What is the Hydro Generators Market Size?

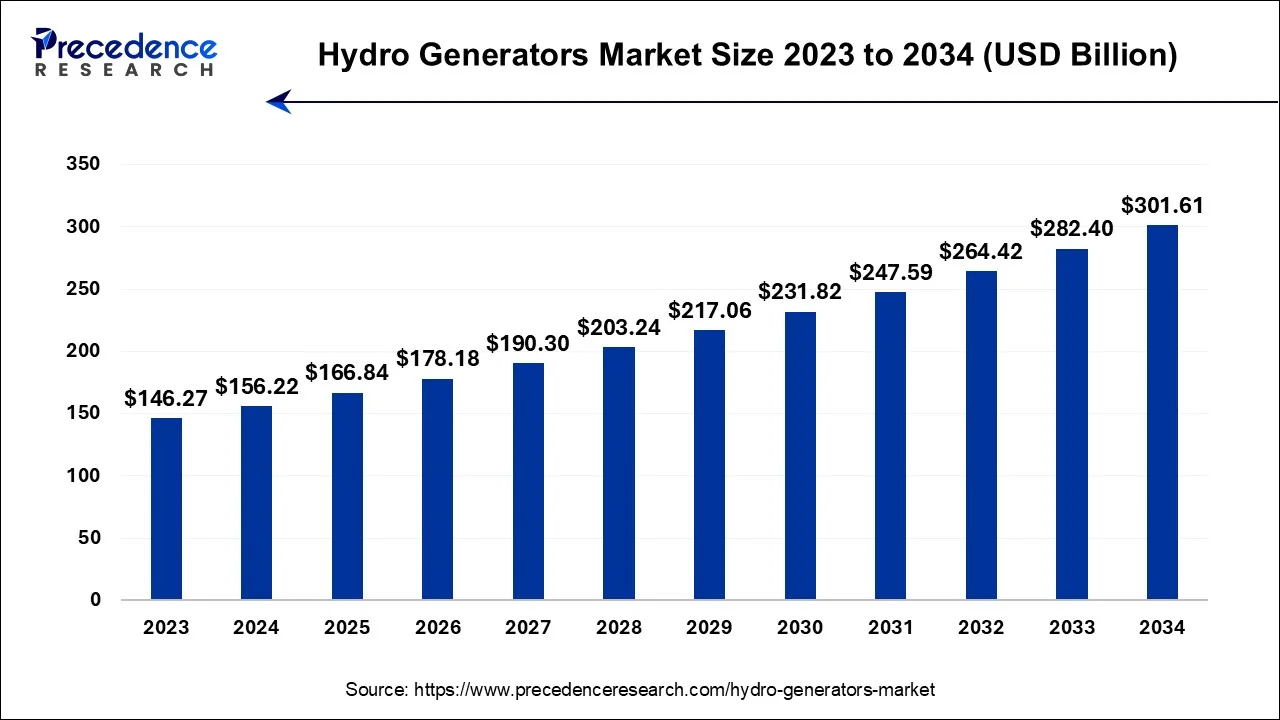

The global hydro generators market size accounted for USD 166.84 billion in 2025 and is predicted to increase from USD 178.18 billion in 2026 to approximately USD 320 billion by 2035, expanding at a CAGR of 6.73% from 2026 to 2035.

Market Highlights

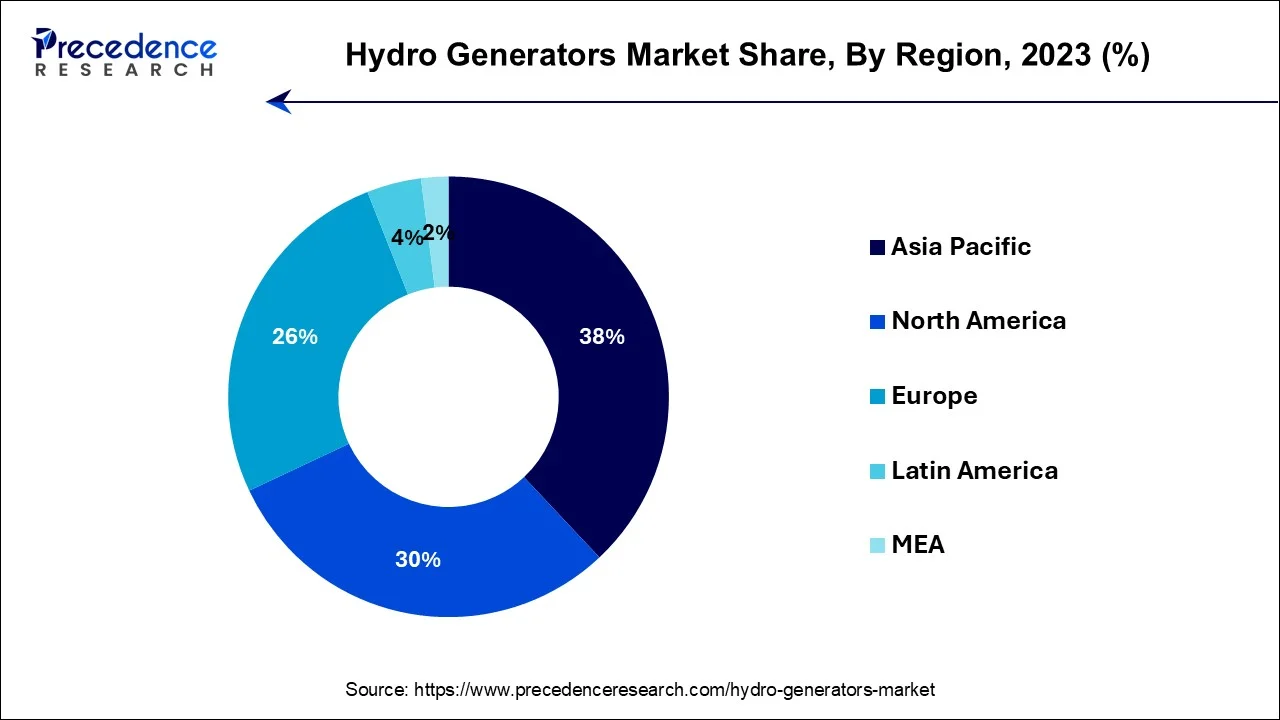

- Asia-Pacific has held a major revenue share of 38% in 2025.

- Europe is estimated to expand at the fastest CAGR during the forecast period.

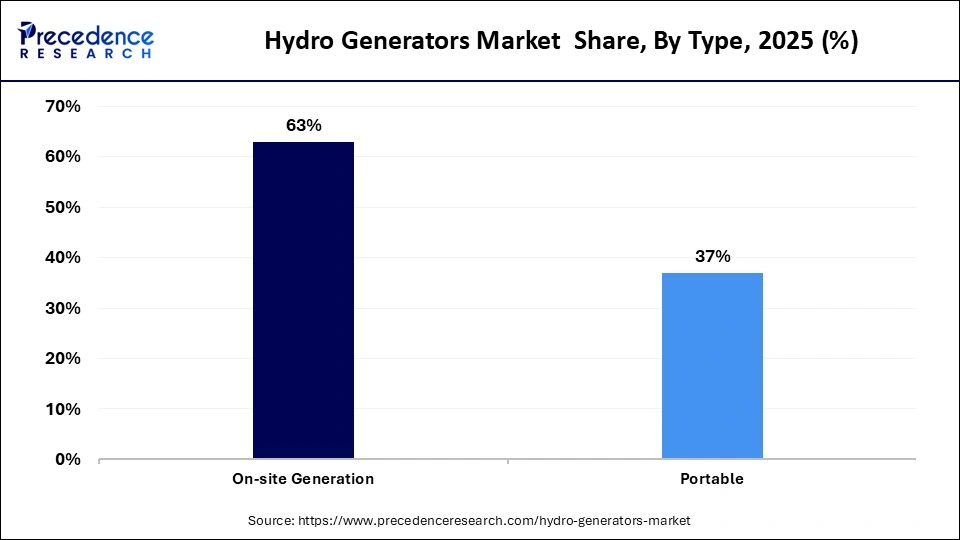

- By Type, the On-site generation segment has held the largest revenue share of 63% in 2025.

- By Type, the portable segment is expected to grow at a CAGR of 7.8% during the projected period.

- By Capacity, the 101 to 250W segment held the highest market share of 39% in 2025.

- By Capacity, the 501 to 750W segment is anticipated to expand at the fastest CAGR over the projected period.

Market Overview

Hydro generators are electromechanical devices used in hydropower plants to convert the kinetic energy of flowing water into electrical energy. They form a critical component of the hydroelectricpower generationprocess. As water flows through a dam or penstock, it strikes the blades of the hydro generator's turbine, causing it to spin. This rotational motion is then transformed into electricity through electromagnetic induction. Hydro generators are available in various types, including synchronous, asynchronous, direct drive, and permanent magnet generators, catering to a wide range ofhydropowerapplications, from large-scale hydroelectric plants to small, decentralized micro-hydropower systems, contributing to clean and sustainable energy production.

Hydro Generators Market Growth Factors

The hydro generators market is currently experiencing substantial growth driven by the global transition to renewable energy sources. Hydro generators, as integral components of hydropower plants, play a central role in this transition. Governments worldwide are increasingly advocating for cleaner and more sustainable energy solutions, with hydropower being a reliable and environmentally friendly option. Supportive policies and incentives further boost the market's expansion, encouraging the development of hydropower projects where hydro generators are pivotal. Key growth drivers for the hydro generators market include the global shift towards renewable energy, the need to expand hydropower capacity to meet escalating electricity demands, continuous technological advancements enhancing generator efficiency, and government initiatives such as financial incentives and regulations supporting hydropower projects.

In addition to these drivers, industry trends encompass the development of small and micro hydropower projects tailored to localized energy requirements and the integration of digital technologies for real-time monitoring and control, which enhances operational efficiency and reliability.

However, The hydro generator industry encounters significant challenges, primarily centered around mitigating the environmental impact of hydropower projects and navigating intricate and time-consuming regulatory approval processes. Environmental concerns, particularly related to aquatic ecosystems and local communities, necessitate rigorous planning and mitigation measures. Moreover, obtaining the necessary approvals can be a complex endeavor.

Despite these challenges, the industry presents substantial business opportunities. One notable opportunity lies in global expansion, particularly in emerging markets with untapped hydropower potential. Generator manufacturers have the chance to tap into these regions and contribute to their sustainable energy development. Additionally, there is a growing market for retrofitting existing hydropower facilities with modern generators and providing comprehensive maintenance services. Ensuring the efficient operation and longevity of these facilities aligns with the industry's commitment to sustainability and presents a lucrative avenue for growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 178.18 Billion |

| Market Size in 2025 | USD 166.84 Billion |

| Market Size by 2035 | USD 320 Billion |

| Market Growth Rate from 2026 and 2035 | CAGR of 6.73% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 and 2035 |

| Segments Covered | Type, Capacity, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Global transition to renewable energy and hydropower capacity expansion

The pressing need to expand hydropower capacity is another force propelling market demand. Among these sources, hydropower stands out as both reliable and sustainable. Hydro generators play a pivotal role in harnessing the kinetic energy of flowing water to generate clean and environmentally friendly electricity, cementing their crucial position within the renewable energy landscape. In this context, hydro generators emerge as indispensable components, ensuring the efficient conversion of water's kinetic energy into clean electrical power.

Moreover, the need to expand hydropower capacity is driving the market further. Growing electricity demands necessitate the development of new hydropower projects, both large and small. Governments and utilities are actively investing in these projects to secure a stable energy supply. Hydro generators are the heart of these installations, ensuring efficient energy conversion from water to electricity. In essence, the hydro generators market is thriving as it aligns with global environmental goals and addresses the pressing need for expanded hydropower capacity in the quest for a sustainable energy future.

Restraints

Environmental impact and regulatory approvals

The hydro generators market faces notable restraints in the form of environmental impact concerns and complex regulatory approval processes. which includes the environmental impact of hydropower projects presents a significant challenge. Hydropower, while a clean and renewable energy source, can have adverse effects on aquatic ecosystems, including alterations in water flow, temperature, and habitat disruption. These environmental concerns require meticulous planning and mitigation measures, which can increase project costs and timelines.

Furthermore, navigating the complex web of regulatory approvals is a formidable obstacle. Developing hydropower projects often involves lengthy and intricate permitting processes, varying from region to region. These hurdles can delay project commencement and increase overall investment risks. The need to satisfy environmental impact assessments, stakeholder consultations, and compliance with numerous regulations demand substantial resources and expertise. As a result, these restraints can hinder market growth by deterring potential investors and developers from engaging in hydropower projects, despite the industry's undeniable potential for clean and sustainable energy production.

Opportunities

Retrofitting existing facilities and comprehensive maintenance services

Retrofitting existing hydropower facilities and offering comprehensive maintenance services play a vital role in surging the market demand for the hydro generators market. As aging hydropower plants require upgrades to maintain efficiency and comply with modern environmental standards, the demand for retrofitting services has risen significantly. Upgrading these facilities with modern, efficient hydro generators improves overall power generation and extends the lifespan of the plant, ensuring its continued contribution to the energy grid.

Furthermore, the market for comprehensive maintenance services is expanding as the reliability and performance of hydropower facilities become paramount. Preventive maintenance and timely repairs ensure uninterrupted power generation and reduce downtime, saving costs and enhancing the long-term viability of these plants. As hydropower continues to be a key component of renewable energy strategies, retrofitting and maintenance services are pivotal in optimizing existing infrastructure and driving the Hydro Generators Market's growth, supporting a more sustainable and reliable energy future.

Segment Insights

Type Insights

The On-Site Generation has held 63% revenue share in 2023. On-site generation hydro generators are stationary installations integral to hydroelectric power plants. They directly convert the kinetic energy of flowing water into electricity. These generators are engineered for continuous, high-capacity power production, primarily utilized in large-scale hydropower facilities. In the hydro generators market, on-site generation hydro generators maintain their dominance, bolstered by the global proliferation of grid-connected hydropower projects.

The current trends focus on elevating their efficiency and longevity through technological advancements and innovative materials. Moreover, the industry places growing importance on environmental sustainability, prompting initiatives to mitigate the ecological impact of on-site generation projects. This includes the development of fish-friendly turbine designs and more effective water management practices, aligning with the industry's commitment to eco-conscious practices and minimizing environmental disruption.

The Portable segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. Portable hydro generators are compact, versatile units designed for mobility and ease of deployment. They can be transported to various locations to harness energy from natural water sources, making them suitable for off-grid or remote areas. The portable hydro generator segment is witnessing growth due to its suitability for decentralized energygeneration in remote regions. A notable trend is the development of more lightweight and efficient portable generators, making them easier to transport and install. These generators cater to the demand for small and micro hydropower projects and emergency power generation solutions in off-grid locations. Additionally, advancements in energy storage technologies are complementing portable hydro generators, ensuring a continuous power supply even when water flow is intermittent.

Capacity Insights

The 101 to 250W segment held the largest market share of 39% in 2023. Hydro generators with a capacity of 101 to 250 watts are considered small-scale units, typically employed in micro-hydropower projects or remote off-grid applications. These generators cater to localized energy needs, such as powering rural communities, small industries, or remote agricultural operations. In recent years, the trend for these generators involves increased efficiency and reliability, making them suitable for off-grid electrification initiatives in developing regions and eco-friendly energy solutions in environmentally sensitive areas.

On the other hand, the 501 to 750W segment is projected to grow at the fastest rate over the projected period. Hydro generators within the 501 to 750-watt capacity range are commonly utilized in small to medium-sized hydropower installations. These generators are versatile and adaptable, serving a variety of applications, including decentralized energy generation, rural electrification, and industrial operations. The trend in this capacity segment encompasses enhanced automation and digitalization, allowing for real-time monitoring and control. This trend not only improves operational efficiency but also aligns with the broader industry shift towards smart grid integration, optimizing the utilization of hydropower resources within a modern energy landscape.

Regional Insights

What is the U.S. Hydro Generators Market Size?

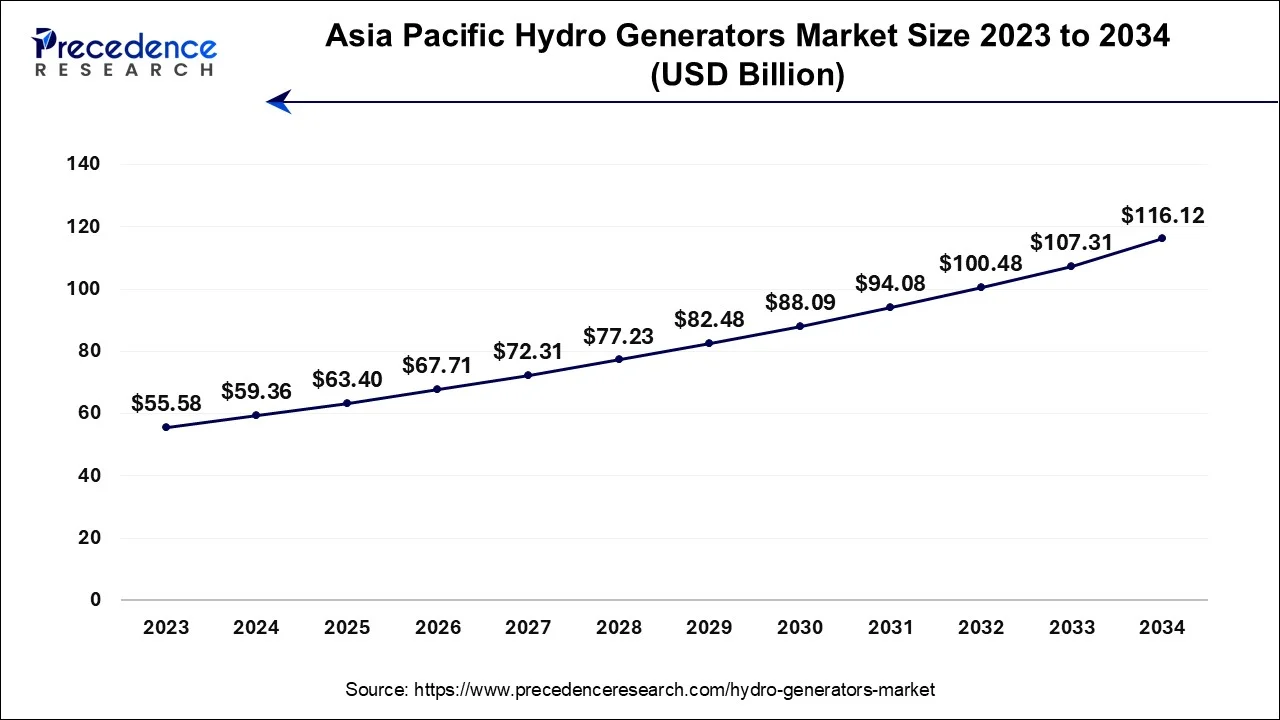

The Asia Pacific hydro generators market size reached USD 63.40 billion in 2025 and is expected to grow around USD 123.61 billion by 2035, growing at a CAGR of 6.90% between 2026 and 2035.

How is the Dominating Growth of the Asia Pacific in the Hydro Generators Market in 2025?

Asia-Pacific has held the largest revenue share 38% in 2023. In the Asia-Pacific region, the hydro generators market is witnessing robust growth. Countries like China, India, and Southeast Asian nations are investing heavily in hydropower projects to meet escalating energy demands sustainably. Small and micro hydropower installations are gaining popularity, catering to localized energy needs. Additionally, digitalization is on the rise, with the integration of real-time monitoring and control systems enhancing operational efficiency. The region's commitment to renewable energy and the potential of untapped hydropower resources continue to drive market trends.

India Hydro Generators Market Analysis

The market in India is growing due to government initiatives promoting renewable energy, financial support, and an increased focus on grid stability and storage. Hydropower development plans and financial incentives, such as budget allocations and schemes to develop several gigawatts of hydro capacity by 2030, also drive market growth.

- In September 2025, Adani Power and Druk Green Power planned to set up a 570MW hydro power project in Bhutan.

Why is Europe Considered the Fastest-Growing Region in the Market? erators Market?

Europe is estimated to observe the fastest expansion in Europe, the hydro generators market is experiencing a resurgence. This renewed focus has reignited interest in the sector, leading to a resurgence in investments and developments. Notably, offshore hydropower projects, especially in the North Sea region, are rapidly expanding. This expansion is driving an increased demand for specialized hydro generators, highlighting the region's dedication to harnessing the potential of clean and sustainable energy from hydropower sources. A shift towards high-efficiency generators and the incorporation of digital technologies for improved performance are prominent trends. Europe's emphasis on sustainability and grid integration remains a driving force, with countries actively modernizing and expanding their hydropower infrastructure to meet clean energy targets.

U.S. Hydro Generators Market Analysis

The market in the U.S. is growing due to its large hydropower capacity and ongoing investments in plant modernization. Initiatives like the $430 million DOE funding in 2024 to upgrade hydroelectric facilities support advanced turbine and generator technologies, while the increasing need for grid-stabilizing storage solutions further drives market growth. Additionally, favorable policies and a focus on renewable energy integration strengthen the U.S.'s leading role in the region.

How does North America stand out as an outstanding Region in the Hydro Generators Market?

The hydro generators market in North America is on an upward trajectory. The United States and Canada are actively investing in upgrading existing hydropower facilities and exploring new projects. A focus on advanced turbine technology and grid integration solutions is evident. This region's commitment to clean energy sources continues to drive market growth and innovation in the hydro-generator industry.

How is the Significant Growth of the Hydro Generators Market within South America?

South America is expected to experience significant growth during the forecast period due to the expansion of data centers, mining operations, and logistics hubs. The hydropower provides more than half of the total electricity supply in many countries in South America.

How is the Momentous Drive of the Middle East and Africa in the Hydro Generators Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by the increasing demand for electricity, energy storage solutions, and decarbonization. Africa has great opportunities to develop its economy using renewable and efficient energy.

Germany Hydro Generators Market Analysis

Germany is a major contributor to the European market due to its advanced engineering capabilities and strong focus on renewable energy. The country invests heavily in hydropower modernization and high-efficiency turbine technologies, supporting both domestic energy needs and exports to other European nations. Additionally, Germany's supportive policies for clean energy and its established industrial base make it a key player in hydro generator production.

How is the Opportunistic Growth of the Hydro Generators Market within Latin America?

The market in Latin America is expected to grow at a lucrative rate during the forecast period. This is mainly due to the region's abundant hydropower resources and ongoing investments in both large and small hydro projects, particularly in countries like Brazil and Colombia, which leverage extensive river systems and favorable geography to expand capacity. Governments are also focusing on modernizing aging hydropower infrastructure and integrating hydropower with broader renewable energy strategies to enhance energy security and grid reliability, creating demand for advanced hydro generator equipment.

What Drives the Market in the Middle East & Africa?

The market in the Middle East & Africa (MEA) is driven by the increasing demand for electricity, energy storage solutions, and decarbonization goals. The regional market is also driven by the need to diversify energy mixes and increase electricity access, especially in Africa, where abundant untapped hydropower resources are being developed to meet rising demand and support electrification in rural areas. Countries like Ethiopia and South Africa are investing in large and small hydro projects to improve energy security and reduce reliance on fossil fuels, while international funding and infrastructure modernization further encourage market growth.

Value Chain Analysis

- Raw Material Sourcing

This stage includes the sourcing of critical materials such as steel, copper, magnetic materials, and high-performance alloys required to manufacture hydro generators and turbines.

Key Players: GE Renewable Energy, Voith Hydro, Siemens Energy, Toshiba Energy Systems & Solutions, Harbin Electric & Dongfang Electric.

- Component Manufacturing

Components like turbine blades, rotors, stators, shafts, and bearings are fabricated in this stage.

Key Players: Andritz Hydro, Voith Hydro, GE Renewable Energy, Siemens Energy.

- End Users / Utilities

The final stage involves the generation and distribution of electricity to consumers via utility companies.

Key Players: State Grid Corporation of China, NTPC Limited, Électricité de France (EDF), Eskom.

Hydro Generators Market Companies

- General Electric Company

- Siemens AG

- Andritz AG

- Voith Group

- Toshiba Corporation

- Bharat Heavy Electricals Limited (BHEL)

- Mitsubishi Heavy Industries, Ltd.

- Harbin Electric Company Limited

- Alstom Hydro

- The Columbia Machine Works, Inc.

- Flovel Energy Private Limited

- Canyon Hydro

- CKD Blansko Engineering, a.s.

- Toshiba Hydro Power (Hangzhou) Co., Ltd.

- WWS Wasserkraft GmbH

Recent Developments

- In September 2025, ABB launched a hydroelectric generator refurbishment line at its Bilbao, Spain factory, leveraging the site's legacy in hydropower technology. This new setup offers customers closer European access for lifecycle upgrades, enhancing plant safety, performance, and efficiency.(Source:https://new.abb.com)

- In October 2025, Siemens AG invited calls for more investment in power grids, AI, and resilience of energy systems.

(Source: https://press.siemens.com/ ) - In October 2025, Toshiba Corporation announced a major investment to accelerate power transmission and distribution (T&D) equipment production.

(Source: https://www.global.toshiba/ ) - In 2022, GE Renewable Energy partnered with Avista Utilities, a U.S. energy company, to upgrade four generator units at the Long Lake hydropower facility. This renovation project aims to boost the plant's installed capacity to over 100 MW, equivalent to the energy needs of around 80,000 households.

- In 2022, a Japanese multinational imaging and electronics corporation introduced a pico-hydro generation system designed for use with irrigation canals and industrial drainage systems. Pico-hydro systems, characterized by capacities of less than 5 kW, offer versatile and sustainable energy solutions.

- In 2022,witnessed collaborative efforts between India and Nepal to construct a 695 MW hydropower facility, tapping into the Himalayan region's renewable energy potential to address electricity shortages. The project, named the Arun IV project, is a joint venture between India's Satluj Jal Vidyut Nigam (SJVN) Ltd. and the Nepal Electricity Authority (NEA).

- In 2021, a substantial 25 GW of hydropower capacity was added globally, elevating the total hydropower capacity to nearly 1360 GW. This capacity primarily derives from large hydro plants employing a series of large hydro generators and backup systems to ensure electricity supply during emergencies.

Segments Covered in the Report

By Type

- On-Site Generation

- Portable

By Capacity

- Up to 100 W

- 101 to 250 W

- 251 to 500 W

- 501 to 750 W

- 751 W and above

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting