What is the Law Enforcement Software Market Size?

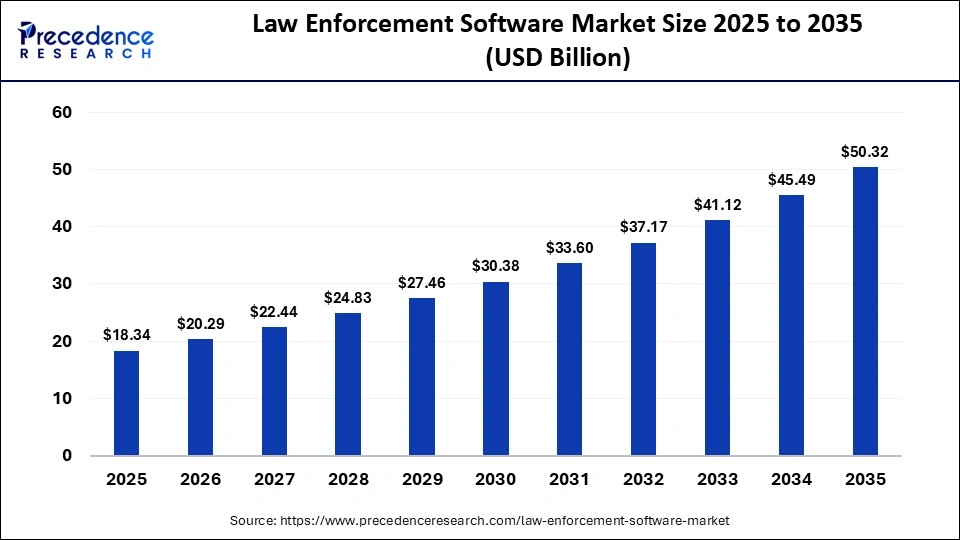

The global law enforcement software market size was calculated at USD 18.34 billion in 2025 and is predicted to increase from USD 20.29 billion in 2026 to approximately USD 50.32 billion by 2035, expanding at a CAGR of 10.62% from 2026 to 2035. The market is driven by the increasing need for advanced technologies to enhance public safety and streamline operations within law enforcement agencies. Additionally, growing concerns over crime rates and the demand for better data management and analysis capabilities are fueling the adoption of innovative software solutions in the sector.

Market Highlights

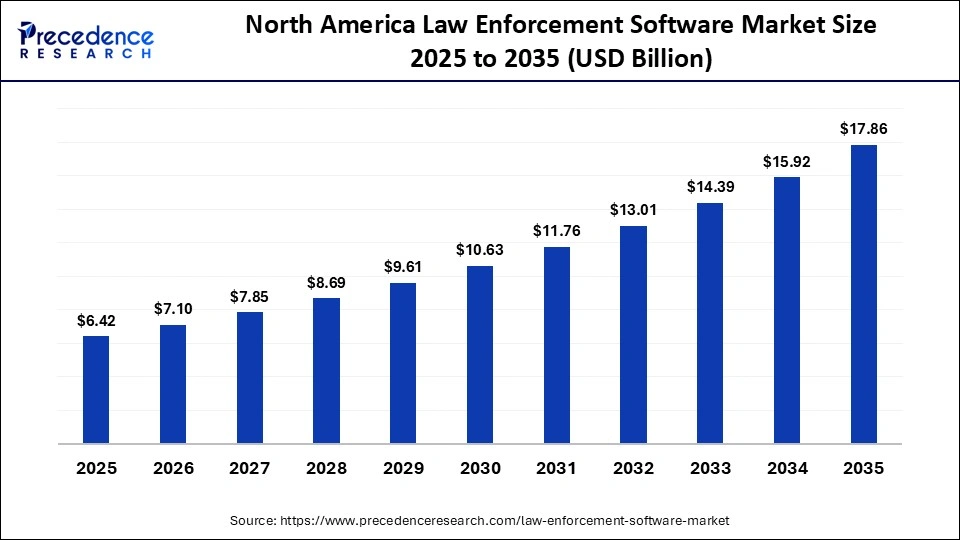

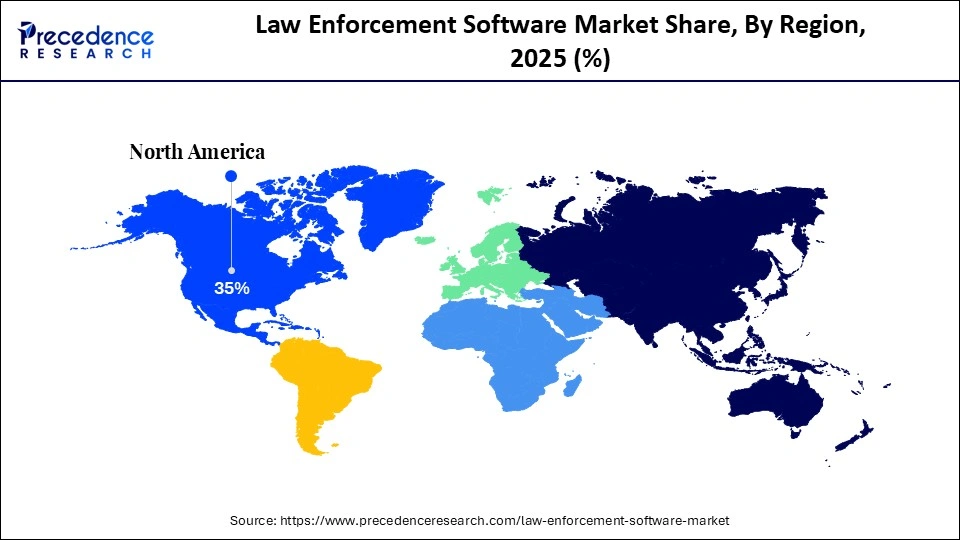

- North America dominated the global market with the largest market share of 35% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

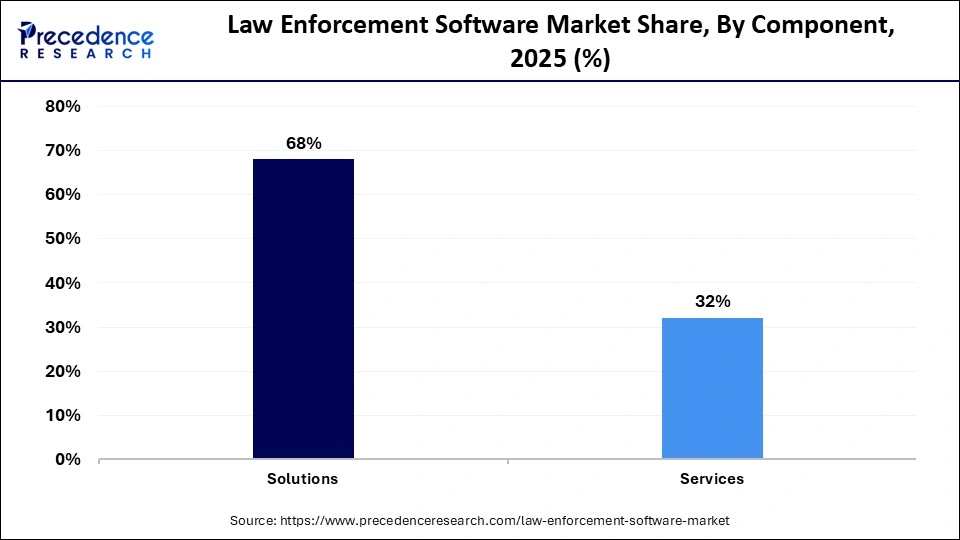

- By component, the solutions segment accounted for the biggest market share of 68% in 2025.

- By component, the services segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By deployment, the cloud segment accounted for a considerable revenue share in the market in 2025.

- By deployment, the on-premises segment is expected to grow at a significant CAGR in the market during the studied years.

- By end use, the police departments segment dominated the global market in 2025.

- By end use, the municipalities segment is expected to expand at a significant CAGR in the market in the coming years.

Policing Goes Digital: The Rise of Law Enforcement Software

The law enforcement software market is evolving as agencies modernize operations to address increasingly complex crime patterns. Growing demand for real-time intelligence, data-driven policing, and faster case resolution is accelerating software adoption across local, state, and federal agencies. Digital platforms now support everything from incident reporting to predictive crime analysis. Budget allocations toward public safety technology and smart city initiatives are further strengthening market growth. As cybercrime and cross-border threats rise, software-enabled coordination has become mission-critical.

Role of AI in Law Enforcement Software

Integrating artificial intelligence (AI) and machine learning (ML) into law enforcement software facilitates facial recognition, predictive policing, and pattern analysis. State-of-the-art data analytical devices are facilitating quicker evidence processing and mapping of crimes. Officer access to records in real-time in the field is being enabled by mobile-first solutions. Operational processes are also being changed with integration with the Internet of Things (IoT) devices, including body-worn cameras and surveillance systems.

Law Enforcement Software Market Trends

- Intelligence-led Policy Models: Police departments are also moving away from reactive crime response to proactive, intelligence-led policy models.

- Digital Evidence: Digital evidence is becoming increasingly critical in law enforcement, especially as agencies move towards a more tech-savvy approach to crime fighting.

- Cybersecurity: The rise of cybersecurity threats has made it essential for law enforcement to integrate robust digital forensics into their strategies. Digital forensics involves the recovery and investigation of material found in digital devices, which can provide crucial evidence for criminal cases.

- Data Monitoring: Protecting sensitive data and maintaining the integrity of digital evidence is paramount. The implementation of comprehensive cybersecurity measures is essential to prevent unauthorized access and data breaches that could compromise investigations.

- Safety of Digital Forensics: In this evolving landscape, the intersection of digital evidence, cybersecurity, and digital forensics is shaping new methodologies for law enforcement. Agencies are now better equipped to tackle cybercrimes and utilize digital intelligence in their operations, leading to more effective and informed policing.

- Effective Crime-Solving Methods: Overall, the integration of these trends into the market is paving the way for more efficient and effective crime-solving methods, ultimately enhancing public safety.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.34 Billion |

| Market Size in 2026 | USD 20.29 Billion |

| Market Size by 2035 | USD 50.32 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.62% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Insights

Why the Solutions Segment Dominated the Law Enforcement Software Market?

The solutions segment held a major revenue share of the market in 2025, because many integrated platforms have been adopted to make the daily policing operations easier. These solutions include records management, computer-aided dispatch, case management, digital evidence, and analytics. The popularity of extensive software suites provided by the agencies is owed to lessening the number of data silos and enhancing the performance of the departments. The growing application of AI-powered analytics and real-time intelligence also enhances the need for solution-based offerings. Adoption is also driven by regulatory pressure to guarantee proper reporting and data disclosure.

The services segment is expected to witness the fastest growth in the market over the forecast period, driven by expertise in deployment, customization, and support. System integration, training, and consulting are also professional services that are important in the successful implementation of complex software platforms. Managed services are becoming popular because of the need for constant monitoring, cybersecurity control, and upgrading of the software. Budget limitations and insufficient IT availability within the agencies facilitate the need for outsourced service models. The trend of cloud and AI-powered platforms further intensifies the segment's growth.

Deployment Insights

Why the Cloud Segment Dominated the Law Enforcement Software Market?

The cloud segment accounted for the highest revenue share in the market in 2025, due to its scalability, affordability, and user-friendliness. Cloud-based solutions facilitate real-time information exchange between jurisdictions and improve the level of collaboration and response rates. Cloud solutions are appealing because of low initial infrastructure expenses, particularly in small and medium-sized agencies. State-of-the-art security networks and compliance requirements have enhanced trust in cloud deployments. Dominance is also supported by frequent software upgrades and the fast rollout of features.

The on-premises segment is expected to show lucrative growth in the market over the studied period, as agencies deal with very sensitive or classified information. Numerous law enforcement organizations tend to use on-premise implementations to ensure that they have complete control over the safety of their data and system customization. In some locations, regulatory demands encourage the use of local data storage, which promotes on-premise deployment. On-premise solutions are easier to integrate in large agencies that have legacy infrastructure. Local deployments are also suitable for the high-performance requirements of mission-critical operations.

End Use Insights

Which End Use Segment Led the Law Enforcement Software Market?

The police departments segment led the market in 2025 because of the vast operational and investigational requirements of law enforcement in police departments. To effectively organize patrol missions, crime documentation, evidence, and live dispatching, software solutions are needed. An increase in the complexity of crimes and data volumes requires using sophisticated analytics and computerized tools. Programs aimed at modernizing public safety, funded by the government, also provide adoption. Adopting body-worn cameras and digital evidence management platforms is also among the first with police departments.

The municipalities segment is expected to grow at a notable CAGR in the foreseeable future, due to the idea of integrated public safety platforms as an enhancement of urban security and emergencies, which is gaining popularity with local governments. Municipal law enforcement software enables data-driven decisions and cooperation among agencies. The adoption is encouraged by budgetary allocations on digital governance and infrastructure modernization. Cloud solutions enable them to be deployed in municipalities that have fewer IT capabilities.

Regional Insights

How Big is the North America Law Enforcement Software Market Size?

The North America law enforcement software market size is estimated at USD 6.42 billion in 2025 and is projected to reach approximately USD 17.86 billion by 2035, with a 10.77% CAGR from 2026 to 2035.

Why North America Dominated the Law Enforcement Software Market?

North America held a dominant revenue share of the market in 2025, driven by a surge in crime rates and the subsequent demand for effective data management tools, which have prompted law enforcement agencies to adopt innovative software solutions. This evolution is particularly evident in the transition from traditional methods to advanced software platforms that support various functions from incident reporting to predictive analytics.

Furthermore, the integration of cloud-based services is enabling greater inter-agency collaboration, allowing for more coordinated responses to crime. As agencies continue to modernize, the need for reliable and sophisticated law enforcement software will become even more paramount.

What is the Size of the U.S. Law Enforcement Software Market?

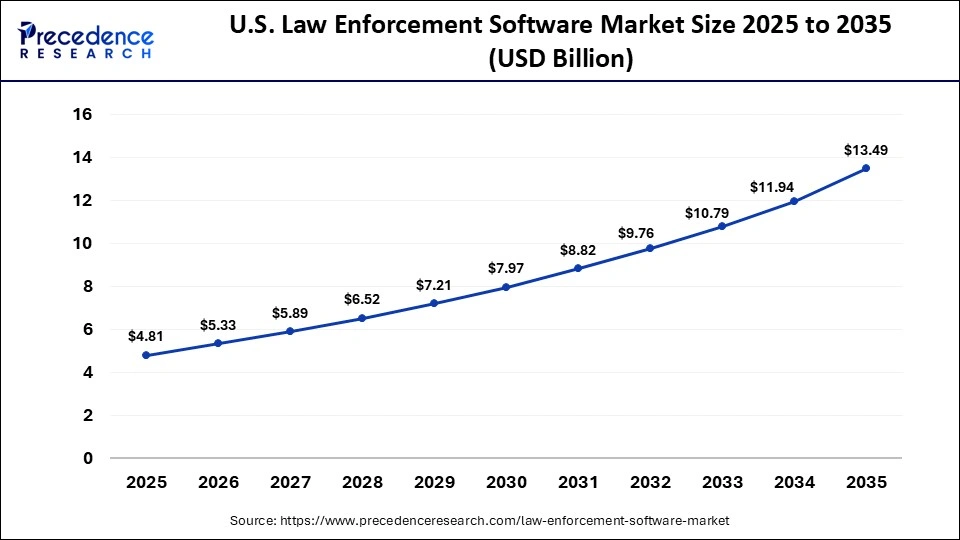

The U.S. law enforcement software market size is calculated at USD 4.81 billion in 2025 and is expected to reach nearly USD 13.49 billion in 2035, accelerating at a strong CAGR of 10.86% between 2026 and 2035.

U.S. Country Level Analysis

The U.S. is a frontrunner in the market, primarily due to substantial investments in public safety technology and the widespread adoption of advanced solutions by various law enforcement agencies. The country's law enforcement sector emphasizes a proactive approach, leveraging data analytics and cloud-based platforms to respond to complex crime patterns effectively. The availability of funding through federal grants and state budgets for technology enhancements further fuels this market. Additionally, the integration of AI and ML in policing methods supports the development of smart cities and efficient crime-solving.

How is Europe Growing in the Law Enforcement Software Market?

Europe is expected to witness the fastest growth during the predicted timeframe. The market is rapidly evolving in response to the demands of modern policing. As agencies increasingly seek advanced technologies to enhance public safety, there is a notable shift towards real-time intelligence and data-driven decision-making. This evolution is fueled by rising crime rates and the imperative for better data management solutions.

Cloud-based platforms are becoming essential, allowing law enforcement agencies to improve scalability and inter-agency collaboration. Moreover, innovations such as predictive policing and AI are transforming traditional approaches to crime-solving, making operations more efficient. Ultimately, the integration of these technologies is paving the way for a safer society and a more effective justice system.

Country Level Analysis

Germany is a dynamic landscape and is investing heavily in law enforcement software to modernize their agencies. Governments are recognizing the importance of advanced technologies in combating not only traditional crime but also emerging threats like cybercrime. By implementing these digital solutions, nations are not only improving their crime response but also enhancing the overall safety of their communities. The proactive approach adopted by many law enforcement agencies reflects a commitment to adapting to new challenges in public safety.

Law Enforcement Software MarketValue Chain Analysis

- Raw Material Sourcing

Raw material sourcing primarily involves cloud infrastructure, data storage resources, cybersecurity frameworks, and development toolkits. Reliable access to secure servers, encryption technologies, and scalable computing platforms is critical to ensure system resilience and compliance.

Key players: Amazon Web Services (AWS), Microsoft Azure, Google Cloud, Oracle

- Component Fabrication

Component fabrication focuses on software development, including analytics engines, AI algorithms, user interfaces, and database architectures. Vendors design modular components that integrate case management, records management, and real-time intelligence tools.

Key players: Motorola Solutions, Tyler Technologies, Hexagon Safety & Infrastructure, OpenText

- Testing and Certification

Testing and certification ensure software reliability, cybersecurity resilience, and compliance with criminal justice and data protection standards. Solutions undergo rigorous functional, penetration, and interoperability testing before deployment.

Key players: Accenture, IBM, Booz Allen Hamilton, NTT Data

- Installation and Commissioning

Installation and commissioning involve system deployment, data migration, user training, and integration with existing IT infrastructure. Seamless onboarding and minimal operational disruption are key success factors at this stage.

Key players: Motorola Solutions, Accenture, CGI, Capgemini

- Distribution and Sales

Distribution and sales are typically conducted through direct government contracts, system integrators, and long-term service agreements. Strong procurement expertise and local regulatory knowledge play a critical role in winning contracts.

Key players: Tyler Technologies, NEC Corporation, Axon Enterprise, Thales Group

- Product Lifecycle Management

Product lifecycle management includes continuous software updates, cybersecurity patches, feature enhancements, and customer support. Vendors focus on long-term partnerships, ensuring systems evolve alongside regulatory and operational needs.

Key players: Axon Enterprise, Motorola Solutions, IBM, Oracle

Who are the Major Players in the Global Law Enforcement Software Market?

The major players in the law enforcement software market include Axon Enterprise, Inc., Datamaran, EcoVadis, FactSet, Hexagon, LSEG, NAVEX Global, Inc., NEC Corporation, TRULEO, OneTrust, LLC., SAS Institute Inc., Sustainalytics, Tyler Technologies, Inc., Verisk Analytics, Inc., and Wolters Kluwer N.V.

Recent Developments

- In December 2025, the city of Coconut Creek in the U.S. state of Florida announced the use of an advanced law enforcement technology, including new drones, software, and training resources. The police aims to boost search, surveillance, and incident response capabilities through state funding and advanced Skydio systems.(Source: https://www.airmedandrescue.com)

- In November 2025, Cognyte Software Ltd. announced a new multi-unit win, valued at approximately $5 million, with a Tier-1 law enforcement agency in the Europe/Middle East/Africa region (EMEA). The agency will use Cognyte's SIGNIT solutions to help identify, prevent, and mitigate criminal activity, support search and rescue operations, and more.(Source: https://www.businesswire.com)

- In February 2025, Flock Safety introduced new AI-powered tools aimed at enhancing police investigations by significantly increasing the speed at which law enforcement can solve cases. These innovations leverage advanced technology to streamline evidence collection and analysis, ultimately improving public safety and operational efficiency for police departments.(Source: https://www.police1.com)

Segments Covered in the Report

By Component

- Solutions

- Computer-Aided Dispatch

- Record Management

- Case Management

- Jail Management

- Incident Response

- Digital Policing

- Others

- Services

- Implementation

- Training and Support

- Consulting

By Deployment

- On-premises

- Cloud

By End Use

- Police Departments

- Law Enforcement Agencies

- Federal and State Agencies

- Municipalities

- Correctional Facilities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting