IT Services Market Size and Forecast 2025 to 2034

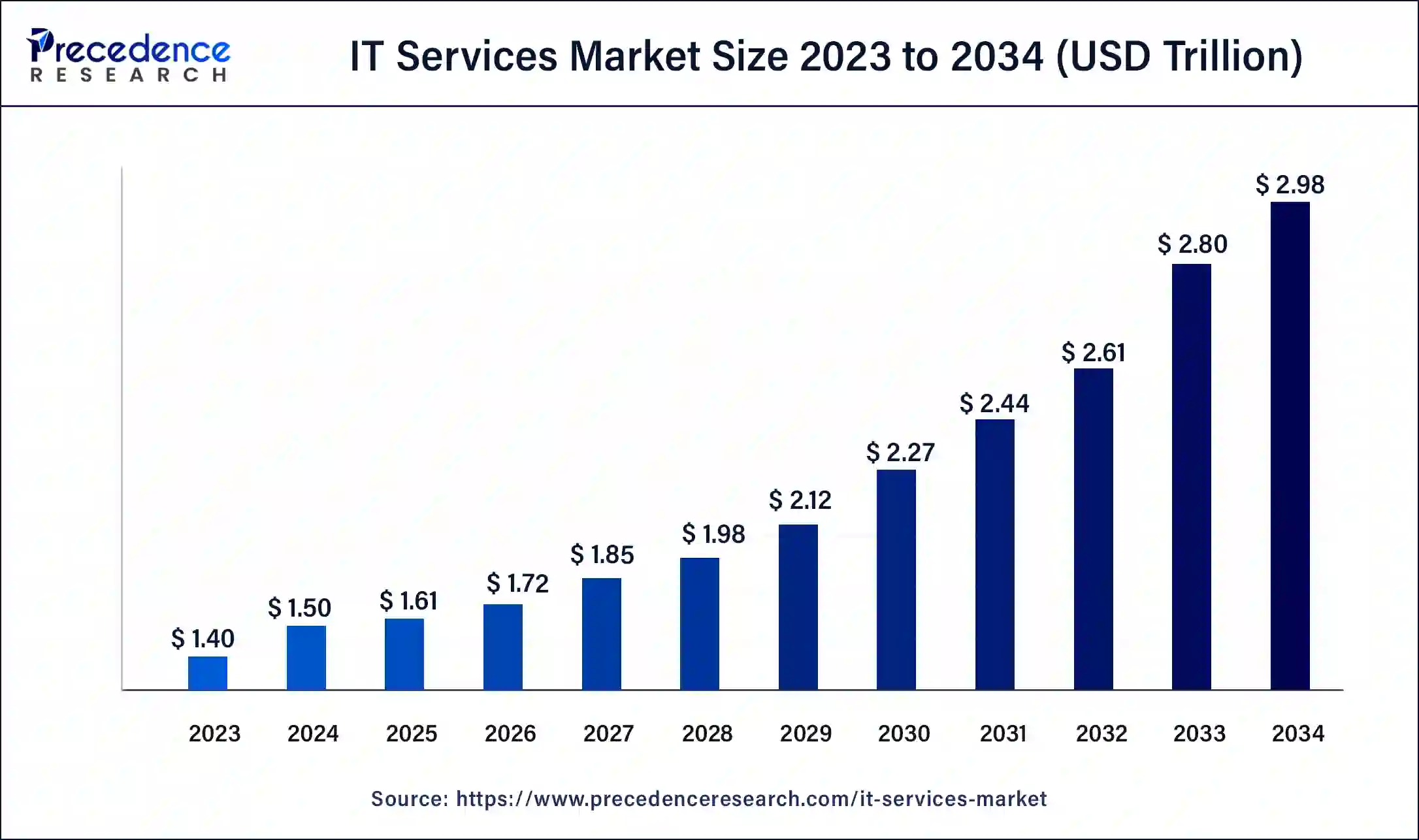

The global IT services market size was calculated at USD 1.50 trillion in 2024 and is expected to reach around USD 2.98 trillion by 2034, expanding at a CAGR of 7.11% from 2025 to 2034. The IT services market size reached USD 520 billion in 2023. The IT services market is driven by the broad usage of cloud computing.

IT Services Market Key Takeaways

- In terms of revenue, the market is valued at USD 1.61 trillion in 2025.

- It is projected to reach USD 2.98 trillion by 2034.

- The market is expected to grow at a CAGR of 7.11% from 2025 to 2034.

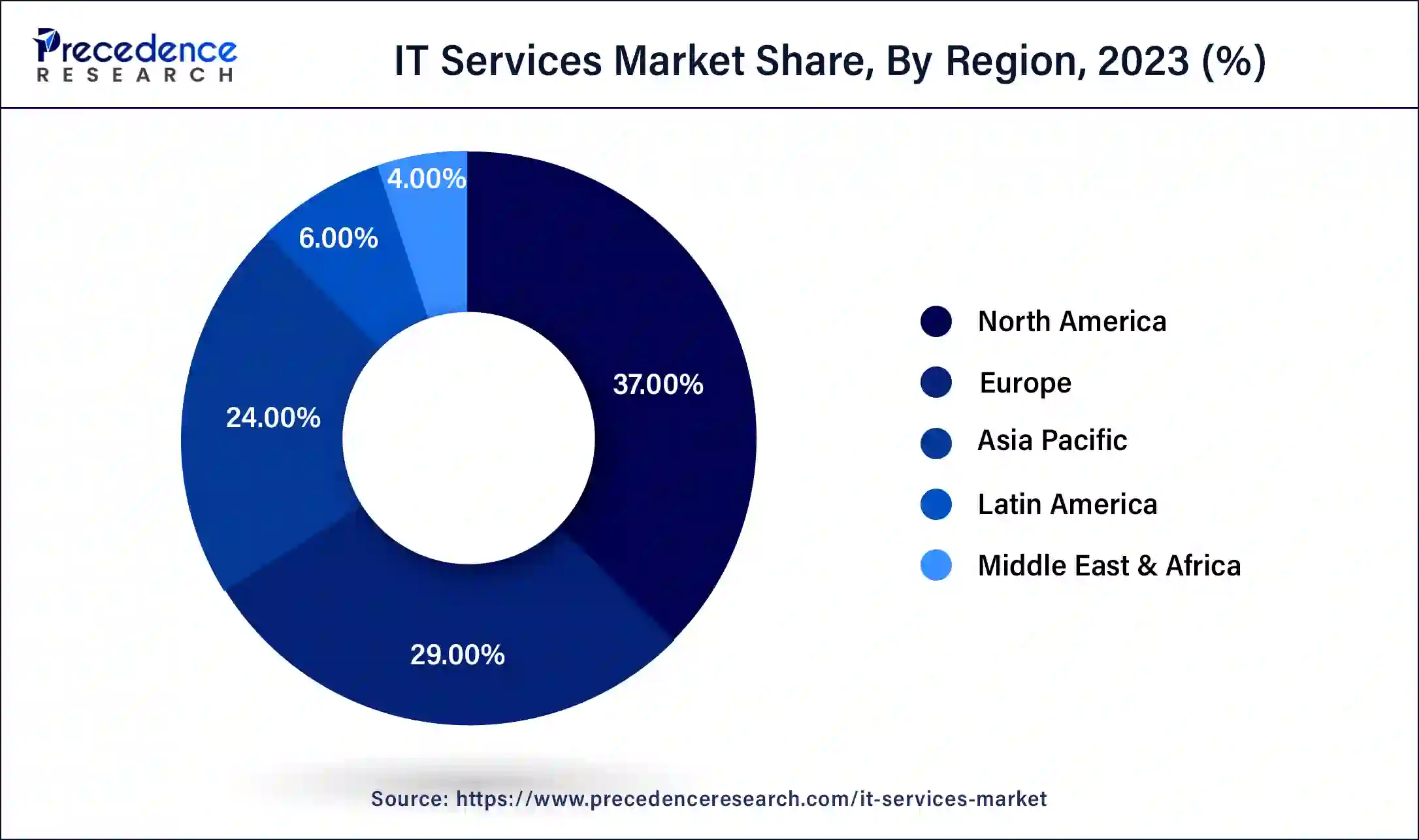

- North America dominated the IT services market in 2024 with a revenue share of 37%.

- By approach, the reactive IT services segment dominated the market with a revenue share of 57% in 2024.

- By type, the operations & maintenance segment dominated the IT services market in 2023 with a revenue share of 64%.

- By application, the application management segment holds the largest share of around 31.7% in 2024.

- By technology, the AI & machine learning segment dominated the market in 2024 with a revenue share of 32%.

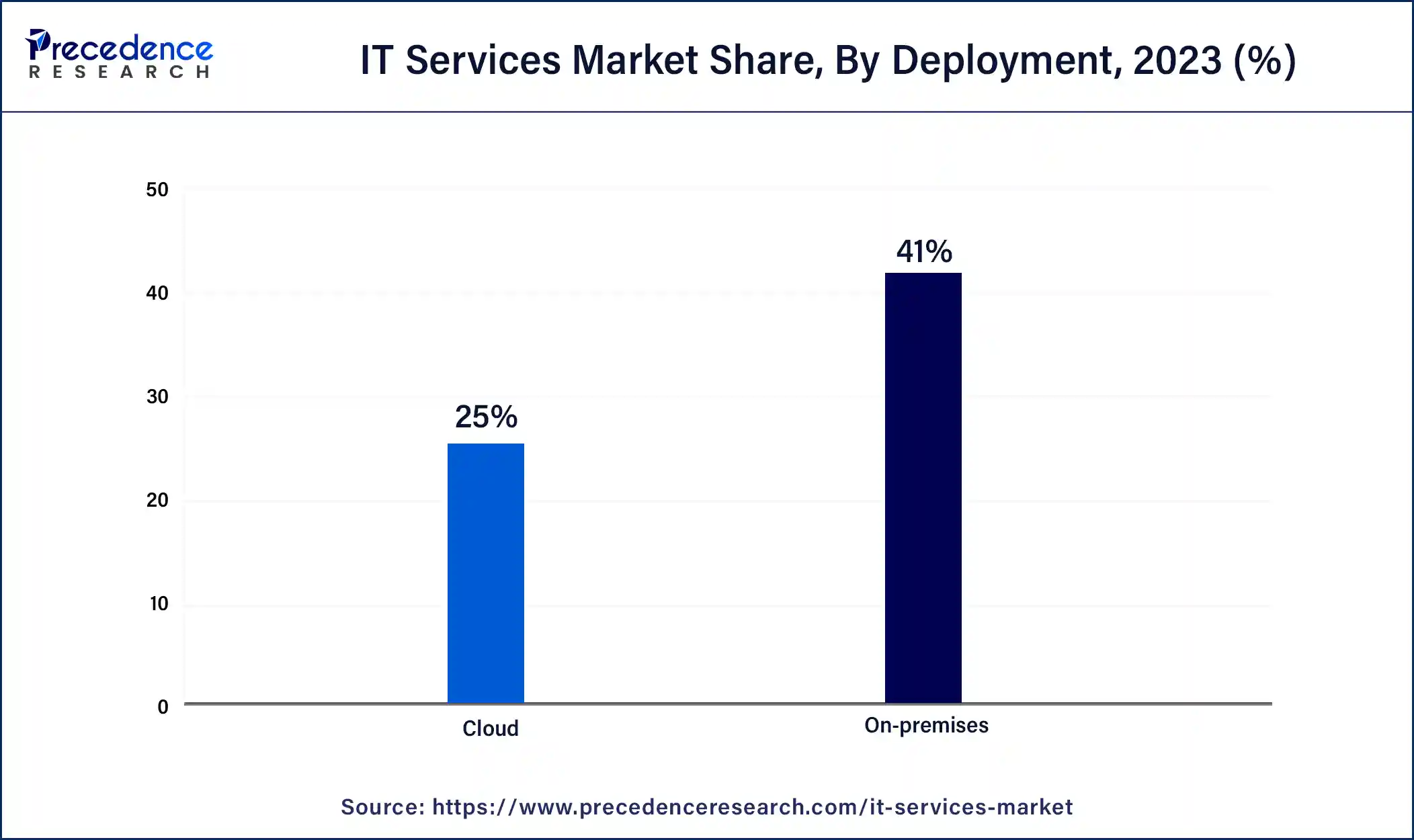

- By deployment, the cloud segment has captured a revenue share of around 55% in 2024.

- By enterprise size, the large enterprise segment holds the largest share of 60.4% in 2024.

- By end-use, the IT & telecom segment has held the largest share of around 17.6% in 2024.

U.S. IT Services Market Size and Growth 2025 to 2034

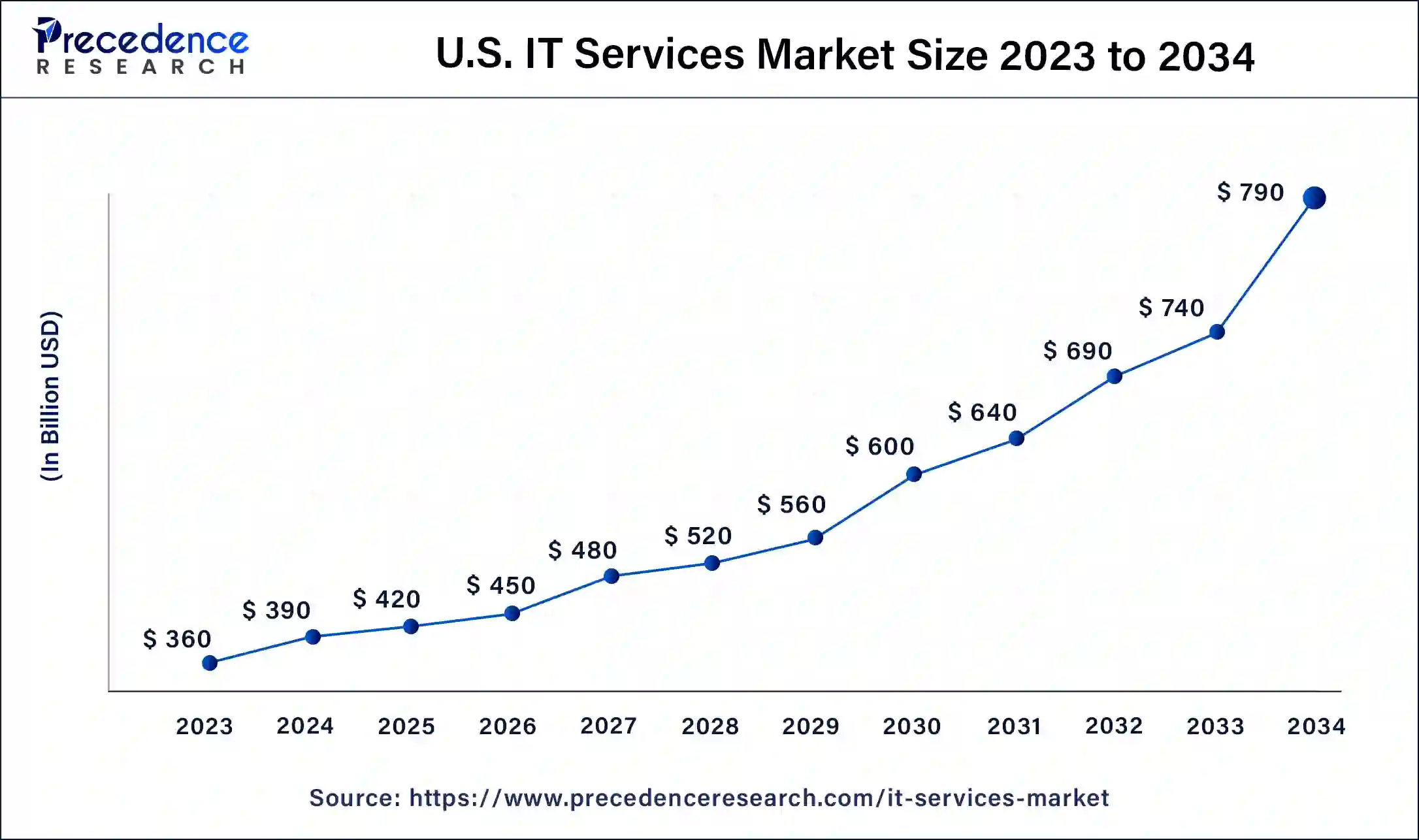

The U.S. IT services market size was estimated at USD 390 billion in 2024 and is predicted to attain USD 790 billion by 2034, at a CAGR of 7.31% from 2025 to 2034.

North America has its largest market share in 2024 and is observed to sustain its position in the IT services market throughout the predicted timeframe. Silicon Valley in California and other tech hotspots like Seattle and Boston have promoted an atmosphere of entrepreneurship and funding for cutting-edge technologies. Top talent is drawn to this environment, which also fosters industry-academia collaboration. In addition to well-established businesses, this area supports a thriving startup and tech community.

These elegant and creative businesses upend established business models, drive innovation across the industry, and provide specialized solutions, all of which significantly impact the IT services market. The existence of tech incubators, accelerators, and venture capital firms contributes to the expansion of the IT industry.

U.S.

- In October 2023, with new AI technologies, IBM highlighted the next step in developing its managed detection and reaction service offerings. One of these features helps clients receive faster security response times by automatically escalating or closing to 85% of alarms. The client's hybrid cloud environments are covered by the new Threat Detection and Response Services (TDR), which offer round-the-clock monitoring, investigation, and automated remediation of alerts about security from all pertinent technologies. This includes cloud, on-premises, operational technologies (OT), and the client's security tools and investments.

- In June 2023, Genpact extended its collaboration with Walmart in North America to continue assisting the Retailer's finance and accounting operations. The current extension strengthens the two companies' connection, which started in North America in 2018 and has since spread to additional areas in South Africa and Latin America.

Canada

- PwC Canada intends to enhance its artificial intelligence capabilities with a $200 million investment spread over three years.

- Asia- Pacific is the fastest growing IT services market during the forecast period. The region's governments and businesses are investing significantly in digital infrastructure, such as data centers, cloud computing platforms, and high-speed internet networks. This infrastructural advancement may allow enterprises to extend their operations more effectively and employ modern IT services.

China

- In March 2024, One of China's first international tech brands, Huawei Technologies, was entangled in the security and technological disputes between China and the US. In addition to denying Huawei access to computer chips and software, including Google services for its smartphones, the US has prohibited US corporations from doing business with Huawei. Huawei has also been banned from selling its telecommunications equipment to US consumers. Because of its improved product selection and robust sales, the company has made a net profit of 87 billion yuan (about USD 12 billion). Revenue increased to 704.2 billion yuan (USD 97.4 billion) from an almost 10% increase a year earlier.

Japan

- With its headquarters in Tokyo, Fujitsu Limited is a multinational firm specializing in providing information and communications technology services and products. Based on yearly sales, it ranks as Japan's most prominent IT services provider and the sixth largest globally. Fujitsu's most recent financial reports state that the company's total revenue (TTM) is $26.31 billion. The business brought in $27.80 billion in revenue in 2022. Its financial goals for the 2025 fiscal year are ¥4.2 trillion in revenue and a 12% adjusted operating profit margin.

India

- In July 2023, Tata Consultancy Services (TCS) has declared that it is broadening its collaboration with GE Healthcare to revolutionize and expedite innovation. TCS will oversee enterprise IT applications' creation, upkeep, standardization, and rationalization. GE Healthcare can offer care solutions to over 1 billion patients across 160 countries through this transition.

Market Overview

IT services are the application of technical and business knowledge to help firms establish, manage, and optimize business processes and information or to make those processes easier to access. The abilities used to deliver the service (design, construct, run) can be used to segment the market for IT services. Services can also be divided into infrastructure, applications, and business processes.

- In March 2023, to help Aecon Group Inc. with its cloud transformation journey, Virtusa Corporation announced a strategic cloud migration agreement. The agreement highlights Virtusa's abilities to manage strong and ongoing innovation to create processes that are future-proof while smoothly transferring Aecon's digital activities to the Amazon Web Services (AWS) Cloud.

IT Services Market Growth Factors

- The increasing need for IT services for management and implementation is driven by the broad adoption of cloud computing and its advantages, including scalability, cost-effectiveness, and automatic updates.

- Companies are actively seeking automation solutions to boost productivity and streamline processes. This strategic focus on efficiency is a key driver behind the increased demand for IT services in automation.

- Companies are concentrating increasingly on digital transformation projects, which call for IT services for security solutions, software deployment, and infrastructure upgrades.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.98 Trillion |

| Market Size in 2025 | USD 1.61 Trillion |

| Market Size in 2024 | USD 1.50 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 7.11% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Approach, Type, Application, Technology, Deployment, Enterprise Size, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing concerns regarding data security and privacy protection

In terms of data security and privacy, there are opportunities and difficulties arising from the fast use of advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and big data analytics. Strong security measures are needed for these technologies to protect private information, stop illegal access, and lessen algorithmic bias, data breaches, and privacy violations. IT service providers provide specialized solutions to ensure ethical data use, secure AI/ML models, and integrate IoT security policies.

- For instance, in April 2024, Fortinet releases significant updates to its operating system for real-time network security to enable businesses to strengthen their networks. New generative AI, data protection, management, and unified agent features are delivered via security fabric upgrades and the most recent version of FortiOS. This sole operating system seamlessly combines networking and security.

High demand for data analytics & big data solutions

Data analytics and big data solutions greatly aid risk management and regulatory compliance. Sophisticated analytics are essential to the financial, healthcare, and cybersecurity industries to spot irregularities, stop fraud, and ensure industry rules are followed. These solutions support businesses in proactively reducing risks and preserving the security and integrity of their data.

Restraint

Cost concerns over product customization

Proficient IT specialists, including developers, designers, and project managers, are needed for customization projects. When resources are dedicated to a customized project, they become unavailable for other jobs or projects. This can affect an IT services provider's overall productivity and resource usage. A balanced resource allocation is necessary to prevent overcommitting or underutilizing important skills.

Opportunity

Growing adoption of digital technologies

Cybersecurity has become an organization's top concern as corporate operations and data become more digital. IT providers provide cybersecurity services like vulnerability assessments, threat detection and response, security consulting, and managed security services. They support customers in protecting their digital assets, adhering to rules, and reducing cyberthreats such as ransomware assaults, insider threats, and data breaches. The necessity for strong defenses and the increasing complexity of cyber threats are driving demand for cybersecurity services.

Approach Insights

The reactive IT services segment dominated the IT services market in 2024. Even though they are reactive, contemporary IT service providers in this market use sophisticated analytics and monitoring tools to identify problems early on or anticipate possible failures. Reactive IT services can occasionally detect and resolve problems before they become severe interruptions by proactively monitoring systems and examining data patterns.

Type Insights

The operations & maintenance segment dominated the IT services market in 2024. The IT environment changes due to new trends, technologies, and difficulties. The operations and maintenance sector invests in innovation and technological know-how to stay ahead of the curve. This entails keeping up with the most recent security patches, software updates, and industry best practices. By utilizing cutting-edge equipment and techniques, this sector may provide excellent services and assist companies in maintaining their competitiveness.

- In May 2023, the most significant IT infrastructure and services supplier, NTT Ltd., and global technology pioneer Cisco established a partnership to develop and implement integrated solutions that enable businesses to boost productivity and achieve sustainability objectives.

Application Insights

The application management segment held the largest share in the IT services market in 2024. Application management services are a comprehensive enterprise-wide initiative offering governance to guarantee that applications operate as effectively as possible, from end-user experience to interaction with back-office business operations. Productivity increases when effective management techniques minimize the person's hours spent in meetings. As fewer and fewer application problems arise, effective application management techniques can also reduce the need to hire costly outside consultants and lower total operating costs.

If contemporary apps appropriately address business functions, business process solutions can be launched more swiftly, cheaply, and efficiently. When applications are handled effectively, more IT resources are available to concentrate on novel business difficulties and competitive issues.

The data management segment shows a significant growth in the IT services market during the forecast period. Data management is known for safeguarding, arranging and preserving an organization's data to be examined for business choices. Data management solutions are crucial for making sense of the massive volume of data enterprises create and consume at previously unheard-of speeds. Organizations can eliminate redundancies and confusion created by various conflicting data sources by making a single source of truth for enterprise data through data management.

For instance, data management guarantees that the company won't try to reach out to customers with outdated and current contact information when their information changes for sales or marketing purposes.

Technology Insights

The AI & machine learning segment dominated the IT services market in 2024. It becomes difficult to maintain smooth operations when multiple databases and apps run independently. Time-consuming and ineffective manual procedures are utilized to find and fix problems. Identifying significant situations and responding to them quickly and efficiently becomes challenging. Businesses use artificial intelligence (AI) in their IT operations to solve these obstacles.

Artificial Intelligence has drawn attention due to its ability to improve decision-making, stimulate creativity, and optimize operations. AI is revolutionizing IT by enabling businesses to improve cybersecurity, optimize operations, and glean insightful insights from large data sets.

The big data analytics segment shows a significant growth in the IT services market during the forecast period. Discovering patterns, trends, and correlations in more significant amounts of unprocessed data is the goal of big data analytics, which aids in making data-driven decisions. With more modern technologies, these procedures use well-known statistical analytic techniques, such as regression and clustering, to create larger datasets. Big data analytics techniques are now coupled with emerging technologies like machine learning to find and scale more sophisticated insights.

Deployment Insights

The cloud segment shows a substantial growth in the IT services market during the forecast period. Cloud-based services deliver information technology (IT) as a service via the Internet or a dedicated network, with usage-based billing and on-demand delivery. Virtual desktops, servers, storage, and whole applications and development platforms are all examples of cloud-based services.

In contrast to a conventional IT setup, where departmental funds are allocated beforehand for software and infrastructure, which takes months to implement, cloud-based services provide IT resources within minutes or hours and match costs to real consumption. Organizations are, therefore, more flexible and able to handle costs more effectively.

Enterprise Size Insights

The large enterprise segment held the largest share in the IT services market in 2024. Due to their scale, large enterprises typically have complex and diverse IT needs. These organizations often operate in multiple geographic locations, have numerous departments, and manage large volumes of data. As a result, they require a wide range of IT services, such as network infrastructure management, cybersecurity, cloud computing, software development, and enterprise resource planning (ERP) solutions.

End-use Insights

The IT & telecom segment held the largest share in the IT services market in 2024. Telecom operators obtain meaningful insights into customer behavior, network efficiency, and market trends by utilizing IT-driven analytics and company intelligence solutions. Telecom firms may maximize service offerings, boost customer happiness, and discover new revenue streams using big data analytics, machine learning methods, and predictive modeling techniques. The telecommunications business has undergone a transformation thanks to the incorporation of information technology, which has enabled operators to provide users globally with faster, more dependable, and more innovative communication services.

The retail segment shows significant growth in the IT services market during the forecast period.

The IT industry's specialty in retail-oriented solutions, including the most recent advancements, radio frequency technologies, computers, and the Internet, has made using cutting-edge technology in retail viable. Data visualization, predictive modeling, and advanced analytics are some of the IT solutions available to the retail sector. Retailers may stay competitive by optimizing inventory management, gaining a deeper understanding of customer behavior, and making well-informed strategic decisions by utilizing these services.

IT Services Market Companies

- Amazon Web Services, Inc.

- Avaya

- Cisco Systems, Inc.

- DXC Technology Company

- Fortinet, Inc.

- Hewlett Packard Enterprise Development LP

- Broadcom (Symantec Corporation)

- Oracle

- Huawei Technologies Co., Ltd.

- IBM Corp.

- Juniper Networks, Inc.

- Microsoft

Recent Developments

- In April 2025, Infosys, a global leader in next-generation digital services and consulting, and Spark New Zealand (Spark), New Zealand's largest telecommunications and digital services company, announced a strategic agreement that will support the transformation of Spark's technology delivery model through digital innovation. Under the collaboration, Infosys will provide its global DevOps and software engineering capabilities to help build, test, integrate, and deliver Spark's systems and applications, along with monitoring and support. ( Source: prnewswire.com )

- In February 2025, Tata Power announced a strategic collaboration with Amazon Web Services to accelerate the country's transition to a greener, smarter, and more consumer-centric energy ecosystem. Tata Power's partnership with AWS exemplifies this digital-first approach, harnessing cloud computing, artificial intelligence (AI), and IoT to build a smarter, more efficient power ecosystem. (Source: business-standard.com )

- In March 2025, Hitachi Energy and AWS's strategic collaboration accelerated innovation in the cloud and advanced the energy transition. The initial focus of the agreement delivers Hitachi Vegetation Manager, an artificial intelligence (AI)-driven vegetation management system, on AWS. This innovative solution aims to significantly reduce power or system outages caused by vegetation interference with critical infrastructure. ( Source: hitachienergy.com )

- In May 2025, IBM accelerated the deployment of enterprise-ready agentic AI systems by strengthening its partnerships with Oracle, AWS, and Salesforce. Through integrations across hybrid cloud environments and enterprise platforms, IBM aims to make it easier for businesses to adopt intelligent agents that automate workflows, act on data in real time, and scale AI use cases securely and efficiently.(Source: channele2e.com )

- In May 2025, Zain Jordan and Ericsson launched a cloud-native transformation for next-gen telecom services. Ericsson and Zain Jordan are transforming digital services with a cloud-native BSS upgrade, enhancing customer experience, agility, and 5G monetization. This strategic partnership will modernize Zain Jordan's converged BSS architecture to a cloud-native model, driving innovation and flexibility in the Hashemite Kingdom's evolving telecom and Information Technology (IT) landscape.(Source: techafricanews.com )

- In March 2025, NTT DATA, a global leader in digital business and technology services, announced the launch of its Agentic AI Services for Hyperscaler AI Technologies. This news builds on NTT DATA's recently announced Smart AI Agent™, enabling enterprises to integrate AI-driven automation across business functions.(Source: businesswire.com )

- In November 2023, a strategic relationship between NVIDIA and Amazon Web Services, Inc. has expanded to offer customers cutting-edge services, software, and infrastructure to power their generative artificial intelligence (AI) advancements.

- In September 2022, to support businesses in fostering innovation and achieving their goals for digital growth, IBM revealed plans to purchase Dialexa, a top provider of digital product engineering services in the United States. The acquisition is anticipated to expand IBM's knowledge in product engineering and enable the company to provide clients with full-service digital transformation solutions.

Segments Covered in the Report

By Approach

- Reactive IT Services

- Proactive IT Services

By Type

- Design & Implementation

- Operations & Maintenance

By Application

- Systems & Network Management

- Data Management

- Application Management

- Security & Compliance Management

- Others

By Technology

- AI & Machine Learning

- Big Data Analytics

- Threat Intelligence

- Others

By Deployment

- On-premises

- Cloud

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

By End-use

- BFSI

- Government

- Healthcare

- Manufacturing

- Media & Communications

- Retail

- IT & Telecom

- Others

ByGeography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting