What is the Functional Mushroom Market Size?

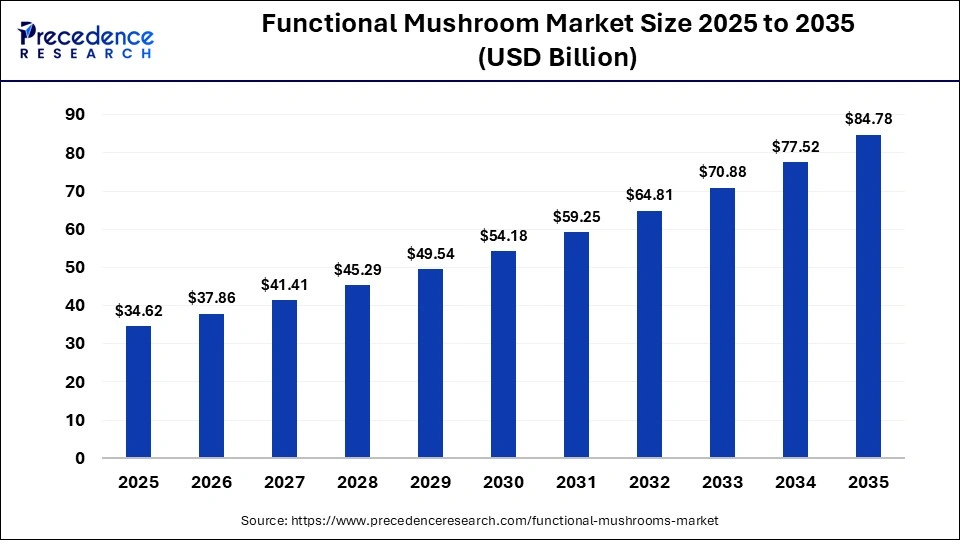

The global functional mushroom market size was calculated at USD 34.62 billion in 2025 and is predicted to increase from USD 37.86 billion in 2026 to approximately USD 84.78 billion by 2035, expanding at a CAGR of 9.37% from 2026 to 2035. The market is driven by the rising consumer demand for natural solutions for immunity, cognition, and overall wellness.

Market Highlights

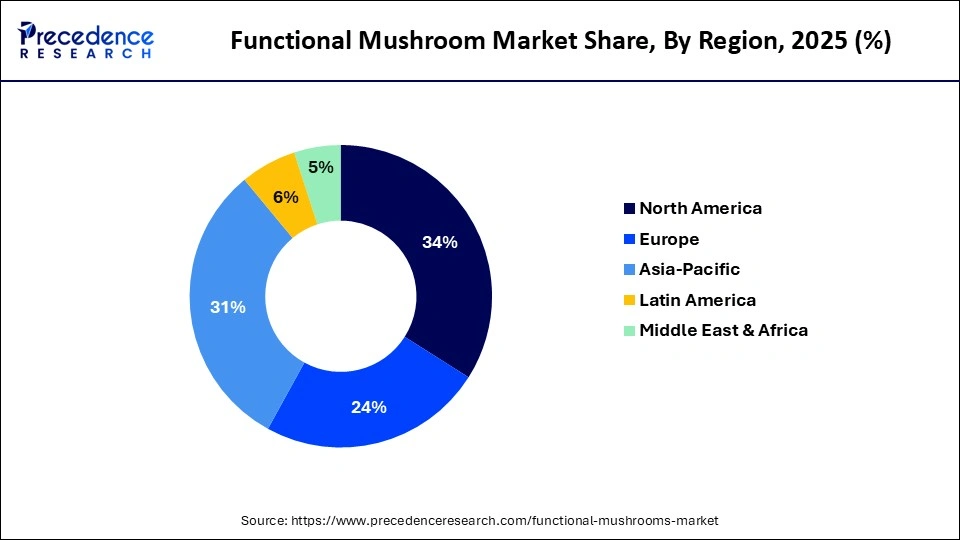

- By region, North America dominated the market with the largest share of 34% in 2025.

- By region, Asia Pacific is expected to grow at the fastest rate between 2026 and 2035.

- By mushroom type, the Reishi segment led the market with a 21% share in 2025.

- By mushroom type, the lion's mane segment is expected to grow at the fastest rate during the forecast period.

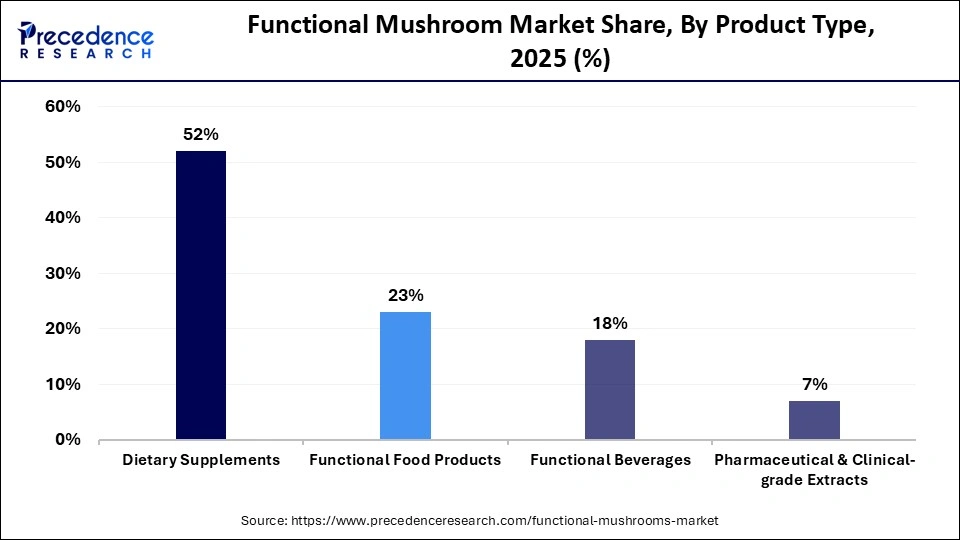

- By product type, the dietary supplements segment dominated the market with the largest share of 52% in 2025.

- By product type, the functional beverages segment is expected to grow at the fastest rate in the upcoming period.

- By form, the powder segment dominated the market with a 37% share in 2025.

- By function / health benefit, the immune support segment dominated the market with a 29% share in 2025.

- By distribution channel, the online / e-commerce platforms segment dominated the market with a 41% share in 2025.

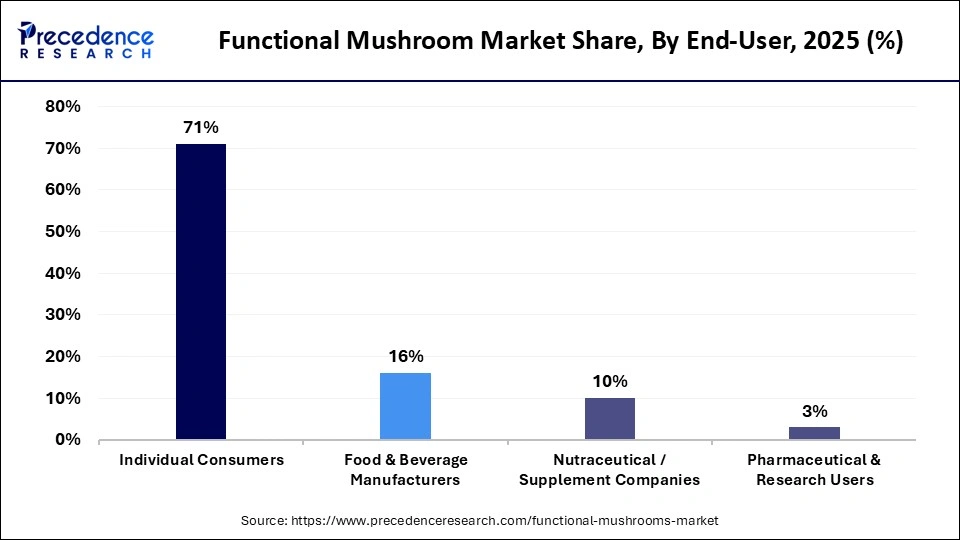

- By end-user, the individual consumers segment dominated the market with the highest market share of 71% in 2025.

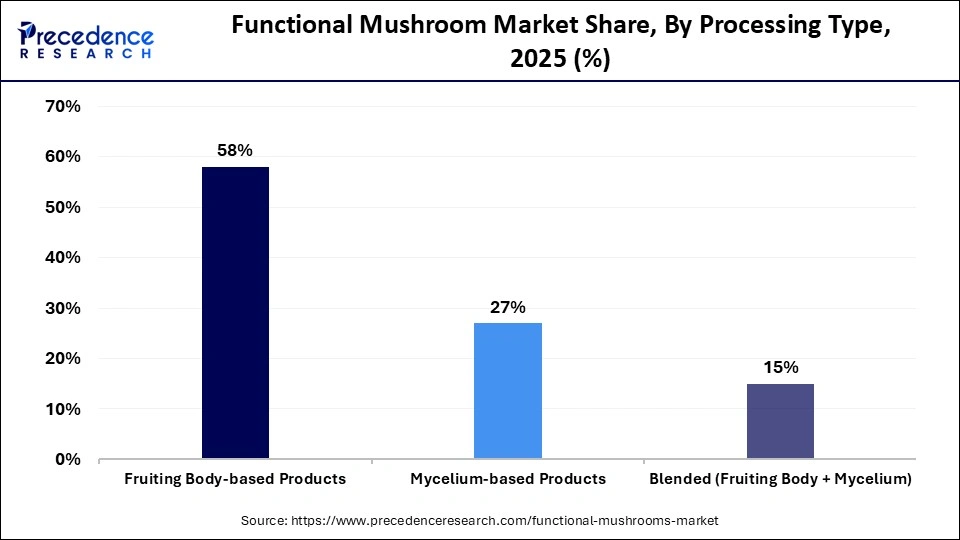

- By processing type, the fruiting body-based products segment dominated the market with a 58% share in 2025.

What is the Functional Mushroom Market?

The global functional mushroom market includes mushroom-based ingredients and finished products used for health, wellness, and functional nutrition applications. These products leverage bioactive compounds such as beta-glucans, polysaccharides, triterpenoids, and antioxidants, and are positioned for immune support, cognitive health, energy/stamina, gut health, stress management, and general well-being. The market spans dietary supplements, functional foods & beverages, nutraceutical ingredients, and pharmaceutical-grade extracts, driven by rising consumer demand for natural health products, growing adaptogen trends, and expanding distribution through e-commerce and specialty retail.

How are Technological Shifts Influencing the Functional Mushroom Market?

The quality, consistency, and scalability of functional mushroom products are improving significantly, driven by ongoing technological innovation across cultivation, extraction, and formulation. Advanced growing methods such as controlled indoor farming, vertical agriculture, and substrate optimization are enhancing substrate bioactivity and enabling reliable, year-round production. At the same time, extraction technologies are evolving, moving beyond traditional hot-water methods toward dual extraction and precision fractionation. These approaches deliver higher bioavailability of key bioactive compounds, including beta-glucans, polysaccharides, and triterpenoids. Further innovation is taking place at the formulation stage, with encapsulation, microencapsulation, and nano-delivery systems increasingly used to improve stability, control release, and targeted absorption in functional supplements and beverages.

Key Market Trends

- There is a growing trend toward the integration of functional mushrooms into everyday consumer products, including coffee alternatives, teas, protein shakes, snack bars, and ready-to-drink beverages.

- Clean-label and organic positioning is becoming increasingly critical, with consumers demanding greater transparency around sourcing, cultivation, and processing methods.

- The demand for nootropic and stress-management formulations featuring mushrooms such as lion's mane and cordyceps is rising due to their perceived cognitive and energy-enhancing benefits.

- Mushroom-based immunity blends have gained sustained momentum following the pandemic, as consumers become more informed about adaptogens and holistic wellness solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 34.62Billion |

| Market Size in 2026 | USD 37.86 Billion |

| Market Size by 2035 | USD 84.78Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.37% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Mushroom Type , Product Type , Form,Function/Health Benefit , Distribution Channel , End-User , Processing Type , and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment insights

Mushroom Type insights

Why Did the Reishi Segment Dominate the Functional Mushroom Market?

The Reishi segment dominated the market with a 21% share in 2025, owing to its long-standing reputation for supporting immunity, stress management, and longevity. Often regarded as a core adaptogenic and immunity-enhancing ingredient, Reishi forms the foundation of numerous functional mushroom products and wellness brands. Its versatility allows it to be incorporated into capsules, powders, teas, and functional beverages, making it highly adaptable for diverse product formats.

Growing consumer demand has also driven the adoption of controlled cultivation techniques to ensure consistent potency, bioactive content, and year-round supply. Despite the rise of newer functional mushrooms, Reishi continues to command a significant portion of market revenues, reflecting its established presence and enduring consumer trust.

The lion's mane segment is expected to grow at the fastest CAGR during the projection period, owing to the increasing consumer interest in cognitive health, concentration, and mental acuity. Recognized as a natural nootropic, Lion's Mane appeals to students, working professionals, and the ageing population, as awareness of brain wellness and stress-related cognitive decline continues to rise. Brands are actively incorporating Lion's Mane into coffees, gummies, and ready-to-drink beverages, broadening its accessibility and consumer adoption.

Its marketability is further strengthened by scientific evidence highlighting neuro-supportive compounds, enhancing credibility among health-conscious consumers. The combination of cultural relevance, innovation, and demonstrable cognitive benefits positions Lion's Mane as one of the high-growth drivers in the market.

Product Type insights

What Made Dietary Supplements the Dominant Segment in the Functional Mushroom Market?

The dietary supplements segment dominated the market while holding a 52% share in 2025 due to the ease of incorporating concentrated mushroom extracts into capsules, tablets, powders, and gummies, which offer precise dosing and convenience for consumers. Rising awareness of immunity, cognitive health, and stress management has driven demand for supplement-based consumption, as they provide targeted health benefits compared to foods and beverages. Additionally, clean-label preferences, regulatory clarity, and product standardization have strengthened consumer trust in supplements, making them the preferred choice in the market.

The functional beverages segment is expected to expand at the fastest CAGR in the upcoming period, driven by growing consumer demand for everyday wellness solutions. Mushroom-infused coffees, teas, and energy drinks are emerging as popular alternatives to traditional caffeinated beverages, appealing to consumers who seek sustained energy without jitters. Innovations in flavor masking, formulation, and ready-to-drink formats have improved palatability and accessibility, particularly among younger and urban consumers, making health-focused functional beverages a rapidly expanding segment in the market.

Form insights

Why Did the Powder Segment Dominate the Functional Mushroom Market?

The powder segment dominated the market with a 37% share in 2025 because of its versatility, longer shelf life, and ease of storage and transport compared to fresh mushrooms. Powdered functional mushrooms are utilized in supplements, beverages, and food products. Manufacturers prefer powders for bulk production and customizable formulations, while consumers value their flexibility for home use, such as adding them to smoothies, teas, or recipes. These practical advantages have established powders as the most widely adopted form in the market.

The gummies / chewables segment is expected to expand at the fastest rate over the forecast period, driven by the rising demand for convenient and edible wellness products. These formats are particularly appealing to younger consumers and those who prefer alternatives to capsules or powders, and their health positioning has been strengthened through flavor innovation and reduced-sugar formulations. Mushroom-based gummies targeting cognition and immunity are gaining popularity, while their highly desirable format encourages repeat consumption and brand loyalty, contributing to their rapid expansion in the functional mushroom market.

Function/Health Benefits insights

How Does the Immune Support Segment Lead the Functional Mushroom Market?

The immune support segment led the market with a 29% share in 2025 due to the widespread recognition of mushrooms like Reishi, Chaga, and Turkey Tail for their immunity-boosting and adaptogenic properties. Rising consumer awareness around preventive health, post-pandemic wellness, and natural immunity enhancement has driven strong demand for products targeting immune support. Additionally, the incorporation of these mushrooms into supplements, beverages, and functional foods has made immune-focused offerings the most dominant and trusted segment in the market.

The cognitive health & focus segment is expected to grow at the highest CAGR during the projection period, driven by growing consumer interest in enhancing mental performance, memory, and clarity. Lion's Mane serves as the primary ingredient in formulations targeting concentration, cognitive support, and brain wellness, while rising stress levels and screen-heavy lifestyles are increasing demand for natural, brain-friendly solutions. These products are particularly popular among professionals, gamers, and ageing populations, and companies are increasingly combining mushrooms with other nootropics to boost perceived efficacy. The strong alignment of these offerings with modern lifestyle needs is fueling rapid growth in this segment.

Distribution Channel insights

Why Did the Online / E-commerce Platforms Segment Dominate the Functional Mushroom Market?

The online / e-commerce platforms segment dominated the market with the largest share of 41% in 2025 due to the convenience, wide product selection, and accessibility it offers to consumers seeking wellness and adaptogenic solutions. E-commerce allows direct-to-consumer delivery, subscription models, and easy comparison of brands and formulations, which is particularly attractive for niche products like mushroom supplements, powders, and functional beverages. Additionally, rising digital adoption and targeted online marketing have made it easier for brands to reach health-conscious and urban consumers, further solidifying the dominance of the segment.

The DTC / subscription segment is expected to grow at a significant rate in the coming years. This is because it provides convenience, regular product delivery, and personalized wellness solutions directly to consumers. Subscription models encourage consistent use of supplements, powders, and beverages, which enhances the perceived effectiveness of mushroom products. Brands also benefit from customer data-driven customization, improved retention, and predictable revenue streams, making DTC and subscription offerings a high-growth distribution channel in the market.

End-User insights

What Made Individual Consumers the Dominant Segment in the Functional Mushroom Market?

The individual consumers segment dominated the market by holding the largest share of 71% in 2025, driven by rising self-care, preventive health, and wellness-oriented lifestyles. Consumers increasingly adopt functional mushrooms as part of their daily routines for immunity, energy, stress management, and cognitive support. The availability of diverse formats such as capsules, powders, gummies, and beverages enhances ease of use and accessibility. Direct-to-consumer marketing and digital education have strengthened consumer understanding of mushroom benefits. Brand loyalty is high in this segment, particularly for products positioned with clean-label and science-backed claims.

The food & beverage manufacturers segment is expected to grow at the fastest rate throughout the forecast period, as manufacturers integrate functional mushrooms into everyday consumables. Mushroom-infused coffees, teas, snacks, and fortified foods are increasingly appealing to consumers seeking health benefits without changing consumption habits. This segment benefits from innovation in formulation, flavor masking, and dosage optimization. Food and beverage companies are also leveraging mushrooms to differentiate products in competitive wellness categories. Regulatory acceptance of mushrooms as functional ingredients further supports adoption, driving the segmental growth.

Processing Type insights

Why Did the Fruiting Body-based Products Segment Dominate the Functional Mushroom Market?

The fruiting body-based products segment dominated the market with a major revenue share of 58% in 2025 due to their high concentration of bioactive compounds such as beta-glucans, polysaccharides, and triterpenoids, which are key to immunity, cognition, and overall wellness. Consumers and manufacturers prefer fruiting body extracts due to their superior efficacy, better standardization, and strong scientific validation. These products are widely used in premium supplements and functional foods, supporting higher price points. Advances in cultivation have improved the consistency and scalability of fruiting body production. Additionally, the versatility of fruiting body products in capsules, powders, teas, and functional beverages has reinforced their position as the most trusted and widely adopted processing type in the market.

The blended segment is expected to expand at the fastest CAGR during the projection period due to its formulation flexibility. Blends allow manufacturers to target multiple health benefits within a single product, such as immunity, energy, and cognition. This approach supports cost optimization while maintaining perceived functional value. Blended products also enable customized solutions for different consumer demographics. Innovation in extraction and standardization is improving consistency and consumer confidence. These advantages are driving rapid growth in blended processing solutions.

Regional Insights

How Big is the North America Functional Mushroom Market Size?

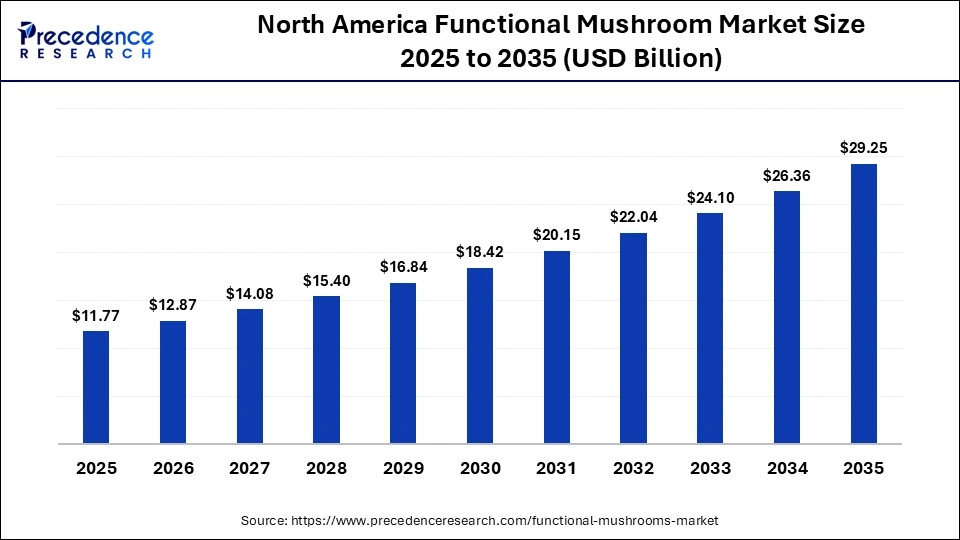

The North America functional mushroom market size is estimated at USD 11.77 billion in 2025 and is projected to reach approximately USD 29.25 billion by 2035, with a 9.53% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Functional Mushroom Market?

North America dominated the functional mushroom market by holding a 34% share in 2025. The region's dominance in the market is attributed to a heightened consumer awareness of preventive healthcare, functional nutrition, and adaptogenic ingredients. The region has a well-developed dietary supplement and functional food ecosystem, enabling rapid commercialization of mushroom-based products across multiple formats. High disposable income and willingness to pay for premium, clean-label, and organic products support the market's growth.

Scientific positioning and evidence-based marketing resonate strongly with consumers, encouraging brands to invest in standardized extracts and clinically backed formulations. The presence of advanced cultivation facilities and contract manufacturing capabilities ensures supply consistency and quality control. Additionally, digital commerce and subscription-based wellness models have significantly improved market accessibility and consumer engagement.

What is the Size of the U.S. Functional Mushroom Market?

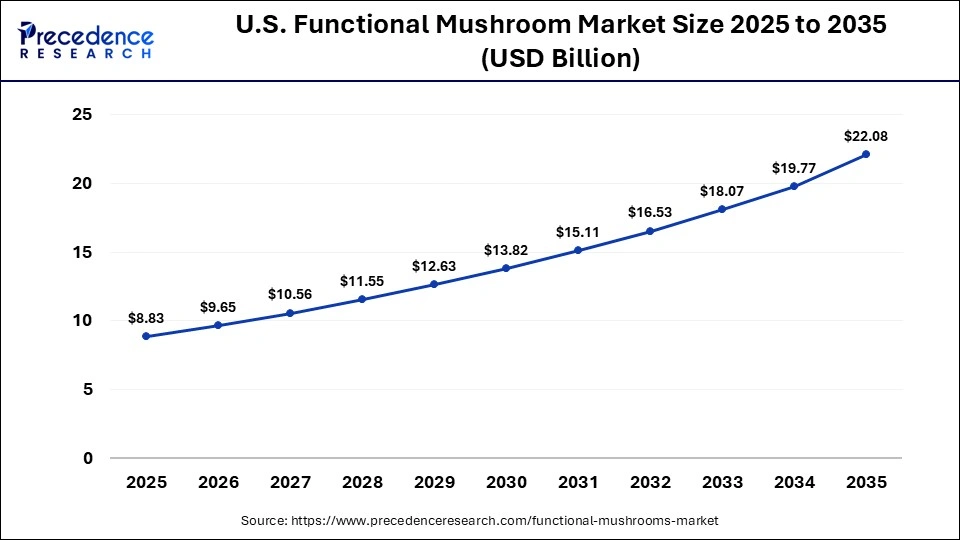

The U.S. functional mushroom market size is calculated at USD 8.83 billion in 2025 and is expected to reach nearly USD 22.08 billion in 2035, accelerating at a strong CAGR of 9.6% between 2026 and 2035.

U.S. Market Trends

The U.S. accounts for the largest share of the North American functional mushroom market due to its mature nutraceutical industry and strong innovation pipeline. U.S.-based companies are leading in product diversification, particularly in mushroom-infused beverages, nootropic blends, and sports nutrition applications. Regulatory clarity around dietary supplements, while strict on claims, provides a structured framework that encourages long-term industry investment.

Canada Market Trends

Canada is also a major contributor to the North American Market, supported by rising demand for plant-based and natural health products and strong acceptance of traditional herbal remedies. Canadian producers also play a strategic role in sustainable cultivation and organic-certified mushroom supply. This country reinforces North America's leadership through innovation, premiumization, and strong consumer trust.

Why is Asia Pacific Considered the Fastest-Growing Region in the Functional Mushroom Market?

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. This is mainly due to the high adoption of mushrooms in countries like China, India, South Korea, and Japan. Mushroom holds the historical and traditional place in Asian countries. The adoption of functional mushrooms has also increased in Asia due to rising awareness of cognitive health and the growing trend of plant-based nutrition. Moreover, the robust conventional medical system, Ayurveda, drives the adoption of functional mushrooms in Asia.

Growing awareness, strong research & development initiatives, and regulatory support for functional food productions solidifying the cultivation of mushrooms. Japan and South Korea are continuously innovating in products, including Lion's Mane, Cordyceps, and Reishi. Government initiatives like Japan's tax incentives for biotechnology and the cultivation of mushrooms are fueling this growth.

China Market Trends

China is leading the regional market due to its high production and consumption rates. China is a major producer of functional mushrooms in the Asia Pacific. Strong cultivation, processing industry existence, and strong logistic support with robust supply chain distribution reach are the key factors boosting the country's market. For instance, the major functional food specialty, Yalexian, has expanded sales of functional mushroom products to novel markets, including New Zealand and Europe, in May 2025, to comply with consumer demands for natural and umami food products.

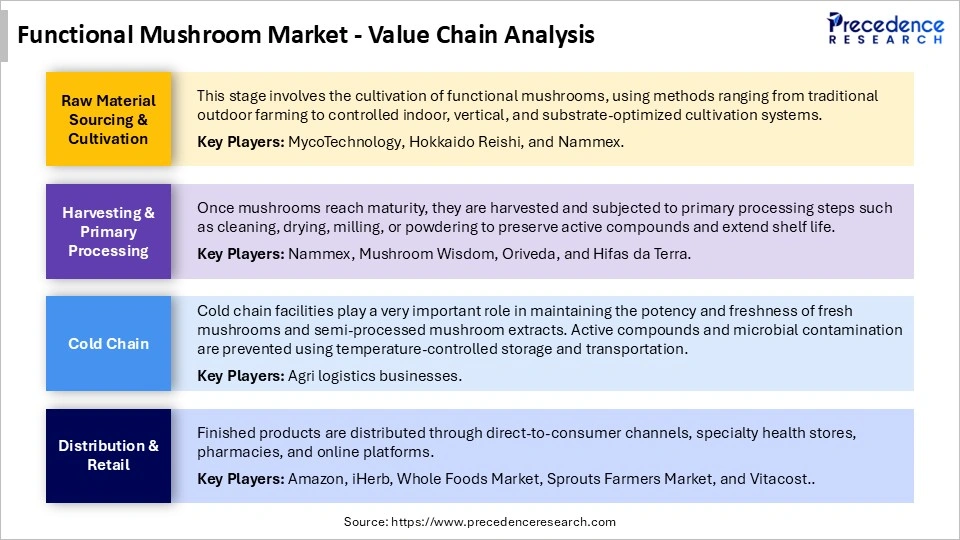

Functional MushroomMarket Value Chain Analysis

Who are the Major Players in the Global Functional Mushroom Market?

The major players in the functional mushroom market include Nammex, Hirano Mushroom LLC, Lianfeng (Suizhou) Food Co. Ltd, Hokkaido Reishi Co. Ltd, CNC Exotic Mushrooms, M2 Ingredients, Mitoku Company Ltd, Shanghai Finc Bio-tech Inc.

Recent Developments

- In January 2026, Vancouver-based Maia Farms is shifting to a "farm to pharmacy" model, emphasizing public health through its innovative mushroom-based ingredients. To fuel this transition, the food-tech startup recently completed an oversubscribed C$3.75 million ($2.7 million) Seed funding round, bringing its total capital to C$8.8 million ($6.3 million).

Segments Covered in the Report

By Mushroom Type

- Reishi

- Lion's Mane

- Chaga

- Cordyceps

- Turkey Tail

- Shiitake

- Maitake

- Other Functional Mushrooms

By Product Type

- Dietary Supplements

- Capsules/tablets

- Gummies

- Liquid extracts/tinctures

- Functional Food Products

- Snacks & bars

- Fortified foods

- Functional Beverages

- Mushroom coffee blends

- Ready-to-drink beverages

- Pharmaceutical & Clinical-grade Extracts

By Form

- Powder

- Capsules & Tablets

- Liquid Extracts / Tinctures

- Gummies / Chewables

- Other Forms

By Function / Health Benefit

- Immune Support

- Cognitive Health & Focus

- Energy, Stamina & Performance

- Stress, Sleep & Mood Support

- Gut Health & Digestive Support

- Anti-inflammatory & Recovery Support

By Distribution Channel

- Online / E-commerce Platforms

- Specialty Health & Nutrition Stores

- Supermarkets & Hypermarkets

- Pharmacies / Drug Stores

- Direct-to-Consumer (DTC) / Subscription

By End-User

- Individual Consumers

- Food & Beverage Manufacturers

- Nutraceutical / Supplement Companies

- Pharmaceutical & Research Users

By Processing Type

- Fruiting Body-based Products

- Mycelium-based Products

- Blended (Fruiting Body + Mycelium)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content