Hexafluorosilicic Acid Market Size and Forecast 2025 to 2034

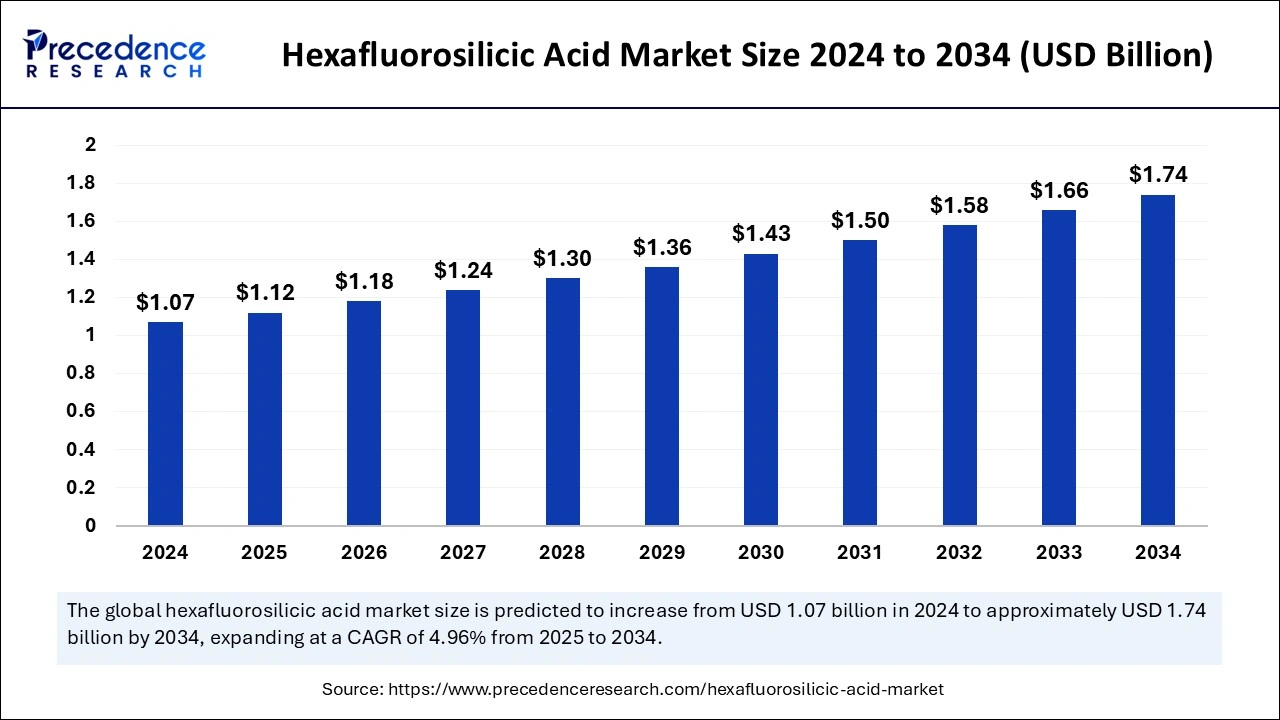

The global hexafluorosilicic acid market size was estimated at USD 1.07 billion in 2024 and is predicted to increase from USD 1.12 billion in 2025 to approximately USD 1.74 billion by 2034, expanding at a CAGR of 4.96% from 2025 to 2034. Rising applications of hexafluorosilicic acid in sterilization technologies are the key factor driving market growth. Also, increasing awareness regarding oral hygiene coupled with the growing regulatory approvals on products can fuel market growth further.

Hexafluorosilicic Acid Market Key Takeaways

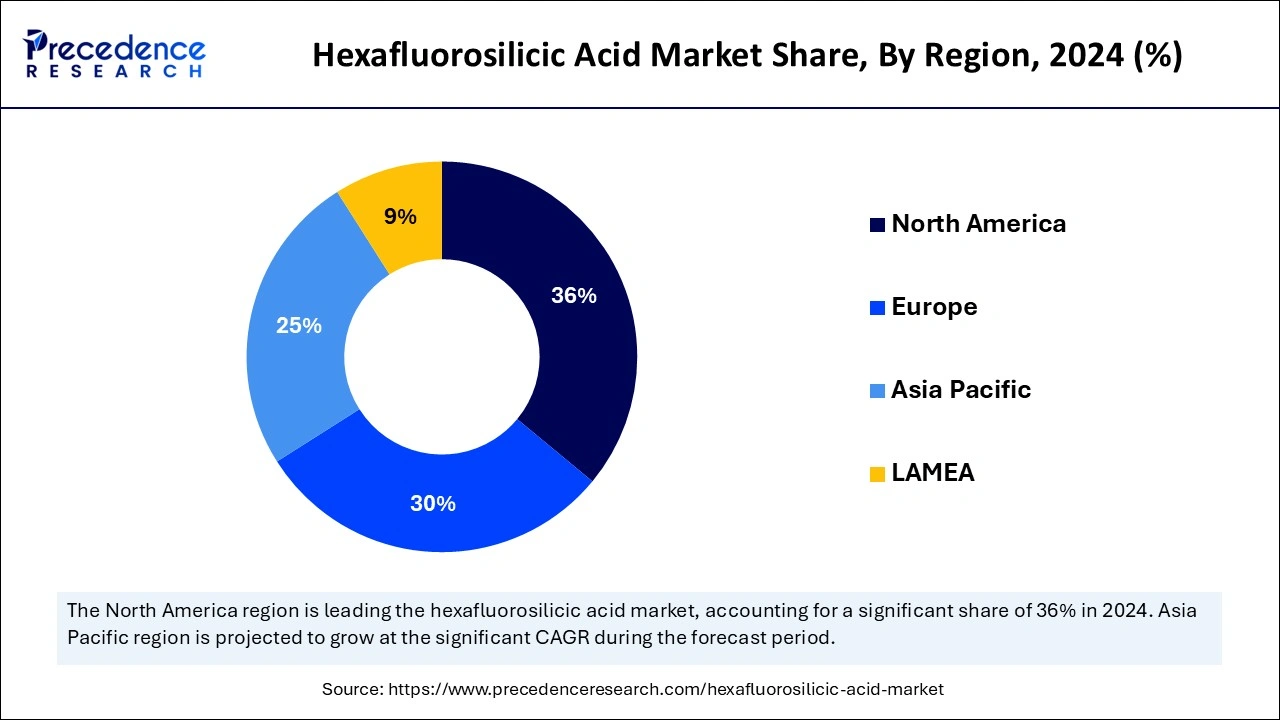

- North America dominated the global hexafluorosilicic acid market with the largest market share of 36% in 2024.

- Asia Pacific is expected to show the fastest growth over the studied period.

- By form, the liquid segment held the largest market share in 2024.

- By form, the powder segment is anticipated to grow at the fastest rate during the projected period.

- By purity level, the more than 90% segment led the market by holding the largest share in 2024.

- By purity level, the less than 50% segment is expected to show fastest growth during the forecast period.

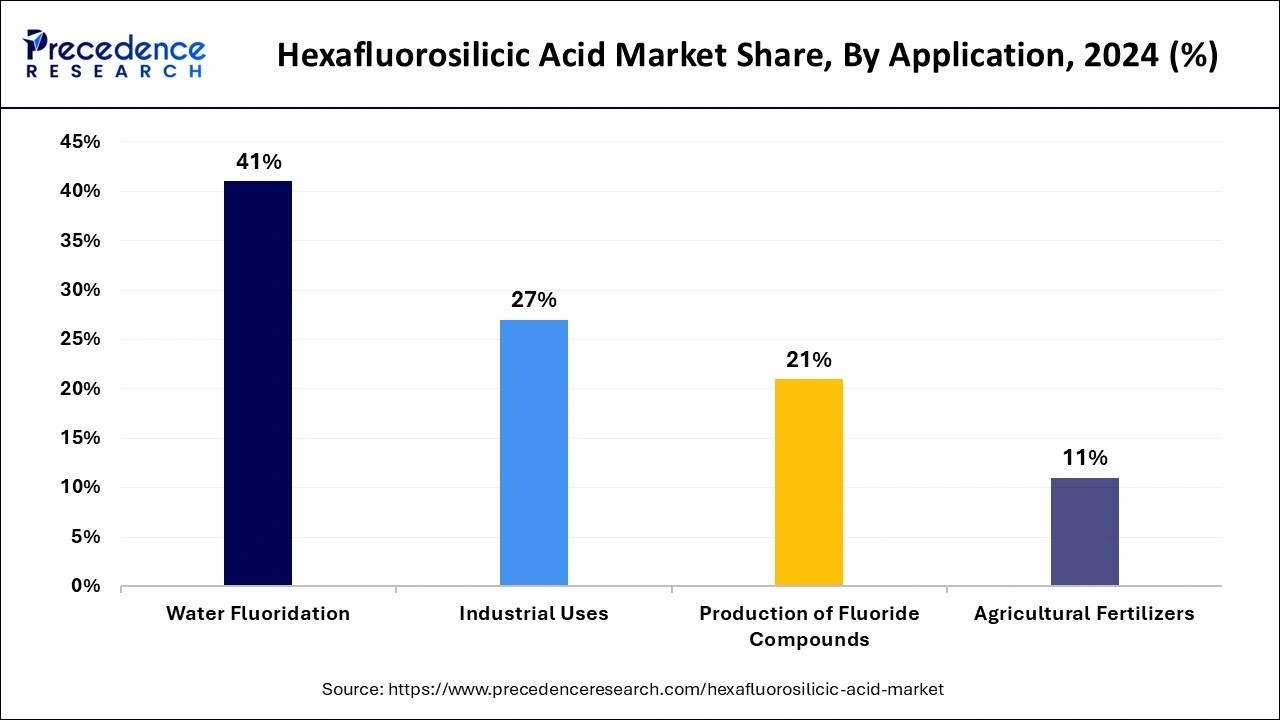

- By application, the water fluoridation segment dominated the global market in 2024.

- By application, the industrial uses segment is expected to grow at the fastest rate over the forecast period.

- By end-use industry, the water treatment segment led the market in 2024.

- By end-use industry, the chemical manufacturing segment is expected to grow at the fastest rate over the forecast period.

The Role of Industrial Artificial Intelligence (AI) in Chemical Manufacturing

Industrial Artificial Intelligence (AI) is a type of AI technology used for critical operations like force chain operation and storehouse of goods using advanced analytics. The hexafluorosilicic acid market is highly reliant on external factors such as temperature and pressure. AI considers all these factors to give real-time temperature and pressure control advice to generate the enhanced yield. Furthermore, AI can be utilized through the product and process development steps to boost product innovation.

- In January 2025, Basetwo, an AI platform for manufacturing engineers, announced it had raised USD USD 11.5 million in Series A funding led by AVP with participation from existing investors Glasswing Ventures, Deloitte Ventures, Global Brain Ventures, Shimadzu Corporation, Chiyoda Corporation, and prominent UAE angel investors via Qora71.

U.S. Hexafluorosilicic Acid Market Size and Growth 2025 to 2034

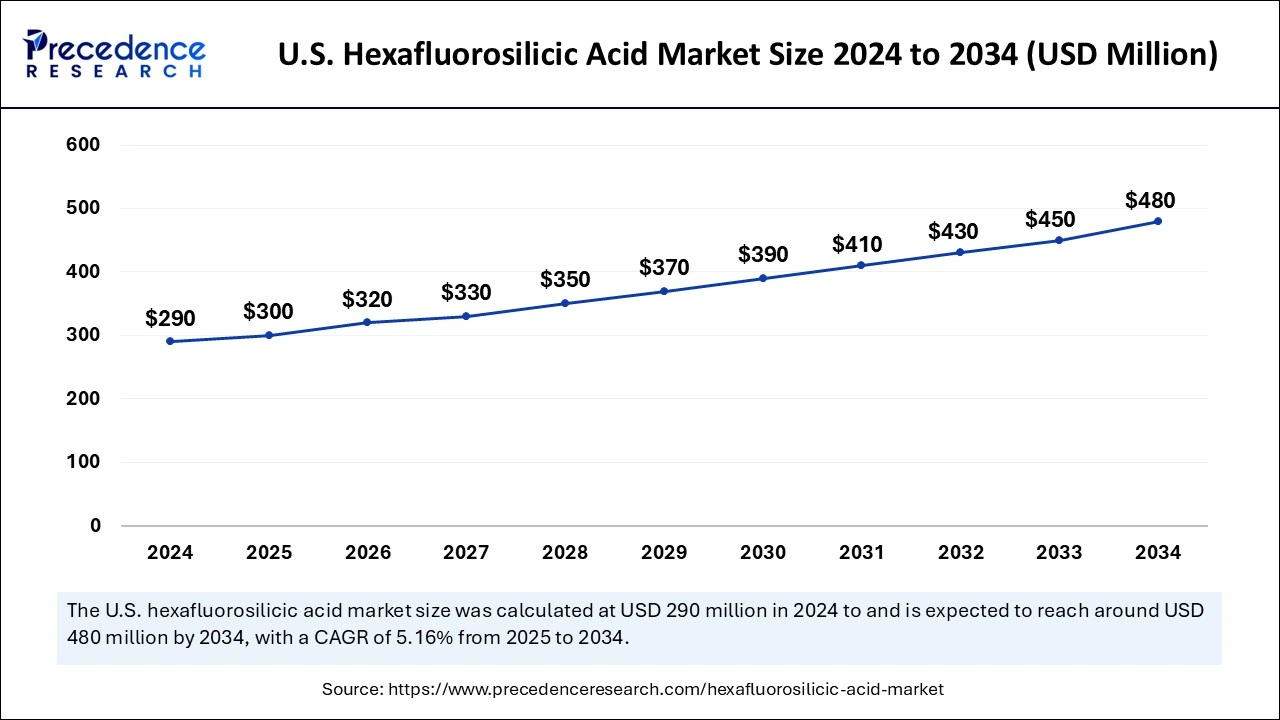

The U.S. hexafluorosilicic acid market size was exhibited at USD 290 million in 2024 and is projected to be worth around USD 480 million by 2034, growing at a CAGR of 5.16% from 2025 to 2034.

North America dominated the global hexafluorosilicic acid market in 2024. The dominance of the segment can be attributed to the region's escalating metal surface treatment and textile industries coupled with the rise in water fluoridation applications. Furthermore, the region's focus on improving dental health facilities can boost market growth during the forecast period. Future innovations and advancements in the region will likely help with market expansion soon.

- In May 2023, Gelest, a leading specialty chemicals company, made a significant announcement regarding the acquisition of a fluorosilicic acid production facility in the United States.

Asia Pacific is expected to show the fastest growth in the hexafluorosilicic acid market over the studied period. The growth of the region can be credited to the increasing awareness of health benefits and government support for fluoridation practices across the region. Moreover, developing economies such as China and India have experienced significant growth in the chemical and textile industry.

Market Overview

Hexafluorosilicic acid is a type of chemical generally utilized as a source of fluoride. It is a corrosive, colorless liquid and can also be found in the gas state. It can be converted into various useful hexafluorosilicate salts. It's a key reagent for cleaving Si-O bonds. It is widely used in the surface transformation of calcium carbonate and in wood preservation, too. This compound can be produced industrially and naturally.

Top 5 Chemical companies in the world in 2025

| Country | Market Capitalization |

| ExxonMobil | USD 405.99 billion |

| Chevron Phillips Chemical | USD 283.03 billion |

| Reliance Industries | USD 200.2 billion |

| Linde | USD 193.46 billion |

| PetroChina | USD 166.89 billion |

Hexafluorosilicic Acid Market Growth Factors

- Rising demand for hexafluorosilicic acid from applications like water fluoridation is expected to boost hexafluorosilicic acid market growth soon.

- Growing disposable incomes and changing lifestyles across the globe can propel market growth shortly.

- Innovations in textile manufacturing and growing demand from the textile industry will likely contribute to the market expansion further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1.74 Billion |

| Market Size by 2025 | USD 1.12 Billion |

| Market Size in 2024 | USD 1.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.96% |

| Leading Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Purity Level, Application, End Use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Surge in the agricultural sector

The hexafluorosilicic acid market is substantially impacted by the growth in the agriculture sector. Hexafluorosilicic acid is utilized in agricultural applications, especially as a raw material of fluorine in fertilizers, acting as a key nutritional ingredient for crops. In addition, the push for more agricultural yields and the increasing requirement for sustainable farming solutions have enabled farmers to seek advanced solutions to improve crop performance and overall soil health.

- In November 2024, Researchers at Oxford University developed a new method to extract fluorine from fluorspar (CaF2) using oxalic acid and a fluorophilic Lewis acid in water under mild reaction conditions.

Restraint

Environmental concerns

Using hexafluorosilicic acid can create environmental concerns, especially if not disposed of and handled properly. Its future impact on human health and aquatic ecosystems has facilities regulatory challenges and increased scrutiny. Moreover, strict safety and health regulations associated with the handling, preservation, and transportation of this acid can cause hurdles for manufacturers and end-users in the hexafluorosilicic acid market.

Opportunity

Growth of fluorosilicic acid facilities

The expansion of fluorosilicic acid facilities is the latest market trend. The hexafluorosilicic acid market is witnessing growth due to market players' escalation in production and storage facilities. This expansion trend enables companies to strengthen their product offerings to propel their market share. Furthermore, key market players are emphasizing increasing their operations to specific to the growing need for this versatile chemical. Commercially,hexafluorosilicic acid is used as a raw material in the manufacturing of glass, animal hides, and ceramics.

- In October 2024, Tanfac Inds commissions expanded hydrofluoric acid manufacturing capacity. The company mainly produces hydrofluoric acid (HF) and aluminum fluoride (ALF). TIL also produces sulphuric acid. In addition, it manufactures specialty fluorides that are sold to diverse customers.

Form Insights

The liquid segment held the largest hexafluorosilicic acid market share in 2024. The dominance of the segment is due to the wide utilization of liquid compounds, particularly in municipal water systems, along with the growing demand for fluoridated water. The expansion in industrial processes increasingly requires liquid hexafluorosilicic acid for various purposes.

- In August 2023, chemical supplier Chemours entered the market for two-phase immersion cooling fluids with a product that says it has less global warming potential than current rivals such as 3M's Novec. Option 2P50 is a proprietary hydrofluoroolefin (HFO) dielectric fluid designed for two-phase immersion cooling systems, where the coolant is allowed to boil and recondense, removing heat more efficiently than simple immersion cooling.

The powder segment is anticipated to grow at the fastest rate during the projected period. The growth of the segment is because of the ongoing developments in product applications and innovation in various forms. However, the powder form of the compound is very toxic and, hence, should avoid direct contact with the hands of the operator.

Purity Range Insights

In 2024, the more than 90% segment led the hexafluorosilicic acid market by holding the largest share. The dominance of the segment can be credited to the increasing use of this range of purity compounds in high-end applications, which need strict control over impurities, hence holding a significant market share. Furthermore, the application of compounds across end-use chemical industries should be increased to ensure proper treatment.

The less than 50% segment is expected to show fastest growth during the forecast period. The growth of the segment is owing to the increasing demand for high-grade materials from several end-use industries, as this range purity compound is needed to carry out certain industrial processes. Moreover, the growing demand for water fluoridation in emerging economies like China and India can influence positive segment growth.

Application Insights

The water fluoridation segment dominated the global hexafluorosilicic acid market in 2024. The dominance of the segment can be attributed to the increasing focus on public health initiatives aimed at preventing dental issues. This application is important because it focuses on the significance of fluoride in community water supplies and its impact on decreasing cavities. Additionally, maximum levels of fluoridation can prevent caries by offering consistent and frequent contact with low levels of fluoride, preventing tooth decay further.

- In August 2024, Luscombe Drinks, the innovative soft drinks producer famed for its commitment to using the finest ingredients, announced the launch of its bottled water brand, 'Dartmoor Spring.' The new range, featuring both still and sparkling water, will be available in convenient 27cl bottles through Luscombe's existing distribution network.

The industrial uses segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be linked to the rising importance and demand for compounds from various end-use industries for numerous industrial applications such as glass production and metal surface treatment. Also, the industrial segment requires hexafluorosilicic acid for many manufacturing processes.

End Use Industry Insights

The water treatment segment led the hexafluorosilicic acid market in 2024. The dominance of the segment can be credited to the extensive adoption of hexafluorosilicic acid for fluoridation purposes to improve overall dental health. Water treatment facilities are important to remove hazardous substances and contaminants from the water, which makes it safer and cleaner to drink. However, the large amount of fluoride used in water can be toxic, causing fluoride-induced tooth discoloration.

The chemical manufacturing segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the growing use of the compound in chemical manufacturing settings because it is a main ingredient in manufacturing various fluorinated chemicals. Moreover, the growth in the chemical industry, especially in emerging economies, is fuelling the demand for chemical intermediates like hexafluorosilicic acid.

Hexafluorosilicic Acid Market Companies

- KMG Chemicals

- Honeywell International

- Indorama Ventures

- Solvay

- Occidental Chemical Corporation

- American Vanguard Corporation

- Arkema

- Ferro Corporation

- Advanced Chemical Company

- Namibia Rare Earths

- Tetra Technologies

- AquaSourcing

- BASF

- Albemarle Corporation

- Chemours

Latest Announcement by Market Players

- In August 2024, Honeywell and Repsol announced a collaboration to create new production pathways for biofuels and circular materials. The two will also explore the possible integration of these methods into Repsol's existing facilities. The companies plan to scale and commercialize Honeywell's technologies, which use various wastes like fats, oils, greases, biomass, and solids for chemical production.

- In June 2024, Arkema, a leader in specialty materials, announced a breakthrough in new manufacturing processes that integrate up to 40% post-consumer recycled content from end-of-life packaging products into its powder coating resins. This new technology will empower end markets to better respond to increasing societal expectations to preserve resources and reduce climate impact.

Recent Developments

- In June 2023, IXOM, a global leader in water treatment and chemical solutions, made an exciting announcement about the introduction of a new line of fluorosilicic acid products specifically tailored for the textile processing market.

In April 2024, Hydrite, an integrated manufacturer and supplier of chemicals and related services, announced its acquisition of Fife Water Services Inc., a supplier of water treatment and water process products and automation, and Precision Polymer Corporation (PPC), a custom blend manufacturer.

Segments Covered in the Report

By Form

- Liquid

- Powder

- Granular

By Purity Level

- Less than 50%

- 50% to 90%

- More than 90%

By Application

- Water Fluoridation

- Industrial Uses

- Production of Fluoride Compounds

- Agricultural Fertilizers

By End Use Industry

- Water Treatment

- Chemical Manufacturing

- Pharmaceuticals

- Agriculture

- Mining

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting