyperscale data centers creates strong demand for high-speed multimode connectivity solutions.

- The growing deployment of AI and machine learning workloads increases the need for low-latency, high-bandwidth chipsets.

- Rising adoption of 400G and upcoming 800G optical modules opens opportunities for advanced multimode chipset development.

- Increasing focus on energy-efficient networking encourages innovation in low-power and thermally optimized chipsets.

- Emerging markets investing in digital infrastructure and 5G networks offer untapped growth potential for chipset manufacturers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.00 Billion |

| Market Size in 2026 | USD 12.12 Billion |

| Market Size by 2035 | USD 28.92 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.15% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology Type, Application/Device, End User / Sector, Communication Generation and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Will Drive Future Demand for Multimode Chipsets?

| Future Demand Driver | Impact of Market Demand |

| AI & High-Performance Computing (HPC) | Drives demand for ultra-low latency and high-bandwidth data transmission. |

| 400G/800G Optical Module Adoption | Accelerates the requirement for next-generation multimode transceivers and chipsets |

| Cloud & Edge Computing Growth | Boosts deployment of compact, energy-efficient multimode networking solutions |

| Energy Efficiency Regulations | Encourages adoption of low-power, thermally optimized multimode chipsets |

| Enterprise Network Upgrades | Supports steady demand for cost-effective, scalable multimode connectivity |

Segmental Insights

Technological Type Insights

Which Technological Type Dominated the Market in 2025?

The 5G/4G/3G multi-mode segment dominated the multi-mode chipset market with 42.3% market share, motivated by their adaptability in supporting several communications standards at once. Due to their seamless network switching capabilities, which guarantee dependable connectivity and compatibility with current infrastructure, these chipsets are extensively used in smartphones and consumer electronics. They are the preferred options for large-scale consumer electronics manufacturing because of their integration, which also lowers device complexity and cost.

The 5G/4G/3G+ satellite segment is growing rapidly, with 9.6% CAGR driven by the growing need for sophisticated hybrid connectivity solutions in cutting-edge applications where reliable worldwide coverage is essential, such as satellite-based IoT, industrial automation, and remote monitoring. The need for remote connectivity in underserved areas and growing investments in satellite communication infrastructure both contribute to the segment's growth.

Application/Device Insights

Why Smartphones Dominated the market in 2025?

The smartphones segment dominated the multi-mode chipset market with 35.8% market share since they continue to be the main devices needing multi-standard high-performance connectivity. This market is further strengthened by growing customer demand for seamless network switching and faster data speeds. Higher adoption of multi-mode chipsets is also fueled by the growth of mobile gaming, AR/VR apps on smartphones, and multimedia streaming. Sustained demand for cutting-edge chipsets in flagship devices is ensured by ongoing improvements in mobile networks.

The automotive segment is growing rapidly, with 9.7% CAGR driven by the growth of industrial automation systems, smart factories, and connected cars, all of which depend more on multi-mode chipsets for reliable low-latency communication. Chipset requirements are further increased when AI-driven apps and predictive maintenance solutions are integrated into industrial setups. Adoption in this market is greatly accelerated by the development of autonomous vehicles and smart transportation systems.

End User/Sector Insights

What made the OEMs Segment Dominant in the Market in 2025?

The OEMs segment is dominating the market with 38.7% multi-mode chipset market share, as they incorporate multi-mode chipsets into consumer electronics, wearables, and smartphones. Their extensive production and well-established distribution networks keep them at the top of the market. Strong supply chain alliances and economies of scale help OEMs adopt newer chipsets more quickly. Additionally, their emphasis on product differentiation and innovation guarantees ongoing chipset upgrades in consumer electronics.

The automotive Tier 1 segment is growing rapidly, with 9.8% CAGR driven by the increasing use of industrial IoT solutions and connected car technologies, which call for extremely dependable multi-standard connectivity components. Government programs that support connected infrastructure and smart manufacturing also help the segment. Chipset deployment in IoT ecosystems is further enhanced by collaborations with cloud service providers and telecom operators.

Communication Generations Insights

Which Communication Generations Dominated the Market in 2025?

The 4G/LTE & 5G combined segment dominates the multi-mode chipset market with 55.8% market share, demonstrating the industry's current preference for hybrid chipsets that can support both established 4G networks and newly developed 5G connectivity. This permits quicker, lower-latency communication while guaranteeing backward compatibility. These hybrid solutions are preferred by businesses and mobile carriers to optimize network performance and coverage. Additionally, the segment gains lower deployment risks and wide device compatibility.

The 5G/NR segment is growing rapidly with 10% CAGR as 5G network deployment around the world picks up speed. These next-generation chipsets are being rapidly adopted due to demand from gaming, industrial IoT, and high-speed data applications. This market is further strengthened by ongoing advancements in 5G NR technology, such as mmWave and support for massive MIMO. For chipset manufacturers, early adoption in developed markets guarantees rapid revenue growth.

Regional Insights

What is the Asia Pacific Multi-mode Chipset Market Size?

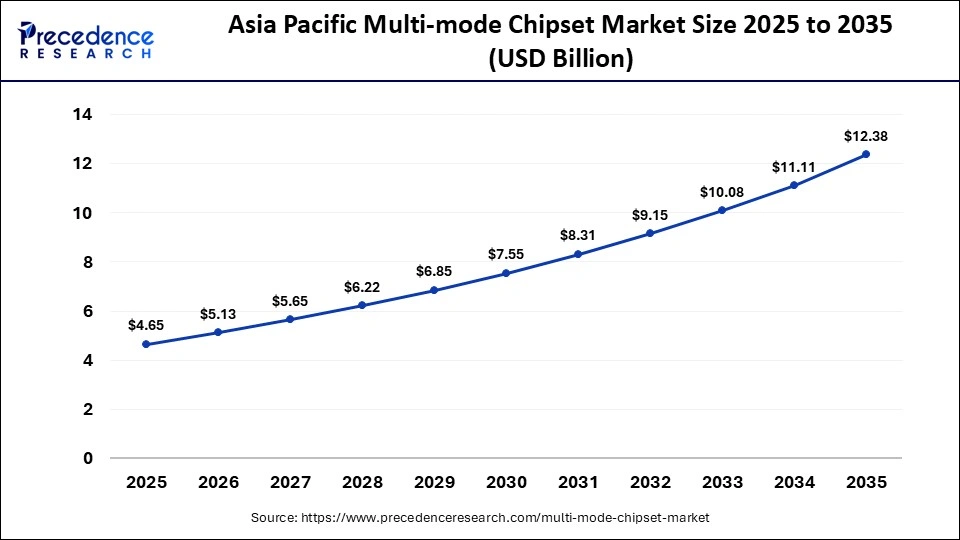

The Asia Pacific multi-mode chipset market size is expected to be worth USD 12.38 billion by 2035, increasing from USD 4.65 billion by 2025, growing at a CAGR of 10.29% from 2026 to 2035.

Which Region Dominated the Market in 2025?

The Asia Pacific region dominates the multi-mode chipset market with 42.3% market share, bolstered by robust smartphone manufacturing, widespread IoT adoption, and regional government programs encouraging 5G deployment. China, South Korea, India, and other nations are crucial to maintaining this dominance. Its leadership is further cemented by the robust infrastructure for electronics manufacturing, the high demand from consumers for mobile devices, and its capacity for economic production. Regional partnerships on smart city initiatives and 5G standardization also increase market penetration.

India Multi-mode Chipset Market

India plays a leading role in the market because of the quick uptake of smartphones, the expanding rollout of 5G, and the growing use of IoT applications in various industries. Government programs promoting smart cities, digital infrastructure, and homegrown semiconductor production bolster market expansion.

The Rising Use of 5G is Driving North America

North America is growing rapidly with 10.8% multi-mode chipset market share because of the quick rollout of 5G, the growing use of connected cars, and the growth of industrial IoT. This accelerated growth is fueled by the region's strong focus on advanced chipset R&D and early adoption of 5G. Growth prospects are improved by government support for cutting-edge communication infrastructure and significant investments from top tech firms. Another factor accelerating the market is the growing emphasis on private 5G networks for business and defense applications.

U.S. Multi-mode Chipset Market

The U.S. market is expanding rapidly because of the early adoption of cutting-edge 5G technologies, the robust presence of top chipset manufacturers, and the high demand from the defense, automotive, and industrial IoT sectors. Market development is greatly accelerated by ongoing investments in private 5G networks and R&D.

Latin America is growing consistently, supported by growing IoT adoption, improving mobile connectivity, and the region's slow rollout of 5G networks. Sustained market expansion is supported by growing digital transformation initiatives and better telecom infrastructure.

Brazil Multi-mode Chipset Market

Brazil is leading the Latin American market due to its large consumer base, strong demand for smartphones, and ongoing investments in 4G and 5G network expansion. Growth in automotive connectivity and industrial automation further boosts chipset adoption.

Europe represents a mature market for multi-mode chipsets, supported by advanced telecom infrastructure, high smartphone penetration, and established industrial IoT ecosystems. The region's focus on connectivity standards, automotive innovation, and smart manufacturing sustains stable demand.

Germany Multi-mode Chipset Market

Germany stands out as a leading European country in the multi-mode chipset market due to its strong automotive industry, Industry 4.0 initiatives, and early adoption of connected manufacturing technologies. High demand for reliable, multi-standard connectivity drives chipset integration across industrial applications.

The MEA region is emerging as a high-potential market due to expanding 5G infrastructure, increasing smart city projects, and rising demand for connected devices. Growing investments in digital transformation and telecom modernization support long-term growth.

UAE Multi-mode Chipset Market

The UAE is at the forefront of the market within the MEA region due to aggressive 5G deployment, strong government support for smart city initiatives, and early adoption of advanced connectivity solutions. High demand from sectors such as transportation, utilities, and industrial automation further strengthens market leadership.

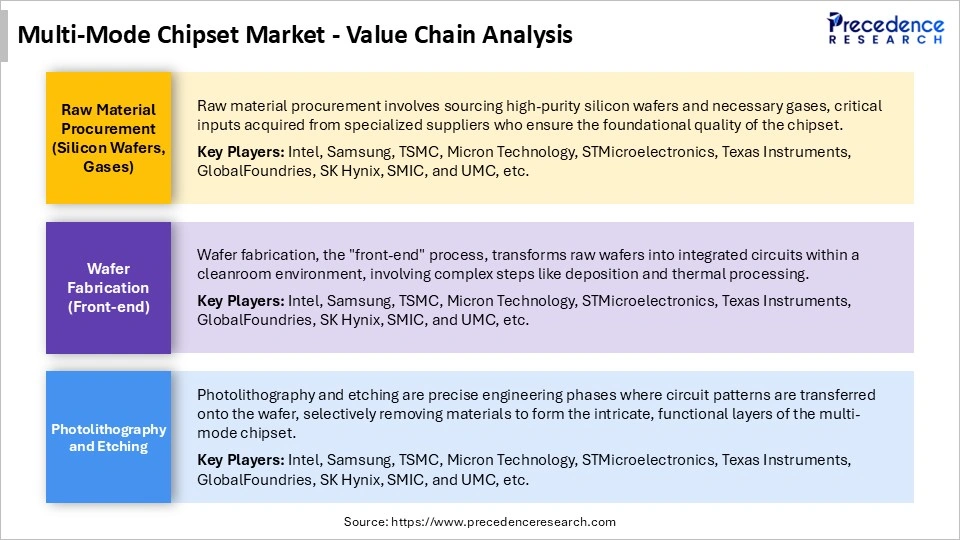

Multi-Mode Chipset Market Value Chain Analysis

Multi-Mode Chipset Market Top Companies

- Qualcomm Technologies, Inc: Dominates the global premium 5G and high-end mobile processor market with its advanced Snapdragon Elite series.

- MediaTek Inc: Primary supplier of cost-effective chipsets for mid-range smartphones and tablets using efficient 2nm architecture.

Samsung Electronics Co., Ltd.: Designs powerful internal chipsets for its Galaxy ecosystem and external partners to enable unified AI intelligence. - Intel Corporation: Focuses on connectivity solutions for industrial, automotive, and large-scale infrastructure sectors using high-throughput enterprise standards.

- Broadcom Inc: Provides highly integrated wireless and networking solutions for enterprise and consumers using, targeting mission-critical connectivity needs.

Who are the Major Players in the Global Multi-Mode Chipset Market?

The major players in the multi-mode chipset market include UNISOC Communications Inc., NXP Semiconductors N.V.,STMicroelectronics N.V., Marvell Technology, Inc., Texas Instruments Incorporated, Analog Devices Inc., Skyworks Solutions, Inc., Qorvo, Inc., Infineon Technologies AG, Renesas Electronics Corporation, Nokia Corporation, ZTE Corporation, GCT Semiconductor Inc., and Fujitsu Limited.

Recent Developments

- In September 2025, MACOM Technology Solutions Inc. launched a new chipset that extends PCIe and CXL connectivity over multimode optical fiber, improving high-bandwidth, low-latency links in disaggregated computing systems. This solution enhances long-distance multimode fiber performance up to 100 m, crucial for next-generation data center architectures.(Source:https://www.beyondspx.com)

- In March 2025, Semtech Corporation announced the launch of the industry's first ITU-compliant asymmetric 50G PON OLT chipset (GN7161, GN7153BW, GN25L80B), enabling compact and power-efficient fiber broadband deployments. This chipset supports scalable next-generation network upgrades and is expected to accelerate 50G PON adoption globally.(Source:https://www.semtech.com)

- In March 2025, Keysight Technologies, Inc. & Coherent Corp. unveiled new 200G per lane multimode VCSEL technology at the Optical Fiber Communication Conference (OFC), doubling data throughput capacity for short-reach optical interconnects. This technology is designed to meet the growing bandwidth needs of AI/ML data center environments with better power and cost efficiency.(Source:https://in.investing.com)

- In March 2025, Lessengers Inc. announced an industry-first 1.6 Terabit OSFP multimode optical transceiver with a low-power, high-performance design for AI/ML workloads, showcased at OFC 2025. This high-capacity transceiver aims to address the bandwidth and energy challenges of hyperscale data centers.(Sourcehttps://www.businesswire.com)

Segments Covered in the Report

By Technology Type

- 5G/4G/3G multi-mode

- 5G/4G/3G + Wi-Fi

- 5G/4G/3G + Satellite

- Software-defined / Programmable Chipsets

By Application/Device

- Smartphones

- Tablets

- Wearable Devices

- Automotive

- Industrial IoT

By End User / Sector

- OEMs

- Telecom Module Manufacturers

- Automotive Tier-1 Suppliers

- Industrial IoT Providers

By Communication Generation

- 2G / 3G

- 4G / LTE

- 5G / NR

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting