What is Industrial Fabric Market Size?

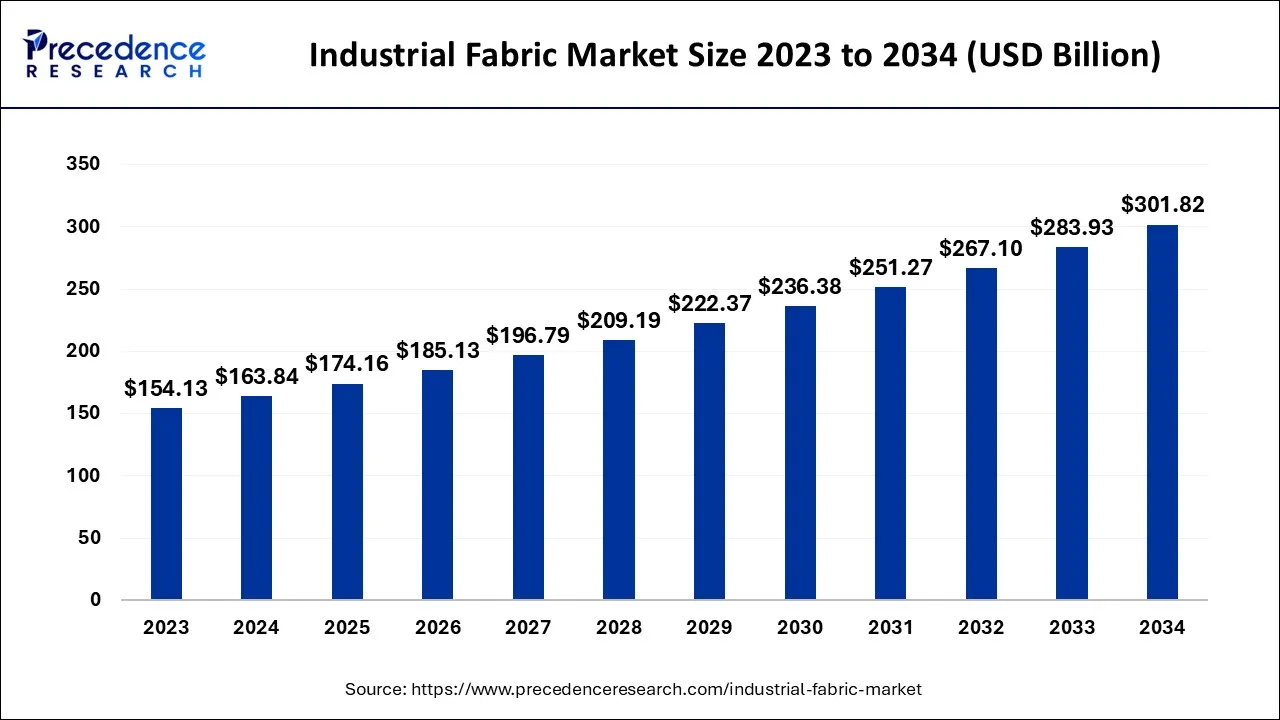

The global industrial fabric market size is expected to be valued at USD 174.16 billion in 2025 and is anticipated to reach around USD 318.15 billion by 2035, expanding at a CAGR of 6.21% over the forecast period 2026 to 2035. Factors such as the increased quality of industrial fabric features and the increasing application of industrial fabric in the automotive industry are driving the growth of the market. However, stringent government regulations are one of the major factors impeding the growth of the Industrial Fabric Market. Furthermore, the expansion of filtration applications will provide a tremendous opportunity in the industrial fabrics market during the forecast period.

Market Highlights

- Asia Pacific led the global market and generated for the largest market share in 2025.

- By Fiber Type, the polyester fibre type segment captured for the largest market share in 2025.

- By Applications, the automotive carpet segment dominated the market share and is predicted to grow from 2026 to 2035

Market Overview

Industrial fabrics are widely used in construction, transportation, and automotive industries due to their exceptional strength, durability, and permeability. They are extensively used in manufacturing belting, cord, filter cloth conveyor belting, hose, and seat cover fabrics. These fabrics are produced from several textile fibers and threads and can withstand wear and tear. Some of the materials used to make industrial fabrics include aramid fibers, fiberglass yarns, nylon, Kevlar, graphite, polyester, and Teflon. The rising production of fabric is expected to contribute to market expansion.

Industrial Fabric Market Growth Factors

- The increasing demand for industrial fabric in the automotive industry is expected to propel the growth of the market during the forecast period. Industrial fabric is used to manufacture automobile interior trims such as carpets, roof and door liners, and seat covers.

- Rising use in filtration applications is anticipated to fuel the growth of the industrial fabrics market in the coming years.

- Increasing urbanization and industrialization are expected to contribute to the market's growth.

- The increasing demand for conveyor and transmission belts is anticipated to accelerate the growth of the industrial fabric market during the forecast period.

- Rising focus on sustainability and eco-friendly practices increases demand for industrial fabrics made from biodegradable or recycled materials.

How does technological innovation impact the Industrial Fabric Market?

Technological advancements have transformed the textile industry. Advancements in manufacturing processes have resulted in the development of high-performance industrial fabrics with improved functionalities, including waterproofing, flame resistance, and chemical resistance. The integration of nanotechnology enables the textile industry to manufacture clothing with enhanced performance, like self-cleaning, fire-repellent, and water-repellent.

- In April 2024, Sight Machine introduced a new manufacturing data solution for integrating production data into Microsoft Fabric. The solution is expected to bring Sight Machine's data and analytics tools, such as Factory Copilot, into Microsoft Fabric, allowing organizations to combine and analyze contextualized manufacturing data with financial, supply chain, enterprise resource planning, and manufacturing execution systems data.

- In April 2024, Altair, a global leader in computational intelligence, acquired Cambridge Semantics, a prominent provider of modern data fabric solutions. Cambridge Semantics' graph-powered data fabric technology streamlines the creation of comprehensive enterprise knowledge graphs, seamlessly integrating the intricate network of structured and unstructured enterprise data into a unified, simplified perspective. The acquisition propels data fabric innovation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 174.16 Billion |

| Market Size in 2026 | USD 185.13 Billion |

| Market Size by 2035 | USD 318.15 Billion |

| Growth Rate from2026 to 2035 | CAGR of 6.21% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Fiber Type, Applications, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for functional and structural fabrics

Industrial fabrics are non-apparel, high-performance, and highly functional fabrics predominantly used in commercial and industrial applications. They are frequently used as components of other products to modify their functional properties, strength, and functionality. The growing demand for such tough fabrics is intended to prevent mishaps and to withstand environmental and mechanical stress. Furthermore, one of the potential drivers for this market is the growing demand for geosynthetics from various end-use sectors.

The growing use of geotextiles for geotechnical applications and environmental engineering is also expected to drive industrial fabric growth. Geotextiles and similar products are used in civil engineering applications such as railways, embankments, retaining walls, and other structures. For instance, the National Highways and Infrastructure Development Corporation of India announced the use of geosynthetics due to their life-extension and durability benefits.

Geosynthetics is one of the industrial fabric applications that has grown in popularity over the last few decades. Technical textiles such as geomembranes and geotextiles are widely used in various applications such as barrier tubes, liners, structural supports, reservoir covers, geotechnical, hydraulics, and other niche applications.

The growing popularity of such materials can be attributed to their high functionality and superior properties, which are expected to drive the market. Furthermore, technological advances in textile manufacturing processes and the implementation of automated systems for manufacturing and packaging processes are increasing in demand for conveyor belts, transmission belts, and other fabric components of industrial machines. This is expected to have a positive effect on market growth.

Restraint

Complexed manufacturing process

One of the most challenging and complicated processes is the production of these fabrics. These processes use highly valued fibers and materials that are difficult to manipulate due to their configuration and intrinsic performance specifications. For instance, glass fibres are highly abrasive and must be handled cautiously during manufacturing. On the other hand, regular and detailed testing using highly accurate and reliable methods can extend the life of these industrial fabrics.

Moreover, Industrial fabric is expensive due to the high investment required for manufacturing. New technologies for producing low-cost industrial fabric must be developed to commercialise the end products. Several production and development projects are underway to reduce the manufacturing costs of industrial fabric products using technology and process solutions. Low-cost industrial fabric development is expected to enable its use in a wide range of applications.

The majority of industrial fabric products are made with expensive synthetic fibre. Carbon and aramid fibres, which are commonly used in the production of industrial fabric for use in military and protective apparel applications, are expensive. As a result, market participants face a significant challenge in producing cost-effective industrial fabric.

Opportunity

Growth in the Indian textile industry

The advancement of Indian E-Commerce companies opens opportunities for the Indian textile industry in domestic and international markets. The major players in the Indian e-commerce industry are Amazon, Flipkart, Jabong, and Myntra. The textile industry in India is one of the country's oldest, dating back several centuries. Also, presently, the textile industry is one of the most important contributors to India's exports, accounting for approximately 13% of total exports.

The Indian textile industry is highly diverse, with hand-spun and hand-woven textile sectors on one end of the spectrum and capital-intensive sophisticated mills on the other. The decentralized power dominates the textiles sector, looms/hosiery, and knitting sector.

The textile industry's close relationship to agriculture (for raw materials such as cotton) and the country's ancient textile culture and traditions distinguish the Indian textile sector from other industries. The Indian textile industry can produce a wide range of products suitable for various market segments in India and worldwide.

Rising government initiatives to boost textile production further fuel the growth of the market. For instance, in India's Union Budget 2025-26, Finance Minister Nirmala Sitharaman has outlined significant measures that promise to reshape the Indian textile industry. The budget has notably increased the allocation for the textile industry to ?4,417.09 crore, up by ?974 crore (~$116.15 million) than the previous year.

According to the India Brand Equity Foundation (IBEF) report:

- In FY25 (April- June), the total exports of textiles stood at US$ 9.17 billion

- In June 2023, the Government approved R&D projects in the textile sector worth USD 7.4 million (Rs. 61.09 crore).

- In February 2023, the union government approved 1,000 acres of land for setting up a textile park in Lucknow.

- In 2022-23, fiber production in India stood at 2.15 million tonnes, while for yarn, it stood at 5,185 million kgs during the same period.

Segment Insights

Fibre Type Insights

Based on the fibre type, the global industrial fabric market is segmented into polyester, aramid, polyamide, composite, and others. In 2025, the polyester fibre type segment accounted for the largest market share. Polyester fibers are used in clothing and home furnishings, upholstered furniture, and a wide range of industrial applications such as car tire reinforcements, safety, and conveyor belts.

Furthermore, these materials can create sportswear and high-quality clothing combined with natural fibers. Rapidly changing fashion trends and modern living standards will develop opportunities for high-end polyester fibers with high durability, quick-drying, and easy-to-clean properties. Rising income levels and rapid urbanization have fueled fashion trends in several emerging economies. With easy internet access in many rural and semi-urban areas, demand for the latest fashion products in the apparel and home decoration segments is expected to rise further.

Furthermore, the rise of the e-commerce industry is expected to boost demand for polyester fiber. It enables a wide range of affordable products, quick delivery options, simple return policies, and material assurance, increasing product demand globally. Furthermore, factors such as the digitalization of manufacturing facilities, shorter lead times, and the growing textile industry in developing countries contribute to market share.

Application Insights

Based on applications, the global industrial fabric market is segmented into transmission belts, protective apparel, conveyor belt, automotive carpet, flame resistance apparel, and others. In 2023, the automotive carpet segment held the largest market share and is expected to grow during the forecast period. Carpets are used for a variety of purposes in the automotive industry. The carpet is a dense full-floor package typically made of cotton or man-made fibers, primarily if it covers the entire floor. A carpet is a fabric floor covering that usually has a stacked top layer attached to the backrest. Molded carpets are typically carpets used inside automobiles. Carpet backing comes in two varieties: poly backing and large-area backing.

The majority of cars use mass support. The carpet is designed to be attached to the vehicle's bottom/bottom, so there should be no air passages or pockets to prevent dust from entering the compartment. Carpets on the floor of a vehicle reduce noise, improve the aesthetic appearance of the interior, and provide insulation.

- The increasing production of vehicles further contributed to segmental dominance. According to the data published by the Society of Indian Automobile Manufacturers (SIAM), the auto industry produced a total of 2,59,31,867 vehicles, including commercial vehicles, passenger vehicles, two-wheelers, three-wheelers, and quadricycles, between April 2022 and March 2023, up from 2,30,40,066 units between April 2021 and March 2022.

The floor carpet is made of various materials depending on the requirements. Carpets on car floors also provide cushioning for the passengers. It also keeps water and dirt out of the car and protects the floor from corrosion. Moreover, the development and innovation of advanced technology in automotive keys are expected to drive the growth of this segment.

Regional Insights

How did the Asia Pacific Region dominate the Industrial Fabric Market in 2025?

Asia Pacific dominated the global industrial fabric market, holding a maximum market share in 2023. This is due to the high demand applications for interior trims of automobiles, fire protective apparel in countries such as China, India, and Japan. The Asia-Pacific region is the world's largest producer of industrial fabric. Bridgestone Corporation, Forbo International SA, Habasit, and TORAY INDUSTRIES, INC. are some leading industrial fabric manufacturers.

Furthermore, the rising mining activities are expected to drive market growth for this region. Moreover, a significant market trend in the global market is the increasing use of industrial fabric in the production of a wide range of denim products such as jeans, shirts, jackets, and other denim products. Cotton's widespread availability has fueled the advancement of the region's industrial fabric market.

China Industrial Fabric Market Analysis

Furthermore, preferential market access has been a critical component in boosting Bangladesh's textile sector, resulting in a significant increase in demand for industrial fabric. China is likely to maintain its dominance over the forecast period due to steady economic growth and urbanization. Increased government investment in innovative textiles, a growing consumer preference for luxury brands, and changing lifestyles are expected to propel India's textile and clothing industry into double-digit growth.

- According to the IBEF report, the textile industry contributes 2.3% to the India's GDP, 13% to industrial production, and 12% to exports. The textile industry in India is projected to double its contribution to the GDP, rising from 2.3% to approximately 5% by the end of this decade.

Why is North America the Fastest-Growing Region in the Industrial Fabric Market?

North America is expected to grow significantly in the market during the forecast period, owing to the increased demand for industrial fabric across the construction, automotive, and healthcare sectors. The manufacturing initiatives and trade policies of the North American government protect domestic supply chains and impact the industrial fabric and textile sectors.

• In April 2025, Nuveen, the leading market player in the USA, invested USD 13.5 million in fabric. The investment is made to advance the smart fleet infrastructure of electric vehicles and IoT-based mobility solutions.

U.S. Industrial Fabric Market Analysis

The U.S. market for industrial fabric is expanding due to technological advancements like smart textiles, AI, and automation, and government support for domestic manufacturing. The National Defense Authorization Act (NDAA) and the National Council of Textile Organizations (NCTO) support a strong domestic textile manufacturing in the U.S. This act also aims to expand the procurement of defense-related textiles made in America.

How is the Notable Growth of Europe in the Industrial Fabric Market?

Europe is expected to grow at a notable rate in the market during the studied period due to the increased focus on workplace safety, decarbonization mandates, and digital transformation. The European Parliament recently approved new measures on textile waste. Supportive regulatory frameworks, investment in industrial infrastructure, and a focus on sustainable manufacturing practices are driving market expansion. Together, these factors are reinforcing Europe's position as a mature yet innovative hub for industrial fabrics.

• In February 2025, the European Union and the Ministry of Textiles launched seven projects to advance the growth of the handicraft and textile sector in India. The European Union funded €9.5 million EU grant through this project.

What are the Major Factors Contributing to the Industrial Fabric Market within South America?

South America is expected to experience a lucrative market growth during the forecast period due to innovations in technologies and sustainability, which include eco-friendly materials, digital transformation, and local resources. Government infrastructure projects and increasing industrial investments are further boosting demand for industrial fabrics. Collectively, these trends are positioning South America as a growing market for industrial fabric applications.

In March 2024, Valmet planned to invest in filter fabric manufacturing in South America to meet the growing demand for high-performing filter fabrics in both the pulp and paper and mining industries in this region. The investment has improved local services and response times in the region.

What Opportunities Exist in the Middle East and Africa in the Industrial Fabric Market?

MEA is expected to grow at a significant rate in the market in the coming years, driven by large-scale infrastructure projects, industrial safety and regulation, and eco-friendly trends. There is a strong focus on decarbonization and localized manufacturing by the regional countries like Oman, the UAE, South Africa, and Egypt. Increasing infrastructure development, urbanization, and industrialization are fueling the need for durable, high-performance fabrics used in filtration, protective clothing, and industrial applications.

Industrial Fabric Market-Value Chain Analysis

- Feedstock Procurement

This stage is driven by the expansion of sustainable feedstocks like recycled polyester and bio-based feedstocks.

Key Players: Toray Industries, DuPont, Aditya Birla Group, Lenzing AG, Hyosung Corporation, and Invista. - Distribution to Industrial Users

This stage is expanding due to the rising trends like specialized warehousing, e-commerce integration, and direct-to-user distribution.

Key Players: DuPont, Toray Industries, Ahlstrom, Berry Global, Freudenberg Group, Arvind Limited, Johns Manville. - Waste Management and Recycling

This stage includes major innovations such as AI-driven sorting, chemical depolymerization, and polycotton solutions.

Key Players: Lenzing AG, Birla Cellulose, Unifi, Inc., Worn Again Technologies, Aquafil S.p.A., Renewcell, Indorama Ventures.

Industrial Fabric Market Companies

- Habasit AG

- TORAY INDUSTRIES, INC

- W.Barnet GmbH & Co. KG

- Bridgestone Corporation

- Forbo International SA

- Johns Manville

- Fitesa

- G.R. Henderson Co. Textiles Ltd

- Ahlstrtom-Munksjo

- Dupont

Recent Developments

- In September 2024, Mimaki Europe, a leading provider of industrial inkjet printers, cutting plotters, and 3D printers, introduced four new printers for sign graphic, industrial, and textile applications. The CJV200 Series, a range of roll-to-roll print and cut eco-solvent machines, and the TS330-3200DS, a hybrid direct and transfer sublimation printer, will both be demonstrated for the first time in Europe at The Print Show (September 17-19th, NEC Birmingham, UK).

- In September 2024, a Textile Task Force (TTF) was established for the first time by the Southern Gujarat Chamber of Commerce and Industry (SGCCI) to address a range of industry-related challenges and bring different segments of the textile sector on a single platform.

Segment Covered in the Report

By Fiber Type

- Polyester

- Aramid

- Polyamide

- Composite

- Others

By Applications

- Transmission Belt

- Protective Apparel

- Conveyor Belt

- Automotive Carpet

- Flame Resistance Apparel

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting