What is the Impregnated Foam Dressing Market Size?

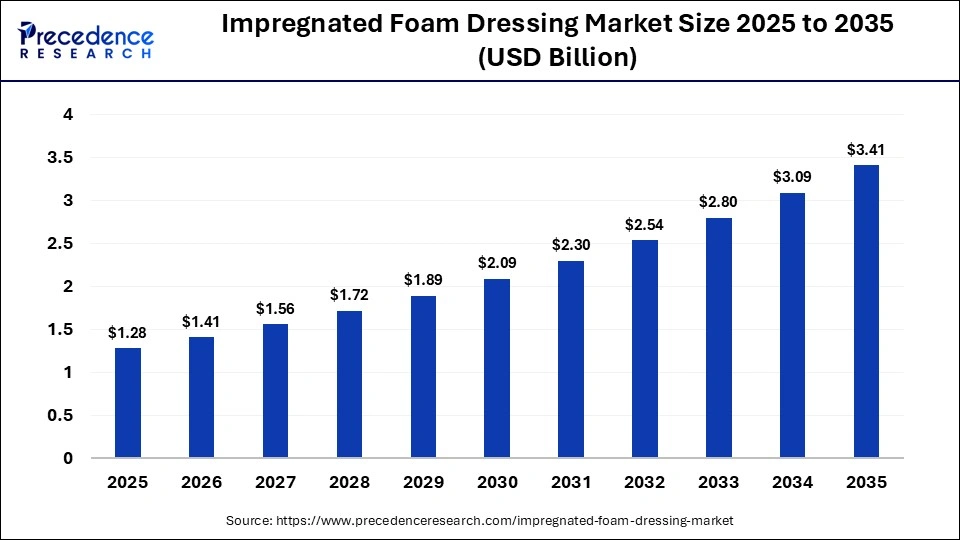

The global impregnated foam dressing market size was calculated at USD 1.28 billion in 2025 and is predicted to increase from USD 1.41 billion in 2026 to approximately USD 3.41 billion by 2035, expanding at a CAGR of 10.30% from 2026 to 2035. The market is growing consistently owing to the increasing cases of chronic wounds, including diabetic foot ulcers, pressure ulcers, and venous leg ulcers. The growing need for antimicrobial and highly absorbent dressing technologies is also being accelerated by increased awareness about the advancement of wound care solutions and the rising number of aging populations.

Market Highlights

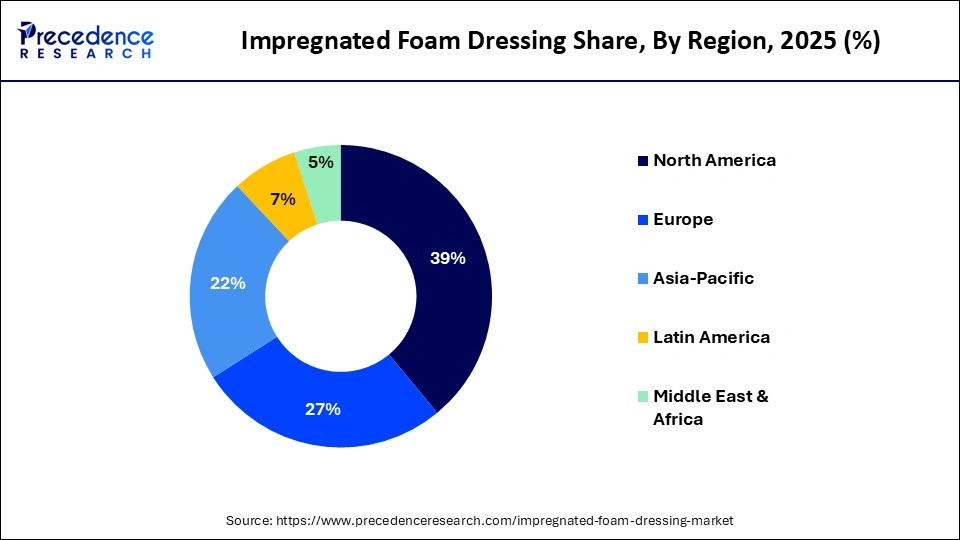

- North America dominated the global impregnated foam dressing market with a share of approximately 39% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR of approximately 10.5% in the market during the forecast period.

- By product/dressing type, the silver-impregnated foam dressings segment held a dominant position in the market with a share of approximately 38% in 2025.

- By product/dressing type, the other impregnated variants segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

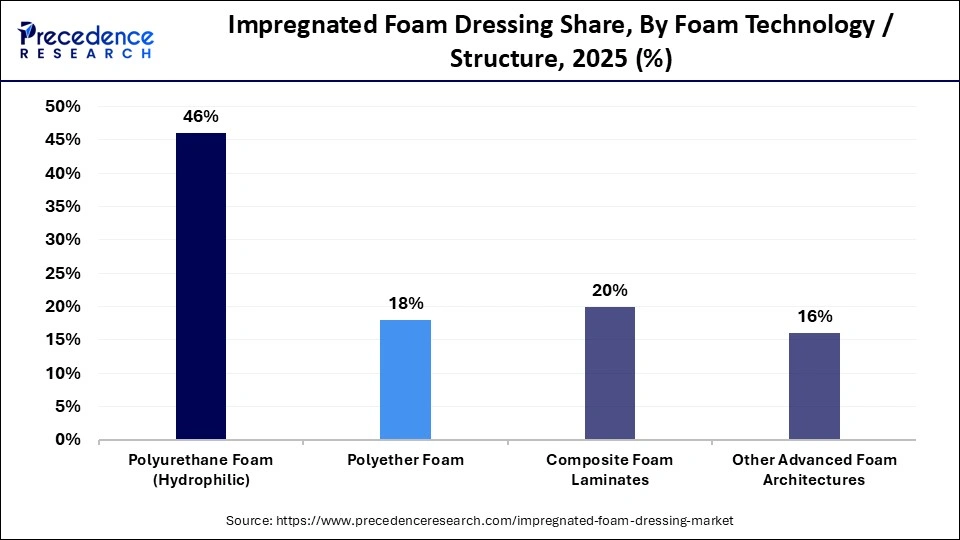

- By foam technology/structure, the polyurethane foam (hydrophilic) segment led the global market with a share of approximately 46% in 2025.

- By foam technology/structure, the composite foam laminates segment is expected to grow with the highest CAGR in the market during the studied years.

- By wound type/application, the chronic wounds segment dominated the global market with a share of approximately 51% in 2025.

- By wound type/application, the acute wounds segment is expected to expand rapidly in the market in the coming years.

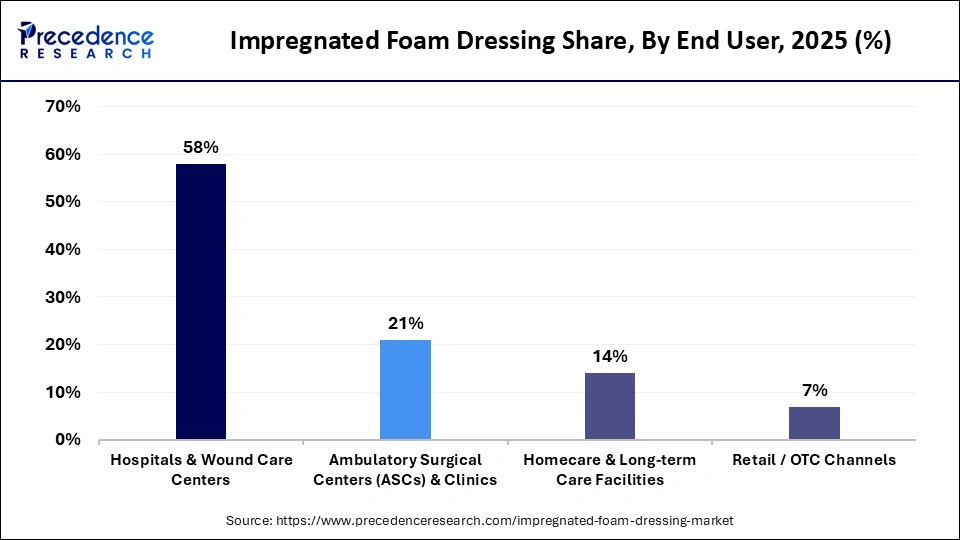

- By end user, the hospitals and wound care centers segment held a major revenue share of approximately 58% in the market in 2025.

- By end user, the homecare and long-term care segment is expected to gain the highest market share between 2026 and 2035.

- By distribution channel, the medical distributors/wholesalers segment held the largest revenue share of approximately 45% in the impregnated foam dressing market in 2025.

- By distribution channel, the retail/pharmacy and e-commerce segment is expected to account for the fastest growth over the studied period.

- By pricing/purchase model, the per-unit/per-dressing pricing segment held a major revenue share of approximately 68% in the market in 2025.

- By pricing/purchase model, the bundled kits and value-added services segment is expected to gain the highest market share between 2026 and 2035.

- By material and impregnant, the silver + foam segment contributed the biggest revenue share of approximately 38% in the market in 2025.

- By material and impregnant, the bioactive/growth factor-impregnated segment is expected to show the fastest growth over the forecast period.

Impregnated Foam Dressing: Intelligent Absorption by Smart Wound Care

Impregnated foam dressings are essential to the wound management process because they offer advanced absorption capacity and therapeutic capability. Active agents such as silver or iodine are impregnated into these dressings to provide antimicrobial protection and keep the wound environment moist. Impregnated foams are becoming more popular in hospitals and outpatient care settings because they are effective at reducing the risk of infection and shortening healing time. The increasing number of surgical procedures and trauma cases worldwide further supports the market's growth. Moreover, the use of technology to enhance foam structure and exudate management is strengthening product performance and patient comfort.

What is the Role of AI in the Impregnated Foam Dressing Market?

In advanced wound care, the use of artificial intelligence (AI) is becoming common in wound assessment and dressing optimization. Imaging AI can assist clinicians in assessing wound size, depth, and risk of infection so they can better choose impregnated foam dressings. Predictive analytics helps in identifying the patients who have a high risk of complications of chronic wounds, and this aids in early intervention strategies. AI and machine learning (ML) algorithms can analyze vast amounts of patient data and identify wound severity and suggest appropriate dressing. Moreover, digital health platforms with AI are augmented to remotely track wounds, enhance compliance, and prevent readmission.

Impregnated Foam Dressing Market Trends

- Improved Absorption Technologies: High-end polyurethane foams are designed to have the best fluid retention and minimum risk of maceration.

- Antimicrobial Protection: Demand is growing for dressings that prevent biofilm development and hospital-acquired infections.

- Chronic Wound Management: Increasing attention to definitive treatment of diabetic ulcers, pressure ulcers, and vascular wounds.

- Increasing Number of Surgeries: The growing number of surgeries, such as caesarean section and vascular surgeries, promotes the need for impregnated foam dressings.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.28 Billion |

| Market Size in 2026 | USD 1.41 Billion |

| Market Size by 2035 | USD 3.41 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.30% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product/Dressing Type, Foam Technology/Structure, Wound Type/Application, End User, Distribution Channel, Pricing/Purchase Model, Material & Impregnant, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product/Dressing Type Insights

Which Product/Dressing Type Segment Dominated the Impregnated Foam Dressing Market?

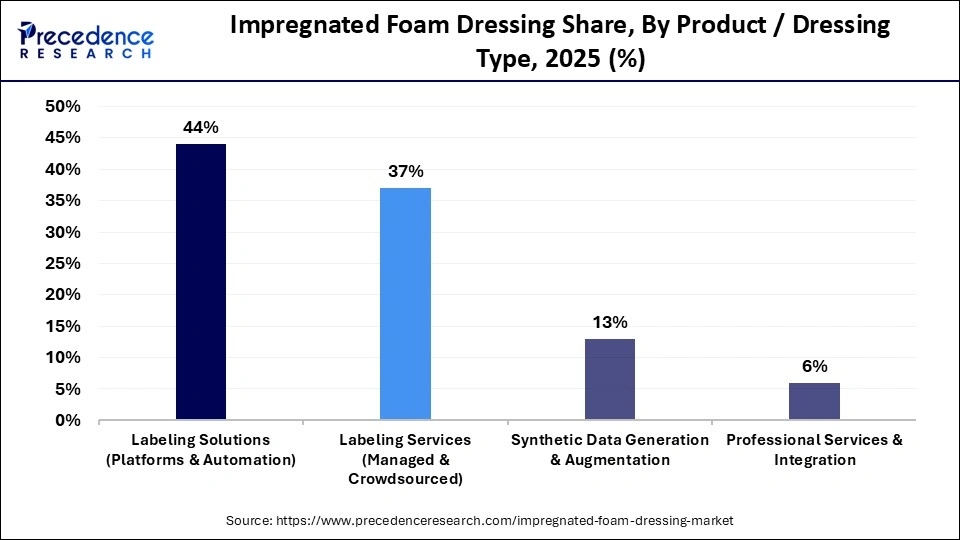

The silver-impregnated foam dressings segment held a dominant position in the market with a share of approximately 38% in 2025 because of their wide-spectrum antimicrobial properties. These dressings are also very useful in decreasing bacteria and inhibiting biofilm development in moderate- to heavily exuding wounds. Clinical preference is enhanced by their capability to deliver prolonged antimicrobial discharge and retain a wet healing area. It is also supported by a strong adoption among hospitals and advanced wound care centres, boosting the segment's growth.

The other impregnated variants segment is expected to grow at the fastest CAGR in the market between 2026 and 2035, driven by innovative dressings to actively enhance tissue regeneration and anaerobic recovery. The increasing demand for bioactive wound care solutions and innovations through regenerative technologies augments the segment's growth. Researchers identify novel impregnated variants other than the traditional ones to provide personalized treatment to patients, leading to faster recovery.

Foam Technology/Structure Insights

How the Polyurethane Foam (Hydrophilic) Segment Dominated the Impregnated Foam Dressing Market?

The polyurethane foam (hydrophilic) segment accounted for a considerable revenue share of approximately 46% in the market in 2025, due to its high absorption capacity and structural stability. The material is effective in exudate management and has the best moisture balance in the wound bed. Its supportiveness and elasticity enhance comfort and lessen pressure-related complications of the patient. Polyurethane foam also exhibits a great deal of compatibility with antimicrobial impregnates, including silver and iodine.

The composite foam laminates segment is expected to grow with the highest CAGR in the market during the studied years. These are multi-layered designs that incorporate both absorption and barrier protection as well as adhesive functionality in one dressing. They have improved durability and increased wear time, reducing the frequency of dressing changes. It is supported by increased focus on cost-efficiency and better clinical outcomes. Multilayer wound care technologies are advancing, which is increasing demand in the healthcare environment.

Wound Type/Application Insights

What Made Chronic Wounds the Dominant Segment in the Impregnated Foam Dressing Market?

The chronic wounds segment dominated the market with the largest share of approximately 51% in 2025, due to the rising incidences of diabetic foot ulcers, venous leg ulcers, and pressure injuries, leading to continued product usage. These wounds are long-term care wounds that need infection control and prefer advanced impregnated foam solutions. The aging population and the increasing rates of diabetes also propel the segment's growth. Prevention of complications and amputation, which is clinically focused, strengthens the adoption.

The acute wounds segment is expected to expand rapidly in the market in the coming years, driven by increasing cases of surgical operations and trauma cases, which are increasing the need for effective ways to manage post-operative wounds. Impregnated foams offer absorption and antimicrobial defence, which minimizes the chances of infection. The acceleration of recovery in the operating room is a motivating factor to use advanced dressings. Both the enhancement of hospital protocols and infection prevention approaches spur growth.

End User Insights

Which End User Segment Led the Impregnated Foam Dressing Market?

The hospitals and wound care centers segment led the market with a share of approximately 58% in 2025, driven by the ability to handle complicated and high-risk wound cases that necessitate high antimicrobial dressings. Demand is stable due to a large inflow of patients and developed procurement contracts. Proficiency and availability of multidisciplinary wound care teams increase product use. The leadership of this segment is further accrued through institutional buying power.

The homecare and long-term care facilities segment is expected to witness the fastest growth in the market over the forecast period, driven by the growing popularity of home-based and outpatient wound management. Patients with long-term problems enjoy convenient dressing solutions that do not need frequent changes. Product pricing is improved by telehealth integration programs and caregiver training programs. Strategies of cost containment also promote decentralization of wound care services.

Distribution Channel Insights

How the Medical Distributors and Wholesalers Segment Dominated the Market?

The medical distributors and wholesalers segment held the largest revenue share of approximately 45% in the market in 2025, as these distribution channels make supply chain operations effective and extensive in geographical coverage. Large-volume purchase contracts with hospitals make their presence stronger in the market. Well-established networks of logistics ensure sterility and timely supply. Medical distributors and wholesalers are highly preferred due to the long-term relationship with manufacturers.

The retail/E-commerce segment is expected to gain the highest impregnated foam dressing market share between 2026 and 2035. Online health systems are enhancing access to high-end wound care products. Purchasing trends are changing distribution patterns to direct-to-consumer purchasing trends. The presence of chronic wound patients with care management increases patient convenience. The increasing confidence in the online procurement platforms facilitates the segment's growth.

Pricing/Purchase Model Insights

Why Did the Per-unit/Per-dressing Pricing Segment Dominate the Market?

The per-unit/per-dressing pricing segment held a major revenue share of approximately 68% in the market in 2025. Most health practitioners buy dressings separately, depending on patient needs. The model gives flexibility in procurement and easy budgeting. This structure is favored by hospitals in the routine wound care inventory management. Buys are based on transparent cost-per-dressing calculations.

The bundled kits and value-added services segment is expected to show the fastest growth over the forecast period. These packages are combination packages including dressings and complementary wound care supplies or digital monitoring devices. Providers have access to easier procurement and standard treatment protocols. Trends of value-based healthcare promote full-service provision. The adoption is boosted due to the changes in care paradigms, where an outcome-driven model is the central one.

Material and Impregnant Insights

Which Material and Impregnant Segment Dominated the Impregnated Foam Dressing Market?

The silver + foam segment accounted for a considerable revenue share of approximately 38% in the market in 2025, driven by the strong antimicrobial effect that promotes the management of infections in acute and chronic wounds. Drug delivery technology improves treatment therapy. Physician confidence is strengthened by long usage and clinical validation. Good outcomes that are heavily evidence-based keep it at the top.

The bioactive/growth factor-impregnated segment is expected to expand rapidly in the market in the coming years. These products stimulate the proliferation of cells and tissues. The growing attention to the higher-order regenerative wound care facilitates its quick uptake. Biologically active formulations are innovated to promote the healing rate. Increasing clinical research impacts the expansion of the segment.

Regional Insights

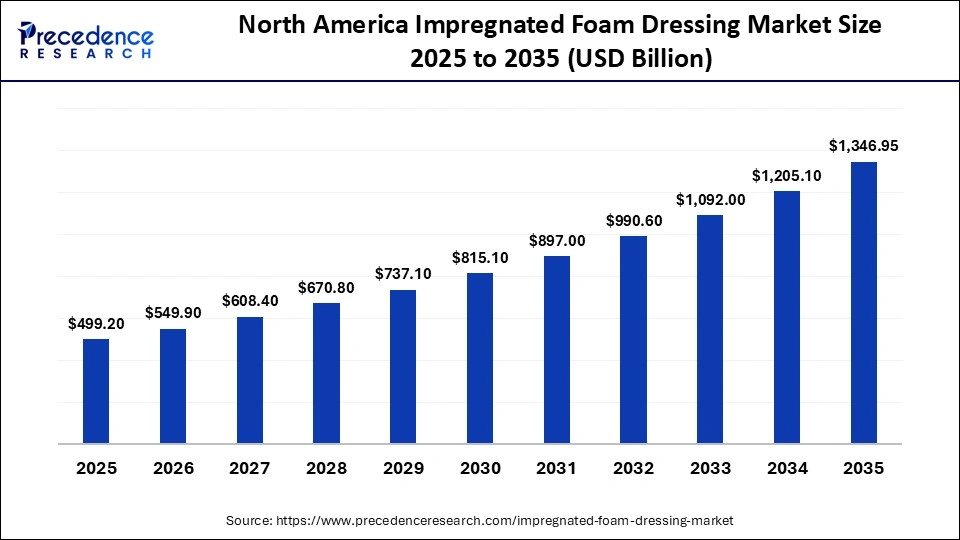

How Big is the North America Impregnated Foam Dressing Market Size?

The North America impregnated foam dressing market size is estimated at USD 499.20 million in 2025 and is projected to reach approximately USD 1,346.95 million by 2035, with a 10.44% CAGR from 2026 to 2035.

Why North America Dominated the Impregnated Foam Dressing Market?

North America dominated the global market with a share of approximately 39% in 2025, driven by high healthcare expenditure and growing awareness of the advanced wound management solutions. The presence of dominant wound care manufacturers enhances innovation and product availability. The use of advanced reimbursement systems promotes the use of premium dressings. The demand is further increased by the growing prevalence of chronic diseases. Well-developed clinical infrastructure and uniform treatment guidelines strengthen market growth.

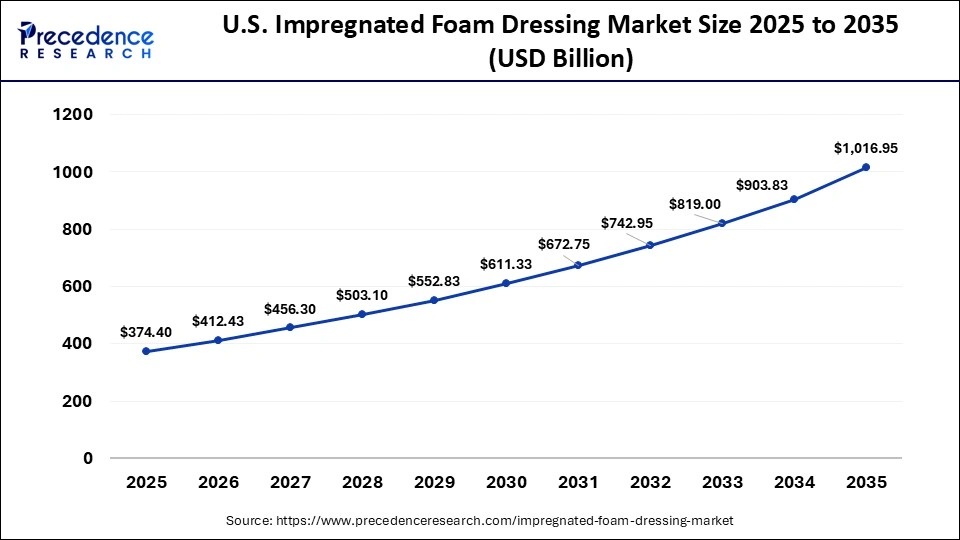

What is the Size of the U.S. Impregnated Foam Dressing Market?

The U.S. impregnated foam dressing market size is calculated at USD 374.40 million in 2025 and is expected to reach nearly USD 1,016.95 million in 2035, accelerating at a strong CAGR of 10.51% between 2026 and 2035.

U.S. Country-Level Analysis

On the country level, the U.S. takes the biggest portion in North America because of its massive number of patients and well-developed healthcare centers. There is high utilization of antimicrobial and bioactive dressings in both outpatient centers and hospitals. Canada is another country that makes consistent contributions, supported by publicly funded healthcare systems and the growing geriatric populations. Infection prevention and quality care standards are among the main focuses of both countries.

How is Asia-Pacific Growing in the Impregnated Foam Dressing Market?

Asia-Pacific is expected to witness the fastest growth with a CAGR of approximately 10.5% during the predicted timeframe. The rapidly expanding healthcare sector and the high rate of urbanization are creating the need to use new wound care products. The rise in diabetes cases and an increase in surgical operations are some of the factors that cause chronic and acute wounds. Increased knowledge of infection control is driving the uptake of impregnated foam dressings. Healthcare access and insurance coverage are also improved, which is one more stimulus to growth. An increase in local manufacturing also helps in the expansion of the regional markets.

Country-Level Analysis

China is a significant engine of growth at the country level because of increased investments in healthcare and a significant number of patients. India is in steady growth due to rising incidences of diabetes and the development of private medical systems. Japan has a good demand that is backed by its aging population. Nations in Southeast Asia are slowly enhancing hospital infrastructure and wound awareness. All these are making Asia-Pacific the most vibrant regional market.

Impregnated Foam Dressing MarketValue Chain Analysis

- Research and Development

In the creation of new foam matrices with a better absorption rate, durability, and the controlled release of antimicrobials, research has a significant ground-breaking role. Firms conduct research in the field of multi- functional properties, including odor control and pain reduction.

Key Players: Smith + Nephew, Molnlycke Health Care, 3M Health Care, ConvaTec Group, Coloplast.

- Clinical Trials and Regulatory Approvals

Clinical assessment guarantees the safety of products, antimicrobial efficacies, and adherence to regulations. In the real-world clinical setting, trials determine healing rates, infection control performance, and patient comfort. Regulatory approval processes also differ depending on the region, necessitating strong clinical evidence.

Key Players: 3M, ConvaTec, Smith + Nephew, Medline Industries, Hartmann Group.

- Formulation and Final Dosage Preparation

The manufacturing process includes the use of specific impregnation of foam substrates with active components like silver ions or iodine compounds. Modern production technologies are aimed at increasing the scale, but without compromising sterility standards.

Key players: Molnlycke Health Care, Coloplast, Paul Hartmann AG, DermaRite Industries, Advancis Medical.

- Distribution to Hospitals, Pharmacies

Distribution channels encompass direct hospital-supplying contracts and retail pharmacy channels. E-commerce sites are slowly creating wider access to high-quality wound care products. Effective logistics systems are also required to ensure sterility and product availability on time.

Key players: Cardinal Health, McKesson Corporation, Owens and Minor, Medline Industries, and Henry Schein.

- Patient Support and Services

Patient support and services involve wound care education, home-care guidance, and online monitoring technologies to enhance treatment adherence. Firms provide telehealth care and train caregivers and patients with chronic wounds on how to manage their wounds at home.

Key Players: Smith +Nephew, Molnlycke Health Care, ConvaTec, Coloplast, 3M Health Care.

Who are the Major Players in the Global Impregnated Foam Dressing Market?

The major players in the impregnated foam dressing market include Smith and Nephew, Coloplast, 3M, ConvaTec, Acelity, Medline Industries, Cardinal Health, B.Braun, Medtronic, Hollister, Paul Hartmann, Top-medical, Lohmann and Rauscher, Winner Medical, Derma Sciences, Hartmann, ActivHeal, and HandR Healthcare.

Recent Developments

- In October 2025, Smith+Nephew announced the launch of ALLEVYN COMPLETE CARE 5-layer foam dressing in the U.S., with plans to expand internationally in 2026. The dressing is designed to capture and dissipate shear forces, which helps in the elimination of pressure injuries among vulnerable patients. (Source: https://www.smith-nephew.com)

- In September 2024, Solventum announced the launch of the V.A.C. Peel and Place Dressing, an integrated dressing and drape that can be applied in less than 2 minutes and worn by patients for up to 7 days. The dressing features a built-in perforated, non-adherent layer that reduces tissue ingrowth and makes dressing removal less painful. (Source: https://www.prnewswire.com)

Segments Covered in the Report

By Product/Dressing Type

- Silver-impregnated Foam Dressings

- Iodine-impregnated Foam Dressings

- Hydrogel-impregnated Foam Dressings

- Antimicrobial/CHG-impregnated Foam

- Other Impregnated Variants (growth factors, alginate blends)

By Foam Technology/Structure

- Polyurethane Foam (Hydrophilic)

- Polyether Foam

- Composite Foam Laminates

- Other Advanced Foam Architectures

By Wound Type/Application

- Chronic Wounds (Diabetic Foot Ulcers, Venous Leg Ulcers, Pressure Ulcers)

- Acute Wounds (Surgical, Traumatic)

- Burns

- Other (Dermatological, Post-op sites)

By End User

- Hospitals & Wound Care Centers

- Ambulatory Surgical Centers (ASCs) & Clinics

- Homecare & Long-term Care Facilities

- Retail/OTC Channels

By Distribution Channel

- Medical Distributors & Wholesalers

- Direct Sales (Manufacturers to Hospitals/Chains)

- Retail/Pharmacy & E-commerce

- Others (Tender/Government Supply)

By Pricing/Purchase Model

- Per-unit/Per-dressing Pricing

- Contract/Tender Supply Agreements

- Bundled Kits & Value-added Services

- Service/Outcome-linked Contracts

By Material & Impregnant

- Silver + Foam

- Iodine + Foam

- Hydrogel + Foam

- Antimicrobial (CHG/BPO) + Foam

- Bioactive/Growth Factor-impregnated

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting