In-flight Catering Market Size and Forecast 2025 to 2034

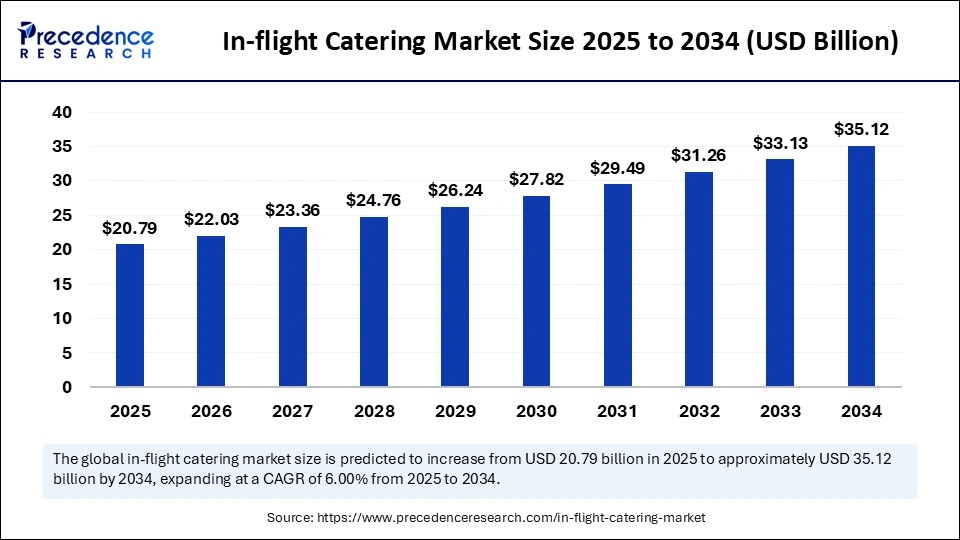

The global in-flight catering market size accounted for USD 19.61 billion in 2024 and is predicted to increase from USD 20.79 billion in 2025 to approximately USD 35.12 billion by 2034, expanding at a CAGR of 6% from 2025 to 2034. The increasing air travel demand and the rising requirements to improve passenger experience drive the growth of the market.

In-flight Catering Market Key Takeaways

- In terms of revenue, the in-flight catering market is valued at $20.79 billion in 2025.

- It is projected to reach $35.12 billion by 2034.

- The market is expected to grow at a CAGR of 6% from 2025 to 2034.

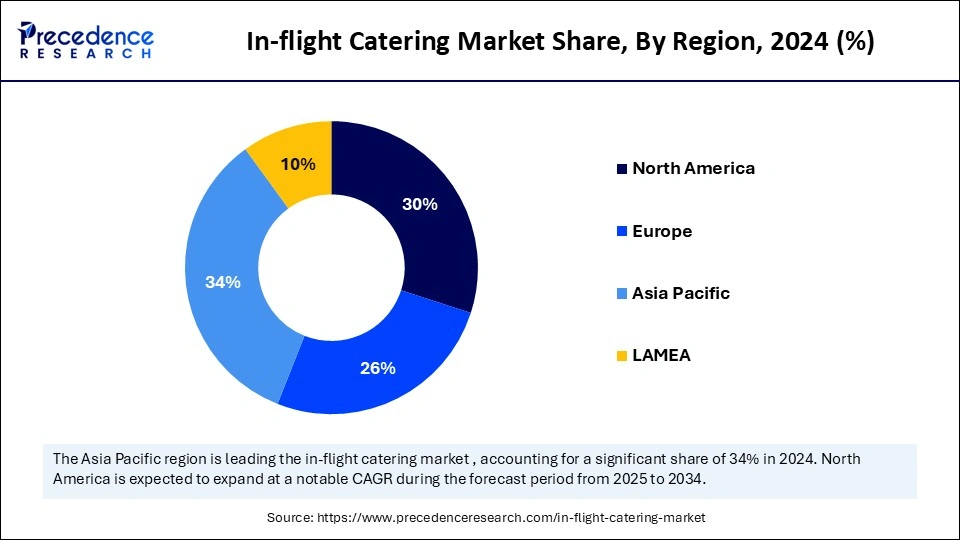

- Asia Pacific dominated the market with the largest share of 34% in 2024.

- Europe is expected to grow at a CAGR of 6.6% during the forecast period.

- By flight type, the full-service carrier segment held the major market share 73% in 2024.

- By flight type, the low-cost carrier segment is projected to grow at a significant rate in the coming years.

- By airline, the large airlines segment contributed the highest share of 66% in 2024.

- By airline, the medium airlines segment is expected to grow at a CAGR of 6.5% during the forecast period.

- By airline class, the economy segment accounted for the biggest market share of 62% in 2024.

- By airline class, the premium economy segment is growing at a CAGR of 9.6% during the forecast period.

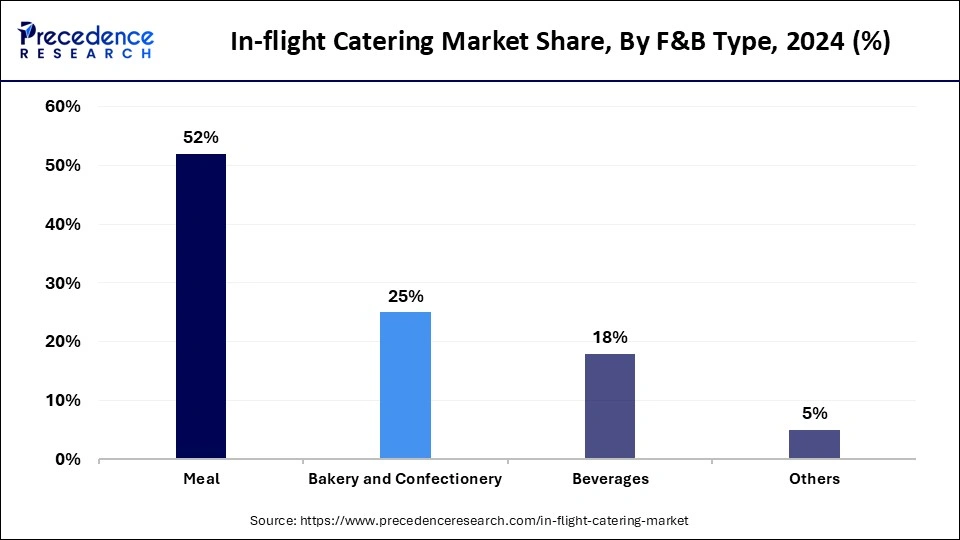

- By F&B type, the meal segment generated the largest market share of 52% in 2024.

- By F&B type, the bakery and confectionery segment is expected to grow at a CAGR of 7% between 2025 and 2034.

Can AI Enhance Food Safety and Hygiene Standards in Airline Catering Kitchens?

Enhancing food safety and hygiene in airline catering kitchens is becoming more and more dependent on artificial intelligence (AI). AI can keep an eye on vital appliances like ovens and refrigerators by combining internet of things IoT sensors withpredictive analytics, guaranteeing that they operate effectively and maintain the right temperature. Food contamination and spoilage are less likely as a result. Furthermore, AI-driven computer vision systems can monitor kitchen settings in real-time, guaranteeing that employees adhere to hygienic practices like hand washing, glove wear, and cross-contamination prevention, all of which are critical for upholding strict safety regulations in the mass food industries.

AI enhances transparency and traceability throughout the food supply chain. AI systems can analyze large datasets to identify contamination risks early and facilitate quick corrective action from sourcing ingredients to meal assembly. For example, machine learning-powered smart imaging technologies can identify visual irregularities in prepared meals, preventing passengers from receiving subpar food. In addition, AI helps airline catering businesses adhere to international food safety standards and boost operational effectiveness. AI offers a multi-layered defense against violations of food safety in airline catering.

Asia Pacific In-flight Catering Market Size and Growth 2025 to 2034

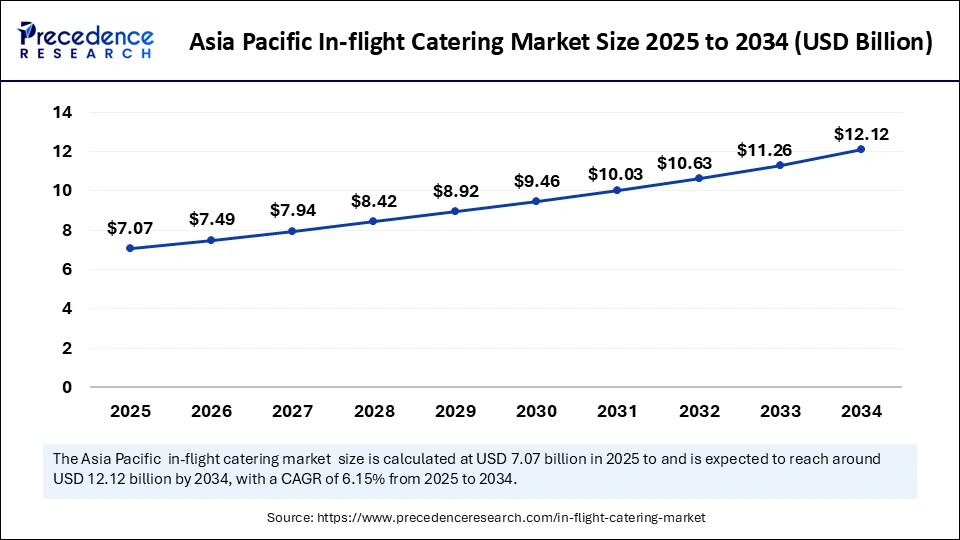

The Asia Pacific in-flight catering market size was exhibited at USD 6.67 billion in 2024 and is projected to be worth around USD 12.12 billion by 2034, growing at a CAGR of 6.15% from 2025 to 2034.

Asia Pacific dominated the in-flight catering market with the largest share in 2024 because of increased air travel and the quick expansion of low-cost and full-service airlines. Emerging countries such as China, Japan, Singapore, and India have expanded their domestic and international routes in the last few years. High-quality in-flight meal services are a hallmark of airlines like Singapore Airlines, Cathay Pacific, and ANA, which frequently highlight local cuisine to improve traveler experience. Furthermore, the government's efforts to upgrade aviation infrastructure and rising consumer disposable income significantly bolstered the demand for catering services. The availability of top local caters, such as SATS Ltd and TajSATS, have invested heavily in innovative technologies to expand their operations.

Europe is expected to expand at the fastest CAGR during the forecast period. The growth of the market in the region can be attributed to strong demand for premium travel, rising tourism, and an increase in the frequency of travel. In-flight meals from full-service airlines such as Lufthansa, Air France, and British Airways are becoming more sustainable, as these airlines are focusing on locally sourced and gourmet options. Many European airlines are implementing eco-friendly packaging and zero-waste catering procedures due to a strong emphasis on environmental responsibility. Food waste and expenses are being decreased in the region by the growing use of advanced technologies, such as AI-based inventory management and digital preordering. New airline partnerships with boutique food brands or celebrity chefs are facilitating elevated passenger expectations and rapid growth.

North America is expected to witness notable growth in the in-flight catering market in the coming years. This is mainly due to the high number of domestic flights. There is a rising demand for gourmet snacks, foods, baked goods, and beverages. Personalized, preorder meals are also becoming more popular, particularly in premium cabins, and are backed by airline loyalty programs and smartphone apps. Large airlines in the U.S. are operated by catering companies like Gate Gourmet and LSG Sky Chefs, enabling the distribution and production of food on a large scale. North American carriers are increasingly concentrating on sustainable, nutritious meal options and dietary customization to stand out in a crowded market.

Market Overview

The in-flight catering market has been witnessing significant growth, driven by the aviation sector's explosive growth and the rise in both domestic and international passengers. Airlines are improving their food and beverage offerings to increase customer loyalty, differentiate their brand, and improve customer satisfaction. The need for individualized, superior, and varied meal options that satisfy different dietary requirements has increased.

Technological developments and strategic alliances between airlines and caterers are also shaping the market landscape. Advancements like meal ordering platforms, eco-friendly packaging, and better food preservation techniques have all contributed to the effectiveness and allure of in-flight dining. Furthermore, the increasing focus on health and wellness encourages airlines to offer healthier and more organic meal options, contributing to market growth.

In-flight Catering Market Growth Factors

- Rising Air Passenger Traffic: Increased global travel, especially in emerging economies, is driving the demand for onboard food services. This rise is fueled by growing disposable incomes and improved connectivity across regions.

- Enhanced Passenger Expectations: Travelers now expect better quality, variety, and personalization in in-flight meals. This trend is particularly evident in premium and long-haul segments.

- Airline Differentiation Strategy: Airlines use premium catering services to stand out in a competitive market and enhance brand loyalty. Unique meal offerings are now part of the overall passenger experience strategy.

- Technological Advancements: Innovations like pre-booked meals. AI-based inventory management, and eco-friendly packaging support efficiency and appeal. These technologies also help reduce food waste and improve operational accuracy.

- Expansion of Low-cost Carriers: Budget airlines increasingly offer optional meal services, contributing to overall market growth. This adds to a revenue stream while catering to evolving passenger preferences.

- Strategic Partnerships: Collaborations between airlines and catering companies help streamline operations and improve quality. These partnerships also support innovations and cost efficiency in menu development.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 35.12 Billion |

| Market Size in 2025 | USD 20.79 Billion |

| Market Size in 2024 | USD 19.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Flight Type, Airline, Airline Class, F&B Type and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market dynamics

Drivers

Growth in the Global Aviation Industry

Onboard catering services are in greater demand due to the ongoing expansion of airline networks and the addition of new routes, which drives the growth of the in-flight catering market. There is a direct correlation between the number of flights and the demand for catering. AirAsia and IndiGo Airlines, for example, have quickly increased their destinations and fleets throughout Asia in the last few years. Basic catering is becoming available on even short-haul flights as regional connectivity improves, which raises the volume of service provided overall. Government investments in airport infrastructure are fueling growth in developing markets like Africa and India. As a result, businesses such as Gate Gourmet and Dnata are expanding their production kitchens near airport hubs.

Rising Tourism and Business Activities

Meal consumption on flights is rising due to an increase in leisure and business travel worldwide. This is particularly important in areas like the Middle East and Asia Pacific. Both domestic and international travel have increased because of the post-pandemic recovery. The demand for travel to business hubs like Dubai, Singapore, and New York has returned to its pre-pandemic level. Consequently, airlines such as Turkish Airlines and Lufthansa are expanding their flight schedules and improving their catering offerings. In response to this trend, catering companies like LSG Sky Chefs are providing more scalable and flexible options.

Restraints

High Operational Cost

In-flight catering involves significant costs in food sourcing, preparation, packaging, and logistics, which hampers the growth of the in-flight catering market. The need for freshness, quality, and compliance with aviation standards adds to the cost. Companies like LSG Sky Chefs and Dnata face increased fuel costs, labor shortages, and supply chain distribution. Costs for raw materials and transportation are further raised by inflation and exchange rate changes. Particularly for low-cost airlines attempting to maintain low fares, these high expenses frequently reduce profit margins. One of the industry's biggest challenges is still striking a balance between cost-effectiveness and high-quality service. Additionally, last-minute flight delays or menu changes may incur extra logistical costs.

Food Waste and Inventory Management Challenges

Food waste and inventory management challenges hinder the growth of the in-flight catering market. Food shortages or waste frequently result from the difficulty of accurately forecasting meal demand per flight. Passengers may be unhappy if their preferred meals are not served, particularly in first-class cabins. To cut down on these inefficiencies, Newrest makes significant investments in technology. Waste issues are exacerbated by short food shelf lives, flight delays, and last-minute cancellations. A constant battle is striking a balance between variety and overproduction. Overstocking also raises the risk of food spoiling and shortage expenses.

- In March 2023, Lufthansa launched an AI-powered tool designed to predict meal demand with greater accuracy, aimed at reducing food waste. The system integrates with its catering partners to monitor passenger preferences in real time, allowing for better meal preparation planning. By aligning demand with available meals, the initiative seeks to lower operational costs tied to overproduction, which had previously led to significant food waste.

Opportunities

Sustainability Initiatives

The growing focus on sustainable practices is likely to create immense opportunities in the in-flight catering market. As environmental regulations and concerns have grown, sustainability has become a major field of focus. Airlines and catering businesses are making investments in locally sourced food and eco-friendly packaging. They are also focusing on reducing food waste. In addition to lessening their negative effects on the environment, sustainability initiatives attract eco-aware passengers who favor airlines that share their values.

- In January 2024, Air France rolled out its "zero-waste" catering program, focusing on reducing the amount of food waste generated on its flights. The airline partnered with its catering suppliers to introduce compostable packaging and minimized food waste through better forecasting and on-demand meal offerings. The initiative targets select European routes, with plans to expand globally, reinforcing Air France's commitment to sustainability.

Personalized Meal Selection

The trend of personalization of in-flight meals is rising, which gives travelers the chance to tailor their meals to their dietary requirements or health objectives and offers airlines special changes to enhance customer satisfaction. In February 2024, British Airways launched a new service for first-class passengers, allowing them to pre-order customized meals up to 72 hours before their flight. Through its app, passengers can choose from various gourmet options, including vegetarian, vegan, and gluten-free, tailored to their dietary needs. This feature allows the airline to reduce waste while enhancing the dining experience, allowing passengers to curate meals to their taste.

Flight Type Insights

The full-service carrier segment held the largest share of the in-flight catering market in 2024 because it provides a wide range of meals in first-class, business, and economy cabins. To provide top-notch meals and improve the overall travel experience, fill-service carriers frequently work with fine dining chefs and upscale catering businesses. Airlines such as Qatar Airways and ANA have responded to changing passenger tastes by introducing wellness-focused menus and regional specialties. Additionally, FSCs provide more options for meal customization and pre-selection, which raises client retention and satisfaction. Their emphasis on long-haul international routes also raises the demand for complex and multi-meal services, bolstering the segment's growth.

The low-cost carrier segment is projected to grow at a significant rate in the coming years. The growth of the segment is attributed to the rising affordability of air travel, particularly in emerging markets. Nowadays, LCCs are investing in ancillary revenue streams like onboard meals by providing pre-booked meal services, branded snacks, and à la carte menu options. To reduce waste and increase efficiency, airlines such as IndiGo (India) and easyJet (Europe) have implemented mobile app integrations that allow passengers to personalize and pre-order meals. Additionally, LCCs can offer fresh regional dishes at competitive prices thanks to partnerships with cloud kitchens and local food brands. Additionally, the growth of high-frequency and short-haul flights is driving the demand for quick-service compact meal models that cater to travelers with limited budgets.

Airline Insights

The large airlines segment dominated the in-flight catering market with the largest share in 2024 due to their robust brand alliances, long-haul routes, and vast worldwide network. Usually, these airlines provide meal services for several cabin classes, including first-class and business-class. Large airlines, such as Singapore Airlines Emirates and Delta, have long-term agreements with international catering leaders like LSG Sky Chefs and Gate Gourmet to ensure consistent quality throughout their routes. Large airlines often have dedicated catering units. They have a competitive edge because of their capacity to fund technological advancements in food service sustainability projects and innovative cooking. Large airlines also frequently set the standard for industry trends like AI-based meal forecasting and zero-waste initiatives, which strengthens their position as leaders.

The medium airlines segment is expected to grow at a significant rate during the forecast period, driven by their adaptability, regional reach, and growing global aspirations. Particularly on medium-haul routes, these airlines are rapidly raising the caliber of their catering in response to passenger expectations. To improve the passenger experience, medium airlines like Vistara (India) and Copa Airlines (Latin America) have implemented improved meal services and pre-booking options. Many medium airlines collaborate with nearby food vendors and cloud kitchens to provide culturally appropriate meals while controlling expenses. Additionally, medium-sized airlines are more receptive to developments that facilitate their quick expansion. They are incorporating digital menu access solutions and real-time passenger feedback systems. They are establishing themselves as major participants in the evolving in-flight catering market thanks to their ability to strike a balance between quality and affordability.

Airline Class Insights

The economy segment led the in-flight catering market with the largest share in 2024 due to the increased volume of passengers flying in this category. Airlines concentrate on providing standardized, reasonably priced meals that satisfy a range of regional preferences. Depending on the route and carrier model, airlines such as American Airlines, IndiGo, and Ryanair provide a combination of free and buy-on-board options. Although meal service has been simplified, demand remains consistently high due to high passenger traffic on short- and medium-haul routes. A lot of airlines are also implementing technologically advanced pre-ordering systems in economy cabins to cut down on waste and boost customer satisfaction. Carriers can also minimize expenses while preserving operational effectiveness by using bulk catering in the economy.

The premium economy segment is anticipated to grow at the fastest rate during the forecast period because luxury travel is becoming more and more popular, particularly on long-distance and international routes. This group of passengers anticipates individualized excellent meals with several course options that are frequently prepared using ingredients that are sourced locally or by celebrity chefs. Airlines such as Singapore Airlines, Japan Airlines, and Qatar Airways have invested significantly in fine dining experiences, including wine pairings and on-demand meal services. High-spending leisure travelers and increased business travel drive innovation and value addition in this market. Rapid growth in this category is being driven by premium plating presentation real-time customization options and the use of AI to track passenger preferences. This trend has been further accelerated by the renewed emphasis on premium services brought about by the post-pandemic recovery.

F&B Type Insights

The meal segment held the largest share of the in-flight catering market in 2024. To accommodate varying dietary and cultural preferences, meals usually consist of a main course, side dishes, salads, and desserts. The onboard experience is improved by airlines such as Emirates Lufthansa and Cathay Pacific, which provide regionally tailored meals that are based on passenger demographics and route profiles. Airlines are also being forced to expand their menus in response to the rising demand for vegetarian, vegan, gluten-free, and halal/kosher food. More and more full-service carriers are working with famous chefs and nutritionists to create aesthetically pleasing, well-balanced meals that satisfy health and taste requirements. Furthermore, freshness and uniformity in large-scale meal service are guaranteed by the application of intelligent packaging and reheating technologies.

The bakery & confectionery segment is expected to grow at the fastest rate in the upcoming period due to the increase in the demand for gourmet snack options. Light snacks like muffins, croissants, cookies, chocolates, and pastries are preferred by passengers as convenient meal substitutes or add-ons, particularly on short-haul or low-cost flights. For shorter flights, airlines like JetBlue and Qantas have increased passenger satisfaction by adding artisanal baked goods and high-end confectionery to their snack menus. Furthermore, without significantly increasing costs, branded partnerships with well-known brands like Godiva Lotus Biscoff or neighborhood bakeries contribute to creating a memorable experience. The rise in popularity of healthier snacks like gluten-free sweets and low-sugar bars also helps the market. All airline types are seeing an increase in this category due to growing preferences for customization and mid-flight snacking.

In-flight Catering Market Companies

- ANA HOLDINGS INC.

- dnata

- DO & CO Aktiengesellschaft

- Emirates Flight Catering

- Flying Food Group, LLC

- Gate Group (Gate Gourmet)

- LSG Lufthansa Service Holdings AG

- Newrest International Group

- SATS Ltd.

- Servair SA

Recent Development

- In September 2024, KLM implemented an artificial intelligence (AI) system, developed in collaboration with Kickstart AI, to optimize meal planning and reduce waste in its in-flight catering services. By forecasting passenger numbers more effectively, this system minimizes excess meal preparation, aligning with sustainability goals while maintaining service quality.

Segments Covered in the Report

By Flight Type

- Full-Service Carrier

- Low-Cost Carrier

- Other

By Airline

- Large Airlines

- Medium Airlines

- Small Airlines

By Airline Class

- Economy

- Premium Economy

- Business

- First Class

By F&B Type

- Meal

- Bakery & Confectionery

- Beverages

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting