What is the India Mushroom Market Size?

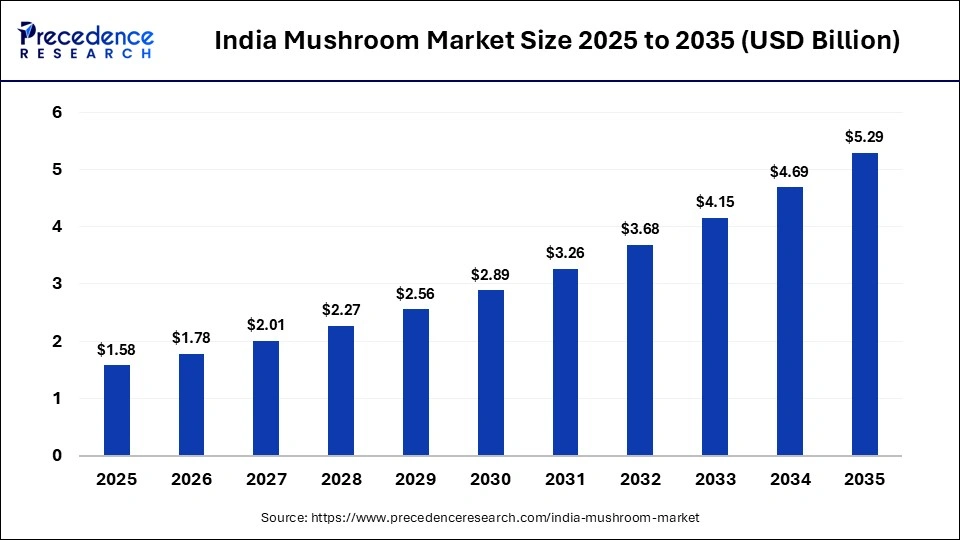

The India mushroom market size accounted for USD 1.58 billion in 2025 and is predicted to increase from USD 1.78 billion in 2026 to approximately USD 5.29 billion by 2035, expanding at a CAGR of 12.84% from 2026 to 2035. The India mushroom market is growing steadily, driven by rising nutrition awareness, growing vegetarian & vegan trends, technological advancements in farming, and expansion of processed & value-added products, among others.

Market Highlights

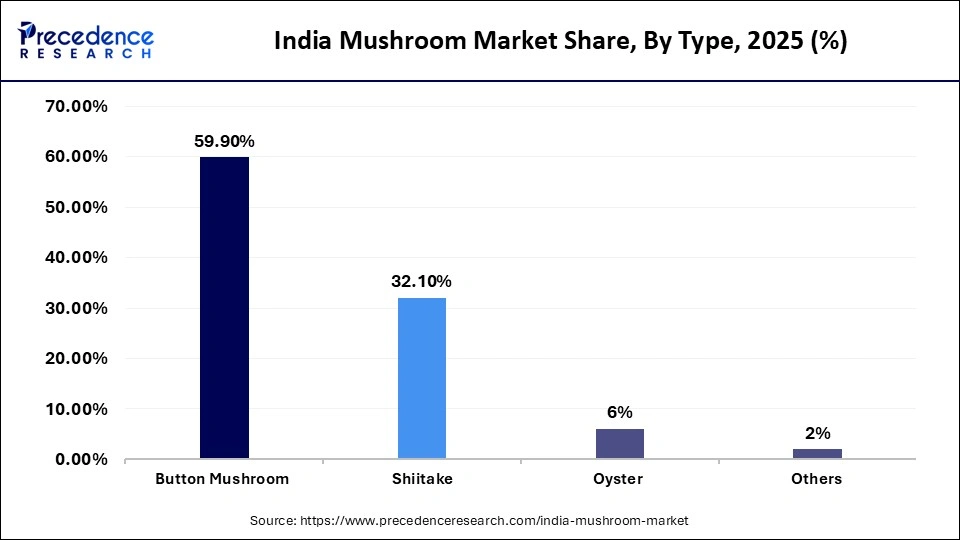

- By type, the button mushroom segment captured approximately 59.9% market share in 2025.

- By type, the shiitake segment is growing at the highest CAGR of 12.1% between 2026 and 2035.

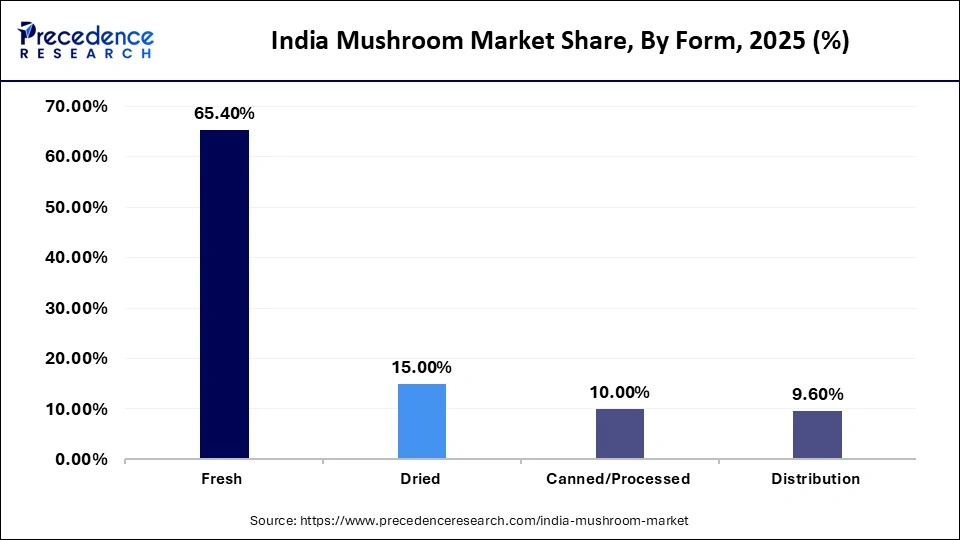

- By form, the fresh segment led the market and held approximately 65.4% market share in 2025.

- By form, the canned/processed segment is expected to expand at a notable CAGR of 12.2% from 2026 to 2035.

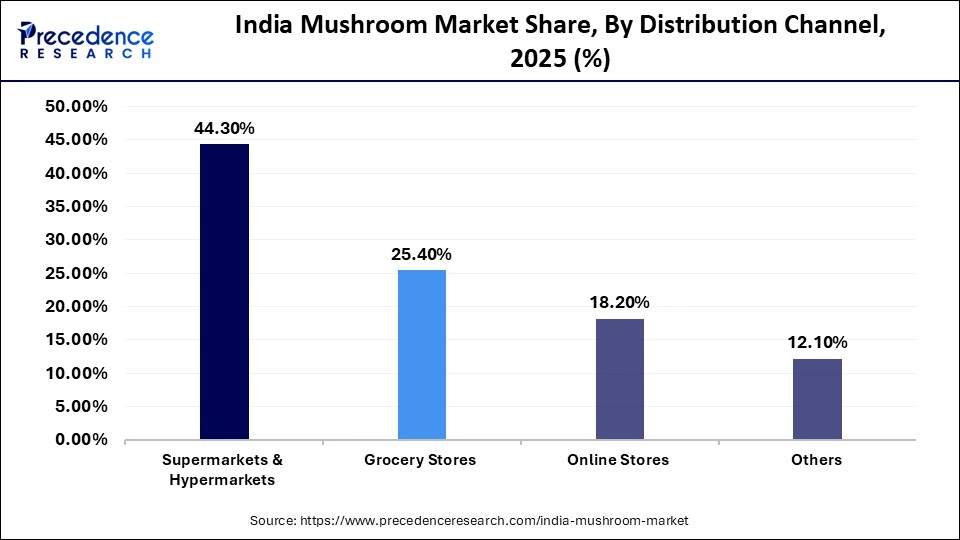

- By distribution channel, the supermarkets & hypermarkets segment captured approximately 44.3% market share in 2025.

- By distribution channel, the online stores segment is poised to grow at a healthy CAGR of approximately 12.3% between 2026 and 2035.

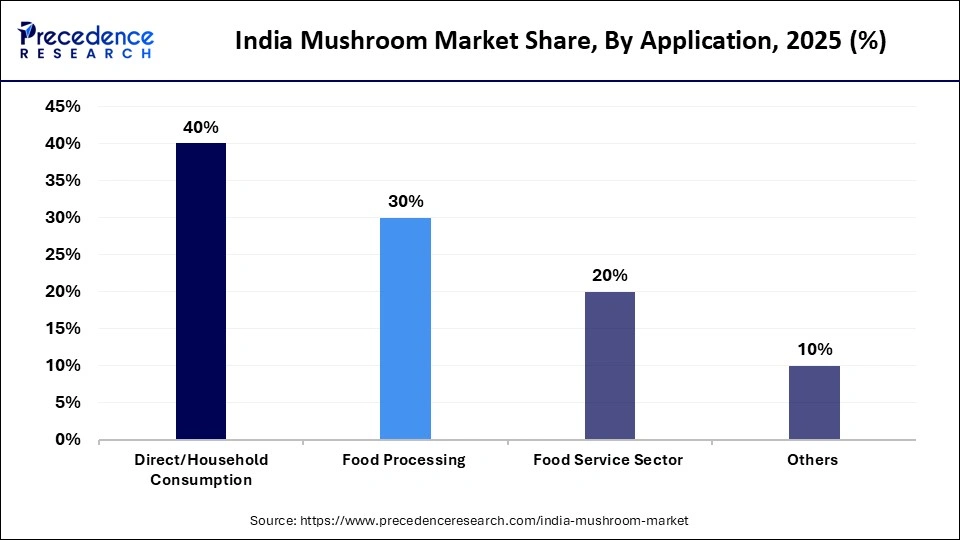

- By application, the direct/household consumption segment held approximately 40% market share in 2025.

- By application, the food processing segment is projected to grow at a solid CAGR of approximately 12.5% between 2026 and 2035.

Why Is India's Mushroom Market Growing at a Rapid Pace?

The Indian mushroom market is driven by rising health awareness, increasing demand for nutrient-rich and plant-based foods, and changing dietary preferences among urban consumers. Growth is supported by expanding commercial cultivation, improved farming technologies, and government training programs promoting mushrooms as a sustainable agribusiness. The market is also witnessing diversification into processed, dried, and ready-to-cook mushroom products. Expanding modern retail, e-commerce penetration, and growing adoption in hotels, restaurants, and households further strengthen market momentum across India.

Increasing investment in controlled-environment cultivation is improving year-round production consistency and yield stability. Strengthening cold chain infrastructure and packaging solutions is extending shelf life and reducing post-harvest losses across distribution channels. Rising interest from food processing companies is also supporting product innovation and value-added mushroom-based offerings for domestic consumption.

How is AI Shaping Mushroom Farming in India?

Artificial intelligence integration can transform mushroom farming in India by bringing precision, automation, and data-driven decision-making to a traditionally manual sector. Smart systems using AI, IoT sensors, and real-time analytics can automatically regulate temperature, humidity, CO2, and ventilation, ensuring optimal conditions for growth with minimal human intervention. In Bihar, facilities are being developed where AI adjusts environmental controls like foggers and hut temperature to stabilize production conditions. Innovators like iYarKai Tech Lab's Silir system combine AI and IoT to boost yield, cut energy and water use, and reduce manual labor through automated environmental control.

Emerging automation solutions showcased at the India Mushroom Summit integrate smart climate controllers with real-time monitoring dashboards to aid farmers across multiple farms. Together, these advances help improve yield consistency, reduce contamination and resource waste, and make cultivation more scalable and profitable for Indian growers.

Primary Trends Influencing the Development of the India Mushroom Market

- Shift Toward Organic and Sustainable Mushroom Farming: There's a strong movement toward organic and sustainable cultivation practices, driven by growing consumer concerns about health and the environment. Urban buyers increasingly prefer mushrooms grown without synthetic pesticides or chemicals, prompting producers to adopt eco-friendly substrates, natural pest control, and certifications that boost quality and command premium pricing.

- Rise of Specialty and Exotic Mushroom Varieties: Beyond traditional button mushrooms, specialty and exotic varieties like oyster, shiitake, and milky mushrooms are gaining traction. These varieties appeal to health-savvy and culinary-curious consumers with unique flavors and textures. Their growth supports diversification, higher margins, and niche markets, including gourmet dining and functional wellness consumption.

- Growth of Processed and Value-Added Products: Convenience-oriented consumers are driving demand for processed, ready-to-cook, and value-added mushroom products such as dried mushrooms, mushroom powders, snacks, and canned variants. These products extend mushroom shelf life, fit busy lifestyles, and expand use beyond traditional cooking into snacks and functional food segments.

- Digitalization and E-Commerce Expansion: The mushroom market in India is benefiting from digital retail channels and e-commerce platforms, making fresh and processed mushrooms accessible beyond urban centers. Farm-to-consumer apps and online grocery services offer convenience, competitive pricing, and broader product variety, while digital marketing educates consumers about mushroom benefits, boosting online sales.

- Technological Integration in Cultivation: Advancements like IoT climate control, automation, and precision farming are improving yields and reducing crop losses. Agri-tech startups and smart farming tools help standardize production, optimize environmental conditions, and accelerate mushroom growth cycles, enabling year-round farming even in non-traditional regions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.58 Billion |

| Market Size in 2026 | USD 1.78 Billion |

| Market Size by 2035 | USD 5.29 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.84% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Form, Distribution Channel, and Application |

Segment Insights

Type Insights

Why Was the Button Mushroom Segment Dominant in the Indian Market During 2025?

The button mushroom segment dominates the India mushroom market with a share of approximately 59.9%, mainly because of its wide culinary acceptance, affordability, and ease of cultivation. Button mushrooms are mild in flavor and versatile across Indian and global cuisines, making them preferable for everyday cooking. They are relatively inexpensive and readily available in mainstream retail, encouraging regular consumption. Producers also favor button mushrooms due to simpler and well-established farming practices that support large-scale, routine production. These combined factors keep demand consistently high and reinforce the segment's leading position.

The shiitake segment is estimated to be the fastest-growing segment in the market, with the highest CAGR of approximately 12.1% in India, driven by rising health awareness, as shiitake is known for immune-boosting and medicinal properties. Growing demand from premium restaurants, hotels, and health-conscious urban consumers supports adoption. Increasing exposure to Asian cuisines and small-scale controlled cultivation further encourages market growth.

Form Insights

What Is the Reason for Fresh Segment to Be the Leader in the Market for Indian Mushrooms?

The fresh segment dominates the India mushroom market with a share of approximately 65.4% because consumers prefer its natural taste, texture, and nutritional value over processed forms. Fresh mushrooms are widely used in everyday home cooking and available through supermarkets, local markets, and e-commerce channels. Their short shelf life encourages frequent purchases, while quick preparation and versatile culinary use strengthen demand across households and restaurants.

The canned mushroom segment is estimated to be the fastest-growing in the Indian market with a notable CAGR of approximately 12.2% due to rising demand for convenience and long-shelf-life products. Busy lifestyles and expanding modern retail boost sales of ready-to-use mushrooms. Value-added forms like dried, sliced, and marinated mushrooms appeal to urban consumers and foodservice channels, while improved processing infrastructure enhances quality and distribution reach.

Distribution Channel Insights

Why Do Supermarkets & Hypermarkets Represent the Largest Segment during 2025?

The supermarkets & hypermarkets segment dominates the India mushroom market with a share of approximately 44.3% because it offers wide product variety, consistent quality, and convenient one-stop shopping. Organized retailers provide better cold-chain management for perishable mushrooms, attractive displays, and promotional activities that attract middle-class consumers. Their expanded reach into urban and semi-urban areas also improves accessibility and boosts regular sales.

The online stores segment is the fastest-growing segment in the India mushroom market, with a notable CAGR of 12.3% due to rising e-commerce adoption, smartphone penetration, and convenience-driven shopping behavior. Consumers increasingly prefer home delivery of fresh and processed mushrooms, especially in urban and peri-urban areas. Online platforms also offer wide variety, competitive pricing, and easy comparison, while integrating efficient logistics and cold-chain support strengthens reliability and repeat purchases.

Application Insights

Why Did Direct/Household Consumption Dominate the India Mushroom Market in 2025?

The direct/household consumption segment dominates the India mushroom market with a share of approximately 40% because mushrooms have become a regular part of home cooking due to rising health awareness and changing dietary preferences. Urban families increasingly include mushrooms in daily meals for their nutritional benefits and versatility. Easy availability through local markets, supermarkets, and online platforms also supports frequent household purchases, reinforcing consistent demand across Indian kitchens.

The food processing segment is the fastest-growing segment in the India mushroom market, with the highest CAGR of approximately 12.5% due to rising demand for ready-to-cook, canned, dried, and value-added mushroom products. Processors cater to busy urban consumers, restaurants, and packaged food manufacturers. Advancements in preservation techniques and packaging allow mushrooms to maintain quality and shelf life, supporting wider distribution and boosting adoption in processed and convenience food segments.

Country Insights

Why Is North India the Top Consumption Region for the India Mushroom Market?

North India dominates the India mushroom market due to its favorable climatic conditions, fertile soil, and well-established cultivation infrastructure. States like Himachal Pradesh, Punjab, and Uttar Pradesh have a strong tradition of mushroom farming supported by skilled labor and government initiatives. Proximity to major urban centers ensures easy distribution, while advanced farming techniques and training programs help maintain high-quality production, reinforcing the region's leading position.

East India Mushroom Market Trends

East India is the fastest-growing region in the India mushroom market due to rising awareness of mushroom cultivation, government support, and favorable climatic conditions in states like Bihar and Odisha. Small and medium farmers are increasingly adopting commercial mushroom farming as a profitable agribusiness. Growing urban demand, expanding retail penetration, and initiatives for skill development and modern farming techniques further drive rapid market growth in this region.

West India Mushroom Market Trends

West India is growing at a notable rate in the India mushroom market due to increasing urbanization, rising health-conscious consumers, and expanding retail networks in states like Maharashtra and Gujarat. Adoption of modern cultivation techniques, awareness programs, and government support encourages more farmers to enter mushroom farming. Additionally, growing demand from restaurants, hotels, and processed food industries contributes to steady market expansion in the region.

Who are the Major Players in the India Mushroom Market?

The major players in the India mushroom market include Dr. Kurade's Mushrooms, Fresh Lawn Mushroom Pvt. Ltd., Krishidev Fertilizers and Seeds Ltd., Chenab Impex Pvt. Ltd., Shobha International, Shrim Industries Pvt. Ltd., Pisum Food Services Pvt. Ltd., Surabi, Agrosophia, Aroh Foundation, Annavarshni Foods LLP, Agro Dutch Industries Ltd, Himalaya International Ltd., Flex Foods Ltd., and Manegrow Mushrooms.

Recent Developments

- In January 2026, Krishi Vigyan Kendra (KVK) in Anjaw district, Arunachal Pradesh, successfully conducted oyster mushroom cultivation trials using large cardamom waste as a substrate. The initiative promotes sustainable farming, resource recycling, and crop diversification for remote northeastern farmers. The trials demonstrated high yield potential while utilizing agricultural by-products, reducing waste, and providing additional income opportunities. Officials noted that adopting such environmentally friendly methods could encourage mushroom farming as a viable livelihood in areas with limited agricultural options.(Source: https://arunachal24.in)

- In January 2026, Punjab has emerged as a significant mushroom-producing state, ranking sixth nationally, as part of efforts to diversify agricultural activities. Punjab Agricultural University (PAU) has been actively promoting mushroom cultivation training, technical support, and awareness campaigns for local farmers. The push aims to encourage commercial mushroom farming alongside traditional crops, offering higher profitability and employment opportunities. Industry experts highlight that technical guidance and farm diversification strategies are helping Punjab strengthen its presence in India's growing mushroom market.

(Source: https://www.tribuneindia.com) - In January 2026, In Jharkhand's Gumla district, the Deputy Commissioner launched a mushroom farming training initiative targeting tribal and rural communities. The program focuses on enhancing technical skills, promoting income diversification, and increasing adoption of modern mushroom cultivation methods. Participants learned about substrate preparation, spawn usage, and environmental control for high-yield production. Officials emphasized that integrating mushroom farming into rural livelihoods could provide sustainable income streams, reduce migration, and strengthen local food security while supporting the growth of the regional mushroom market.(Source: https://timesofindia.indiatimes.com)

Segments Covered in the Report

By Type

- Button Mushroom

- Shiitake

- Oyster

- Others

By Form

- Fresh

- Dried

- Canned/Processed

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Grocery Stores

- Online Stores

- Others

By Application

- Direct/Household Consumption

- Food Processing

- Food Service Sector

- Others

Get a Sample

Get a Sample

Table Of Content

Table Of Content