Multi-Mode Receiver Market Size and Forecast 2025 to 2034

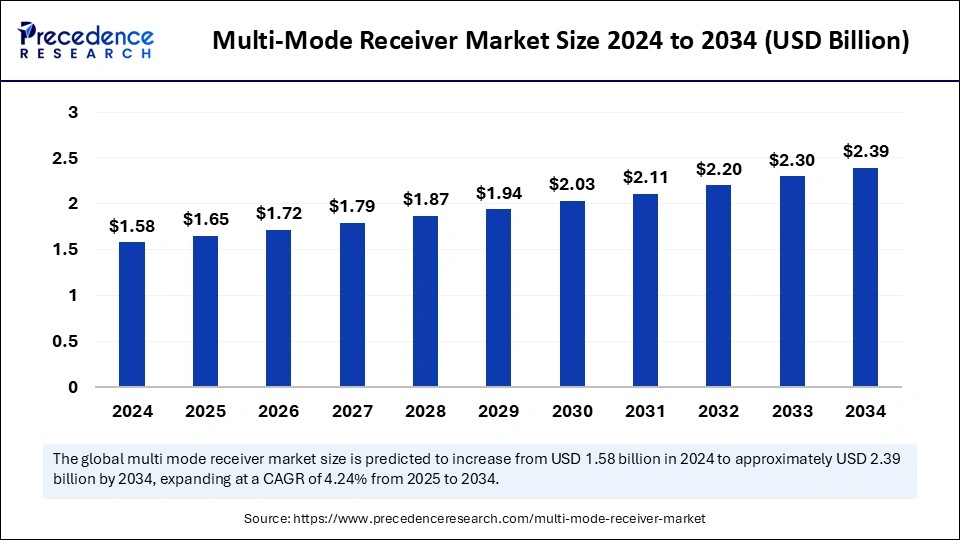

The global multi-mode receiver market size accounted for USD 1.58 billion in 2024 and is predicted to increase from 1.65 billion in 2025 to approximately USD 2.39 billion by 2034, expanding at a CAGR of 4.24% from 2025 to 2034. The capability of multi-mode receivers to combine and accumulate multiple navigation functionalities is the key factor driving market growth. Also, innovations in semiconductor technology, coupled with the surging number of air passengers across the globe, can fuel market growth further.

Multi-Mode Receiver Market Key Takeaways

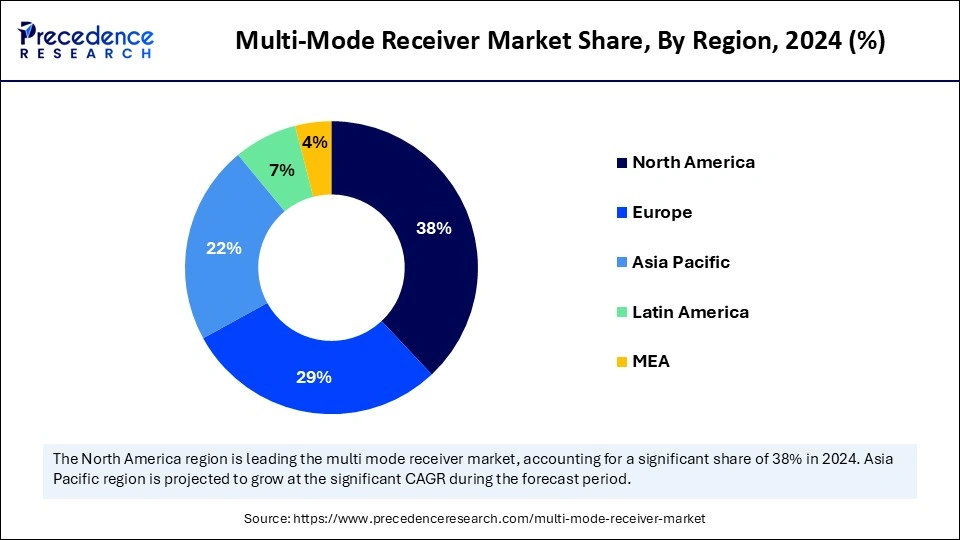

- North America dominated the global market with the largest market share of 38% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR the period studied.

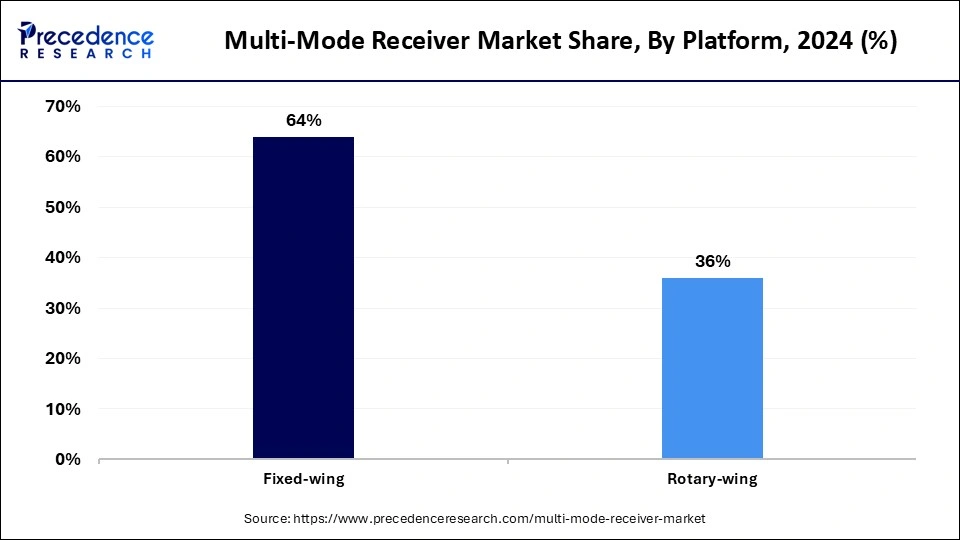

- By platform, the fixed-wing segment held the largest market share of 64% in 2024.

- By platform, the rotary-wing segment is anticipated to grow at the fastest CAGR over the forecast period.

- By fit, the line-fit segment contributed the highest market share in 2024.

- By fit, the retrofit segment is expected to grow rapidly over the forecast period.

- By application, the navigation and positioning segment held the biggest market share in 2024.

- By application, the landing applications segment will expand significantly during the projected period

- By end use, the aerospace and defense segment generated the major market share in 2024.

- By end use, the telecommunication segment is projected to grow at the fastest CAGR during the forecast period.

Role of Artificial Intelligence (AI) in Signal Processing and Demodulation

Artificial Intelligence,especially machine learning, plays an important role in the multi-mode receiver market, improving reliability and performance by facilitating innovative signal processing and tackling impairments such as phase noise and IQ imbalance. Furthermore, AI algorithms like SVM (Support Vector Machine) are utilized to develop robust and computationally efficient demodulation techniques.

- In February 2025, DeepSig, a pioneer in AI-native wireless communications, showcased its latest advancements in AI-driven radio access networks (RAN) at the Mobile World Congress (MWC) 2025 in Barcelona alongside the AI-RAN Alliance demonstrations. The over-the-air demonstration, as part of the AI-for-RAN Working Group of the AI-RAN Alliance.

U.S. Multi-Mode Receiver Market Size and Growth 2025 to 2034

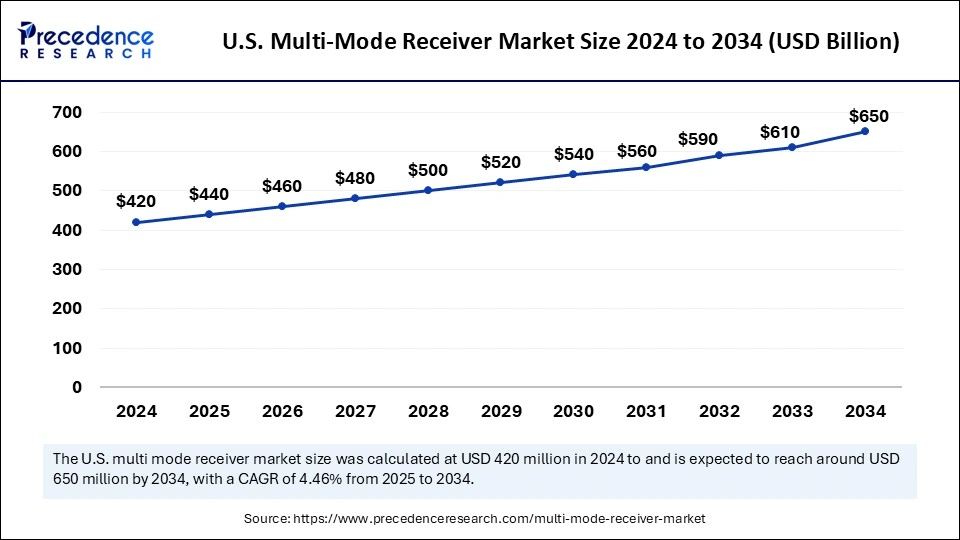

The U.S. multi-mode receiver market size was exhibited at USD 420 billion in 2024 and is projected to be worth around USD 650 billion by 2034, growing at a CAGR of 4.46% from 2025 to 2034.

North America dominated the multi-mode receiver market in 2024. The dominance of the region can be attributed to the growing use of next-generation navigation technologies, such as ILS, GLS, and GNSS systems, that ensure precise and smooth flight operations, hence impacting positive market growth. Furthermore, defense forces and commercial airlines are heavily investing in the modernization of fleets.

U.S. Market Trends

In North America, the U.S. led the multi-mode receiver market owing to the rising demand for the latest narrow-body aircraft from consumers across the globe, along with the increasing emphasis of multiple market players on innovating existing fleets. The country is also home to various aviation technology companies.

Asia Pacific is expected to grow at the fastest rate in the multi-mode receiver market over the period studied. The growth of the region can be credited to the increasing implementation of satellite-based systems such as GLS and ground-based augmentation systems (GBAS) in the region. Moreover, a substantial rise in demand for the latest consumer-connected devices technology in the region is propelling regional growth.

- In February 2025, Japan's space agency successfully launched a navigation satellite on its new flagship H3 rocket as the country seeks to have a more precise location positioning system of its own. The H3 rocket carrying the Michibiki 6 satellite lifted off from the Tanegashima Space Center on a southwestern Japanese island.

China Market Trends

In Asia Pacific, China dominated the multi-mode receiver market. The dominance of the country can be linked to the increasing demand for wearables created by major market players in the country. Major consumer electronics players in the country are increasingly focusing on developing advanced devices.

Market Overview

A multi-mode receiver is a unit with numerous functions that involve all the onboard receiving practices that are needed for a pilot to position, navigate, and land an aircraft. It offers an efficient and cost-effective solution for advanced facilities with enhanced avionics. The multi-mode receiver includes various stand-alone receivers like microwave landing system (MLS) receivers, landing system (ILS) receivers, and GPS landing system receivers in single units of the aircraft industry.

Multi-Mode Receiver Market Growth Factors

- Strict regulations focusing on aviation safety are expected to boost multi-mode receiver market growth shortly.

- Increasing adoption of autonomous systems and rapid deployment of 5G telecommunication networks can soon propel market growth.

- The growing emphasis on retrofitting older aircraft with the latest systems will likely contribute to the market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.39 Billion |

| Market Size in 2025 | USD 1.65 Billion |

| Market Size in 2024 | USD 1.58 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.24% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform, Fit, Application, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Surge in fleet expansion

The rising global air traffic has become a major growth factor for the multi-mode receiver market. Passenger density is increasing frequently, particularly in developing economies like India and China, where the middle-class population, along with the family income, is surging. In addition, this growth has led to a surge in demand for air travel, allowing airlines to expand their fleets and add new routes.

- In September 2023, Creonic GmbH, a leading provider of IP cores for communication systems, introduced its DVB-S2X Multi-Carrier Demodulator IP core. Designed to enhance satellite communication systems, this innovative addition to Creonic's SATCOM IP core portfolio offers unparalleled versatility.

Restraint

Potential cybersecurity threats

As aircraft are majorly dependent on satellite-based systems and digital technologies, cybersecurity has emerged as a crucial obstacle for the multi-mode receiver market. These receivers are integral to landing capabilities and aircraft navigation. However, their dependence on real-time data transmission, satellite signals, and digital integration makes them vulnerable to cyberattacks.

Opportunity

Increasing shift towards integrated solutions

There is a rising trend of bringing multichannel receivers into more compact and smaller units within all sectors of industries. Wearables and smartphones, particularly car systems, are impacted by the utilization of a multi-mode receiver for networks like GPS/Wi-Fi/Bluetooth. Furthermore, in the automobile sector, multi-mode receivers optimize innovative autonomous vehicles and driver-assistance systems (ADAS), offering smoother navigation.

- In April 2024, American Airlines signed a sizeable agreement with Airbus for multiple avionics systems and airframe upgrades on 150 A320ceo family aircraft in its in-service fleet. Avionic systems retrofits will add valuable modern features such as improved weather events prediction thanks to the latest generation of weather radar supporting pilot decision-making.

Platform Insights

The fixed-wing segment held the largest multi-mode receiver market share in 2024. The dominance of the segment can be attributed to the increasing use of these receivers in the aviation system. The multi-mode system is designed for aircraft that create lift through fixed wings. Additionally, fixed-wing platform receivers play a crucial role in the smooth operations of the aviation industry.

The rotary-wing segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the growing use of helicopters by many industries, including aerospace, transportation, critical infrastructure management, and defense. Moreover, these receivers are utilized in aircraft that use rotating blades to develop lift, which is essential for takeoff.

Fit Insights

The line-fit segment dominated the multi-mode receiver market in 2024. The dominance of the segment can be linked to the integration of multi-mode receivers in new aircraft during manufacturing. In addition, original equipment manufacturers (OEMs) and airlines prefer line-fit solutions because they ensure smooth compatibility with innovative avionics systems.

The retrofit segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the ongoing fleet upgrade projects launched by various airline industry participants. Furthermore, these latest agreements include the addition of advanced Satellite Augmentation Systems and Air Traffic Services Units (ATSU), etc.

Application Insights

The navigation and positioning segment held the largest multi-mode receiver market share in 2024. The dominance of the segment is owing to the increasing incidences of harsh weather conditions, which leads to delays in workloads on pilots. Furthermore, the multi-mode receiver is mainly deployed to receive various signals from numerous systems and technologies, leading to segment expansion soon.

- In February 2025, Japan launched a navigation satellite on its new flagship H3 rocket as the country seeks to have a more precise location positioning system of its own. The H3 rocket carrying the Michibiki 6 satellite successfully lifted off from the Tanegashima Space Centre on a southwestern Japanese island.

The landing applications segment is estimated to grow at the fastest rate during the projected period. The growth of the segment is due to the rising need for innovative technology-assisted guidance systems along with the increasing prevalence of landing delays caused due to harsh weather. Also, rising traffic at busy airports is impacting positive market segment growth.

End-Use Insights

In 2024, the aerospace and defense segment dominated the multi-mode receiver market by holding the largest share. The dominance of the segment can be credited to the rising use of innovative multi-mode receivers in business airline fleets, commercial airline fleets, and defense aircraft. The defense and aerospace industry depends on smooth technology assistance for landings, lifts, and security protocol adherence.

The telecommunication segment is projected to grow at the fastest rate during the forecast period. The growth of the segment is because of the increasing use of connected devices technology and the surge in the ubiquity of smartphones. Moreover, the use of these receivers in automotive applications for different functionscan propel segment growth further.

Multi-Mode Receiver Market Companies

- AE Systems

- Garmin Ltd.

- Honeywell International Inc.

- Indra Sistemas

- Intelcan Technosystems Inc.

- Leonardo S.p.A.

- Deere & Company

- Collins Aerospace

- Saab AB

- systems interface (FREQUENCIES)

- Thales

- Trimble

- VAL Avionics Ltd.

Latest Announcements by Market Leaders

- In December 2024, Honeywell announced the signing of a strategic agreement with Bombardier, a global leader in aviation and manufacturer of world-class business jets, to provide advanced technology for current and future Bombardier aircraft in avionics, propulsion, and satellite communications technologies. The collaboration will advance new technology to enable a host of high-value upgrades for the installed Bombardier operator base.

- In March 2025, Garmin, the world's most innovative and recognized marine electronics manufacturer, announced Force Pro – a brushless trolling motor engineered with extreme power and Garmin's most precise GPS positioning technology. It gives anglers everything they love about Force, now with multi-band GPS for superior anchor lock performance and a built-in GT56UHD.

Recent Developments

- In 2024, Collins Aerospace is collaborating with the European Agency for Space Programme (EUSPA) on the Multi-Mode Global Positioning System and Galileo (MUGG) project to enhance the resilience and availability of commercial navigation systems. This initiative focuses on developing a dual-frequency, multi-constellation satellite-based augmentation system (SBAS) receiver.

- In December 2024, Honeywell revealed that Avianca chose its avionics and mechanical systems for its new Airbus A320neo fleet to optimize operational performance. The list comprises Honeywell's 131-9A APUs, Pegasus II A320 FMS, IntuVue RDR-4000 weather radar, TCAS, and the Integrated Multi-Mode Receiver, enhancing navigation and situational awareness for pilots.

Segments Covered in the Report

By Platform

- Fixed-wing

- Rotary-wing

By Fit

- Line-fit

- Retrofit

By Application

- Navigation & Positioning

- Landing

- Others

By End-Use

- Telecommunications

- Automotive

- Aerospace and Defense

- Marine and Shipping

- Agriculture

- Construction and Surveying

- Transportation and Logistics

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting