What is the Smart Fitness Market Size?

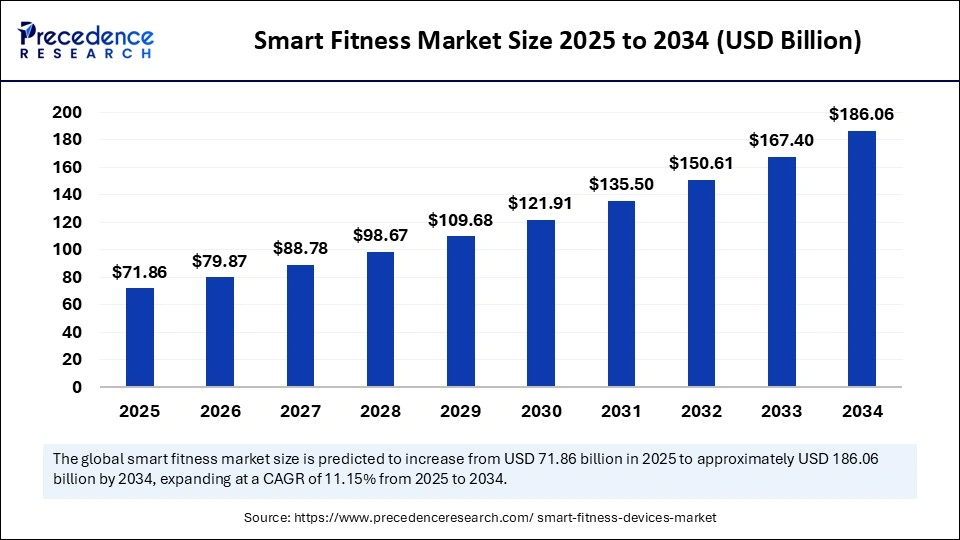

The global smart fitness market size was calculated at USD 64.65 billion in 2024 and is predicted to increase from USD 71.86 billion in 2025 to approximately USD 186.06 billion by 2034, expanding at a CAGR of 11.15% from 2025 to 2034. The market is growing due to rising health awareness, technological advancements such as AI and IoT, and consumer demand for convenient and personalized fitness solutions.

Market Highlights

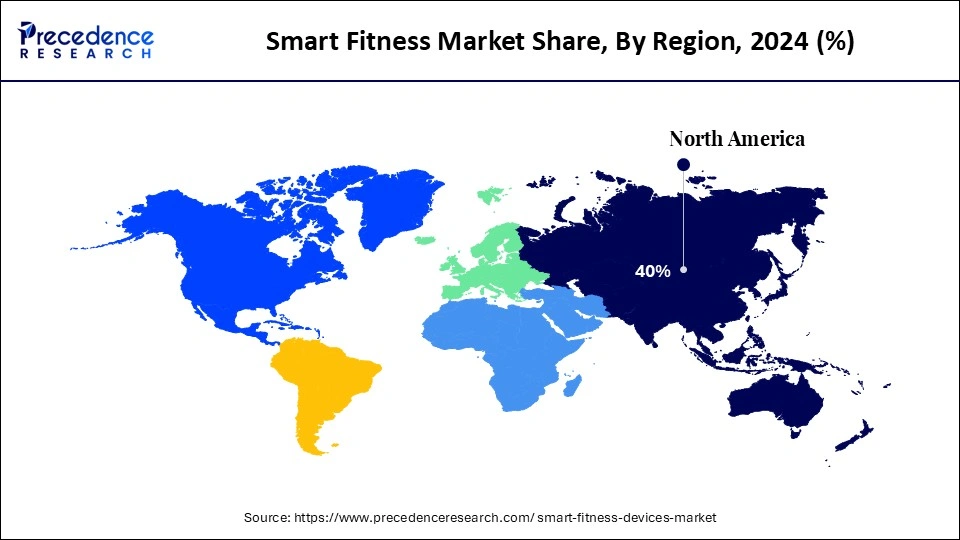

- North America dominated the smart fitness market with the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at a notable CAGR during the forecast period.

- By product type, the smart wearables segment held the biggest market share of 38% in 2024.

- By product type, the connected cardio equipment & VR fitness segment is expected to grow at the fastest CAGR during the forecast period.

- By component, the hardware segment captured the biggest market share of 52% in 2024.

- By component, the software/platforms & subscription services segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the personal fitness & wellness segment contributed the highest market share of 45% in 2024.

- By application, the corporate wellness programs segment is expected to grow at the fastest CAGR during the forecast period.

- By end user, the individual consumers segment is expected to grow at the fastest rate of 50% in the smart fitness market.

- By end user, the fitness centers & gyms segment led the market in 2024.

- By enterprise size, the large enterprise segment generated the major market share of 65% in 2024.

- By enterprise size, the SMEs/startups segment is expected to grow at the fastest CAGR during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 64.65 Billion

- Market Size in 2025: USD 71.86 Billion

- Forecasted Market Size by 2034: USD 186.06 Billion

- CAGR (2025-2034): 11.15%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

What Is Encompassed in the Smart Fitness Market?

The global smart fitness market is experiencing significant growth, driven by shifting consumer preferences and technology breakthroughs. The shift toward home-based and hybrid fitness models offers convenience and flexibility. At the same time, AI, IoT, and machine learning enable customized workouts and real-time tracking through wearable devices and smart equipment. An essential component of contemporary health and lifestyle trends, smart fitness solutions are further supported by the growing use of fitness applications and corporate wellness initiatives.

How Is AI Transforming the Smart Fitness Market?

Artificial Intelligence is transforming the smart fitness industry by making health and fitness experiences highly personalized, driven by wearables, fitness apps, and smart gym equipment. This enables the creation of tailored workout plans, provides real-time performance feedback, and delivers predictive health insights. Home-based and hybrid fitness models are becoming possible with the aid of AI-powered virtual trainers and intelligent coaching features. At the same time, community-driven experiences are being fostered through integration with social media and mobile apps. Fitness is becoming more accurate, convenient, and engaging thanks to AI, which enables individuals to track their health and maintain their well-being.

- In September 2025, Meta launched the Oakley Meta Vanguard smart glasses, designed for athletes. Priced at $499, these glasses integrate with fitness platforms like Garmin and Strava, providing real-time training stats and post-workout summaries. They feature a centered action camera, improved speakers, and enhanced water resistance. The glasses will debut in the U.S. and Canada on October 21, 2025.(Source: https://www.reuters.com)

Smart Fitness Market Growth Factors

- Technological Advancements: AI, IoT, and machine learning enhance personalized workouts, real-time tracking, and integration with apps and wearables.

- Rising Health Awareness: Increasing focus on fitness, wellness, and preventive healthcare drives demand.

- Home & Virtual Workouts: Post-pandemic, consumers prefer convenient at-home or online fitness options.

- Wearable Devices: Smartwatches, fitness bands, and connected gym equipment boost engagement and data tracking.

- Integration with Mobile Apps: Companion apps provide progress tracking, goal setting, and social connectivity.

- Corporate Wellness Programs: Businesses are adopting smart fitness solutions to improve employee health and productivity.

- Gamification & Social Features: Features like challenges, leaderboards, and virtual communities motivate users to stay active.

- Rising Disposable Income: Increased spending power allows consumers to invest in high-tech fitness devices.

- Fitness tourism & Lifestyle Trends: Growing interest in fitness retreats, wellness travel, and lifestyle experiences supports smart fitness adoption.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 64.65 Billion |

| Market Size in 2025 | USD 71.86 Billion |

| Market Size by 2034 | USD 186.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, End-User, Enterprise Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Health & Wellness Awareness

As obesity, diabetes, and other lifestyle-related diseases are on the rise, people are paying more attention to staying fit and healthy overall, leading to growth in the smart fitness market. With the help of real-time data on heart rate, calories burned, and activity levels, smart fitness devices help users maintain accountability. Growing government initiatives that support preventive healthcare and healthy living are also fueling this trend. Additionally, fitness coaches and social media influencers are raising awareness and encouraging people to invest in connected fitness solutions.

Technological Advancements

Wearables that are lighter have longer battery life and better sensors in the smart fitness market. Bluetooth Low Energy IoT integration and 5G are examples of advanced connectivity that enable devices and apps to sync seamlessly. AI-driven analytics make workouts safer and more intelligent by converting raw data into actionable insights. Moreover, immersive fitness experiences are being created through the use of augmented reality and virtual reality by drawing in tech-savvy customers.

Restraints

Data Privacy and Security Concerns

Smart fitness devices collect highly sensitive health information, including location tracking, sleep patterns, and heart rate. Major privacy concerns are raised by breaches or misuse of such data is a huge concern in the market for smart fitness. Trust in the ecosystem has already been eroded by several fitness app leaks. Additionally, there is a greater chance that data will be sold or used for financial gain as devices are integrated with insurance and healthcare systems. Customers may be deterred from fully adopting connected fitness solutions due to these concerns, particularly in markets with lax data protection regulations.

High Competition and Market Saturation

With high-end companies like Apple and Peloton, as well as more reasonably priced Asia entrants, the smart fitness market is overrun with brands. Smaller businesses often struggle to grow or survive in this fiercely competitive environment. Consumers become confused about which device offers the best value, or as a result of frequent price wars and feature imitation, which weakens product differentiation. Entry into this fiercely competitive market is becoming increasingly difficult for newcomers.

Opportunities

Integration with Digital Healthcare Ecosystem

There is an increasing chance to connect fitness equipment to digital healthcare platforms, telemedicine, and remote monitoring. Smart fitness solutions have the potential to play a significant role in preventive medicine by directly syncing data with physicians' insurers and hospitals. Chronic diseases, such as diabetes, hypertension, and cardiovascular problems, can now be monitored in real-time thanks to this integration. Businesses that collaborate with insurers and healthcare systems may be able to tap into new sources of revenue.

Smart Clothing and Wearable Innovation

The market has the opportunity to expand into smart clothing, shoes, and accessories, in addition to watches and other brands. Shoes can track running form and give real-time feedback, while smart shirts can measure breathing posture and muscle activity. These developments have the potential to simplify and lessen the intrusiveness of fitness tracking for users. Flexible electronics and textile-based sensors also create new categories. Professional sports, yoga, and rehabilitation are examples of niche markets.

Segmental Insights

Product Type Insights

Why Did the Smart Wearables Segment Dominate the Smart Fitness Market in 2024?

Smart wearables dominate the smart fitness market with a 38% share, given that they are not the most widely available and used product category for monitoring activity and health. Users can access real-time information about their heart rate, caloric expenditure, sleep patterns, and daily activities through gadgets such as fitness bands, health trackers, and smartwatches. They have become popular in both developed and emerging markets.

- In September 2023, Fitbit (Google) launched the Fitbit Charge 6, featuring advanced health tracking capabilities such as ECG monitoring and SpO? measurement.(Source:https://blog.google)

Connected cardio equipment & VR fitness are the fastest-growing segments as immersive technologies and interactive exercises become increasingly popular. Fitness with virtual reality capabilities provides captivating experiences that increase the appeal and enjoyment of exercise for younger audiences. The proliferation of connected devices in the home is accelerating this trend even further. The growing affordability of VR devices is expanding their user base.

- In August 2025, Peloton introduced the Peloton Bike+ with enhanced connectivity features, including live streaming classes and personalized workout recommendations(Source: https://www.bloomberg.com)

Component Insights

What Made the Hardware Segment Dominate the Smart Fitness Market in 2024?

Hardware dominates the market for smart fitness with a 52% share, led by gadgets that serve as the foundation for smart fitness solutions, including wearables, smart gym equipment, and sensors. The strength of this market is still being driven by its accuracy in data collection and the rising demand for connected health devices. Adoption is also being increased by the growing durability and miniaturization of devices. Hardware sales are being strengthened by increasing compatibility with smartphones and IoT platforms.

- In September 2023, Apple released the Apple Watch Series 9, offering improved battery life and new fitness tracking sensors.

(Source: https://www.apple.com)

Software, platforms & subscription services are the fastest-growing, fueled by the increasing popularity of customized digital training plans and AI-powered fitness applications. Cloud-based platforms that provide customized experiences are quickly increasing user adoption. Subscription-based fitness ecosystems are becoming increasingly popular. User engagement is being further enhanced by integration with social features and AI coaches.

- In February 2025, MyFitnessPal launched the 2025 Winter Release, introducing new features and updates to empower members in building healthier habits.

(Source: https://www.prnewswire.com)

Application Insights

Why Did the Personal Fitness & Wellness Segment Dominate the Smart Fitness Market in 2024?

Personal fitness & wellness lead the market for smart fitness with a 45% share, driven by consumers' growing reliance on smart devices for maintaining fitnessroutines, tracking progress, and monitoring health. The growing emphasis on preventive health and lifestyle management reinforces this dominance. Apps for mental wellness are gaining popularity, which is benefiting the market. The growth of holistic fitness platforms that integrate exercise, mindfulness, and nutrition is being reinforced by their increasing availability.

Corporate wellness programs are the fastest-growing, as smart fitness solutions are being adopted by businesses to enhance worker productivity and health. To lower healthcare expenses and encourage work-life balance, employers are investing in digital fitness platforms. Employees are becoming more interested in these solutions thanks to incentive-driven programs. The trend toward remote and hybrid work is driving an increase in demand for digital wellness solutions.

- In July 2024, Virgin Pulse partnered with PEIA to offer a new health and wellness platform, providing policyholders with opportunities to earn rewards through health activities.(Source: https://peia.wv.gov)

End User Insights

Why Did Individual Consumers Dominate the Market for Smart Fitness in 2024?

Individual consumers are driving the smart fitness market with a massive 50% share, as wearable apps and connected fitness solutions become increasingly popular, reflecting a growing awareness of personal health. This sector contributes the most because it is easily accessible and convenient. Demand is also being reinforced by peer sharing of fitness data and social influence. Consumer stickiness is increasing as smart devices are increasingly integrated with lifestyle apps.

Fitness centers & gyms are the fastest-growing segment, driven by offering members data-driven, interactive workouts that combine digital platforms and connected equipment. The demand for hybrid workouts is driving the growth of this market. Gamifying workouts is also improving member engagement. Through collaborations with tech firm's gyms can set themselves apart from the competition.

- In April 2025, Equinox expanded its partnership with Aescape to integrate AI-driven massage technology into 60 Equinox gym locations.(Source: https://www.newsweek.com)

Enterprise Size Insights

What Made Large Enterprises Dominate the Smart Fitness Sector?

Large enterprises dominated the smart fitness market with a massive share of 65% in 2024, driven by the utilization of connected wearable solutions and advanced analytics to improve worker wellness and reduce medical expenses. Their capacity to invest in ecosystems of complete fitness ensures ongoing leadership. This segment is being further strengthened through partnerships with insurance providers. Their adoption of global wellness policies is conferring a significant advantage.

- In August 2023, Cigna Healthcare and Virgin Pulse launched a personalized digital experience for individuals to improve health and vitality, empowering Cigna customers to set personal health goals and track daily metrics.(Source: https://newsroom.cigna.com)

SMEs and startups are the fastest-growing, as they implement affordable and expandable smart fitness devices to enhance employee health and well-being. Their ability to try out cutting-edge digital platforms and fitness apps allows them to grow. Small teams are gaining traction quickly thanks to customized solutions. Adoption is also being accelerated by growing government support for the digitalization of SMEs.

- In October 2025, FitBudd secured Series A funding to expand its AI-powered personal training app for small businesses.

(Source: https://www.fitbudd.com)

Regional Insights

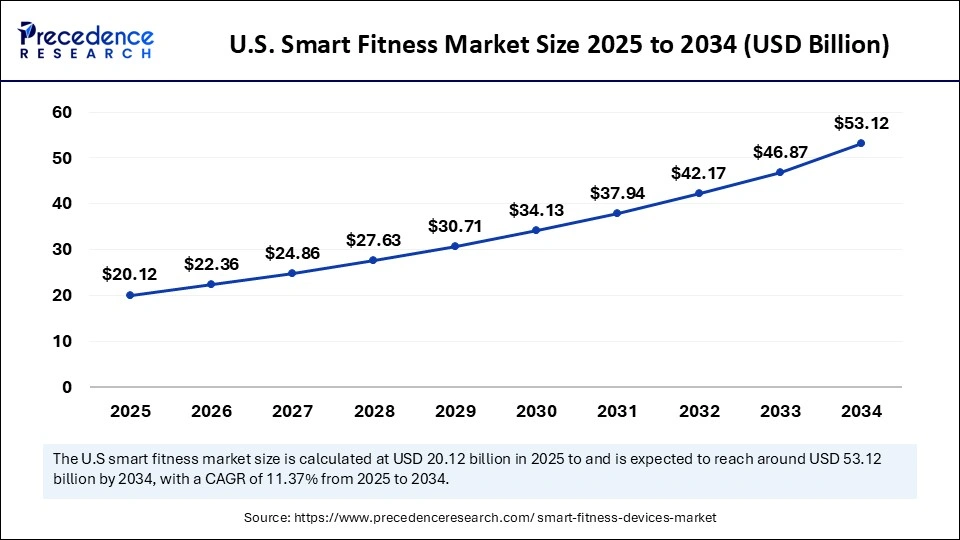

U.S. Smart Fitness Market Size and Growth 2025 to 2034

The U.S. smart fitness market size was exhibited at USD 18.10 billion in 2024 and is projected to be worth around USD 53.12 billion by 2034, growing at a CAGR of 11.37% from 2025 to 2034.

What Made North America Dominate the Smart Fitness Market?

North America dominates the smart fitness market with a 40% share due to its robust infrastructure supporting digital health, high consumer awareness, and widespread adoption of advanced technologies. The prevalence of wearables, connected devices, and fitness applications has been accelerated by the presence of top companies spearheading innovation in these fields. High disposable incomes maintain this dominance.

Asia Pacific is the fastest-growing region in the smart fitness market, driven by a rise in the use of connected fitness solutions and heightened health consciousness. Smart device and app accessibility is being made easier by expanding digital infrastructure and rising smartphone adoption. The growing interest in interactive workouts and at-home fitness is benefiting the market.

Smart Fitness Market Companies

- Peloton Interactive, Inc.

- Fitbit (Google)

- Apple Inc.

- Garmin Ltd.

- Samsung Electronics

- Xiaomi Corporation

- Technogym S.p.A.

- NordicTrack (ICON Health & Fitness)

- Life Fitness (Brunswick Corporation)

- Johnson Health Tech

- Echelon Fitness

- MyZone

- Tonal

- Mirror (Lululemon)

- Whoop

- Withings

- Suunto

- Polar Electro

- Bowflex (Nautilus Inc.)

- Amazfit (Zepp Health)

Recent Developments

- In September 2025, Meta launched the Oakley Meta Vanguard smart glasses, featuring a 12MP ultra-wide camera, open-ear speakers, and integration with Garmin and Strava for real-time performance stats.(Source: https://www.reuters.com)

- In September 2025, UREVO launched the “3x8 Wellness Ecosystem” at IFA 2025, showcasing next-generation smart fitness and wellness solutions.

(Source: https://www.prnewswire.com) - In May 2025, Geaux Above launched a report identifying top fitness equipment trends for 2025, including smart & connected equipment, compact & modular designs, and recovery & mobility zones.(Source: https://www.geauxabove.com)

Segments Covered in the Report

By Product Type

- Smart Wearables (Fitness Bands, Smartwatches)

- Connected Cardio Equipment (Treadmills, Ellipticals, Bikes)

- Strength Training Equipment (Smart Dumbbells, Smart Benches)

- Fitness Apps & Platforms

- Virtual & Augmented Reality Fitness Solutions

By Component

- Hardware

- Software/Platforms

- Services (Subscription, Training, Analytics)

By Application

- Personal Fitness & Wellness

- Professional/Gym & Fitness Centers

- Rehabilitation & Physiotherapy

- Corporate Wellness Programs

By End-User

- Individual Consumers

- Fitness Centers & Gyms

- Hospitals & Rehabilitation Centers

- Corporates

By Enterprise Size

- Large Enterprises (Global Smart Fitness Companies)

- Small & Medium Enterprises (Regional/Startup Players)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting