What is the Industrial Salts Market Size?

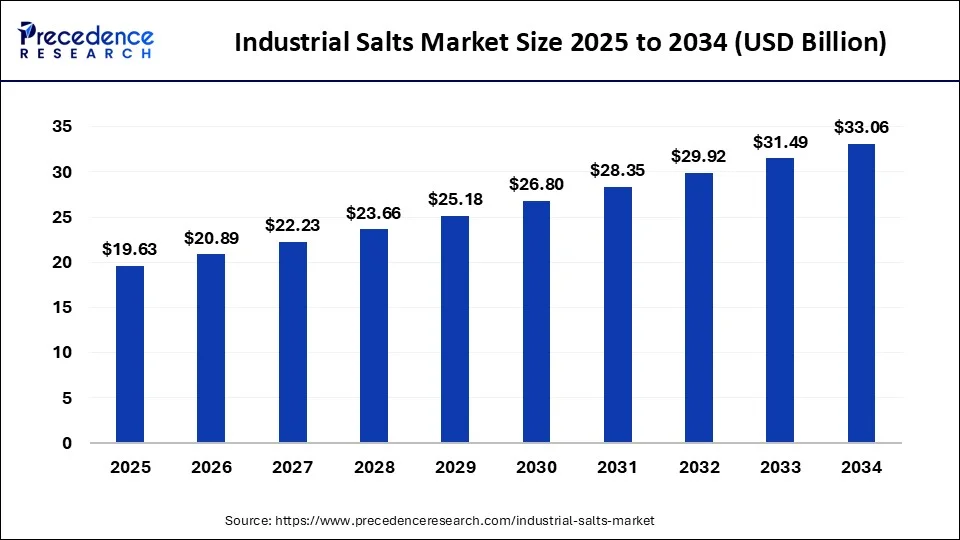

The global industrial salts market size is valued at USD 19.63 billion in 2025 and is predicted to increase from USD 20.89 billion in 2026 to approximately USD 33.06 billion by 2034, expanding at a CAGR of 6.01% from 2025 to 2034.

Industrial Salts Market Key Takeaways

- Asia-Pacific region has accounted highest revenue share of 39.4% in 2024.

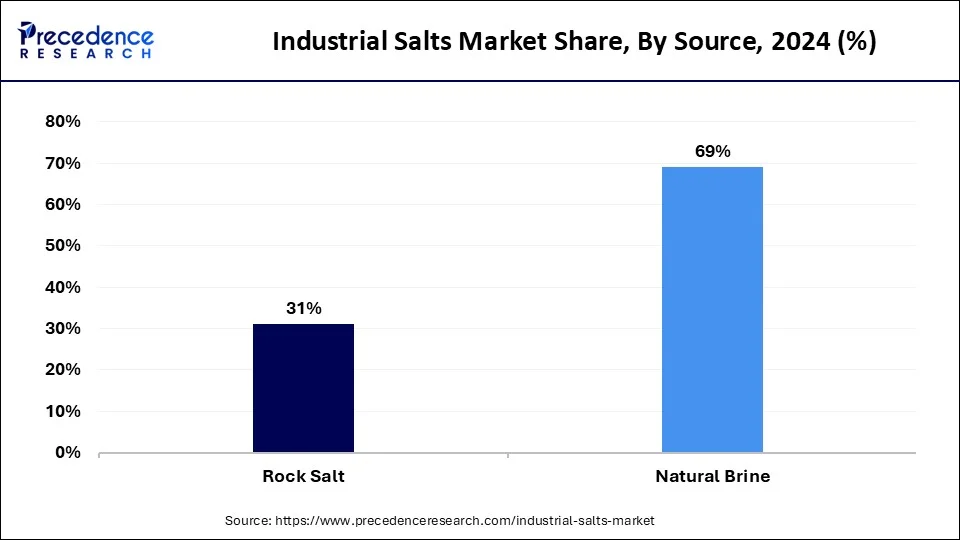

- By source, the natural brine segment garnered the highest revenue share 69% in 2024.

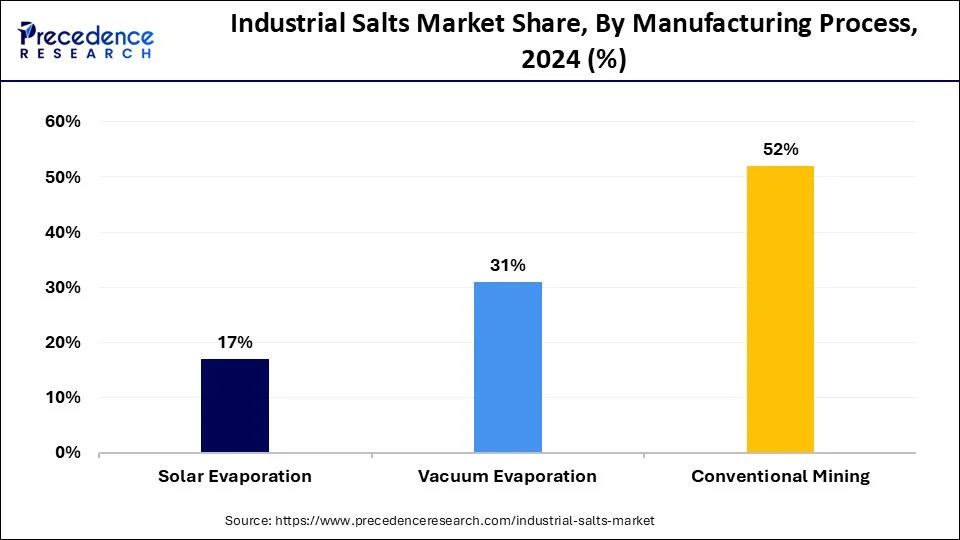

- By manufacturing process, the conventional mining segment contributed 52% market share in 2024.

- By application, the chemical processing segment has generated 47% in 2024.

Market Overview

Sodium chloride is derived by using seawater and rock salt for its extraction. This industrial salt is used in agriculture, water treatment, de-icing, chemical processing. When it comes to the usage of industrial sales for the chemical industry it is used in the production of chlorine caustic soda and ash soda. Caustic soda is used in the production of paper and pulp, detergents and soap, chemical products and petroleum products.

For manufacturing glass soda ash is produced across the world and it is also used in the production of soaps detergent in the powdered form and the rechargeable batteries soda ash is also used in the food industry metallurgical processes, pharmaceutical and cosmetic industries. All of these factors or the applications of industrial salts will help in the growth of the market in the coming years.

Industrial Salts Market Outlook

- Industry Growth Overview: Between 2025 and 2034, the industrial salts market is expected to grow moderately, driven by resilient demand from core industries such as chemical processing, water treatment, and de-icing. High-growth niches include the use of high-purity salt in pharmaceuticals, food processing, and emerging applications in renewable energy.

- Demand from the Chemical Processing Sector: Over half of global salt production is crucial for the chlor-alkali process, which manufactures chemicals like chlorine and caustic soda used extensively in plastics, paper, and detergents. This large-scale industrial use, which has no economically viable alternatives, is the main driver of the global market.

- Global Expansion: Leading companies are expanding geographically, with the Asia-Pacific region expected to be the fastest-growing market due to rapid industrialization, urbanization, and high demand from the chemical and water treatment sectors. North America remains a major consumer. Expansion often involves strategic partnerships and investments in local infrastructure, such as new salt refining plants in the MEA.

- Major Investors: The market is led by large, established companies such as Cargill, K+S AG, Compass Minerals, and Tata Chemicals. Investment activity mainly involves strategic acquisitions and partnerships to boost production capacity and expand global distribution networks.

- Startup Ecosystem: Although the core market is mature and led by established players, innovation is taking place in niche, technology-focused areas. Emerging players are working on using AI to improve extraction efficiency, creating high-purity salts for specialized uses like LiFSI in batteries, and exploring additional revenue sources such as lithium extraction from saline brines.

Growth Factors

The demand for industrial salt is expected to grow in the coming years due to the manufacturing of caustic soda and chlorine on a large scale. The demand for the product is expected to grow in the coming years as it is used in many industries. Agriculture chemical processing and water treatment are the major applications of industrial salts. For the production of chlorine and caustic soda industrial salts are used maximum in chemical industries across the world. The industrial salts market is expected to grow well in the coming years as there is no other alternative which is cost effective.

The other products that are available in the market are expensive hence they are not preferred by many industries. There are many local manufacturers and global manufacturers of industrial salts that manufacturer industrial salts in various forms and these salts are provided to various industries. As the raw material which is used in the manufacturing of the industrial salts is derived from the natural resource this market is extremely price sensitive and the amount of profits earned by the organizations are also less.

- For water treatment and chemical processing industrial salt is used on a large scale and the demand for it will continue to grow in the coming years.

- Industrial salt will be used maximum for chemical processing as it helps in manufacturing chlorine caustic soda and soda ash.

- The availability of industrial sales in various forms will also help in the market growth as it helps in providing a large range of product portfolio.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 |

USD 19.63 Billion |

| Market Size in 2026 |

USD 20.89 Billion |

| Market Size by 2034 |

USD 33.06 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.01% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Manufacturing Process, Application, and Geography |

Market Dynamics

What are the drivers of the industrial salts market?

- Application of industrial solves in many areas- Industrial salt is used in many different applications. One of the major applications of industrial salts is the chemical processing industries. In the chemical processing industries industrial salt is used as the raw material. It is used in the manufacturing of soda ash chlorine as well as caustic soda. In the recent years these chemicals are in great demand and this will drive the market growth in the coming years. In the countries like China as well as India the industrial salts market will grow fast as the demand for it has increased.

- Plenty salt reserves- There's a large-scale availability of the reserves of salt which happens to be the raw material through which the industrial salts are extracted. The availability of salt results will help in meeting the demand of various countries. The use of the industrial salts is expected to be more in the Asia Pacific region due to a number of projects undertaken by the government. The use of industrial salts in water treatment is expected to help in the growth of the market as 27 projects of water treatment are under construction in India. It is used for the purification and the softening of the water.

What are the challenges in the industrial salts market?

- Availability of the salt pans or the salt mines on lease- Salt mines or the salt pans are provided on lease basis to the organizations for the extraction and usage of rock salt in the manufacturing of the industrial salts. As there is no ownership, the availability of these sites is not constant. This is one of the major challenges that will hamper the growth of the market in the coming years.

- Health and environmental issues- When it comes to the usage of industrial salt in various industries for the production of other materials a large amount of emissions come out of these industries which are harmful for the environment and stringent regulations of various nations regarding the compliance for carbon emissions will also hamper the growth of the market in the coming years.

- Logistics services are cost intensive- The availability of a warehouse or the fulfillment of the need by any provider decides the cost of logistics. The in transparent market of warehousing is another challenge that the industry faces.

What are the opportunities in the industrial salts market?

- Unavailability of cost-effective alternatives- In order to manufacture the products like ethylene dichloride industrial salts are used and this is the only available option which is cost effective. It shall provide major opportunities for the growth of the market in the forecast period. 50% of industrial salts are demanded for the chemical processes across the world.

- Rapid industrialization and urbanization- the demand for different types of chemical products has increased in the recent years which has created more demand for the industrial salts.

- Segmental Insights

Source Insights

On the basis of the source, the natural brine segment is expected to have the largest market share in the coming years period this segment has dominated the market in the past due to urbanization and industrialization throughout the world. For manufacturing PVC industrial salts are used on a large scale and it is also used in the manufacturing of inorganic chemicals. Highly concentrated constituents like molecules elements and oils which are present in natural brine makes them a better option for manufacturing the industrial salts.

Brains are extremely saline as a large amount of dissolved materials are present in brines. It is used for the water purification procedure and it is also used in softening of water. the need for detergents and other chemicals used in laundry are growing in the North American market. And the increased use of such products will help in the growth of the market in the coming years.

Manufacturing Process Insights

On the basis of the manufacturing process, the conventional mining segment is expected to have the largest market share in the coming years. As plenty salt mines are available throughout the world this segment is expected to grow well in the coming years. In this procedure underground salt deposits are extracted through mining.

Evaporation is the procedure used for extraction of the salt. Cheap resources and cost-effective resources will be instrumental in the growth of the market. As the number of innovations in the market have increased for the production of the pesticides and other products used in agriculture there shall be an increased need for the industrial salts.

Application Insights

On the basis of application, the chemical processing segment is expected to have the largest market share in the coming years as it has dominated the market even in the past. Manufacturing of soda ash and caustic soda is done with the help of industrial salts in chemical industries. As the need four different types of petroleum products has increased due to rapid urbanization the demand for industrial salts is expected to grow in the coming years. Glass is used in a lot of modern constructions and it is also used in the display of electronic products these two applications will also increase the demand for industrial salts in the coming years.

The demand for the cosmetic products and the pharmaceutical products has also increased to a great extent in the recent years especially after the outbreak of the COVID-19 pandemic and the use of industrial salts in the manufacturing of these products will help in the growth of the market during the forecast period. The extensive use of industrial salts in various industries will drive the market growth during the forecast. Most of the products which are used in the manufacturing of the end products are making use of industrial salts as there are no other alternatives available that are cost effective.

Regional Insights

Why Asia Pacific Region is Dominating the Industrial Salt Market?

Asia Pacific region has dominated the industrial salt market in the past with the largest market share in terms of revenue and it will continue to grow in the coming years. Rapid industrialization and urbanization are two main factors that have resulted in the growth of the market in the Asia Pacific region.

Increased need for cleanliness and health care has created more demand for various products that are used as cleansing agents and these cleansing agents are manufactured with the help of industrial salts hence the market is expected to grow well in the coming years for the Asia Pacific region.

The demand for the disinfection products and laundry detergents has grown to a great extent. As the population of various nations in the Asia Pacific region like China and India is huge the demand for different types of food products will also help in the growth of the market in the coming years.

Industrial salts are used in the agricultural sector and they increased use of this product to meet the growing demands of food in the various nations of Asia Pacific region will help in the growth of the market in the coming years period industrial salts are used in the manufacturing of herbicides and pesticides. The government of various regions are making investments which will help in the growth of the market in the coming years.

The market in China is growing at the largest pace and the amount of salt produced in China is maximum as compared to any other nations in the Asia Pacific region. Out of the total salt production across the globe 8.8% of it is manufactured in India.

China Industrial Salts Market Trends

China is the largest producer and consumer of industrial salt in Asia-Pacific and worldwide. Its market dominance is backed by extensive salt reserves and high-volume production, mainly through solar evaporation. Government-supported smart healthcare and infrastructure projects further increase demand for industrial salt across applications, from chemical manufacturing to water treatment to the growing de-icing sector.

How is the Opportunistic Rise of North America in the Industrial Salts Market?

North America is a significant market for industrial salts, fueled by a mature industrial base and diverse applications. The main driver in this region is the widespread use of salt for de-icing roads during winter months, which makes up a large part of the market. Additionally, the region has a strong chemical processing industry that relies on salt as a primary raw material for vital chemicals. North America benefits from an advanced infrastructure and the presence of major global salt producers.

U.S. Industrial Salts Market Trends

The U.S. leads the market in North America, as it is a major global consumer and producer of industrial salt. Its dominance is driven by steady and high demand for deicing salts in northern states with harsh winters. The country also has a robust chemical manufacturing sector and widespread use of salt in water treatment and food processing, supported by technological advancements in extraction and efficient logistics networks that ensure a reliable supply across industries.

How Crucial is the Role of Europe in the Industrial Salts Market?

Europe plays a significant role in the industrial salts market, known for high consumption in de-icing during winter and a substantial chemical processing industry. The market faces strict environmental regulations on extraction and use, which boost investment in sustainable production methods and eco-friendly alternatives to traditional rock salt for de-icing. Major companies lead the market, emphasizing R&D for high-purity salts used in pharmaceuticals and premium food processing.

Germany Industrial Salts Market Trends

Germany is a key player in the market, driven by strong demand from its large chemical manufacturing sector and significant de-icing requirements for road safety in cold weather. Home to major chemical companies like K+S AG, the country is a leader in salt production and processing technology. The market is shaped by the nation's focus on sustainability, promoting advanced, energy-efficient production methods, especially in de-icing applications.

What Potentiates the Growth of the Latin America Industrial Salts Market?

The market in Latin America is driven by strong demand from the chemical processing, food, and oil & gas industries. The region has abundant natural salt deposits and large production capacities, especially in countries like Chile and Brazil. Salt is essential for manufacturing key chemicals and is also widely used in agriculture as a livestock supplement. Additionally, it plays a growing role in the water treatment sector to meet increasing demand for clean water due to urbanization.

Brazil Industrial Salts Market Trends

Brazil is a major player in the market in Latin America, with growth driven by strong domestic demand from its large chemical and food processing industries. The agricultural sector is another key consumer, using salt as a vital mineral supplement for livestock across its vast interior regions. Brazil relies heavily on solar evaporation for cost-effective salt production along its extensive coastline, though it also imports salt, mainly from Chile, to meet its significant industrial needs.

What Factors Drive the Growth of the Industrial Salts Market in the Middle East and Africa?

The market in the MEA region is expanding as it takes advantage of its ideal climate for low-cost solar salt production from plentiful seawater and brine sources. The main driver is industrial applications, especially in the oil and gas sector, water treatment, and the chemical industry. Countries are increasingly investing in large, modern production facilities to boost efficiency and meet both local and global demand, shifting from traditional methods to industrial-scale operations.

Saudi Arabia Industrial Salts Market Trends

Saudi Arabia plays a distinctive role in the market, largely shaped by its government's economic diversification goals and the critical need for water treatment in an arid climate. The country is a major producer of desalinated water, and the byproduct brine from these plants is increasingly used to extract high-quality industrial salt for the chemical and oil & gas sectors. Demand is robust for use in the chlor-alkali industry to produce essential chemicals with major companies like SASA Saudi Salt in the market.

Value Chain Analysis

- Raw Material Extraction

This involves obtaining salt from rock deposits or natural brine using mining, solar evaporation, or solution mining.

Key Players: Cargill, K+S Aktiengesellschaft, Compass Minerals, and Tata Chemicals. - Processing and Refining

Raw salt is processed through crushing, washing, drying, and screening to remove impurities. High-purity applications use vacuum evaporation.

Key Players: Cargill, K+S Aktiengesellschaft, Tata Chemicals, and INEOS Enterprises. - Distribution and Supply Chain Management

This manages the logistics of delivering industrial salt in bulk or bags via road, rail, and sea, with seasonal demand a key factor.

Key Players: Cargill, Incorporated, K+S Aktiengesellschaft, Tata Chemicals Limited, INEOS Group Ltd - End-User Applications and Consumption

Industrial salt is used across a wide range of industries. The main use is for chemical production followed by road de-icing, water treatment, and food processing.

Key Players: Solvay, INEOS.

Top Companies in the Industrial Salts Market

- Cargill, Inc.: Produces high-purity salt for chemical processing, water treatment, road de-icing, and oil and gas drilling.

- K+S AG: Offers various salts, including rock, vacuum, and sea salt, for chemical manufacturing, road safety, water softening, and pharmaceuticals.

- INEOS: Provides high-grade vacuum salt and brine solutions primarily used in chemical manufacturing, food processing, and pharmaceuticals.

- Tata Chemicals Ltd.:Supplies vacuum-evaporated and solar salts for industries like glass, detergents, textiles, petrochemicals, and water purification.

- Mitsui & Co. Ltd.: Distributes and invests in industrial-grade salts for agriculture, chemical manufacturing, and de-icing applications.

Other Key Players

- Nouryon

- Rio Tinto Group

- Compass Minerals America Inc.

- China National Salt Industry Co.

- Dominion Salt Ltd

Recent Developments

- In March 2025, The Michigan Potash & Salt Co. announced the launch of Michigan Salt, set to produce 1 million tons of food-quality salt annually from the nation's largest and lowest-cost evaporative salt plant. This facility will help meet high demand for salt in the Midwest, supporting water softening and winter road safety.

(Source: businesswire.com) - In May 2025, Minerals Development Oman (MDO) partnered with Dev Salt for the Naqa Salt Project in Mahout, aiming to establish the largest industrial salt production facility in the region. Utilizing sustainable solar evaporation technology, it will produce bromine-rich industrial salt, enhancing Oman's mining sector and export capabilities.

(Source: prnewswire.com)

Segments covered in the report

By Source

- Rock Salt

- Natural Brine

By Manufacturing Process

- Conventional mining

- Solar evaporation

- Vacuum evaporation

By Application

- Agriculture

- Chemical processing

- Food processing

- Water treatment

- Deicing

- Oil and gas

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content