Image Sensors Market Size and Forecast 2025 to 2034

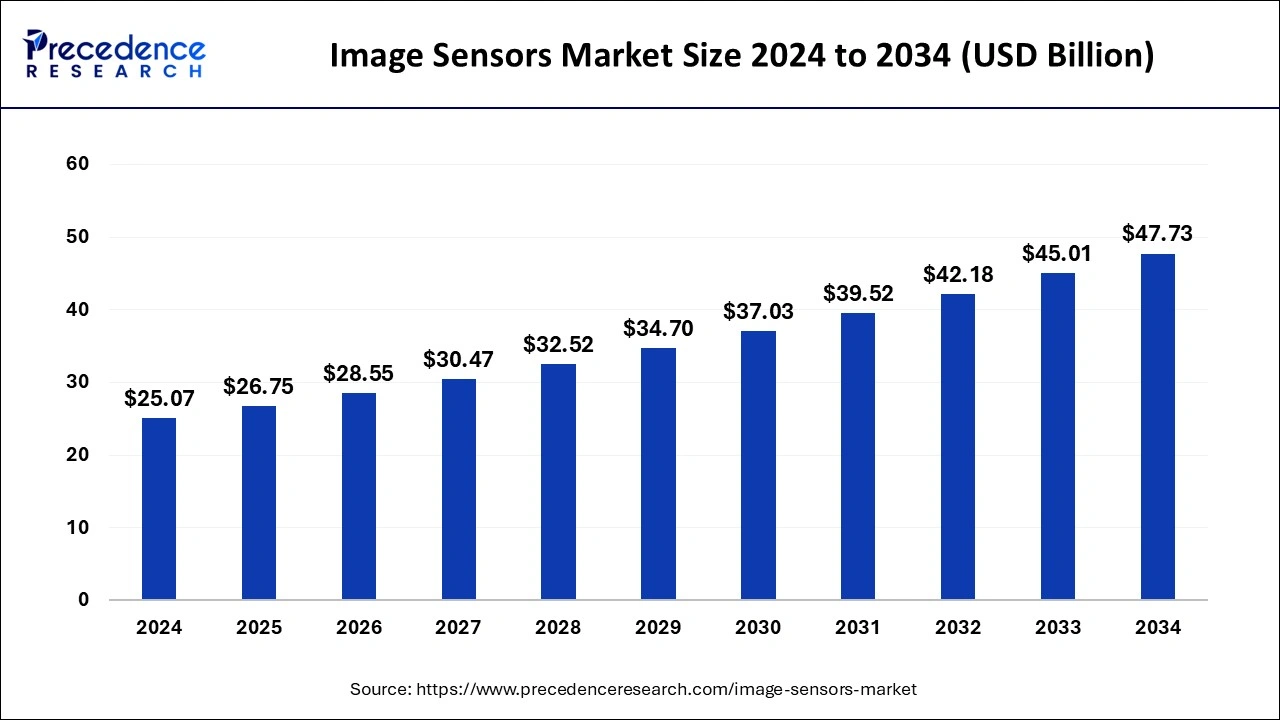

The global image sensors market size was estimated at USD 25.07 billion in 2024 and is predicted to increase from USD 26.75 billion in 2025 to approximately USD 47.73 billion by 2034, expanding at a CAGR of 6.65% from 2025 to 2034.

Image Sensors Market Key Takeaways

- In terms of revenue, the global image sensors market was valued at USD 25.07 billion in 2024.

- It is projected to reach USD 47.73 billion by 2034.

- The market is expected to grow at a CAGR of 6.65% from 2025 to 2034.

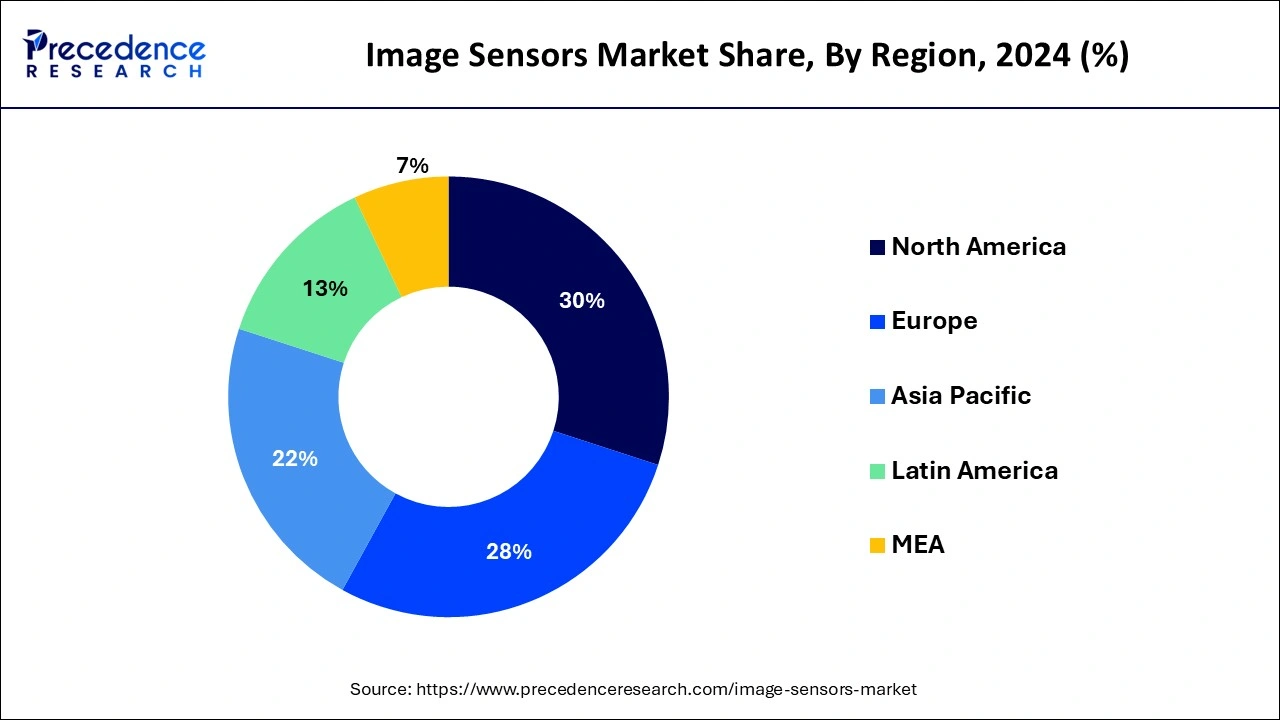

- North America dominated the market with the largest share of 30% in 2024.

- By technology, the CMOS image sensors segment held the largest share of the market in 2024.

- By application, the consumer electronics segment dominated the market in 2023.

- By application, the automotive segment is observed to grow at the fastest CAGR during the forecast period.

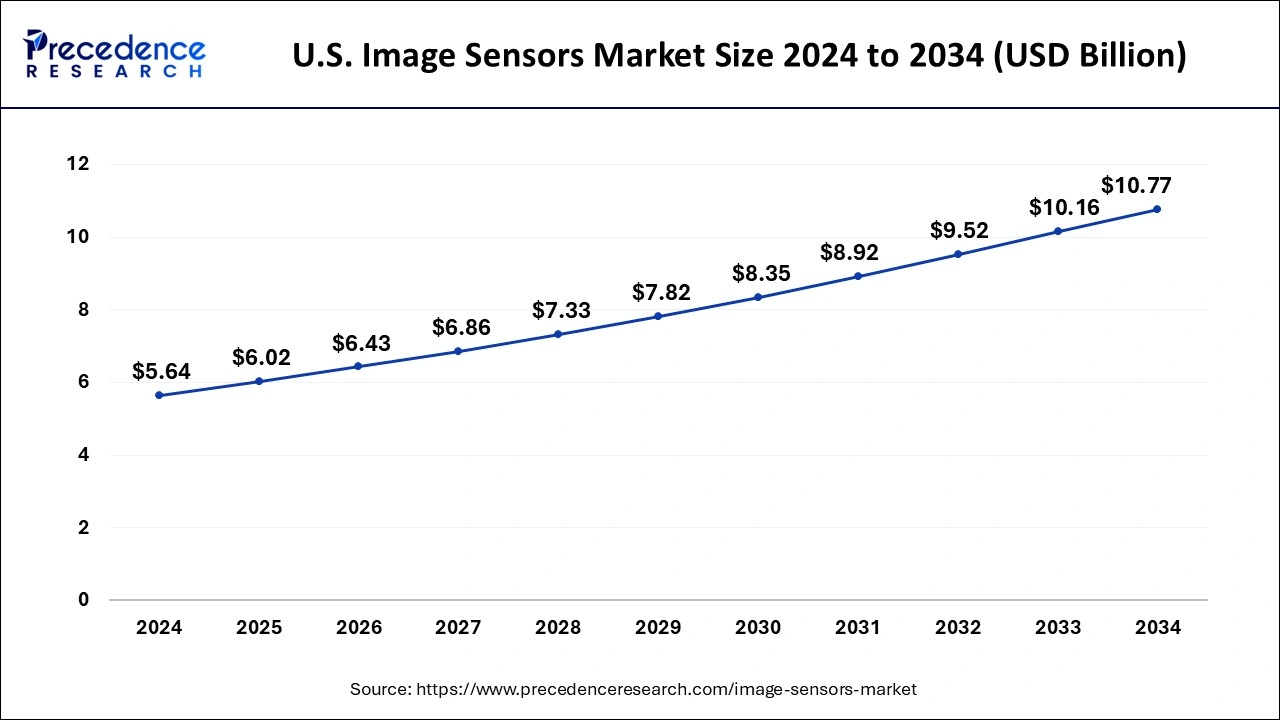

U.S. Image Sensors Market Size and Forecast 2025 to 2034

The U.S. image sensors market size reached USD 5.64 billion in 2024 and is expected to be worth around USD 10.77 billion by 2034, growing at a CAGR of 6.68% from 2025 to 2034.

North America led the global market with the highest market share of 30% in 2024. The robust presence of the consumer electronics sector, which is driving the rapid usage of mobile camera modules and other portable devices, is the reason for the expanding acceptance of CMOS image sensors throughout the United States. Smartphones are becoming the most popular camera device in consumer electronics, outperforming DSLRs and other cameras.

Strong rivalry in the smartphone market has forced manufacturers to offer better cameras to gain an advantage over rivals, leading to significant expenditures in technological advancements in this area. In 2022–2023, the US Census Bureau projected that smartphone sales will be valued at USD 74.7 billion. The US has seen a fall in smartphone shipments, which has resulted in this slow growth.

The largest contributing cause to the slump was a fall in sales of low-end smartphones, which is projected to reverse in the coming years due to economic issues, high inflation, and weak seasonal demand. The expansion of image sensors in the consumer electronics market, which encompasses not just smartphones but also PCs, laptops, and tablets is anticipated to be significantly impacted by these sales patterns.

Furthermore, robotic cameras are revolutionizing several sectors by changing how people record, monitor, and interact with their environment. These advanced gadgets, furnished with state-of-the-art technology, provide a multitude of benefits, rendering them indispensable resources in domains spanning from manufacturing and entertainment to security and surveillance.

Hence, CMOS sensors use less power and are more effective at producing digital images than CCD sensors. Their fabrication is less expensive than that of a CCD, which drives demand in the regional market. They may also be bigger than a CCD, providing high-resolution pictures.

Market Overview

The image sensors market offers devices that detect and convey information used to create an image. It is a crucial component in digital cameras, smartphones, and other imaging devices. The image sensor converts light into electrical signals, which can be processed to form a digital representation of the scene or subject being captured. There are different types of image sensors, with two main categories being complementary metal-oxide-semiconductor (CMOS) sensors and charge-coupled device (CCD) sensors. CMOS sensors have become more popular due to their lower power consumption and cost, while CCD sensors are known for their higher image quality in certain conditions.

Image Sensors Market Growth Factors

- The proliferation of smartphones with advanced camera systems has been a significant driver for the image sensors market. Consumers increasingly prioritize camera quality when choosing smartphones, leading to the integration of higher-resolution sensors, multiple camera setups, and advanced imaging features.

- The automotive industry's growing adoption of image sensors for applications such as advanced driver assistance systems (ADAS), parking assistance, and in-car cameras has been a significant driver. The trend towards autonomous vehicles further fuels the demand for image sensors for perception and vision systems, promoting the growth of the image sensors market.

- The growing demand for image sensors from the medical industry is expected to propel the image sensors market during the forecast period. Advances in medical imaging technologies have led to the integration of high-performance image sensors in various medical devices. This includes applications in endoscopy, diagnostic imaging, and wearable health devices.

Image Sensors Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.65% |

| Market Size in 2025 | USD 26.75 Billion |

| Market Size by 2034 | USD 47.73 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing advancements in 3D imaging technology

3D imaging technology, such as ToF sensors and structured light, enables biometric identification and facial recognition. These sensors offer an improved level of security and precision in person identification, which is crucial for mobile devices, access control, and security applications. Touchless gesture control in gaming, car infotainment systems, and human-machine interactions is made possible via 3D imaging. Without making physical touch, users may engage with systems and gadgets, improving both user experience and safety. The image sensors market is expected to rise rapidly due to the increasing improvements in 3D imaging technology.

Restraints

High cost associated with 3D packaging

The producers of CMOS image sensors deal with several technological difficulties. Smaller 3D-stacked CMOS image sensors are now absolutely required, but it's getting harder for suppliers to integrate these sensors with characteristics like low production costs and power-efficient performance. 3D packaging is one of the largest technological obstacles a vendor must overcome to manufacture 3D-stacked CMOS image sensors. Packing will become one of the most costly and time-consuming activities in the CMOS image sensor production process with specialized packaging. Thereby, the high cost associated with 3D packaging acts as a restraint for the image sensors market.

Opportunity

Growing partnership

The growing partnership in the industry is expected to offer a potential opportunity for the image sensors market over the forecast period. For instance, in June 2023, the collaboration between Sony Semiconductor Solutions Corporation (Sony), the world leader in image sensors, and Hexagon, the leader in digital reality solutions combining sensor, software, and autonomous technologies, will improve Hexagon's leading reality capture solutions, which include the Leica BLK product line. With this partnership, Hexagon will improve the speed and precision of its reality capture solutions by using Sony's cutting-edge Time-of-Flight image sensor and software technology.

Hexagon and Sony's partnership will reduce the time between data gathering and results delivery by enabling a smooth workflow for data capture and processing. Through the integration of Hexagon's reality capture capabilities with Sony's sophisticated processing software library, the two companies will create solutions that offer quicker field feedback and more comprehensive data gathering capacities.

Technology Insights

The CMOS image sensors segment held the largest share of the image sensors market. The segment dominance is attributed to the growing automotive sector. The growing use of advanced driver-assistance systems (ADAS) in several vehicle categories is driving up demand for CMOS image sensors in the automotive and transportation industries. The broad use of camera sensor systems has been impacted by the incorporation of high-performance protection features into automotive systems, especially in consideration of the approaching global deployment of autonomous cars.

New business opportunities are being created by the continuous development of connected and autonomous automobiles. In the recent announcement, the Federal Transit Administration (FTA) made available up to USD 6.5 million for demonstration projects, of which USD 5 million would go toward adding ADAS to transit buses and an additional USD 1.5 million would go toward the first phase of Automated Transit Bus Maintenance and Yard Operations.

Furthermore, the UK declared in April 2023 that Ford's BlueCruise advanced driver assistance system (ADAS), which is expected to pave the way on the nation's highways, has been approved for the use of hands-free driving technology. Besides, the CCD image sensors segment is expected to grow at a significant rate over the projected period owing to its favorable properties.

CCD sensors have been known for their excellent image quality, especially in low-light conditions. They are often preferred in applications where capturing high-quality images with low noise is crucial, such as professional photography and certain industrial and scientific applications.

Application Insights

The consumer electronics segment held the dominating share of the image sensors market in 2024. The segment expansion is attributed to the growing adoption of smartphones along with better-quality cameras. The integration of advanced image sensors is a key driver in the smartphone industry. Consumers increasingly prioritize camera capabilities when choosing smartphones. Manufacturers compete to offer higher megapixel counts, improved low-light performance, and additional features like multiple lenses, optical zoom, and advanced image processing algorithms.

- For instance, the annual State of Mobile Internet Connectivity Report 2023 from the GSMA states that over half (54%) of the world's population, or around 4.3 billion people, currently owns a smartphone. Moreover, ongoing developments focus on improving sensor technology, including higher resolution, enhanced low-light performance, faster autofocus, and improved image processing algorithms.

Besides, the automotive segment is expected to grow at the fastest CAGR during the forecast period. Image sensors play a crucial role in ADAS applications, providing visual information for features such as lane departure warning, collision avoidance, adaptive cruise control, and parking assistance. The growing demand for safer and more automated driving experiences has driven the adoption of image sensors in vehicles.

Image Sensors Market Companies

- OMNIVISION

- STMicroelectronics NV

- SK HYNIX INC.

- Panasonic Corporation

- Canon Inc.

- PixArt Imaging Inc.

- Sony Group Corporation

- ON Semiconductor Corporation

- GalaxyCore Shanghai Limited Corporation

- Samsung Electronics Co. Ltd

Recent Developments

- In November 2023, with the highest*1 pixel count in the market at 5.32 effective megapixels, Sony Semiconductor Solutions Corporation announced the upcoming release of the IMX992 short-wavelength infrared (SWIR) image sensor for industrial equipment. The new sensor achieves the smallest*1 pixel size in the market among SWIR image sensors, measuring 3.45 μm, by utilizing SSS's exclusive Cu-Cu connection. Additionally, it has a pixel structure tuned to capture light effectively, allowing for high-definition imaging throughout a wide spectrum (wavelength: 0.4 to 1.7 μm) that spans from visible to invisible short-wavelength infrared areas. In addition, compared to traditional goods, new shooting modes provide high-quality photographs with noticeably less noise in low-light areas.

- In September 2023, the OX08D10 8-megapixel (MP) CMOS image sensor with TheiaCelTM technology made its premiere at AutoSens Brussels. OMNIVISION is a major global producer of semiconductor solutions, including innovative digital imaging, analogue, and touch & display technologies. By improving the resolution and picture quality of external cameras used for autonomous driving (AD) and advanced driver assistance systems (ADAS), the new technology increases car safety. With a 50% smaller footprint than comparable external cabin sensors in its class, the OX08D10 boasts low power consumption and industry-leading low-light performance. It is the first image sensor to use OMNIVISION's advanced 2.1-micron (µm) TheiaCelTM technology, which eliminates LED flicker under all lighting conditions by utilizing the power of next-generation lateral overflow integration capacitors (LOFIC) and OMNIVISION's DCGTM high dynamic range (HDR) technology. The OX08D10 can take HDR pictures up to 200 meters away due to TheiaCelTM. For exterior camera applications in automobiles, this range is ideal because it offers the optimum mix of SNR1 and dynamic range.

- In December 2023, two new ISOCELL Vizion sensors were released by Samsung Electronics, a global leader in innovative semiconductor technology. The ISOCELL Vizion 63D is a time-of-flight (ToF) sensor, while the ISOCELL Vizion 931 is a global shutter sensor. Samsung's ISOCELL Vizion family, which was first unveiled in 2020, consists of ToF and global shutter sensors made expressly to provide visual capabilities for a wide range of next-generation mobile, commercial, and industrial use cases.

Segments Covered in the Report

By Technology

- CCD Image Sensors

- CMOS Image Sensors

By Application

- Industrial

- Defense and Aerospace

- Medical

- Consumer Electronics

- Automotive

- Security and Surveillance

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting