What is the Lancet Market Size?

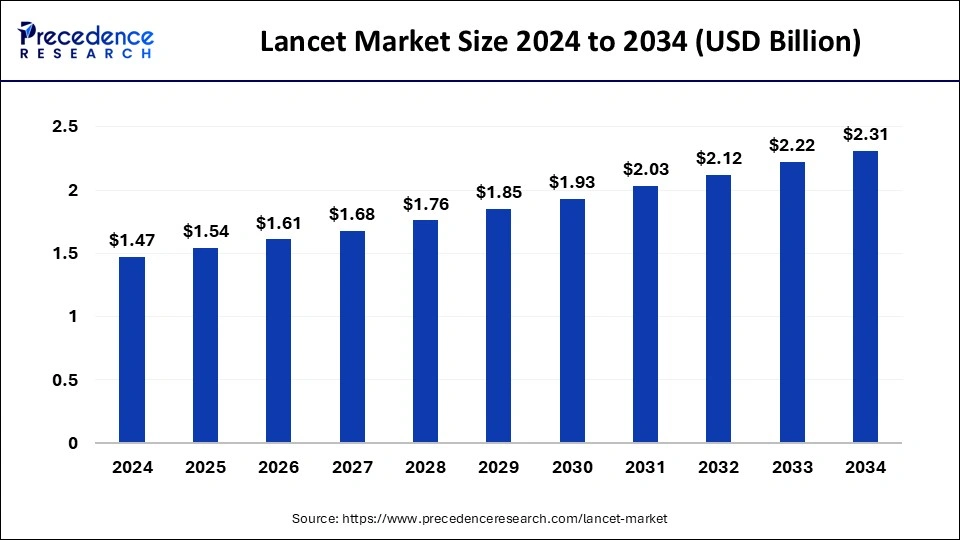

The global lancet market size was estimated at USD 1.54 billion in 2025 and is predicted to increase from USD 1.61 billion in 2026 to approximately USD 2.41 billion by 2035, expanding at a CAGR of 4.58% from 2026 to 2035. The need for frequent blood glucose monitoring is driven by the increasing number of diabetes patients worldwide, which is driving up demand for lancet devices.

Lancet Market Key Takeaways

- The global lancet market was valued at USD 1.54billion in 2025.

- It is projected to reach USD 2.41billion by 2035.

- The lancet market is expected to grow at a CAGR of 4.58% from 2026 to 2035.

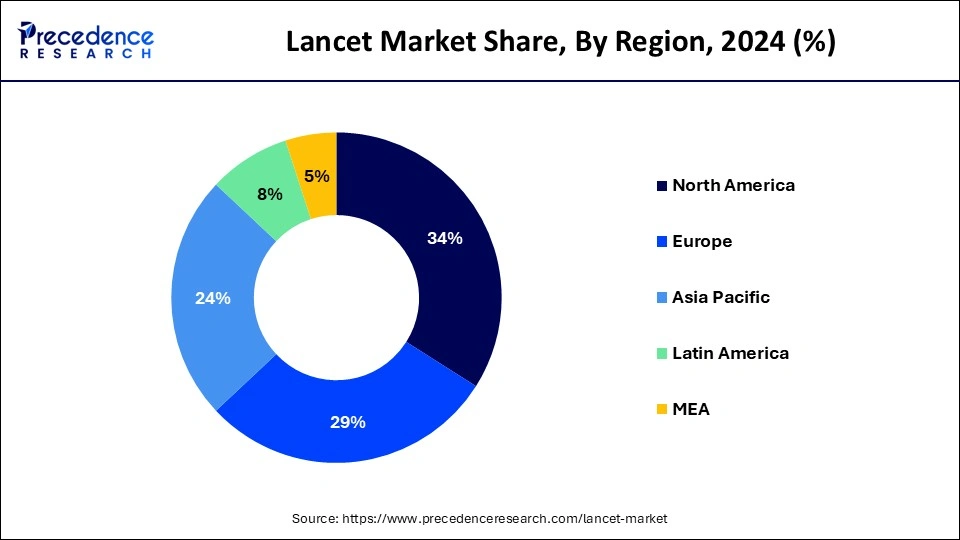

- North America dominated the market with the largest revenue share of 41% in 2025.

- Asia Pacific is expected to be the fastest-growing market during the forecast period.

- By type, the standard lancets segment has contributed more than 39% of revenue share in 2025.

- By type, the safety lancets segment is expected to grow at the fastest rate in the market during the projected period.

- By size, the 23G-33G segment has held a major revenue share of 44% in 2025.

- By size, the 22G and below segment is expected to grow at the fastest rate in the market during the projected period.

- By end use, the hospital segment has generated more than 32% of revenue share in 2025.

- By end use, the ambulatory surgical centers segment is expected to register significant growth in the market over the forecast period.

Market Overview

The term ‘Lancet Market' describes the industry that deals with the production and commercialization of lancets, which are tiny medical instruments used to draw blood from capillaries. Diabetics frequently utilize these devices for additional diagnostic tests that call for small volumes of blood, such as glucose testing. Creation of devices with customizable penetration depths and painless lancets.

The lancet market, which is necessary for blood samples in medical diagnostics, is expanding significantly due to the increase in the incidence of infectious and chronic diseases, especially diabetes. The need for regular blood tests due to the rising prevalence of diabetes, cardiovascular illnesses, and other chronic ailments is driving up demand for lancets.

Companies are expanding their product ranges and reach through smart acquisitions and alliances. The lancet market is expected to develop significantly due to the rising demand for home healthcare solutions and diabetic monitoring. For manufacturers hoping to take advantage of the expanding market potential, innovation and calculated entry into emerging markets will be crucial.

Artificial Intelligence: The Next Growth Catalyst in The Lancet

AI is radically transforming the lancing device industry by driving the development of smart connected devices that pair with smartphone apps for real-time blood glucose monitoring and data analysis. These AI-enabled systems allow for personalized treatment adjustments by analyzing longitudinal patient data, enhancing management for chronic conditions like diabetes.

Beyond the consumer-facing technology, manufacturers are integrating AI-driven automation in production, such as AI-powered quality control and robotic assembly, to ensure high precision, lower production costs, and reduce defects.

Lancet Market Growth Factors

- The aging global population is more prone to chronic illnesses, especially in North America and Europe, which is fueling the lancet market expansion. The rising prevalence of diabetes and other chronic illnesses further fuels the need for frequent blood tests, driving up demand for lancets.

- The user experience and safety of lancet technology are being improved by innovations, including the creation of micro-needle lancets that reduce pain and the addition of safety measures to prevent needlestick accidents. These developments are growing the lancet market and drawing in additional customers.

- Another factor driving the increase is the use of lancets for the detection of infectious disorders like hepatitis B. The need for additional blood tests due to the growing burden of infectious diseases is driving up demand for lancets.

- Particularly in the wake of the COVID-19 epidemic, the trend toward point-of-care testing and home-based surveillance has quickened. This change is increasing demand for at-home, handy, and easy-to-use lancet devices.

- The expanding healthcare infrastructure, growing knowledge of self-monitoring health problems, and the rising prevalence of chronic diseases are all contributing to the significant lancet market expansion that Asia Pacific is experiencing. Similar reasons are driving sustained growth in Latin America as well.

Market Outlook

- Market Growth Overview: The lancet market is expected to grow significantly between 2025 and 2034, driven by the rising prevalence of diabetes and chronic disease, expansion of home healthcare, and safety-engineered devices.

- Sustainability Trends: Sustainability trends involve eco-friendly materials and reduced plastic, the adoption of the ESG framework, and green manufacturing and certification.

- Major Investors: Major investors in the market include Becton, Dickinson, F. Hoffmann-La Roche Ltd, HTL-STREFA S.A., and Abbott Laboratories.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 2.41 Billion |

| Market Size in 2025 | USD 1.54 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.58% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising incidence of infectious diseases

The lancet market is being greatly impacted by the increased prevalence of infectious diseases. The need for lancet devices has increased due to the rise in blood testing and diagnostic procedures that are required due to the prevalence of diseases like COVID-19, malaria, dengue, chikungunya, and the Zika virus.

Lancet instruments, such as safety, standard, and specialty lancets, are frequently used for a variety of testing needs, such as cholesterol, hemoglobin, and blood glucose monitoring. The expansion of the lancet market is also driven by improvements in the infrastructure of healthcare, especially in emerging nations. Further propelling market expansion is the emphasis on preventative healthcare and the creation of quick diagnostic test kits.

Restraint

Reputation risk

In the lancet market, reputation risk is the possibility of loss or damage to a brand or company's reputation when producing or selling lancets. Lancets are medical instruments used for blood collection, especially in diabetic patients for glucose monitoring. Fines, penalties, and reputational harm may result from breaking regulatory norms and obligations. It suggests to stakeholders and consumers that the business might not put quality and safety first. Poor customer service can cause unhappiness among customers and eventually harm the company's reputation. Examples of this include unresponsive support for product faults or complaints.

Opportunity

Healthcare innovation

In the lancet market, the idea of making blood sampling less painful is becoming more and more important. One example of such innovation is the use of ultra-thin needles in lancets, which minimize discomfort and tissue damage. Automated lancet devices are becoming more and more common, particularly in situations where several blood samples are needed. Depending on the requirements of each patient, these devices can be programmed to change the penetration depth and speed.

Another trend is integration with digital health technologies. In order to track blood glucose levels, certain lancets now connect to smartphones or other devices. This can be especially helpful for individuals who have diabetes. Lancets are becoming easier to use and more accessible for patients who self-monitor their blood glucose levels or perform other diagnostic procedures at home, thanks to improvements in ergonomics.

Segment Insights

Type Insights

The standard lancets segment dominated the lancet market in 2025 and is projected to sustain its position throughout the forecast period. Standard lancets are widely accessible in the market and are used for a variety of medical applications, most notably the measurement of blood glucose in individuals with diabetes. Lancets are tiny, sharp devices that puncture the skin to draw blood. Patients with diabetes mostly use them to check their blood glucose levels. Standard lancets are commonly accessible online, at pharmacies, and at medical supply stores. Considerations including needle gauge, compatibility with lancing devices, and user comfort are crucial when buying conventional lancets.

The safety lancets segment is expected to grow at the fastest rate in the lancet market during the projected period. Within the market, safety lancets are a significant category that is mostly used for single-use blood sampling in medical settings. Safety lancets are used for capillary blood collection, usually for diagnostic tests that need a little blood sample or glucose monitoring (as in diabetes treatment). Safety lancets are made with inbuilt safety features, as opposed to conventional lancets, which must be removed and disposed of manually. After usage, these devices automatically retract or shield the needle, reducing the possibility of needle stick accidents and guaranteeing safe disposal. In order to guarantee user safety and product efficacy, safety lancet manufacturers are required by law to comply with stringent safety and performance criteria in the majority of countries where medical devices are regulated.

Size Insights

The 23G-33G segment dominated the lancet market in 2025. The gauge sizes of lancets used in medical devices, such as lancing devices for blood glucose monitoring, are denoted by the designations ‘23G' and ‘33G'. The patient's pain threshold, the amount of blood required for the test, and the particular specifications of the lancing equipment are some of the variables that influence the decision between these gauges. Users may have varied preferences for different gauge sizes.

Thinner lancets (higher gauge numbers, such as 33G) are frequently preferred because of their smaller needle size and, hence, decreased pain perception. But, in comparison to thicker lancets (lower gauge numbers, such as 23G), they might yield a smaller blood sample, which might be taken into account based on the testing specifications.

The 22G and below segment is expected to grow at the fastest rate in the lancet market during the projected period. Lancets are commonly available in various gauge sizes, commonly denoted as G (gauge). The term ‘22G and below size segment' describes lancets with gauge sizes of no more than 22.

The thickness of the lancet needle is determined by gauge size; thinner needles are indicated by bigger gauge numbers, and thicker needles are indicated by smaller gauge numbers. Smaller gauge sizes (22G and below) of lancets are usually reserved for special uses in medicine and diagnostics when a finer needle is needed, including pediatric blood collection or for individuals with extremely sensitive skin. These lancets reduce pain and trauma while drawing blood.

End-use Insights

The hospital segment held a significant share of the lancet market in 2025. Compared to those used at home, hospital-grade catheters frequently have to adhere to stricter regulations. Features including sterile packaging, healthcare professionals' simplicity of use, and interoperability with a range of testing methods and equipment might be necessary. Regulatory frameworks that are strict are usually in place for hospitals (depending on the country or location). All hospital-use Lancets must follow these rules in order to guarantee patient safety and efficacy. Hospitals typically purchase medical equipment through official procurement procedures that entail assessing variables like quality, cost-effectiveness, supplier dependability, and post-purchase assistance. Suppliers of Lancet aiming for the hospital market need to manage these procedures successfully.

The ambulatory surgical centers segment is expected to register significant growth in the lancet market over the forecast period. Within the market, the ambulatory surgical centers (ASCs) segment usually concentrates on offering specialized lancets and related products used in outpatient surgical operations. Lancets are essential medical instruments in many healthcare settings, including ASCs, where they are used for capillary blood samples.

ASCs are made for outpatient operations that don't need to remain overnight. For a variety of medical operations, including minor surgeries and diagnostic procedures involving the use of lancets for blood samples, they provide convenient, affordable, and specialized care. Medical gadgets that are user-friendly, safe, and efficient are given priority by ASCs. Lancets used in these environments must adhere to strict quality requirements in order to guarantee patient safety and precise blood collection.

Regional Insights

What is the U.S. Lancet Market Size?

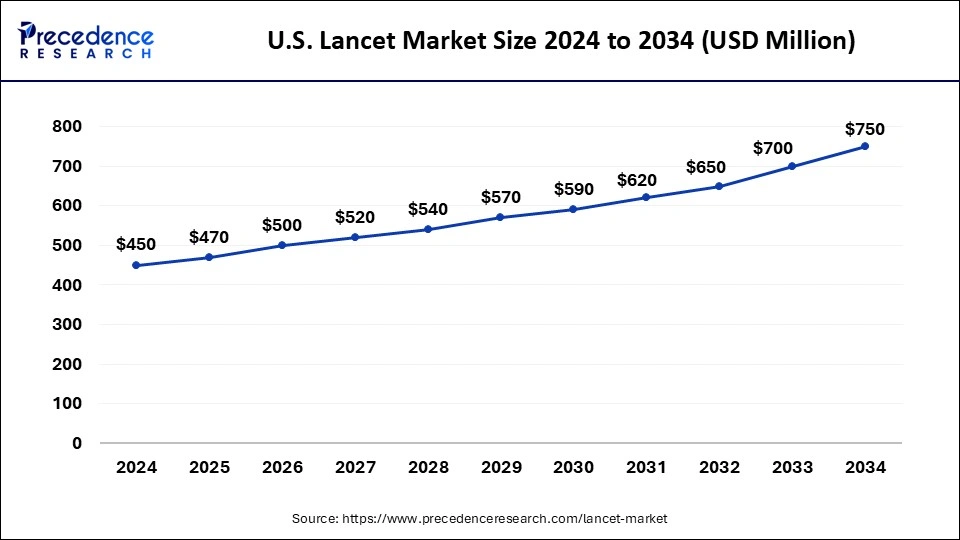

The U.S. lancet market size was exhibited at USD 470 million in 2025 and is projected to be worth around USD 800 million by 2035, poised to grow at a CAGR of 5.46% from 2026 to 2035.

North America held the largest share of the global lancet market in 2025. The medical device industry's lancet market in North America is a vibrant and quickly expanding sector. The high prevalence of chronic diseases, including diabetes and cardiovascular problems, which call for frequent blood tests, is the main factor driving the region's market supremacy.

The market is expanding due to ongoing advancements in lancet design, such as safety lancets that lessen discomfort and lower the chance of infection. Leading companies in the development of efficient and user-friendly improved lancets are Abbott Laboratories. Because of the high prevalence of chronic diseases, technological developments, and the growing use of homecare diagnostics, the market in North America is expected to rise significantly.

U.S. Lancet Market Trends

The U.S.'s massive healthcare expenditure and a critical shift toward safer, user-friendly diagnostic tools in both clinical and home-care environments. The high-precision sector focused on eliminating needle-stick injuries through automated button and pressure-activated designs.

Asia Pacific is expected to be the fastest-growing lancet market during the forecast period. The Asia Pacific market is expanding significantly due to rising rates of chronic diseases, including diabetes, advances in medical technology, and rising healthcare costs.

The market appeal of lancets is being increased by technological innovations, including the creation of safety lancets and user-friendly designs for home diagnostics. Lancet use at home is rising due to the shift toward home-based healthcare solutions, particularly for diabetes control. With the help of a growing emphasis on patient-centric healthcare solutions and technological advances, the Asia Pacific lancet market is expected to grow rapidly.

China Lancet Market Trends

China's mandatory safety regulations and a rapidly expanding diabetic population. Local manufacturers are focusing on cost-effective, innovative designs featuring ultra-fine needles and push-button technology to meet high demand in both public and private healthcare sectors.

How Did Europe Experience A Notable Growth in the Lancet Market?

Europe's EMA regulatory frameworks mandate high-quality, injury-prevention standards for a population where 1 in 10 may soon face diabetes. Innovation is led by giants like Siemens Healthineers and Roche, who are prioritizing retractable, automated mechanisms to serve the region's massive geriatric demographic.

Germany Lancet Market Trends

Germany is focused on high-gauge needles (28G+) and push-button activation to enhance patient comfort in both clinical and expanding homecare settings. While strict safety regulations solidify the dominance of infection-preventing designs, manufacturers must navigate reimbursement pressures and pricing constraints within the broader healthcare system.

Value Chain Analysis of the Lancet Market

- Research & Development and Design

This stage focuses on designing user-friendly, minimally invasive devices that reduce pain and improve safety.

Key Players: BD (Becton, Dickinson and Company), Roche Diagnostics, Owen Mumford, Terumo Corporation, and MTD Medical Technology and Devices. - Manufacturing & Assembly

Raw materials are converted into finished lancets through precision injection molding and automated needle grinding. Advanced safety features (retractable mechanisms) are assembled and sterilized to prevent contamination. Key players are increasing production capacity in response to growing demand.

Key Players: HTL-STREFA S.A., BD, Greiner Bio-One, B. Braun SE, and Medline Industries. - Distribution & Logistics

Finished products are stored, packaged, and distributed to hospitals, laboratories, and retail outlets, often requiring cold chain management for accompanying diagnostic kits.

Key Players: DHL and FedEx

Lancet Market Companies

- F. Hoffmann-La Roche Ltd.: Roche contributes significantly to the lancet market as a global leader in diabetes care, manufacturing the widely used Accu-Chek line of lancing devices and integrated safety lancets.

- Abbott Laboratories: Abbott drives market innovation through its groundbreaking FreeStyle Libre continuous glucose monitoring (CGM) system, which has notably shifted many patients away from traditional lancing entirely.

- Terumo Corporation: Terumo is a key player in the high-volume hospital and clinical segments, providing ultra-fine, sterile safety lancets that are essential for minimizing needle-stick injuries and cross-contamination in professional healthcare settings.

Recent Developments

- In February 2024, according to exclusive Reuters reporting released on Wednesday, Eli Lilly intends to introduce its best-selling type 2 diabetes medication, Mounjaro (tirzepatide), in India as early as next year. Currently, Mounjaro is being examined by India's health regulatory agencies.

- In February 2024, according to Mykhailo Fedorov, Minister of Digital Transformation, Ukraine will sign the first contracts for the mass production of attack drones that resemble the Russian Lancet drones. The 40-kilometer-range Lancet is a kamikaze drone manufactured by ZALA Aero Group, a division of the massive Russian armaments manufacturer Kalashnikov Concern.

Segment Covered in the Report

By Type

- Safety Lancets

- Standard Lancets

- Manually Activated Lancets

- Automatically Activated Lancets

By Size

- 22G and Below

- 23G-33G

- Above 33G

By End-use

- Hospitals

- Clinics

- Homecare Settings

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content