Pumped Hydro Storage Market Size and Forecast 2025 to 2034

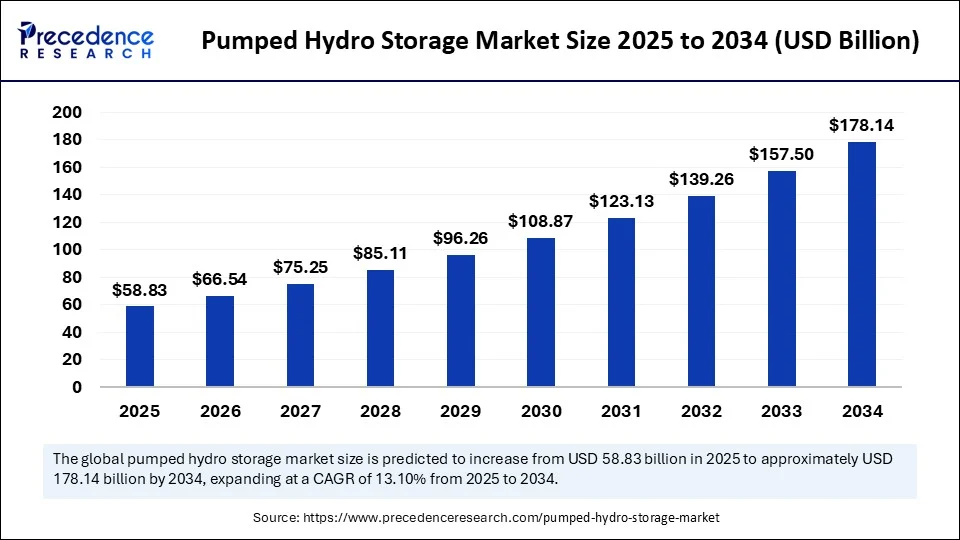

The global pumped hydro storage market size accounted for USD 52.01 billion in 2024 and is predicted to increase from USD 58.83 billion in 2025 to approximately USD 178.14 billion by 2034, expanding at a CAGR of 13.10% from 2025 to 2034. This market is growing due to the increasing need for large-scale, long-duration energy storage to support renewable energy integration and grid stability.

Pumped Hydro Storage Market Key Takeaways

- In terms of revenue, the global pumped hydro storage market was valued at USD 52.01 billion in 2024.

- It is projected to reach USD 178.14 billion by 2034.

- The market is expected to grow at a CAGR of 13.10% from 2025 to 2034.

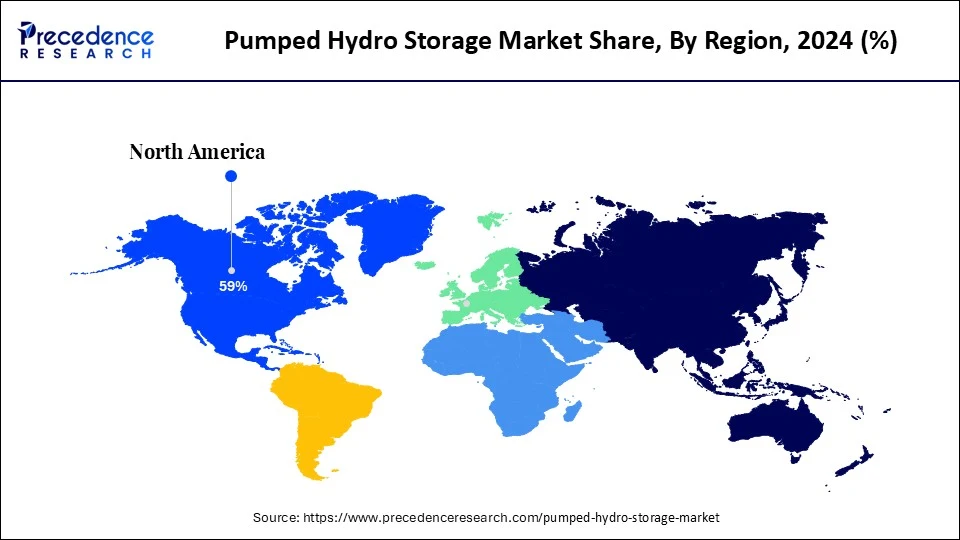

- Europe dominated the pumped hydro storage market with the largest share of 59% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- North America remains a notable region in the global pumped hydro storage market.

- By type, the open-loop systems segment held the biggest market share in 2024.

- By type, the closed-loop systems segment is expected to grow at the fastest CAGR during the forecast period.

- By capacity, the above 1000 MW segment held the major market share in 2024.

- By capacity, the 500-1000 MW segment is expected to grow at the fastest CAGR in the upcoming period.

How is Artificial Intelligence Transforming the Operations of Pumped Hydro Storage Systems?

Artificial Intelligenceis revolutionizing the operations of pumped hydro storage systems by enabling smarter, more efficient, and predictive energy management. Through advanced algorithms and machine learning models, AI optimizes water flow, turbine speed, and energy dispatch based on real-time grid demand and weather forecasts. AI also enhances predictive maintenance by analyzing sensor data to detect early signs of wear and tear, reducing downtime and extending equipment life. In addition, AI-powered digital twins allow operators to simulate and optimize different operational scenarios without affecting real systems. By integrating AI, PHS facilities are becoming more responsive, cost-efficient, and reliable, especially as they increasingly support intermittent renewable energy sources like solar and wind.

Europe Pumped Hydro Storage Market Size and Growth 2025 to 2034

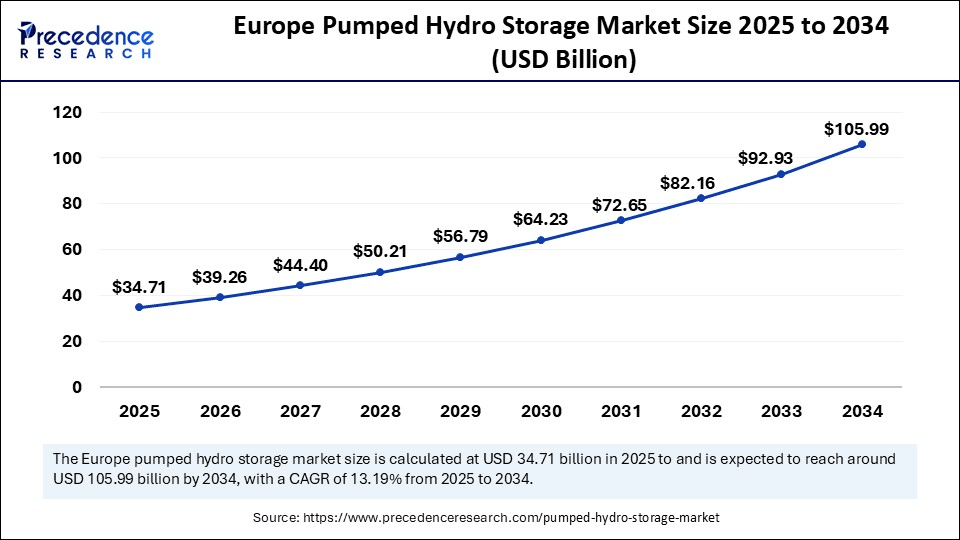

The Europe pumped hydro storage market size is exhibited at USD 34.71 billion in 2025 and is projected to be worth around USD 105.99 billion by 2034, growing at a CAGR of 13.19% from 2025 to 2034.

Which Region Dominate the Global Pumped Hydro Storage Market?

Europe dominated the pumped hydro storage market by holding the largest share in 2024. This is due to its robust energy transition regulations and well-established hydropower infrastructure. The region leads in installed capacity because it has a long history of implementing large-scale hydro projects such as pumped storage. Additional development and improvements are supported by favorable terrain and environmental planning regulations. Clean energy goals and grid modernization initiatives are driving investment in PHS projects, both new and old. The need for reliable long-duration energy storage has increased due to the integration of renewable energy sources, further solidifying Europe's market leadership.

What Factors Contribute to Asia Pacific Pumped Hydro Storage Market Growth?

Asia Pacific is expected to grow at the fastest rate in the coming years, driven by the rising demand for energy and the increased emphasis on integrating renewables. The growth of new PHS projects is being aided by rising investments in long-duration storage infrastructure. Due to the topography of the area, a variety of site development options, including both closed-loop and open-loop systems, are possible. Pumped hydro is being given priority by developers for grid reliability due to government incentives and strategic energy planning. Rapid growth is being driven throughout the region by strong momentum in energy diversification and infrastructure improvements. In addition, the rising demand for renewable energy supports market expansion. PHS can be strategically integrated with solar and wind farms, optimizing energy storage and dispatch to maximize the benefits of renewable energy sources.

North American Pumped Hydro Storage Market Trends

North America is considered to be a significantly growing area. The growth of the market in the region is driven by a strong emphasis on updating existing infrastructure and incorporating renewable energy. The region is concentrating on increasing energy storage capacity in order to facilitate a flexible and robust power grid. Pumped hydro projects are progressing thanks to policies supporting long-duration storage and decarbonization. Efforts to optimize water management and retrofit existing dams are becoming more popular as affordable fixes. North America plays a crucial role in the advancement of pumped hydro storage worldwide despite its steady growth. Various government policies, subsidies, and incentives are promoting the development of renewable energy and energy storage projects, including PHS, contributing to regional market growth.

Market Overview

Pumped hydro storage is one of the ways to produce hydroelectric energy. It utilizes water reservoirs at different elevations, releasing water to generate electricity when needed. Typically, water is pumped from a lower elevation to a higher one during periods of lower electricity demand and released during high-demand times to generate power. This is a reliable way to store electricity during low demand and use it when demand is high, efficiently balancing supply and demand while stabilizing the power grid. The increasing adoption of intermittent renewable sources like solar and wind necessitates large-scale energy storage to balance supply and demand. PHS is well-suited to address this need.

What are the Major Factors Supporting the Pumped Hydro Storage Market to Grow?

- Long-Term Cost Efficiency: Though costly upfront, PHS offers low maintenance and 40–60 years of service life.

- Strong Government Support: Policies, subsidies, and renewable energy goals are pushing investments in PHS projects.

- Tech Advancements: Modern turbines and smart monitoring boost efficiency and reduce operational issues.

- Growing Energy Needs: Rising global electricity demand and the need for grid reliability are accelerating adoption.

- Shift to Closed-Loop Systems: Eco-friendly, off-river PHS designs reduce environmental impact and ease site approvals.

- Seasonal Energy Storage: PHS enables long-duration storage, ideal for storing energy across seasons, not just hours or days.

- Declining Battery Limits: Batteries struggle with lifespan and large-scale needs, positioning PHS as a more scalable alternative.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 178.14 Billion |

| Market Size in 2025 | USD 58.83 Billion |

| Market Size in 2024 | USD 52.01 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.10% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Capacity, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Continuously Increasing Electricity Needs Due to Growing Industrialization

Electricity consumption has significantly increased in recent years due to rising industrialization and domestic electricity use, driven by growing consumer preference for appliances and electrical gadgets in daily tasks. Industrial growth and technological advancements have created more reliance on machines and equipment. Automation, reducing human labor, has also increased energy demand. In urban areas, population growth continuously expands energy consumption and requirements. Electrical appliances for lighting, heating, and cooling significantly drive energy demand. Continuous infrastructure development in urban areas requires a substantial amount of energy. All these factors continuously drive energy requirements, and to meet these, sustainable and reliable energy solutions like pumped hydro storage are among the best available options.

Restraint

High Initial Investment

One of the key restraints in the pumped hydro storage market is the high initial investments required for building reservoirs, tunnels, and equipment such as turbines and control systems. These large initial investments act as a barrier to project development. Creating reservoirs impacts natural ecosystems and water flow, necessitating systematic mitigation and balance. Pumped hydro storage projects cannot be built in any geography; they require certain topographic features, such as hills or mountains, and accessibility to water resources. Finding these sites is one of the challenging tasks. Moreover, building a pumped hydro storage plant is time-consuming, often taking several years due to the extensive infrastructure involved, restraining the growth of the market.

Opportunity

Government Support

The pumped hydro storage market presents numerous opportunities, considering grid stability and the increasing demand for renewable energy. Governments support pumped hydro storage plants through various schemes and policies to meet energy needs via renewable sources. With environmental concerns, clean energy is the future, rapidly driving this market. The continuously increasing energy demands and the effectiveness of pumped hydro storage will lead to significant growth soon.

Type Insights

Why Did the Open-Loop Systems Segment Dominate the Pumped Hydro Storage Market?

The open-loop systems segment dominated the market with the largest share in 2024 due to the increased pressure on utilities to reduce energy costs. These systems eliminate the need for costly artificial reservoirs by relying on naturally occurring water bodies like lakes or rivers. When it comes to construction, closed-loop systems are less expensive and time-consuming than open-loop systems. In areas like North America and Europe with ideal topography and plenty of water, open-loop projects are frequently implemented. Their market position is further reinforced by the ease of integration with traditional power systems and the infrastructure that is already in place. In areas with lax environmental regulations, governments also prefer to implement them.

The closed-loop systems segment is expected to grow at the fastest rate in the coming years due to their flexibility and scalability. These systems do not rely on continuous inflow from natural water bodies, giving developers greater flexibility in choosing sites. These systems use two artificial reservoirs, making them ideal for deployment in water-scarce or environmentally sensitive areas. With increasing environmental concerns and regulatory hurdles, closed-loop designs are gaining traction due to minimal ecological disruption. They are particularly useful in regions aiming to expand storage without disturbing natural ecosystems. Advances in engineering have also made these systems more cost-competitive.

Capacity Insights

Which Capacity Segment Leads the Pumped Hydro Storage Market?

The above 1000 MW segment dominated the market with the biggest share in 2024. Hydro storage systems with the storage capacity of above 1000 MW are perfect for national grid-scale applications due to their enormous energy storage and release capabilities. In areas that are heavily populated or industrial, these sizable facilities aid in balancing the power supply during peak and off-peak hours, guaranteeing continuous electricity. Even though they require a large initial investment, their scale enables considerable cost savings over time. Nations with developed energy infrastructure have already put in place a number of these large-capacity systems. They are also essential for integrating significant amounts of renewable energy and supporting energy-intensive industries. Major utility providers choose them first because of their economies of scale.

The 500-1000 MW segment is witnessing the fastest growth, especially in regional grid projects and developing countries. These mid-capacity storage systems appeal to nations with limited resources or space because they provide a balance between output and investment. Because of their modest size, they can be approved and built more quickly, which guarantees faster returns on investment. These plants are being used by numerous emerging economies to stabilize grids that are rapidly expanding due to solar and wind power. Moreover, utility companies are selecting this capacity range for storage at the regional level in situations where ultra-large projects might not be needed. Their market expansion is being accelerated by their flexibility and shorter project cycles.

Pumped Hydro Storage Market Companies

- ANDRITZ AG (Austria)

- Siemens AG (Germany)

- Enel SpA (Italy)

- Duke Energy Co. (U.S.)

- Voith GmbH & Co. KGaA (Germany)

- GE Vernova (U.S.)

- Power Construction Corporation of China (China)

- Torrent Power (India)

- ITC Holdings (U.S.)

- NextEra Energy, Inc. (U.S.)

- China Energy Engineering Corporation (China)

Recent Developments

- In May 2025, AGL acquired 100% ownership of two pumped hydro energy storage projects held by Upper Hunter Hydro Top Trust and its trustee (UHH). The two early-stage projects are located in the Hunter region, NSW. The projects at Glenbawn and Glennies Creek aim to provide 770 MW 10-hour and 623 MW 10-hour pumped hydro energy storage capacity respectively with the future opportunity for integrated wind farms.

(Source: https://www.agl.com.au) - In April 2025, the Scottish Government approved UK's pumped storage hydro project at Loch Earba. This will be the largest pumped hydro storage project, which will have 1800 MW installed energy production capacity and 40,000 MWh storage capacity, surpassing the currently existing storage capacity.

(Source: https://www.newcivilengineer.com) - In March 2025, the Madhya Pradesh, India, government launched a scheme for the development and implementation of pump hydro storage projects in the state in an attempt to tackle the surplus energy available in the state.

(Source: https://timesofindia.indiatimes.com) - In March 2025, SSE and Gilkes Energy submitted a Section 36 planning consent application to Scottish Government for a proposed joint venture Fearna pumped storage hydro (PSH) project in Scotland's Highlands. The 50:50 development joint venture project is located at the western end of Glengarry, around 25km west of Invergarry and adjoins SSE Renewables' existing Loch Quoich reservoir in the Great Glen hydro scheme. Under the terms of the joint venture agreement, Gilkes Energy will lead the project's development under a developer services agreement with SSE Renewables.

(Source: https://www.sserenewables.com) - In January 2025, the provincial government of Ontario, Canada, commenced the pre-development work on a pumped hydro energy storage project, which have a storage capacity of 1G/11GW. Ontario will invest up to CA$285 million (US$198 million) to advance the Ontario Pumped Storage Project, proposed for construction in Meaford, a coastal municipality about 180km from Toronto.

(Source: https://www.energy-storage.news)

Segments Covered in the Report

By Type

- Open Loop

- Closed Loop

- By Capacity

By Capacity

- Below 500 MW

- 500-1000 MW

- Above 1000 MW

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting