What is the Home Insurance Market Size?

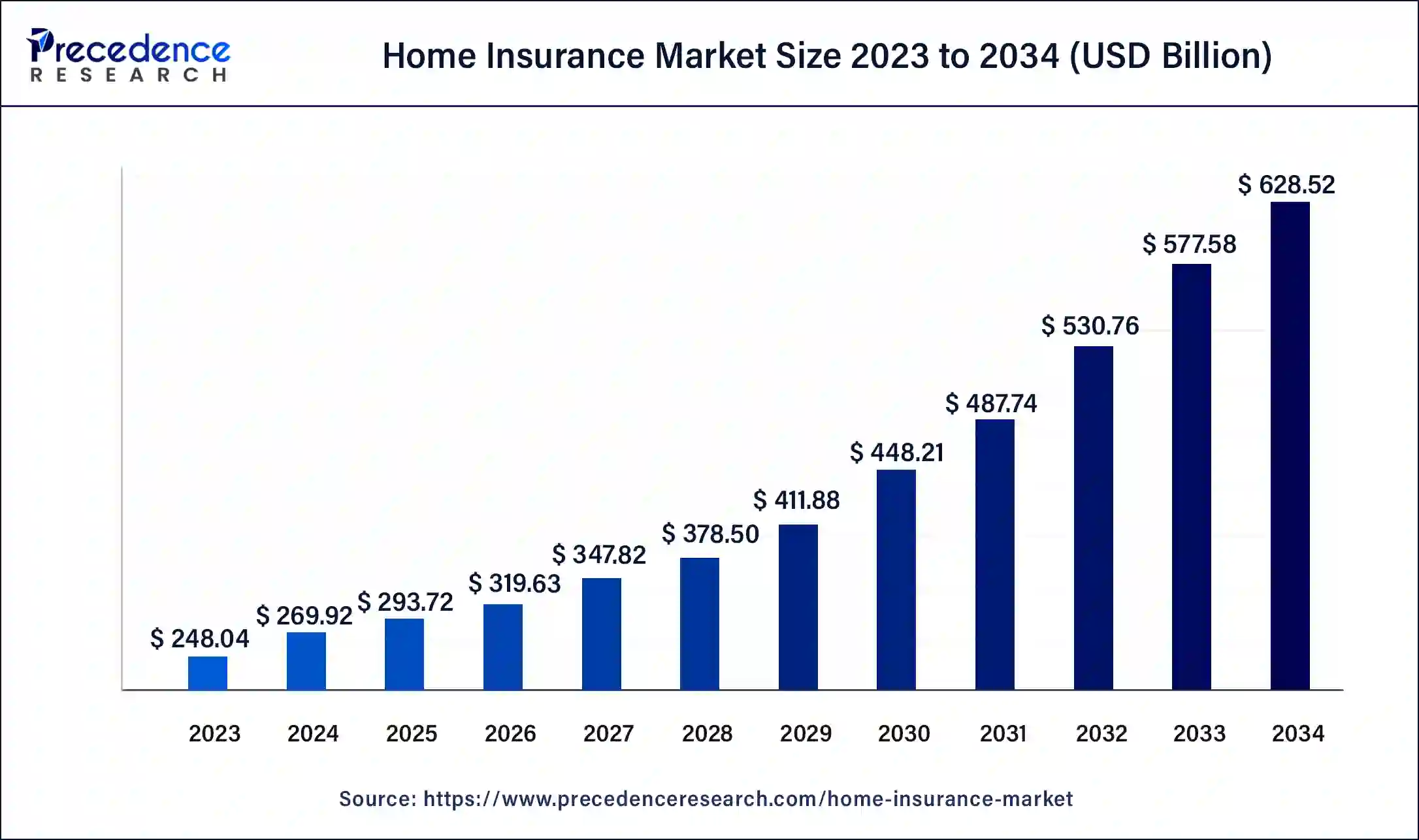

The global home insurance market size was estimated at USD 269.92 billion in 2025 and is predicted to increase from USD 293.72 billion in 2026 to approximately USD 621.87 billion by 2035, expanding at a CAGR of 8.70% from 2026 to 2035. Increasing global population and rapid urbanization are leading to more home ownership. Globally, governments are also working to promote insurance knowledge, driving growth in the home insurance market.

Home Insurance Market Key Takeaways

- The global home insurance market was valued at USD 269.92 billion in 2025.

- It is projected to reach USD 621.87 billion by 2035.

- The home insurance market is expected to grow at a CAGR of 8.70% from 2026 to 2035.

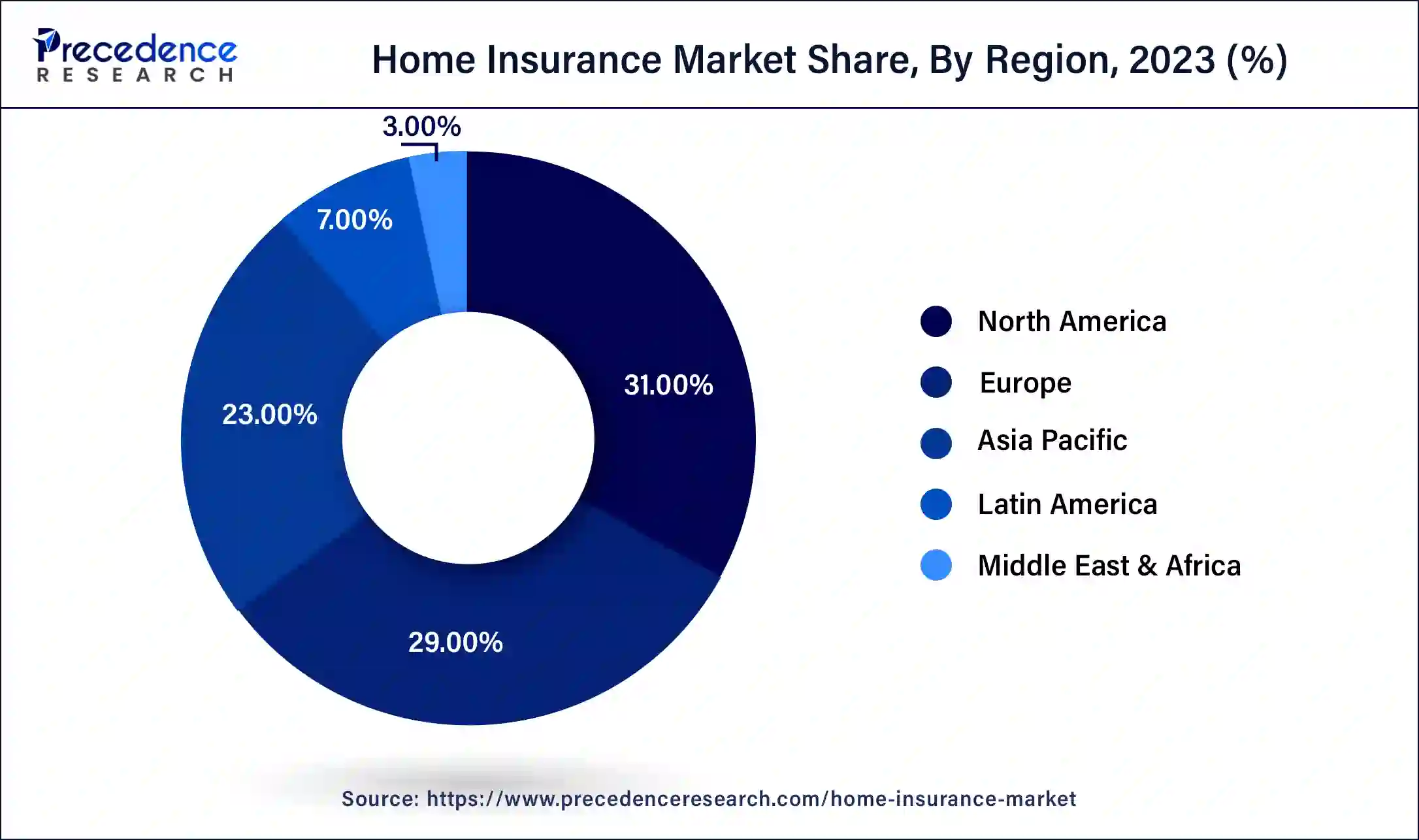

- North America dominated the home insurance market with the largest market share of 31% in 2025.

- Asia Pacific is anticipated to grow at a significant rate during the forecast period.

- By coverage, the comprehensive coverage segment dominated the home insurance market in 2025.

- By coverage, the dwelling coverage segment is expected to be the fastest-growing segment in the market.

- By distribution channel, the brokers segment held the largest share of the market in 2025.

- By distribution channels, the tied agents & branches segment is expected to be the fastest growing in the forecast period between 2024 and 2033.

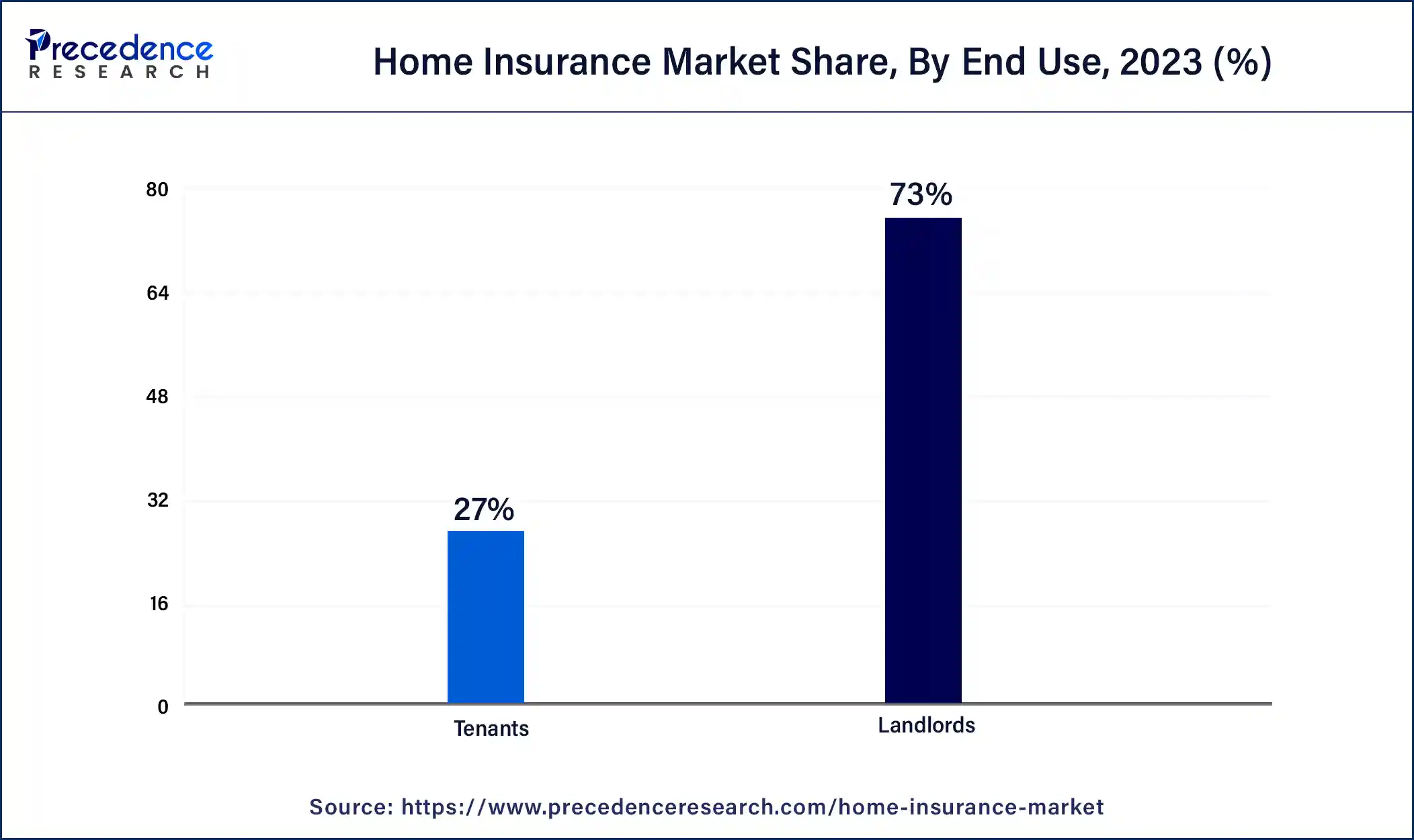

- By end use, the landlords segment has contributed the largest market share of 73% in 2025.

- By end use, the tenants segment is set to show significant growth between 2026 to 2035.

What is Home Insurance?

Homeowners insurance is a type of property insurance that covers damages and losses to your home. It covers damage to any furnishings, fittings, and other assets in the home. Home insurance also covers liability against accidents or injuries that take place on the property but does come with a liability limit. Phenomena such as earthquakes and floods are typically not covered by home insurance policies since they are classified as ‘Acts of God.' If the property is in an area prone to natural disasters, homeowners need special coverage. Home insurance is not the same as warranty or mortgage insurance.

The home insurance market is growing due to a rise in per capita disposable income worldwide and growing urbanization. Homeownership rates have gone up significantly. As a result, driving the demand for homeowners' insurance. Economic downturns are one of the major restrictions on the market. Financial instability causes homeowners to cut down on discretionary spending and prioritize other expenses over insurance coverage. The integration of new technologies like AI, big data, blockchain, data analytics, and geolocation are innovative opportunities for future growth in the home insurance market.

How is AI contributing to the Home Insurance Industry/Process?

The field of home insurance is being redefined by AI with a combination of automation and in-depth data intelligence in underwriting, pricing, claims, and customer service. It allows more precise property risk assessment, quicker quotes, easier claims payments, enhanced fraud detection, proactive loss mitigation via linked equipment, and more intimate and personalized and always-connected homeowner experiences that are timely and relevant.

Home Insurance Market Growth Factors

- Rising homeownership due to urbanization and the rise of disposable income is driving growth in the home insurance market.

- Growing awareness around insurance policies and the need for comprehensive coverage is also a major factor for growth in the market.

- Climate change and the increasing frequency of natural disasters are leading homeowners to opt for home insurance policies.

- Governments are changing rules and regulations around property ownership, at times mandating home insurance policies.

Market Outlook

- Industry Growth Potentials: The conducive environment of awareness and climate volatility increases the need to protect, and the trend is directed towards adaptive and customer-focused solutions by insurers.

- Sustainability Trends: Green homes become the focus of attention because insurers manage to align their incentives for coverage with resilience and environmental responsibility.

- Global Expansion: Asia-Pacific is faster in adoption, and the established regions enhance products with innovation and risk sophistication.

- Major investors: Allianz, Berkshire Hathaway, AXA, MetLife, and Ping An Insurance are the foundations of capital strength.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 621.87 Billion |

| Market Size in 2026 | USD 293.72 Billion |

| Market Size in 2025 | USD 269.92 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.70% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Coverage, Distribution Channel, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Climate change and the need for mandatory home insurance

Climate change and the rise of global natural disasters have prompted many homeowners to increasingly opt for home insurance. The increasing incidences of floods, earthquakes, landslides, and other natural disasters are driving homeowners to take up insurance policies to protect against such losses. Rapid urbanization and industrialization have substantially driven up demand for home ownership, especially in Asia Pacific. As home ownership grows, so does the need for insurance protection. In many developed countries, banks require compulsory residential insurance as part of their mortgage lending contracts. This boosts the demand for residential insurance.

- Home ownership made up approximately 70% of the increase in the average value of urban household assets in China in 2019, according to a recent consumer survey by the central bank.

Restraint

Lack of consumer awareness around home insurance policies

One of the major restraints to the home insurance market is the lack of awareness and understanding of home insurance coverage. Many consumers are unaware of the ambit of home insurance and misunderstand premium rate calculations. There are also rising incidences of fraudulent claims. This increases overall costs for insurance companies and leads to higher premiums for policyholders. This has led to companies adding stricter underwriting and verification processes, which makes it difficult for potential policyholders to purchase homeowners' insurance. These factors are limiting growth in the home insurance market.

Opportunity

The advent of AI and geolocation

There are several opportunities for growth in the home insurance market due to the advent of artificial intelligence and related technologies. High smartphone penetration and the rising use of application program interfaces have made property insurance more accessible to underinsured populations. Big data analytics and geolocation programs make the calculation of premiums easier than before. The digital transformation of the home insurance industry also helps businesses cater to individual customer needs.

An essential task for insurance businesses is risk assessment. Big data enables businesses to examine vast amounts of historical and current data to get meaningful insights into risk factors from socioeconomic indicators, demographic data, geographic data, and data from the Internet of Things devices. Insurance companies can create precise prediction models with the help of these insights. Using the collected data, machine learning algorithms can also be used to develop more precise predictive models for fraud detection, identity theft, and claim probability. In the end, these more sophisticated tools for risk assessment will help both the insured and the insurer by reducing losses.

Segment Insights

Coverage Insights

Based on coverage, the comprehensive coverage segment dominated the home insurance market in 2024. Comprehensive coverage policies insure against a broad spectrum of potential losses, including belongings in the home that may be damaged or stolen. Protection is also extended to natural disasters, fire, vandalism, and more. Comprehensive policies cover everything by default, with the exception of those few that are specifically excluded. This broad coverage makes it a popular option for policyholders.

The dwelling coverage segment is expected to grow the fastest between the forecast period of 2024 and 2033. Rising disposable income has not only led to higher ownership rates for residents but has also led consumers to look at home ownership as an investment. Dwelling coverage usually includes the home's walls, roof, floors, built-in appliances, furnishings, and permanent fixtures attached to the home. However, there are some exceptions, as this type of insurance does not cover personal possessions, pets, or anything not attached to the home, such as a shed or pool. Property valuations, construction and replacement costs, and location-associated risks have driven growth in the dwelling coverage segment.

Content coverage is also a growing segment in the home insurance market. This type of insurance offers financial compensation for damage to stand-alone goods and is suitable for tenants who move in furnishings and other appliances. Content insurance offers compensation for damage or theft of personal property.

Distribution Channel Insights

The brokers segment held the largest share of the home insurance market in 2024. Brokers provide tailored advice and customized insurance policy solutions. They are able to educate the masses about insurance coverage and help them navigate the complex landscape of insurance policies. As a result, broker-mediated insurance services have seen substantial demand in the past decade.

The tied agents and branches segment is set to see the fastest growth between 2025 and 2034. Tied agents tend to have established connections in local communities and are seen as trusted sources of information regarding the insurance market. This puts them in a unique position to advise homeowners regarding which policy they should opt for and why. Tied agents and branches are backed by big players in the insurance market, providing them with adequate resources to educate consumers and support the sale of home insurance policies.

End Use Insights

The landlords segment held the largest share of the home insurance market in 2024. Rapid urbanization and the development of new residential properties have led to a rise in consumers buying and renting houses globally. A rise in property leasing has led many landlords to opt for comprehensive home insurance policies to protect against damages, fire, and theft facing tenants in their properties. Landlord insurance generally covers the physical structure of the property and provides liability protection for landlords in cases of injury to tenants and property damage.

The tenants segment is expected to be the fastest growing in the period between 2025 and 2034. Consumers are increasingly opting for rental arrangements in cities where high costs of living delay home ownership. The rising cost of living is also making the cost of home ownership prohibitively high. In these cases, several city dwellers are turning to renting instead of buying property. There is an increasing awareness of insurance policies and the need for liability coverage, leading to rising demand in this segment.

Regional Insights

What is the U.S. Home Insurance Market Size?

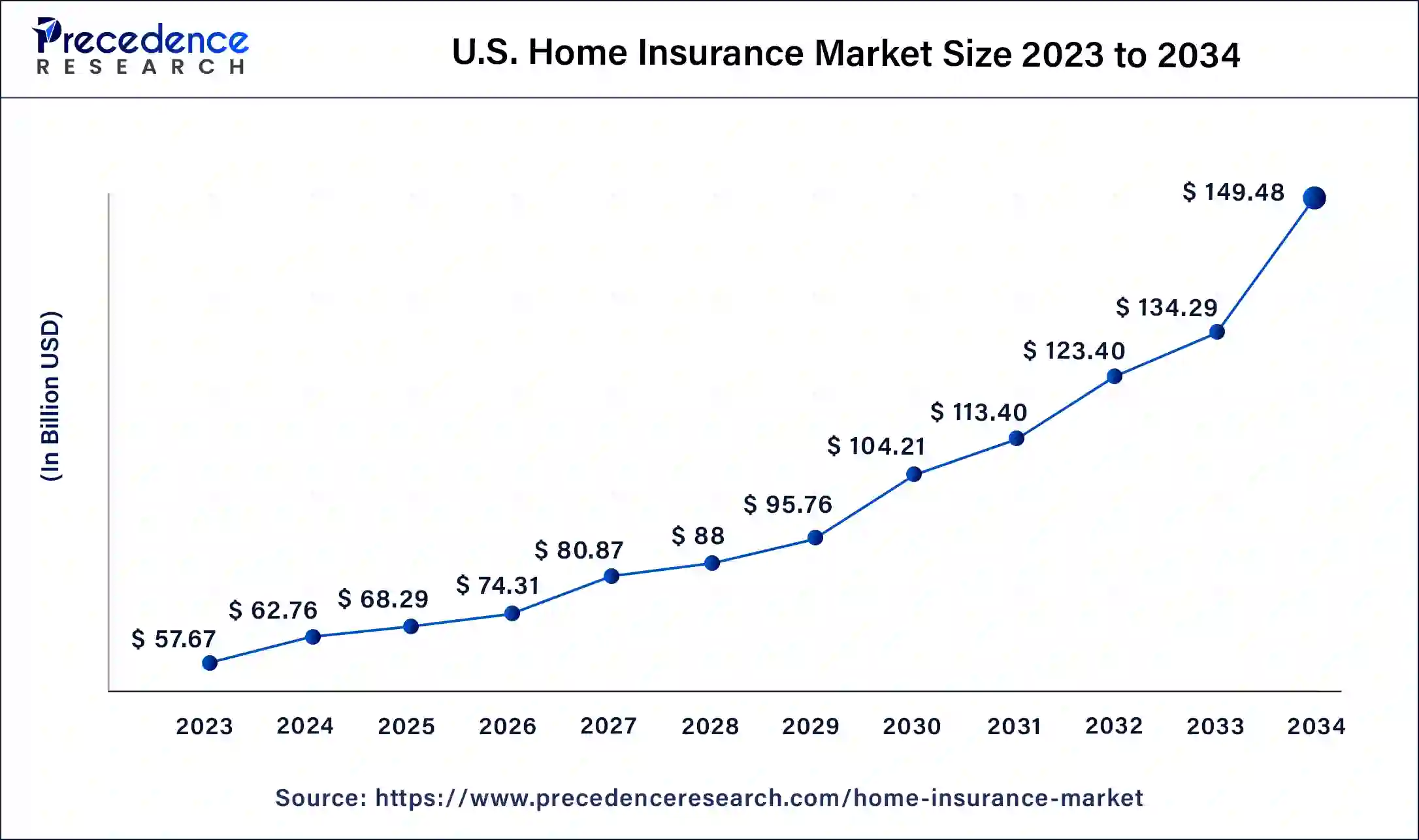

The U.S. home insurance market size was valued at USD 62.76 billion in 2025 and is projected to be worth around USD 144.59 billion by 2035, poised to grow at a CAGR of 8.70% from 2026 to 2035.

North America dominated the home insurance market in 2024. The market in the region has seen steady growth due to rising home ownership and the frequent occurrence of natural disasters. The insurance industry is highly established in the region, spilling over into the home insurance sector. Government regulation and mandatory insurance policy requirements in certain states in the United States have been a major contributor to growth. Technological advancements and increasing awareness around insurance products, along with robust distribution channels, are driving growth in the North American home insurance market. The U.S. market is also expected to grow significantly in the forecast period.

- The U.S. is expected to witness an increase in home insurance prices of 11% by the end of 2025, due to President Donald Trump's tariffs on materials used to build homes will push home repair costs even higher in the country

Asia Pacific is expected to grow significantly between 2025 and 2034. Rising disposable income and increasing awareness about insurance benefits are leading to more homeowners opting for home insurance policies. The integration of smart technologies and the rise of digital insurance platforms are making obtaining insurance easier than before. Economic prosperity in the region has led to an environment where individuals feel confident in making long-term financial commitments that come with owning property.

Japan Home Insurance Market & Trends

Japan is leading the regional market due to the country's property and casualty insurance industry. Japan is a leader in property insurance. Clean energy, climate change, and environmental, social, and governance (ESG) considerations are the key factors contributing to Japan's home insurance. Natural disasters, an aging population, and regulatory governments further contribute to the market expansion. Companies are investing in digitalization to facilitate digital platforms to enhance transparency and customer experiences.

- In March 2025, Aon plc, a leading global professional services firm, completed its transaction to acquire the in-house insurance agency business of Mitsubishi Chemical Group (MCG) on March 1, enhancing Aon's Risk Capital and Human Capital capabilities in Japan.

- According to the People's Bank of China, the average wealth of urban households stood at CNY3.18 million (USD449,200), with a median value of CNY1.63 million in 2020. This has led China to reach a 96 percent urban homeownership rate, according to the central bank.

The European home insurance market is also set to see substantial growth in the forecast period. Many governments in the region are mandating insurance policies for homeowners. The robust regulatory frameworks and increasing adoption of smart home technologies, especially focused on sustainability, are driving growth in the region.

UK Home Insurance Trends

The UK is a major leader of the European home insurance market, growth driven by changing consumer preferences and digital transformation. The UK government provides a digital platform to improve customer experiences and streamline operations. The UK provides personalized coverage options to meet customers' needs for high-value item coverage. The rapid trend of smart home integrations has become a key trend in the UK's home insurance policies. The UK's home insurance for smart home integration provides coverage for cyber risks, protecting against data breaches, hacking, and even theft of personal information.

- The Sky Protect Smart Home Insurance is the most popular company for smart home insurance in the UK.

- According to the Allianz Global Insurance Report 2024, there was strong growth in the Property and Casualty segment (+7.0%) in 2023, driven by all regions around the globe.

Home Insurance Market Companies

- Chubb: The premium provided by Chubb has all-risk coverage, extended replacement, cash settlements, detailed appraisals, and high-value home protection.

- PICC RE: PICC Re assists insurers by providing expertise in reinsurance, the diversification of portfolio risks, capital efficiency, and state-of-the-art catastrophe risk management skills in numerous locations around the globe.

- Zurich: Zurich provides various home protection options such as contents coverage, accidental damage, emergency policy, and customization of the policy to suit customers.

Other Major Key Players

- Allianz

- Admiral

- Allstate Insurance Company

- Liberty Mutual Insurance

- AXA

- MetLife Services and Solutions

- American International Group, Inc.

- State Farm Mutual Automobile Insurance

Recent Developments

- On April 8, 2025, Orion180, a leading provider of flexible, customer-centric homeowners and flood insurance solutions, launched its FLEX Home Insurance product in 14 coastal counties of Florida.

- In February 2025, Porch Group, Inc., a homeowner's insurance and vertical software platform, announced its financial results for the fourth quarter ended December 31, 2024.

- In April 2024, Arch Insurance North America (Arch Insurance), part of Arch Capital Group Ltd., announced entering into an agreement to acquire the U.S. MidCorp and Entertainment insurance businesses for US$450 million.

- In May 2024, AXA Hong Kong and Macau (AXA) partnered with Hong Kong Broadband Network (HKBN) to provide the latter's users with comprehensive home insurance protection. AXA intends to offer an all-in-one solution that includes a dual guarantee for home broadband, network security, and asset protection.

- In January 2024, Allianz Direct, the European branch of Allianz, announced the acquisition of Luko, a French online insurer. The deal was valued at approximately €5m ($5.42m). The acquisition is a strategic move by Allianz Direct to extend its services in the region and maintain the Luko brand with its existing customer base.

Segments Covered in the Report

By Coverage

- Comprehensive Coverage

- Dwelling Coverage

- Content Coverage

- Other Optional Coverage

By Distribution Channel

- Tied Agents & Branches

- Brokers

- Others

By End Use

- Landlords

- Tenants

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting