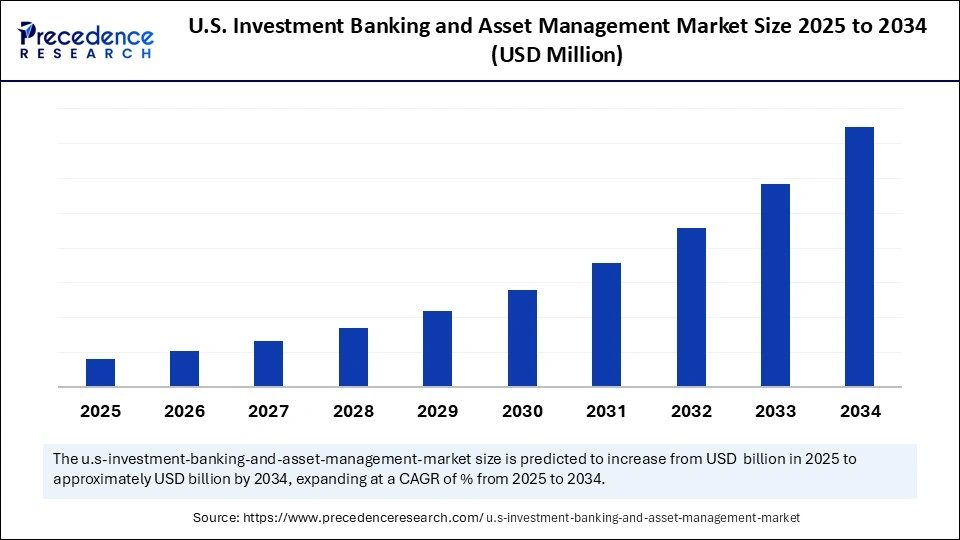

U.S. Investment Banking and Asset Management Market Size and Forecast 2025 to 2034

The U.S. Investment Banking and Asset Management Market is evolving—track innovations, challenges, and future growth prospects across segments. The market growth is attributed to the rising demand for wealth advisory services and continued innovation in financial technologies.

U.S. Investment Banking and Asset Management MarketKey Takeaways

- By service type, the mergers & acquisitions (A&S) segment dominated the U.S. investment banking and asset management market in 2024.

- By service type, the debt capital markets (DCM) segment is expected to grow at the fastest rate in the coming years.

- By client type, the large enterprises segment dominated the market with the largest share in 2024.

- By client type, the small & medium enterprises (SMEs) segment is expected to grow at the fastest rate during the forecast period.

- By component, the services segment dominated the market in 2024.

- By component, the software segment is expected to grow at a rapid pace in the upcoming years.

How is AI Changing the Investment Decisions in Asset Management?

Artificial Intelligence is influencing asset management investment choices by facilitating quicker, more accurate, and data-driven strategies. Large-scale datasets such as financial reports and market sentiment are analyzed by machine learning models, which reveal trends and predictive insights that conventional approaches might overlook. These models can increase decision-making and risk-adjusted returns by analyzing asset correlations, spotting market irregularities, and optimizing portfolios in real-time. By modifying asset allocation and tailoring investments to client behavior and objectives, AI-driven algorithms are assisting asset managers in making the transition from reactive to proactive strategies. This not only increases productivity but also improves customer satisfaction in a market that is becoming more and more competitive.

Market Overview

The U.S. investment banking and asset management market is experiencing robust growth, driven by the growth of high-net-worth individuals, increasing use of digital financial tools, and increased capital market activity. Asset managers are seeing a spike in demand for specialized portfolios, ESG-focused funds, and passive investment strategies, while investment banks are profiting from record numbers of mergers, acquisitions, and initial public offerings. Technological advancements and operational efficiency include robo-advisors and AI-driven advisory platforms. Market participation and confidence are also being increased by regulatory changes meant to increase transparency and investor protection.

What Types of Clients do Investment Banks and Asset Managers Typically Serve?

Investment banks primarily serve corporate clients, institutional investors, and government entities. Their offerings address major financial requirements such as facilitating mergers and acquisitions, offering strategic advice, and raising capital through equity or debt offerings. On the other hand, asset managers work with a wider range of customers, including endowments, retail investors, high-net-worth individuals, and pension funds. They emphasize long-term wealth preservation, financial planning, and investment portfolio management. Despite dealing with financial markets, their clientele's objectives and service needs vary greatly.

U.S. Investment Banking and Asset Management MarketGrowth Factors

- Increased capital market activity: Higher levels of IPOs, M&A deals, and corporate restructuring have expanded opportunities for investment banking advisory services, driving overall market growth.

- Rising Demand for Wealth Management: The growing high net-worth individual (HNWI) population and rising disposable income levels fuel the need for personalized asset management and financial planning.

- Technological Advancements: The integration of AI, algorithmic trading, and robo-advisory enhances efficiency, accuracy, and scalability across investment and portfolio management services.

- Shift towards passive and ESG investing: Growing interest in passive funds and environmental, social, and governance strategies is reshaping asset allocation approaches and attracting a new class of investors.

- Regulatory Support and Financial Reforms: Evolving regulatory frameworks that encourage transparency and investor protection have strengthened confidence in the financial services ecosystem.

Market Scope

| Report Coverage | Details |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Client Type, Component, and Region |

Market Dynamics

Drivers

Rising Affluence and HNWI Population

The growing number of high-net-worth individuals in the U.S. is a major factor boosting the demand for wealth management services due to factors like inheritance, stock market gains, and tech entrepreneurship. Asset managers are tailoring their investment strategies to focus on risk profiling, estate planning, tax optimization, and wealth transfer between generations. Many HNWIs are branching out into alternative investments like venture capital, real estate, and hedge funds. Major financial institutions in private banking departments are also increasing their family office offerings to cater to ultra-HNWIs. The demand for customized discrete and worldwide solutions is fostering enduring client-manager partnerships.

Digitization and Fintech Integration

Rapid digitization is driving the growth of the U.S. investment banking and asset management market. In investment banking and asset management, digital transformation improves customer satisfaction and operational effectiveness. Personalized advice on risk assessment and trade execution is being optimized by AI-driven analytics. Human advisors can now concentrate on more complex strategies as robo advisors take care of routine investment tasks. Digital workflows have also made client onboarding and KYC procedures quicker and safer. Investment banks are using blockchain to track real-time transactions and smart contracts. Fintech platforms give smaller investors access to tools that were previously only available to institutions.

Restraints

Market Volatility and Economic Uncertainty

Market volatility and economic uncertainty hamper the growth of the U.S. investment banking and asset management market. Macroeconomic variables like inflation rates, the Federal Reserve's monetary tightening, and geographical developments have a significant impact on the investment banking industry. Mergers and acquisitions frequently slow down initial public offerings are delayed and overall capital market activity declines during uncertain times. Clients often switch to safer lower yield investments or stop investing altogether during recessions which lowers fee income for asset managers. Moreover, long-term strategic planning is challenging due to erratic earnings and declining profit margins. Investor sentiment may also be impacted by this, particularly for publicly traded companies, as earnings become unpredictable and volatile. Long-term instability may occasionally lead to company restructuring or layoffs.

Increased Competition from Fintech

Financial services are now more widely accessible thanks to the emergence of fintech companies and digital investment platforms, which has led to a pricing war in the sector. Younger investors are down to robo advisors like Wealth Front and Betterment because they provide inexpensive algorithm-driven portfolio management services. Index funds and exchange-traded funds (ETFs) are examples of passive investment products that have gained popularity recently because of their simplicity and reduced fees. Consequently, investment banks and traditional asset managers deal with declining margins and fee compression. Active managers find it more difficult to defend performance-based fees as a result of the growing number of large institutional clients moving their allocations to passive strategies. To remain competitive, this has compelled established businesses to either innovate quickly or buy out smaller tech-driven businesses.

Opportunities

Expansion of Digital Platform and AI-driven Advisory

An important area of growth for asset managers and investment banks alike is the use of AI machine learning and digital platforms. Automated trading strategies, more precise risk assessments, and large-scale customized portfolio management are made possible by these technologies. Real-time data analysis is made possible by AI-driven insights, which enhances decision-making for both clients and wealth managers. Digital advisory platforms are anticipated to draw in younger tech-savvy investors looking for simple, affordable financial services. Early digitization can greatly improve client experience and retention for businesses as demand for self-service portals and 24/7 financial access continues to rise. Additionally, cutting-edge chatbots, predictive analytics, and virtual advisors are lowering operating and client acquisition expenses.

Private Market and Alternative Investment Expansion

Alternative assets such as hedge funds, infrastructure, private equity, and venture capital are becoming more and more popular. High-net-worth individuals and institutional investors are moving away from conventional stocks and bonds. By providing individualized access to private markets, investment banks and asset managers can draw in new clientele by developing co-investment banks and asset managers can draw in new clientele by developing co-investment vehicles or feeder funds that give retail and semi-institutional investors access to alternative assets businesses can also increase their capital. Additionally, private investments are becoming more accessible and liquid due to the growing trend of digital asset tokenization, offering early adopters a significant revenue opportunity.

Service Type Insights

Why did Mergers & Acquisitions Segment Dominate the U.S. Investment Banking and Asset Management Market in 2024?

The mergers & acquisitions (A&S) segment dominated the market with the largest share in 2024. This is mainly due to the rise in industry consolidation, corporate restructuring, and large firm's strategic portfolio optimization. Businesses in the energy technology and healthcare sectors are aggressively seeking M&A services to broaden their product offerings, increase their geographic reach, or obtain cutting-edge capabilities. M&A services have become crucial as investment banks use AI and data analytics to provide sophisticated deal-sourcing valuation and due diligence.

The debt capital markets (DCM) segment is expected to grow at the fastest rate in the coming years. As market conditions change, companies try to raise money at favorable interest rates. Investment banks are looking to increase their DCM capabilities as a result of the growing demand for structured debt and refinancing, as well as growing investor appeal for fixed-income securities. Predictive risk analytics and technology-backed underwriting are also speeding up adoption in this field. ESG-linked debt instruments and green bonds are accelerating momentum. Additionally, businesses are being encouraged to use DCM by the central bank for rate stabilization and regulatory support.

Client Type Insights

How Does the Large Enterprises Segment Dominate the Market in 2024?

The large enterprises segment dominated the U.S. investment banking and asset management market by capturing the largest share in 2024. Large enterprises are ideal customers for full-service investment banks because they have more complicated financial needs and higher capital requirements. These businesses actively participate in treasury management, capital raising, high-value M&A, and international expansion. They have established their dominance in the banking and asset management sectors thanks to their preference for all-inclusive advisory compliance and technology-driven portfolio solutions. Additionally, their long investment horizon supports high-end wealth management services. Access to a wider range of financial products is also made possible by their excellent credit ratings.

The small & medium enterprises (SMEs) segment is expected to grow at the fastest rate during the forecast period due to expanded access to capital markets services powered by fintech and customized investment advisory services. More SEMs are utilizing asset management and financial advisory services thanks to government-hacked funding programs, digital onboarding, and scalable portfolio tools. Additionally, investment banks are introducing sector-specific funds, working capital financial and private placements as SEM-specific offerings. Participation from SEM is also being encouraged by cloud-based finance platforms and reduces entry barriers. Additionally, the need for structured investment advice is growing due to entrepreneurs' increased financial literacy.

Component Insights

What Made Services the Dominant Segment in the U.S. Investment Banking and Asset Management Market?

The services segment dominated the market with the largest share in 2024 due to their primary responsibilities in compliance, advising wealth planning, and deal structuring. Investment banking and asset management continue to place a high value on human expertise and strategic advice. Personalized services like tax optimization, credit consulting, and portfolio rebalancing are still highly sought after and indispensable as businesses negotiate complicated regulations and unstable markets. Furthermore, service-led interactions are becoming increasingly important because of hybrid advisory models. To keep institutional investors and high-net-worth clients, relationship management is still essential.

The software segment is expected to grow at a rapid pace in the upcoming years. The software helps with risk modeling, client analytics, and automated trading. As robo-advisory platforms are becoming more and more preferred options by investors and institutions alike, the need for software is rising. Due to investment firms' emphasis on digital transformation, more money is being spent on CRM systems and compliance monitoring software. Institutional clients are drawn to platforms with improved cybersecurity. Furthermore, smooth back-office and front-office integrations are made possible by APIs and data interoperability.

Country Level Analysis

The U.S. is flourishing in the investment banking and asset management sectors, driven by extensive institutional and retail investor bases, deep capital markets, and a well-established financial infrastructure. There is a demand for a variety of financial services, including private equity, M&A, advisory, IPO underwriting, and ESG-focused asset management, as well as high levels of innovation and digital adoption are all factors that benefit the sector. Rising high-net-worth individual participation, growing interest in alternative investments, and developing digital wealth platforms are additional factors propelling growth. State-level regulations impact compliance operations and product offerings, and while federal regulation guarantees market stability, businesses must continue to be flexible and adaptable to stay competitive and win over investors.

U.S. Investment Banking and Asset Management Market Companies

- Bank of America

- Citigroup

- Trust Financial

- U.S. Bank Branch

- Wells Fargo & Co

Latest Announcement by Industry Leader

- On 22 February 2025, U.S. Bank launched a new division dedicated to serving private capital firms and global asset managers, consolidating services like fund custody, administration, lending, and capital markets underwriting. CEO of the company stated, “By creating a specialized division, we're enhancing our commitment to private capital clients, providing them with streamlined services and dedicated expertise to support their growth.”

(Source: https://investor.wedbush.com)

Recent Developments

- On 3 March 2025, BlackRock announced the acquisition of Preqin, enhancing its capabilities in private markets data and analytics. This strategic move strengthens BlackRock's position in the private market sector, providing clients with comprehensive data and technology solutions. Preqins integration is expected to enhance transparency and access to private market investments. (Source: https://ir.blackrock.com)

- On 30 January 2025, Danske Bank implemented BlackRock's Aladdin Wealth platform to enhance its investment advisory services and deliver personalized portfolio management. The integration of Aladin Wealth allows Danske Bank to offer clients advanced analytics and risk management tools, improving investment decision-making and client engagement. This move aligns with the bank's digital transformation strategy.

(Source: https://www.finextra.com)

Segments Covered in the Report

By Service Type

- Mergers & Acquisitions (M&A)

- Debt Capital Markets (DCM)

- Equity Capital Markets (ECM)

- Trading & Related Services

- Structured Finance

- Private Credit

By Client Type

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Component

- Services

- Software

- Hardware

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting