Inactivated Vaccines Market Size and Forecast 2025 to 2034

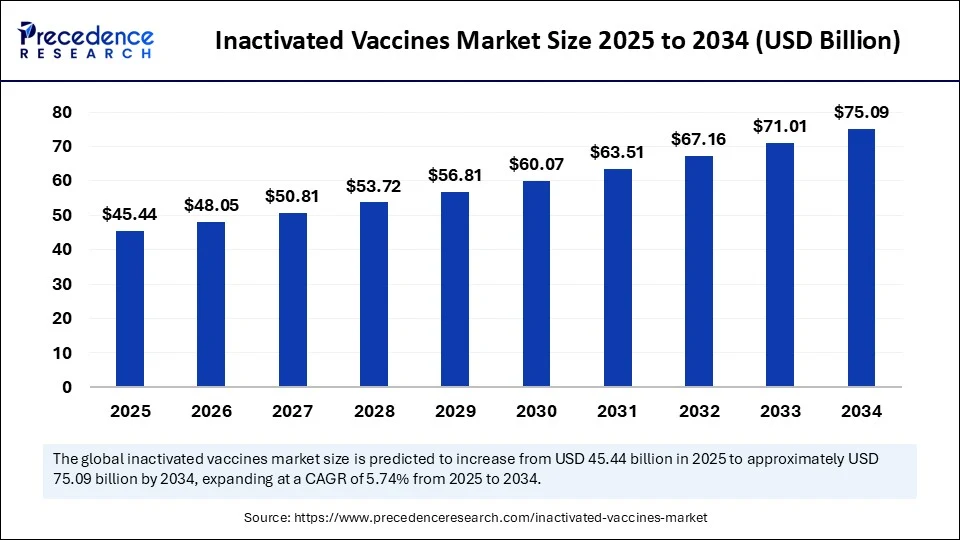

The global inactivated vaccines market size accounted for USD 42.97 billion in 2024 and is predicted to increase from USD 45.44 billion in 2025 to approximately USD 75.09 billion by 2034, expanding at a CAGR of 5.74% from 2025 to 2034. The market is experiencing significant growth due to an increasing emphasis on preventive healthcare and the rising incidence of infectious diseases. The market growth is further fueled by the proven safety, stability, and suitability of inactivated vaccines for immunocompromised individuals. Additionally, ongoing advancements in vaccine manufacturing and government immunization programs are expected to support continued market growth.

Inactivated Vaccines MarketKey Takeaways

- In terms of revenue, the global inactivated vaccines market was valued at USD 42.97 billion in 2024.

- It is projected to reach USD 75.09 billion by 2034.

- The market is expected to grow at a CAGR of 5.74% from 2025 to 2034.

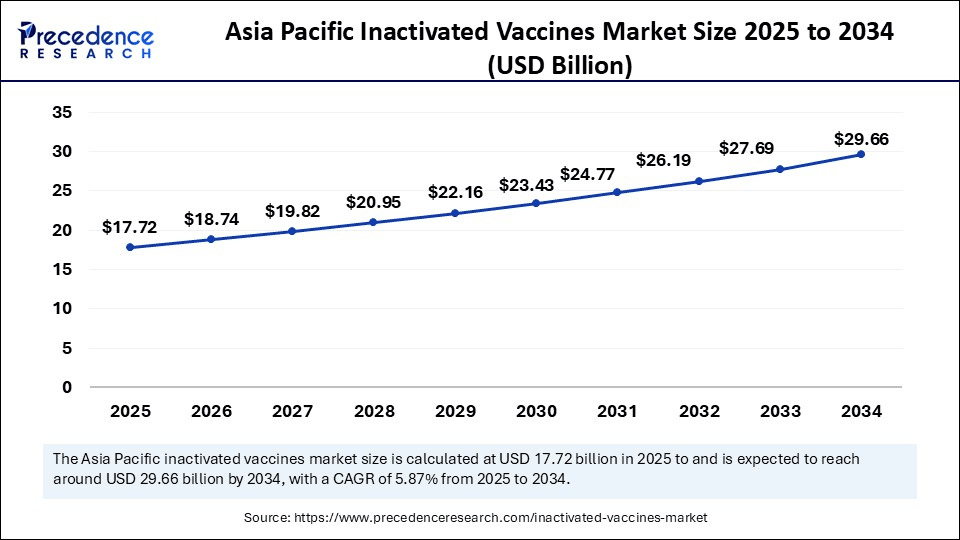

- Asia Pacific dominated the inactivated vaccines market with the largest share of 39% in 2024.

- The Middle East & Africa is expected to grow at a significant CAGR from 2025 to 2034.

- By vaccine type, the whole virus inactivated vaccines segment held the major market share of 46% in 2024.

- By vaccine type, the subunit inactivated vaccines segment is projected to grow at the highest CAGR between 2025 and 2034.

- By disease indication, the polio segment captured the biggest market share of 27% in 2024.

- By disease indication, the COVID-19 segment is likely to expand at a significant CAGR from 2025 to 2034.

- By age group, the pediatrics (0–18 years) segment contributed the largest market share of 63% in 2024.

By age group, the geriatrics segment is anticipated to grow at a significant CAGR from 2025 to 2034. - By end user, the public immunization programs segment generated the major market share of 68% in 2024.

- By end user, the travel & occupational health centers segment is expected to grow at a significant CAGR over the projected period.

- By distribution channel, the government supply contracts segment led the market in 2024.

- By distribution channel, the direct institutional sales segment is expected to grow at a significant CAGR from 2025 to 2034.

How is AI Impacting the Inactivated Vaccines Market?

Artificial intelligence (AI) is transforming the inactivated vaccines market by significantly reducing development timelines through streamlining antigen discovery, optimizing vaccine design, and improving preclinical and clinical testing efficiency. AI algorithms simulate interactions between antigens and the immune system, aiding in designing immunogens that provoke robust, specific responses. AI also improves clinical trial procedures by enabling faster patient recruitment, predicting adverse reactions, and facilitating adaptive protocols based on real-time data, speeding up approval. Post-deployment, AI monitors safety and effectiveness by analyzing real-world data from electronic health records, social media, and adverse event reports.

Asia Pacific Inactivated Vaccines Market Size and Growth 2025 to 2034

The Asia Pacific inactivated vaccines market size was exhibited at USD 16.76 billion in 2024 and is projected to be worth around USD 29.66 billion by 2034, growing at a CAGR of 5.87% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Inactivated Vaccines Market in 2024?

Asia Pacific dominated the inactivated vaccines market while holding the largest share in 2024. This is mainly due to the increased government immunization programs and the large population in countries like China and India, which created high demand for vaccines. Countries such as India and China have been heavily investing in their biotech and pharmaceutical industries, enabling large-scale, cost-effective production. Governments around the region are actively investing in healthcare infrastructure, launching national immunization programs, and supporting vaccine research and development, fostering a favorable environment for manufacturers. The high prevalence of infectious diseases in the region further drives demand for both preventive and therapeutic vaccines. Investments in vaccine technology and manufacturing are improving affordability and efficiency.

- In January 2024, Indian Immunologicals Ltd. (IIL) launched India's first indigenously developed hepatitis A vaccine, Havisure, marking a significant step forward in India's fight against hepatitis A and promising to make a substantial contribution to public health. The vaccine is the result of extensive research and development by IIL's dedicated team.

(Source: https://www.business-standard.com)

China Inactivated Vaccines Market Trends

China remains a major player in the market due to its extensive R&D and manufacturing capabilities, especially demonstrated during the COVID-19 pandemic with vaccines like CoronaVac and BBIBP-CorV. While traditionally relying on inactivated vaccine technology, China's vaccine industry is exploring newer approaches while maintaining a critical role in meeting domestic and global needs, particularly in developing countries, due to its established infrastructure and ongoing advancements.

What Makes the Middle East & Africa the Fastest-Growing Region in the Inactivated Vaccines Market?

The Middle East & Africa is the fastest-growing region within the global market, driven by a rising disease burden from illnesses like influenza, polio, hepatitis A, and typhoid, which increase demand for inactivated vaccines. Improvements in manufacturing, such as better storage solutions and faster production, are making these vaccines more accessible and affordable. Additionally, the expansion of public health infrastructure, especially in countries like the UAE, Saudi Arabia, South Africa, Nigeria, and Egypt, helps improve vaccine distribution and availability. Collaborations with global organizations like the Gavi Vaccine Alliance further support the region's immunization efforts.

UAE Inactivated Vaccines Market Trends

UAE is emerging as a key player in the market, focusing on both local needs and international cooperation. During the COVID-19 pandemic, the UAE partnered with Sinopharm for the world's first Phase III clinical trial of an inactivated vaccine and subsequently launched a joint venture to produce Hayat-Vax, the first COVID-19 vaccine made in the Arab world. Notably, a new regional vaccine distribution hub in Abu Dhabi, created through a collaboration between the Department of Health, Abu Dhabi, and GSK, aims to improve vaccine access and resilience across the region, utilizing the UAE's strategic position and advanced cold-chain logistics infrastructure.

Why is Europe Considered a Notable Market for Inactivated Vaccines?

Europe is expected to experience significant growth in the coming years, mainly due to the rising prevalence of infectious diseases and strong healthcare infrastructure. Governments of various European countries are making efforts to promote vaccination. Rising vaccination campaigns and partnerships aimed at increasing vaccine access across Europe further support regional market growth. Public health campaigns and initiatives play a vital role in encouraging vaccination and addressing safety and efficacy concerns.

What Opportunities Exist in North America for the Inactivated Vaccines Market?

There is a significant opportunity for market expansion in North America. This is mainly due to the increasing occurrence of infectious diseases, greater awareness of vaccination benefits, and technological advances in vaccine development. Companies like SmithKline Beecham have developed multicomponent vaccines. Additionally, biotech firms such as MedImmune have collaborated on recombinant vaccines. Government funding and strategic partnerships support vaccination campaigns and improve vaccine access. A strong healthcare system and favorable reimbursement policies ensure widespread vaccine distribution, establishing North America as an emerging market for inactivated vaccines.

What Factors Contribute to the Inactivated Vaccines Market in Latin America?

The market in Latin America is expected to grow due to the high burden of infectious diseases, including influenza, dengue, HPV, hepatitis, and rotavirus infections. Growing public health awareness about vaccination is boosting demand for inactivated vaccines across the region. Governments across Latin America are increasing investments in national immunization programs, and initiatives like the Pan American Health Organization's (PAHO) Revolving Fund help in procuring vaccines affordably. Many countries are working to enhance local vaccine production to reduce reliance on imports and increase self-sufficiency, supporting market growth.

Market Overview

The inactivated vaccines market includes vaccines developed using viruses or bacteria that have been killed or inactivated so they can no longer replicate but still elicit an immune response. Unlike live attenuated vaccines, inactivated vaccines are considered safer for immunocompromised individuals. They are stable, easy to store, and are often used in routine immunization programs. These vaccines are administered in multiple doses and frequently include adjuvants to boost immunity. The market is expanding due to ongoing global vaccination efforts, rising infectious disease rates, investments in pandemic preparedness, technological advances, and supportive government policies.

What are the Key Trends in the Inactivated Vaccines Market?

- Growing Awareness of Immunization: Public health campaigns and educational initiatives are enhancing awareness about the benefits of vaccination, particularly among parents regarding childhood immunization. This has led to a higher demand for vaccines, including inactivated vaccines.

- Advancements in Vaccine Development:Ongoing research and development efforts are aimed at improving the efficacy, safety, and delivery methods of inactivated vaccines. This includes the use of adjuvants and innovative delivery systems, resulting in the development of more effective and convenient options.

- Government Initiatives and Funding:Many governments are implementing national immunization programs and providing funding for vaccine research and development. Supportive policies further contribute to the growth of the inactivated vaccines market.

- Growth in Hospital and Home Care Settings:The increasing number of vaccinations administered in hospitals and the expansion of home care settings are also driving market growth. This is particularly true for pediatric vaccinations, where there is a rising demand for preventive healthcare measures due to the prevalence of infectious diseases.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 75.09 Billion |

| Market Size in 2025 | USD 45.44 Billion |

| Market Size in 2024 | USD 42.97 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.74% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vaccine Type, Disease Indication, Age Group, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Global Prevalence of Infectious Diseases

One of the major factors driving the growth of the inactivated vaccines market is the increasing global prevalence of infectious diseases, such as influenza, polio, and hepatitis. This is amplified by factors such as population growth, urbanization, climate change, and increased travel, which facilitate disease spread. The outbreak of COVID-19 notably boosted the demand for inactivated vaccines like Sinopharm and Sinovac, highlighting their role in outbreak control. Ongoing research, including clinical trials for inactivated vaccines against diseases like Zika and malaria, is driven by the need to address emerging and re-emerging infectious diseases, demonstrating the market's responsiveness to local disease burdens. Moreover, the rising focus on pandemic preparedness propels the growth of the market.

Restraint

Lower Efficacy in Producing a Strong and Long-Lasting Immune Response

A significant restraint in this market is the lower efficacy of inactivated vaccines in producing a strong, long-lasting immune response compared to live attenuated vaccines. This often requires the use of adjuvants and booster shots to maintain protection, leading to multiple doses or the addition of adjuvants for adequate immunity. Many inactivated vaccines rely on adjuvants to enhance their immunogenicity. While effective, adjuvants can increase production complexity and costs. Additionally, high manufacturing and distribution costs can limit access, especially in developing and underdeveloped countries.

Opportunity

Meeting the Growing Demand for Safe and Effective Vaccines

A significant future opportunity for the inactivated vaccines market lies in meeting the growing demand for safe and effective vaccines amid the emergence of new infectious diseases and rising awareness of preventive healthcare. The emergence of new pathogens and the resurgence of controlled diseases drive the need for reliable vaccines, with inactivated vaccines valued for their safety. Innovations in vaccine formulation, delivery systems, and production methods aim to improve immune responses, reduce costs, and increase accessibility. R&D efforts are focused on enhancing vaccine formulations with new adjuvants and delivery methods to boost immunogenicity and protection duration.

Vaccine Type Insights

What Made the Whole Virus Inactivated Vaccines the Dominant Segment in the Inactivated Vaccines Market in 2024?

The whole virus inactivated vaccines segment dominated the market in 2024. This is mainly due to their safety profile, well-established technology, and capacity for mass production. These vaccines, made from killed pathogens, eliminate the risk of causing the disease they target, making them safer for immunocompromised individuals or those with other health conditions. Many countries include whole virus inactivated vaccines for diseases like polio, hepatitis A, and influenza in their national immunization schedules, which further supports their dominance. The straightforward manufacturing process and compatibility of these vaccines with national vaccination programs also contribute to their widespread use.

The subunit inactivated vaccines segment is expected to experience the fastest growth during the forecast period. This is mainly due to their safety profile, effectiveness against various diseases, and increasing demand for preventive healthcare. These vaccines contain only specific, purified antigens from a pathogen, not the whole harmful organism, making them very safe. They are suitable for vulnerable groups like the elderly or those with chronic illnesses. Subunit vaccines can induce strong immune responses by targeting key parts of the pathogen that trigger immunity, proving effective against diseases like hepatitis B, tetanus, diphtheria, shingles, and some cancers.

Disease Indication Insights

How Does the Polio Segment Lead the Inactivated Vaccines Market in 2024?

The polio segment maintained a leading position in 2024, mainly due to ongoing global efforts to eradicate polio and the shift toward using only inactivated poliovirus vaccine (IPV) in routine immunizations, especially in developed nations. This shift was driven by concerns about vaccine-derived polioviruses and the goal to minimize paralysis risks associated with oral polio vaccine (OPV). The WHO launched the Global Polio Eradication Initiative in 1988, intending to eradicate polio worldwide. This initiative has heavily influenced the increased adoption of IPV, particularly in countries that have eliminated or are close to eliminating the disease.

The COVID-19 segment is expected to grow at the fastest rate in the upcoming period, driven by the ongoing pandemic, the need for a booster dose, and the emergence of new variants. The virus keeps mutating, creating variants that may spread more easily or resist current vaccines. This necessitates the development of new or updated vaccines. Vaccine induces immunity over time, and emerging variants require booster doses for continued protection. This ongoing challenge has accelerated vaccine development through unprecedented collaborations and increased public funding.

Age Group Insights

Why Did the Pediatrics (0–18 Years) Segment Dominate the Inactivated Vaccines Market in 2024?

The pediatrics (0–18 years) segment dominated the market in 2024, mainly because children are more susceptible to infectious diseases and comprehensive vaccination programs target this age group. Children's developing immune systems make them particularly vulnerable, prompting widespread immunization efforts to protect these systems, making them a primary target for vaccination. Many countries have established strong national immunization programs specifically aimed at children, ensuring high vaccination coverage rates. Increased awareness among parents and healthcare providers about the benefits of childhood vaccination in preventing serious illnesses and promoting overall health contributes to the high demand for pediatric vaccines.

The geriatrics segment is expected to expand at the fastest CAGR over the projection period, driven by a decline in immune system effectiveness with age, making older adults more vulnerable to infections and less responsive to traditional vaccines. Since older adults often have multiple chronic conditions that can worsen the risk of complications from infectious diseases, this highlights the need for effective vaccines. Coupled with an aging global population and the prevalence of chronic diseases in older adults, this increases demand for specialized, more effective vaccines for this demographic. Growing awareness of the benefits of vaccination in older adults leads to increased demand for preventive measures.

End User Insights

How Does the Public Immunization Programs Segment Dominate the Inactivated Vaccines Market in 2024?

The public immunization programs segment held the dominant market share in 2024, mainly because of their focus on reaching large populations and their ability to address prevalent diseases like influenza, which are managed through these programs by prioritizing widespread, often seasonal, diseases. These programs leverage government support and global health initiatives to ensure broad vaccine access, especially for vulnerable groups such as children. In contrast, private markets may focus on specific, often higher-priced vaccines for niche populations to achieve broader vaccination coverage.

The travel & occupational health centers segment is likely to grow at a rapid pace in the coming years, primarily driven by the rebound in international travel, increased awareness, a focus on preventive healthcare, and convenient, targeted vaccine solutions. Travelers are more aware of region-specific health risks and the importance of preventative measures. The emergence of new pathogens like Zika and Ebola, along with changing disease patterns, requires continuous updates in vaccine recommendations and availability. Digital health platforms and government advisories facilitate access to information on recommended vaccinations and the availability of combination vaccines, streamlining the vaccination process and improving compliance among travelers.

Distribution Channel Insights

Why Did the Government Supply Contracts Segment Dominate the Inactivated Vaccines Market in 2024?

The government supply contracts segment dominated the market in 2024. This is mainly due to their key role in ensuring equitable access, affordability, and large-scale procurement of vaccines, which are crucial, especially for developing countries. Government supply contracts, particularly those facilitated by organizations like UNICEF, Gavi, and the WHO, leverage their purchasing power and global reach to negotiate favorable prices and distribution agreements, delivering vaccines to where they are most needed. Overall, by managing procurement and distribution, these organizations contribute to global health security by preventing outbreaks and controlling disease spread.

The direct institutional sales segment is expected to grow at the highest CAGR during the forecast period, driven by increased government focus on immunization programs, strategic partnerships between manufacturers and healthcare providers, and direct procurement by large institutions like hospitals and public health agencies. This approach minimizes intermediaries, ensuring efficient and timely vaccine access, particularly for large-scale vaccination campaigns. Certain institutions also have specific requirements to overcome vaccine storage, which the direct sales model can meet.

Inactivated Vaccines Market Companies

- Sanofi Pasteur

- GSK plc

- Bharat Biotech (Covaxin, Typbar)

- Sinovac Biotech Ltd.

- Sinopharm (CNBG)

- Serum Institute of India (SII)

- Pfizer Inc.

- Valneva SE

- Moderna, Inc. (expanding into inactivated pipeline)

- Biological E. Limited

- Panacea Biotec Ltd.

- Chumakov Institute of Poliomyelitis and Viral Encephalitides (Russia)

- IDT Biologika

- Emergent BioSolutions

- Novavax, Inc. (subunit but related pipeline)

- Incepta Vaccine Ltd. (Bangladesh)

- Haffkine Bio-Pharmaceutical Corporation Ltd.

- Bio Farma (Indonesia)

- Instituto Butantan (Brazil)

- Walvax Biotechnology Co., Ltd. (China)

Recent Developments

- In July 2025, Sanofi announced it would acquire Vicebio, a biotech company, for up to USD 1.6 billion. This move advances Sanofi's focus on vaccine innovation by bringing in an early-stage vaccine candidate capable of developing next-generation combination vaccines. These vaccines could protect older adults against multiple respiratory viruses through a single shot, supported by Vicebio's Molecular Clamp technology.(Source: https://www.worldpharmaceuticals.net)

- In February 2025, Zydus Lifesciences launched India's first seasonal flu protection vaccine for the year, following the WHO-recommended composition for quadrivalent influenza vaccines. The Quadrivalent Inactivated Influenza vaccine VaxiFlu-4 offers protection against H1N1-like viruses, H3N2-like viruses, B/Victoria lineage, and B/Yamagata lineage strains, covering both influenza A and B, and has been approved by the Central Drug Laboratory (CDL).

(Source: https://www.healthcareradius.in) - In March 2024,Cadila Pharmaceuticals introduced the Cadiflu Tetra Vaccine, a next-generation quadrivalent influenza vaccine aimed at preventing influenza, a widespread and serious viral infection. Approved by DCGI for use in adults and children, it targets four strains of influenza A and B, responsible for seasonal epidemics. The vaccine mimics the virus's outer structure but contains no active genetic material.(Source: https://www.cadilapharma.com)

- In April 2024, Euvichol and Euvichol-Plus inactivated oral cholera vaccines produced by EuBiologicals Co., Ltd received prequalification from the World Health Organization (WHO). The inactivated oral vaccine Euvichol-S has similar effectiveness to existing vaccines but features a simplified formulation, which helps rapidly increase manufacturing capacity. Prequalification is expected to allow a quick boost in production and supply, urgently needed in many communities battling cholera outbreaks.

(Source: https://www.who.int)

Segments Covered in the Report

By Vaccine Type

- Whole Virus Inactivated Vaccines

- Inactivated Polio Vaccine (IPV)

- Rabies Vaccine

- Hepatitis A Vaccine

- Inactivated COVID-19 Vaccines (e.g., Sinovac, Covaxin)

- Split-Virion Inactivated Vaccines

- Subunit Inactivated Vaccines

- Pertussis (aP)

- Influenza (Split Virion, Subunit)

- Tetanus & Diphtheria

- Combination Inactivated Vaccines

- DTP

- DTaP-IPV-HepB-Hib

- Adjuvanted Inactivated Vaccines

By Disease Indication

- Polio

- Influenza

- COVID-19

- Hepatitis A

- Rabies

- Japanese Encephalitis

- Cholera

- Pertussis

- Tick-Borne Encephalitis

- Combination Indications

By Age Group

- Pediatrics (0–18 years)

- Adults

- Geriatrics

- Travelers & At-Risk Populations

By End User

- Public Immunization Programs

- Private Clinics & Hospitals

- Military & Emergency Preparedness

- Travel & Occupational Health Centers

By Distribution Channel

- Government Supply Contracts (e.g., UNICEF, Gavi, WHO)

- Hospital Pharmacies

- Retail Pharmacies

- Direct Institutional Sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting