What is the IT Operations Analytics Market Size?

The global IT operations analytics market size is calculated at USD 22.47 billion in 2025 and is predicted to increase from USD 29.15 billion in 2026 to approximately USD 278.70 billion by 2035, expanding at a CAGR of 28.63% from 2026 to 2035.

IT Operations Analytics Market Key Takeaways

- In terms of revenue, the market is valued at $22.47 billion in 2025.

- It is projected to reach $278.70billion by 2035.

- The market is expected to grow at a CAGR of 28.63% from 2026 to 2035.

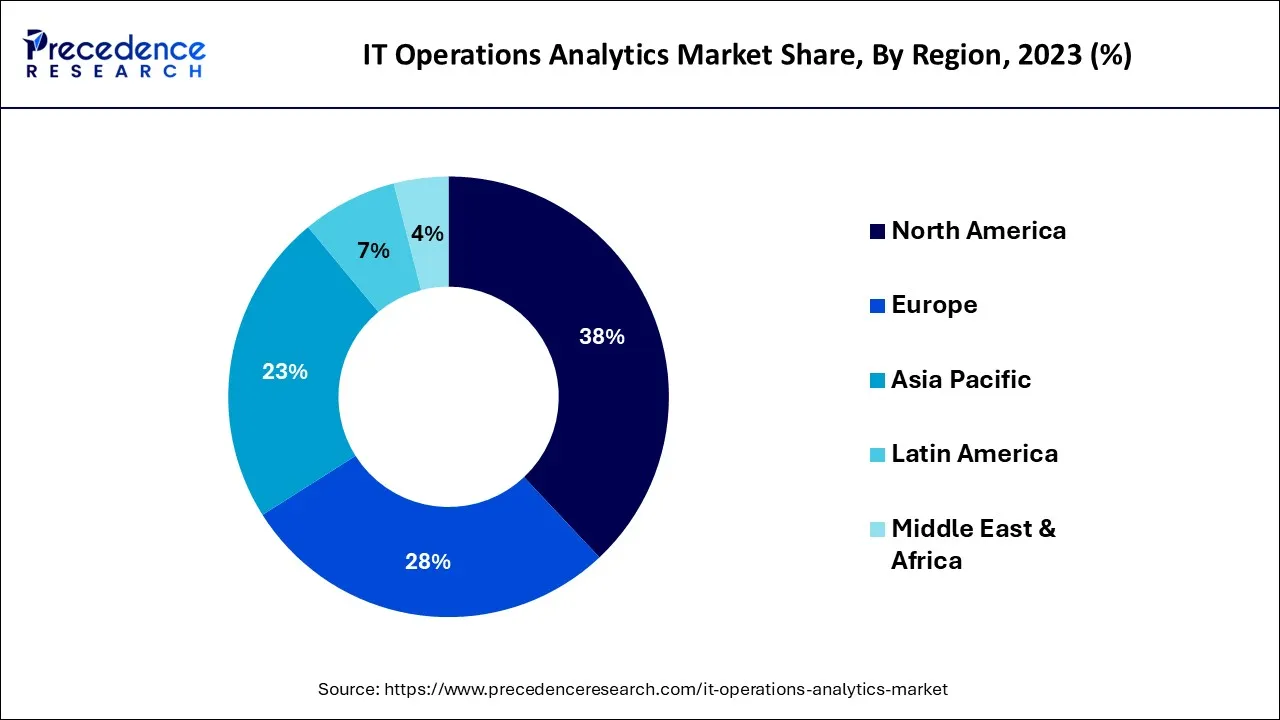

- North America dominated the market in 2023 with the largest market share of 38%.

- Asia Pacific is expected to register the fastest rate of growth during the forecast period.

- By type, the root cause analytics segment dominated the market in 2025, the segment is expected to remain significant throughout the forecast period. On the other hand, the predictive analytics segment is expected to witness significant growth.

- By deployment, the cloud-based segment dominated the market in 2025 with the highest market share of 73%.

- By end-use, the BFSI segment held the largest share of the market in 2025.

- By application, the asset performance management segment held the largest share of the market in 2025.

Market Overview

IT operations analytics market refers to the industry that manages the processing of data, analyzing it and interpreting the same which is generated by an organization's IT infrastructure and applications. The market encompasses various software solutions, tools and technologies designed to monitor and optimize IT systems and services. These tools help businesses detect issues, predict potential problems and make informed decisions to ensure smooth IT operations and better overall performance. The market has been growing since organizations seek multiple ways to enhance their IT management processes.

- According to the latest forecast by Gartner, Inc., India IT spending is projected to total USD 160 billion in 2025, an increase of 11.2% from 2024.

IT Operations Analytics Market Growth Factors

The IT operations analytics (ITOA) market has grown significantly as a result of many major factors, including increasing business use of ITOA solutions and services to decrease operating costs and improve infrastructure. Organizations are looking for effective solutions to monitor and manage their operations as contemporary IT systems become more sophisticated. ITOA solutions give useful insights into system performance, detect possible obstacles, and fix issues proactively, resulting in better operational efficiency and cost savings.

IT operations analytics solution enables organizations to make data-driven choices, optimize resource utilization, and minimize downtime by employing sophisticated analytics and machine learning, resulting in improved overall infrastructure performance. Also, artificial intelligence (AI) and machine learning (ML) technologies have revolutionized the analytics environment. AI and ML algorithms are used in IT Operations analytics to automate anomaly detection, predictive maintenance, and other vital operations. This capacity improves operational efficiency, lowers downtime, and enables proactive problem-solving, propelling IT Operations analytics' long-term market development.

Market Outlook

- Industry Growth Overview: Strong momentum in the IT operations analytics market is being driven by increasing complexity of IT infrastructure, the use of hybrid IT environments, and the demand for real-time insights into performance. Enterprises are relying more heavily on predictive analytics to lower the likelihood of downtime and enhance the efficiency of operations.

- Sustainability Trends: Sustainability is becoming a major force as organizations utilize IT operations analytics to help them reduce energy usage, optimize server utilization, and lessen their carbon footprint. Analytics-driven automation permits the creation of greener data centers, as well as the development of responsible IT governance strategies.

- Global Expansion: The global expansion of IT operations analytics is being driven by multinational companies implementing standardization of IT visibility across different geographical locations. Cloud-native analytics platforms support centralized monitoring, enable fast incident resolution, and maintain consistent levels of service by providing visibility into globally-distributed IT operations.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 278.70 Billion |

| Market Size in 2025 | USD 22.47 Billion |

| Market Size in 2026 | USD 29.15 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 28.63% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Deployment, End-use, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The massive expansion of IT operations

Due to the industry's fast change and the complexity of IT infrastructures, a tremendous amount of operational data is produced every day. This data contains insightful information that businesses can use to improve performance, streamline processes, and optimize their IT systems. Finding the underlying causes of IT system performance issues promptly is one of the main benefits of IT operations analytics (ITOA) solutions.

Traditional methods of troubleshooting and issue-solving required a lot of physical labor and were frequently time-consuming. Organizations analyze operational data more flexibly and affordably with ITOA solutions, which enables them to see problems early and take timely action. The user experience is improved, system downtime is reduced, and overall system performance is increased due to this proactive approach to problem-solving. Additionally, ITOA solutions give businesses the ability to analyze substantial volumes of operational data gleaned from various applications and IT infrastructure parts.

Organizations get a comprehensive understanding of their IT operations, spot trends, spot abnormalities, and make data-driven choices by integrating data from diverse sources. This thorough study aids in capacity planning, infrastructure management, and resource allocation optimization. The benefit of using ITOA solutions is further increased by real-time analytical capabilities. Organizations quickly spot potential problems, analyze operational data in real-time, and obtain rapid insights into system performance. Thereby, the massive expansion of IT operations across the industry is observed to act as a driver for the market.

Restraint

Complex nature of IT infrastructure

The complexity of IT infrastructure poses a restraint for the IT operations analytics market because it makes data collection, integration and analysis more challenging. The intricate network of hardware, software and various components creates difficulties in identifying relevant data sources and establishing consistent data flows. Complexity can lead to incomplete or inaccurate insights, making it harder for detecting issues, optimizing performance and making informed decisions. Organizations mat hesitate to invest in analytics solutions that struggle to effectively handle the intricacies of their IT environments.

Opportunity

Growing demand from businesses for comprehensive 360-degree visibility

The growing demand for comprehensive 360-degree visibility from multiple businesses presents a significant opportunity for the market to grow. Traditional domain-centric monitoring systems offer insightful information in a limited number of areas, but they frequently fall short of delivering a connected end-to-end picture across IT domains.

Due to this restriction, there is a gap in monitoring and resolving infrastructure problems that affect many domains, which might cause inefficiencies and disruptions. IT operations analytics solutions provide a significant chance to close the gap and give organizations all-encompassing visibility and analytical capabilities. Such solutions give organizations a comprehensive perspective of their IT environment by combining data from many sources and domains, revealing correlations and relationships that conventional tools can overlook.

Additionally, ITOA solutions make it easier for various teams and domains to collaborate and synchronize their operations. The collaborative nature of ITOA enables IT teams to collaborate easily and use their combined knowledge and experience to effectively tackle challenging problems. Another big possibility provided by ITOA solutions is real-time analysis. Organizations can spot abnormalities and possible problems as they arise by monitoring operational data in real time, enabling proactive response. By lowering the mean time to resolution (MTTR), reducing downtime, and improving operational efficiency, this feature helps. Organizations might maintain a high degree of service availability and responsiveness by having the capacity to detect and fix issues in real time.

Segment Insights

Type Insights

On the basis of types, the root cause analytics segment held the largest share in 2025, the segment is expected to remain attractive throughout the forecast period. The root cause analytics targets smooth operations, making it an important component of IT management. By identifying the root cause of problems, organizations can efficiently address issues and reduce downtime. The segment allocates resources effectively while addressing operational issues.

On the other hand, the predictive analytics segment is expected to witness significant growth during the forecast period. By analyzing historical data and patterns, predictive analytics can forecast system failures, network downtime and performance bottlenecks. This proactive approach reduces downtime, enhances operational efficiency and minimizes costs, making it a crucial tool for maintaining IT infrastructure and delivering seamless services.

Deployment Insights

On the basis of deployment, the cloud segment held the largest share in 2025 and is expected to continue this trend throughout the forecast period. Cloud solutions offer easy and effective access to resources, enabling businesses to quickly scale their operational levels.

Moreover, cloud-based deployment is attractive to organizations looking to analyze and manage IT operations efficiently while staying agile in the rapidly changing technological landscape. In addition, the scalability and flexibility offered by cloud-based deployment supplement the segment's growth.

End-Use Insights

On the basis of end-use, the BFSI segment dominated the market in 2025, the segment is observed to sustain its position during the forecast period. The industry heavily relies on technology for seamless operations, data security and fraud detection. Whereas IT operations analytics services help banking, financial services and insurance institutions to monitor and analyze complex IT infrastructure in real-time, ensuring efficient operations.

According to the data published by the IBEF, the Indian Fintech industry is estimated to be at Rs. 36,47,123 crore (US$ 421 billion) by 2029. India has the third-largest FinTech ecosystem globally.

In addition, the sector of BFSI has a complex or critical nature while considering transactions and data management. The continuous demand for managing such complexities in the sector can be fulfilled by IT operations, analytics services and solutions. As banks and other financial institutions focus on mitigating the risks in operations, the integration of IT operations analytics services is observed to grow.

Application Insights

On the basis of applications, the asset performance management segment held the largest revenue share in 2025. Due to the rising need for digital solutions to monitor asset performance and decrease operating expenditures in organizations, the application of analytics inasset performance management has seen substantial expansion in numerous industries. The asset performance management application enhances operational efficiency, reduces downtime and lowers maintenance costs.

The segment's dominance is driven by industries including energy and utilities where maintaining the data about assets and their performance is crucial. Asset performance management has the capability to prevent failures and optimize asset lifecycle aligns well with the goals of IT operations analytics. Thereby, the segment is observed to continue to grow throughout the forecast period.

Regional Insights

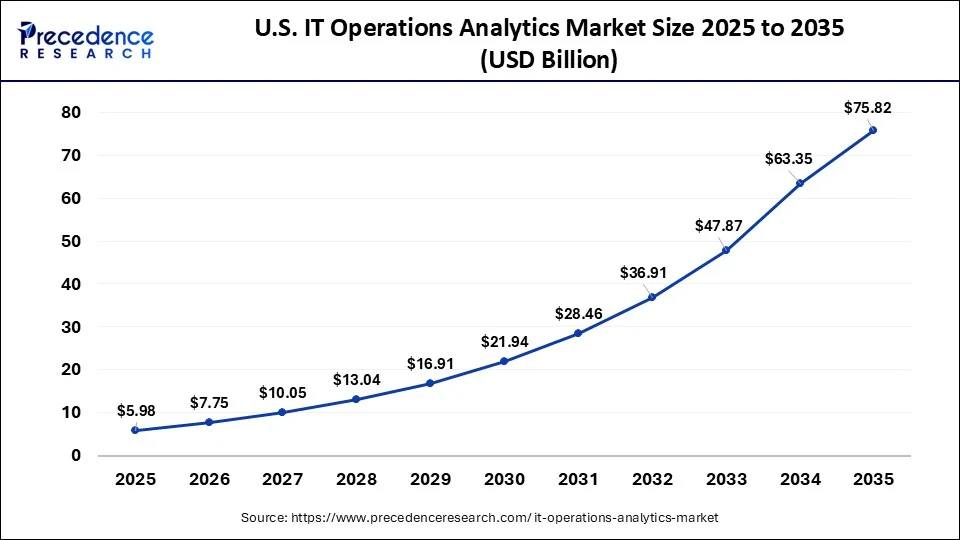

What is the U.S. IT Operations Analytics Market Size?

The U.S. IT operations analytics market size is accounted for USD 5.98 billion in 2025 and is projected to be worth around USD 75.82 billion by 2035, poised to grow at a CAGR of 28.92% from 2026 to 2035.

North America dominated the global IT operations analytics market in 2025, the region is observed to sustain its position throughout the forecast period. Companies situated in the United States such as Splunk, Oracle, Microsoft, SAP are the most effective and sophisticated in terms of implementing operational analytics systems. These companies continuously produce massive volumes of data that can be utilized to improve their IT operations. Companies in the region are often early adopters of new technologies. The willingness to take calculated risks and embrace novel solutions gives them an advantage in terms of experience and expertise in implementing and optimizing ITOA solutions. These factors are likely to support the growth of the market in the region.

In May 2025, Exabeam, a global leader in intelligence and automation that powers security operations, announced the global expansion of its partnership with Inspira Enterprise, a global Cyber security,Data Analytics, and Artificial Intelligence services provider with a presence in North America, Association of Southeast Asian Nations (ASEAN), the Middle East, India, and Africa. As part of this expanded collaboration, Inspira will offer the complete suite of Exabeam products as both a managed security services provider (MSSP) and an authorized reseller.

Asia Pacific is expected to grow at the fastest rate during the forecast period.Countries like China, India, and Japan are witnessing rapid digital change across various industries. As a result, the generation of IT data in diverse organizations has increased dramatically.

The region is also witnessing significant growth in the construction of data centers to meet the increased demand for digital services and cloud-based applications. Data centers are vital hubs for data management and processing, making them excellent applications for ITOA solutions. Businesses in this area are striving to establish and maintain modern IT infrastructures in response to the increased acceptance of digital technologies and the rise in internet penetration. This involves bringing their networks, server systems, and cloud environments up to date.

According to rating agency ICRA, India's data centre (DC) operational capacity is expected to increase to 2,000-2,100 MW by March 2027 from around 1,150 MW as of December 2024, involving an investment of Rs 40,000-45,000 crore in FY2026- FY2027, drive by internet/data usage and data localisation initiatives. The revenue for the top five data centre (DC) players, which account for around 75-80% of overall industry revenues and operational capacities in India, is expected to expand by 18-20% YoY in FY2026, supported by an increase in rack capacity utilisation and the ramp-up of new DCs.

In August 2024, Arcesium, a leading provider of tech solutions for asset managers, announces major plans to expand capacity in Hyderabad. The firm's expansion plans solidify Hyderabad's reputation as a premier destination for global tech firms. As part of expansions, the company will hire 500 high-end tech talent in Hyderabad in the next two years.

Europe: Precision-Driven Digital Operations Landscape

Europe's IT operations analytics is influenced by strict regulations, data privacy laws, and advanced digital transformation programs affecting organizations. This means organizations are placing more weight on analytics for operational resilience, continuity of service, and the proactive management of risk as they continue to operate in the digital age. The financial services, manufacturing, and telecom industries are amongst those that are putting greater emphasis on using analytics.

Germany IT Operations Analytics Market Trends

The fastest-growing country in Europe is Germany, where the adoption of industry and the establishment of smart manufacturing ecosystems are happening at a record pace. More and more German organizations are implementing analytics to have a better view of their complex operations that involve operating in both OT and IT environments.

Latin America: Accelerating Enterprise IT Modernization

Latin America is seeing an increase in IT operations analytics as more organizations modernize their legacy IT systems and migrate to cloud-based IT operations. Organizations have an increasing need for IT operations analytics as they are trying to improve the visibility, optimize costs, and increase service reliability as they expand their customer base through the use of digital channels.

Brazil IT Operations Analytics Market Trends

Brazil is the fastest-growing country in Latin America for IT operations analytics due to Brazilian organizations increasingly adopting cloud technology and growing the number of fintechs in Brazil. Companies are increasingly utilizing analytics to help them manage their multi-cloud environments and to help them increase their system uptime.

Middle East & Africa (MEA): Building Resilient Digital Foundations

The Middle East and Africa region is witnessing increasing demand for the use of IT operations analytics, with year-on-year investment from enterprises and governments in smart cities, digital infrastructures, and the transformation to a more cloud-focused economy. Adoption of analytics aids in guaranteeing uptime, being prepared for cyberattacks, and optimizing overall performance across large-scale IT environments.

The UAE IT Operations Analytics Market Trends

The United Arab Emirates continues to emerge as a high-growth area across the region as it offers various smart city projects and a government that is committed to a cloud-first approach to doing business. Enterprises within the UAE are implementing analytics platforms to provide a real-time view of their IT environments, which further drives the amount of Digital Investment into the region and encourages additional adoption of solutions.

IT Operations Analytics Market Companies

- IBM Corporation

- BMC Software Inc.

- Microsoft Corporation

- Apptio, Inc.

- SAP SE

- ExtraHop Networks

- Glassbeam Inc.

- Splunk Inc.

- Oracle Corporation

- Hewlett Packard Enterprise Development LP

Recent Developments

- In September 2024, ManageEngine, a leading provider of enterprise IT management solutions, announced a significant upgrade to its flagship IT analytics solution, Analytics Plus. Version 6.0 introduces Spotlight, a contextual recommendations engine powered by AI, designed to identify key inefficiencies in IT operations and suggest corrective strategies.

- In April 2025, IBM introduced new agentic and automation capabilities to its managed detection and response service offerings to help enable autonomous security operations and predictive threat intelligence for clients. The new advanced AI capabilities assist in transforming cybersecurity operations, driving precision and efficiency in threat hunting, detection, investigation, and response.

- In April 2025, Kenvue Inc., maker of consumer health products, announced a five-year collaboration with Microsoft, which aims to establish a strong foundation for transforming digital operations through advanced Artificial Intelligence (AI) technologies. These technologies include machine-enabled collaboration, predictive analytics, smart agents, digital twins, and generative AI.

- In August 2024, Palantir Technologies Inc. and Microsoft Corporation announced a significant advancement in their strategic partnership to bring some of the most sophisticated and secure cloud, AI, and analytics capabilities to the U.S. Defense and Intelligence Community.

- In March 2023, Cisco announced the launch of their new ThousandEyes Cloud Intelligence platform. This platform aims to offer cloud-based insight and analytics on the performance of cloud-based apps and services.

- In February 2023,IBM announced the introduction of its new Watson AIOps platform. This platform makes use of AI and machine learning to automate IT operations activities and improve decision-making.

- In January 2023, Splunk announced its acquisition of SignalFx, a major supplier of cloud-based observability and analytics products. Splunk will be able to increase its capabilities in the IT operations analytics industry as a result of this accretion.

Segments Covered in the Report

By Type

- Predictive Analytics

- Visual Analytics

- Root Cause Analytics

- Behavior Analytics

By Deployment

- On-premise

- Cloud

By End-use

- BFSI

- Healthcare

- Retail

- Manufacturing

- Government

- IT & Telecom

- Others

By Application

- Asset Performance Management

- Network Management

- Security Management

- Log Management

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting