What is the Industrial Control Systems Security Market Size?

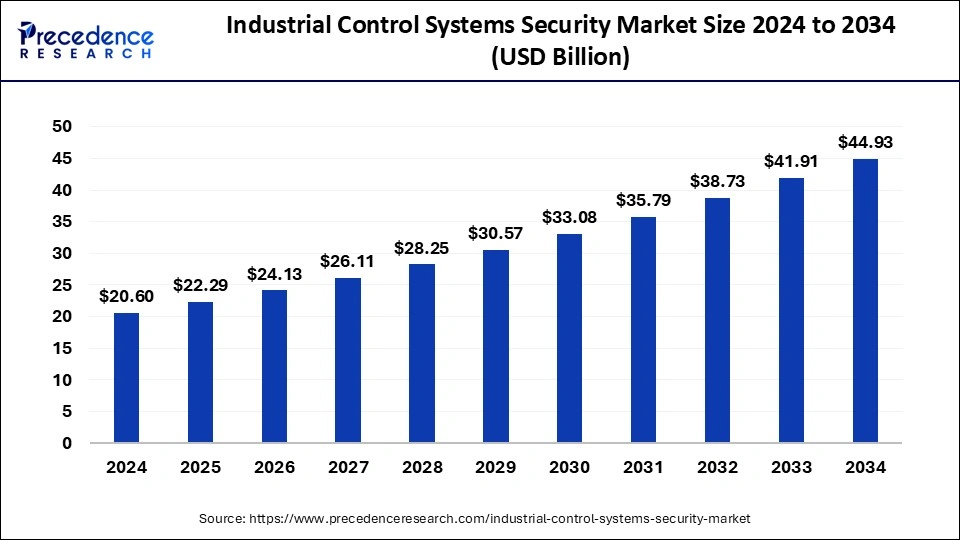

The global industrial control systems security market size is calculated at USD 22.29 billion in 2025 and is predicted to increase from USD 24.13 billion in 2026 to approximately USD 48.06 billion by 2035, expanding at a CAGR of 7.99% from 2026 to 2035.

Industrial Control Systems Security Market Key Takeaways

- The global industrial control systems security market was valued at USD 22.29 billion in 2025.

- It is projected to reach USD 48.06 billion by 2035.

- The industrial control systems security market is expected to grow at a CAGR of 7.99% from 2026 to 2035.

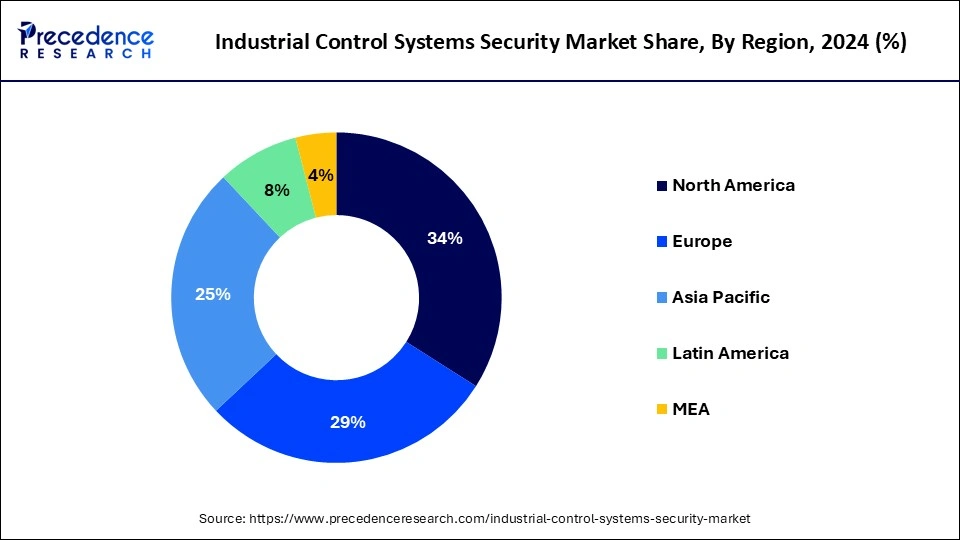

- North America dominated the industrial control systems security market with the major revenue share of 34% in 2025.

- Asia Pacific is expected to show the fastest growth in the market during the forecast period.

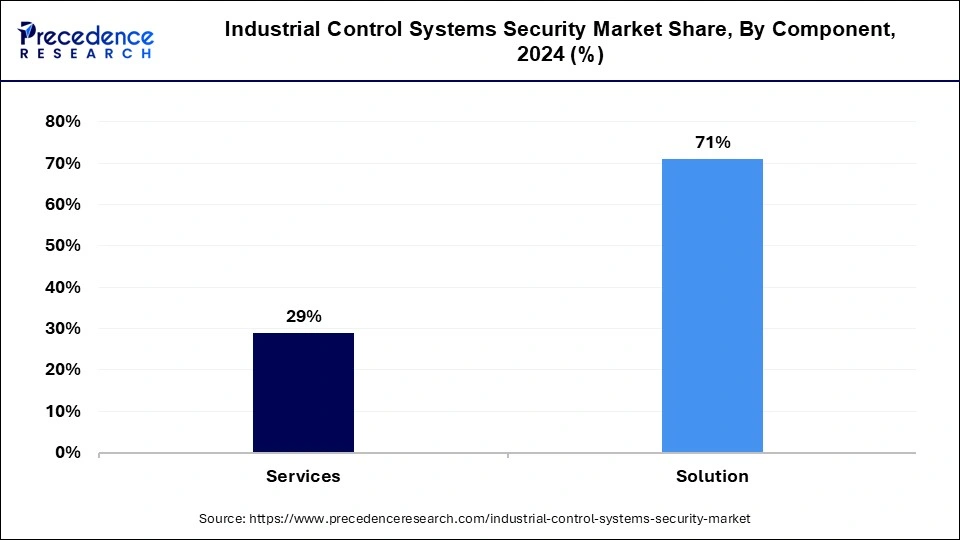

- By component, the solution segment has contributed more than 71% of revenue share in 2025.

- By component, the services segment is expected to grow at a solid CAGR of 7.99% during the forecast period.

- By solutions, the identity & access management (IAM) segment led the market in 2025.

- By solutions, the encryption segment is expected to grow at the fastest rate in the market over the forecast period.

- By services, in 2023, the professional services segment dominated the market.

- By services, the managed services segment is projected to grow at the fastest rate in the market during the forecast period.

- By end use, the energy & utilities segment held the largest share of the market in 2025.

- By end use, the automotive segment is expected to grow at the fastest rate in the market over the projected period.

Market Overview

Industrial control systems (ICS) security involves the implementation of measures and practices to safeguard these systems from cyber threats and unauthorized access. ICS is essential for managing and operating critical infrastructure like power plants, water treatment facilities, manufacturing plants, and transportation networks. Unlike traditional IT systems, ICSs are designed to monitor and control physical processes and can pose unique cybersecurity challenges. Additionally, the main objective of ICS Security is to maintain the availability, integrity, and confidentiality of these systems and the information in the process. Availability ensures that these systems operate continuously and reliably without interruptions.

How is AI Influencing the Industrial Control Systems Security Industry?

AI algorithms can determine vast amounts of sensor data to forecast equipment failures before they occur, decreasing downtime and maintenance expenses. For example, vibration analysis combined with machine learning can understand subtle changes in equipment performance, enabling just-in-time maintenance. AI-driven alarm management systems can prioritize alarms based on their criticality along with potential impact, reducing alarm fatigue and assisting operators in focusing on the most important issues.

Industrial Control Systems Security Market Growth Factors

- Escalating cyber threats along with regulatory compliance requirements is expected to fuel the industrial control systems security market growth.

- The growing adoption of big data analytics in ICS can boost the growth of the industrial control systems security market in the future.

- Rising industrial automation and virtualization will likely help in the industrial control systems security market expansion shortly.

- Increasing investments in industrial control structures and technologies can propel the growth of the industrial control systems security market.

Market Trends

- The adoption of Industry 4.0 and IoT technologies is expanding the market by pushing industries to integrate comprehensive security solutions in order to protect interconnected systems and data.

- The market is witnessing a growing need for continuous monitoring and managed security services as organizations seek specialized expertise to protect their ICS environments from constantly evolving complex cyber threats.

- Factors like artificial intelligence and machine learning are providing various opportunities by improving threat detection and response capabilities. This is a key trend as organizations continue to seek to fix vulnerabilities in older systems and implement next-generation security solutions.

- The shift towards smart manufacturing is driving the market forward. As industries continue to adopt automation and data analytics, the complexity of ICS increases, thus leading to enhanced security measures.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 48.06 Billion |

| Market Size in 2025 | USD 22.29 Billion |

| Market Size in 2026 | USD 24.13 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.99% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Solutions, Services, Type, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Adoption of advanced technologies

The adoption of advanced technologies like the Internet of Things (IoT) in industries has driven the demand for the industrial control systems security market. The increasing use of IoT and other network devices has expanded the threat landscape for criminals and requires robust security measures. The complex industrial network infrastructure, with its numerous connected sensors and controllers, further complicates security. Hence, the need for ICS security in IoT applications has become critical and propelled market growth.

- In June 2024, EmberOT and Obscura joined forces to introduce a unified solution aimed at addressing the critical and evolving challenges in OT (operational technology) and ICS (industrial control systems) environments. The partnership marks a significant advancement in protecting vital industrial processes and data against increasingly sophisticated threats.

Restraint

Difficulties in legacy systems

Many industrial control systems in critical infrastructure sectors such as energy, manufacturing, and transportation depend on legacy systems that lack robust cybersecurity features. These systems often operate with outdated software and are not easily compatible with modern security solutions, which makes them difficult to secure. However, the vulnerabilities present in these legacy systems are challenging to address. The complexity involved in securing these outdated systems can significantly impede the industrial control systems security market.

Opportunity

The evolving trend of using digital technology in ICS security

The growing demand for the industrial control systems security market to manage operations in the power, manufacturing, and industrial sectors is driven by the increasing reliance on these systems. Every day, ICS face a wide range of security risks that are becoming more sophisticated in the digital economy. As the industrial sector depends more on these control systems, understanding the importance of industrial cybersecurity and monitoring emerging security trends and threats are more crucial than ever.

- In March 2024, NVIDIA Announces Omniverse Cloud APIs to power the wave of industrial digital twin software tools. The five new Omniverse Cloud application programming interfaces enable developers to easily integrate core Omniverse technologies directly into existing design and automation software applications for digital twins or their simulation workflows for testing and validating autonomous machines like robots or self-driving vehicles.

Segment Insights

Component Insights

The solution segment dominated the industrial control systems security market in 2025. ICS security solutions adopt a proactive approach, which helps block threats before they affect critical assets and businesses to minimize risk and enhance industrial operations seamlessly. These solutions also offer integrated AI security, threat prevention, and secure 5G connectivity by protecting ICS in sectors such as manufacturing, energy, utilities, and transportation.

The services segment is expected to witness significant growth in the industrial control systems security market during the forecast period. The growth of the ICS security service segment is driven by consumer demand for regulatory compliance requirements, reliable services, and technological advancements fueling digital transformation in the power and utilities sectors. Organizations are prioritizing cybersecurity investments to protect critical infrastructure and operational continuity.

Solution Insights

The identity & access management (IAM) segment led the industrial control systems security market in 2024. Factors such as rising security breaches and identity-related fraud are driving the growth of the IAM market. Additionally, the market's expansion necessitates more qualified cybersecurity specialists within businesses. The increased adoption of IAM by SMEs, the introduction of AI/ML-powered services, and scalability benefits further contribute to the market's growth.

- In January 2024, Cross Identity launches a privileged identity and access management solution. The development comes after the Reserve Bank of India (RBI) outlined cybersecurity guidelines aimed at enhancing the security posture of financial institutions, specifically addressing privileged users.

The encryption segment is expected to grow at the fastest rate in the industrial control systems security market over the forecast period. In the ICS environment, cryptography is essential for managing and simplifying the encryption of ICS traffic. Encryption involves transforming plaintext into ciphertext using cryptographic algorithms. To decode the data back to plaintext, a decryption key is required, which is a string of numbers or a password generated by an algorithm.

Services Insights

The professional services segment dominated the market in 2025. In software companies, professional services usually refer to a team of technology and solution experts who provide technical advisory and implementation services for customers. OT and IoT security specialists support ICS security professional services by providing technical expertise and a thorough understanding of compliance frameworks.

The managed services segment is projected to grow at the fastest rate in the industrial control systems security market during the forecast period. Managed IT services provider (MSP) is a third-party provider that proactively monitors and manages a customer's server and network infrastructure. Managed cybersecurity services encompass security patch management, firewall management, threat detection, vulnerability assessments, intrusion detection and prevention, and incident response. MSPs also utilize advanced security technologies and best practices to safeguard their clients' data and systems from cyber threats. These factors are expected to drive the demand for industrial control systems security managed services.

- In May 2024, SK Shieldus Co. announced that it had signed an agreement with Yokogawa Electric Korea to expand its security business in operational technology (OT) and industrial control systems (ICS). The two companies will conduct joint research in various areas, such as security diagnosis and consulting for manufacturing and production factories, system integration and construction, and operation and management services.

End-use Insights

The energy & utilities segment held the largest share of the industrial control systems security market in 2025. This can be attributed to the consumer demand for uninterrupted energy and reliable utility services, which drives organizations in these sectors to prioritize cybersecurity. Securing industrial control systems (ICS) is important to maintaining continuous operations and protecting against disruptions that could affect millions of consumers.

The automotive segment is expected to grow at the fastest rate in the industrial control systems security market over the projected period. Automation in the automotive industry is becoming more widespread due to rising labor costs and the need for manufacturers to meet tight deadlines. Devices like industrial PCs, programmable logic controllers (PLCs), and programmable automation controllers (PACs) automate industrial processes without human involvement.

Regional Insights

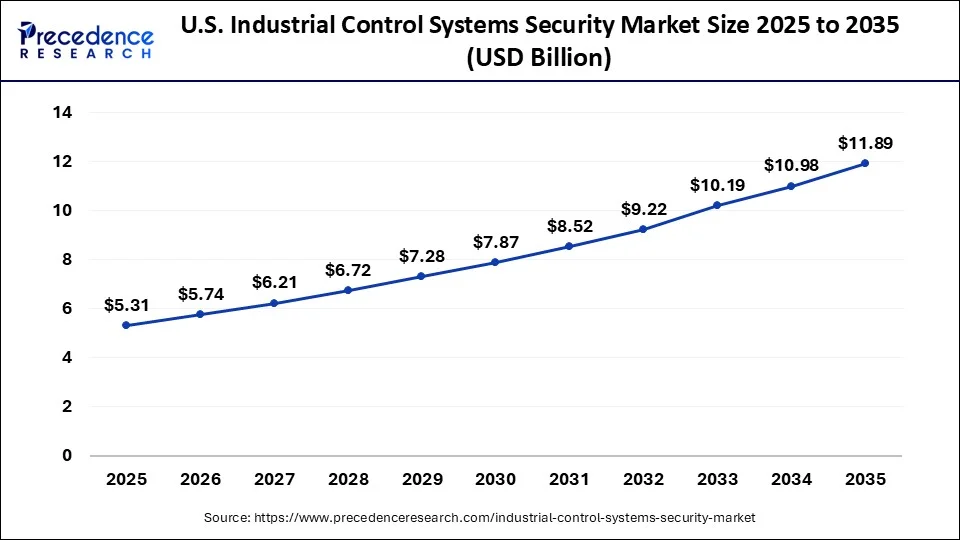

The U.S. industrial control systems security market size is exhibited at USD 5.31 billion in 2025 and is projected to be worth around USD 11.89 billion by 2035, poised to grow at a CAGR of 8.39% from 2026 to 2035.

North America dominated the industrial control systems security market in 2025. North America has one of the largest automobile markets, which drives the demand for industrial control systems. Furthermore, the U.S., amidst its fourth Industrial Revolution, features increased data usage in production and integration with various manufacturing systems across the supply chain. During the forecast period, the growth of the global industrial control systems security market is also expected to benefit from Canada's economic recovery.

U.S. Industrial Control Systems Security Market Trends

The U.S. market is driven by the increasing cyber insurance requirements, along with government regulations for critical infrastructure, which are forcing organizations to upgrade their security posture. The managed services segment is anticipated to grow the fastest, as companies seek expertise to handle complex, 24/7 security environments.

Asia Pacific is expected to show the fastest growth in the industrial control systems security market during the forecast period. Rapid Industrialization will create numerous opportunities for market expansion in the region. With government support, China is expected to lead in deploying industrial networking technology. Governments drive investments by establishing and enforcing cybersecurity regulations and standards, which set minimum security requirements for critical infrastructure. For example, Japan, South Korea, and Singapore have developed comprehensive cybersecurity frameworks that mandate specific security measures for industrial control systems.

In September 2023, Dragos, a company building software to secure the control systems for manufacturing and industrial equipment, raised $74M to secure industrial control systems from threats extension led by WestCap. The round, which brings Dragos' total raised to $440 million, leaves the startup's post-money valuation unchanged for the second year at $1.7 billion.

China Industrial Control Systems Security Market Trends

China's market is rising significantly due to the demand to protect critical infrastructure. There is a stringent enforcement of cybersecurity laws, like the Cybersecurity Law of the PRC, which is forcing industries such as energy, manufacturing, and transportation to adopt strict security standards.

Europe is seen to have the most significant growth rate throughout the forecast period. This growth is propelled by its strong regulatory frameworks and the need for advanced cybersecurity measures across various crucial industries. The region also implements stringent laws, such as GDPR and the EU Cybersecurity Act, which is encouraging organizations to invest in ICS security. Countries like Germany and France have witnessed significant growth due to their ongoing focus on securing energy grids, manufacturing facilities, and transportation networks.

Germany Industrial Control Systems Security Market Trends

Germany's market is driven by the widespread acceptance of smart manufacturing, IoT, 5G, and advanced sensors, which have raised the attack surface, driving the need for robust, OT-native security solutions. With the growth of remote monitoring and control, accepting zero-trust architectures, network segmentation, and secure-remote-access is crucial.

Latin America is expected to pick up pace throughout the forecast years. This is due to the growing demand for ICS security in the region, further fueled by increasing investments in industrial infrastructure, especially in the energy and manufacturing domain. Countries such as Brazil and Mexico are witnessing rapid industrial development, which needs enhanced security measures to protect critical control systems. As industrial automation increases, the need for specialized ICS security solutions in the region is also expected to grow, offering significant opportunities for security vendors and fostering growth and development.

Brazil Industrial Control Systems Security Market Trends

Brazil faces a high security threat index, thus driving investment in protecting vital infrastructure from ransomware and malware. This is due to a lack of in-house OT security talent; Brazilian companies are increasingly adopting managed security services for 24/7 monitoring.

The Middle East and Africa region is expected to witness quite a good amount of growth in the upcoming years. The region is focused on transforming its industrial sectors, especially in oil, gas, and energy, which is in turn, driving the demand for advanced ICS security solutions. The rise in cyber threats that are targeting critical infrastructure and the need for secure control systems in high-risk industries are more such factors that are contributing to market growth. Governments and enterprises in the region are seen increasingly investing in cybersecurity initiatives to safeguard critical assets, thus leading to market expansion.

UAE Industrial Control Systems Security Market Trends

The UAE's market is enforcing stricter standards on vital infrastructure, pushing companies to adopt advanced security frameworks. Moreover, the integration of Industrial IoT and connected infrastructure in the energy and manufacturing sectors is expanding the attack surface, driving the need for comprehensive security solutions.

Value Chain Analysis

- Input and Raw components

The very foundation of this market begins with the physical and network infrastructure, which includes programmable logic controllers, SCADA systems, routers, network switches and secure communication modules to name a few. These components form the so called attack surface that needs to be protected. As industries continue to evolve, more devices are being connected or retrofitted to IT networks, thus expanding popularity and demand.

Key Players: Siemens, Schneider, Cisco - Security Solutions and Services

This stage involves the development of ICS specific security solutions. Given the complexity and the increasing number of cyber-attacks, organizations are seen investing heavily on these types of solutions in order to protect critical infrastructure like utilities, factories, energy and power grids as well as transportation systems. AI and ML tools and systems are gaining traction in this stage in these recent years.

Key Players: Honeywell, Cisco, Palo Alto Networks - Compliance and Management

ICS environments often govern critical infrastructure such as water, energy, manufacturing and transportation, which is why stringent regulatory compliance becomes mandatory. This encourages operators to maintain continuous monitoring audit trails, track response plans and conduct regular security assessments. This stage also captures regular recurring revenue for security vendors, given the fact that continuous compliance is on the rise.

Key Players: Claroty, Honeywell, ABB, Fortinet

Industrial Control Systems Security Market Companies

- Honeywell International Inc.: Honeywell International Inc. provides a comprehensive portfolio of Operational Technology (OT) and even Industrial Control Systems (ICS) security solutions programmed to protect critical infrastructure from cyber threats.

- Microsoft Corporation: Microsoft Corporation offers comprehensive Industrial Control Systems (ICS) along with Operational Technology (OT) security solutions, mainly via Microsoft Defender for IoT.

- Nozomi Networks: Nozomi Networks provides deep visibility, continuous, AI-driven monitoring, and threat detection, enabling industrial operators to secure vital infrastructure without disrupting operations.

Other Major Key Players

- ABB Group

- BAE Systems

- Cisco Systems

- Check Point

- DarkTrace

- Fortinet

- IBM Corporation

- Kaspersky Labs

- Palo Alto

- Siemens AG

- Trend Micro Incorporated

- Yokogawa Electric Corporation

Recent Developments

- In March 2024, the Smart Factory Automation World (SFAW) event in Seoul will showcase cutting-edge automation technologies such as robotics and digital factory solutions. More than 450 companies from nine countries will convene at the COEX Convention & Exhibition Center to present their latest innovations to an anticipated audience of over 70,000 visitors.

- In October 2023, Rockwell Automation, Inc. (NYSE: ROK) and Microsoft Corp. announced an expansion of their longstanding partnership to expedite the design and development of industrial automation using generative artificial intelligence (AI).

- In May 2024, Fortinet announced the launch of a new generation firewall (NGFW) appliance featuring industry-leading security and networking performance, positioned to serve as a cornerstone for modern campuses. Built on the Fortinet operating system and incorporating the 5G Fortinet security processing unit (SP5).

- In November 2025,Siemens SICAM solutions recently launched a protect power grid control system with anomaly detection and encrypted communications. The FactoryTalk Security provides granular access controls and audit trails for production line equipment.

(Source: www.siemens.com )

Segments Covered in the Report

By Component

- Solution

- Services

By Solutions

- Anti-malware/Antivirus

- Firewall

- Encryption

- Identity and Access Management (IAM)

- Security and Vulnerability Management

- Security Information and Event Management (SIEM)

- Distributed Denial-of-Service (DDoS)

- Intrusion detection systems (IDS)/Intrusion Prevention System (IPS)

- Others

By Services

- Professional Services

- Managed Services

By Type

- Endpoint

- Application

- Network

- Database

By End Use

- Energy & Utilities

- Manufacturing

- Power

- Transportation Systems

- Automotive

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting