What is the Group Health Insurance Market Size?

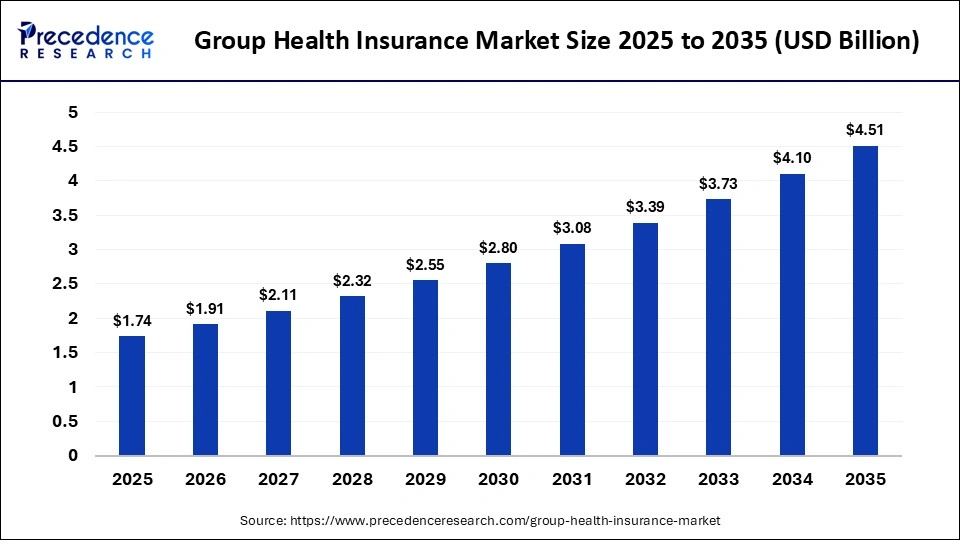

The global group health insurance market size was calculated at USD 1.74 billion in 2025 and is predicted to increase from USD 1.91 billion in 2026 to approximately USD 4.51 billion by 2035, expanding at a CAGR of 10.00% from 2026 to 2035.The group health insurance market has been growing recently due to rising medical inflation, increasing healthcare expenditures, and a growing demand from businesses for employee retention. Introduction of advanced technology in the industry is helpful to manage the lengthy paperwork with ease, along with lowering the administrative costs, which also helps to fuel the growth of the market.

Market Highlights

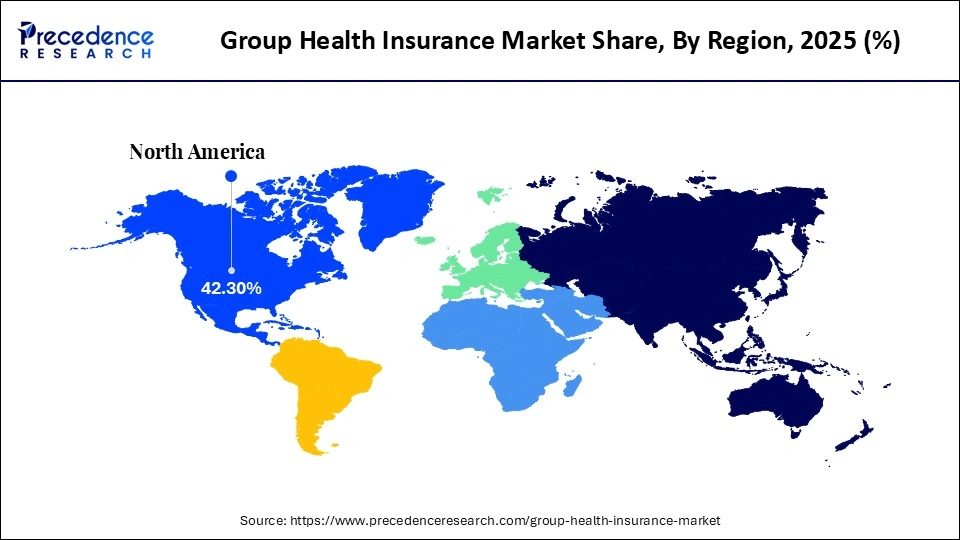

- By region, North America led the group health insurance market in 2025 with approximately 42.3% share.

- By region, the Asia Pacific is observed to be the fastest-growing region in the foreseen period.

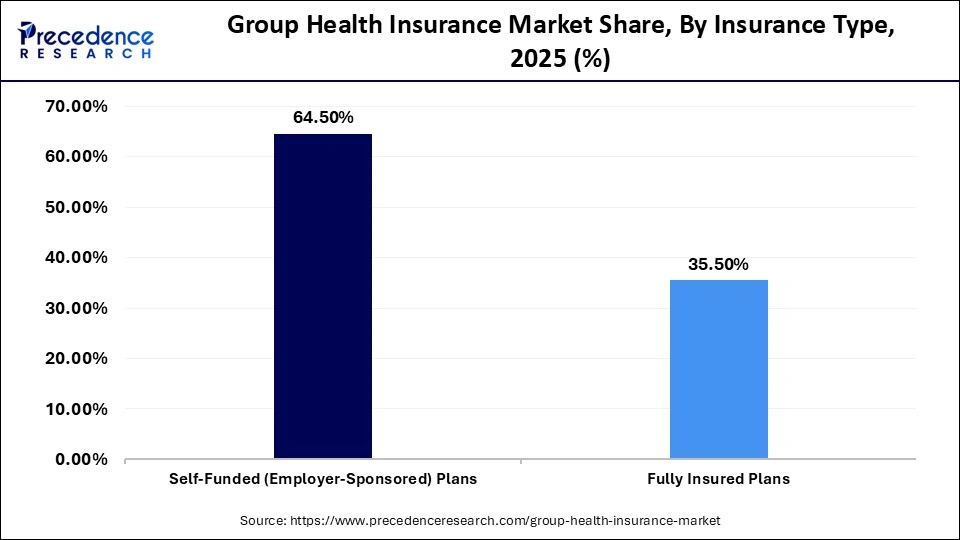

- By insurance type, the self-funded (employer-sponsored) plans segment led the market with approximately 64.5% share in 2025.

- By insurance type, the fully-insured plans segment is observed to be the fastest-growing in the foreseen period.

- By plan type, the health maintenance organization segment led the global market with approximately 25.8% share in 2025.

- By plan type, the preferred provider organization segment is observed to be the fastest-growing segment in the foreseen period.

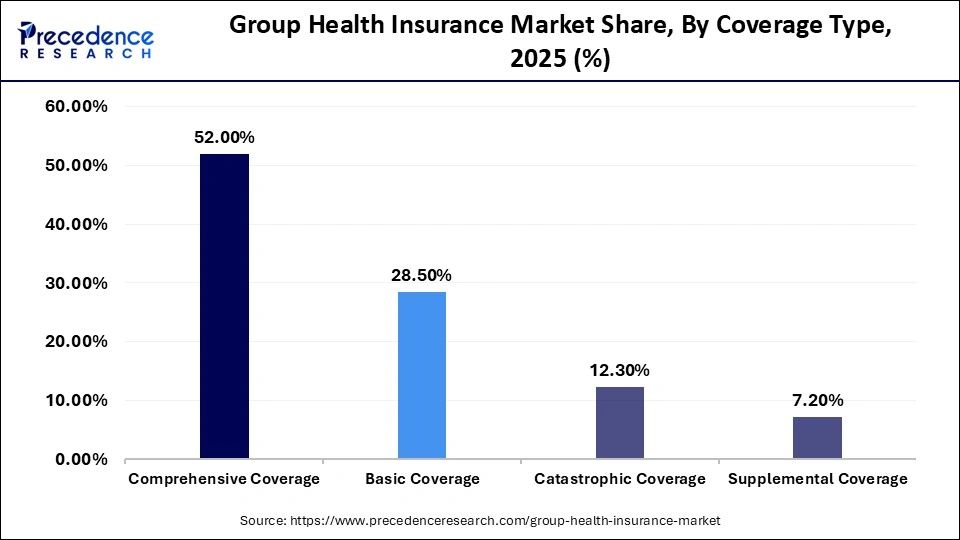

- By coverage type, the comprehensive coverage segment with approximately 52% share led the global market in 2025.

- By coverage type, the basic coverage segment is observed to be the fastest growing in the foreseeable period.

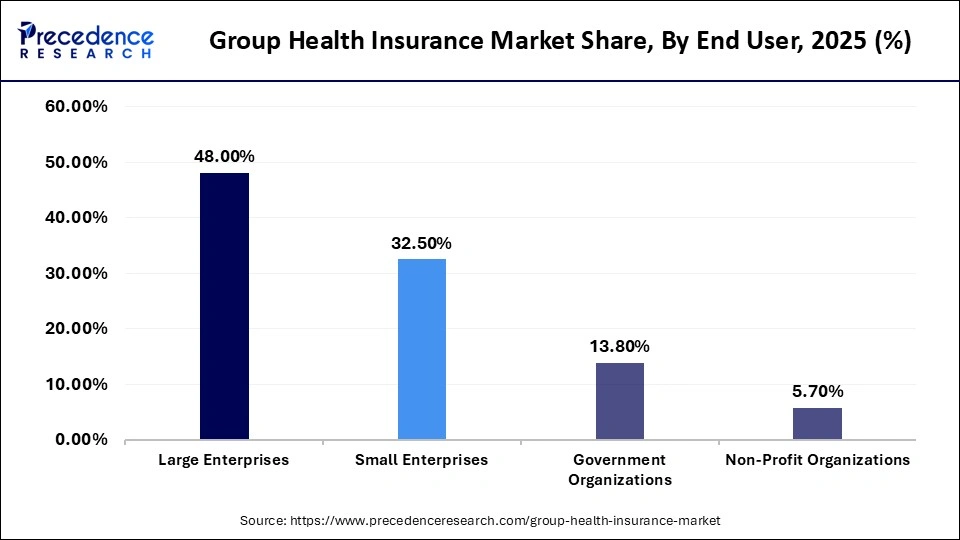

- By end user, the larger enterprises segment with approximately 48% share led the market in 2025.

- By end user, the small enterprises segment is observed to be the fastest growing in the foreseen period.

What is the Group Health Insurance Market?

Group health insurance involves employer-sponsored or organization-level medical coverage that protects employees (and often their dependents) under a single policy, offering benefits such as hospitalization, outpatient care, prescriptions, preventive services, and wellness coverage. It reduces individual risk and administrative overhead while improving workforce health outcomes and retention. Rising healthcare costs, employee benefits focus, and regulatory support are driving strong adoption of group health insurance globally. The prevalence of chronic diseases leading to multiple healthcare facility visits, leading to higher healthcare costs, is another major factor fueling the growth of the market.

Role of Technology in the Growth of the Group Health Insurance Market

Technological advancements have a major role in the growth of the market. Technology has helped the industry to shift from a back-office industry to a customer-centric, operationally efficient one with personalized care, which is helpful for the growth of the market. Advanced technologies in the form of AI, ML, data analytics, robotic process automation, blockchain, and teleconsultation platforms also help to fuel the growth of the market. Technology also helps the industry in the development of user-friendly mobile applications and web portals, allowing instant policy purchases, renewals, and claims tracking, further fueling the growth of the market.

Group Health Insurance Market Trends

- More Coverage- insurers are moving beyond traditional coverage and also including preventive healthcare, mental health support, fitness incentives, and dietary counselling.

- Personalization- providing customized and personalized plans as per the convenience of the employee, rather than opting for a one-size-fits-all insurance plan, is another major factor propelling the growth of the market.

- Technological Advancements- technological advancements in the form of AI and ML integration, data analytics, and digital platforms, which help to streamline the administrative processes, also help to fuel the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.74Billion |

| Market Size in 2026 | USD 1.91 Billion |

| Market Size by 2035 | USD 4.51Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Insurance Type, Plan Type, Coverage Type, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insight

Insight Insurance Type

The self-funded (employer-sponsored) plans segment led the global market with approximately 64.5% share of the market in 2025. The segment involves an insurance policy covering all the employees of the organization. It helps to maintain employee retention and lower absenteeism, further fueling the growth of the market. Growing prevalence of chronic health issues, growing aging and geriatric population, and growing healthcare costs further help to propel the growth of the industry. Growing medical inflation, leading employers to seek better negotiated group rates compared to individual plans, also helps to aid the growth of the market.

The fully insured plans segment is observed to be the fastest-growing in the foreseen period. The segment involves the purchase of coverage by employers directly from the insurance carriers, who assume all financial risk for medical claims. The segment observes growth as it focuses on covering and managing medical claims, protecting employers from high-cost, unexpected claims. The segment is also observed to grow as the plan helps to ease the administrative procedures by letting the employer fix a monthly premium for the plan year, including enrolment and claims processing.

Plan Type Insight

Which Component of the Plan Segment leads the Global Market in 2025?

The health maintenance organization segment led the global group health insurance market in 2025 with approximately 25.8% market share. The segment observes growth due to its progressive features, such as cost-effectiveness, lower premiums, and higher focus on preventive care. The segment involves selecting a primary care physician and using in-network providers for structured and affordable coverage plans, further fueling the growth of the market. Lower insurance premiums, preventive services to avoid expenses, and higher demand for affordable and comprehensive care are also some of the major factors fueling the growth of the market.

The preferred provider organization segment is observed to be the fastest-growing in the foreseeable period. The supportive pointers of the segment, such as higher flexibility, broad network access, lack of referral requirements, and manageable costs, further help to propel the growth of the market. The segment allows the policyholders to visit any physician specialist inside or outside the network without any primary care physician referral, improving flexibility, which is helpful for the growth of the market in the foreseeable period. The segment relies on a contracted network of preferred medical providers, which helps lower the extensive paperwork, helpful for the growth of the group health insurance market in the foreseeable future.

Coverage Type Insight

The comprehensive coverage segment, with approximately 52% market share, led the global market in 2025, as the segment involves insurance plans provided by employers covering various types of medical needs such as hospitalization, maternity, outpatient care, and critical illnesses. Higher demand for preventive care and cost-efficiency also helps to fuel the growth of the market. The segment also covers inpatient, outpatient, maternity, daycare, critical illness, telemedicine, and alternative medicine, further propelling the growth of the market. The segment also focuses on lower premiums and preventive care, and offering network flexibility also helps propel the growth of the market. Higher demand for such plans in small, micro, and medium enterprises is another major factor fueling the growth of the market.

The basic coverage segment is observed to be the fastest-growing segment in the foreseen period. The segment offers various other supportive pointers, such as cost-effectiveness, standardized medical protection, and lower premiums, further fueling the growth of the market in the foreseeable period. The segment is highly supportive for cost-conscious consumers, younger individuals, and small to mid-sized businesses, further propelling the growth of the market in the foreseeable period. Basic coverage plans cover services such as hospital stays, daycare, and some outpatient care, further aiding the growth of the group health insurance market in the foreseeable period.

End User Insight

The large enterprises segment led the global group health insurance market in 2025 with approximately 48% market share, as the segment is accompanied by major favourable options such as self-insured plans, customizable plans, and plans with comprehensive benefits, which are helpful for the growth of the market. The employers can also negotiate the cost of the favourable plans for an efficient deal, which is another major factor for the growth of the market. The segment also helps to eliminate various administrative costs, further fueling the growth of the market. Such plans offer comprehensive, cost-saving, high-value plans including extensive family coverage, mental health, dental health, and vision care support, further fueling the growth of the market.

The small enterprises segment is observed to be the fastest-growing segment in the foreseen period, covering organizations with approximately 2 to 50 employees. Such insurance plans help organizations to mitigate risks and attract talent, further fueling the growth of the market. Such plans offer manageable premiums and coverage, including critical incidents and personal accident coverage, further fueling the growth of the group health insurance market in the foreseeable period. The insurance plans also allow for the addition and removal of employees throughout the year to make the whole procedure seamless.

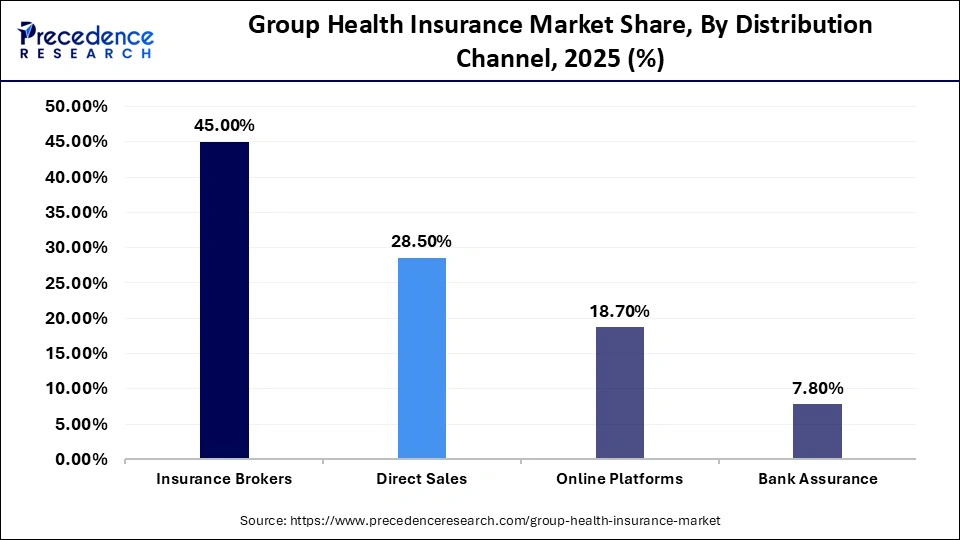

Distribution Channel Insight

The insurance brokers segment led the group health insurance market in 2025 with approximately 45%, as the insurance brokers provide expert advisory, plan customization, and also help with claims support to the organization, further fueling the growth of the market. Brokers are also helpful to compare policies, navigate complex healthcare products, and negotiate premiums, further propelling the growth of the market. Brokers also help employers in selecting, implementing, and managing employee group health insurance plans, for claim resolution, further fueling the growth of the market.

The online platforms segment is observed to be the fastest-growing segment in the foreseen period, mainly due to factors like streamlining enrolment and administration for employers, growing smartphone usage, cloud-based solutions, AI-enabled, and personalized services, which are helpful for the growth of the market. The segment also ensures to support companies in managing, customizing, and purchasing the ideal insurance plan in line with the growth of the digital market, further aiding the growth of the industry in the foreseeable period. The market also observes growth due to higher demand for self-service channels, cloud-based insurance systems, andeasy management of multi-employee organizations, further helpful for the growth of the market.

Regional Insights

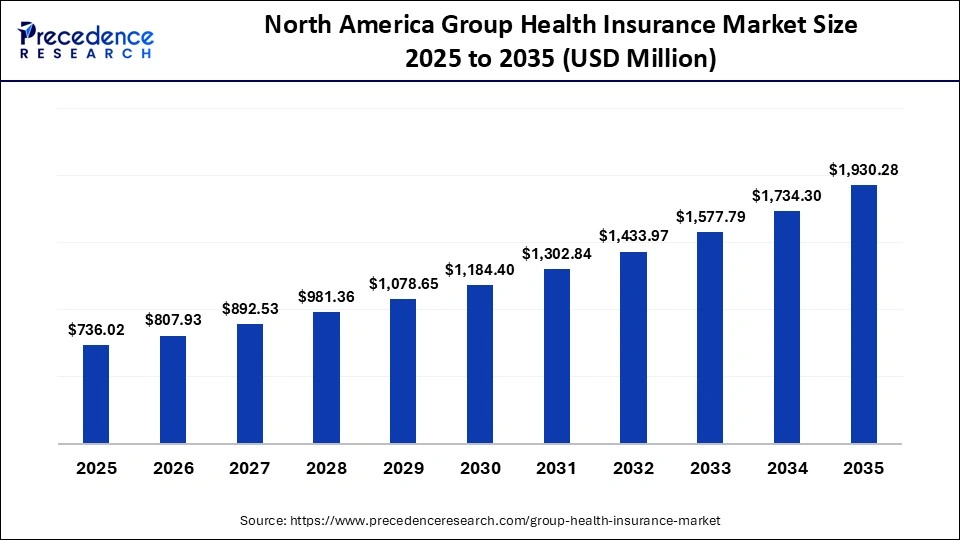

How Big is the North America Group Health Insurance Market Size?

The North America health insurance market size is estimated at USD 736.02 million in 2025 and is projected to reach approximately USD 1,930.28 million by 2035, with a 10.12 % CAGR from 2026 to 2035.

How did North America lead the Global Group Health Insurance Market in 2025?

North America led the global market with approximately 39.9-42.3% in 2025, mainly due to factors such as rising prevalence of chronic illness, premium increasing costs, major shift towards high-deductible insurance plans, and other similar factors. The market also observes growth in the region due to rising adoption of telemedicine, digital health technologies, and data analytics, further propelling the growth of the market. Higher demand for insurance plans focusing on value-based care, wellness programs, and mental health support also helps to fuel the growth of the market. Such insurance plans help to manage the rising healthcare costs efficiently, which is helpful for the growth of the market.

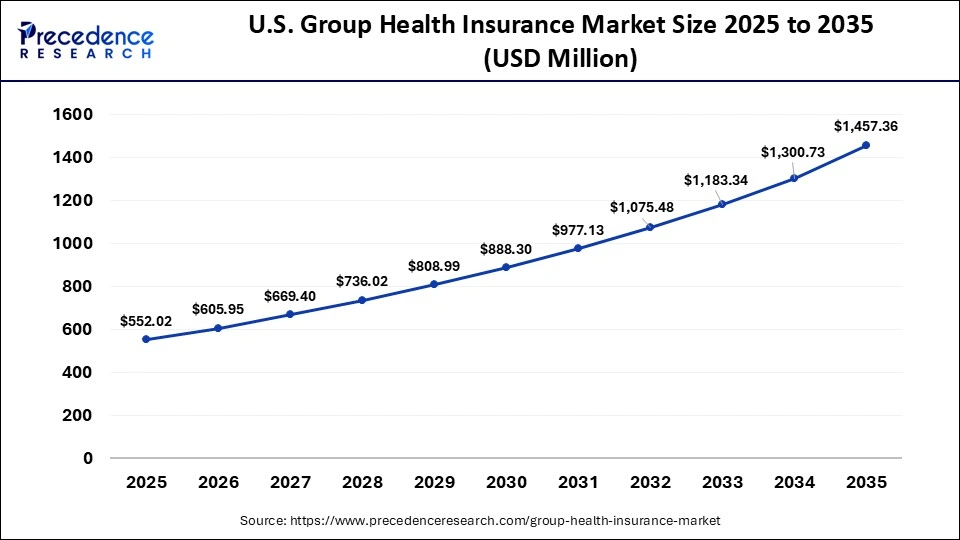

What is the Size of the U.S. Group Health Insurance Market?

The U.S. health insurance market size is calculated at USD 552.02 million in 2025 and is expected to reach nearly USD 1457.37 million in 2035, accelerating at a strong CAGR of 10.19% between 2026 and 2035.

The U.S. Group Health Insurance Market Trends:

The U.S. has a major contribution in the growth of the market due to factors such as rising prevalence of chronic illness, growing aging and geriatric population, and growing digitalization in the insurance industry to manage administrative work seamlessly, fueling the growth of the market.

Why is the Asia Pacific region observed to be the fastest-growing region in the Foreseen Period?

Asia Pacific is observed to be the fastest-growing region in the foreseen period due to growing chronic illnesses such as cancer and cardiovascular issues, growing health awareness post COVID, and growing healthcare expenses, fueling the demand for the market in the region. The market also observes growth due to the growing demand for group health insurance plans in small and medium enterprises to retain talent and lower employee absenteeism. Digital innovation in policy distribution is another major factor propelling the growth of the group health insurance market in the foreseeable period. The market of the region also observes growth due to the integration of insurance into other products. The growing aging population of the region is leading to higher demand for plans covering chronic illnesses like diabetes and heart diseases, further propelling the growth of the market in the foreseeable period.

China has made a major contribution to the growth of the market. Rising prevalence of chronic diseases, growing aging population, increased demand for supplementary coverage, and higher demand for commercial health insurance are some of the major factors propelling the growth of the market. Government initiatives to develop the commercial insurance plans of the region also help to propel the growth of the market in the foreseeable period.

Who are the Major Players in the Global Group Health Insurance Market?

The major players in the group health insurance market include UnitedHealth Group, Anthem (Elevance Health), Aetna (CVS Health), Cigna Corporation, Humana Inc., Blue Cross Blue Shield Association, Allianz SE, AXA SA, Aviva plc, Bupa Global Kaiser Permanente, MetLife, Inc., Prudential Financial, Inc., Manulife Financial Corporation, AIA Group Ltd.

Recent Developments

- In June 2025, Galaxy Health Insurance launched its flagship offering- Galaxy Marvel. The new product offers health-linked incentives and digital wallet credits to policyholders to maintain good health and provide robust and comprehensive coverage.(Source- https://www.expresshealthcare.in)

- In February 2026, AIA launched its AIA Voluntary Health Insurance SelectWise Scheme. The new scheme is designed for everyday consumers in search of an affordable healthcare budget medical insurance plan.(Source- https://www.media-outreach.com)

Segments Covered in the Report

By Insurance Type

- Self-Funded

- Fully Insured Plans

By Plan Type

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO

- Point of Service (POS

- High-Deductible Health Plans (HDHPs)

By Coverage Type

- Comprehensive Coverage

- Basic Coverage

- Catastrophic Coverage

- Supplemental Coverage

By End User

- Large Enterprises

- Small Enterprises

- Government Organizations

- Non-Profit Organizations

By Distribution Channel

- Insurance Brokers

- Direct Sales

- Online Platforms

- Bank Assurance

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting