What is the Healthcare Fabrics Market Size?

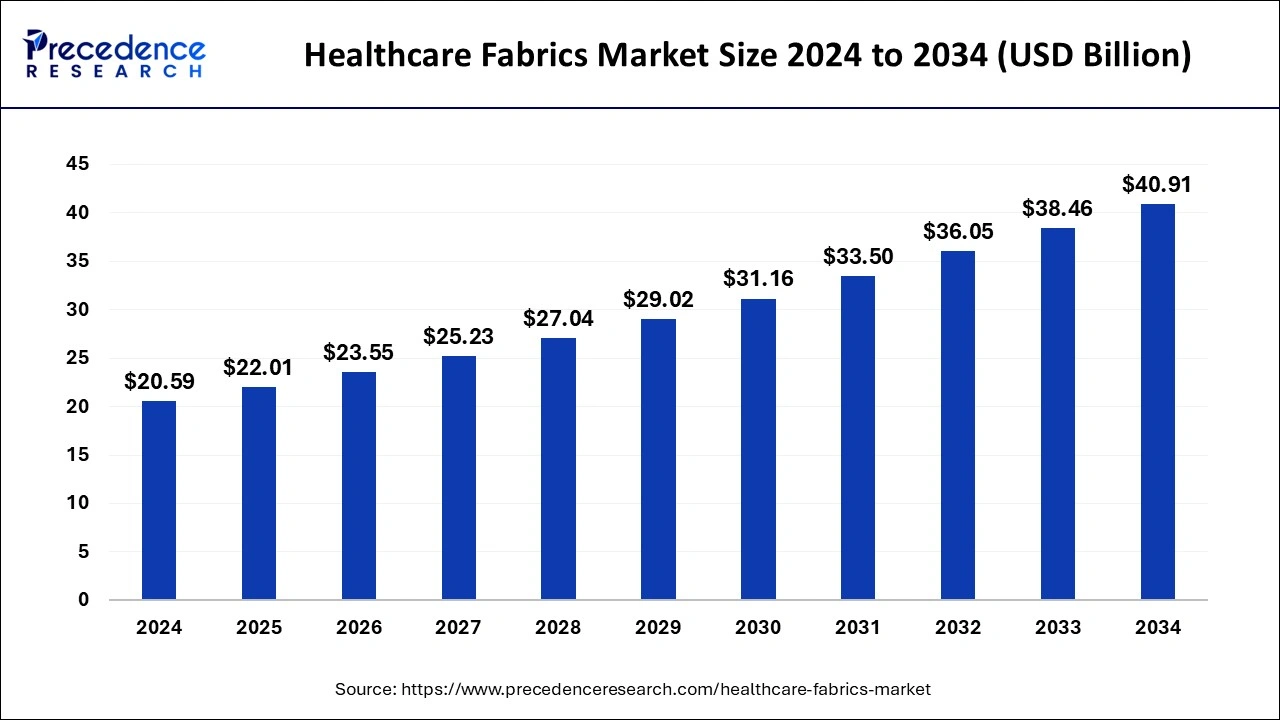

The global healthcare fabrics market size is accounted at USD 22.01 billion in 2025 and predicted to increase from USD 23.55 billion in 2026 to approximately USD 40.91 billion by 2034, growing at a CAGR of 7.10% from 2025 to 2034. The rising innovations in developing eco-friendly healthcare fabrics, increasing investments and collaborations among industries along with the growing government support are driving the growth of healthcare fabrics market.

Healthcare Fabrics Market Key Takeaways

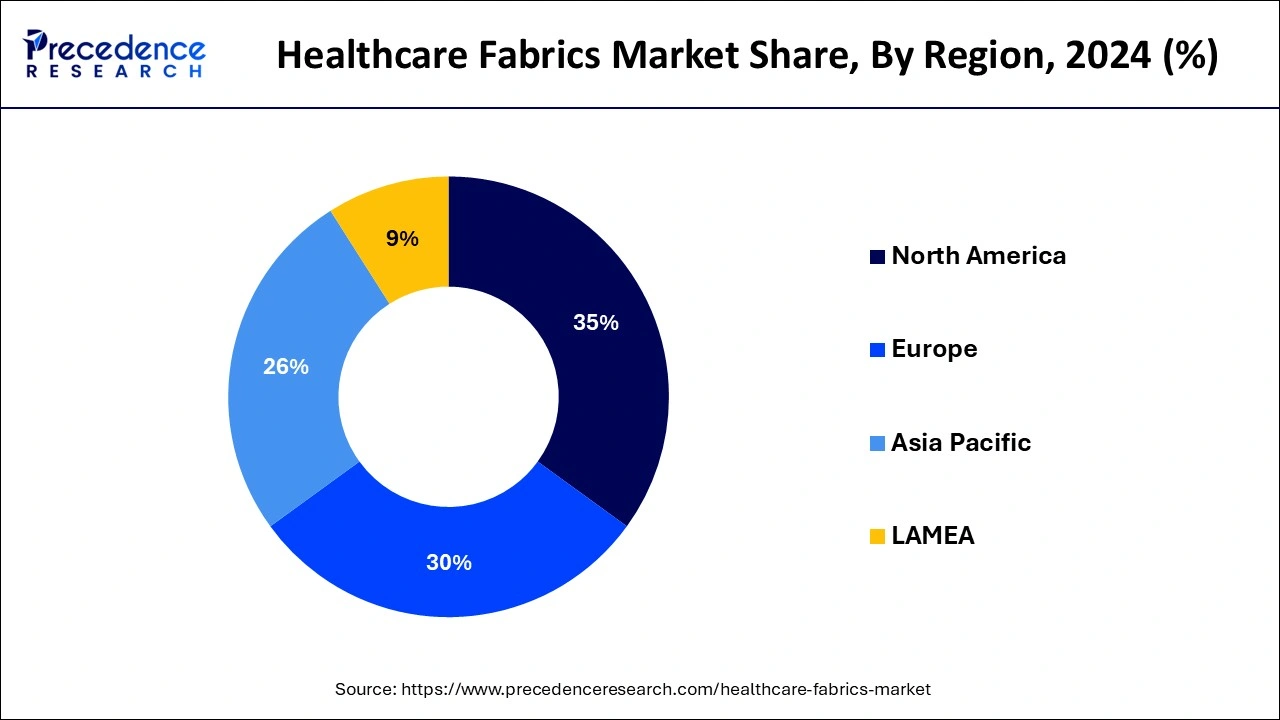

- North America dominated the global healthcare fabrics market with the largest market share of 35% in 2024.

- Asia Pacific is expected to expand at a solid CAGR during the forecast period.

- By raw material, the polypropylene segment contributed the highest market share of 37% in 2024.

- By raw material, the cotton segment is projected to grow at a notable CAGR during the forecast period.

- By fabric type, the non-woven segment dominated the global market in 2024.

- By fabric type, the knitted segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the hygiene products segment has held a major market share in 2024.

How is AI contributing to the Healthcare Fabrics Market?

The integration of AI in healthcare fabrics helps in monitoring the health and vitals of the wearer. Sensors embedded in smart fabrics can applied for tracking physiological data such as heart rate and body temperature. AI algorithms and deep learning tools assist in analysing real-time data for providing insights, for quick response in emergency situations and in risk stratification.

Healthcare Fabrics MarketGrowth Factors

- Rising awareness of consumers and healthcare professionals towards hygiene.

- Increased healthcare expenditure and expansion of healthcare sectors in various regions and developing areas.

- Growing government support in taking initiatives and funding for R&D of healthcare sectors.

- Advancements in manufacturing of healthcare fabrics by using biodegradable materials and integration of technology.

- Use of antimicrobial facilities by healthcare fabrics manufacturers for adhering to stringent regulations and safety.

- Surging investments by various industries and governments in healthcare fabrics and medical textiles.

Market Outlook

- Industry Growth Overview: The healthcare fabrics market is undergoing a speedy transformation, as its growth is mainly attributed to stringent hygiene practices, the management of chronic diseases, and the introduction of antimicrobial and smart textile technologies.

- Sustainability Trends: There is a strong movement towards sustainability that is gradually taking control of the market, as more and more attention is given to the production of medical textiles that are biodegradable, reusable, and consume less energy.

- Global Expansion: The combination of increased healthcare investments and progress in medical textiles is not only a growth factor for developing economies but also for the more advanced ones.

- Major Investors: Big companies are allocating meaningful amounts of money to research and development as well as to automation, which in turn increases the production scale, adds more diversity to the materials, and improves the sustainability outcome.

- Startup Ecosystem: The market is being transformed by innovative startups through the introduction of AI-integrated smart fabrics and biodegradable medical textiles.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.01 Billion |

| Market Size by 2034 | USD 40.90 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Fabric Type, Application, End-use, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Raw Material Insights

The polypropylene segment contributed the highest market share of 37% in 2024. Polypropylene has grown in popularity as a result of continuous advancements in medical procedures and textile technology. The largest end use prospect for disposable high quality non-woven materials is in hygiene and medical applications such as protective apparel for patients and infection free surgical drapes.

The cotton segment is projected to grow at a notable CAGR during the forecast period. Cotton has a number of qualities that make it ideal for use in healthcare. It's absorbent, soft, and safe to use with all three basic sterilizing methods such as steam, ethylene oxide, and gamma radiation. Cotton can be utilized in the healthcare sector in its simplest form as 100% cotton as a fabric composite or combined with other fibers. Thus, cotton is used as healthcare fabrics on a large scale.

Fabric Type Insights

The non-woven segment dominated the global market in 2024.The demand for non-woven healthcare fabrics has grown due to the impact of COVID-19 pandemic. The face masks, personal protective equipment, and gowns are used for the protection against coronavirus outbreak. The government all around the world imposed stringent regulations for the use of such products, which had positive impact on the growth of the segment.

The knitted segment is expected to hit remarkable over the forecast period. As compared to woven healthcare fabrics, knitted healthcare fabrics are more effective and efficient in nature. The growing research and development activities are supporting the expansion of knitted healthcare fabrics segment.

Application Insights

The hygiene products segment has held a major market share in 2024. The products such as gowns, caps, face masks, pads, and sanitary napkins are categorized under hygiene products. The government of developed and developing regions is highly investing for the development of healthcare infrastructure. This is directly impacting the growth of hygiene products in the global healthcare fabrics market.

The dressing products segment is expected to witness fastest rate during the forecast period. The demand for dressing products is growing on a large scale due to accidents. The dressing products help in the protection of stitches and wounds of the patients. These products also help in lowering swelling and pain of the affected area of the body.

Regional Insights

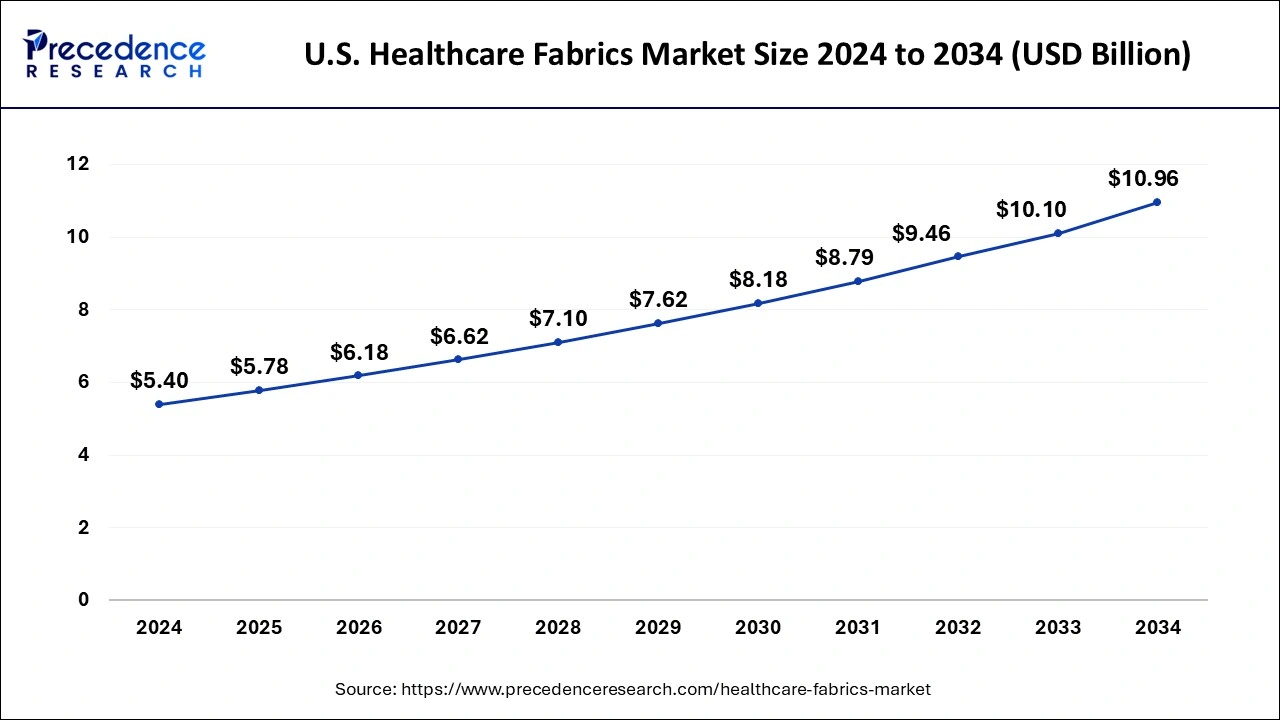

U.S. Healthcare Fabrics Market Size and Growth 2025 to 2034

The U.S. healthcare fabrics market size was evaluated at USD 5.78 billion in 2025 and is predicted to be worth around USD 10.96 billion by 2034, rising at a CAGR of 7.33% from 2025 to 2034.

How is North America Leading the Healthcare Fabrics Market?

North America is at the forefront of the market thanks to its impressive healthcare infrastructure and the early adoption of advanced materials. The region focuses on the use of antimicrobial and smart fabrics for infection control and patient comfort. Regulatory initiatives are the ones that create the demand for high-quality sustainable textiles in hospitals and clinics, backed up by strong R&D and cooperation between material scientists and medical device manufacturers.

United States Healthcare Fabrics Market Trends:

Innovation in performance-based healthcare textiles is what the U.S. market is based on. AI-enabled production lines are now being integrated, which will improve consistency and customization. There is a growing trend towards single-use nonwoven materials and intelligent fabrics for patient monitoring. The industry is deriving benefits from the collaboration of the healthcare sector with manufacturers and research institutions working on hygiene, safety, and environmentally friendly production methods.

How is Asia-Pacific Performing in the Healthcare Fabrics Market?

Asia-Pacific is on the verge of a speedy growth trajectory that is being dictated by healthcare expansion, urbanization, and the general public's increasing awareness of hygiene. The area is working on the development of low-cost but at the same time high-performance healthcare textiles. Rising investments in textile automation, along with the increasing demand for personal protective and hygiene products, are the major factors that contribute to the growth of nonwoven and bio-based medical textiles innovation in the developing world.

China Healthcare Fabrics Market Trends:

The healthcare textiles sector of China is thriving due to innovations in the manufacturing process and advancements in material science. The market is taking over AI-based textile automation for its ability to provide quality and precision all the time. The rising healthcare infrastructure in the country and the growing consciousness among the people about hygiene are the factors that create the demand for highly protective fabrics. The government's plan to be self-reliant and the development of eco-friendly materials will surely help China to position itself as a strong global player.

Europe Healthcare Fabrics Market Trends:

Europe's market is growing quickly, mainly because of the progress in technical textiles and the sustainability goals. There is a remarkable increase in the use of smart medical fabrics, which are equipped with sensors for both the healing and the monitoring of wounds. The strict environmental regulations are contributing to the use of recyclable and low-impact materials, while the R&D centers are cooperating in the creation of high durability and soft for the patients textile innovations.

Germany Healthcare Fabrics Market Trends:

Germany is the leader of the European market due to the synergic environment of the textile engineering and innovation. The manufacturers are concentrating their efforts on the production of smart, antimicrobial, and breathable fabrics, which are meant to be used in advanced clinical settings. The combination of digital textile manufacturing and sustainability objectives leads to breakthroughs in the development of novel materials that are comfortable, hygienic, and compliant with the stringent healthcare safety and environmental regulations.

Value Chain Analysis

- R&D: Through advanced research, fiber technology, and protective material development are the main sources of innovation.

Key Players: Pfizer, Merck & Co., Roche, Johnson & Johnson, and Novartis - Clinical Trials and Regulatory Approvals: The medical-grade compliance, product safety, and performance validation are the outcomes of this process.

Key Players: IQVIA, ICON plc, Parexel, and Syneos Health - Formulation and Final Dosage Preparation: The turning of fiber into medical-grade fabric for the various healthcare uses comes out as a result of this process.

Key Players: Sun Pharma, Cipla, Dr. Reddy's Laboratories, and Lupin - Packaging and Serialization: This process includes labeling, sterilization, and unique coding for traceability and compliance.

Key Players: Amcor plc, Gerresheimer AG, Schott AG, AptarGroup, Inc - Distribution to Hospitals, Pharmacies of Healthcare Fabrics: Timely delivery of sterile medical fabrics is made possible thanks to efficient logistics.

Key Players: McKesson Corporation, Cardinal Health, and AmerisourceBergen Corporation

Healthcare Fabrics Market Companies

- Kimberly-Clark Corporation

- Berry Global Group Inc.

- Freudenberg Group

- Ahlstrom Munksjo OYJ

- Asahi Kasei Corporation

- Knoll Inc.

- Eximus Corporation

- Paramount Tech Fab Industries

- Avgol Industries

- Carnegie Fabrics LLC

Latest Announcements

- In November 2024, Myant Corporation announced the acquisition of Swiss Companies Nanoleq and Osmotex for expanding the global footprint of its health and wellness products. Vincent Martinez, CEO of Nanoleq said that, “Very few companies have succeeded in creating reliable, medical grade smart textiles, so Myant's acquisition of Nanoleq marks an exciting new chapter for us and will significantly scale our activities. Both companies share the vision that our healthcare model is outdated and people must be empowered to learn about their health before they get sick. Everyone in our society will benefit from improved prevention.”

- In October 2024, Rajshree Fabrics, a leading manufacturer of nonwoven fabrics announced the expansion of its expertise in producing high-performance materials for offering to a wide range of consumer products. Mr. Abhinav Kansal, Co-founder of Rajshree Fabrics said that, “The latest addition to our production capabilities is a five-beam SSMMS line, primarily focused on producing nonwoven fabrics for the medical and hygiene sectors. These fabrics are used in products like sanitary napkins, diapers, and medical gowns, addressing the increasing demand for high-performance hygiene products.”

Key Developments

- In January 2025, several researchers from University of Southampton and other universities across UK developed a biodegradable and sustainable electronic textile (e-textile) called SWEET (Smart, Wearable and Eco-friendly Electronic Textiles) offering sustainable solutions for wearable technology in healthcare and environmental monitoring.

- In February 2024, Sinaatec, a leader in the Algerian industry for the manufacturing of non-woven fabrics declared the launch of its cutting-edge high-quality non-woven fabric production factory in Algeria. The fabrics produced in this factory follow stringent quality regulations required in terms of hygiene, medicine and filtration.

Segments Covered in the Report

By Raw Material

- Polypropylene

- Cotton

- Polyester

- Viscose

- Polyamide

- Others

By Fabric Type

- Non-woven

- Woven

- Knitted

By Application

- Hygiene Products

- Sanitary Napkins

- Baby Diapers

- Adult Diapers

- Dressing Products

- Clothing

- Blanket & Bedding

- Upholstery

- Privacy Curtains

- Others

By End-use

- Hospitals

- Private clinics

- Nursing homes

- Ambulatory surgical centers

- Other

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting