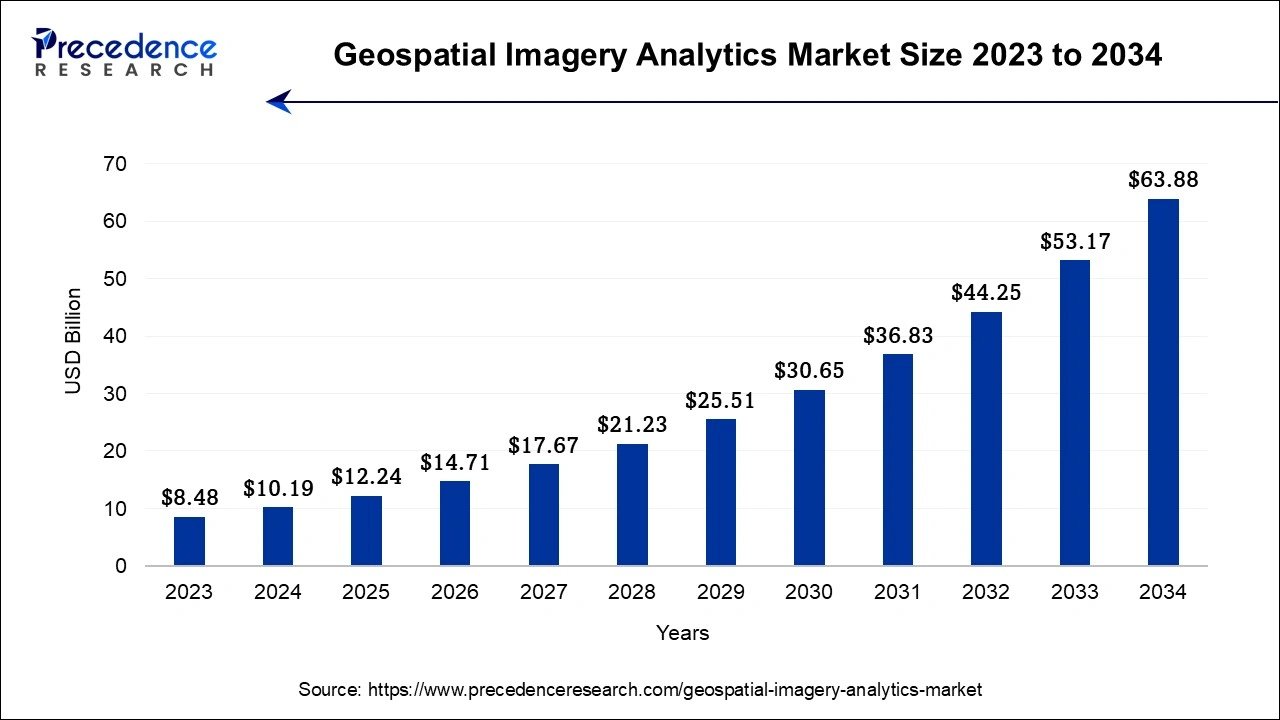

What is the Geospatial Imagery Analytics Market Size?

The global geospatial imagery analytics market size is calculated at USD 12.24 billion in 2025and is predicted to increase from USD 14.71 billion in 2026 to approximately USD 73.40 billion by 2035, representing a healthy CAGR of 20.15% between 2026 and 2035.

Geospatial Imagery Analytics Market Key Takeaways

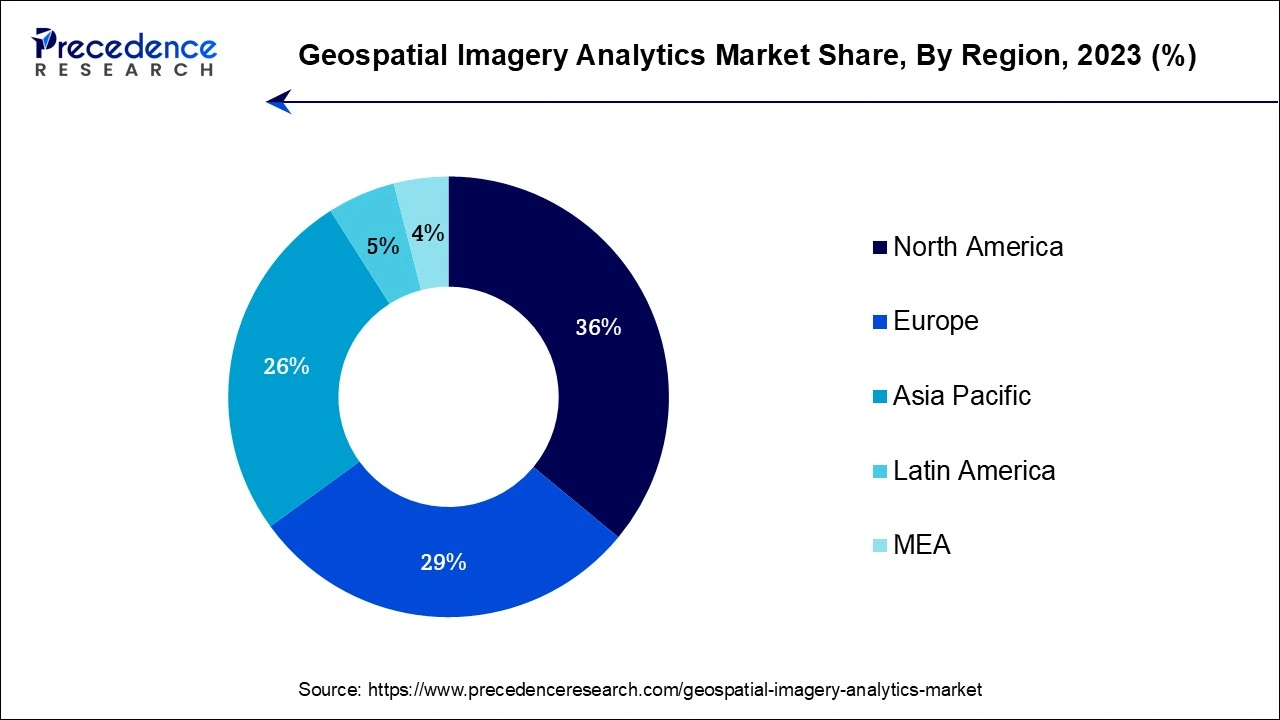

- North America contributed more than 36% of revenue share in 2025.

- By Type, the imagery analytics segment held the highest revenue share in 2025.

- By Technology, the geospatial information system (GIS) segment is expected to grow at a remarkable CAGR during the forecast period.

- By Deployment, the cloud segment is predicted to grow at a notable CAGR during the forecast period.

- By Industry, the environmental monitoring industry segment held the major revenue share in 2025.

Market Overview

Earth-related video and image data are provided through geospatial imagery analytics, sometimes referred to as earth analytics. The use of data to predict hazards in the future and prepare for emergencies is growing among businesses in a variety of industries, which is driving the uptake of geospatial imaging analytics solutions. Geospatial imagery analytics makes use of satellite image data. After then, raster and vector images of the geotagged pictures are shown. Bitmaps, sometimes referred to as raster images, are composed of discrete color pixels. The graphics known as "vector pictures" are created using mathematical formulas and may be scaled endlessly. The growing need for geospatial imaging analytics for analyzing climatic conditions, urban planning, and disaster response management is also likely to fuel the market in the years to come.

Geospatial Imagery Analytics Market Growth Factors

Software for geospatial imaging has evolved into a base for the growth of smart cities. IT infrastructure for installing and administering applications and data at each stage of the development life cycle of smart cities is provided by a centralized information system based on GIS, creating a sizable market opportunity. The need for geospatial analytics is rising as a result of the growing usage of GPS devices and other technological data. The use of recent analytics in areas like ship navigation and logistics management is growing internationally. In the upcoming years, the ability to track someone's whereabouts, study optical satellite photos, and carry out strategic activities are also projected to fuel market growth. The low-band, mid-band, and high-band portions of the spectrum may be predominantly used by the 5G network to sustain market growth during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 73.40 Billion |

| Market Size by 2026 | USD 14.71 Billion |

| Market Size in 2025 | USD 12.24 Billion |

| Growth Rate from 2026 and 2035 | CAGR of 19.62% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 and 2035 |

| Segments Covered | Type, Technology, Deployment, Organization, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for safe and secure mining operations

The analysis of satellite or aerial photographs to generate significant information about the Earth's surface is done by geospatial imaging analytics. This technology is critical in many parts of mining operations, resulting in enhanced efficiency and safety. For instance, it allows mining companies to precisely assess mining conditions by offering a full perspective of the location, which includes topography, terrain, vegetation cover, and infrastructure. Companies can improve safety and reduce accidents by analyzing this data and identifying possible dangers and taking proactive efforts to mitigate them.

Geospatial imaging analytics also aids in mineral exploration by finding possible mineral resources using satellite photos and geological characteristics. This enables corporations to make wiser judgments about where to direct their exploration efforts, lowering costs and improving the likelihood of economically viable mineral resources. Furthermore, by combining geochemical and hydrological data with satellite photography, mining companies may acquire a thorough understanding of the geological and environmental elements driving their operations. This information enables organizations to develop suitable mitigation measures and comply with rules by identifying pollution sources and locations prone to environmental dangers.

Moreover, geospatial imaging analytics helps with mine construction project planning and design by developing precise 3D models of the site, optimizing infrastructure location, and forecasting potential issues during development. Mining businesses can reduce hazards and increase worker safety by including safety factors in the planning phase.

Restraints

Legal and regulatory difficulties

The legal and regulatory issues surrounding the usage of geospatial imaging analytics technologies are difficulties that stem from a variety of issues, including regional variations, location privacy concerns, intellectual property rights, data licensing, and geographical data storage. One of the key limits is the regional variation in data collection techniques. Geospatial imaging analytics is strongly reliant on current and reliable data, such as satellite images and aerial pictures. Access to such data, however, might be limited in particular locations or nations, making it difficult for geospatial technology suppliers to collect complete and consistent data for analysis.

Another critical consideration is location privacy. Geospatial imagery analytics entails gathering and analyzing data about specific areas. This rise worries about individuals' and organizations' privacy, as the device may mistakenly gather sensitive or confidential information. Adhering to privacy standards while undertaking geospatial analysis becomes a difficult issue for a provider, this increases the legal scrutiny and potential constraints. Intellectual property rights are also very important in the geospatial imagery analytics business. Geospatial data frequently contain significant information and insights that are protected by intellectual property. To efficiently use third-party data sources, vendors must handle licensing agreements and maintain compliance with copyright regulations. Failure to get relevant licenses or infringement on intellectual property rights can result in legal consequences and impede the expansion of geospatial technology companies.

Government prohibitions on private investment and data exchange in the geospatial imaging business impose further constraints. In India, for example, governmental rules hinder private investment and inhibit state institutions such as the Indian Space Research Organization (ISRO) from collecting and disseminating certain types of geospatial data. These constraints make it difficult to acquire cutting-edge geospatial technology and limit the operating capabilities of both public and commercial enterprises. Collaboration among technology companies, governments, and regulatory agencies is vital for developing standardized norms and regulations that protect privacy while allowing for the responsible use of geographic data. The industry can negotiate the legal and regulatory framework and realize the full potential of geospatial image analytics by finding a balance between privacy protection and data accessibility.

Opportunities

Increasing deployment of 5G networks

Governments and organizations are rapidly recognizing the value of precise location data and real-time access in advancing smart city development and improving public services. The ability to deliver exact location data is one of the primary benefits of geospatial imaging analytics in the context of 5G. With the growth of connected devices and Internet of Things (IoT) applications in smart cities, precise location data is becoming increasingly important for optimizing resource deployment, regulating traffic flows, and improving public safety.

Geospatial technology can provide extensive insights into a city's physical environment, infrastructure, and assets, allowing for more effective planning and decision-making. Higher frequencies, which are necessary for 5G networks, have a limited range and are prone to interference from a variety of things. This data may be utilized to optimize the location of 5G infrastructure, resulting in higher network coverage and fewer signal disturbances. Several governments that are seeking to attract foreign direct investment have prioritized the development of 5G technology and infrastructure. Geospatial technology is critical in advancing these efforts, notably in the development of smart cities.

The integration of geospatial imaging analytics with 5G networks also opens the door to sophisticated applications and services. Real-time geospatial data, for example, may be utilized in emergency response management, urban planning, environmental monitoring, and predictive analytics. These applications have the potential to improve inhabitants' quality of life, increase operational efficiency, and allow more sustainable and resilient urban development.

Segment Insights

Type Insights

The imagery analytics segment held the largest revenue share in 2023. This is a result of the strong demand for imaging analytics, particularly from the mining, manufacturing, and oil and refinery industries. An enormous refinery or oil rig offers a serious and unforeseen risk. These firms must thus create a balance between safety and exploration, and visuals can help them with this challenging task. Drones or nano-bots inserted within pipes and machinery can be used to take these pictures. In a method that is safe for people, robotics, mapping based on Light Detection and Ranging (LiDAR), and unmanned aerial vehicles (UAVs) contribute to this visual data. Additionally, image analytics provide real-time warnings and proactive maintenance, both of which aid in preventing accidents.

Technology Insights

The geospatial information system (GIS) segment is anticipated to grow at the fastest CAGR during the forecast period. Due to their effectiveness in gathering and storing geographic data, geospatial information systems (GIS) are increasingly used in the mining, industrial, and defense & security industries. Geospatial imagery analytics is an all-inclusive system that delivers both video and picture data of the earth by using the characteristics of global positioning systems (GPS) and geographic information systems (GIS) supported by reliable technology. These data are gathered by suppliers of geospatial imaging analytics, who then make them available to customers.

Deployment Insights

The cloud segment is expected to expand at the fastest CAGR during the forecast period. This is due to elastic cloud computing and online connectivity giving clients much more reach and flexibility across almost all industries. Users can use cloud computing skills for analysis and mapping, as well as easy and affordable access to a vast amount of geographic information on any topic. Through simple apps, users can easily share and combine their data, fostering a sense of community and collaboration. Geospatial analytics are effective decision-making tools that can assess topographic, demographic, and environmental data, assisting corporations, governmental organizations, and regular individuals in making decisions.

Organization Insights

The small and medium-sized businesses (SMEs) segment held the largest revenue share in 2023and is also expected to grow at the fastest CAGR. This is due to the cloud-based goods and services that help users increase productivity and improve business performance. Numerous major companies are using geospatial imaging analytics software and services as a result of the rising popularity of the cloud, and this trend is predicted to continue over the projection period.

Industry Insights

The environmental monitoring industry segment held the largest revenue share in 2023 and is also expected to grow at the fastest CAGR. Environmental changes like global warming are giving people a lot of anxiety. Geospatial technologies like Geographic Information Systems (GIS) and Remote Sensing (RS) are required for efficient environmental change monitoring. Photographs of the Earth are mapped and analyzed using satellite technology. Analyzing geospatial images can help us understand how human activity affects the environment and inspire conservation and preservation efforts.

Regional Insights

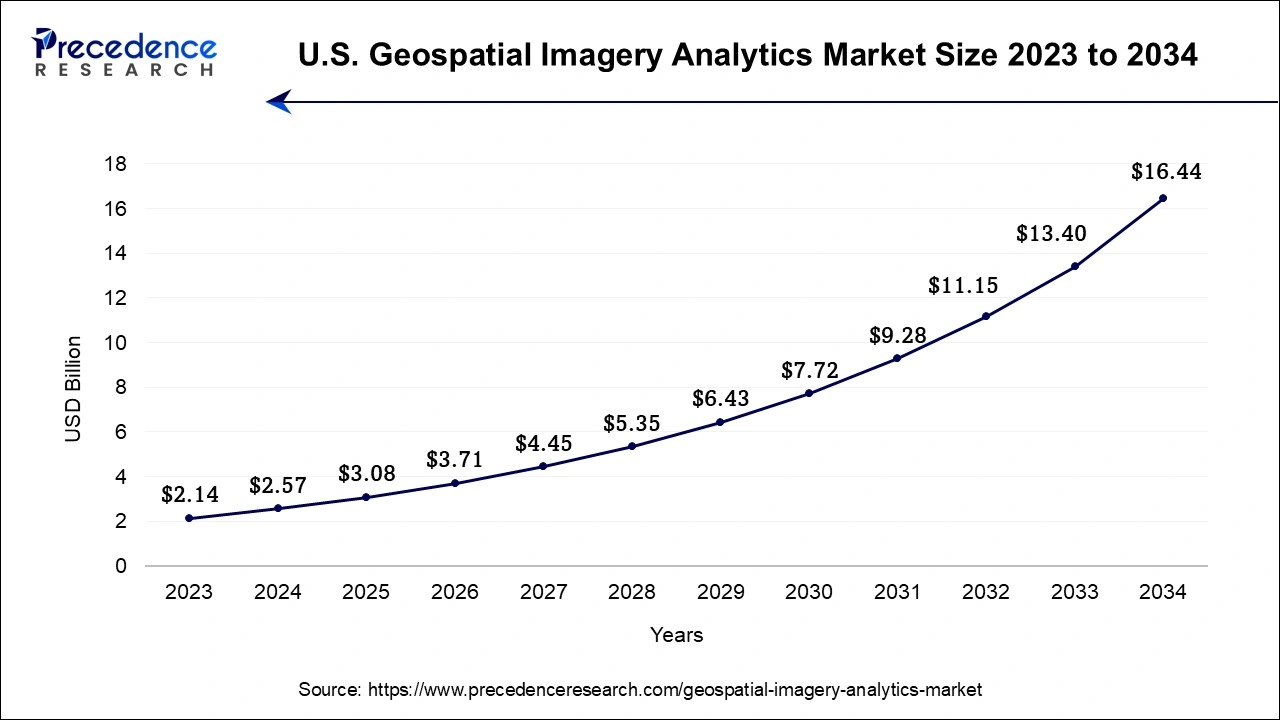

What is the U.S. Geospatial Imagery Analytics Market Size?

The U.S. geospatial imagery analytics market size was exhibited at USD 3.08 billion in 2025 and is projected to be worth around USD 18.95 billion by 2035, poised to grow at a CAGR of 19.92% from 2026 and 2035.

North America region dominated the global market in 2023. Due to the existence of large corporations and rising high-value spending for new satellite systems, this has occurred. It is anticipated that the fast use of big data,machine learning, and cloud computing will fuel market revenue development in this area. The geospatial imagery analytics market in the Asia Pacific region is anticipated to have rapid growth in the forecast period.

U.S. Market Analysis

The U.S. geospatial imagery analytics market is growing due to increasing adoption of satellite and drone-based imaging for applications in urban planning, disaster management, defense, and environmental monitoring. The rising adoption of advanced analytics tools, strong government initiatives, and investment in AI-driven geospatial solutions are also driving market growth.

This is a result of an increase in development projects brought on by a rise in the need for geospatial imaging analytics for urban planning across several growing nations. Furthermore, the increasing demand for geospatial imagery analytics systems is the desire for location-based services and real-time information. The growing e-commerce is also encouraging the integration of these services, particularly for logistical and transportation needs in this region.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest rate in the geospatial imagery analytics market due to rapid urbanization, industrial expansion, and large-scale infrastructure projects, which are driving demand for precise mapping and location-based insights. The region benefits from increasing adoption of advanced technologies such as AI, machine learning, and cloud computing in geospatial data processing. Additionally, supportive government initiatives, rising investments in smart cities, and growing applications across agriculture, defense, and environmental monitoring are fueling market growth.

India Market Analysis

India is a major contributor to the market within Asia Pacific. The market in India is expanding due to rising demand for advanced analytics solutions for urban planning, smart city projects, agriculture monitoring, and disaster management. Government initiatives promoting satellite imaging and geospatial technologies, along with increased adoption of AI and big data analytics in public and private sectors, are contributing to market growth across the country.

Why is Europe Considered a Notably Growing Region in the Market?

Europe is expected to grow at a notable rate during the forecast period. This is mainly due to the increasing adoption of satellite and aerial imaging for urban development, environmental monitoring, and defense applications. Strong investments in geospatial infrastructure, AI-driven analytics, and government-backed smart city initiatives are driving demand, while growing collaboration between public and private sectors accelerates market expansion across the region.

UK Market Analysis

The geospatial imagery analytics market in the UK is growing due to the rising use of satellite and drone-based imaging in urban planning, disaster management, and environmental monitoring. Government initiatives supporting smart cities and geospatial infrastructure, along with growing adoption of AI and advanced analytics by public and private organizations, are driving market growth and technological advancements in the region.

Geospatial Imagery Analytics Market Companies

- Microsoft: Provides cloud, AI, and Azure-based geospatial analytics solutions that support satellite imagery processing, spatial data analysis, and integration with enterprise applications.

- Google: Offers geospatial tools like Google Earth Engine and mapping APIs, enabling scalable satellite data analysis, visualization, and location-based insights for diverse industries.

- Oracle: Delivers spatial databases and cloud services that support management, analysis, and integration of geospatial imagery for enterprise-scale decision-making and analytics.

- Hexagon AB: Provides geospatial software and sensor technologies for mapping, spatial analytics, remote sensing, and digital twin solutions across industries, including defense, infrastructure, and agriculture.

- ESRI: A leading provider of ArcGIS geospatial software, enabling advanced mapping, spatial analytics, imagery processing, and visualization for government, business, and research sectors.

- L3Harris Corporation: Offers geospatial imaging systems, sensors, and analytical tools for defense, intelligence, and public safety applications requiring real-time spatial insights.

- UrtheCast: Provides high-resolution satellite imagery and analytics services for earth observation, monitoring, and decision support across agriculture, environment, and infrastructure sectors.

- Maxar Technologies: Delivers satellite imagery, geospatial data, and analytics platforms that power mapping, intelligence, and monitoring solutions worldwide.

- Geocento: Offers affordable satellite imagery and analytics services with easy access to diverse geospatial data for commercial and research applications.

Other Major Key Players

- Sparkgeo

- Trimble

- SafeGraph

- Mapidea

- Geospin

- Alteryx

- Orbital Insight

- OneView

- Boston Geospatial

- Hydrosat

- Planet Labs

Recent Developments

- In April 2025, Bentley Systems partnered with Google to improve infrastructure management through advanced asset analytics. By integrating Google Imagery Insights, Street View, Vertex AI, and Blyncsy, the collaboration enables transportation authorities to quickly assess roadway conditions, monitor infrastructure, and track changes over time for more efficient maintenance and planning.

(Source: investors.bentley.com/ ) - In February 2025, Esri launched the Content Store for ArcGIS, a web app developed with SkyWatch to simplify access to commercial satellite imagery. The platform offers seamless high-resolution imagery from providers like Maxar, consolidating multiple vendor services and streamlining data acquisition for more efficient organizational use.

(Source: www.esri.com) - In February 2025, Fugro acquired EOMAP GmbH & Co. KG, a German company specializing in satellite-based mapping of marine and freshwater environments. The acquisition strengthens Fugro's Earth Observation capabilities and expands its global presence in the water sector by enhancing its mapping and monitoring solutions.

(Source: www.fugro.com/ ) - In November 2022, TerraScope, a self-service analytics tool, was introduced by Orbital Insight. TerraScope democratizes geographic information by providing rich, actionable insights based on automated analysis of phone, car, truck, ship, and satellite location data

- In September 2022, Sanborn Map Company Inc. purchased Applied Geographics, Inc., Applied Geographics, Inc. has worked with a variety of organizations, including governments and corporations, to provide the best location intelligence, GIS, and geospatial solutions for their specific needs.

- In November 2021, to provide clients with sophisticated agriculture data solutions, Planet Labs bought VanderSat.

Segments Covered in the Report

By Type

- Imagery Analytics

- Video Analytics

By Technology

- Global Positioning Systems

- Geographical Information Systems

- Remote Sensing

- Unmanned Aerial Vehicles

By Deployment

- On-premises

- Cloud

By Organization

- Small and Medium-sized Organizations

- Large Organizations

By Industry

- Defense and Security

- Energy and Utility

- Engineering and Construction

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting