Investment Banking and Trading Services Market Size and Forecast 2025 to 2034

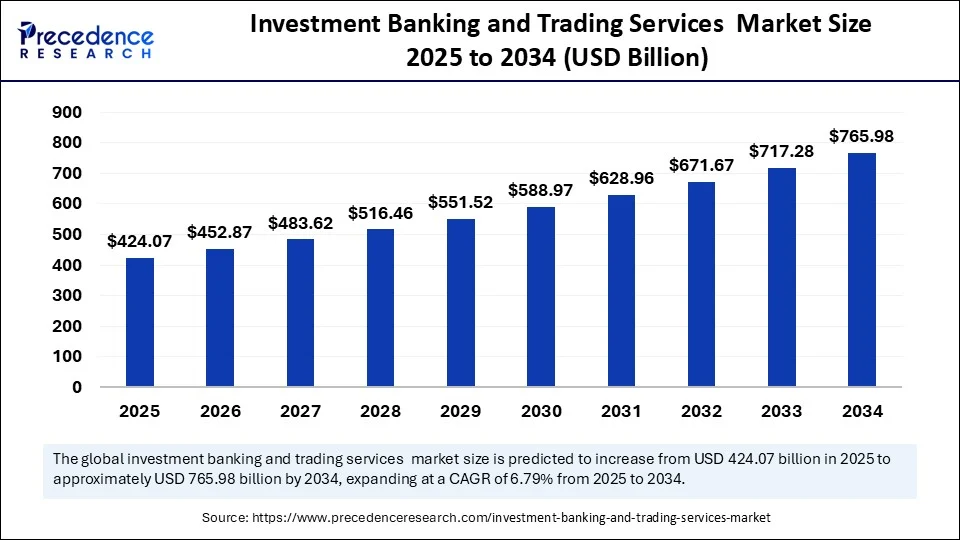

The global investment banking and trading services market size accounted for USD 397.11 billion in 2024 and is predicted to increase from USD 424.07 billion in 2025 to approximately USD 765.98 billion by 2034, expanding at a CAGR of 6.79% from 2025 to 2034.The market growth is attributed to the increasing adoption of advanced trading technologies, rising capital market activity, and growing demand for specialized financial advisory services across industries.

Investment Banking and Trading Services MarketKey Takeaways

- In terms of revenue, the investment banking and trading services market was valued at USD 397.11 billion in 2024.

- It is projected to reach USD 765.98 billion by 2034.

- The market is expected to grow at a CAGR of 6.79% from 2025 to 2034.

- North America dominated the global investment banking and trading services market with the largest share in 2024.

- Asia Pacific is expected to grow at the highest CAGR from 2025 to 2034.

- By service type, the trading & related services segment held a major market share in 2024.

- By service type, the equity underwriting & debt underwriting services segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By industry vertical, the BFSI segment contributed the biggest market share in 2024.

- By industry vertical, the IT & telecom segment is expected to grow at a significant CAGR between 2025 and 2034.

Impact of Artificial Intelligence on the Investment Banking and Trading Services Market

Artificial Intelligence (AI) is revolutionizing the investment banking and trading services market by enabling precision and strategic decision-making. Major organizations use AI to automate several complex processes, such as risk evaluation and execution of trades. Predictive analytics helps investment bankers to construct scenarios of deals, assess valuations in a more precise and customize strategies of advice congruent to the objectives of the clients. Furthermore, AI also ensures compliance with regulatory standards by enabling fraud detection and risk management.

Market Overview

The global investment banking and trading services market is witnessing rapid growth, driven by the rising demand for financial advice and trading strategies, spurred by technological advances and the influx of institutional money. Investment banks are focusing on synthetic trading and cloud-based infrastructure in order to optimize execution speed, risk analytics, and portfolio optimization. The U.S. Securities and Exchange Commission (SEC) reported that trading volume of equity and derivatives reached new records in the U.S. in 2023 due to institutional trade and real-time trading. At the same time, it was highlighted by the European Securities and Markets Authority (ESMA) in the report on market trends of the year 2024 that automation and digitalization contributed to the increased provision of cross-border liquidity and operational resilience in EU capital markets. Moreover, the socially focused financial instruments and digital transformation are also expected to boost innovation and rivalry in investment banking services globally.

(Source: https://www.esma.europa.eu)

Investment Banking and Trading Services MarketGrowth Factors

- Rising Demand for Cross-Border Advisory Services: The growing globalization of corporate operations is fuelling demand for cross-border M&A and capital market guidance.

- Boosting Infrastructure Financing Needs: Large-scale public and private infrastructure projects are driving underwriting and structured finance activity worldwide.

- Expanding Role of Private Equity and Venture Capital: Surging activity from alternative investment funds is boosting deal origination and transaction support services.

- Growing Adoption of Blockchain in Settlements: Integration of distributed ledger technologies is propelling back-end trading efficiency and transparency.

- Driving Focus on Compliance and Regulatory Tech (RegTech): Heightened regulatory scrutiny is driving the adoption of automation and analytics in compliance workflows.

- Fuelling Demand for Customized Derivative Products: Market volatility and risk hedging strategies are increasing demand for bespoke derivatives across asset classes.

- Accelerating Digital Transformation in Wealth Management: The expansion of digital platforms for portfolio advisory is driving collaboration between investment banks and fintech providers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 765.98 Billion |

| Market Size in 2025 | USD 424.07 Billion |

| Market Size in 2024 | USD 397.11 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.79% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Strategic Financial Advisory Services

The increasing demand for sophisticated financial advisory services is expected to drive the growth of the investment banking and trading services market. Companies navigating mergers, acquisitions, and complex capital structuring require strategic guidance carefully tailored with complex analytics and knowledge of specific markets. As a result, advisory teams are providing valuation models, risk advice, and scenario planning, which allow clients to make high-stakes decisions with higher confidence.

Firms are also expanding industry-specific groups and cross-border transactional expertise to capitalize on deal flow in emerging and frontier markets. The Financial Times in 2024 reported that cross-border M&A advisory mandates involving U.S. and EU banks had risen significantly, with a significant focus on the tech and clean energy segments. These mandates are favored by industry participants who shifted toward high-growth sectors. A European Central Bank (ECB) released a report in the year 2024 showing that tightening of regulatory controls on capital adequacy has also led to higher demand for advisory services to maximize capital structure. Furthermore, most of the capital markets action was centered around equity and debt transactions led by advisors, encouraging the shift toward financial structuring strategic, further fueling the market.

(Source: https://www.cbh.com)

(Source: https://www.bankingsupervision.europa.eu)

Restraint

Regulatory Complexities Across Jurisdictions Limiting Operational Flexibility

Operational flexibility for investment banking and trading services is expected to be hampered by complex regulatory hurdles across different jurisdictions. The presence of varying legal frameworks, disclosure norms, and capital requirements in different countries causes inefficiencies in compliance for financial institutions operating internationally. The fragmentation of regulations, including those for derivatives clearing, ESG disclosures, and digital asset management, delays deal timelines. Additionally, the unstable regulations governing algorithmic trading and financial crime reporting pose further challenges for institutions aiming to scale smoothly across international markets.

Opportunity

How Are Globalization and Cross-Border Financial Flows Influencing the Investment Banking and Trading Services Market?

The market players are expected to have immense opportunities due to high capital inflows from institutional investors. The increase in capital inflows from these investors facilitates underwriting, deal syndication, and structured finance transactions. Pension funds, sovereign wealth funds, and insurance companies are allocating more capital to fixed-income, equity, and alternative asset classes, which require sophisticated structuring and risk-adjusted returns.

Investment banks are responding by expanding their product lines and improving their expertise in debt and equity capital markets. These inflows also support large financing transactions and secondary market depth, particularly in volatile market conditions. According to an IMF report, the syndicated loan markets saw increased interest from pension funds and endowments in 2024, which drove the demand for customized credit solutions. The Securities and Exchange Board of India (SEBI) noted in its 2024 bulletin that the rise in foreign institutional investor activity in primary equity was one reason the Indian capital market remained resilient during volatile interest rate environments.

Service Type Insights

Why Did the Trading & Related Services Segment Dominate the Investment Banking and Trading Services Market in 2024?

The trading & related services segment dominated the market with the largest share in 2024. This is mainly due to the high volatility in equity and commodities, intensified institutional trading, and the significant implementation of algorithmic trading. There was a high demand for market-making, brokerage, and execution services among financial institutes due to fluctuating interest rates. Traders, such as stock index arbitrators, utilized high-frequency trading through platforms and data-driven execution systems to capitalize on temporary inefficiencies in the pricing.

In 2023, regulatory filings by SEC and activity reports by the FINRA confirmed high volumes in both the equities and derivatives business, especially in North America and Europe. This trading approach led to an increase in revenue as companies found it necessary to employ more technological extent and human resources into real-time analytics and infrastructure cross asset trading. Furthermore, the rapid advances in data processing capabilities among advanced trading services bolster segmental growth.

(Source: https://www.finra.org)

The equity underwriting & debt underwriting services segment is expected to grow at the fastest CAGR in the upcoming period, driven by the increasing need for capital solutions in both the private and public sectors. Companies want money to finance acquisitions, build infrastructure, and work on sustainability-based activities, creating demand for equity and debt-based instruments and services. In 2024, there were various regulatory efforts that promoted more systematized and transparent capital market activity.

It is also expected that more sovereign and corporate issuers from emerging markets are entering the international markets. Successful entry requires the brokerage skills of global investment banks across different cross-border regulatory regimes. In 2024, the Reserve Bank of India (RBI) had liberalized the norms of listing corporate bonds in order to bring more corporations into the bond market, while the People's Bank of China (PBoC) leveraged the offshore issuance of RMB bonds in order to expand the foreign capital access. These trends support the growth in the underwriting services, especially in the growth-oriented industries that require long-term funding solutions.

(Source: https://www.outlookmoney.com)

Industry Vertical Insights

What Factors Contribute to the BFSI Segment's Dominance in the Investment Banking and Trading Services Market in 2024?

The BFSI segment dominated the market with the largest revenue share in 2024, due to the sector's extensive financial transactions, huge capital base, and continuous requirement of advisory and trading skills. Mergers, digital transformation, and a diversification of portfolios by financial institutions acted as major elements that generated substantial opportunities in underwriting services and equity issuance services.

The U.S. SEC and the FCA documented a surge in transaction volume and complexity in the banking sector in the year 2023, thereby increasing demand of investment banks' professional services. A large number of asset managers and hedge funds are adopting algorithmic trading and real-time analytics platforms, contributing to segmental growth. These platforms facilitated the usefulness of trading services offered to the institutional financial client. Additionally, the European Central Bank (ECB) noted high levels of trading in its 2023 bulletin, due to insurance firms and pension funds seeking yield in unstable markets, which is likely to boost the segment growth in the coming years.

(Source: https://www.fca.org.uk)

(Source: https://www.ecb.europa.eu)

The IT & telecom segment is expected to grow at a significant CAGR during the forecast period, driven by a high rate of public offering by tech companies and industry consolidation. There is a high need for technology companies to secure funds to invest in cloud infrastructure, AI research, and international expansion. This, in turn, boosts the demand for IPO advice, equity underwriting, and debt restructuring services.

Bloomberg reported a revival of the tech IPO pipeline in Asia and the U.S. in 2024, due to favorable market conditions and the presence of strategic investors in the next generation of digital platforms. Increased transparency in prospectuses by securities regulators in the tech sector, along with a rise in pre-launch IPOs, is expected to fuel the segment's growth in the coming years.

(Source: https://www.bloomberg.com)

Regional Insights

What Made North America the Dominant Region in the Investment banking and trading services market in 2024?

North America dominated the Investment banking and trading services market, capturing the largest revenue share in 2024. This is mainly due to profound capital markets, sophisticated trading infrastructure, and the presence of well-established institutional investors. Global capital flowed into New York and Toronto because of the ease of regulations, robust market liquidity, and the presence of superior technology supporting high-frequency and algorithmic trading.

The FINRA reported a large number of equity and derivatives transactions in 2023, indicating the increased level of institutional activity. M&A and corporate restructuring were common practices among large corporations headquartered in the area, augmenting the need for advisory and underwriting services. The growth of securities linked to digital assets and the ever-increasing importance of technological fixed-income trading on major U.S. exchanges further bolstered the market growth. Furthermore, the efforts of U.S. banks to syndicate a lot of deals abroad due to favorable tax regimes and interest rates is expected to ensure the long-term market growth.

(Source: https://www.finra.org)

Asia Pacific is expected to grow at the fastest rate in the upcoming period, owing to high economic growth rates, liberalization of capital markets, and increased participation of both institutional and retail investors. Developing economies, including India, China, Indonesia, and Vietnam, are actively expanding their financial infrastructure. This, in turn, boosts the demand for cross-border advisory and capital-raising solutions.

In 2024, Securities and Exchange Board of India (SEBI) reported an unprecedented rise in IPO and corporate bonds. The policies with regard to internationalization of RMB encouraged by People Bank of China (PBoC) resulted in an increase in offshore bonds issuance and cross-border listings within equity. In Japan, the Financial Services Agency (FSA) approved pilot runs of digital securities, accelerating investment banks' adoption of blockchain-based capital markets applications. These trends indicate that Asia Pacific is becoming a strategic hub when it comes to eventual growth, especially in the context of cross-border transactions, IPOs in the tech sector, and underwriting of ESG-related deals.

(Source: https://www.sebi.gov.in)

Europe is expected to grow at a notable rate in the coming years due to the presence of multinational corporations in the financial sector, stringent regulatory frameworks, and inter-state capital integration. London, Frankfurt, and Paris are key financial centers for equity issuance, M&A advisory, and secondary market trading.

The European Securities and Markets Authority (ESMA) and the European Central Bank (ECB) reported record-high activity in fully integrated pan-eurozone cross-border equity trading, driven by regulatory harmonization post-Brexit and increased investor interest in eurozone trade. Moreover, the rising demand for advisory services related to deglobalization and supply chain adjustments, particularly in industrial and energy-intensive sectors, further supports regional market growth.

Investment banking and trading services market Companies

- Wells Fargo & Company

- UBS Group AG

- Morgan Stanley

- JP Morgan Chase & Co.

- Goldman Sachs

- Deutsche Bank AG

- Credit Suisse Group AG

- Citigroup Inc.

- Barclays Bank PLC

- Bank of America Corporation

Latest Announcement by Industry Leader

- In February 2025, Nomura Holdings, Inc. announced plans to establish a new Banking Division, effective April 1, 2025, as part of its broader strategy to expand its private market capabilities and bespoke financial offerings. The division will integrate the strengths of Nomura Trust and Banking Co., Ltd. and Nomura Bank (Luxembourg) S.A., focusing on areas such as asset building, estate planning, and tailored client solutions. According to Kentaro Okuda, Nomura's President and Group CEO, the move aligns with the firm's long-term “Reaching for Sustainable Growth” vision for 2030. “Our products and services are backed by our long-standing commitment to support the development of the financial and capital markets. With the new division, we aim to move swiftly to make these available to a broader range of clients,” Okuda stated. The initiative marks a key step in establishing the Banking business as the fourth core pillar of the Nomura Group.

(Source: https://www.nomuraholdings.com)

Recent Developments

- In June 2023, New York-based independent prime broker Clear Street announced the formation of a dedicated investment banking team as part of its expansion into advisory services. The new division, which will become operational following regulatory approval, aims to offer strategic guidance, transaction execution, and capital solutions tailored to the needs of emerging growth companies. This move marks a significant milestone in the company's mission to diversify its offerings and deepen its role in the capital markets ecosystem.

(Source: https://www.businesswire.com)

- In October 2024, BNY Mellon and Mizuho Bank, the banking subsidiary of Japan-based Mizuho Financial Group, announced a strategic partnership to strengthen correspondent banking connectivity for global trade. The agreement is set to streamline cross-border transaction services and improve financial infrastructure for international commerce, reinforcing both institutions' commitment to enabling efficient and secure trade financing across key global markets.

(Source: https://www.bny.com)

- In February 2025, Siebert Financial Corp. announced the launch of Siebert Investment Banking, a new division focused on middle-market clients traditionally underserved by larger institutions. Led by capital markets veterans Kimberly Boulmetis and Ajay Asija, the division will initially target clients in FinTech, depository institutions, and specialty finance. Plans include expanding into emerging sectors such as blockchain and digital assets, as Siebert aims to provide customized advisory, M&A, and capital raising solutions to a broader market.

(Source: https://www.globenewswire.com)

Segments Covered in the Report

By Service Type

- Equity Underwriting & Debt Underwriting Services

- Financial Advisory

- Trading & Related Services

- Others

By Industry Vertical

- BFSI

- Energy & Utilities

- Healthcare

- IT & Telecom

- Manufacturing

- Media & Entertainment

- Retail & Consumer Goods

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting