Interactive Fitness Market Size and Forecast 2025 to 2034

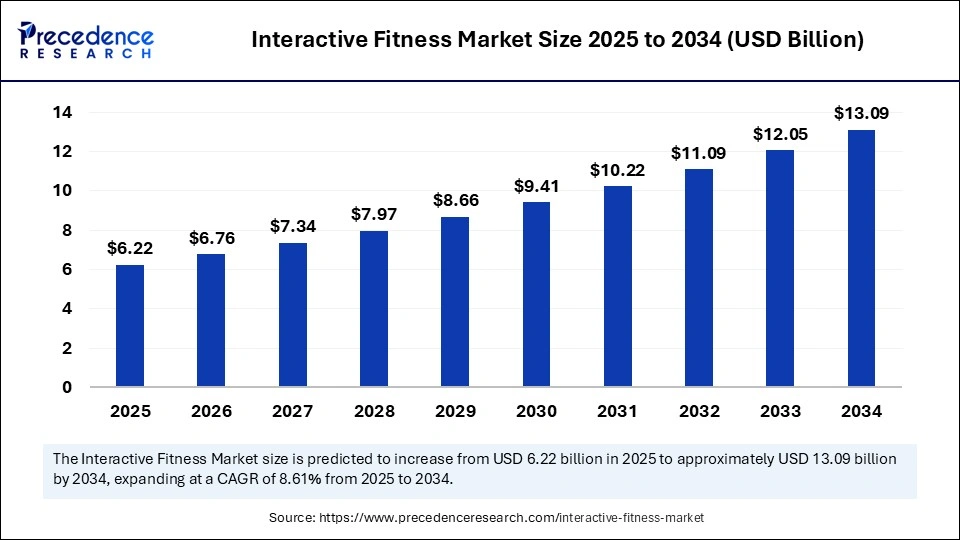

The global interactive fitness market size accounted for USD 5.73 billion in 2024 and is predicted to increase from USD 6.22 billion in 2025 to approximately USD 13.09 billion by 2034, expanding at a CAGR of 8.61% from 2025 to 2034. The market growth is attributed to the rising demand for personalized, tech-enabled workout experiences that enhance convenience, engagement, and measurable fitness outcomes.

Interactive Fitness MarketKey Takeaways

- In terms of revenue, the interactive fitness market is valued at $6.22 billion in 2025.

- It is projected to reach $13.09 billion by 2034.

- The market is expected to grow at a CAGR of 8.61% from 2025 to 2034.

- North America dominated the interactive fitness market with the largest revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By product, the fitness equipment segment held the major revenue share of the market in 2024.

- By product, the software system segment is expected to grow at the highest CAGR during the forecast period.

- By application, the household segment contributed the biggest revenue share in 2024.

- By application, the gym segment is expected to expand at a significant CAGR in the coming years.

- By end-user, the residential segment dominated the market in 2024.

- By end-user, the non-residential segment is expected to register the fastest CAGR over the projection period.

Impact of Artificial Intelligence on the Interactive Fitness Market

Fitness centers heavily rely on artificial intelligence AI to check user progress in real-time, which helps them offer customized workout plans and guidance based on each person's goals and performance. Fitness app developers are incorporating machine learning capabilities to analyze user data, such as heart rate, movement levels, and progress in healing. This further helps create customized workout plans. Using AI-powered apps and equipment helps users gain faster and better workout results, which enables them to stay with the service for a long time. Furthermore, AI offers real-time feedback and guidance, making virtual coaching possible.

Market Overview

The interactive fitness market is evolving rapidly as people care more about healthy living. Technological advancements have brought fresh experiences to old-fashioned workouts. Modern technologies fuse devices and software, allowing people to benefit from instant feedback and distant encouragement. Advanced technologies make it easier to customize workouts and measure user achievements with great precision. In 2024, the CDC noted that using digital fitness tools helped adults achieve higher levels of physical activity, usually in favor of broader public health plans. These officials and organizations consider these devices successful at tackling the problems of inactivity and chronic illness. Furthermore, the WHO includes digital fitness in its strategies to encourage people everywhere to do more physical activity, thus further fuelling the interactive fitness solutions market.

(Source: https://www.cdc.gov)

Interactive Fitness MarketGrowth Factors

- Rising Adoption of Wearable Health Devices: Growing consumer interest in fitness tracking wearables is driving demand for integrated interactive fitness platforms that provide comprehensive health insights.

- Boosting Digital Community Engagement: Increasing popularity of social and competitive features in fitness apps is fueling user motivation and long-term adherence to exercise routines.

- Growing Corporate Wellness Programs: Expanding workplace health initiatives are propelling investments in interactive fitness solutions to enhance employee productivity and reduce healthcare costs.

- Advancements in AI-Powered Personalized Training: Continuous development in AI algorithms is driving smarter, adaptive workout plans that improve user outcomes and satisfaction.

- Increasing Penetration of High-Speed Internet: Growing access to reliable broadband connectivity in urban and rural areas is supporting seamless streaming of interactive fitness content globally.

- Fueling Expansion of Hybrid Fitness Models: Combining in-person and digital workouts is boosting market reach by appealing to diverse user preferences and schedules.

- Propelling Integration with Smart Home Ecosystems: Rising compatibility of fitness devices with home automation platforms enhances user convenience and encourages sustained engagement.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.09 Billion |

| Market Size in 2025 | USD 6.22 Billion |

| Market Size in 2024 | USD 5.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.61% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Personalized Workouts to Drive Innovation in Interactive Fitnes

Increasing demand for personalized workout experiences is expected to drive the growth of the interactive fitness market. The demand for personalized fitness programs is expected to lead to major changes on connected fitness platforms. People want workout programs that respond to their actual progress, targets, and individual tastes. AI, biometric devices, and smartphone apps are combined to help users stick with their routines and notice changes. Custom content offered by Peloton and Tonal is drawing many users because the routines are adjusted based on the feedback they receive. Such a trend encourages people to use services for a long time and feel comfortable with higher prices.

Personalized and wearable technology-focused workouts were listed as top trends in the global fitness scene in the 2024 ACSM Fitness Trends Report. This further emphasizes how important they are in influencing today's fitness routines. According to the CDC's 2024 Physical Activity Guidelines Compliance Report, a majority of people who exercised regularly stated that customized digital fitness programs were more appealing than generic classes. Furthermore, advanced platforms help people stick with their workouts, which further facilitates market expansion.

(Source: https://acsm.org)

(Source: https://www.cdc.gov)

Restraint

High Equipment Costs Expected to Limit Market Growth

The high cost associated with interactive fitness equipment is expected to limit its adoption, especially among price-sensitive consumers. Equipment needed for interactive workout platforms includes high-tech treadmills and rowing machines that are connected to the internet and motion-sensing devices. These are expensive to purchase at the beginning. As traditional gym memberships cost less, it is not easy for many consumers to justify the price of a fitness studio. Regular updates to hardware cost users' additional money and not all improvements are fit for the old equipment, which further hampers the market growth.

Opportunity

Integration of Gamified Experiences

Spurring integration of gamification features is projected to create favorable opportunities for key players competing in the market. The use of gamification is expected to bring more engagement for platform users. Introducing gamification elements is projected to engage users more and allow businesses to stand out from the competition. Gamification features like achievement badges motivate users. They bring a competitive and successful feeling to workouts that most gyms cannot offer. People create communities by taking part in team workouts, sharing posts, and setting goals together. Furthermore, the launch of new and advanced workout games for a wider audience is expected to expand the market in the coming years.

For instance, the Tron-inspired fitness game Sportvida CyberDash was launched in May 2025 on Quest and PC VR. Designed to deliver stress relief through intense physical challenges, Sportvida CyberDash takes place in a futuristic world where users need to smash obstacles, sprint, and dodge to advance across 30 different maps. Previously released in early access on Quest, the game aims to test your reflexes, focusing on continuous forward movement and acceleration as you race towards the finish line.

(Source: https://www.uploadvr.com)

Product Insights

Why did the Fitness Equipment Segment Dominate the Market in 2024?

The fitness equipment segment dominated the interactive fitness market with the largest share in 2024 as more people were choosing to work out at home, and advanced technologies were now included in many forms of fitness equipment. Having interactive screens and real-time feedback made connected treadmills, stationary bikes, and rowing machines popular with fitness lovers looking for engaging methods to exercise. People are working from home and are health-conscious, so they now prefer equipment that supports virtual coaching. Furthermore, the increased shift toward workout equipment with digital features bolstered the growth of the segment.

The software system segment is expected to grow at the highest CAGR during the forecast period, owing to the more use of cloud services and AI for personalized experience. Fitness apps make it possible for users to partake in personalized training and online group exercises and to follow their progress on several gadgets. Workouts are adjusted on the spot by reviewing user personal data during workout sessions. Such models allow users to get more updates and use more areas to talk with similarly interested users.

Fitness studios and those who make equipment are embedding software to offer users combined services that link their machines with digital options. Software solutions lead to good prospects for interactive fitness. In 2024, ACSM revealed that using digital tools involves roughly two-thirds of fitness industry services, which underlines that the sector is increasingly using software. Additionally, the rising demand for digital solutions leads to a greater number of people using software.

(Source: https://acsm.org)

Application Insights

How Household Segment Dominate the Interactive Fitness Market in 2024?

The household segment dominated the market with the largest revenue share in 2024, due to the rising consumer preference for home-based fitness solutions. Because awareness about health has increased and technology has evolved, individuals are increasingly choosing to purchase connected fitness equipment for home settings. Fitness equipment meant for home use has virtual trainers, adjustable plans, and customized options to make sure users continue exercising regularly. Moreover, the equipment makers are bringing out options that are not only immersive but also designed to take up a little space in the house. Due to the busy lifestyles, more people are choosing home-based equipment solutions, contributing to segmental growth.

The gym segment is expected to expand at a significant CAGR in the coming years, owing to the rising use of advanced workout tools in commercial gyms. Gyms use smart treadmills, connected bikes, and interactive training programs to draw more members who are comfortable with advanced technologies. The rise in the need for personal trainers and instant gratification is likely to drive segmental growth. Furthermore, gyms made use of interactive platforms to organize live events and classes, which helped boost user participation. The rising population of fitness freaks further supports segmental growth.

End-User Insights

What Made the Residential the Dominant Segment in 2024?

The residential segment dominated the interactive fitness market in 2024. As home-based fitness solutions offer convenience, a large number of people preferred to exercise at home rather than go to the gym, which made residential the dominant segment. People are seeking customized workout plans, making home-based solutions popular. Being health conscious and the ease of working out at home made more people buy interactive fitness equipment and try out digital fitness apps. Enhanced interfaces and improved connectivity caused consumers to find equipment that fits with smart homes. Furthermore, the trend of staying fit at home has emerged rapidly, especially after the COVID-19 pandemic, which bolstered the growth of the segment.

The non-residential segment is expected to register the fastest CAGR over the projection period, as corporate offices, gyms, and fitness centers are buying interactive fitness solutions. A large number of gyms are adopting technology for group classes. Businesses focus on improving their employees' well-being, which leads them to install interactive fitness solutions. With more employees choosing hybrid work, companies are encouraged to add on-site gym facilities that include digital and in-person connections. Improvements in technology let gyms watch over their clients and change their fitness programs. Partnerships between fitness technology providers and fitness centers make it easier for many people to use advanced fitness solutions at the gym.

Regional Insights

What Made North America the Dominant Region in 2024?

North America dominated the interactive fitness market, capturing the largest revenue share in 2024. This is mainly due to its advanced technological infrastructure, facilitating the widespread adoption of digital interactive fitness equipment. With the increased health consciousness, North American consumers have shifted toward sophisticated fitness solutions. Many consumers have chosen to acquire high-tech exercise machines and related software over outdated fitness solutions. The busy lifestyles and the increased awareness among people about active lifestyles encouraged them to either prefer home-based fitness solutions or go to the gym. The rise in the number of people living without enough physical activity and increased concerns about obesity have made many people more interested in taking care of their health and fitness, which raised demand for at-home workouts.

The U.S. and Canada are major forces in the North American interactive fitness market. Being in an active culture, consumers in the U.S. and Canada are always willing to buy and use novel fitness solutions. The Centers for Disease Control and Prevention (CDC) highlighted that about 60% of U.S. adults take part in technology-based exercise in 2024. Moreover, the availability of various gym subscription options supports market growth.

(Source: https://www.cdc.gov)

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The increase in economic growth in China, India, Japan, and South Korea has made it possible for more people to benefit from interactive fitness programs. Many working people are preferring modern ways to work out. The proliferation of smartphones and better internet access in the region makes it easy to include fitness apps, online workouts, and smart exercise equipment. Manufacturers and new businesses in the area are making interactive fitness products that match the region's culture and different fitness wishes. Furthermore, the rising health and wellness trend is encouraging people to work out, contributing to market expansion.

Europe is expected to witness notable growth in the upcoming period. Consumers in Germany, the UK, France, and the Nordic nations are especially interested in staying fit by using modern fitness solutions. European people often use fitness software and virtual classes that allow them to work out anytime at their convenience. The pandemic has accelerated the adoption of digital fitness solutions. With the growing health consciousness and increased awareness about physical well-being, more people are preferring home-based fitness solutions. Increased disposable income is letting people invest in premium fitness solutions, contributing to regional market growth.

Interactive Fitness Market Companies

- Axtion Technology LLC

- BowFlex Inc.

- EGYM Inc.

- Evervue USA Inc.

- Motion Fitness LLC

- Nexersys Corp

- Paradigm Health and Wellness Inc.

- Peloton Interactive Inc.

- SMARTfit Inc.

- TECHNOGYM Spa

Recent Developments

- In June 2025, iFIT Inc., a global leader in connected fitness and interactive content, today announced the expansion of its iFIT AI Coach (beta) across 19 countries: Australia, Austria, Belgium, Canada, Finland, France, Germany, Ireland, Italy, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, and the UK. This strategic expansion brings iFIT's intelligent, personalized fitness technology to more athletes around the globe.

(Source:https://via.ritzau.dk)

- In April 2025, Gymijet, a cutting-edge fitness startup, unveiled its AI-powered portable gym system, designed to deliver precision training, real-time feedback, and unmatched convenience for users on the go. Created by entrepreneur Eyal Levy during the pandemic, the system blends isokinetic resistance technology with an intelligent mobile app that customizes workouts according to each user's form, fitness goals, and ongoing performance. Weighing just six pounds and compact enough to fit in a carry-on, Gymijet empowers users to maintain consistent, high-quality training routines anywhere, whether at home, while traveling, or outdoors—redefining flexibility and personalization in modern fitness.(Source: https://www.globenewswire.com)

Segments Covered in the Report

By Product

- Fitness Equipment

- Software System

By Application

- Gym

- Household

By End-User

- Residential

- Non-residential

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content