Healthcare Reimbursement Market Size and Forecast 2025 to 2034

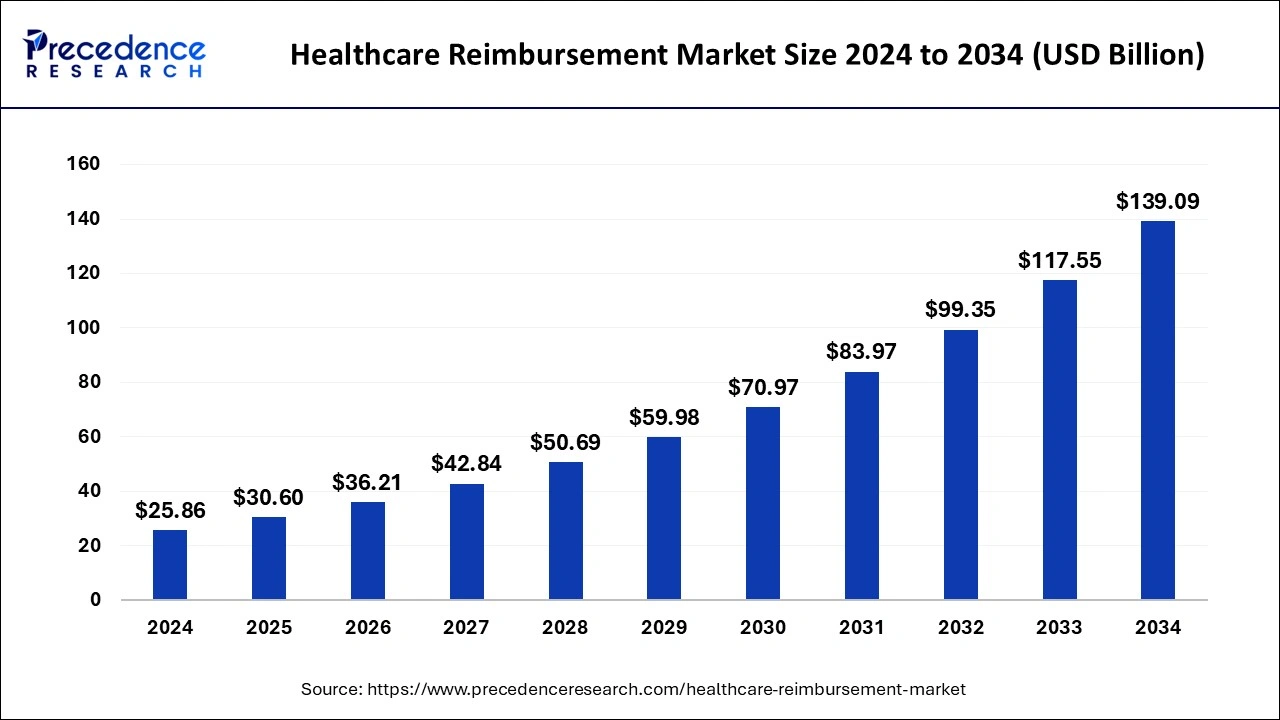

The global healthcare reimbursement market size was accounted for USD 25.86 billion in 2024 and is anticipated to reach around USD 139.09 billion by 2034, growing at a CAGR of 18.32% from 2025 to 2034. An aging population, and growing insurance coverage is leading to high growth in the healthcare reimbursement market.

Healthcare Reimbursement Market Key Takeaways

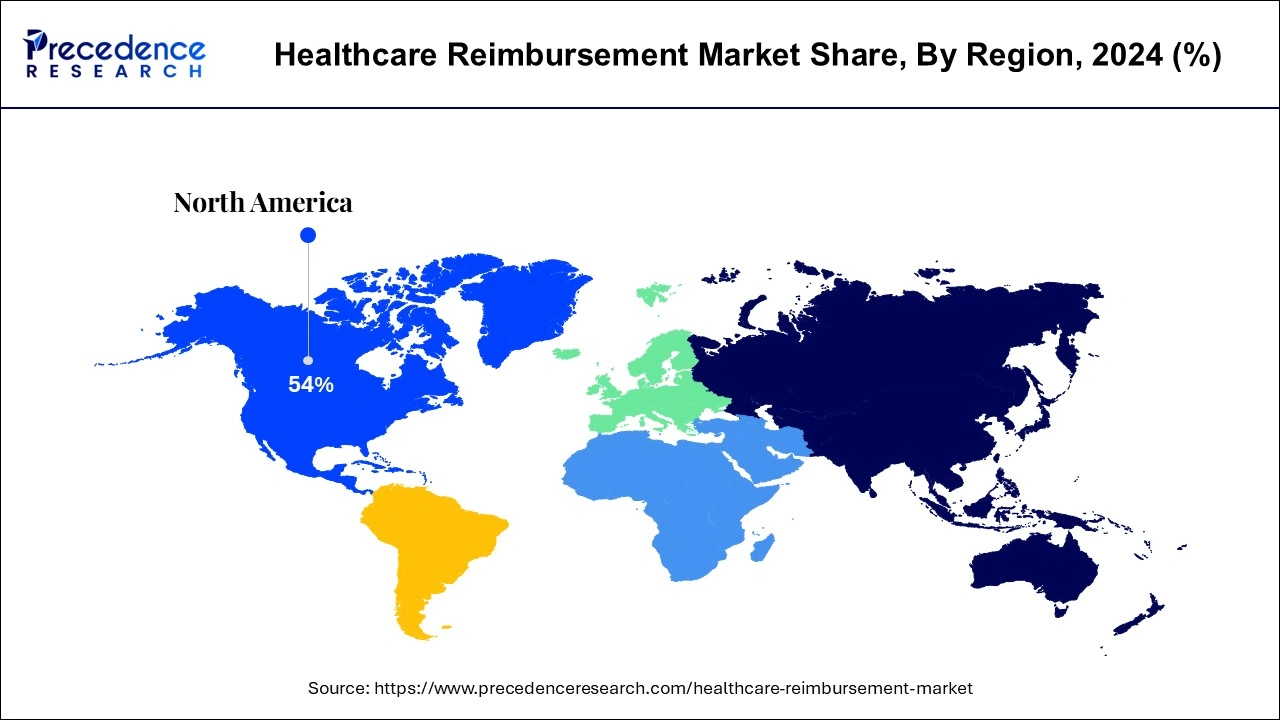

- North America dominated the global market with the largest market share of 54% in 2024.

- Asia Pacific is projected to expand at the notable CAGR during the forecast period.

- By claim, the underpaid segment contributed the highest market share in 2024.

- By Payer , the private payers segment captured the biggest market share in 2024.

- By Service Provider, the hospitals segment has held the largest market share in 2024.

Role of AI in the Healthcare Reimbursement Market

Artificial intelligence has widely influenced the healthcare reimbursement market by improving the transparency, efficiency, and accuracy of several methods such as payment management, billing, and coding. It can keep track of all the bills of the patients and help to get all the details in segregated form which can ease and speed up the process of reimbursement by reducing delays. It helps to detect any fault in calculation which makes this process smooth and convenient for both healthcare employees as well as other people.

U.S. Healthcare Reimbursement Market Size and Growth 2025 to 2034

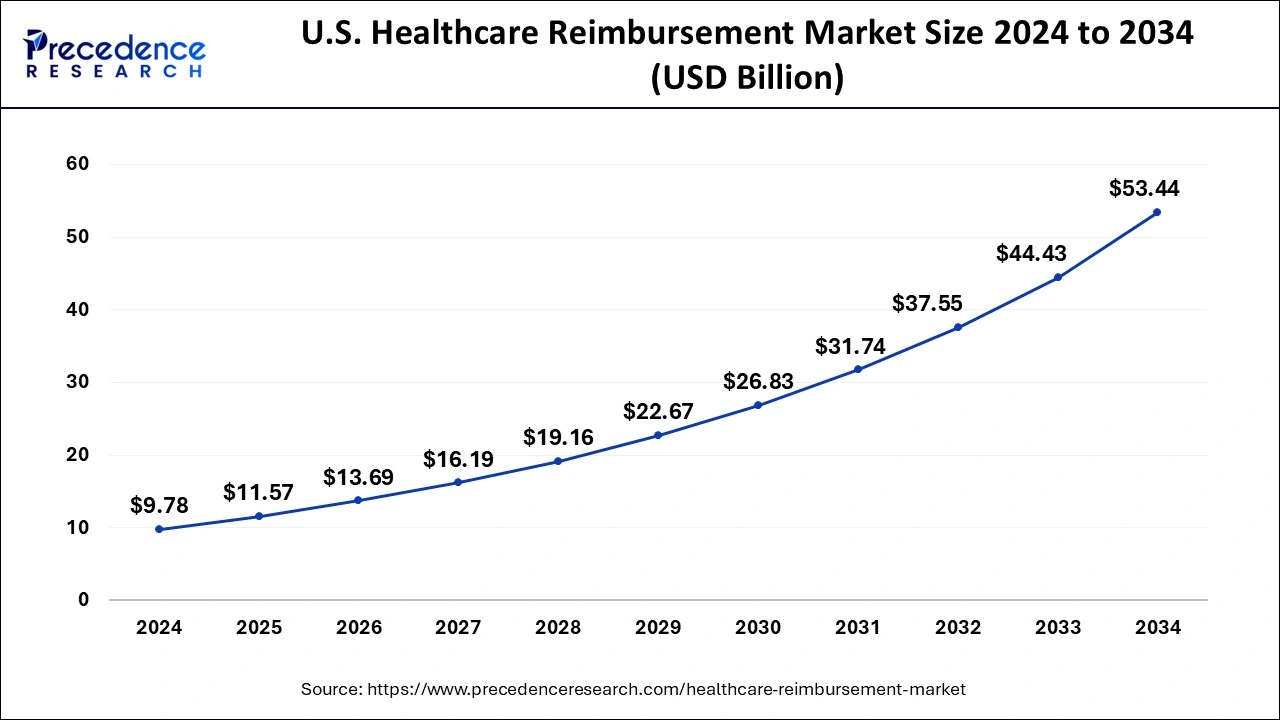

The U.S. healthcare reimbursement market size was exhibited at USD 9.78 billion in 2024 and is projected to be worth around USD 53.44 billion by 2034, growing at a CAGR of 18.51% from 2025 to 2034.

North America region dominated the market in 2024. This is projected to remain dominant through the forecast period. The existence of strong reimbursement guidelines and framework and a huge number of insurance players are the key developments benefiting the development of the market. Also, the Inexpensive Care Act makes its obligatory to possess coverage. The particular states that performed not obey were penalized by the federal government. Therefore, it works as a power for the regional market.

The North America is been followed by the European countries in terms of the share of the market. Improving elderly population and subsequently growing long-term diseases, such as respiratory system diseases, cardiovascular diseases, and vascular disease, are driving the market in European countries. Asia Pacific is poised to experience the speediest expansion over the outlook period. The increasing number of geriatric people and the supporting government initiatives in the developing financial systems are a couple of the leading factors required to raise the market's expansion in this region. Also, the go up in private and public healthcare costs, high economic development, penetration of insurance policy services in non-urban and urban areas, lead to market progress.

In U.S. government representatives are taking efforts to boost the healthcare management and reimbursement system. A group of senators is acting towards availing medicare cover at-home COVID-19 tests for seniors, like commercial insurance companies do for their customers.

Healthcare Reimbursement Market Growth Factors

- Healthcare reimbursement is the type of payment mode which helps patients to pay bills easily. The growth of healthcare reimbursement is being driven by the adoption of advanced and innovative technologies for tracking and monitoring patient's health. The expansion of the healthcare sector is also contributing towards the growth and development of the healthcare reimbursement market.

- Medicare's per household expenditure is predicted to increase by an average total annual rate of 4.6 % during the next 10 years, due to an increase in the use of services and regarding care, growing medicare insurance enrollment, and increasing healthcare prices.

- The factors that are boosting the growth of the global healthcare reimbursement market are the growing incidents of chronic disorders and the surge in the cost of medical care. The key market players are also collaborating with the government for the development of the global healthcare reimbursement market.

- Deteriorating quality regarding the availability of proper care for patients in requirement of treatments with high-cost and burden of administration which is often faced by physicians is likely to hinder the expansion of the industry during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 30.6 Billion |

| Market Size by 2034 | USD 139.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.32% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Claim, Payers, Service Provider,and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Claim Insights

The underpaid segment contributed with the greatest share of the market still to pay to increasing variety of unnecessary utilization and fake claims of healthcare services causing in underpaid negotiations. There are many cases of deceive of federal and local government individuals and businesses health care programs. This includes distributing a claim for services, healthcare treatment, pharmaceutical and medical devices that were never rendered. On the other hand, to have control of all the frauds, the Phony Claim Act was introduced. Also, individuals are prone to utilize services if they are not paying the full cost of those services. There are consumers who intentionally use healthcare services which are not required medically. Intended for instance, some individuals might visit a medical doctor or a walk-in clinic for the social value of human companionship quite in order to address a medical necessity. This factor will bolster the market growth over the forecast time period.

Payer Insights

In 2024, private payers segment dominated the global healthcare reimbursement market. Due to the presence of a high number of private companies in the market, they are expected to stay dominant during the projected period. In addition, in the U.S., more than 125 health insurance firms provide private health care. In the U.S. the Affordable Care Act, also known as the Patient Protection and Affordable Care Act (PPACA), has been in operation since 2014.Health-care reform legislation aims to make health insurance more affordable, accessible, and useful. Several aspects of the Affordable Care Act call for the private insurance market to be expanded. It incentivizes employers to provide health insurance and mandates that consumers who are not covered by a government or employer-sponsored plan acquire private health insurance.

Service Provider Insights

On the basis of service providers, private hospitals were the leading segment in the healthcare reimbursement market in 2024. This is mainly because of increasing geriatric populace along with increasing number of surgical procedures. Merging hospital systems to protect a huge inhabitants or geographic area generates more negotiating capacity to turn reimbursement.

In North America, usually hospitals are paid on the basis of diagnosis-related group (DRG) which represents fixed amount for each and every and every clinic stay. The clinic treating someone and spending less as opposed to DRG settlement, makes earnings then when hospitals spend more than diagnosis related groups (DRG) payment to take care of patients, they generate failures.

Diagnostic lab segment is anticipated to observe prominent growth during the forecast period due to increasing patient pool alongside with increasing govt. reforms pertaining to adoption of innovative healthcare infrastructure. In addition, contributing on numerous insurance coverage indicate that providers have gain access to a sizable pool of potential patients, maximum of them gain from low-cost health-related coverage under ACA.

Healthcare Reimbursement Market Companies

- UnitedHealth Group

- Aviva

- Allianz

- CVS Overall health

- BNP Paribas

- Aetna

- Nippon Life Insurance policies

- WellCare Health Ideas

- Agile Health Insurance

- Violet Cross Blue Cover Association.

Recent Development

- In August 2024, MediBuddy announced the launch of its AI-powered fraud detection system 'Sherlock' for healthcare reimbursement claims. The system is based on artificial intelligence (AI), machine learning (ML), and data analytics and quickens the reimbursement process while accurately detecting and preventing fraudulent claims in real time.Organisational fraud goes beyond finances, damaging reputation and inviting regulatory scrutiny.

- In January 2024, Mastercard announced the launch of a medical claim payment solution with key partners in India. “We're on a mission to integrate our technology into platform providers to drive seamless B2B payment experiences at greater scale,” Chad Wallace, global head of Commercial Solutions at Mastercard, said in the release.

- In September 2024, MIAMI announced the launch of Ontrak Quality, its latest product offering designed to help healthcare payers, providers, and stakeholders close gaps in care, thereby improving quality measures and ultimately quality scores. This newest innovation continues Ontrak's expansion of its Advanced Engagement System to solve healthcare organizations' toughest problems.  Quality scores are vital in shaping healthcare, impacting reimbursement rates, star ratings, and patient outcomes.

Segments Covered in the Report

By Claim

- Fully Paid

- Underpaid

By Payers

- Private

- Public

By Service Provider

- Hospitals

- Diagnostic Labs

- Physician Office

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting