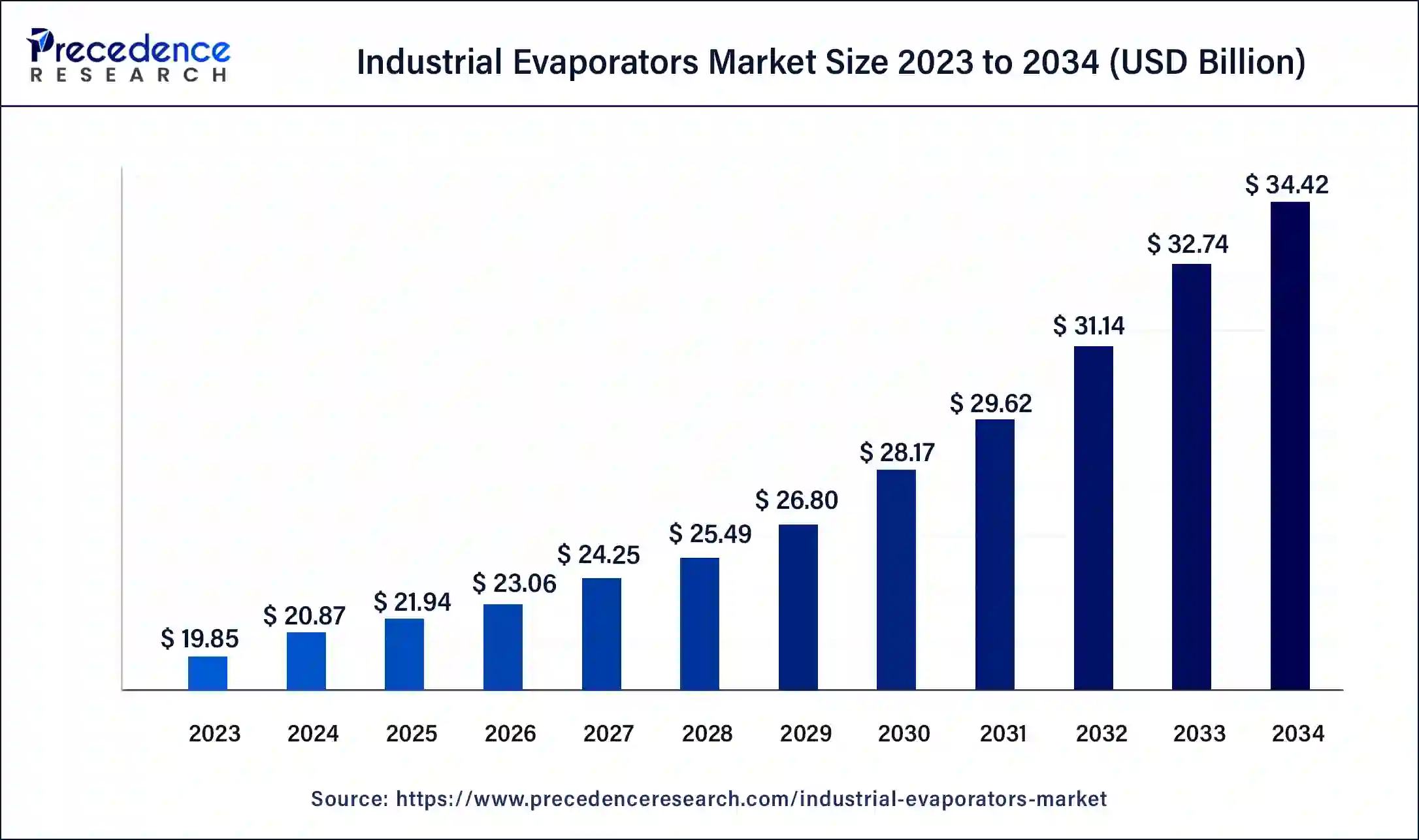

Industrial Evaporators Market Size and Forecast 2025 to 2034

The global industrial evaporators market size is expected to be worth around USD 34.42 billion by 2034 from USD 20.87 billion in 2024, at a CAGR of 5.13% from 2025 to 2034. The increasing demand in countless industries, such as food and beverage, chemical, pharmaceutical, pulp and paper, and wastewater treatment, is driving the growth of the industrial evaporators market.

Industrial Evaporators Market Key Takeaways

- The global industrial evaporators market was valued at USD 20.87 billion in 2024.

- It is projected to reach USD 34.42 billion by 2034.

- The industrial evaporators market is expected to grow at a CAGR of 5.13% from 2025 to 2034.

- North America led the global industrial evaporators market in 2024.

- Asia Pacific is expected to host the fastest-growing market throughout the forecast period.

- By type, the plate evaporator segment has contributed the largest share of the market in 2024.

- By type, the shell & tube evaporator segment is expected to show considerable growth in the market over the forecast period.

- By functionality, the mechanical vapor recompression (MVR) segment accounted for the largest share of the market in 2024.

- By functionality, the forced circulation evaporators segment is anticipated to witness significant growth in the market over the studied period.

- By end use, the food & beverage segment held the largest share of the market in 2024.

- By end use, the chemical industry segment is expected to grow at the fastest rate in the market during the forecast period.

AI Integration in the Industrial Evaporators Market

Artificial intelligence (AI) and machine learning will be among the technologies that will shape the future of the industrial evaporators market. Smart, AI-based control systems will further automate vacuum evaporation plants, realizing real-time monitoring, predictive maintenance, and adaptive operation according to the changing wastewater composition with higher efficiency and less requirement for human intervention.

Market Overview

Industrial evaporators are used to remove a liquid from a solution by heating the mixture to promote evaporation. The concentrated solution so obtained or purified product can be applied in several industries, such as food and beverages, pharmaceuticals, chemicals, and wastewater treatment. To remove a solvent, most evaporation processes are carried out under vacuum to decrease the solvent's boiling temperature so it can be easily removed from the solution or solid.

In most industries, evaporation is required for various purposes; product concentration: two or several components have to be separated, increasing product quality. Industrial evaporators are designed to handle large volumes of products continuously, thus making their use crucial for efficient and large-scale manufacturing. High-performance evaporators are required in process industries such as food, desalination, and refineries.

Industrial Evaporators Market Growth Factor

- The rising application in the food and beverage industry is one of the major factors driving the industrial evaporators market growth.

- The rising focus on environmental sustainability and stringent regulatory standards associated with wastewater treatment further fuelled the industrial evaporators market.

- The industrial evaporators market is driven by rapid industrialization, rising demand for energy-efficient methods, and the expanding manufacturing industries.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 34.42 Billion |

| Market Size in 2025 | USD 21.94 Billion |

| Market Size in 2024 | USD 20.87 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.13% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Functionality, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising focus on environmental sustainability

The industrial evaporators market products are used to remove liquid from a solution or suspension by heating the liquid to promote evaporation. They are widely used in chemical, pharmaceutical, food and beverage production, and wastewater treatment plants. The main objective of installing an evaporator is to minimize water consumption, reduce wastewater discharge, and decrease environmental impact. However, when choosing an evaporator technology for your process line or new plant, it can be very difficult as there are numerous available options to select from. Evaporators are extensively used for the purification of organic chemicals such as natural oils, fatty acids, herbicides, and insecticides.

Minimal liquid waste discharge achieved. Environmental pollution decreased, meeting strict regulations and the corporation's sustainable development policy. The increasing population, coupled with the industrial and infrastructural development, also leads to a rise in the volume of waste generation, which is a factor supporting the growth of the industrial evaporators market.

Stringent regulatory standards

Industries using multi-effect evaporators can meet stringent pollution control regulations, ensuring compliance with environmental standards. Regulatory agencies establish stringent purity standards for water used in drug production. Contaminants generated during pharmaceutical manufacturing are hazardous and pose risks, highlighting the necessity of wastewater evaporation equipment. Stringent regulations at national, state, and local levels necessitate minimal industrial wastewater discharge.

Wastewater evaporators can achieve zero liquid discharge, exceeding regulatory requirements. Wastewater evaporators are pivotal in addressing challenges such as removing oily waste from parts washer water and aligning operations with evolving clean water regulations, thus fuelling the growth of the industrial evaporators market globally.

Administered by the EPA, the National Pollutant Discharge Elimination System (NPDES) issues permits dictating allowable water purity levels from wastewater treatment plants. These permits authorize facilities to release regulated pollutant amounts under strict conditions. As authorized by the Clean Water Act, the NPDES permit program controls water pollution by regulating point sources that discharge pollutants into the waters of the United States.

Restraint

High maintenance and operating costs

High maintenance and operating costs are a significant drawback for the industrial evaporators market. The cost related to the energy required to operate the evaporators leads to additional operational expenses. Regular maintenance is crucial for ensuring optimal performance and durability, involving repair and cleaning expenses. The complexity of advanced evaporator systems often necessitates specialized knowledge for operational and maintenance, further increasing cost.

Opportunity

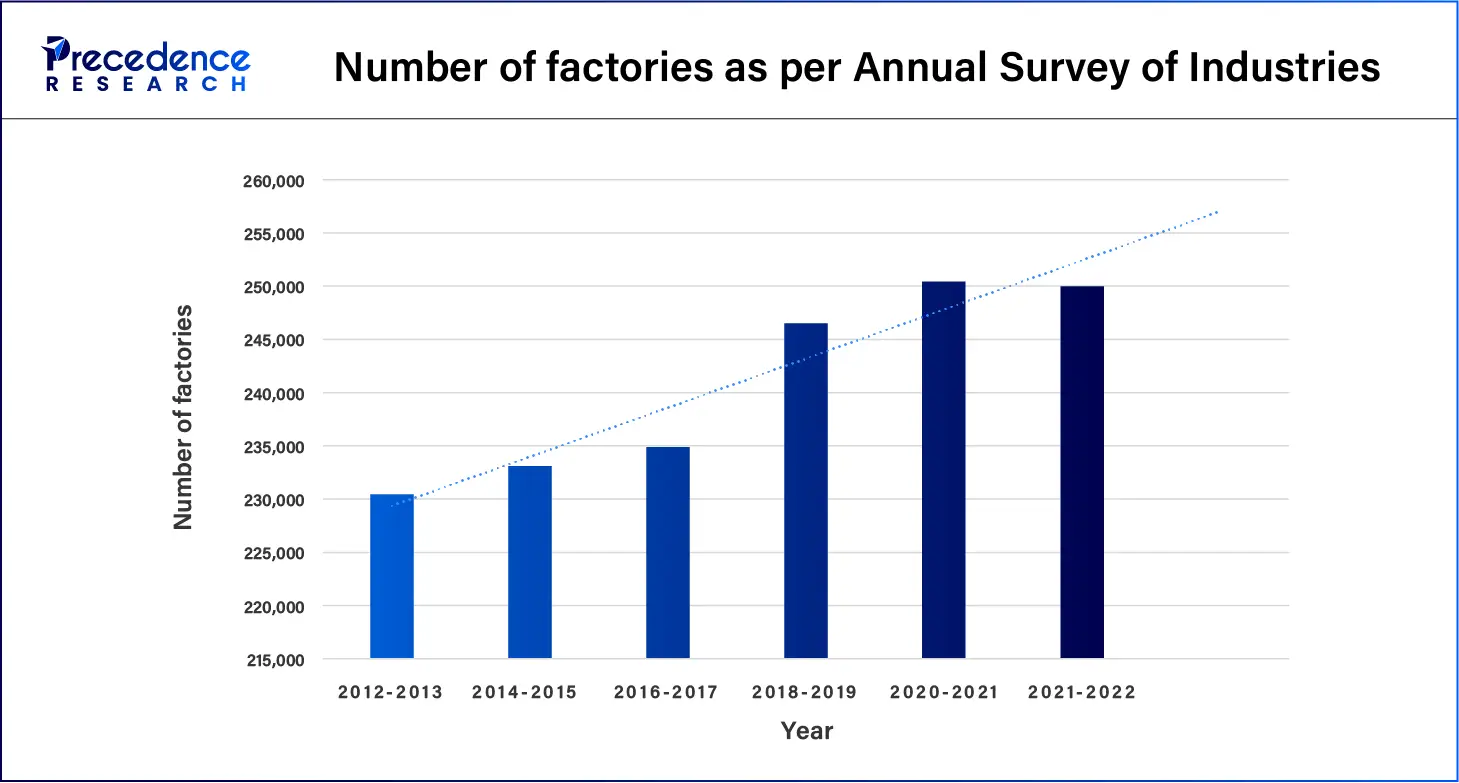

Industrialization in Developing Countries

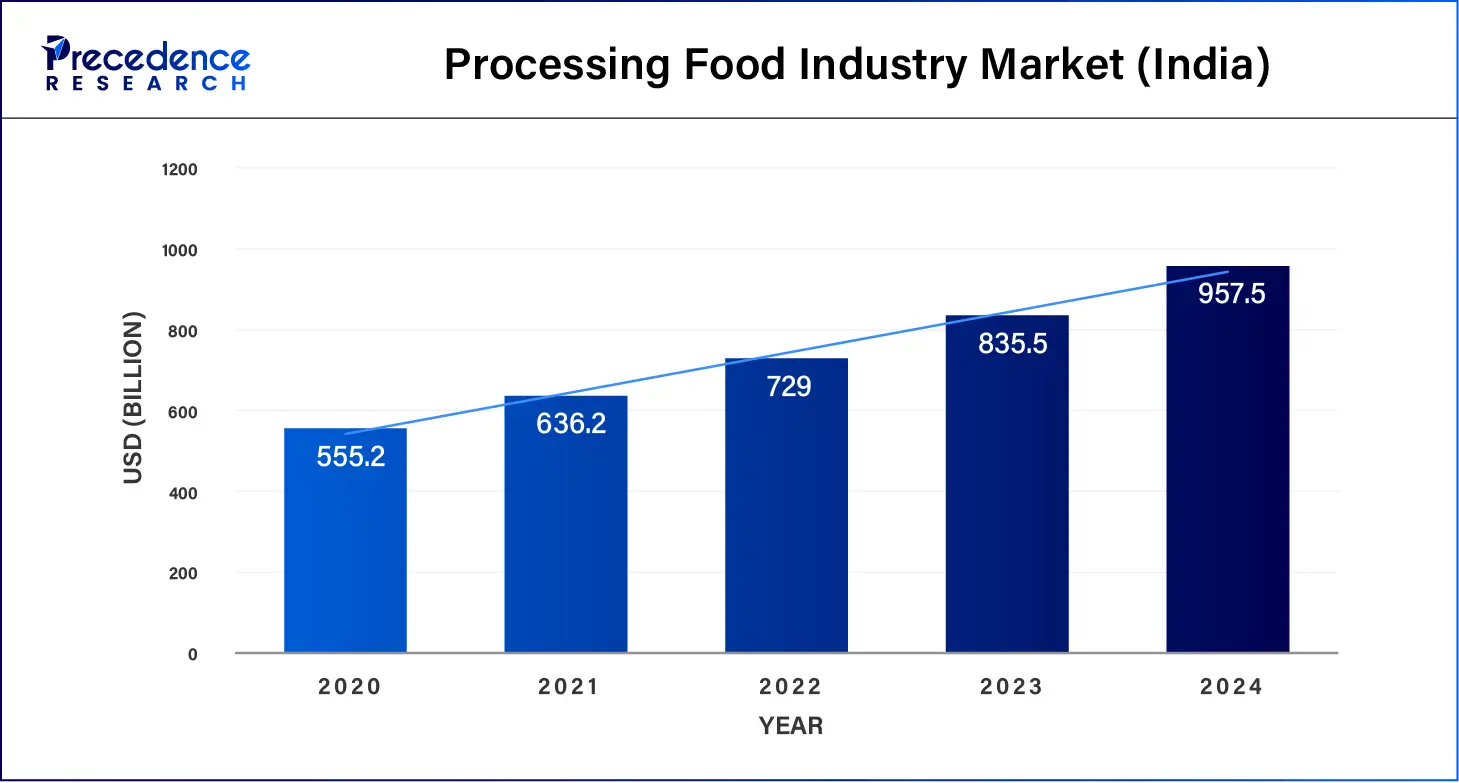

The acceleration in industrialization in Asia Pacific countries like Japan, China, and India has opened the way for the industrial evaporators market to grow. The market is mainly propelled by several factors, such as the rising demand for efficient evaporation systems, the expansion of the food and beverage industry as well as the chemical and pharmaceutical industries, and the increasing focus on environmental sustainability.

Type Insights

The plate evaporator segment has contributed the largest share towards the industrial evaporators market in 2024. A forced circulation plate provides so high shear rates that they lessen viscosity and power consumption. For smaller applications, it is a more economical choice. Tubular forced circulation is an economical option for bigger capacities, they occupy less floor space and are easier to maintain and clean. A rising film plate is a perfect solution for the small capacities and clean process liquors.

The shell & tube evaporator segment is expected to show considerable growth in the industrial evaporators market over the forecast period. The evaporator range is particularly designed for air conditioning and industrial refrigeration systems, and its function is to cool water or brine. Shell and tube evaporators come in a large number of sizes and shapes and can be classified according to different criteria, such as the type of construction, the refrigerant supply method, or the application.

Functionality Insights

The mechanical vapor recompression (MVR) segment accounted for the largest share of the industrial evaporators market in 2024. The evaporator components are like steam-driven systems, but with the addition of a mechanical compressor or fan. Mechanical energy compresses evaporated process vapor to a higher pressure and condensing temperature, and returns it to the process, minimizing steam consumption. Gas prices are increasing, so MVR has become the popular choice for cutting down on operating costs, especially at higher evaporation rates. The installation of fewer numbers of vessels required in the case of a combined effect multiple steam system generates lower installation costs.

The forced circulation evaporators segment is anticipated to witness significant growth in the industrial evaporators market over the studied period. Forced circulation evaporators, the liquid is pumped through a heat exchanger, where it is heated. The next stop is a flash vessel where it is depressurized, which is followed by the volatile liquid vaporization of the liquid. Force-based circulating evaporators have advantages such, as reducing precipitation or scaling, reducing excessive fouling at high temperatures, and higher shear rates for higher concentrations. The best option for small capacities on solutions with high viscosity that will not be able to withstand falling film. The forced circulation evaporators are the most commonly used by the distillery, pulp and paper, chemical, and pharmaceutical industries.

End-use Insights

The food & beverage segment held the largest share of the industrial evaporators market in 2024. Food products are concentrated in the food processing industry which is their main aim is to increase the lifespan of food products, ensure minimum volume and weight, minimize storage costs and transportation expenses, and give added value to the products. Concentration of fresh foods, such as fruit juices, is a profitable way to make use of perishable crops during peak harvest periods. Fruit juice concentrates and tomato paste is two examples of seasonal foods that evaporation preserves for year-round consumption. Lower water activity, which is a general indication of microbiological stability, preserves concentrated foods.

The chemical industry segment is expected to grow at the fastest rate in the industrial evaporators market during the forecast period. The chemical and kraft paper industries are two main applications of evaporation that are often used to recover chemicals of value, which are usually non-volatile. In the kraft pulping process, the solution is drained of most of the water, and solids are concentrated instead (i.e., black liquor). The remaining inorganic chemicals can then be purified and reused. While desalination of seawater is being treated as a reverse process in Zero Liquid Discharge plants, evaporation in this instance is removing the desirable drinking water from the undesired solute/product, salt. Chemical engineering applies evaporation in various processes.

Regional Insights

North America led the global industrial evaporators market in 2024. The region has economic stability and well-developed infrastructure. The manufacturing plants such as food and beverage, chemical, Pharmaceutical, Pulp, and paper require evaporators for various applications like cleaning, purifying, and wastewater treatment. The environmental concern and strict regulation further boost the growth of the market.

Asia Pacific is expected to host the fastest-growing industrial evaporators market throughout the forecast period. The rapid industrialization and urbanization expanded manufacturing industries in countries such as China, Japan, India, and South Korea. Investment in the industrial sector and infrastructure drives the growth of the market. Industries such as chemical, pharmaceutical, food and beverage, and wastewater treatment drive the market.

Industrial Evaporators Market Companies

- GEA Group

- SPX Flow

- Alfa Laval

- Thermal Kinetics

- Swenson Technology

- Belmar Technologies Ltd.

- Veolia

- DE Dietrich Process Systems

- Coilmaster Corporation

- ENCON Evaporators

Recent Developments

- In March 2023, Colmac Coil Manufacturing announced the release of three new configurations for its A+P Insulated Penthouse Air Coolers (evaporators), including insulated base, pitched base, and dual coil options to increase flexibility and installation customization.

- In April 2023, Artisan Industries presented the ROTOTHERM MINI, a continuous lab-scale evaporator/dryer. Operating the same thin-film separation technology, the ROTOTHERM MINI is intended for the continuous evaporation and liquid-to-powder drying of heat-sensitive materials.

Segments Covered in the Report

By Type

- Plate Evaporators

- Shell & Tube Evaporators

By Functionality

- Falling Film

- Rising Film

- Forced Circulation

- Agitated Thin Film

- Mechanical Vapor Recompression

- Others

By End-Use

- Pharmaceutical

- Chemical

- Food & Beverage

- Pulp & Paper

- Wastewater Treatment

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting