Leukapheresis Devices Market Size and Forecast 2025 to 2034

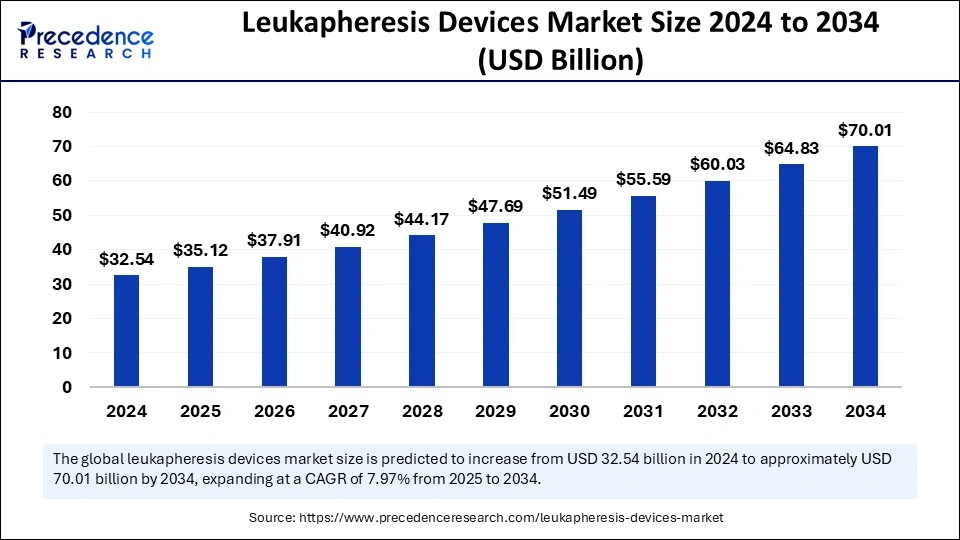

The global leukapheresis devices market size accounted for USD 32.54 billion in 2024 and is predicted to increase from USD 35.12 billion in 2025 to approximately USD 70.01 billion by 2034, expanding at a CAGR of 7.97% from 2025 to 2034. The growing prevalence of leukemia is the key factor driving market growth. Also, technological innovations in leukapheresis procedures, coupled with the rising demand for personalized medicine, can fuel market growth further.

Leukapheresis Devices Market Key Takeaways

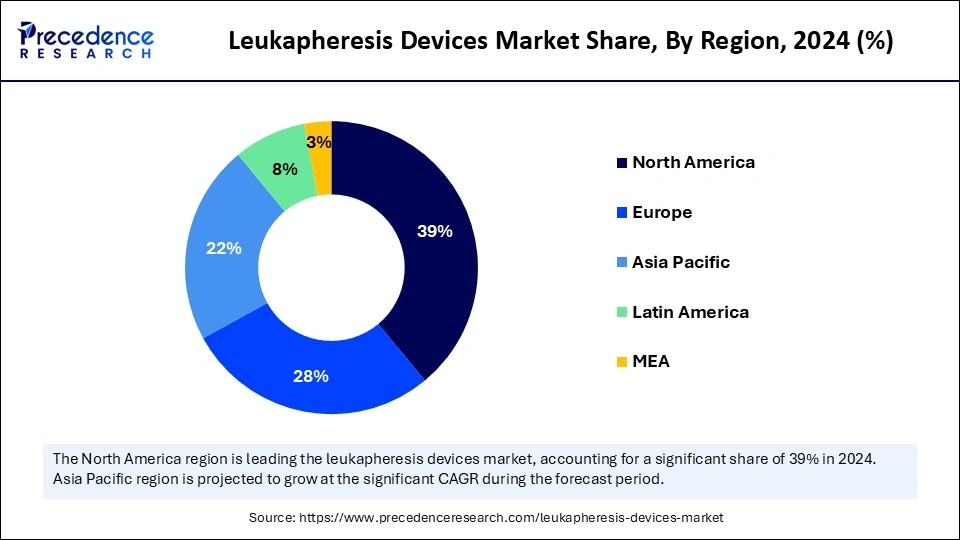

- North America dominated the global market with the largest market share of 39% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the period studied.

- By device type, the apheresis devices segment dominated the market in 2024.

- By device type, the leukapheresis columns and cell separators segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the research application segment held the largest market share in 2024.

- By application, the therapeutic applications segment is anticipated to grow at the fastest CAGR over the forecast period.

- By end user, The hospital segment dominated the market by holding the largest market share in 2024.

- By end user, the academic and research institutes segment is estimated to grow at the fastest CAGR during the projected period.

Artificial Intelligence (AI) Improving Leukapheresis Devices

Artificial Intelligence is revolutionizing the leukapheresis devices market by improving accuracy, enhancing monitoring, and streamlining procedures and patient outcomes, which can lead to more efficient and sophisticated devices. Furthermore, AI can monitor the performance of the leukapheresis device and the vital signs of patients, alerting medical professionals to any potential deviations or problems from the expected parameters. This can facilitate early detection and intervention, enhancing patient safety and outcomes.

U.S. Leukapheresis Devices Market Size and Growth 2025 to 2034

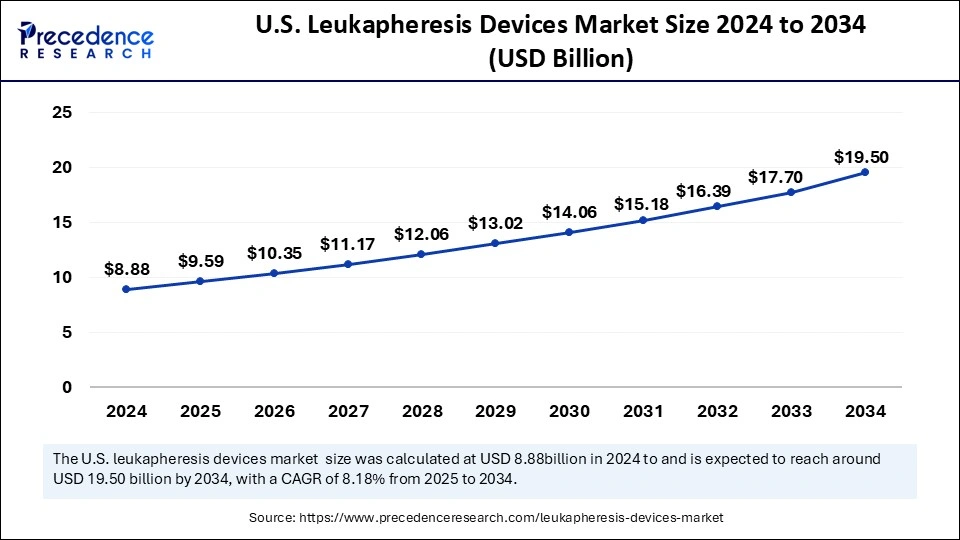

The U.S. leukapheresis devices market size was exhibited at USD 8.88 billion in 2024 and is projected to be worth around USD 19.50 billion by 2034, growing at a CAGR of 8.18% from 2025 to 2034.

North America dominated the leukapheresis devices market in 2024. The dominance of the region can be attributed to the innovative healthcare infrastructure, coupled with the increasing adoption of advanced medical technologies. Moreover, the region also benefits from the strong presence of major market players, research centers, and academic institutions emphasizing the latest leukapheresis procedures.

- In May 2023, TERUMO BCT, INC. launched the first training program initiative to support cell and gene therapy manufacturers in improving the cell collection processes and boosting therapeutic commercialization.

In North America, the U.S. led the market owing to the supportive regulatory environment, well-established healthcare system, and growing incidence of hematologic disorders. Also, innovations in cell therapies and the growing demand for leukoplakia can impact market growth positively.

Asia Pacific is expected to grow at the fastest rate over the period studied. The growth of the region can be credited to the growing healthcare expenditure, rapid urbanization, and an increasing patient population with autoimmune diseases and hematologic disorders. Furthermore, countries such as China, India, and Japan are heavily investing in medical infrastructure development.

In Asia Pacific, China dominated the leukapheresis devices market by holding the largest market share. The dominance of the country is due to the rapidly evolving healthcare sector in China and the government's initiatives to enhance healthcare affordability and access. The region is also witnessing a rising incidence of blood cancers and autoimmune disorders.

Market Overview

The market encompasses the global industry for products and specialized equipment utilized in the process of separating and collecting leukocytes from blood for research or therapeutic purposes. The leukapheresis devices market includes an extensive range of devices, like leukapheresis columns, apheresis machines, leukoreduction filters, and cell separators. The latest trend in the is the growing use of leukopaks in CAR cell therapy.

Leukapheresis Devices Market Growth Factors

- The growing number of blood donation campaigns globally is expected to boost market growth soon.

- The surge in usage rates of leukapheresis kits and machines can propel market growth shortly.

- Increasing health awareness among individuals, along with the rise in medical tourism, will likely contribute to the leukapheresis devices market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 70.01 Billion |

| Market Size in 2025 | USD 35.12 Billion |

| Market Size in 2024 | USD 32.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.97% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Application, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising incidence of hematologic disorders

The increasing prevalence of hematologic disorders, like lymphoma and leukemia, is a major factor driving the leukapheresis devices market. These disorders necessitate efficient treatment approaches, and hence, leukapheresis devices play an essential role in managing abnormal WBC counts. In addition, leukapheresis devices can rapidly decrease the number of leukemic cells in the blood to tackle symptoms and prepare individuals for therapies.

In September 2024, PharmaEssentia Corporation, a global biopharmaceutical innovator leveraging deep expertise and proven scientific principles to deliver new biologics in hematology and oncology, announced the availability of BESREMi (ropeginterferon alfa-2b) in Singapore.

Restraint

Regulatory hurdles

Strict regulatory requirements for efficacy, safety, and quality create a substantial hurdle to entry for market players, negatively impacting product development and market growth. Moreover, concerns about the cost-effectiveness of this treatment as compared to other therapies or conventional blood banking methods may affect the overall adoption rates of leukapheresis devices.

Opportunity

Increasing demand for blood and blood products

The ongoing surge in the need for blood and blood products is a major factor boosting the leukapheresis devices market. As the amount of trauma cases, surgical procedures, and chronic diseases increases, the demand for efficient blood component separation becomes crucial. Furthermore, the increasing emphasis on blood donation awareness campaigns will likely contribute to the growing volume of blood collections. Hence, healthcare settings are investing heavily in innovative leukapheresis technologies.

- In August 2024, Haemonetics Corporation, a global medical technology company focused on delivering innovative solutions to drive better patient outcomes, announced the full market release of its VASCADE MVP XL mid-bore venous closure system.

Device Type Insight

The apheresis devices segment dominated the leukapheresis devices market in 2024. The dominance of the segment can be attributed to the rising prevalence of leukemia across the globe and innovations in medical technology, especially in therapeutic apheresis procedures. Additionally, government initiatives and rising awareness regarding blood donation are propelling the availability of blood components, which impacts segment growth positively.

The leukapheresis columns and cell separators segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the rising incidence of autoimmune diseases along with the increasing demand for individualized medicine and research. Also, these devices optimize the separation of blood components, enabling the selective removal or collection of specific cells, such as leukocytes.

- In January 2025, SGS announced the launch of Germany's first commercial cell-sorting service via fluorescent-activated cell sorting (FACS) for the biopharmaceutical industry. This service leverages the BD FACSAria Fusion system to support the development of advanced therapeutic medicinal products (ATMPs) and drive innovation in cell and gene therapy.

Application Insight

The research application segment held the largest leukapheresis devices market share in 2024. The dominance of the segment can be linked to the rise in research on blood cancer along with the innovations in leukapheresis procedures. Moreover, researchers are emphasizing developing novel therapies for many diseases, such as cancer and autoimmune disorders. Leukapheresis procedures can be utilized to separate specific cell populations, such as T cells or stem cells.

The therapeutic applications segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the growing adoption of cell-based therapies and individualized medicine. Therapeutic applications include utilizing leukapheresis to collect bone and blood marrow stem cells to help build bone marrow after chemotherapy treatment. Emergency leukapheresis also has better outcomes and lower mortality rates.

End User Insight

In 2024, the hospital segment dominated the leukapheresis devices market by holding the largest share. The dominance of the segment is owing to the growing emphasis on patient-centered treatments coupled with innovative therapeutic procedures. Furthermore, the hospital plays a key role in the treatment of blood disorders such as lymphoma and leukemia and in the stem cell transplantation process. Hospitals are major caregivers for patients with hematologic conditions.

The academic and research institutes segment is estimated to grow at the fastest rate during the projected period. The growth of the segment is due to interdisciplinary research, global collaboration, and government investment. Moreover, government funding and policies play a key role in funding research projects and supporting research infrastructure. Partnerships between universities and businesses are essential for translating research into practical applications.

Leukapheresis Devices Market Companies

- Terumo BCT

- Fresenius SE and Co. KGaA

- Haemonetics Corporation

- Asahi Kasei Corporation

- Macopharma SA

- Miltenyi Biotec

- Medical Spa

- Puriblood Medical Co. Ltd.

- Beijing ZKSK Technology Co. Ltd.

- SB-Kawasumi Laboratories, Inc.

- Nikkiso Co., Ltd.

- Charles River Laboratories International, Inc.

- Discovery Life Sciences, Inc.

- Precision for Medicine, Inc.

Latest Announcements by Market Leaders

- In December 2024, Lonza announced its "One Lonza" restructuring strategy, which aims to reorganize its CDMO business, simplify its operating model, enhance manufacturing and engineering, and expand its production footprint. The company plans to exit the Capsules and Health Ingredients (CHI) business to focus on its core CDMO business, which will be structured into three new platforms.

Recent Developments

- In March 2024, the FDA approved Bristol Myers Squibb's Breyanzi, an innovative CAR T cell therapy for adult patients with specific types of leukemia and lymphoma. The treatment process begins with leukapheresis, where patients' white blood cells are collected to create the therapy.

- In March 2023, Haemonetics Corporation, headquartered in the United States, made an exciting announcement regarding the release of their latest innovation in the form of intelligent control software for their Cell Saver Elite and Autotransfusion services.

- In August 2023, the FDA approved the Reveos Automated Whole Blood Processing System by Terumo Blood and Cell Technologies. This system improves the efficiency of processing whole blood into white blood cells and other components, supporting efforts to increase the U.S. blood supply.

Segments Covered in the Report

By Device Type

- Therapeutic Leukapheresis

- Cytapheresis

- Stem Cell Collection

- Research Applications

- Leukapheresis Columns and Cell Separators

- Leukapheresis Disposables

- Apheresis Devices

By Application

- Research Application

- Therapeutic Application

By End User

- Hospitals

- Blood Centers

- Academic and Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting