Laboratory Robotics Market Size and Forecast 2025 to 2034

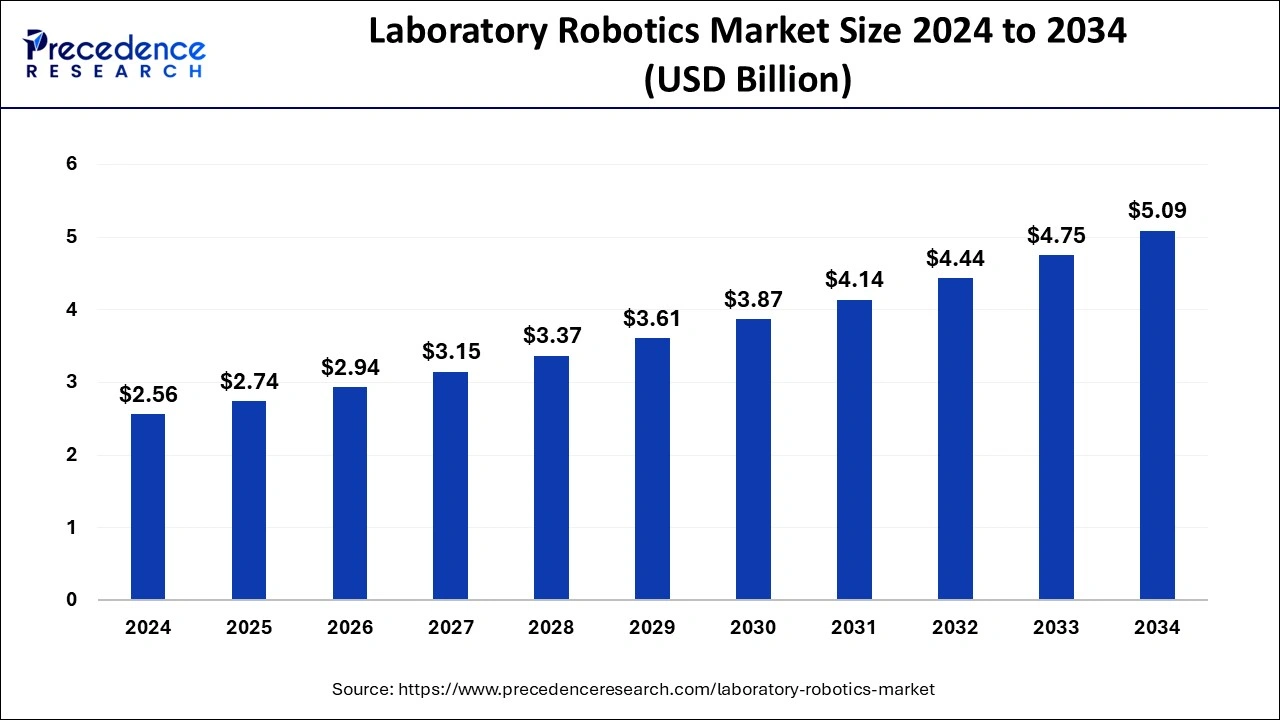

The global laboratory robotics market size accounted for USD 2.56 billion in 2024 and is expected to exceed around USD 5.09 billion by 2034, growing at a CAGR of 7.12% from 2025 to 2034. The growing demand for efficient laboratory operations is the key factor driving the laboratory robotics market growth. Also, the increasing adoption of robotic systems in the medical industry coupled with the advancements In technology can fuel market growth further.

Laboratory Robotics Market Key Takeaways

- In terms of revenue, the laboratory robotics market is valued at $2.74 billion in 2025.

- It is projected to reach $5.09 billion by 2034.

- The laboratory robotics market is expected to grow at a CAGR of 7.12% from 2025 to 2034.

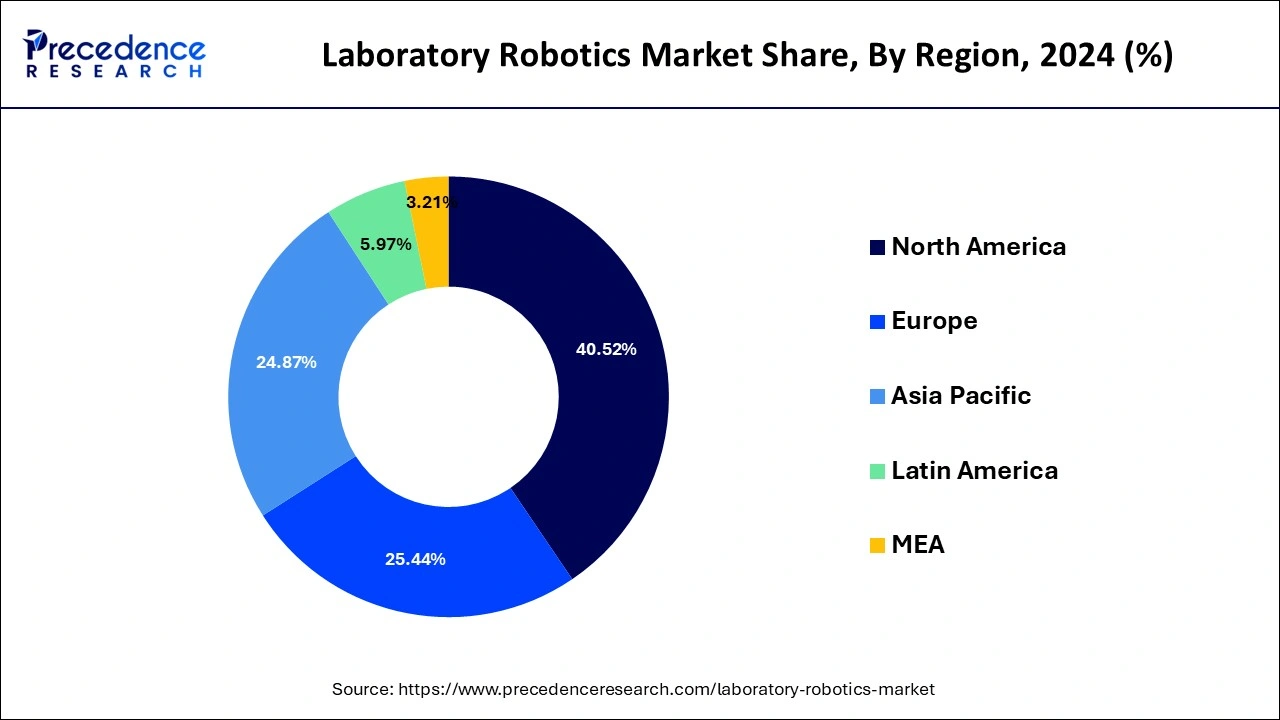

- North America dominated the laboratory robotics market with the largest market share of 40.52% in 2024.

- Asia Pacific will witness substantial growth during the studied period.

- By product, the lab automation workstations segment contributed the highest market share of 38% in 2024.

- By product, the automated plate handlers segment is expected to grow at the fastest rate over the forecast period.

- By application, the drug discovery segment generated the biggest market share of 29% in 2024.

- By application, the clinical diagnosis segment is anticipated to grow at the fastest rate during the forecast period.

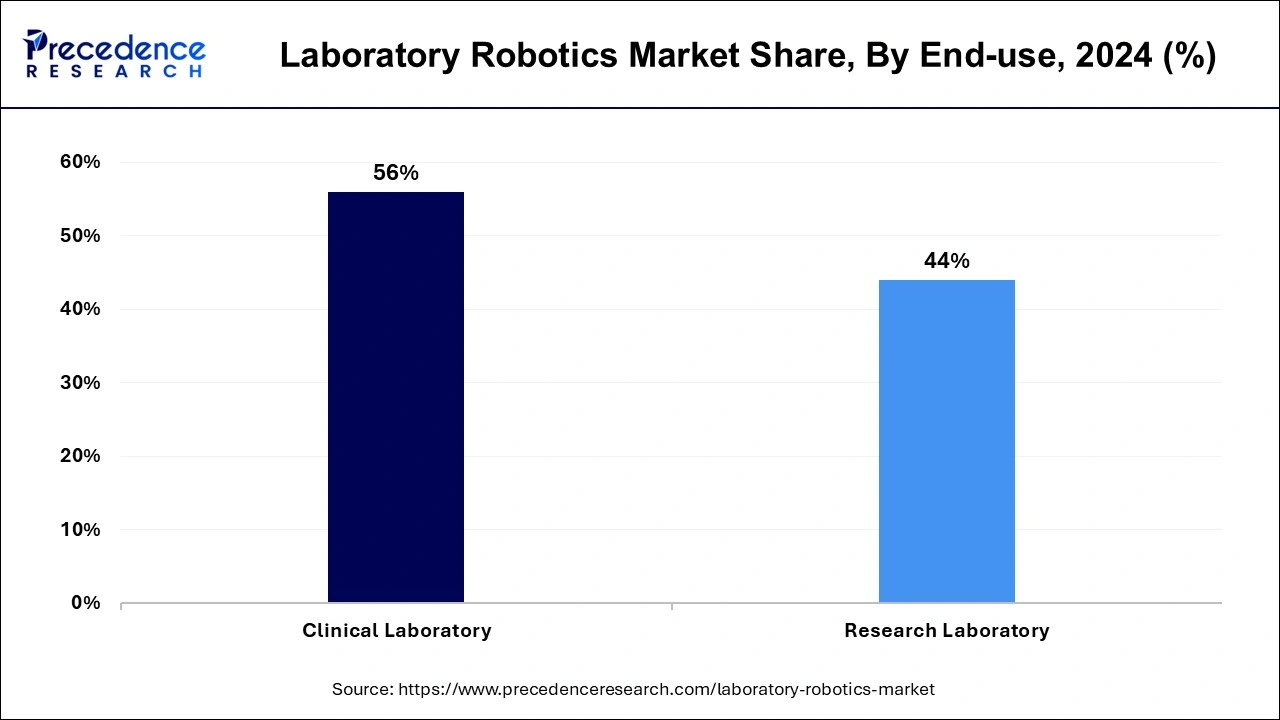

- By end use, the clinical laboratory segment has held the largest market share of 56% in 2024.

- By end use, the research laboratory segment is estimated to grow at the fastest pace during the projected period.

The Role of Artificial Intelligence (AI) in Laboratory Robotics Market

Artificial intelligence is revolutionizing the laboratory robotics market by facilitating automation. AI algorithms can process and interpret large sets of data at a rapid pace. This ability is useful in tasks like predictive modeling, data mining, and pattern recognition. Furthermore, AI can learn each task from zero, continuously enhancing its performance over time. The capability of AI to learn and adapt makes it a powerful tool for lab automation.

- In November 2024, Hyundai Motor Company and Kia Corporation introduced a reliable companion for industrial work, the wearable robot 'X-ble Shoulder.' This device, just by being worn, can increase workers' efficiency and reduce musculoskeletal injuries. The X-ble Shoulder can reduce shoulder load by up to 60% to improve the quality of life of workers.

In November 2024, Tata Elxsi, a global leader in design and technology services, collaborated with DENSO Robotics Europe and AAtek to inaugurate the 'Robotics and Automation Innovation Lab' at Tata Elxsi's Frankfurt office. The newly opened lab aims to transform robotics automation across multiple sectors, including medical devices, pharmaceuticals, life sciences, and food science.

U.S. Laboratory Robotics Market Size and Growth 2025 to 2034

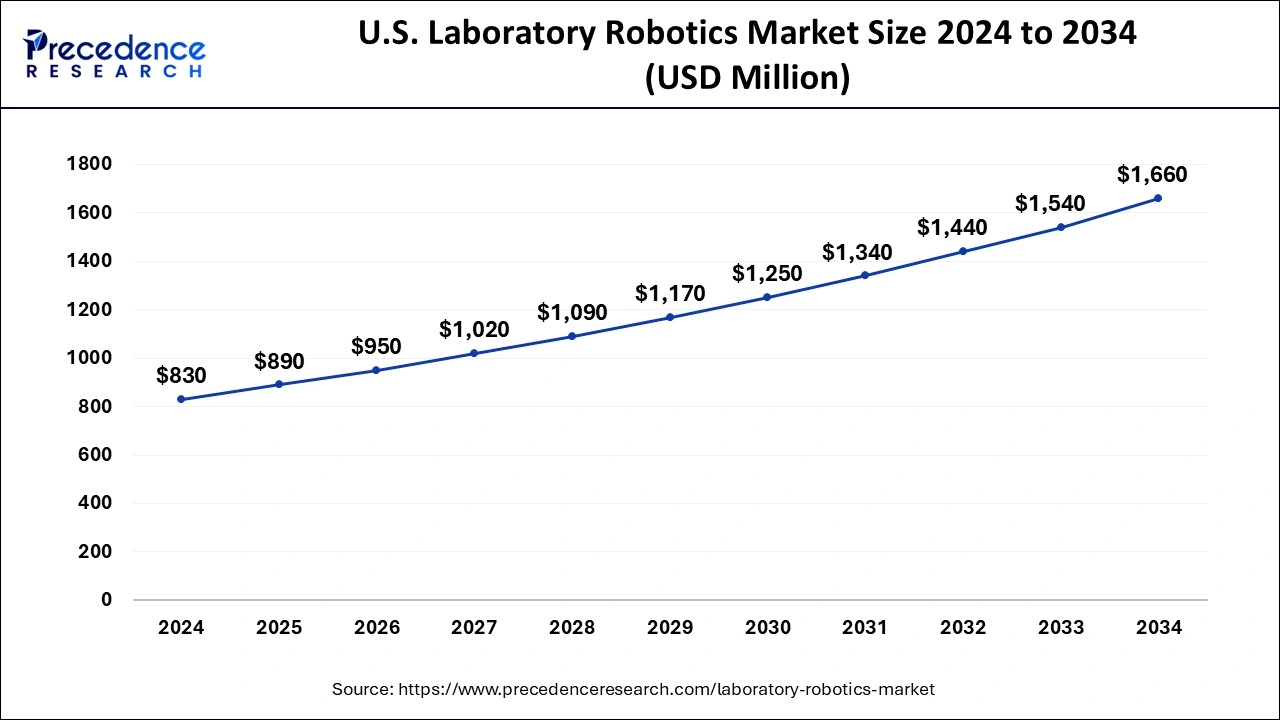

The U.S. laboratory robotics market size was exhibited at USD 830 million in 2024 and is projected to be worth around USD 1,660 million by 2034, growing at a CAGR of 7.17% from 2025 to 2034.

North America dominated the laboratory robotics market in 2024. The dominance of the region can be attributed to the rising need for automation in laboratories coupled with the technological advancements in the field. Moreover, the ongoing expansion of pharmaceutical, healthcare, and biotechnology companies in the region is also propelling the rapid adoption of laboratory robotics in the region. In North America, the U.S. led the market owing to the easy acceptance of innovative technologies in the country.

- In 2024, RobotShop Inc. announced the development of its integrator network via a strategic partnership with Fractal Robotics, a leading service robotics integrator in Canada.

Asia Pacific will witness substantial growth in the laboratory robotics market during the studied period. The growth of the region can be credited to the increasing funding and investment in advanced technologies. The region is also dealing with surging demands for advanced robotic technology from a number of stakeholders, such as doctors. Furthermore, In the region, China led the market due to technological developments in robotics technology.

China Laboratory Robotics Market

The increasing demand for quicker research and testing methods, especially in the pharmaceutical and biotechnology sectors, is leading to the uptake of lab automation and increasing laboratory robotics market. High-throughput screening systems enable scientists to quickly evaluate thousands of compounds and samples, accelerating drug discovery and development efforts. Technological progress, such as the integration of robotics, AI, and machine learning, has enhanced the efficiency and user-friendliness of lab automation. Improved software tools for data management and analysis allow researchers to achieve greater insights from their experiments while lessening manual tasks. Increasing funding in the robotics field from the government and businesses enhances the laboratory robotics sector.

- China's National Development and Reform Commission has declared the establishment of a state-supported venture capital fund centered on robotics, AI, and advanced innovation. The long-term fund is projected to gather around 1 trillion yuan (US$138 billion) in investments from local governments and the private sector within two decades.

Market Overview

Laboratory robotics is an automation process in which there is greater use of instruments to perform lab processes, which limits the human input. The laboratory automation process enhances the overall precision of lab results and also improves the workflow effectively. Automation enables skilled people to place more emphasis on complex activities in the laboratory robotics market. This system consists of many parts, such as robotics, conveyor systems, hardware and software, and machine vision.

- In November 2024, Microsoft opened its first research and development center in Japan, named Microsoft Research Asia Tokyo. This new lab will integrate AI with robotics, developing research in key areas like manufacturing, healthcare, and societal applications. It's Microsoft's latest step in expanding its global network of AI research centers.

Laboratory Robotics Market Growth Factors

- Growth in research and development activities is expected to boost laboratory robotics market growth soon.

- The increasing demand for automation in laboratory processes can propel market growth shortly.

- Innovations such as AI-powered robotics and integrated software solutions will likely contribute to the market expansion over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 2.56 Billion |

| Market Size in 2025 | USD 2.74 Billion |

| Market Size in 2034 | USD 5.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.12% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for high-throughput screening process

The pharma industry across the globe is witnessing high pressure to manufacture new drugs because of an increasing number of chronic disorders that lack the proper treatment, which in turn results in a throughput screening process. Furthermore, the increasing trend for individualized therapies is also increasing the need for the laboratory robotics market for HTS.

Restraint

Slow adoption of laboratory robotics among SMSL

The adoption of the laboratory robotics market is slow, particularly in small and medium-sized laboratories (SMLs). Many labs emphasize the use of total laboratory automation, which sometimes leads to failure at the primary stages. Moreover, the cost of implementing robotics in the laboratory is very high for hospitals and SMLs.

Opportunity

Increasing adoption of robotics in healthcare education

Educational institutes globally are focusing on launching advanced robotics systems in healthcare education to optimize the growth of the laboratory robotics market and to ensure the proper penetration of these innovations in the healthcare industry. Furthermore, many pharmaceutical, healthcare, and biotechnology organizations across the globe depend more on automation to fulfill daily tasks such as mixing, pipetting, and sorting to improve the efficient workflow in the laboratory.

- In November 2024, RobotShop Inc. announced the expansion of its integrator network through a strategic partnership with Fractal Robotics, a leading service robotics integrator in Canada. This collaboration will enhance the capabilities of the RobotShop Robotics Integration Service (RRIS) and further strengthen its position in the service robotics market.

Product Insights

The lab automation workstations segment dominated the laboratory robotics market in 2024. This dominance can be attributed to the rising demand for optimized laboratory processes due to the increasing requirement for efficiency and higher throughput. Furthermore, developments in robotics technology, including enhanced flexibility and accuracy, are expanding the abilities of automated workstations, leading to further segment growth.

- In October 2024, Tate & Lyle launched its new 'Automated Laboratory for Ingredient Experimentation,' known as 'ALFIE,' at its Customer Collaboration and Innovation Centre in Singapore. Through the pioneering use of automated robotics, ALFIE represents a revolution in the delivery of mouthfeel solutions for customers.

The automated plate handlers segment is expected to grow at the fastest rate in the laboratory robotics market over the forecast period. The growth of the segment can be credited to the technological advancements that led to the development of versatile and efficient plate handling systems which has the ability to handle many types of plates with accuracy and speed. Also, the integration of innovative features like vision systems, robotic arms, and sophisticated software can contribute to segment expansion in the upcoming years.

Application Insights

The drug discovery segment led the global laboratory robotics market in 2024. The dominance of the segment can be linked to the rising demand for advanced drugs to treat many diseases, propelling wide R&D efforts in biotechnology & pharmaceutical companies. However, innovations in technology, including machine learning and artificial intelligence, are transforming drug discovery by enabling virtual screening and predictive modeling.

The clinical diagnosis segment is anticipated to grow at the fastest rate in the laboratory robotics market during the forecast period. This growth can be driven by a rising focus on personalized healthcare and precision medicine. Also, there is an increasing need for precise and effective diagnostic solutions. Laboratory robotics plays an essential role in automating many diagnostic processes, such as sampling, testing, and assessment, enhancing the overall operational efficiency of the process.

End-use Insights

In 2024, the clinical laboratory segment dominated the laboratory robotics market by holding the largest market share. The dominance of the segment can be driven by developments in clinical research along with government support. Rising funding for medical infrastructure and new research initiatives are boosting the growth of laboratory robotic systems. Furthermore, these systems improve precision, automate repetitive tasks, and enhance workflow efficiency in laboratories.

The research laboratory segment is estimated to grow at the fastest pace in the laboratory robotics market during the projected period. The growth of the segment is due to technological advancements and raised investments in research and development. In addition, research laboratories are investing largely in automation to improve accuracy, productivity, and high throughout the process. The increasing demand for reproducibility in experiments is enabling labs to include innovative robotic systems.

- In August 2023, Material Solutions Company 3M inaugurated its first abrasive robotics lab in India, located at its Bengaluru center. This addition brings the global count of such labs to 17 within the company 3M India, the Indian listed entity of 3M, has approximately 1,100 employees, forming part of the overall employee base of about 90,000 people working mostly in the R&D department.

Laboratory Robotics Market Companies

- Peak Analysis & Automation

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

- Hudson Robotics

- Anton Paar GmbH

- Beckman Coulter, Inc.

- Siemens Healthcare Private Limited

- AB Controls, Inc.

- Abbott

- Biomérieux

Latest Announcement by Market Leaders

- In September 2024, Thermo Fisher Scientific, the world leader serving science, announced the latest recipients of the Oncomine Clinical Research Grant, designed to support emerging research on molecular profiling in oncology and to help democratize the future of precision medicine. Now in its fourth year, the grant recognizes research from the Tata Memorial Centre in India.

- In December 2023, PerkinElmer, a leading global analytical services and solutions provider announced that it had acquired Covaris, a leading developer of solutions to empower life science innovations. The merger will accelerate Covaris' growth potential and expand PerkinElmer's existing life sciences portfolio into the high-growth diagnostics end market.

Recent Developments

- In May 2025, Trilobio, the company developing the fully automated robotic lab-in-a-box designed for biologists, declared that it secured $8 million USD in Seed funding. The round, which was oversubscribed, was led by Initialized Capital, with involvement from Argon Ventures and Lowercarbon Capital. This funding will facilitate the enhancement of the Trilobio Platform's robotic functions and no-code software capabilities, allowing for the integration of an expanding range of tailored lab equipment and protocols into one comprehensive, fully automated system.

- In January 2025, ABB Robotics and Agilent Technologies, a worldwide leader in analytical, laboratory technology, and software, entered into a partnership agreement to provide automated laboratory solutions. Collaborating, ABB and Agilent will merge their technological advantages to help firms in various industries, including pharmaceuticals, biotechnology, energy, and food and beverage, enhance their laboratory operations by streamlining processes like research and quality control to be quicker and more efficient.

- In March 2025, Insilico Medicine, a biotech firm at the clinical stage that is leading the way in generative AI for drug discovery and development, revealed the introduction of the first bipedal humanoid in its AI-driven fully-robotic drug discovery lab. The robotic figure, named "Supervisor," marks an important advancement in developing genuinely autonomous research centers where robots can handle devices initially created for human operation.

- In March 2024, INDUS Holding AG acquired Berlin-based Gestalt Robotics, a company specializing in custom AI-based automation solutions for industrial applications. Gestalt Robotics' portfolio includes advanced image processing and control technology driven by artificial intelligence.

- In January 2024, Bruker Corporation acquired Chemspeed Technologies, a company specializing in vendor-agnostic automated laboratory R&D. Chemspeed focuses on modular automation and robotics solutions for pharmaceutical drug formulation.

Segments Covered in the Report

By Product

- Automated Liquid Handling Robots

- Automated Plate Handlers

- Robotic Arms

- Lab Automation Workstations

- Microplate Readers and Washers

- Others

By Application

- Drug Discovery

- Clinical Diagnosis

- Microbiology Solutions

- Genomics Solutions

- Proteomics Solutions

By End-use

- Clinical Laboratory

- Research Laboratory

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting