What is Household Robots Market Size?

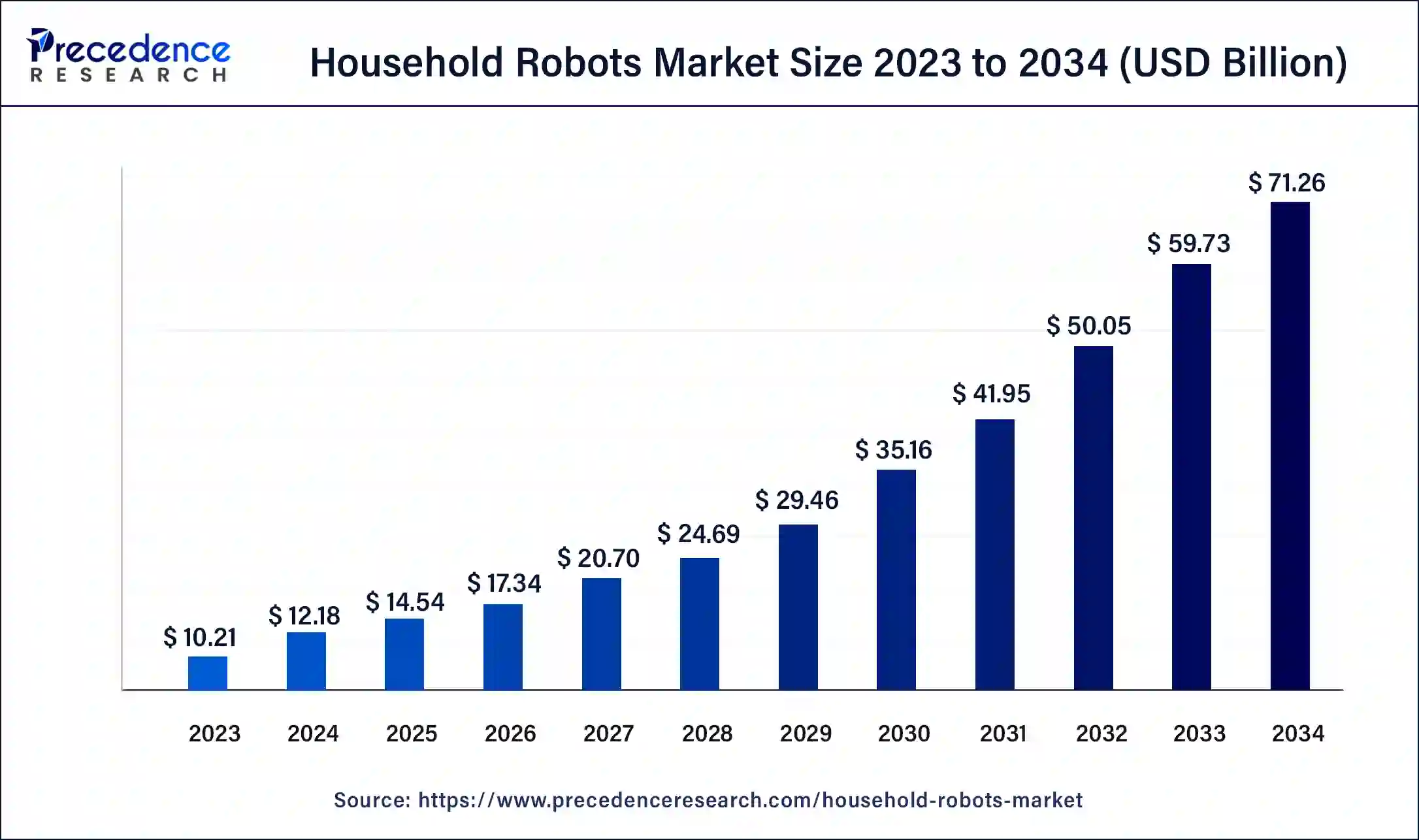

The global household robots market size was estimated at USD 14.54 billion in 2025 and is predicted to increase from USD17.34 billion in 2026 to approximately USD 71.26 billion by 2034, expanding at a CAGR of 19.32% from 2025 to 2034. The household robots market growth is due to the increasing elderly population, integration of smart home technology and innovations that improves the consumers' interest

Market Highlights

- Asia Pacific held the largest share of the household robots market in 2024.

- North America is expected to showcase notable growth in the market in the upcoming period.

- By component, the hardware segment accounted for the largest share of the global market in 2024.

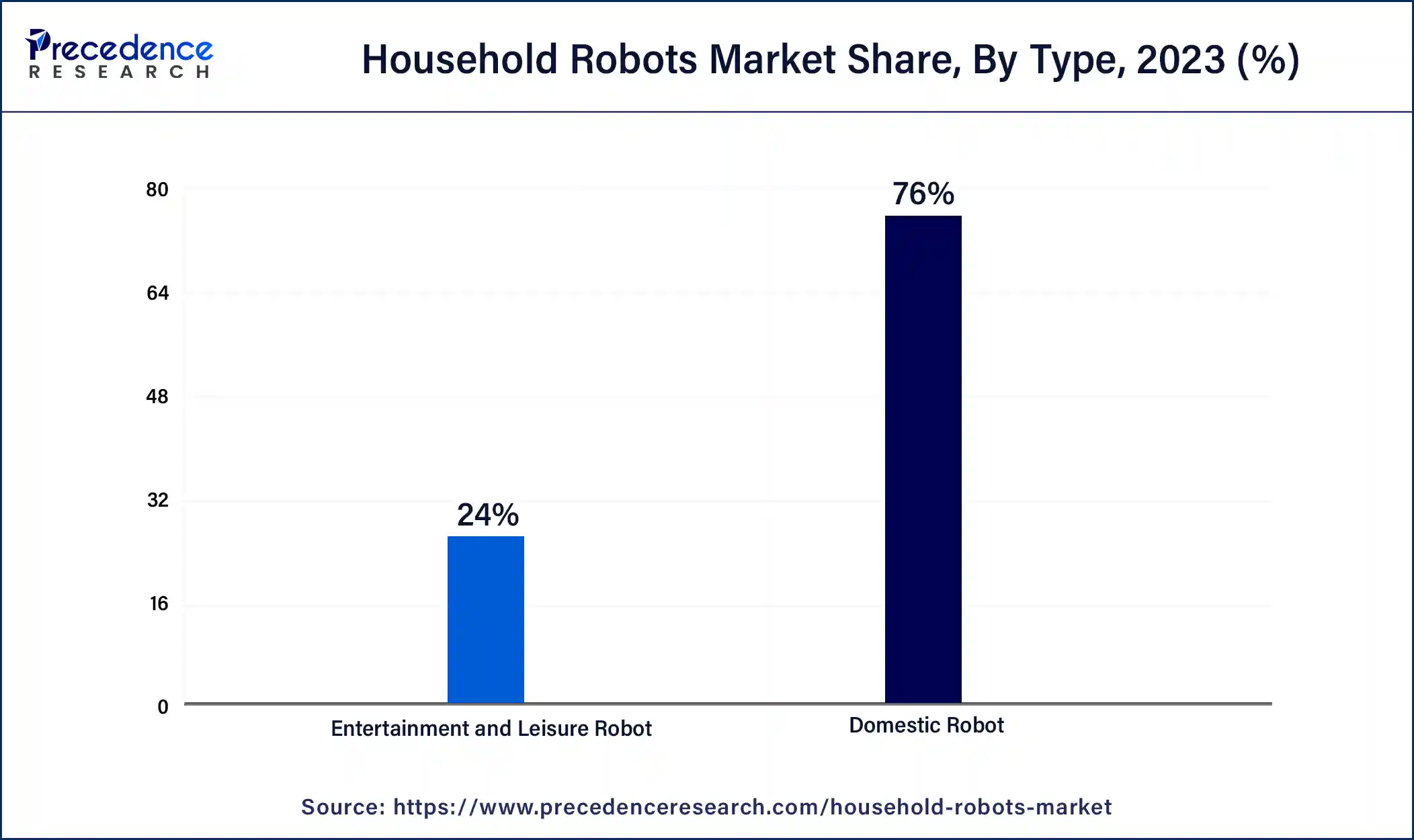

- By type, the domestic robots segment accounted for the largest market share of 76% in 2024.

- By type, the entertainment & leisure robots segment will register the fastest growth in the market during the foreseeable period.

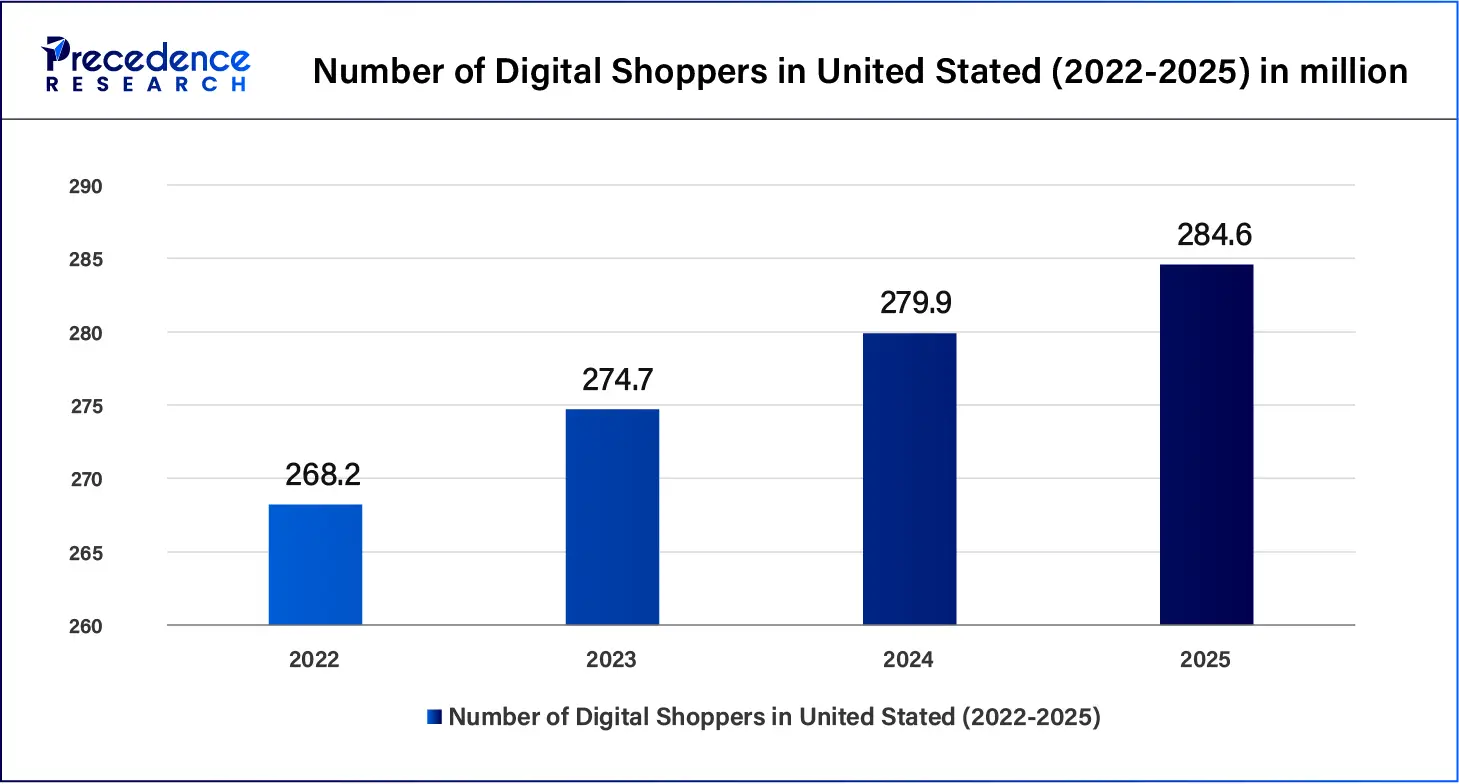

- By distribution channel, the online channel segment dominated the global market in 2024.

- By distribution channel, the retail stores segment is expected to grow significantly in the market during the forecast period.

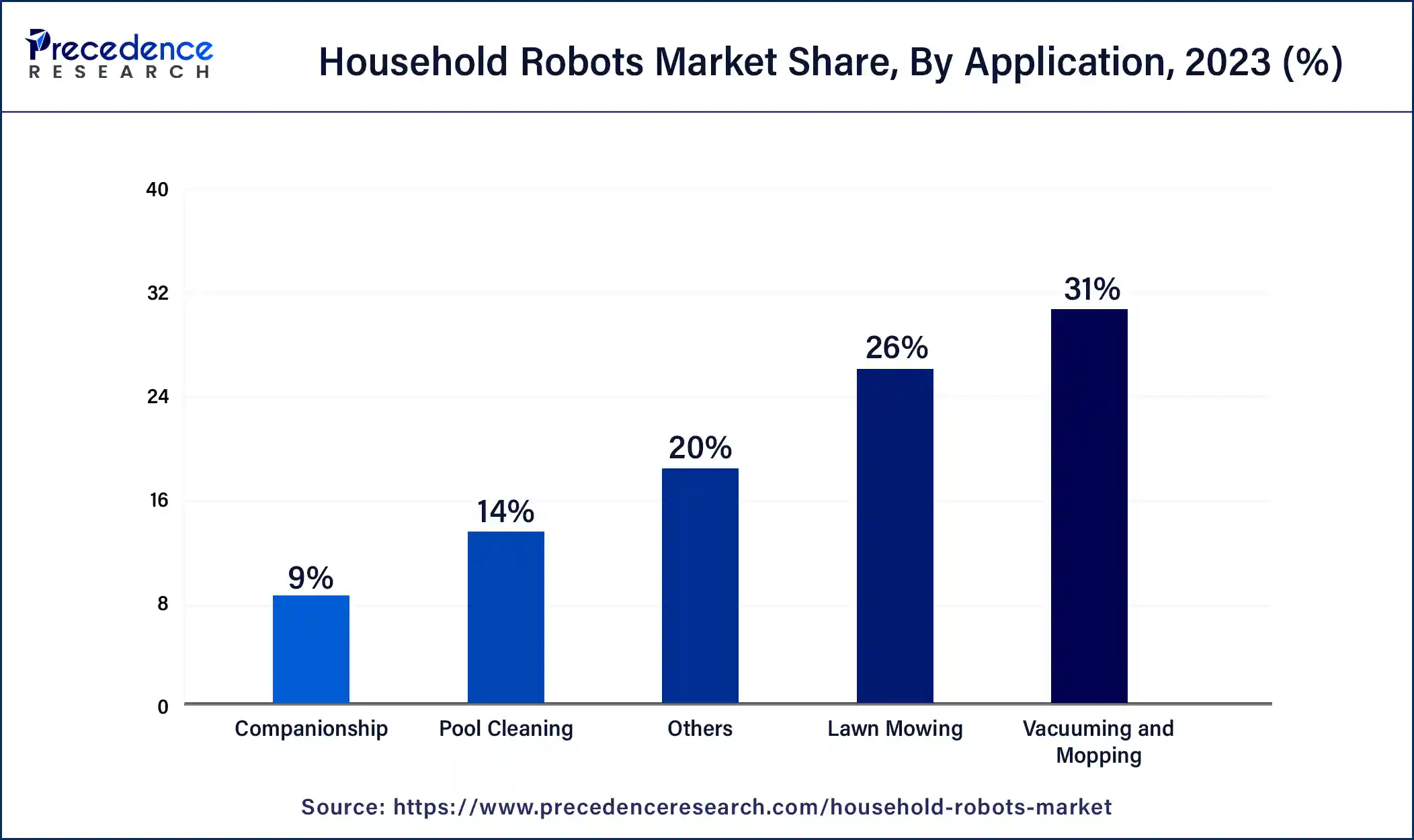

- By application type, the vacuuming and mopping segment held the biggest market share of 31% in 2024.

- By application type, the pool cleaning segment is expected to grow significantly in the market during the forecast period.

Home Robots: Enhancing Comfort and Quality of Life

Robots such as vacuum cleaners, lawnmowers, and window cleaners automate tasks. This automation leads to reduced working time for individuals and families to engage in more enjoyable or productive activities, enhancing the quality of life. The most common kind of home robot is the cleaning robot. These devices autonomously navigate through the home to provide cleaning services for floors without any obstruction.

The diverse roles that robots can play in different areas of the house

| Robot vacuums and mops | Robotic vacuum cleaners were first introduced in this category, followed by other cleaning robot such as window, grill and pool robot cleaners. |

| Security and surveillance | The high-tech cameras and sensors of security and surveillance robots monitor activities inside and around the house, offering the homeowners with peace of mind. |

| Entertainment and companionship | Social and companion robots revolutionize the way consumers interact and entertain. With innovative AI technology, these robots are able to engage in conversations, play games, tell jokes, and also assist with daily tasks. |

| Healthcare and personal well-being | From reminding users to take medication and monitoring vital signs to providing exercise guidance, they are a convenient and smart way to keep track of well-being in general. |

| Grill and gardening robot | For outdoor tasks, grill and garden robots can help keep up with maintenance. Gardening robots can automate tasks such as weeding gardens, mowing lawns, and cleaning patios. On the other hand, after the barbecue party, grill robot cleaners can clean, scrub, and scrap the grill grate, saving time and energy. |

| Pool cleaner robot | Pool cleaning can be labor-intensive and time-consuming. Therefore, many people have turned to pool cleaner robots. |

| Education robot | Unlike traditional teaching methods, they can tailor the content based on the child's capability, and offer a range of activities, games and challenges that captivate young minds. |

How is AI enhancing advancements in the Household Robots Market?

Artificial intelligence (AI) integration with the household robot enhances the working efficiency, accuracy, and quality of the product. Most home AI-enabled robots interact with smart home systems via wireless networks such as Wi-Fi and Bluetooth. They are portable and can be operated through applications or voice and control other smart-based devices, including lights, thermostats, and security cameras, among others. Some examples of household robots are iRobot Roomba, which helps with cleaning; Amazon Alexa, which is a voice-activated personal assistant; and Ring's Always Home Cam, which is used for security.

- In May 2023, A Japanese A) startup firm launched a robot for residential applications. The newly launched robot delivers items when instructed verbally, for instance, where he can bring condiments as well as dishes to the dining room table or drinks or books to the sofa. Manufactured by Tokyo-based Preferred Robotics, Kachaka is a wheeled robot that mounts underneath of table with castor wheels.

- In August 2024, 1X, a pioneer in humanoid robotics, unveiled NEO Beta, a prototype of its bipedal humanoid designed for home use.

Household Robots Market Growth Factors

- The integration of artificial intelligence, machine learning, and sensors increases the effectiveness of the performance of the household robot.

- Increasing consumer demand for convenience.

- The increasing market for smart home systems forces people to integrate robots into the system, enhancing overall home automation.

Market Outlook

- Industry Growth Offerings- The market is growing rapidly due to increasing demand for convenience, smart home integration, and time-saving solutions. Rising disposable incomes, busy lifestyles, and technological advancements in AI and robotics are driving adoption across global residential markets.

- Major Investors- Major investors in the household robots market include venture capital firms and corporate investors such as SoftBank Vision Fund, Sequoia Capital, Intel Capital, Samsung Ventures, and GV (Google Ventures), funding companies that develop smart home, cleaning, and companion robots.

- Startup Ecosystem-The startup ecosystem is thriving, with agile companies developing AI-powered cleaning, companion, and smart-home robots. Key hubs include the U.S., Europe, and Asia, focusing on innovation, affordability, and integration with IoT and smart-home platforms.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 14.54 Billion |

| Market Size in 2026 | USD 17.34 Billion |

| Market Size by 2025 | USD 71.26 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 19.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Type, Distribution Channel, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Incorporation of smart home systems

Smart robots are specifically designed and programmed to interact intelligently with their environment, including humans. They use advanced technologies such as artificial intelligence, machine learning, and natural language processing (NLP) to learn and adapt to new situations. Security systems with the use of automation and robotics, and smart home systems have been integrated into home security as well and operations have transformed home automation or domestic and housework assisting solutions.

A smart home setup to control home heating, ventilation, air conditioning, lighting systems, entertainment appliances, and pro lucrative security systems including alarms, locks, sensors, etc. Exploiting Wi-Fi technology, home automation creates a network of smart electronic products within a home environment powered by Artificial Intelligence.

- In January 2023, Roborock Technology released its S8 Series of flagship robot vacuum cleaners that include Roborock S8 Pro Ultra, Roborock S8+, and the Roborock S8. These robots feature the intelligence to navigate home autonomously, providing more hands-off deep cleaning.

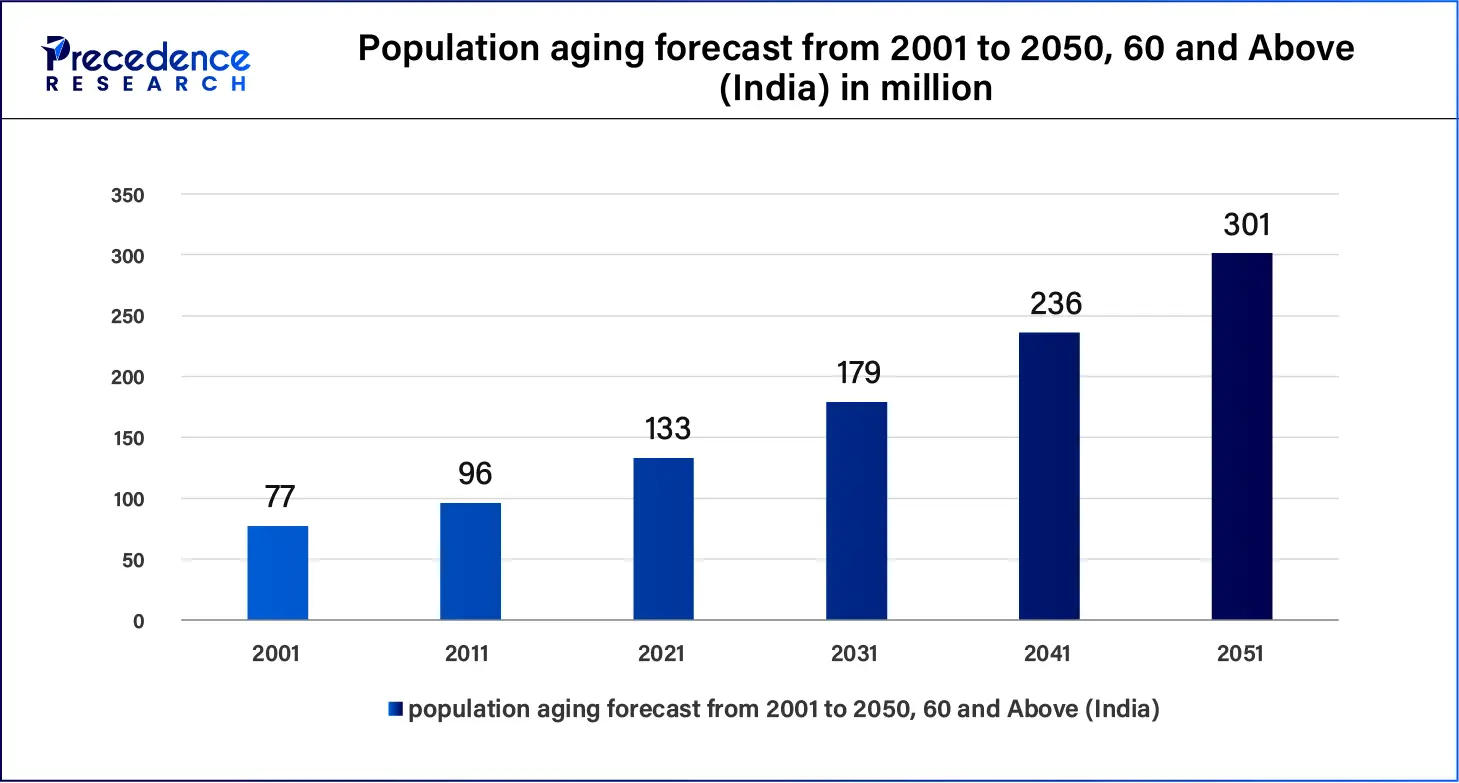

Rising aging population

It is projected that more than 12% of the United States population will be aged 65 years and above in the year 2030. Technologies like robots make it possible to get help for older people with the problems that accompany aging. Human-sized mobile manipulators, especially robots, can successfully exist in the home environment and help elderly people. The population of the elderly is projected to rise. The geriatric population can face challenges in doing their daily activities. Mobile manipulators help older adults in performing daily tasks that help them to live in their homes.

- The Olympic Area Agency on Aging (O3A) and Intuition Robotics revealed in March 2023 that ElliQ, an AI-based care companion robot, can be applied to older adults in Grays Harbor and Pacific Counties who require additional assistance.

- According to WHO, by 2050, the world's population of people aged 60 years and older will double (2.1 billion). The number of persons aged 80 years or older is projected to triple between 2020 and 2050 to reach 426 million.

Restraints

High maintenance cost

The expenses such as purchasing, installing, and configuring the robot are expensive, with additional costs for maintenance and repairs. That hinders the growth of the market. Also, rising research and development costs are associated with the household robots market. The increased capital spent on technology by different organizations witnessed growth in the use of artificial intelligence, machine learning, and robotics.

Opportunity

Increased research and development

With the increasing research and development expenditures, there is an opportunity for the household robots market. Rising innovation through research and development offers the market a great chance for development. Several potential advantages are associated with the utilization of specific features, such as energy efficiency or improved compatibility with smart home systems to increase usage. Moreover, growth in safety and reliability will also mitigate the concerns of the users about relying on such services provided by the robots.

Segment Insights

Component Insights

The hardware segment accounted for the largest share of the global household robots market in 2024. The growing trend has generated various product lines for household robots. Household robots include smart vacuums, social and companion robots,security robots, robot window cleaners, and educational robots. Increasing production of household robots that improve user experience and convenience by integrating smoothly with current smart home ecosystems. The acceptance of products such as robotic vacuums, as well as the increasing consumer awareness and adoption of indoor and outdoor smart home appliances.

Type Insights

The domestic robots segment accounted for the largest share of the household robots market in 2024. A domestic robot or Homebot is a category of a service robot that is generally employed to perform household tasks, though it can also have education, entertainment, or therapeutic purposes. The households' robots were involved in the cleaning of floors and pools, gardening, security and surveillance, companionship, health care, and education, among others. Domestic robots are designed to elevate the daily living experience. From automated lawnmowers and pool cleaners to advanced pet care devices and smart home gadgets.

The entertainment & leisure robots segment will register the fastest growth in the household robots market during the foreseeable period. An entertainment robot is designed for the sole subjective pleasure of humans rather than utilitarian use in production or domestic services. Robotic technologies co-exist in many segments of culture and entertainment. Leisure is going to receive a new boost from robots. With innovative AI technology, these robots can engage in conversations, play games, tell jokes, and also assist with daily tasks. Social and companion robots revolutionize the way they interact and entertain.

Distribution Channel Insights

The online channel segment dominated the global household robots market in 2024. Increase in the sales of household robots through the online platform because of the closure of retail shops and shopping marts during the pandemic. Online channels have relatively less overhead costs as compared to offline channels and are inexpensive to install and maintain. 24/7 access, customers can purchase from anywhere at their convenience.

The retail stores segment is expected to grow significantly in the household robots market during the forecast period. Offline communication can help build trust, rapport, and empathy with interlocutors as they see their expressions, gestures, and emotions. This instant satisfaction can be appealing, especially for urgent or last-minute needs. The physical stores allow the firms to provide customer services face-to-face.

Application Insights

The vacuuming & mopping segment held the biggest share of the household robots market in 2024. The growth in sales of vacuum robots is due to their self-operating and self-sufficient character due to the hectic demand, which boosted the market. A type of robotic vacuum cleaner for the home that is capable of vacuum floor cleaning along with sensors and robotic drives that are equipped with programmable controllers and cleaning cycles.

- In January 2024, ECOVACS unveiled the future of whole-home robotics, including revolutionary robots for floor, air, ceiling, window, and lawn care.

- In April 2024, iRobot Corp released the Roomba combo essential robot, the smart, affordable, and easy-to-use 2-in-1 robot vacuum and mop. At USD 275, the Roomba Combo Essential provides the cleaning essentials that customers were enjoying from the best-selling 1 Roomba 600 Series but with improved performance and a package of features that make it easier to clean as per the desire of the customers.

The pool cleaning segment is expected to grow significantly in the household robots market during the forecast period. Robotic pool cleaners are small, wheeled machines that crawl along the surface of the pool and automatically clean it. There is a range of pool cleaners on the market, but the best ones are robotic ones. It cleans the pool better and faster and they are easier to manage. In addition, they consume less power and chemicals, hence cutting production costs.

- In July 2023, Dreametech Technology, a fast-growing technology company and leading manufacturer of home cleaning appliances, declared the launch of their new product line, Robotic Pool Cleaner.

Regional Insights

Why Asia Pacific Booming Household Robots Market?

Asia Pacific held the largest share of the household robots market in 2024. The advancement of new technology, increase of disposable income, and the growing inclination of people towards innovation. A rising elderly population is a significant driver of the household robot' demand.

- According to the U.S. Census Bureau, by 2060, about 33.7% of Eastern Asia's population is projected to be 65 and older.

The increasing necessity of cleaning houses, security, or even monitoring them through home automation systems in China, Japan, India, and South Korea has further fuelled the demand of the market. The growth in urbanization is also expected to grow the market for cleaning robots for vacuuming and mopping.

- According to the Population Reference Bureau, China and India's urban populations are expected to grow by more than 340 million by 2030.

- According to the International Monetary Fund (IMF), in Asia, China is now the single biggest user of this robot, with an estimated 50% of the region's total industrial robot usage, followed by Korea and Japan.

Automation at Home: China's Booming Household Robots Market

The China market is growing rapidly due to rising disposable incomes, increasing urbanization, and growing consumer demand for convenient, time-saving solutions. Technological advancements in AI and robotics, coupled with smart home integration, drive adoption. Busy lifestyles, dual-income households, and rising awareness of hygiene and cleanliness further fuel the demand for cleaning robots, vacuum cleaners, and other automated home devices across Chinese urban households.

Rising Demand and Innovation Fuel Household Robotics in North America

North America is expected to showcase notable growth in the household robots market in the upcoming period. The growth is due to the increasing desire of people to be more convenient by the use of robots. Smart home automation is adopting robotic services to help ease standard chores, security, and elder care, among others. Additionally, an increasing knowledge of environmental issues is forcing manufacturers to create energy-saving goods.

The high technology literacy level and high disposable income in regions like the United States and Canada also support the implementation of robotic applications. Thus, the pressures for innovation are mounting as firms seek to shield themselves and move for a larger share of this growing global market.

- According to the World Health Organization, over 55% of the world's population lives in urban areas, a proportion that is expected to increase to 68% by 2050.

Can Robotics Redefine Convenience in European Homes?

The Europe household robots market is expanding due to growing adoption of smart home technologies and increasing consumer demand for convenience and time-saving solutions. Rising disposable incomes, busy lifestyles, and heightened awareness of hygiene and energy efficiency drive growth. Technological advancements in AI and robotics enable efficient cleaning, lawn care, and home maintenance, while supportive government initiatives and the presence of leading robotics companies further boost market adoption across the region.

Are UK Consumers Adopting Household Robots Rapidly?

The UK market is expanding due to increasing consumer demand for time-saving, convenient home solutions. Busy lifestyles, rising disposable incomes, and growing awareness of cleanliness and energy efficiency drive adoption. Technological advancements in AI, robotics, and smart home integration enhance the performance of cleaning robots, lawnmowers, and other automated devices. Additionally, supportive retail channels and innovation by local and international robotics companies further boost market growth in the UK.

Why U.S. Consumers are Adopting Household Robots

The U.S. household robots market is expanding due to increasing consumer preference for time-saving and convenient home solutions. Advancements in AI, robotics, and smart home integration enhance the efficiency of cleaning, lawn care, and other automated tasks. Busy lifestyles, rising disposable incomes, and growing awareness of hygiene and energy efficiency drive adoption, while tech-savvy consumers embrace connected devices, boosting demand for vacuum cleaners, lawnmowers, and window-cleaning robots.

Value Chain Analysis

Raw Material Procurement

- Companies need to source metals, plastics, sensors, and electronic components to manufacture household robots.

- Managing a reliable supplier network is crucial for maintaining quality and controlling costs.

- Sustainable and eco-friendly sourcing practices are increasingly important in the production process.

- Key players: iRobot, Robomow, Jibo, Blue Frog Robotics, and Dolphin Robotics.

Retail Distribution (Online/Offline)

- The pandemic led to retail store closures, driving higher household robot sales through online platforms.

- Online channels have lower overhead costs and are easier and cheaper to set up compared to physical stores.

- E-commerce adoption accelerated consumer access to smart home devices.

- Key players: Robomow, Jibo, Blue Frog Robotics, and Dolphin Robotics.

Marketing and Promotions

- Effective promotion focuses on visual storytelling to showcase convenience, innovation, and smart-home benefits.

- Social media, video campaigns, and influencer marketing are key channels to engage consumers.

- Demonstrations of product features and real-life applications help build trust and awareness.

- Key Players: Robomow, Jibo, Blue Frog Robotics, Dolphin Robotics.

Key Players in Household Robots Market and Their Offerings

- Jibo, Inc.: Offers a social home robot designed for companionship and smart-home interaction. Jibo features voice and face recognition, natural-language communication, photo/video capture, and integration with smart home devices, enhancing convenience and engagement in domestic environments.

- Honda Motor Co., Ltd.: Provides advanced robotics solutions, including the Honda Avatar Robot for remote-controlled tasks, mobility assistance robots, and industrial automation platforms. These robots support remote operations, hazardous environment tasks, and human-robot collaboration for industrial and research applications.

- Dolphin Robotics: Delivers industrial robotics and automation solutions, including robotic cells, material handling systems, CNC machine tending, palletizing, and vision-guided robot integration. The company offers design, programming, and consultancy services for custom automation in manufacturing and industrial operations.

- Blue Frog Robotics: Offers “Buddy,” a social and emotional companion robot for homes, education, elder care, and hospitality. Features include AI-based interaction, computer vision, gesture control, natural language processing, and an open developer platform for creating custom applications.

- Robomow (Friendly Robotics / MTD Products): Provides autonomous robotic lawn mowers for residential use. Key features include rechargeable operation, scheduled mowing, app-based control, quiet operation, and suitability for different lawn sizes, enabling automated and convenient garden maintenance.

Recent Developments

- In January 2024, Samsung revealed the Jet Bot Pet, a robot vacuum designed specifically for pet owners.

- In December 2023, Samsung Electronics unveiled a new vacuum cleaner lineup, Bespoke Jet Bot Combo, in 2024. The product is a vacuum & mop robot cleaner with boosted AI features and steam cleaning, offering an easier cleaning experience for users.

- In September 2023, iRobot Corp unveiled the flagship Roomba Combo j9+ robot vacuum & mop. The Roomba Combo j9+ features an innovative clean base auto-fill dock that automatically empties debris and refills the robot with liquid, elevating automation and cleaning performance to a new level.

- In August 2022, Amazon acquired iRobot Corporation to create innovative cleaning products to make customer lives easier.

Segments Covered in the Report

By Component

- Hardware

- Software

- Service

- Support & Maintenance

- Software Subscriptions

- Data analytics

By Type

- Domestic Robot

- Entertainment & Leisure Robot

By Distribution Channel

- Online Sales

- Retail Stores

- Home Improvement Stores

- Appliance Stores

By Application

- Vacuuming and Mopping

- Lawn Mowing

- Pool Cleaning

- Companionship

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting