May 2025

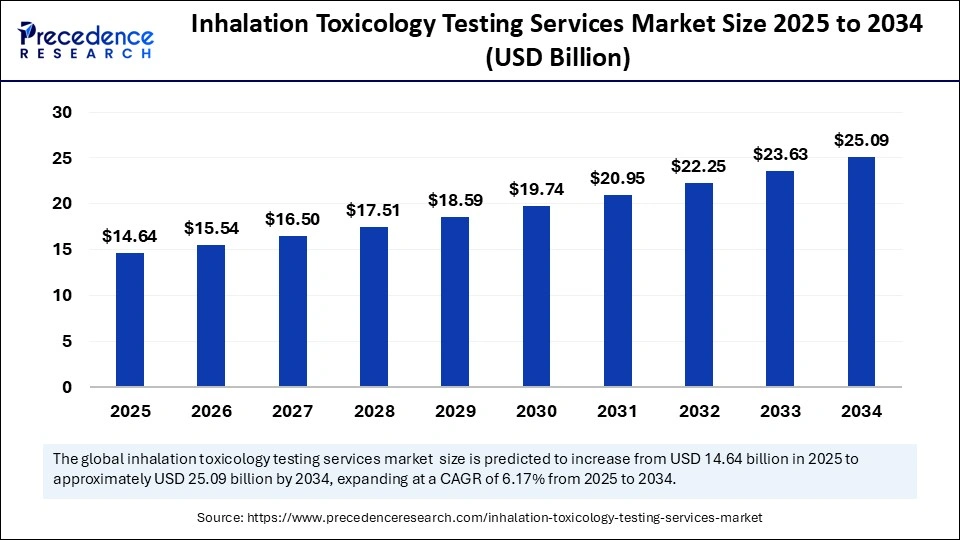

The global inhalation toxicology testing services market size was calculated at USD 13.80 billion in 2024 and is predicted to increase from USD 14.64 billion in 2025 to approximately USD 25.09 billion by 2034, expanding at a CAGR of 6.17% from 2025 to 2034. The increased demand for alternative testing methods and growing government funding for toxicology research are driving the global market. The market is further experiencing significant growth with rapid advancements in technology.

The inhalation toxicity testing services are related to the testing of absorption, distribution, metabolism, and excretion (ADME) toxicology testing. The increased investments in R&D by the government and pharmaceutical and biotechnology companies are allocating budgets for the development of advanced therapeutic solutions. Stringent regulatory guidelines for drug safety and approvals are driving innovations in inhalation toxicology testing methods. Additionally, the rising emphasis on reducing late-stage drug failures with advanced predictive technologies and standardised testing protocols is fueling the need for inhalation toxicology testing services.

Cell culture technology and molecular imaging technology are gaining traction in the global market, driven by the ability of cell culture technology to stimulate human physiological conditions with an automated testing system. The increased need for advanced imaging solutions in research and development is driving the adoption of molecular imaging technologies. Additionally, the regulatory announcements for animal testing alternatives and emphasis on increasing adoption of In-silico testing with advanced computational technologies and artificial intelligence applications are enabling cutting-edge innovations in inhalation toxicology testing services.

Artificial intelligence is playing a significant role in the inhalation toxicology testing services market by enabling predictive modelling, data analysis, risk assessment, and automation. AI algorithms provide predictive modelling of toxicity, including chemical toxicity, and prioritise chemicals for further testing. AI can analyse a broad amount of data from different sources, like omics technologies and high-throughput screening, helping to detect patterns and correlations. AI algorithms enable assessing the risks associated with inhalation exposures to chemicals, providing more accurate and efficient risk evaluations. Moreover, the increased demand for personalized medicine is fueling the integration of AI with inhalation toxicology testing services to help tailor drug treatments for individuals by analysing their genetic data and identifying genetic variants that are associated with drug metabolism and toxicity.

| Report Coverage | Details |

| Market Size in 2024 | USD 13.80 Billion |

| Market Size in 2025 | USD 14.64 Billion |

| Market Size by 2034 | USD 25.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.17% |

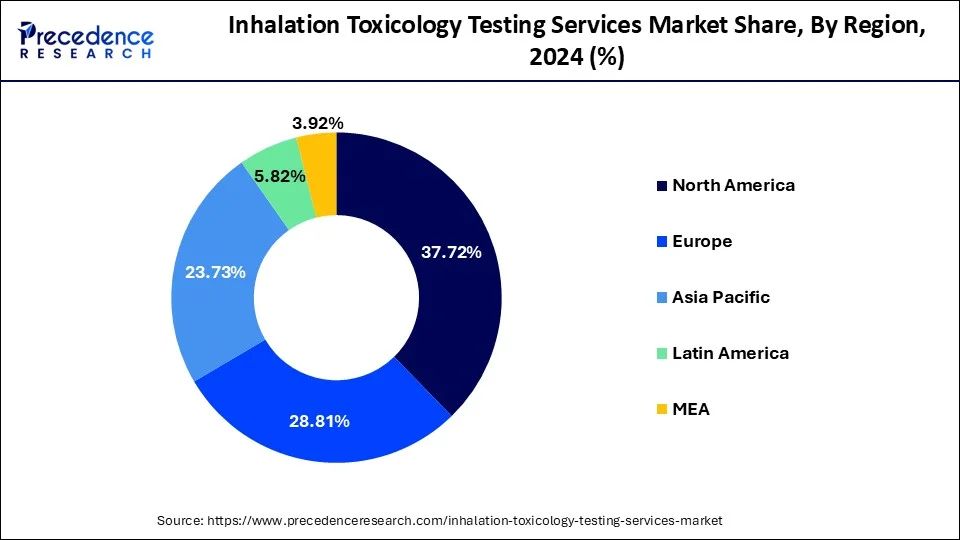

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service/Study Type, Exposure Mode/Atmosphere, Biological Model, Endpoint/Output, End-Market/Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth of Pharmaceuticals and Chemical Industry

Increased R&D spending, the introduction of new drug formulations, and the development of novel chemicals boost the need for safety testing services. The increased demand for toxicology testing in these industries is fostering their growth and innovations. The expansion of the pharmaceutical and chemical industries is fostering drug discoveries and the requirement for regulatory companies. The rising consumer awareness of chemical safety is contributing to the adoption of testing services.

This industry growth is driving the need for more comprehensive and sophisticated solutions, ensuring drug safety and efficacy, and driving the adoption of services that assess chemical components and medical devices for inhalation hazards. Additionally, the requirement of the pharmaceutical and chemical industry to comply with regulatory compliance to meet safety standards is further adding to the increasing adoption of inhalation toxicology testing services.

High Cost

The high cost of inhalation toxicology testing services is a major restraint on the inhalation toxicology testing services market. These services require complex and sophisticated equipment for accurate exposure and dosimetry. The specialised equipment and technology used in this testing are quite expensive. The trained professionals with expertise in biology, toxicology, and chemistry are needed for inhalation toxicology testing services, which adds to the cost. Additionally, the requirement to comply with strict regulatory guidelines also adds to the cost associated with training and operations.

Animal Testing Alternatives

Regulatory bodies are fostering ethical concerns and bans on animal testing to accelerate the adoption of non-animal approaches. The regulatory emphasis on reduction and replacement of animal testing is driving approaches toward in vitro, in-silico, and other alternative testing methods. This approach is driving the adoption of more sophisticated inhalation methods to advance innovations and accuracy. Additionally, advanced silico modeling with computational model advancements, such as Quantitative Structure-Activity Relationship (QSAR) and Quantitative Read-Across (QRA) models, is enhancing inhalation toxicity prediction and providing greater predictability.

Which Service/Study Type Segment Dominated the Inhalation Toxicology Testing Services Market?

The repeated-dose inhalation toxicity (short-term, sub-chronic, chronic) segment dominated the market in 2024, due to the large number of studies with repeated doses. The need for inhalation toxicology testing services is high in repeated-dose toxicity studies for characterising adverse toxicological effects. These effects can occur from daily exposure to a substance for a specific time or period. Pharmaceuticals, environmental pollutants, and chemicals and agrochemicals are the sectors that drive the adoption of repeated-dose inhalation toxicity services.

The in vitro inhalation assays (air-liquid interface [ALI], lung organoids) and NAMs segment is the second-largest segment, leading the market due to its reproducibility and ability to detect toxicity in the early drug development stage. These services enable more physiologically relevant models that replace animal testing. The ability of in vitro inhalation assays and NAMs to offer better respiratory disease and drug discovery insights aligns with 3R principles. The advancements in in vitro systems are driving service adoption in industries like pharmaceuticals, cosmetics, and consumer products.

Which Exposure Mode/Atmosphere Leads the Inhalation Toxicology Testing Services Market?

The aerosol (particulate) — controlled MMAD/PSD segment led the market in 2024, due to its large adoption in accurate drug delivery assessment. Mass Media Aerodynamic Diameter (MMAD) and Particle Size Distribution (PSD) are essential in regulatory compliance and understanding of the health impacts of toxicity. Pharmaceutical companies are driving demand for comprehensive control and measurements of aerosol properties to unveil the efficacy and safety of products. This makes aerosol-controlled MMAD/PSD a high-value area for testing services.

The nebulised/device-specific dosing (pMDI, DPI, nebuliser) segment is expected to grow fastest over the forecast period, driven by the need for device-specific testing. The need for specialised testing for various devices like pressurised metered dose inhalers, dry powder inhalers, soft mist inhalers, and nebulisers is high in the pharmaceuticals, chemicals, and consumer products industry. The inhalation drug product testing is essential for nasal drug products and orally inhaled drug products. Technological advancements like cascade impaction, automated actuation systems, and laser diffraction are contributing to the segment’s growth.

How In Vivo Segment Dominates the Inhalation Toxicology Testing Services Market?

The in vivo (rodent — mouse/rat; non-rodent — rabbit, dog; NHP) segment dominated the market in 2024, due to exclusive tests, regulatory requirements, and increased demand for personalised medicines and innovations in animal models. The regulatory compliance regarding accurate prediction of human toxicity, cost, and the development of new approach methodologies (NAMs) is driving the adoption of inhalation toxicology testing services in in vivo studies. In vivo studies need regulatory approvals for drugs and require chronic toxicity testing. Additionally, the growing emphasis on replacements and reducing animal use, particularly for certain rugs, is contributing to this growth.

The in vitro (primary human airway cultures, ALI, co-culture airway models) segment is the second-largest segment, leading the market, due to an increase in vitro assay activity. The in vitro studies are cost-effective, ethical, and more effective alternatives to animal testing. The innovations in primary human airway cultures, ALI, and co-culture airway models are further driving the adoption of in vitro studies. The growing regulatory emphasis on non-animal methods is further aiding in the growth of in vitro studies, driving the need for advanced inhalation toxicology testing services.

Which End-Point/Output Segment Dominated the Inhalation Toxicology Testing Services Market?

The histopathology and pulmonary pathology segment dominated the market in 2024, due to increased need for detailed, tissue-level evidence for the effects of substances on the respiratory system. The histopathology and pulmonary pathology are essential for safety evaluations and dose estimation in drug development and hazard assessments. The need to ensure sophisticated toxicological profiles, guide regulatory submissions, and prevent the need for more extensive studies, the histopathology and pulmonary pathology are crucial. The inhalation toxicology testing services ensure histopathology and pulmonary pathology.

The biomarkers, cytokines, and omics segment is expected to grow fastest over the forecast period, driven by their crucial role in providing mechanism-based insights into the biological process of toxicity, such as inflammation and immune responses. These biomarkers, cytokines, and omics offer highly sensitive and predictive safety assessments to enhance drug development. The ability of biomarkers to offer more accessible and measurable indicators of toxicity, with cytokines tracking inflammation, makes them crucial in testing services. Omics help to detect patterns in biological signals for revealing toxicity mechanisms and predicting adverse effects.

What Made the Pharmaceutical Segment Dominate the Inhalation Toxicology Testing Services Market?

In 2024, the pharmaceutical segment dominated the market due to the expanding pharmaceutical industry and increased R&D spending. Pharmaceutical companies have increased outsourcing preclinical safety testing to CROs (contract research organisation), enabling cost-effective and emphasizing core competencies. The rising need for rigorous safety assessment for complex biologics and novel drug modalities is further contributing to this growth. Pharmaceutical companies need to comply with strict regulations, the shift to safe, effective, and compliant respiratory condition requirements, driving the adoption of comprehensive inhalation toxicology testing services.

The U.S. inhalation toxicology testing services market size was exhibited at USD 4.35 billion in 2024 and is projected to be worth around USD 8.05 billion by 2034, growing at a CAGR of 6.35% from 2025 to 2034.

North America Inhalation Toxicology Testing Services Market

North America dominated the global inhalation toxicology testing services market, holding the largest share of 45% in 2024, driven by the region’s well-established research and development sector and its strict dug safety regulations. North America has a well-established and expanded pharmaceutical and biotechnology industry, driving demand for new drugs and fostering investments in research and development. The rising regulatory requirements and increased adoption of cutting-edge in-vitro and 3D cell culture technologies are contributing to this growth. The increased demand for new and diverse chemical testing, strong emphasis on technological advancements, and regulatory support are fostering this growth.

The U.S. Market Trends

The U.S. is a major player in the regional market, growth driven by rising research and development activities and strong pharmaceutical and biotechnology companies. The U.S. government is implementing strict regulations for the safety of chemicals, medical devices, and consumer products, driving the need for sophisticated inhalation toxicology testing services. The FDA guidelines for reducing and potentially replacing the use of animals for testing are fostering innovative approaches in the U.S. industry. The rising demand for animal testing alternative methods and expanding testing scope to include novel product categories such as nanoparticles and e-cigarettes are contributing to this growth.

Asia Pacific Inhalation Toxicology Testing Services Market

Asia Pacific is the fastest-growing region in the global market, growth driven by the region’s expanding pharmaceutical industry and increasing prevalence of chronic disease. The expanded pharmaceutical companies have boosted demand for early toxicity detection solutions and services. Governments and companies' investments in research and development activities are enabling innovations and developments of inhalation toxicology testing services across Asia. Additionally, the ongoing emphasis on advancements in technologies like 3D cell culture and in-silico modelling is further contributing to the market growth.

Increased R&D Activity: Fueling Need in China

China is a major player in the regional market, contributing to growth due to the country's well-established and rapidly expanding pharmaceutical and biotechnology sectors. China is the second-largest drug developer globally, driving a significant need for sophisticated toxicology services. The growing pharmaceutical pipeline and the need to ensure drug safety are leveraging this shift. The Government of China is investing in local pharmaceutical companies and supporting R&D activities, which leads to a boost in the country's market.

Europe Inhalation Toxicology Testing Services Market

Europe is a notable player in the global market, contributing to growth due to increasing R&D activity, increased demand for testing novel therapeutic areas, and stringent government regulations. The European Union has implemented strict regulations for drug safety and chemical products, driving the need for comprehensive inhalation toxicology testing services. Additionally, the expanding areas like biologics and personalised medicines are further increasing the adoption of these testing services. Europe’s emphasis on advancements and adoption of cutting-edge technologies like AI and 3D cell culture in drug discovery and testing for more accurate, cost-effective, and fast solutions is boosting this growth.

Strong Pharmaceutical Industry: To Boost German Adoption

Germany dominates the regional market due to the country's robust pharmaceutical industry base. Germany’s government and pharmaceutical companies are investing heavily in R&D. The strong and large laboratory network and strong pharmaceutical companies' commitment to regulatory compliance and innovations are contributing to the rising adoption of sophisticated toxicology testing services, including inhalation toxicology testing services.

By Service/Study Type

By Exposure Mode/Atmosphere

By Biological Model

By Endpoint/Output

By End-Market/Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

July 2025

January 2025

August 2025