Geospatial Analytics Market Size and Forecast 2025 to 2034

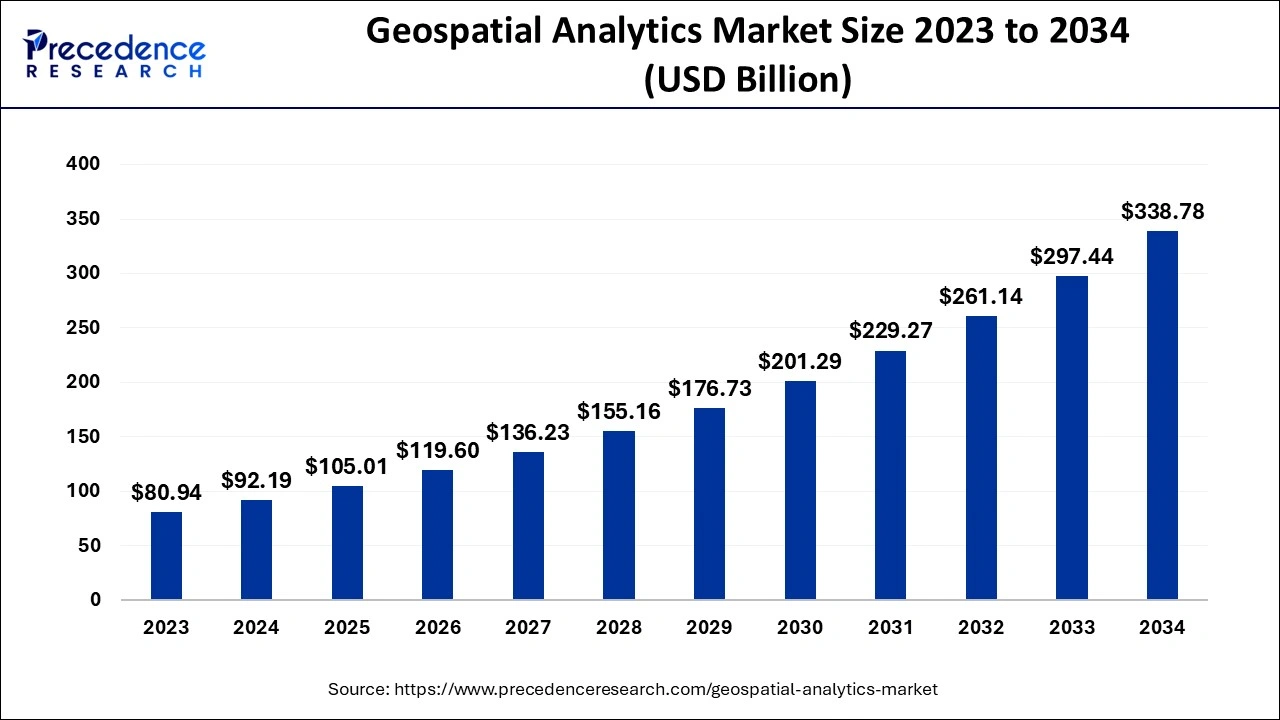

The global geospatial analytics market size is accounted for USD 92.19 billion in 2024 and is predicted to increase from USD 105.01 billion in 2025 to approximately USD 338.78 billion by 2034, growing at a CAGR of 13.90% from 2025 to 2034

Geospatial Analytics Market Key Takeaways

- By component, the software segment has reached 57% revenue share in 2024

- By solution type, the geocoding & reverse geocoding segment has captured 43% revenue share in 2024

- By deployment mode, the on-premise segment accounted for 71% of revenue share in 2024

- By organizational size, the large-scale segment has contributed 69% of revenue share in 2024

- By industry vertical, the smart cities segment has held the highest revenue share in 2024

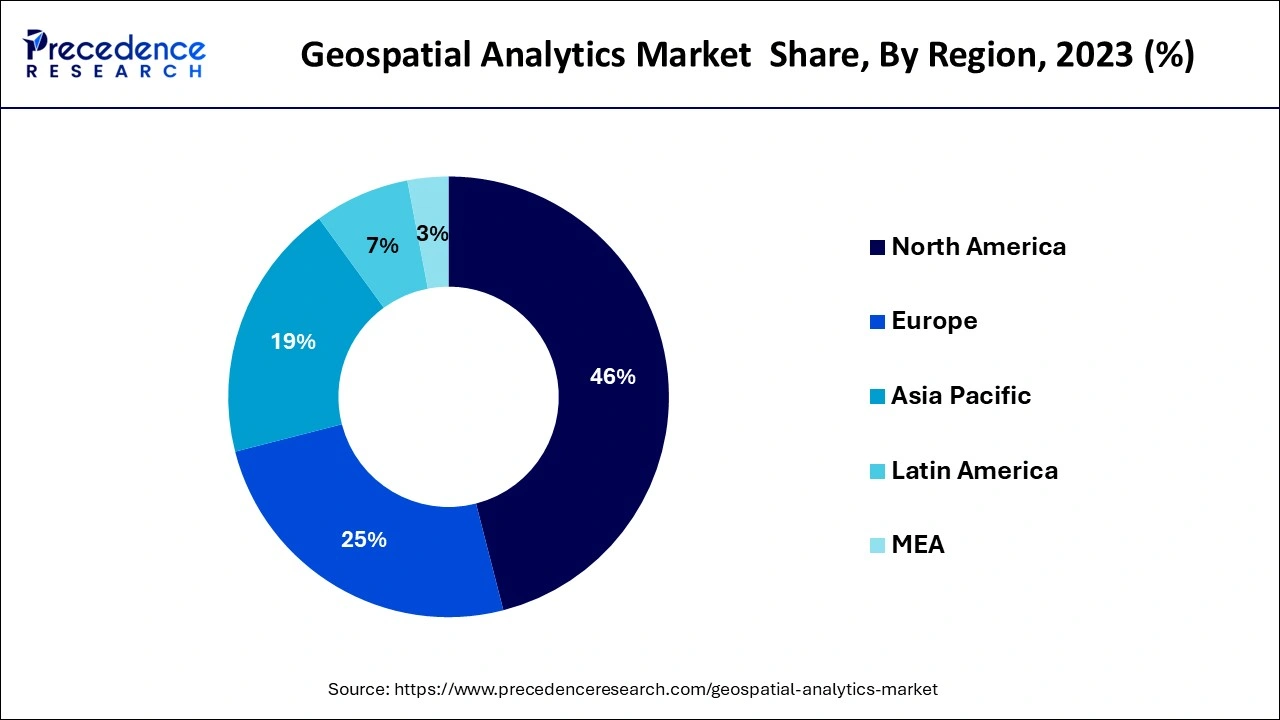

- The North America region has captured the largest revenue share of over 46% in 2024

AI in the Market:

AI is bringing a revolution into geospatial analytics processes by improving data processing accuracy, efficiency, and predictiveness. It can study huge datasets in real time, developer strategic decision-making. AI supports predictive models, trend scoping for better risk assessment, planning, and forecasting. Automation of repetitive processes comes with cost and efficiency benefits. It also helps uncover opportunities and yields results by spotting complex patterns in geospatial data. This provides industries with more significant insights, quicker humanities, and better strategies-from allocation of resources toward city planning and environmental monitoring.

U.S. Geospatial Analytics Market Size and Growth 2025 to 2034

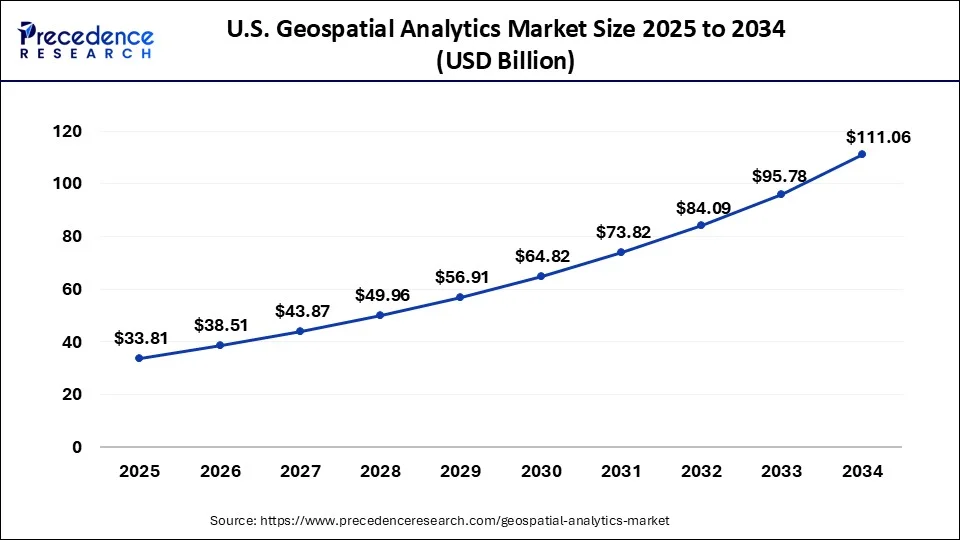

The U.S. geospatial analytics market size is evaluated at USD 29.69 billion in 2024 and is predicted to be worth around USD 111.06 billion by 2034, rising at a CAGR of 14.09% from 2025 to 2034

Asia-Pacific dominated the geospatial analytics market in 2024. China and India dominated the geospatial analytics market in Asia-Pacific region. The growth of geospatial analytics market in Asia-Pacific region is being driven by the growing government initiatives. The Chinese government launched its first thorough geography census in 2018. It will be used to report on the country's overall position as well as statistics on land and soil, water, and agriculture, which will serve as a firsthand reference for policies. In addition, the growing trend of mobility as service facility is also boosting the growth of Asia-Pacific geospatial analytics market. Morgan Stanley estimates that shared miles will account for 35 percent of all miles travelled in India. Along with a continuing huge shift in terms of electrification, sharing, and connectivity, this is one of the primary driving opportunities for new business models in the mobility business.

North America, on the other hand, is expected to develop at the fastest rate during the forecast period. The U.S. dominates the geospatial analytics market in North America region. One of the key drivers driving the growth of North America geospatial analytics market is the growing adoption of innovative and latest technologies such as internet of things, big data analytics, artificial intelligence, andcloud computing. Furthermore, the rising demand for high-speed internet is also supporting the growth of North America geospatial analytics market.

Geospatial Analytics Market Growth Factors

- Each new technological wave has upgraded existing geospatial platforms, engendering their wider acceptance in many industries.

- Increasing investments in smart city development are creating demand for location-based services and spatial analyses.

- With the deployment of 5G technology, quick and precise data gathering and real-time geospatial intelligence are possible.

- Thus, the association of geospatial analytics with IoT and big-data analytics ensures that some renovation in monitoring, planning, and predictive analysis takes place.

- The growing applications in transportation, defense, utilities, and urban planning are the prime forces for the expansion of the market.

Trends Influencing the Future of the Geospatial Analytics Market

- Rising adoption of AI and machine learning- Integration of AI and machine learning enhances data processing, pattern recognition, and predictive capabilities in geospatial analytics, making it more accurate and real-time.

- Expansion of smart cities and urban planning projects- Governments and urban developers are increasingly relying on geospatial tools to plan infrastructure, manage resources, and monitor environmental impacts, boosting market demand.

- Growth in location-based services and IoT devices- The proliferation of GPS-enabled devices and Internet of Things (IoT) applications is driving the demand for real-time geospatial data to support navigation, logistics, and asset tracking.

- Climate monitoring and environmental management- Growing concerns over climate change and natural resource management are prompting increased use of geospatial analytics for monitoring deforestation, water levels, disaster response, and more.

- Advancements in satellite imaging and remote sensing- The increasing availability of high-resolution satellite imagery and drone-based data collection is enhancing the scope and precision of geospatial analysis across sectors like agriculture, defense, and mining.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 338.78 Billion |

| Market Size in 2025 | USD 105.01 Billion |

| Market Size in 2024 | USD 92.19 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.90% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Type, Solution, Technologies, Deployment Mode, Organization Size, Application, and Region. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Value Chain Analysis

- Procurement

Procurement of geospatial analytics includes services, software, hardware, and data procurement that enable organizations to analyze geographical data for insights, to optimize operations, and support decision-making processes. Key players: Google and Microsoft

- Operations

Geospatial analytics operations may comprise analysis of spatial data involving single-layer queries, multi-layer operations (overlay and modeling), network analysis, and surface analysis to spell out patterns, predict outcomes, and make decisions.

Key players: Oracle, Maxar Technologies

- Technology development

Technology development in geospatial analytics would mean continuing development of tools and techniques used for the collection, processing, and analysis of location-based data.

Key players: Esri, Trimble, Hexagon AB

- Marketing and Sales

Marketing and sales for geospatial analytics are focused on location-based insights services to companies and organizations so that they can make smarter decisions and work efficiently.

Key players: Alteryx and Maxar Technologies

- Regulatory landscape

The regulatory landscape of geospatial analytics has to do with an elaborate and ever-changing set of laws, policies, and ethical standards dealing with privacy, data ownership, licensing, and national security.

Key players: Esri, Hexagon AB, Trimble

Component Insights

The software segment dominated the geospatial analytics market in 2024. Enterprises can use geospatial analytics software to locate, evaluate, and respond to changing business circumstances and trends. The market players have commenced to involve in geospatial analytics in order to enhance suppleness and overall operational output, better comprehend business trends, and reduce expenses. The software sector can be thought of as the most advantageous component for generating high-level insights from location data.

The service segment is the fastest growing segment of the geospatial analytics market in 2024. Analytics are being used by government agencies and public safety organizations to monitor natural resources, infrastructure projects, detect cross-border incursions, and improve vehicle safety and security. Businesses are also providing Geospatial Analytics-as-a-Service.

Type Insights

The surface and field analytics segment dominated the geospatial analytics market in 2024. The growth of surface and field analytics segment is attributed to the rising acceptance and adoption by private and government firms. In addition, the growing number of infrastructure development projects are also supporting the growth of the overall market.

The network and location analytics segment is fastest growing segment of the geospatial analytics market in 2024. The technology aids in the improvement of data analytics' functionality, utility, and relevance. It can also analyze and organize enormous amounts of data in real time in order to obtain actionable business insights. It also enables marketers to visualize, comprehend, and interpret data in a variety of ways to demonstrate links, trends, and patterns using globes, maps, charts, and reports. This is critical for every business that wants to grow, expand into new markets, and satisfy customers.

Application Insights

The military intelligence segment dominated the geospatial analytics market in 2024. Strategic intelligence plays an important role in modern military strategies. Strategic intelligence relies heavily on geospatial data. Many countries are constantly strengthening their military as a result of current military confrontations between big economies. Border security operations can use geospatial data to give situational awareness information, enabling quick decision-making, and improve national security.

The surveying segment is fastest growing segment of the geospatial analytics market in 2024. This is due to its widespread adoption in agricultural and natural resource monitoring. During the projected period, however, the military intelligence segment is expected to increase at the quickest rate. This could be due to an increase in the number of remote sensing satellites used for border patrols around the world, necessitating the usage of geospatial analytics.

Geospatial Analytics Market Top Companies

- Harris Corporation

- RMSI, DigitalGlobe, Inc.

- Fugro N.V.

- Hexagon AB

- ESRI

- General Electric Co.

- MacDonald

- ettwiler & Associates, Ltd.

- Trimble Navigation LTD.

- Bentley Systems, Inc.

Recent Developments

- In April 2025, Google added a new feature to Google Maps Platform, providing the ability “to solve real-world problems” with Geospatial Analytics, a powerful tool that can be used for hosting applications, including infrastructure analysis.

- In March 2025, Blue Marble Geographics, a long-standing innovator in the GIS space, launched two innovative solutions with Cloud and AI Capabilities. First, Geographic Calculator Cloud, the company's first cloud-based GIS solution, brings powerful geodetic and coordinate transformation tools to a web-based environment, and another is Global Mapper Insight and Learning Engine, a new AI-powered deep learning tool designed to improve point cloud classification and object detection within the Global Mapper Pro suite.

- In July 2024, GEOACE, a U.S.-based full-service geospatial firm, announced a Kickstarter campaign for a cloud-native data automation software specially created for geospatial workflows. The solution created by GEOACE is a data automation pipeline that fits in a Docker container and is designed for the cloud.

- Trimble stated in June 2021 that it has added a geotechnical collection to its geospatial automated monitoring portfolio as a result of a relationship with Worldsensing, a wireless connectivity technology provider and an industry-leading maker of geotechnical internet of things monitoring solutions. With a comprehensive system that includes geotechnical and geospatial data, geotechnical, survey, and structural engineers will be able to easily increase their monitoring business prospects.

- Hexagon AB will present its Smart M App portfolio in September 2018, a simple to use platform for creating lightweight and dynamic applications that answer a specific need. To provide geospatial analytics as a service, the solution combines content, business operations, and geoprocessing into a single application.

- With regard to the Oracle database, Oracle Corporation added to its idea of machine learning, as well as spatial and graphic elements. This occurred in December 2019 and assisted in the dissemination of a feature that could be useful for deployment and development purposes.

- ESRI announced in May 2021 that ArcGIS Insights, its location analytics product, now assists connecting to cloud-native databases like Snowflake, Amazon Redshift, Google BigQuery, Microsoft Azure SQL, and others, which many establishments have been accepting for cost of ownership, scalability, and performance motives. This makes it simple for companies to combine GIS data and cloud-native databases for analysis.

Segments Covered in the Report

By Component

- Software

- Mapping

- Spatial Analysis

- Geo-visualization

- Data Management

- Services

- System Integration

- Training & Geo-consultation

- Support & Maintenance

By Type

- Surface & Field Analytics

- Network & Location Analytics

- Geovisualization

- Others

By Solution

- Geocoding & Reverse Geocoding

- Data Integration & ETL

- Report Visualization

- Thematic Mapping & Spatial Analysis

By Technologies

- Remote Sensing

- Global Positioning System

- Geographic Information System

- 3D Scanning

By Deployment Mode

- Cloud

- On-premises

By Organization Size

- Large Enterprises

- SMEs

By Application

- Surveying

- Medicine & Public Safety

- Military Intelligence

- Disaster Risk Reduction & Management

- Marketing Management

- Climate Change Adaptation (CCA)

- Urban Planning

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting