What is the Gastrointestinal Bleeding Treatment Market Size in 2026?

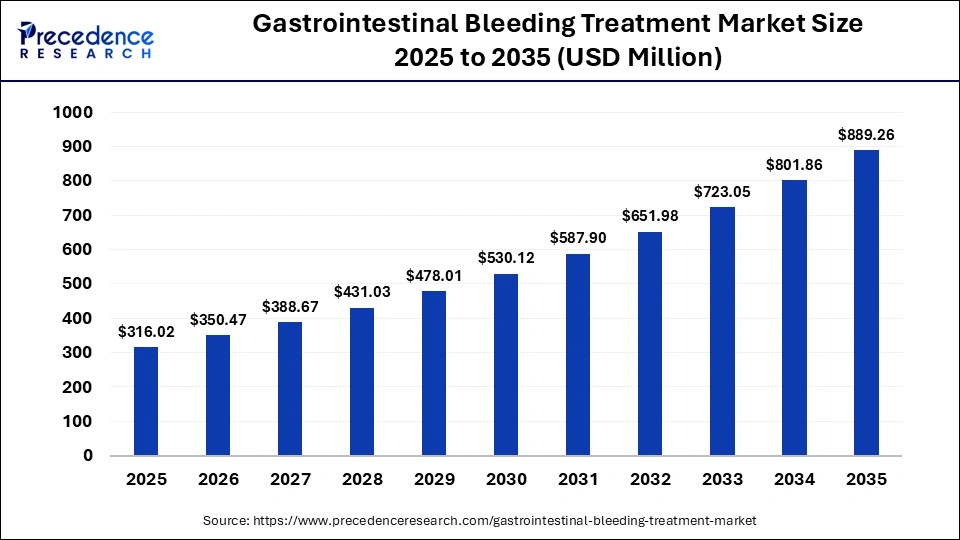

The global gastrointestinal bleeding treatment market size was calculated at USD 316.02 million in 2025 and is predicted to increase from USD 350.47 million in 2026 to approximately USD 889.26 million by 2035, expanding at a CAGR of 10.90% from 2026 to 2035.The market is expanding rapidly due to the rising integration of AI-assisted endoscopy, increasing preference for endoscopic hemostasis, and rising cases of gastrointestinal disorders, such as peptic ulcers, gastritis, and colorectal cancer, which lead to bleeding in the digestive tract.

Key Takeaways

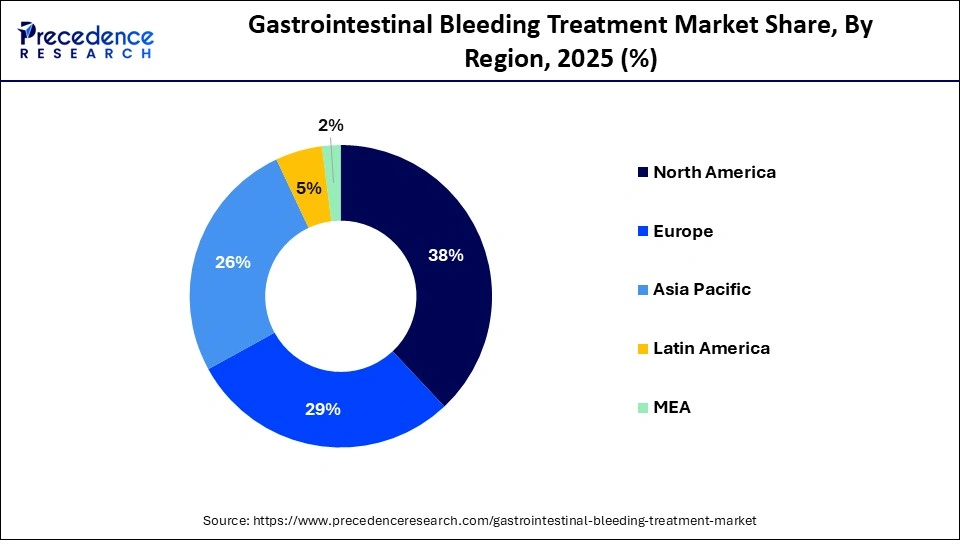

- North America led the gastrointestinal bleeding treatment market with a share of approximately 38% in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR in the market between 2026 and 2035.

- By treatment modality, the endoscopic hemostasis devices and accessories segment held the largest revenue share of approximately 42% in 2025.

- By treatment modality, the embolization and interventional radiology segment is expected to grow at a strong CAGR between 2026 and 2035.

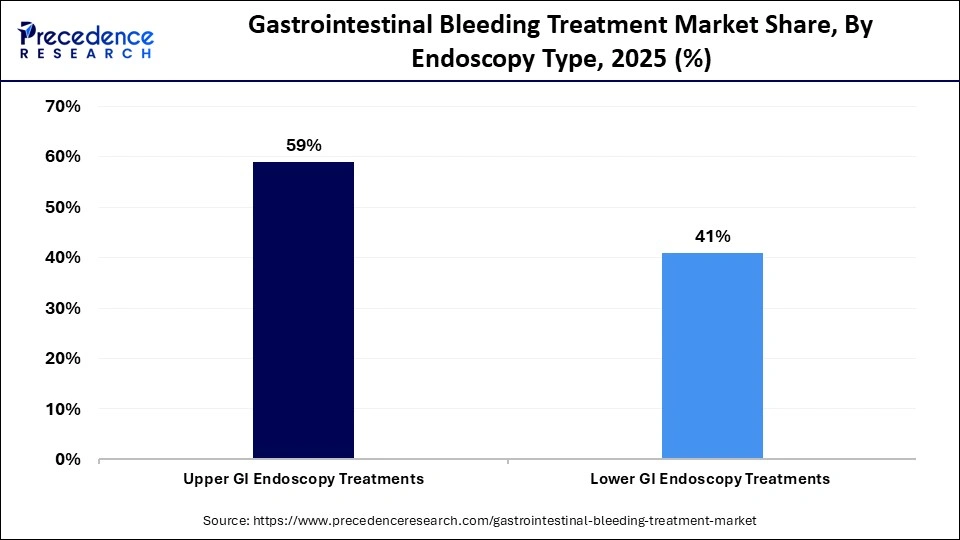

- By endoscopy type, the upper GI endoscopy treatments segment captured the highest revenue share of approximately 59% in 2025.

- By endoscopy type, the lower GI endoscopy treatments segment is expected to expand at the fastest CAGR from 2026 to 2035.

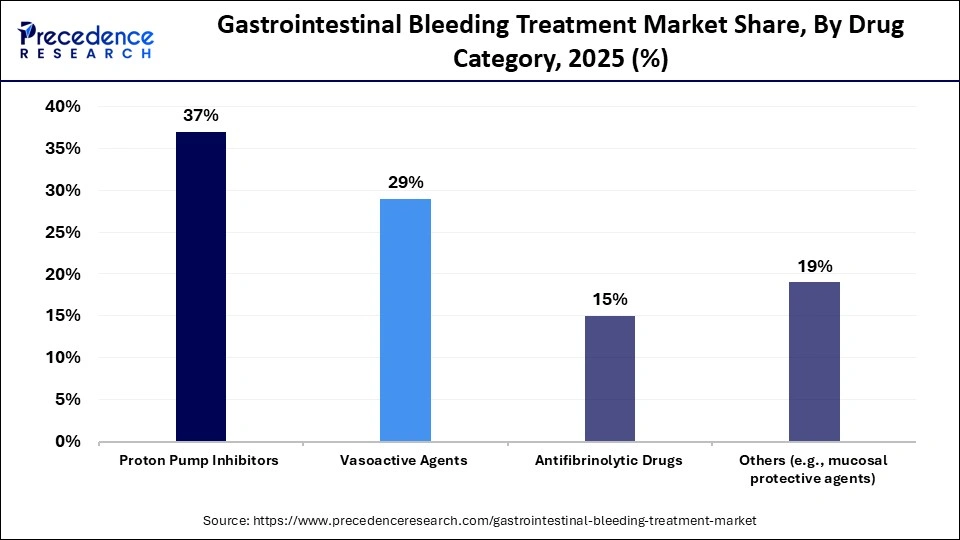

- By drug category, the proton pump inhibitors (PPIs) segment led the market with a share of approximately 37% in 2025.

- By drug category, the others segment is expected to grow at a solid CAGR between 2026 and 2035.

- By end user, the hospitals and specialty clinics segment accounted for the highest revenue share of approximately 51% in 2025.

- By end user, the ambulatory surgery centers segment is expected to grow at a strong CAGR between 2026 and 2035.

Which Factors Drive the Gastrointestinal Bleeding Treatment Market?

The market consists of therapies, devices, and clinical interventions that treat patients with issues related to gastrointestinal (GI) bleeding from anywhere in the digestive tract, including both upper and lower GI.

The ongoing growth of the market is due to the increasing prevalence of peptic ulcer disease and colorectal disease, liver cirrhosis, and bleeding caused by the use of anti-coagulant medications, in addition to patients experiencing difficulty with bleeding following the use of anti-thrombotics. The increased use of advanced endoscopic hemostatic devices, combined with advanced pharmaceutical and advances in emergency department protocols, has improved mortality rates.

As a direct result of the expanding elderly population and the continued rising prevalence of lifestyle-associated GI disorders, the number of people who suffer from gastrointestinal bleeding is increasing. In addition, technological innovations such as advanced endotherapy systems and enhanced imaging capabilities for diagnosis facilitate market growth. The expansion of healthcare systems in developing countries, along with increasing global awareness of timely treatment, is resulting in increased volumes of procedures performed and more patients receiving therapy for GI bleeding.

Artificial Intelligence Transforms the Gastrointestinal Bleeding Treatment Market

Artificial intelligence (AI) has made great strides in the gastroenterology field by improving diagnostic accuracy, increasing the efficiency of clinical workflows, and introducing innovative products to the market. AI-enabled endoscopic systems and machine learning (ML) algorithms now provide real-time detection of subtle sources of bleeding and risk stratification during procedures, resulting in shorter procedure times and improved patient outcomes for hospitals or diagnostic centers.

AI-enabled endoscopic systems are developed for improving visualization and interpretation. AI-supported blood testing assays enable earlier disease detection and subsequent prevention of major complications from GI bleeding. These advances have generated substantial interest among investors, driving an increase in the number of applications of AI in the GI space.

Trends Impacting the Gastrointestinal Bleeding Treatment Market

- Endoscopy Advancements- The continually evolving use of advanced endoscopic techniques such as high definition, capsule endoscopy, and artificial intelligence (AI) aided visualization techniques continues to allow for the discovery of lesions earlier and improve the efficacy of achieving hemostasis.

- Innovations in Hemostasis- The growing use of novel hemostatic agents, including sprays, powders, clips, and over-the-scope devices, enhances the ability to control non-surgical bleeding. These hemostatic innovations provide the opportunity for rapid intervention, increased procedure efficiency, and a greater array of treatment options when managing complex upper and lower GI bleeding cases.

- Biologic and Pharmacological Treatments- The increasing reliance on proton pump inhibitors, biologics, and targeted therapies continues to support the pharmacological management of ulcerative and inflammatory disease processes involving the GI tract. Methods involving a combination of drug therapy together with an endoscopic procedure provide more successful long-term outcomes for patients.

- Expansion of Outpatient Care- The expansion of outpatient endoscopies within ambulatory surgical centers is improving both the cost of treatment and decreasing the burden on hospitals. Enhanced recovery protocols, improved monitoring technology, and minimally invasive approaches have enabled selected patients to be discharged the same day after having had surgical procedures performed on an outpatient basis.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 316.02 million |

| Market Size in 2026 | USD 350.47 million |

| Market Size by 2035 | USD 889.26 million |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.90% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Treatment Modality,Endoscopy Type,Drug Category,End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Treatment Modality Insights

Which Treatment Modality Segment Dominated the Market?

The endoscopic hemostasis devices and accessories segment held a major revenue share of approximately 42% in the gastrointestinal bleeding treatment market in 2025 due to their ability to control bleeding immediately and with minimal invasiveness. The use of clips, band ligation devices, injection needles, and thermal probes in both the upper and lower gastrointestinal (GI) tract for emergent bleeding situations has resulted in a preference among hospitals because of the high rate of success for endoscopic procedures, shorter hospital stays, and fewer surgeries required from using these devices. Continued innovations and improvements in the visualization method boost the segment's growth.

The embolization and interventional radiology segment is expected to grow at the fastest CAGR in the market between 2026 and 2035 because of its effectiveness in treating patients who have failed or are contraindicated for endoscopic therapy. Recent advancements in imaging and microcatheter technology have enabled the accurate targeting of blood vessels with fewer complications.

Additionally, the continued growth of surgeons who perform interventional procedures within hospitals and the increasing availability of interventional radiologists augment the segment's growth. The increasing trend toward less invasive surgical procedures will also support the demand for these procedures.

Endoscopy Type Insights

Which Endoscopy Type Segment Dominated the Gastrointestinal Bleeding Treatment Market?

The upper GI endoscopy treatments segment registered its dominance over the global market with a share of approximately 59% in 2025. This is primarily due to the large volume of patients suffering from peptic ulcers, variceal bleeding, and gastritis-related bleeding. The ability of an endoscopist to see directly inside the stomach and GI tract allows for immediate treatment. Upper GI endoscopy provides rapid diagnosis and is the first-line method for treating patients in emergencies. Strong clinical guidelines and the widespread availability of facilities/equipment for performing endoscopic procedures have further supported the segment's growth.

The lower GI endoscopy treatments segment is expected to grow with the highest CAGR in the market during the studied years, due to a growing number of patients diagnosed with colorectal disorders, inflammatory bowel disease, and age-related bleeding disorders. The segmental growth is attributed to improvements in colonoscopy techniques and easier bowel preparation. The growing public awareness of the importance of colorectal cancer screening promotes the demand for lower GI endoscopic procedures.

Drug Category Insights

Which Drug Category Segment Led the Gastrointestinal Bleeding Treatment Market?

The proton pump inhibitors (PPIs) segment led the global market with a share of approximately 37% in 2025, as PPIs reduce gastric acid secretion, stabilize the clot, and prevent rebleeding. PPIs are generally prescribed for patients suffering from ulcer-related bleeding. PPIs are used routinely and are frequently prescribed before and after endoscopic treatment. There is sufficient clinical evidence supporting the use of PPIs, established treatment protocols, and a variety of i.v. or oral dosage forms available, propelling the segment's growth.

The others segment is expected to expand rapidly in the market in the coming years new products being introduced regularly. Mucosal protective agents help promote mucosal healing and are used in conjunction with standard therapy regimens more frequently than in the past. The continued introduction of new agents and the growing research on novel formulations and adjunctive therapies to decrease recurrence rates promote the demand for mucosal protective agents. In addition, many new therapeutic avenues that do not involve only acid suppression are additionally contributing to this segment's rapid growth.

End User Insights

How the Hospitals and Specialty Clinics Segment Dominated the Market?

The hospitals and specialty clinics segment held the largest revenue share of approximately 51% in the gastrointestinal bleeding treatment market in 2025 because they have extensive emergency care capabilities and greater access to advanced endoscopic infrastructure. Hospitals and specialty clinics have immediate access to multiple specialties, such as gastro-interventionists, surgeons, and critical care physicians. They are widely preferred due to the availability of ICUs and 24-hour service, increasing patient population, and favorable reimbursement policies.

The ambulatory surgery centers segment is expected to witness the fastest growth in the market over the forecast period, driven by affordable treatment costs and quicker turnover rates. The shifting trend towards outpatient endoscopic procedures and improvements in minimally invasive surgery enable patients to move from hospital settings to outpatient settings and surgical centers. Expanded access to reimbursement and convenience for patients will continue to drive the establishment of additional ASCs focused on the GI field.

Regional Insights

How Big is the North America Gastrointestinal Bleeding Treatment Market Size?

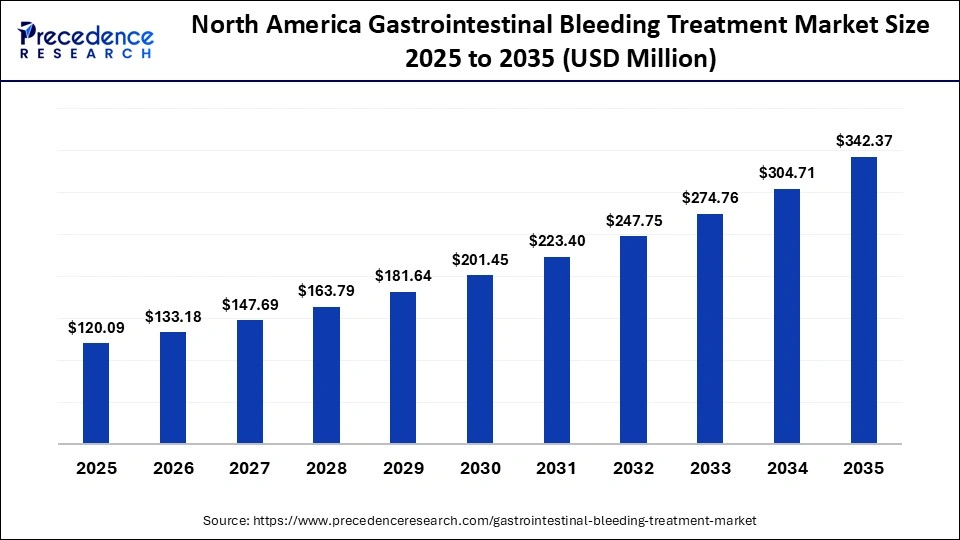

The North America gastrointestinal bleeding treatment market size is estimated at USD 120.09 million in 2025 and is projected to reach approximately USD 342.37 million by 2035, with a 11.04% CAGR from 2026 to 2035.

Why North America Dominated the Gastrointestinal Bleeding Treatment Market?

North America dominated the global market with a share of approximately 38% in 2025, driven by its established healthcare ecosystem, rapid adoption of newer technologies for endoscopic and interventional procedures, and prioritization of preventative care. Continually updated treatment guidelines from major gastroenterology associations and the ability of large hospital networks to facilitate the implementation of cutting-edge therapy options help drive their rapid implementation.

Additionally, clinical practice within North America has also focused on reducing lengths of hospital stays and incorporating AI-based diagnostic technologies into practice, so treatment outcomes continue to be improved, making North America an excellent location for product introductions and partnerships with global medical device and pharmaceutical companies in clinical trials and research.

What is the Size of the U.S. Gastrointestinal Bleeding Treatment Market?

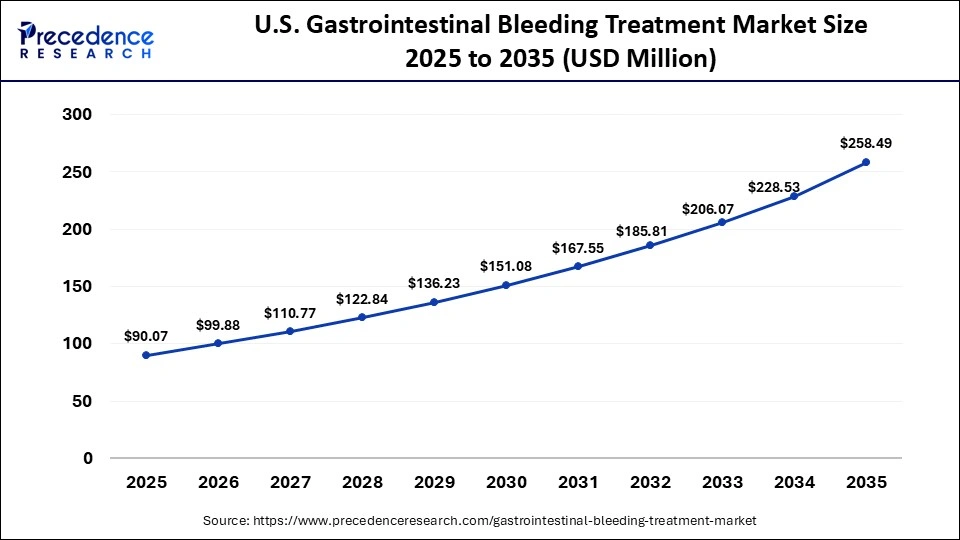

The U.S. gastrointestinal bleeding treatment market size is calculated at USD 90.07 million in 2025 and is expected to reach nearly USD 258.49 million in 2035, accelerating at a strong CAGR of 11.12% between 2026 and 2035.

U.S. Gastrointestinal Bleeding Treatment Market Trends

The U.S. leads North America in the market as a hub for innovation through extensive research to develop and utilize minimally invasive surgical options to treat GI bleeding. Government initiatives aim to increase the availability of acute care treatment protocols in community hospitals and enhance the ability to detect more accurately and in real-time with the use of digital imaging. The large concentration of outpatient specialty provider centers and ongoing clinical trials for the development of new hemostatic agents validate the nation's position as a leader in the innovation of therapy for GI bleeding.

Why is Asia-Pacific Experiencing Fastest Growth in the Gastrointestinal Bleeding Treatment Market?

Asia-Pacific is expected to witness the fastest growth with a CAGR of approximately 11.2% during the predicted timeframe, driven by the increasing investments in healthcare, the continued expansion of health insurance coverage, and the increasing awareness of GI diseases. Asia-Pacific countries are modernizing their medical facilities and increasing the number of gastroenterologists as a priority.

These factors potentiate the demand for both basic and advanced treatment modalities. The increasing population, growing elderly population, and the rising prevalence of GI diseases associated with lifestyle issues help spur the development of healthcare infrastructure and improve access to treatment.

Japan Market Trends

Japan leads in the Asia-Pacific region in the market, driven by a rapidly expanding healthcare ecosystem and the increasing development of new medical technology. Advances in endoscopy suites and the development of a structured patient care pathway have established Japan as a leading nation in the adoption of new-generation medical devices. Collaborative research projects in Japanese universities, hospitals, and medical device manufacturers have allowed for a better understanding of the disease epidemiology, which allows for better care to be delivered through targeting patient needs and developing best practices that are distributed across the region.

Gastrointestinal Bleeding Treatment Market Companies

- Boston Scientific Corporation

- CONMED Corporation

- Cook Group

- ERBE Elektromedizin GmbH

- Medtronic PLC

- Olympus Corporation

- Ovesco Endoscopy AG

- Pfizer Inc.

- STERIS PLC

- US Medical Innovations

Recent Developments

- In June 2024, researchers from McMaster University found that only a few ventilated patients who received pantoprazole experienced clinically important upper GI bleeding compared to the placebo group. The study was conducted on 4,821 ICU patients undergoing invasive ventilation. (Source: https://www.healio.com)

- In February 2024, Fujifilm India launched ALOKA ARIETTA 850 diagnostic ultrasound system in India with its first installation at Fortis Hospital, Bengaluru. The system aims to enhance diagnostic precision and image clarity for GI diseases, performing targeted treatments, such as pancreatic pseudo cyst damage. (Source: https://www.expresshealthcare.in)

Segments Covered in the Report

By Treatment Modality

- Endoscopic Hemostasis Devices and Accessories

- Clips and band ligation devices

- Injection needles and thermal probes

- Pharmaceutical Therapies

- Proton pump inhibitors (PPIs)

- Vasoactive agents

- Antifibrinolytics

- Embolization and Interventional Radiology

- Surgical Interventions

- Other Adjunct Therapies

By Endoscopy Type

- Upper GI Endoscopy Treatments

- Lower GI Endoscopy Treatments

By Drug Category

- Proton Pump Inhibitors

- Vasoactive Agents

- Antifibrinolytic Drugs

- Others (e.g., mucosal protective agents)

By End User

- Hospitals and Specialty Clinics

- Ambulatory Surgery Centers

- Diagnostic and Imaging Centers

- Others (Private Practices, Homecare)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting