What is the Geospatial Analytics Artificial Intelligence Market Size?

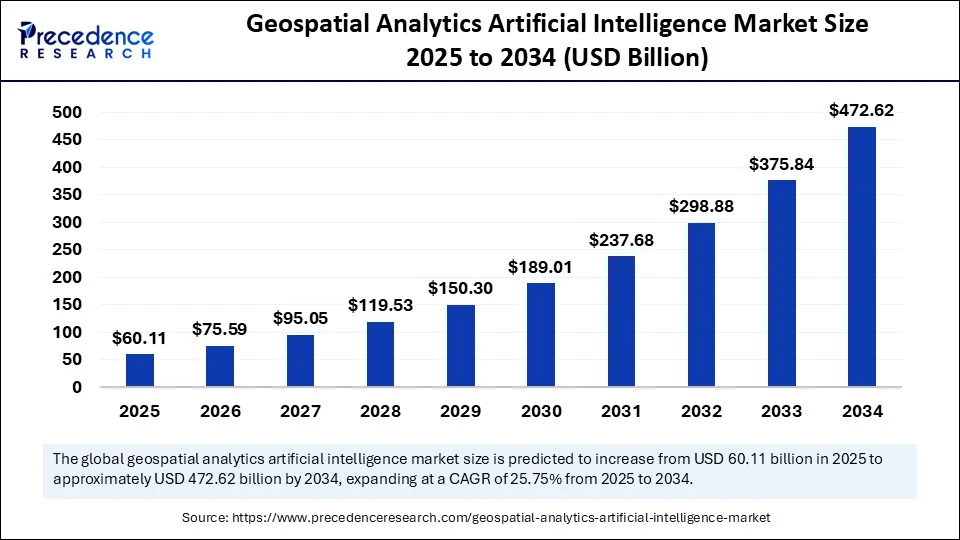

The global geospatial analytics artificial intelligence market size is accounted at USD 60.11 billion in 2025 and is predicted to increase from USD 75.59 billion in 2026 to approximately USD 472.62 billion by 2034, expanding at a CAGR of 25.75% from 2025 to 2034. The market growth is attributed to the increasing deployment of AI-driven geospatial solutions for real-time decision-making in infrastructure development, environmental monitoring, and national security operations.

Geospatial Analytics Artificial Intelligence MarketKey Takeaways

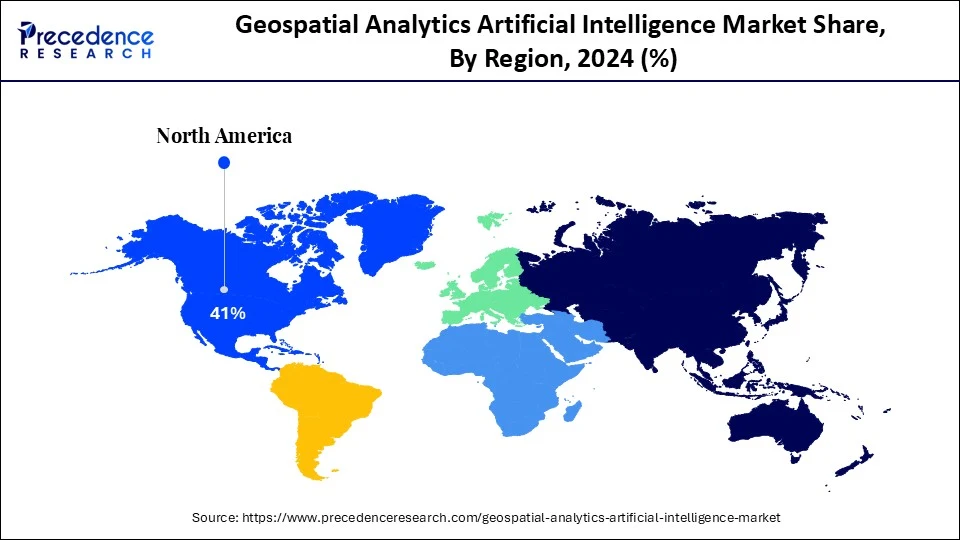

- North America dominated the geospatial analytics artificial intelligence market with the largest share of 41% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By component, the software segment held a major market share of 42% in 2024.

- By component, the services segment is projected to grow at a significant CAGR between 2025 and 2034.

- By technology, the machine learning segment contributed the biggest market share of about 38% in 2024.

- By technology, the computer vision segment is expanding at a significant CAGR between 2025 and 2034.

- By data source, the satellite imagery segment accounted for the major market share of 35% in 2024.

- By data source, the UAV/drone imagery segment is expected to grow at a significant CAGR over the projected period.

- By deployment mode, cloud-based segment captured the highest market share of 48% in 2024.

- By application, the defense & security intelligence segment held the major market share of 30% in 2024.

- By application, the urban planning & smart cities segment is expected to grow at a notable CAGR from 20245 to 2034.

- By end-use industry, the government & public sector segment generated the major market share of 33% in 2024.

- By end-use industry, the agriculture segment is projected to grow at a significant CAGR in between 2025 and 2034.

Market Overview

Geospatial Analytics Artificial Intelligence (AI) Market refers to the integration of AI technologies (such as machine learning, deep learning, and computer vision) with geospatial data and analytics tools to derive intelligent insights from spatial and geographic information. This market includes AI-enabled solutions that process data from satellites, UAVs, GPS, IoT sensors, and mobile devices to support decision-making across various sectors such as defense, urban planning, agriculture, and disaster management.

The rising demand for Earth observation and Artificial Intelligence (AI)-powered understandings is likely to fuel the expanding course of geospatial analytics artificial intelligence (AI) market. AI models can use non-trivial geospatial datasets to draw patterns, forecast, and automate operations that previously required human feedback. As NASA reports, in 2024, the Earth Science Data Systems program distributed more than 50 petabytes of open-access satellite data to researchers and other institutions, enabling the creation of sophisticated AI-based environmental and infrastructure modelling. Furthermore, the increased atmospheric temperatures coupled with the growth of global cities and natural hazards are likely to make the global demand for real-time geospatial intelligence, thus further facilitating the market.(Source: https://www.earthdata.nasa.gov)

Geospatial Analytics Artificial Intelligence MarketGrowth Factors

- Rising Emphasis on Precision Agriculture: Demand for AI-driven geospatial tools is fuelling data-informed crop management, soil monitoring, and yield forecasting.

- Boosting Deployment of 5G and IoT Networks: Enhanced connectivity is accelerating real-time geospatial data collection and analysis across smart infrastructure systems.

- Growing Use of Autonomous Systems: Integration of AI-powered geospatial analytics in drones and unmanned vehicles is driving innovation in logistics, surveillance, and inspection tasks.

- Expanding Applications in Climate Finance and Carbon Mapping: AI-based geospatial platforms are propelling accurate carbon tracking and compliance with international sustainability frameworks.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 472.62 Billion |

| Market Size in 2026 | USD 75.59 Billion |

| Market Size in 2025 | USD 60.11 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 25.75% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, Data Source, Deployment Mode,Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the Increasing Adoption of Satellite Imagery and Remote Sensing Technologies Driving the Growth of the Geospatial Analytics Artificial Intelligence Market?

Increasing adoption of satellite imagery and remote sensing technologies is expected to accelerate the market in the coming years. Earth observation data is becoming the preferred data of governments and private firms for monitoring and tracking purposes, boosting the demand for high-resolution imaging. AI algorithms are essential in processing and interpreting this massive data as close to real-time as possible and making an accurate decision quickly.(Source:https://www.copernicus.eu)

In 2024, the European Space Agency (ESA), via its Copernicus program, was taking in more than 20 terabytes per day of Earth observation data and powering the AI-based applications across Europe, Africa, and Asia. The demand for scalable AI-powered analytics across various verticals continues to grow as the number of satellite constellations and imaging frequencies increases. Furthermore, the rising focus on climate resilience and environmental monitoring is estimated to expand the scope of AI in geospatial analysis. (Source: https://www.nrsc.gov.in)

Restraint

High Implementation and Operational Costs Limit Adoption in Developing Economies

High implementation and operational costs are expected to hinder the growth of the geospatial analytics artificial intelligence market. Organisations in low and middle-income nations do not have the financial capability to implement the geospatial AI systems on a large scale. Furthermore, the concerns over data privacy and national security are expected to limit the expansion of AI-enabled geospatial platforms, thus further hampering the market.

Opportunity

Spurring Investments in Defense and National Security

Spurring investments in defense and national security applications is likely to create immense opportunities for key players competing in the market. The current trend of encouraging investments in defense and national security applications positively influences the assimilation of geospatial platforms that are AI-powered. Defense auxiliaries also use AI-based analytics to analyze both satellite images and UAV shots, control actions on the border, and understand the situation on the battlefield in more detail. The geospatial intelligence smart services via AI are a vital qualification that is targeted in military modernization policies in the U.S., China, and India.

In 2024, DARPA went further in the same Mosaic Warfare direction, adding real-time, AI-enabled geospatial data based on satellite and drone streams into battlefield simulators to make faster tactical decisions. The ISRO is achieving higher levels of artificial intelligence with satellite imaging missions to monitor troop movements and terrain intelligence at high-altitude areas alongside the DRDO. Furthermore, the high investment of government organizations and public sector companies further facilitates the growth of the market in the coming years. (Source: https://www.darpa.mil)

In September 2024, the National Geospatial-Intelligence Agency plans a significant AI investment, projecting up to USD 700 million over five years for data labelling services. NGA Director Vice Adm. Frank Whitworth confirmed this as the agency's largest contract in this area, aiming to expand machine learning capacity for satellite imagery and geospatial data analysis. (Source: https://www.nga.mil)

Segment Insight

Component Insights

The software segment dominated the geospatial analytics artificial intelligence market, accounting for about 42% share in 2024. The dominance of the segment is attributed to the deployment of AI-enhanced geospatial software platforms that allow users to simplify space-related data processing, visualization, and predictive models.

Such platforms allow government agencies, defense institutions, and businesses to utilize these platforms to gain real-time knowledge aided by satellite imagery, drone feed, and sensor-based information. Furthermore, the other firms, including Esri, Palantir Technologies, and Hexagon AB, have augmented their program sources with deep learning and machine learning modules, thus fueling the demand segment growth.

The services segment is expected to grow at the fastest CAGR in the coming years. This is mainly due to the increased complexity of AI-added geospatial solutions, which creates demand for professional activities including system integration, consulting, training, and support. Furthermore, the rising demand for professional and managing services contributes to segmental growth.

Technology Insights

The machine learning segment dominated the geospatial analytics artificial intelligence market, accounting for a 38% share in 2024, due to the introduction of supervised and unsupervised learning models to process large volumes of geospatial data received by satellites, UAVs, and ground sensors based on IoT. Moreover, the major commercial organizations, such as Maxar Technologies and Planet Labs, step in and already actively use ML algorithms to provide their customers with moving maps and infrastructure observations, which also influence the stable growth of this segment.

The computer vision segment is expected to grow at the fastest CAGR in the coming years. Innovations in convolutional neural networks and transformer networks are expected to drastically increase the capability of vision models in object classification, change detection, and semantic segmentation of geospatial imagery. Additionally, such initiatives are expected to hasten the adoption process of the computer vision sub-segment in national security, disaster response, precision farming, and autonomous driving. (Source: https://www.earthdata.nasa.gov)

Data Source Insights

The satellite imagery segment dominated the geospatial analytics artificial intelligence market, holding a 35% share in 2024. This is due to the increased launch of Earth observation constellations and the fast-growing demand for high-frequency, high-resolution data. Eschelon technologies, including ESA Copernicus, NASA Landsat 9, and ISRO Cartosat-3, improved the database of open-access imagery on a large scale. This allows land-cover classification with the help of artificial intelligence and modeling of agricultural production, as well as the identification of disasters.

In 2024, the GEO showed that it has published more than 20 petabytes of satellite Earth observation data across international collaboration platforms. Commercial vendors have launched synthetic aperture radar (SAR) and very-high resolution imagery at maximum refresh rates of 15 minutes, enabling real-time AI analytics in security and environmental applications. Furthermore, the expenditures that space organizations such as CNES, JAXA, and DLR make in AI-on-satellite are expected to enhance the capabilities of satellite imagery, thus further propelling the segment.(Source: https://wmo.int)

The UAV/drone imagery segment is expected to grow at the fastest CAGR in the coming years, owing to the growing use of drones across the agriculture, infrastructure, forestry, and emergency services within emerging economies. Additionally, the Government organizations, such as DLR, NRSC (India), and EUMETSAT, have embarked on collaborating with commercial UAV players to acquire high-resolution data, further fuelling the segment growth.

Deployment Mode Insights

The cloud-based segment dominated the market with a 48% market share in 2024 and is expected to sustain its position in the coming years. This is primarily due to the rising requirement for flexible infrastructure to handle vast geospatial data processing tasks by using AI applications. Integrated geospatial AI services, such as real-time analytics, deep learning model training, and satellite imagery ingestion, have been popular in government, defense, and commercial applications.

Main solution vendors such as Esri, Hexagon AB, Palantir Technologies, and NVIDIA are progressively accommodating their AI geospatial toolkits into cloud systems to simplify their distribution and sharing information between agencies. This change has boosted collaboration and reduced the infrastructural expenses, allowing frequent data updates to strengthen the segment's growth. Additionally, the rising demand for real-time geospatial understanding, especially in urban development, environmental safety, and autonomous transportation, is expected to drive the segment in the coming years.

Application Insights

The defense & security intelligence segment dominated the geospatial analytics artificial intelligence market in 2024, accounting for 30% market share, as military and intelligence automation is used in real-time surveillance, threat identification, and mission preparation by AI-based geospatial sites. The U.S. Department of Defense (DoD), UK Ministry of Defence, and Indian Ministry of Defence have improved funding on AI-geospatial systems in cross-border surveillance, mapping the territory, and alerting their systems. Furthermore, the firms are providing agencies with AI algorithms that combine satellite imagery, UAV video feeds, and ground sensor data to perform predictive modelling, thus further propelling the segment's growth.

In July 2024, Spire Global, Inc., a leading provider of space-based data, analytics, and space services, announced the expansion of its Space Reconnaissance portfolio with advanced radio frequency (RF) geospatial intelligence (GEOINT) capabilities. The upgraded solution is developed to support both U.S. and allied international operations by enabling continuous monitoring, real-time geolocation, and enhanced multi-layer situational awareness.

(Source: https://www.asdnews.com)

The urban planning & smart cities segment is expected to grow at the fastest CAGR in the coming years. This is mainly due to the rising investments in smart city projects. Such an acceleration is projected to be pushed forward by intelligent governance structures, climatic adaptation demands, and an increased urban population. Furthermore, the Open Geospatial Consortium (OGC) projected that smart city projects around the world would use AI-geospatial integration to perform real-time analytics, further facilitating the market in this sector.

End-use Industry Insights

The government & public sector segment held the largest revenue share of the geospatial analytics artificial intelligence market in 2024, accounting for 33% of the market share, due to the mass use of AI in geospatial platforms in the areas of public infrastructures, security and intelligence, disaster response, and mitigation in climate programs. The U.S., India, Germany, and Japan were doing this to increase their spatial data capabilities with AI to increase real-time analysis and coordination across the different agencies. Furthermore, the European Space Agency (ESA), deployed the AI-assisted Earth observations data, further facilitating the market in the coming years.

In August 2024, the European Space Agency (ESA) launched Φsat-2, an AI-powered CubeSat for Earth observation, aboard a SpaceX Falcon 9 from Vandenberg Space Force Base as part of the Transporter-11 mission. Equipped with a multispectral camera and onboard AI processor, the satellite analyzes imagery in orbit to support disaster response, maritime surveillance, and environmental monitoring, marking a major step forward in space-based AI applications.

The agriculture segment is expected to grow at the fastest CAGR in the coming years, owing to the demand for precision agriculture and climate-smart practices. Geospatial tools combined with AI are used to detect the presence of pests, analytics of soil moisture, and improve crop yield with the help of satellite and UAV data.

FAO and ESA, published in 2024, indicated that a majority of the world's agri-innovation programs used the integrated AI-powered spatial data to cut input expenditures and enhance sustainability. Furthermore, the edge computing, hyperspectral imaging, and remote sensing data make agricultural processes in developed and emerging economies highly efficient, thus further propelling the segment. (Source: https://www.fao.org)

Regional Insights

U.S. Geospatial Analytics Artificial Intelligence Market Size and Growth 2025 to 2034

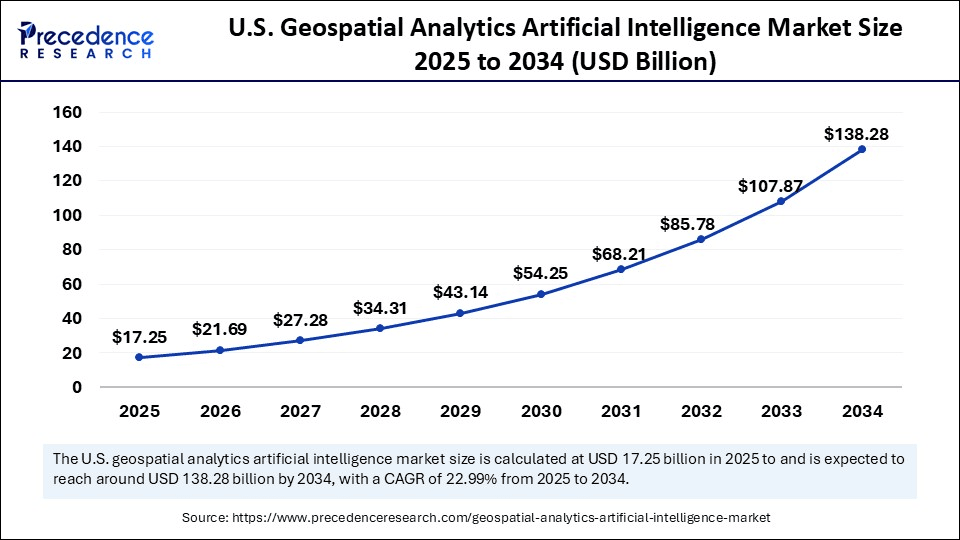

The U.S. geospatial analytics artificial intelligence market size is exhibited at USD 17.25 billion in 2025 and is projected to be worth around USD 138.28 billion by 2034, growing at a CAGR of 25.99% from 2025 to 2034.

How Does North America Lead the Geospatial Analytics Artificial Intelligence Market in 2024?

North America led the geospatial analytics artificial intelligence market, capturing the largest revenue share of 41% in 2024. This is due to its robust ecosystem of technological innovators and the government-driven space programs. Industry giants Esri, Palantir Technologies, IBM, Microsoft, and Amazon Web Services (AWS) have established themselves in the region and provide sector-based integrated AI-geospatial solutions.

Regional agencies, such as NASA, USGS, NOAA, and DARPA, have increased investments in AI-driven solutions for wildfire prediction, disaster resilience, and land-use forecasting. Project Maven, developed by the Department of Defense, was further used to improve automated target recognition, based on satellite and UAV data, to enhance geospatial intelligence in defense operations. Furthermore, the growing collaboration between public and private sector organizations to facilitate innovation in AI-based geospatial systems further fuels the market in this region.

In August 2023, NASA and IBM released the Open Geospatial AI Foundation Model for NASA Earth Observation Data. A collaboration between NASA and IBM Research has resulted in NASA's first open-source geospatial artificial intelligence (AI) foundation model for Earth observation. Developed using NASA's Harmonized Landsat and Sentinel-2 (HLS) dataset, the HLS Geospatial Foundation Model (HLS Geospatial FM) marks a major advancement in AI-powered Earth science. The model enables applications like land use tracking, disaster monitoring, and crop yield prediction. The HLS Geospatial FM is hosted on Hugging Face, an open repository for machine learning models.(Source: https://www.earthdata.nasa.gov)

U.S. Geospatial Analytics Artificial Intelligence Market Trends

In the U.S., the market is being propelled by rising investments in cloud‑native GeoAI platforms, which enable faster, more efficient processing of satellite, drone, and IoT spatial data in real time. In September 2024, the National Geospatial-Intelligence Agency launched the accreditation pilot for GEOINT AI models for the National System for Geospatial Intelligence. In September 2025, UNESCO initiated a groundbreaking workshop on drones, AI, and GIS for disaster reporting in the Caribbean. U.S. agencies are increasingly using AI-driven geospatial tools for surveillance, disaster response, and terrain analysis, driving market growth.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the strong investments in Earth observation satellites and intelligent governance by the public sector. Geospatial infrastructure integrated with AI has become a priority for countries such as India, China, Japan, Australia, and South Korea. All these countries are willing to invest in precision agriculture, climate action, and national security. Furthermore, the availability of free and open data increases, and countries develop national AI plans, Asia Pacific is expected to sustain its position in the market.

India Geospatial Analytics Artificial Intelligence Market Trends

India is a major contributor to the market in Asia Pacific. The market in India is being propelled by the liberalization of geospatial data policies, which has unlocked new opportunities for innovation and private‑sector participation. Rapid urbanization and smart city programs (e.g., Digital India, Smart Cities Mission) are driving demand for real-time location-based analytics to optimize infrastructure, mobility, and resource allocation. There is increasing integration of AI with GIS platforms, enabling more accurate predictive models across sectors such as agriculture, urban planning, and disaster management.

How is the Opportunistic Rise of Europe in the Geospatial Analytics Artificial Intelligence Market?

Europe is expected to see an opportunistic rise in the market in the coming years, as governments and cities invest heavily in smart-city programs and national geospatial infrastructure, using GeoAI to optimize urban planning, resource management, and disaster resilience. Europe is increasingly leveraging its strong sustainability regulatory framework, including the EU Green Deal, to drive adoption of AI-powered geospatial analytics for environmental monitoring, carbon emissions tracking, and smart land use. In November 2025, the Organization for Economic Co-operation and Development (OECD) conducted a survey to evaluate progress in implementing the European Union Coordinated Plan on Artificial Intelligence. This plan is a strategic initiative launched by the European Commission and EU member states to promote investment, collaboration, and AI development.

UK Geospatial Analytics Artificial Intelligence Market Trends

The UK remains a global leader in AI research, development, and adoption. In the UK, the market is being driven by the government's UK Geospatial Strategy 2030, which strongly emphasizes integrating generative AI, high‑performance computing, and cloud-based location intelligence to boost urban planning, climate resilience, and infrastructure decision-making. The UK government is committed to harnessing its potential to foster innovation, economic growth, and productivity.

What Potentiates the Growth of the Latin America Geospatial Analytics Artificial Intelligence Market?

The market in Latin America is expected to grow during the forecast period, driven by advanced regulatory frameworks and government initiatives related to geospatial analytics and AI. They focus on urban planning, environmental monitoring, and improving public sector efficiency. Brazil leads the Latin American market. The Brazilian Artificial Intelligence Plan 2024-2028 mainly focuses on expanding AI research and innovation centers, providing tax incentives for startups, fostering public-private partnerships, training and qualifying AI professionals, and implementing AI in public services such as health, education, and security. Brazilian companies are actively adopting AI, especially in geospatial applications across sectors such as energy and agribusiness.

What Opportunities Exist in the Middle East and Africa?

The Middle East and Africa (MEA) region presents significant opportunities in the geospatial analytics artificial intelligence market, driven by rapid urbanization across GCC nations and African metros, which is driving demand for GeoAI to support smart city planning, digital twins, traffic optimization, and infrastructure monitoring. Countries in the region are leveraging geospatial AI for natural resource management, environmental monitoring, and precision agriculture. Saudi Arabia is a major contributor to the MEA market, driven by Vision 2030's smart city initiatives, including mega projects like NEOM, where AI-powered GIS is used for urban planning, infrastructure optimization, and resource management.

Geospatial Analytics Artificial Intelligence Market Companies

- Airbus Defence and Space

- Astraea Inc.

- AWS (Amazon Web Services)

- Capella Space

- Descartes Labs

- Esri

- GE Digital

- GeoIQ

- Google (Alphabet Inc.)

- Hexagon AB

- IBM Corporation

- Mapillary (Meta Platforms)

- Maxar Technologies

- Microsoft Corporation

- NVIDIA Corporation

- Orbital Insight

- Planet Labs

- Safe Software

- SparkCognition

- Trimble Inc.

Recent Developments

- In June 2025, Earth Systems has introduced its new Remote Sensing and AI Solutions service, designed to deliver geospatial intelligence through the fusion of satellite imagery and artificial intelligence. The service supports environmental monitoring and analysis across sectors like land management, oil and gas, mining, and coastal resource planning.

(Source: https://www.geoweeknews.com) - In February 2025, FADA, part of the EDGE Group and formed to advance the UAE's space independence, unveiled the innovative TACTICA platform at IDEX 2025. This system processes multi-source intelligence�including satellite imagery, signals intelligence, sensor input, and open-source data to produce detailed, actionable insights. TACTICA reflects FADA's strategic AI deployment for intelligence enhancement and decision-making.

(Source:https://edgegroupuae.com) - In January 2024, Deloitte launched the Geospatial and AI Platform for Scenario Planning and Monitoring, incorporating Google Earth tools, Google Earth Engine (GEE), and Generative AI from Vertex AI. The platform supports clients in applying AI and geospatial data for sustainability and climate-related planning, driving economic, social, and environmental impact. It enhances disaster preparedness, infrastructure planning, and urban development, while also providing land use insights and geospatial-based financial modeling for sustainable investments.

(Source:https://www.deloitte.com)

Latest Announcement by Industry Leader

- In July 2025, Esri India Technologies, a leader in Geographic Information Systems (GIS), today announced the launch of a GIS & AI Competency Center at a new facility in Noida. Esri India will allocate over INR 150 crores for this initiative in the next five years. This strategic move aims to accelerate the wider adoption of AI within GIS applications. Agendra Kumar, Managing Director, Esri India, stated, �The fusion of AI and geospatial intelligence is driving fresh innovations in GIS applications. On one side, Esri's GIS technology is evolving rapidly, offering new functionalities and customizable applications. On the other, AI breakthroughs are happening at an equally fast pace. The pace of innovation is so rapid that without dedicated investments, leading the transformation of AI in GIS will be difficult. Engineers at this new GIS and AI Competency Centre will focus on embedding AI into spatial analysis, helping customers draw deeper insights from geospatial data, streamline routine tasks, and make quicker, well-informed decisions.�(Source: https://www.ciol.com)

Segments Covered in the Report

By Component

- Software

- Geospatial Visualization Tools

- Predictive Analytics Software

- Location Intelligence Platforms

- Image Recognition & Processing Tools

- 3D Mapping & Simulation Software

- Hardware

- GPS Sensors

- LiDAR Systems

- Satellite Imaging Sensors

- UAVs/Drones

- Edge Devices for On-field AI Processing

- Services

- Managed Services

- Professional Services (Consulting, Integration, Maintenance)

By Technology

- Machine Learning

- Deep Learning

- Natural Language Processing (NLP)

- Computer Vision

- Reinforcement Learning

- Edge AI

By Data Source

- Satellite Imagery

- UAV/Drone Imagery

- Mobile Device Location Data

- Sensor & IoT Data

- GIS Data

- Social Media Geotagged Data

- 3D Spatial Data

By Deployment Mode

- On-Premise

- Cloud-Based

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application

- Urban Planning & Smart Cities

- Defense & Security Intelligence

- Environmental Monitoring & Conservation

- Agriculture & Forestry

- Disaster Risk Management

- Transportation & Logistics Optimization

- Utilities & Infrastructure Management

- Retail & Real Estate Planning

- Oil & Gas Exploration

- Mining & Natural Resource Management

- Insurance & Risk Analytics

By End-Use Industry

- Government & Public Sector

- Military & Defense

- Agriculture

- Environmental Agencies

- Transportation & Logistics

- Energy & Utilities

- Retail & Real Estate

- BFSI (Insurance & Risk Assessment)

- Healthcare & Epidemiology

- Telecommunications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content