Stationary Energy Storage Market Size and Forecast 2025 to 2034

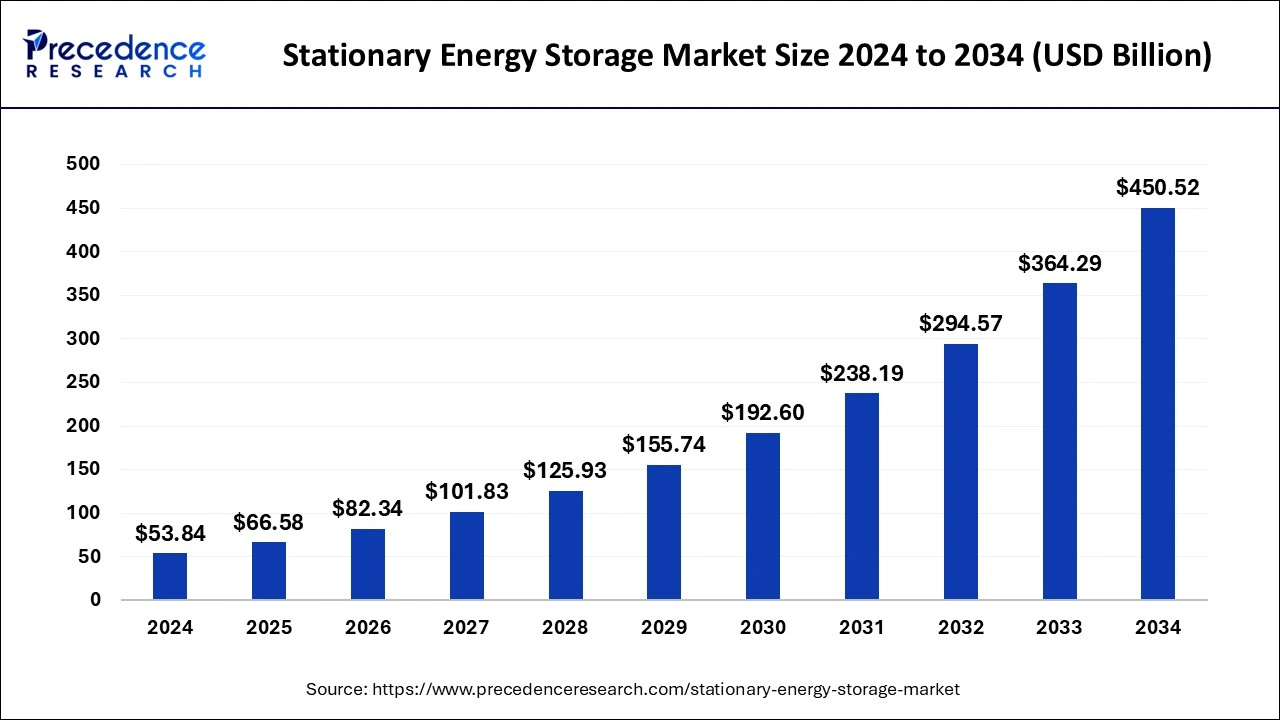

The global stationary energy storage market size was calculated at USD 53.84 billion in 2024 and is predicted to reach around USD 450.52 billion by 2034, expanding at a CAGR of 23.67% from 2025 to 2034. The market growth is attributed to the increasing adoption of renewable energy sources and the growing need for efficient, reliable energy storage solutions to support grid stability and energy security.

Stationary Energy Storage Market Key Takeaways

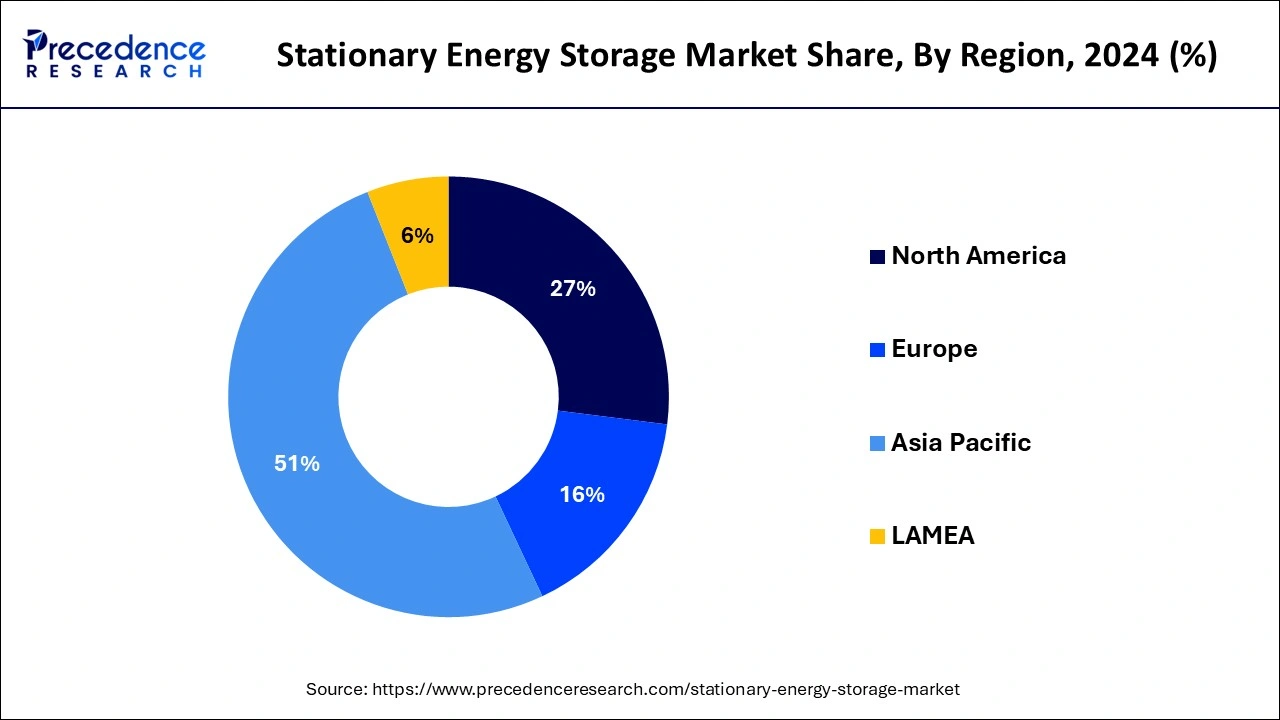

- Asia Pacific dominated the global market with the largest market share of 51% in 2024.

- Europe is projected to expand at the notable CAGR during the forecast period.

- By battery , the sodium sulphur segment contributed the highest market share in 2024.

- By battery, the lithium-ion segments is estimated to be the fastest-growing segment during the forecast period.

- By type of energy storage, the hydrogen and ammonia storage segment captured the biggest market share in 2024.

Impact of Artificial Intelligence on the Stationary Energy Storage Market

Artificial intelligence (AI) is becoming more prevalent in the stationary energy storage market as it extends operational performance, offers better maintenance practices, and optimizes energy management. Artificial intelligence uses data from energy storage devices, including batteries, to predict their performance, look for signs of failure, and manage energy distribution most efficiently. Through machine learning, energy storage systems optimize the effective utilization and integration of energy in the grid system. Furthermore, AI helps in the development of smart storage systems, enabling real-time monitoring of stored energy to avoid further damage to batteries.

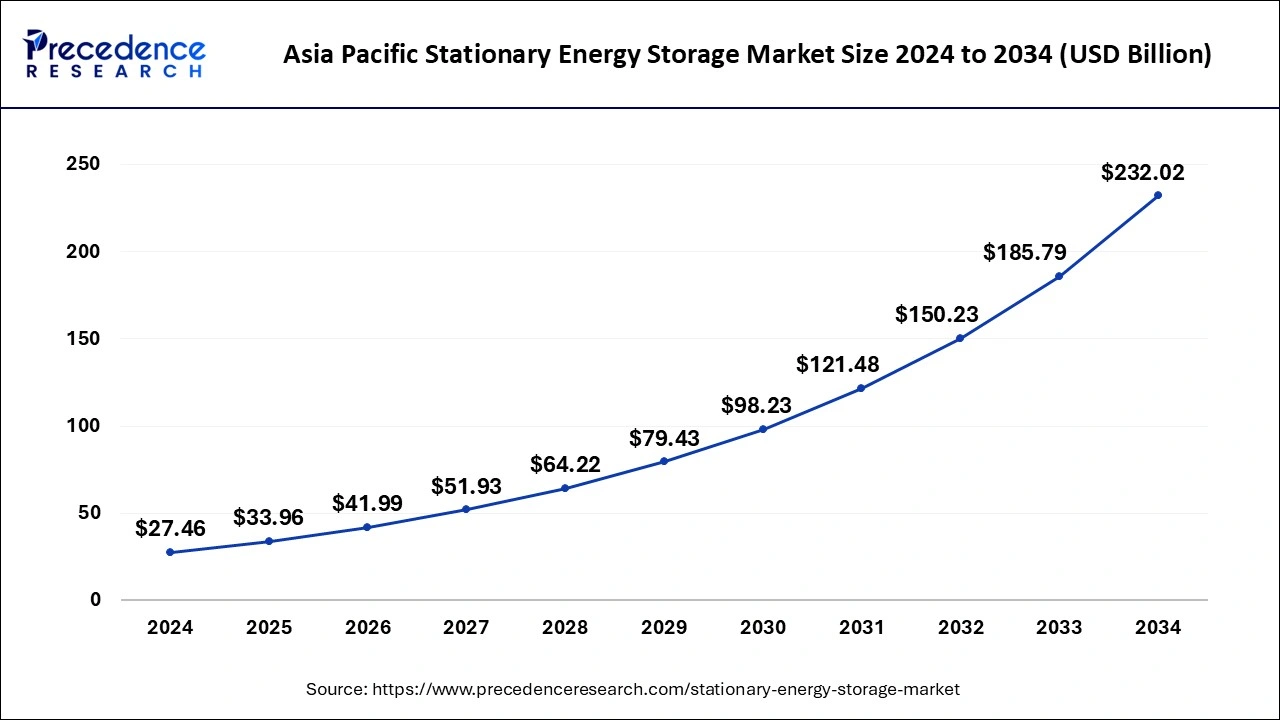

Asia Pacific Stationary Energy Storage Market Size and Growth 2025 to 2034

The Asia Pacific stationary energy storage market size was evaluated at USD 27.46 billion in 2024 and is projected to be worth around USD 232.02 billion by 2034, growing at a CAGR of 23.79% from 2025 to 2034.

Asia Pacific dominated the stationary energy storage market in 2024. The global market for stationary energy storage has been driven by the trend of switching from conventional power generation to clean and green sources of energy.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. Current energy efficiency reforms, along with growing worries about supply security will boost market share. The region's harsh climatic conditions have created a beneficial setting for battery manufacturing companies.

Stationary Energy Storage Market Growth Factors

- Rising global energy demand is spurring investments in stationary energy storage solutions.

- Increasing investments in renewable energy projects worldwide are boosting the need for efficient energy storage systems, thus fueling the growth of the market.

- Rising issues of power outages and disruptions are driving the demand for backup energy storage solutions.

- Growing awareness of the environmental benefits of energy storage systems is encouraging adoption.

- Government initiatives aimed at reducing carbon emissions are further boosting the demand for energy storage technologies.

- Technological advancements in energy storage systems further contributes to market expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 66.58 Billion |

| Market Size in 2034 | USD 450.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 23.67% from 2025 to 2034 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Battery, Type of Energy Storage, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Renewable Energy Integration

The rapid deployment of renewable energy and favorable government measures to reduce carbon emissions are the primary drivers of the stationary energy storage market. With the continued integration of clean energy systems such as wind and solar, the need for cost-effective energy storage solutions for network synchronization is rising, which is likely to drive the demand for stationary energy storage. In addition, the growing demand for renewable energy is anticipated to drive the growth of the market. Tahoe electrical storage systems are important in leveling consumption patterns and supply since they store power generated at hours of excess production and can supply during periods of shortage. According to the IEA, global renewable electricity generation is forecast to climb to over 17,000 terawatt-hours (TWh) by 2030, an increase of almost 90% from 2023. This highlights the need for storage that can handle the diversification of renewable power generation.

Restraint

Technological Limitations

Technological limitations in terms of energy density and efficiency are anticipated to hamper the growth of the market. These challenges can affect the performance and reliability of stationary energy storage systems. These systems also degrade quickly, which makes them less efficient with time and need replacement more often. The current energy storage techniques are not yet optimal, and enhancing these solutions to meet global energy storage needs is challenging. Moreover, integrating energy storage systems with existing energy infrastructure is complex, restraining the growth of the market.

Opportunity

Rising Grid Modernization

Increasing focus on grid modernization creates immense opportunities in the market. Utility companies worldwide are spending heavily on refurbishment and expansion of their ever-demanding electric networks. With the rise of smart grids, there will be a high demand for energy storage systems. Smart grids often require energy storage systems for efficient utilization of renewable energy, power regulation, and grid functionality enhancement. Additionally, the growing focus on modernizing aging infrastructures with smart grid systems will fuel the growth of the market.

Battery Insights

In 2024, the sodium Sulphur segment dominated the stationary energy storage market. The main factors driving product demand are high energy density, increased safety prospects, and long battery life.

The lithium-ion segment, on the other hand, is predicted to develop at the quickest rate in the future years. Lithium-ion batteries having a longer shelf life than conventional batteries, which encourages the use of these batteries.

Type of Energy Storage Insights

In 2024, the hydrogen and ammonia storage segment dominated the stationary energy storage market. In contrast to mobile applications, hydrogen density is not a significant issue in stationary applications. Stationary uses such as compressed hydrogen in a hydrogen tank, liquid hydrogen in a cryogenic hydrogen tank, and slush hydrogen in a cryogenic hydrogen tank can all be used in mobile applications.

Stationary Energy Storage Market Companies

- Tesla

- Durapower

- Exide Technologies

- Duracell

- Toshiba Corporation

- Panasonic Corporation

- Samsung SDI

- Johnson Controls

- Philips

- Hoppecke Batteries

Recent Developments

- In July 2024, Exide Technologies, a global leader in battery storage solutions, continued its legacy of innovation and sustainability by offering Customized Energy Systems (CES). These systems, powered by advanced lithium-ion battery technology, provide stationary and mobile energy storage solutions that help businesses and communities stabilize the grid, optimize energy usage, and minimize environmental impact. With over 100 MWh of installed lithium-ion storage projects, Exide Technologies is pushing forward with its commitment to a net-zero world. Their energy management solutions empower industries to enhance operational efficiency while addressing renewable energy integration challenges.

- In June 2024, BASF Stationary Energy Storage GmbH, in partnership with NGK INSULATORS, LTD., unveiled an advanced container-type NAS (sodium-sulfur) battery, the NAS MODEL L24. This newly developed product features a significantly reduced degradation rate of less than 1% per year, a result of improved corrosion resistance in battery cells. Additionally, the battery incorporates a refined thermal management system, enhancing continuous discharge capabilities and extending the life of the system. This innovation represents a significant leap forward in stationary energy storage, addressing the growing demand for efficient, long-lasting battery solutions in the clean energy sector.

- In September 2023, EnerVenue launched its next-generation Energy Storage Vessels (ESVs), which feature metal-hydrogen battery technology capable of more than 30,000 cycles. This breakthrough technology offers a long lifespan, making it a significant contributor to advancing the energy storage industry. By providing an alternative to traditional lithium-ion batteries, EnerVenue is revolutionizing the way energy is stored, contributing to cleaner, more sustainable energy systems.

Segments Covered in the Report

By Battery

- Lithium Ion

- Sodium Sulphur

- Lead Acid

- Flow Battery

By Type of Energy Storage

- Hydrogen and Ammonia Storage

- Gravitational Energy Storage

- Compressed Air Energy Storage

- Liquid Air Storage

- Thermal Energy Storage

By Application

- Grid Services

- Behind the Meter

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting