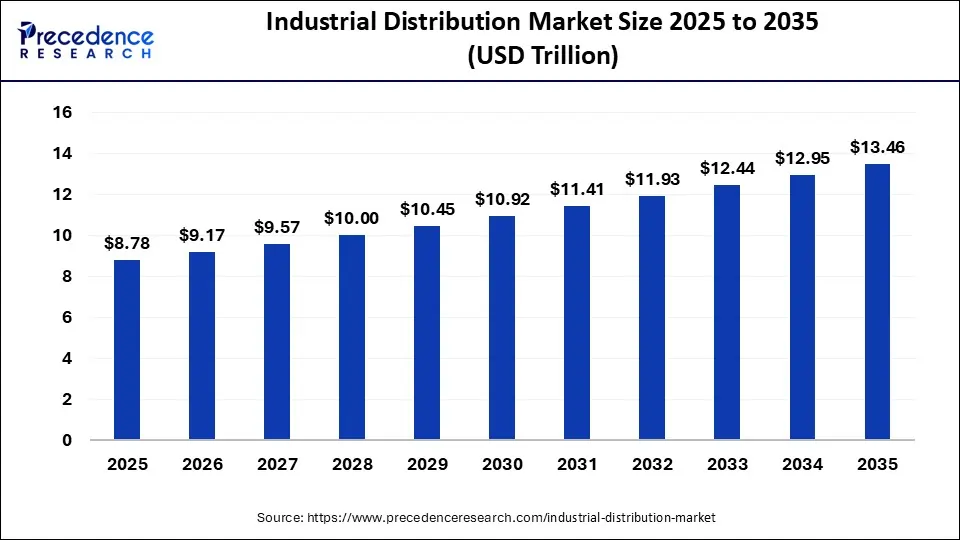

Industrial Distribution Market Size and Forecast 2026 to 2035

The global industrial distribution market size accounted for USD 8.78 trillion in 2025 and is predicted to increase from USD 9.17 trillion in 2026 to approximately USD 13.46 trillion by 2035, expanding at a CAGR of 4.37% from 2026 to 2035.

The goods produced by a company need to be distributed to the consumers by the manufacturer. Industrial distribution is seeking distributors in order to increase its business to grow in the demand for faster services these companies are employing Salesforce and distributors. The manufacturers a point or distributor and many are times these distributors are not appointed formerly by the manufacturers. Industrial distributors want to ensure that the demand for various products while the consumers is met across the nations. In order to concentrate on providing these so to assist the manufacturers are also concentrating on reducing the number of sales staffs.

Industrial Distribution Market Key Takeaways

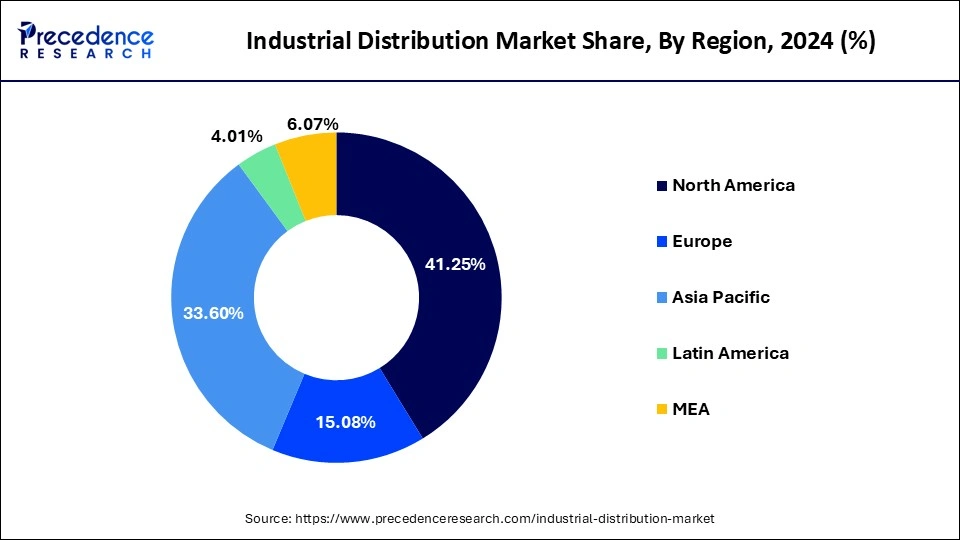

- By Region, North America has accounted for the highest revenue share of 41.25% in 2025

- By product, the MRO supplies segment has generated the largest market share of 31.72% in 2025.

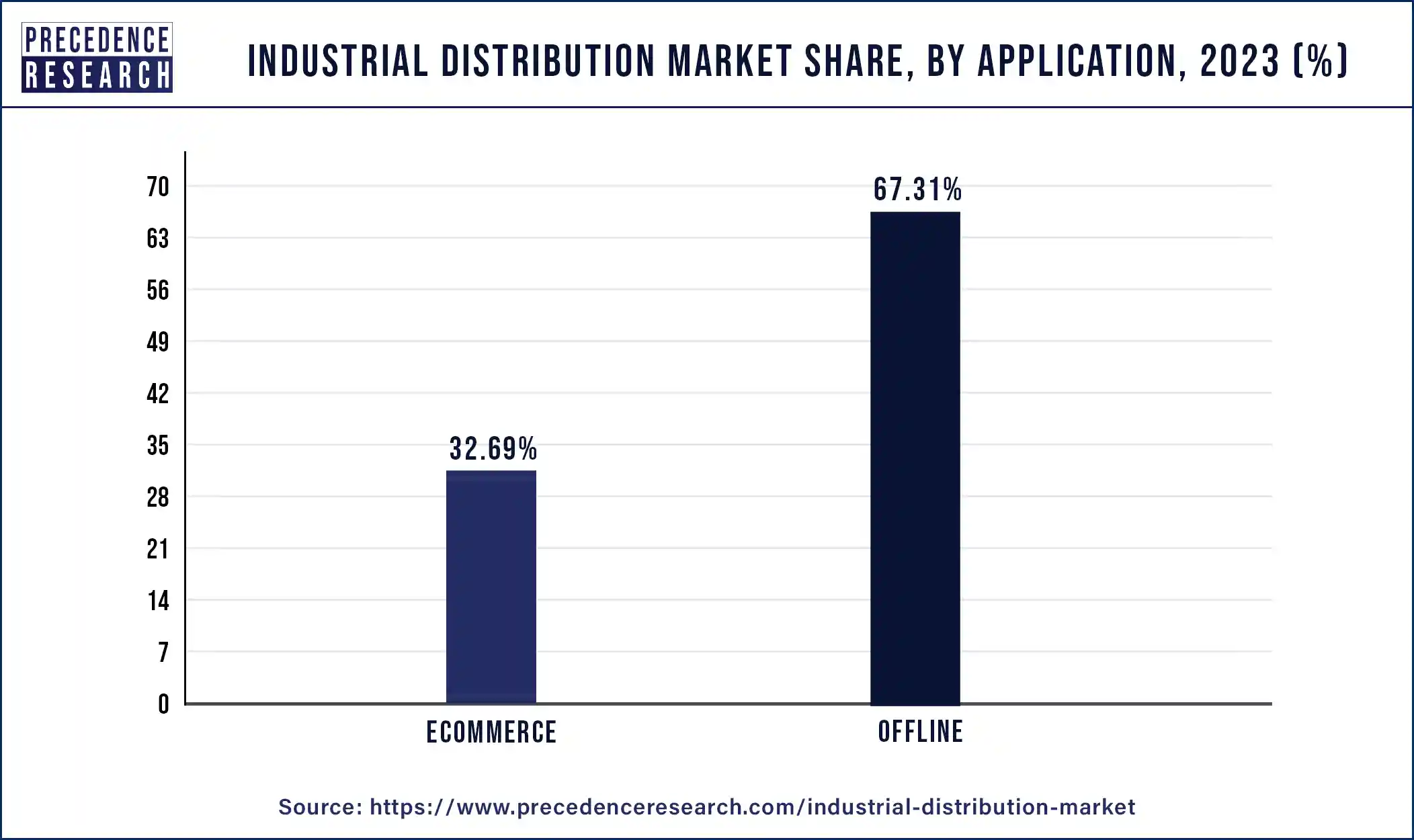

- By applications, the offline segment has held a market share of 67.21% in 2025.

Industrial Distribution Market Growth Factors

Due to an increase in the use of e-commerce customers are seeking faster delivery and zero or no shipping costs. Due to an increase in revenue through online sources, many major manufacturers are shifting to their digital practices. Increased use of smart products will lead to growth in the market. Consumers are demanding transparency in shipping practices. Consumers are seeking customer service which is available 24 by 7 on these websites which helps in tracking their orders. In order to meet the demand of the consumers this industry is investing in order to provide technological innovations. Innovative ways in distribution will provide growth for the market.

Manufacturers are investing in enhancing their supply chains in order to meet customer expectations. Due to the increased use of online platforms as there is an availability of smartphones and Internet connectivity the distributors need to provide operator experience. Increasing investment in enhancing the supply chain will help in meeting consumer demands. Distributors or also providing better platforms for business-to-business customers. In order to stay in the market and retain the already existing consumers market players are concentrating on providing platforms that will engage the consumers. Consumers are not just browsing and buying products online but they're also comparing the availability of these products across different platforms. In the industrial distribution market, the e-commerce segment is expected to drive market growth in the coming years.

Due to the increased use of order management systems which help in providing an automated system for the regular tasks conducted at the end of the manufacturer, there will be a reduction in the errors made. The system is also expected to help in gathering information regarding the availability of the product and the location of delivery. Increased use of the Internet of Things which is helpful in tracking the warehouse and those shipping containers will drive the market growth. The use of the Internet of Things to predict traffic will also enhance the functioning of the industrial distribution market. Increased use of artificial intelligence for the collection of data and for automation in this industry will drive the market truth.

How Artificial Intelligence Reshaping the Industrial Distribution Market?

The industrial distribution market is experiencing rapid change through the application of artificial intelligence (AI) technologies. A key focus area for distributors using AI technologies is enhancing their demand forecasting, inventory optimization and engagement with customers. Distributors have accessed AI analytics to improve their ability to anticipate stock outs, deal with multiple SKUs, and price goods accurately by making sense of complex and fragmented distribution systems. With a growing emphasis on predictive maintenance using machine learning (ML), many distributors can now leverage ML tools to improve their order fulfillment speed and profitability and customer service levels.

By integrating generative AI assistants into an e-commerce platform, industrial distributors are able to leverage real-time data to generate product recommendations, assist with purchase decisions, answer technical queries and provide product-specific customer support. Distributors have also invested in AI-based automation technologies, such as automated warehouses and digital twins for operations, to increase responsiveness to unpredictable demand, thereby enhancing their competitiveness and long-term viability.

What Are the Trends Transforming Industrial Distribution Market?

- Digital Transformation: E-commerce platforms, ERP systems and data analytics are some of the key tools being deployed by industrial distributors to streamline procurement, improve inventory visibility, enhance customer experience and enable faster, more accurate order fulfillment.

- Value-Add Services: Distributors are providing more than products by offering kitting and assembly, inventory management, technical support, and maintenance services to help customers reduce downtime, lower operating costs and build stronger long-term relationships with suppliers.

- Supply Chain Resilience: Companies are diversifying their sourcing, creating regional warehouses and using advanced demand forecasting to limit disruptions, manage volatility and ensure product availability while also ensuring they consistently deliver on service levels during times of global uncertainty.

- Sustainability Focus: As industrial customers place increasing importance on sustainability-related goals, eco-friendly packaging, energy-efficient logistics and ethical sourcing will shape distributor strategies.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 9.17 trillion |

| Market Size by 2035 | USD 13.46 trillion |

| Growth Rate from 2026 to 2035 | CAGR of 4.37% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Applications, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

There has been a change in the buying patterns of consumers in the previous years. Increased use of online platforms for the purchase of various items will drive the market. Distributors are concentrating on having better solutions for tracking their inventory which is extremely useful in meeting customer demands. There's been an increase in the use of various solutions which helped the distributors to improve the experience of shopping the consumers. These solutions are able to provide better visibility by the use of various search engines available online. Industrial distributors are enhancing their online platforms in order to provide a customer experience that would maintain the consumers after so growth in the number of competitors in this market. The use of the Internet of Things has helped in increasing the revenue of these distributors. Due to the adoption of the Internet of Things technology and blockchain technology the companies are expected to make larger profits.

Restraints

An increase in the competition and entry of new market players will hamper the growth of the market For the already existing players. Growing political unrest among nations across the globe is another restraining factor. Due to the availability of different delivery options and competitive price provided by different market players the market will see tough competition. There is a growth in monopoly in the distribution sector due to the use of technology by rival companies. During the pandemic, the manufacturing processes slowed down and the supply chain was also affected to a great extent.

Opportunities

Distributors are concentrating on having an automated workflow that will help in enhancing the productivity of the organization. This will help in increasing the speed and reduce the errors caused by human intervention. Automation in the workflow will help in saving time. Another opportunity for the growth of the market is the collaboration between different distributors. The presence of a centralized management system will provide a unified experience for all the channels of distribution. There has been a major shift of industrial distribution businesses from their old management practices to increased use of smart products. Increasing demand for transparency in shipping it's also expected to provide a growth opportunity in the coming years. Increasing renovation in technology will provide an upper hand. The use of an order management system will be able to provide a platform for different channels to work together and communicate on a real-time basis. It will help in enhancing the speed of delivery. It will also help in reducing errors. The use of robotics and automation in this industry will also provide a great opportunity forage growth in the coming years.

Challenges

Increased use of artificial intelligence to bring in automation in the industrial distribution market the market has become more vulnerable to cyberattacks. The amount of information handled over this platform which is associated with different types of equipment may cost heavily to the company. The availability of sensitive information regarding the equipment used in governments as well as hospitals needs better security. An increase in the number of cyberattacks will happen to be the most challenging factor in the growth of this market. There's growing pressure in the companies due to an increase in the number of competitors. Increased use of blockchain technology and the Internet of Things requires heavy investments. Stringent policies of government pertaining to the and my mental trends will also affect the market growth. Governments across the globe focusing on reducing the carbon emissions cost due to transportation to well great extent. The policy is also focused on making use of green logistic options which puts additional pressure on the industrial distribution market.

Product Insights

Depending on the products the MRO segment is expected to have the largest market growth in the coming years. The maintenance repair and operations products are required for many breakdowns of the devices and four different types of unscheduled repairs. The segment is expected to grow as any damage to the equipment that are manufacturing the products would lead to a great loss to the company. It is extremely important to keep the equipment in proper working condition ask the profitability of any organization is dependent on this equipment. In the case of even a single part that goes missing from extremely expensive equipment that equipment may sit idle which may cause a huge loss. The delay caused in the production would impact the market growth.

Maintaining the efficiency as well as the speed of manufacturing various products happens to be the major challenge for any of the industrial suppliers. Optimized use of machinery is extremely vital for fulfilling the demand the market. The availability of trained human labor and MRO products we will drive market growth. As there is a growing demand for cutting down costs and providing better quality products the market is expected to grow. The segment is expected to dominate the market in the coming years in order to have a consistent performance when it comes to reducing the consumption of power and increasing the output. Due to the enactment of strict regulations by various nations which are favorable for growth, the market is expected to grow.

Industrial Distribution Market Revenue, By Product, 2022-2024 (USD Billion)

| By Product | 2022 | 2023 | 2024 |

| MRO Supplies | 2,459.7 | 2,561.9 | 2,668.9 |

| Electrical Equipment & Supplies | 2,113.3 | 2,209.0 | 2,309.4 |

| OEM Supplies | 1,178.7 | 1,241.9 | 1,308.5 |

| Hand Tools & Power Tools | 768.2 | 798.3 | 829.7 |

| Bearings | 489.3 | 508.1 | 527.7 |

| Office Equipment & Supplies | 232.7 | 242.0 | 251.7 |

| Others (Includes packaging, industrial machinery, farm, lawn, and garden supplies) | 486.7 | 502.1 | 518.1 |

Applications Insights

The offline industrial distribution market segment is expected to have the largest market share in the coming years. The offline segment is expected to grow with the highest compound annual growth rate. Due to the in the availability of many parts of the manufacturing devices through the online mode, the offline segment is expected to grow in the coming years. The offline segment is also efficient in providing better delivery options and competitive prices to consumers. The e-commerce segment is also expected to have a good compound annual growth rate in the coming years. Manufacturers are focusing on providing better customer loyalty. There's a growth in the amount invested in technology that helps in providing a better consumer experience.

The e-Commerce segment provides ample opportunities for the growth of the market. Increasing competition due to the entry of new manufacturers and distributors the integrated solutions will help in providing automation in the operations. Industrial distributors need to be efficient in estimating future demand which will help them in planning their inventory in a better way. Due to the inability of having real-time connectivity between the departments the movement of products and managing these products is a big challenge. As there is a growing demand for low-cost and fast delivery the distributors need to have or tailored pricing system in order to maintain their clients.

The offline industrial distribution market is expected to grow in developing as well as developed nations there has been no great amount of disorganization in the sector. due to a large number of businesses that are smaller in size this industry does not have any large players in industrial distribution. The industrial distribution sector which is extremely fragmented needs to come together. Due to the introduction of smartphones the online distribution market will grow.

Industrial Distribution Market Revenue, By Application, 2022-2024 (USD Billion)

| By Application | 2022 | 2023 | 2024 |

| eCommerce | 2,519.8 | 2,636.5 | 2,759.2 |

| Offline | 5,208.8 | 5,426.8 | 5,654.9 |

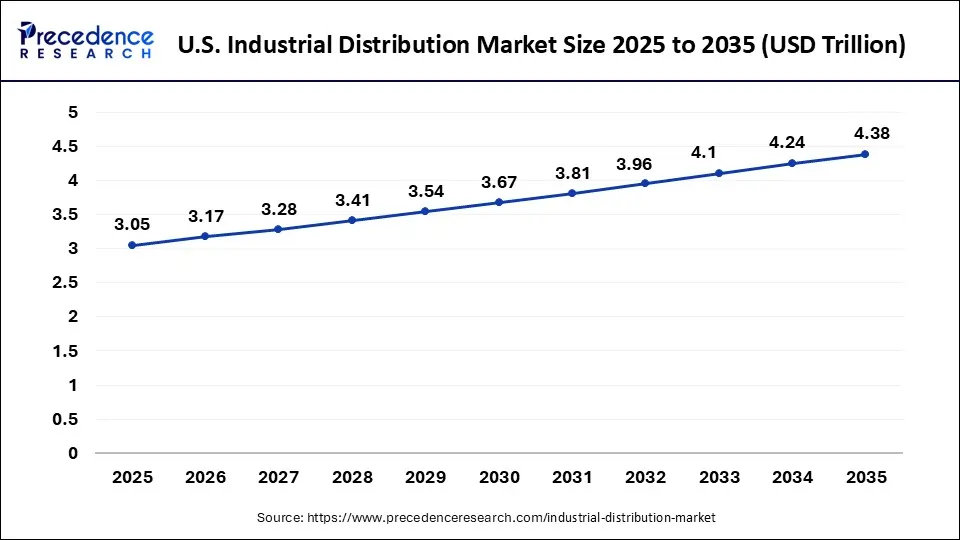

U.S. Industrial Distribution Market Size and Growth 2026 to 2035

The U.S. industrial distribution market size was exhibited at USD 3.05 trillion in 2024 and is projected to be worth around USD 4.38 trillion by 2035, growing at a CAGR of 3.69% from 2026 to 2035.

The North American region has dominated the industrial distribution market. This region is expected to hold a dominant position in the coming years. There is growth in the industrial distribution in this region is due to the increase in the amount spent on supply chain logistics and the investments made in transportation. Due to the current political unrest, there is no pressure on the distributors.

U.S.

The U.S. has consolidated its position as a significant regional player in manufacturing, logistics, and warehouse distribution. With robust growth in the aerospace, automotive, and industrial maintenance industries driving the expansion of U.S. distributors, U.S. distributors can respond quickly to technical requests and the demands of their customers by utilizing digital procurement capabilities, private-label programs, and nationwide distribution networks.

The European region is also expected to see growth in the coming years. As the industrial distributors in the European region are functional across many different sectors the market is expected to grow. Automation in the business and the increasing demand for outsourcing distribution is expected to drive the market.

- The North America industrial distribution market size was valued at USD 3.47 trillion in 2024 and is expected to reach around USD 5.02 trillion by 2033 with a CAGR of 3.8% from 2025 to 2034.

- The Europe industrial distribution market size was estimated at USD 1.26 trillion in 2024 and is projected to hit around USD 1.98 trillion by 2034, growing at a CAGR of 4.41% from 2025 to 2034.

- The Asia Pacific industrial distribution market size was accounted for USD 2.82 trillion in 2024 and is predicted to surpass around USD 4.60 trillion by 2034 with a CAGR of 5.0% from 2025 to 2034.

Germany

Germany's position as the leader in Europe is built on its strong engineering, automotive, and industrial machinery industries. The precision component and maintenance supply markets are providing excellent opportunities for growth. To best support advanced manufacturing customers, German distributors are committed to providing quality assurance, technical support, and efficient logistical solutions.

How Latin America Continues to Grow its Distribution Capability?

Latin America has become an emerging region in which manufacturing, mining, and energy-related industrial activity is on an upward trend. Infrastructure upgrades and foreign investment are associated with increased demand for Industrial supply products. In response to the recent rise in demand from the region, distributors are continuing to invest in regional coverage and inventory availability so they will not have to rely as heavily on imports. Although there continue to be logistical challenges, the growing trend of industrial diversification and localized sourcing should provide new opportunities for expansion of distribution networks throughout the region.

Brazil

Brazil is the dominant player within this region as it has a large industrial base and is seeing significant growth in its manufacturing capabilities. Distributor growth in Brazil is widely being supported by automotive, food processing, and energy industry demand. In order to better satisfy customer needs, many Brazilian distributors have continued to improve their warehousing and regional distribution systems.

Why Industrial Distribution Market is growing in the Middle East and Africa?

The rapidly expanding Middle Eastern and African regions are internationally growing due to diversification of industries, growth of infrastructure, growing manufacturing production, and energy-related and construction industry-driven investments being made by local governments to lessen reliance on raw material export markets. This increase in the demand for aftermarket maintenance and repair operational (MRO) supplies means that industrial distributors should benefit from this increase in MRO demand. In addition, the continuing development of logistics hubs and free trade zones in these regions will increase product availability and encourage more distribution on a global basis.

United Arab Emirates

With the strong logistics networks and initiatives to diversify industries through various sectors, the UAE Directly leads the region as the country with the best logistics/distribution systems in these two regions. Additionally, the construction, energy, and manufacturing sectors will allow for continued growth of distribution and building facilities in the UAE. As a trade hub in the region, distributors in the UAE can distribute products to other Middle Eastern and North African countries efficiently.

Industrial Distribution Market Companies

- W.W. Grainger

- Sonepar USA (Industrial)

- Airgas, Air Liquide, US

- WESCO International (Industrial)

- Würth Industry (USA)

- Border States (Industrial)

- Wolseley Industrial Group

- DXP Enterprises, Inc.

- F.W. Webb

- Kaman Distribution Group

- Edgen Murray

- Motion Industries

- HD Supply

- Rexel USA, Inc.

- Fastenal Company

- Descours et Cabaud

- Winsupply Inc.

- MRC Global

- Applied Industrial Technologies

- MSC Industrial Supply

Recent Developments

- In November 2025: Motion Industries completed its acquisition of Sunset Industrial, a Cerritos, California-based industrial distributor of power transmission parts and lubrication solutions, expanding its West Coast services and customer reach.

- In July 2025: Foundation Investment Partners acquired industrial and safety products distributor AAA Industrial Supply, combining it with Spartan Tool Supply to expand product lines, markets, and ecommerce capabilities under unified leadership.

- In July 2025: Trinity Hunt Partners acquired a majority stake in Blackhawk Supply, launching a new HVAC distribution platform and appointing experienced executives to scale the business nationally.

Segments Covered in the Report

By Product

- MRO Supplies

- Electrical Equipment and Supplies

- OEM Supplies

- Hand Tools and Power Tools

- Bearings

- Office Equipment and Supplies

- Others

By Applications

- eCommerce

- Offline

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting