Liability Insurance Market Size and Forecast 2025 to 2034

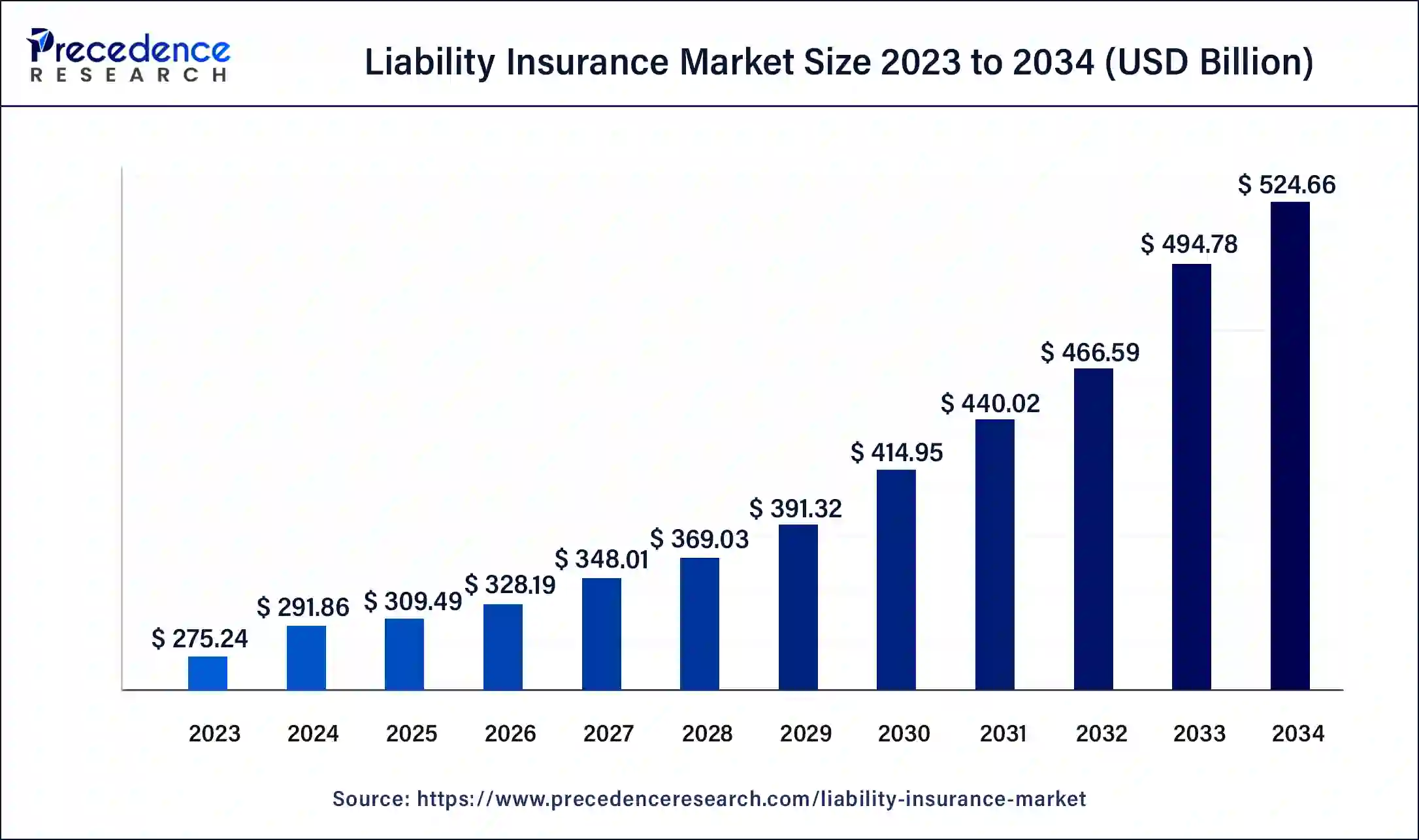

The global liability insurance market size was calculated at USD 291.86 billion in 2024 and is expected to reach around USD 524.66 billion by 2034, expanding at a CAGR of 6.04% from 2025 to 2034. The North America liability insurance market size reached USD 134.26 billion in 2024. The rising demand for burglary insurance across the world is driving the growth of the liability insurance market.

Liability Insurance Market Key Takeaways

- The global liability insurance market was valued at USD 291.86 billion in 2024.

- It is projected to reach USD 524.66 billion by 2034.

- The liability insurance market is expected to grow at a CAGR of 6.04% from 2025 to 2034.

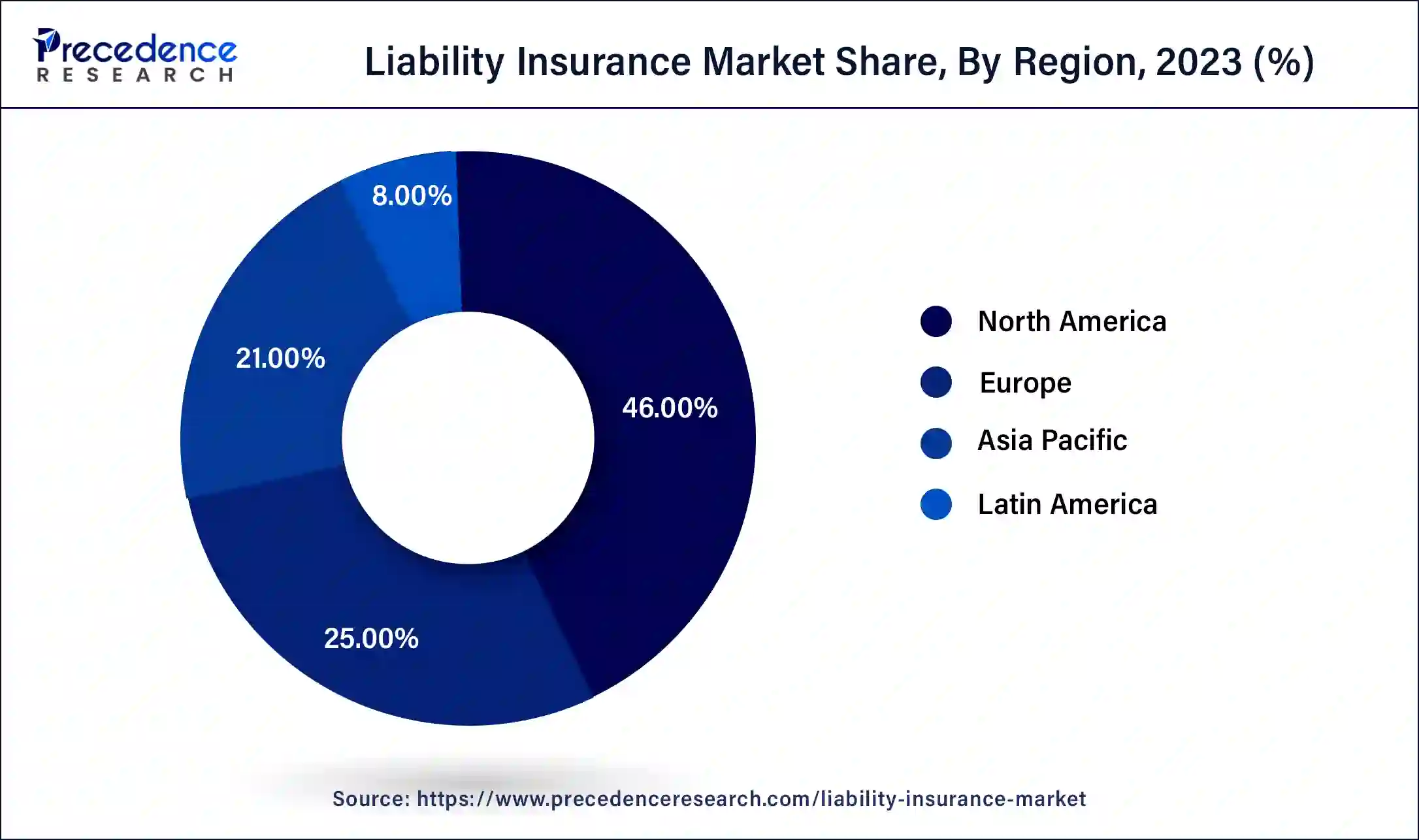

- North America led the liability insurance market with the largest market share of 46% in 2024.

- Asia Pacific is expected to attain the fastest rate of growth during the forecast period.

- By coverage type, the general liability insurance segment held the largest share of the market in 2024.

- By coverage type, the professional liability insurance segment is estimated to exhibit the fastest growth rate during the forecast period.

- By application, the commercial segment dominated the market in 2024.

- By application, the personal segment is the fastest-growing segment during the forecast period.

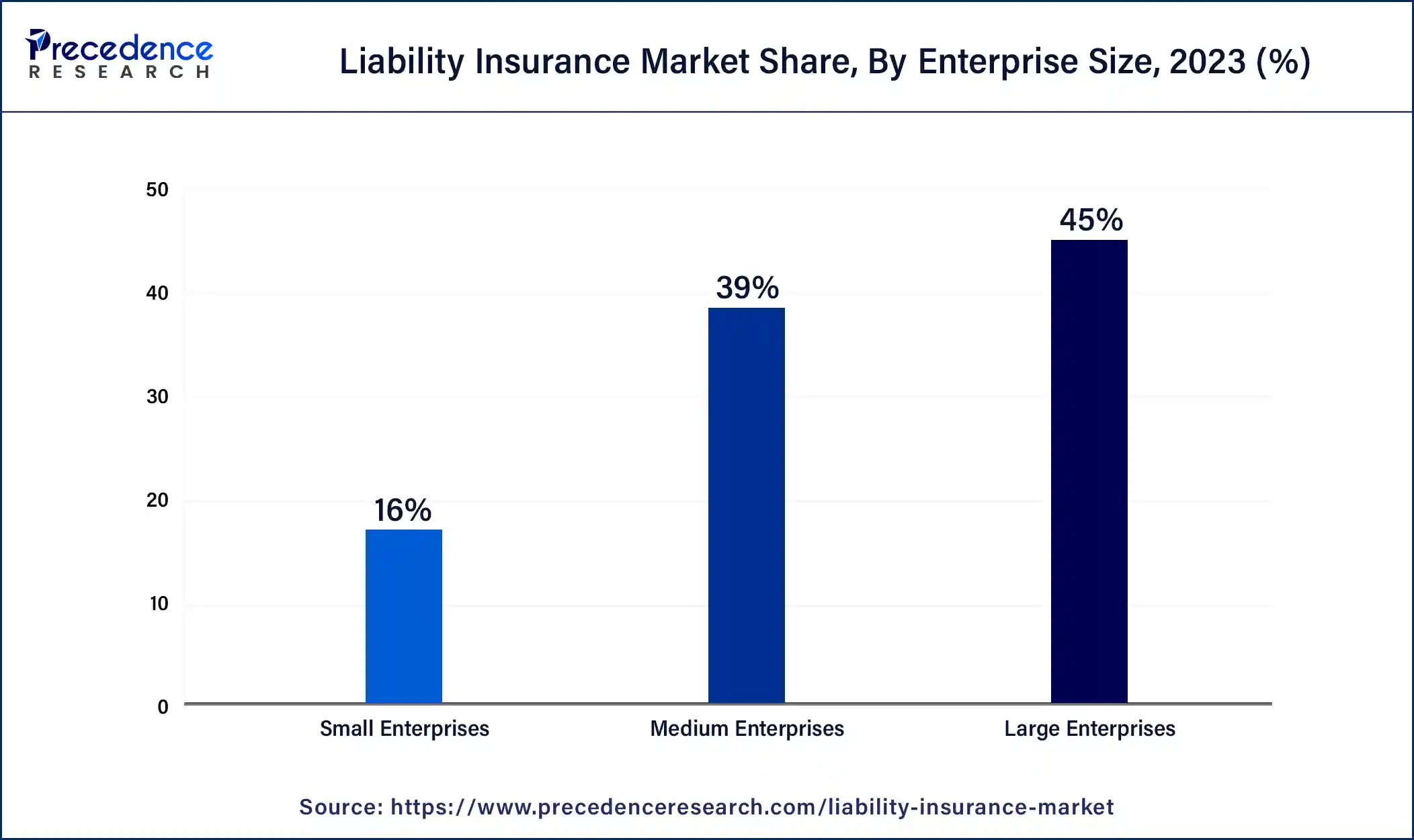

- By enterprise size, the large enterprises segment has contributed more than 45% of revenue share in 2024.

- By enterprise size, the medium-sized enterprises segment is expected to be the fastest-growing segment during the forecast period.

U.S. Liability Insurance Market Size and Growth 2025 to 2034

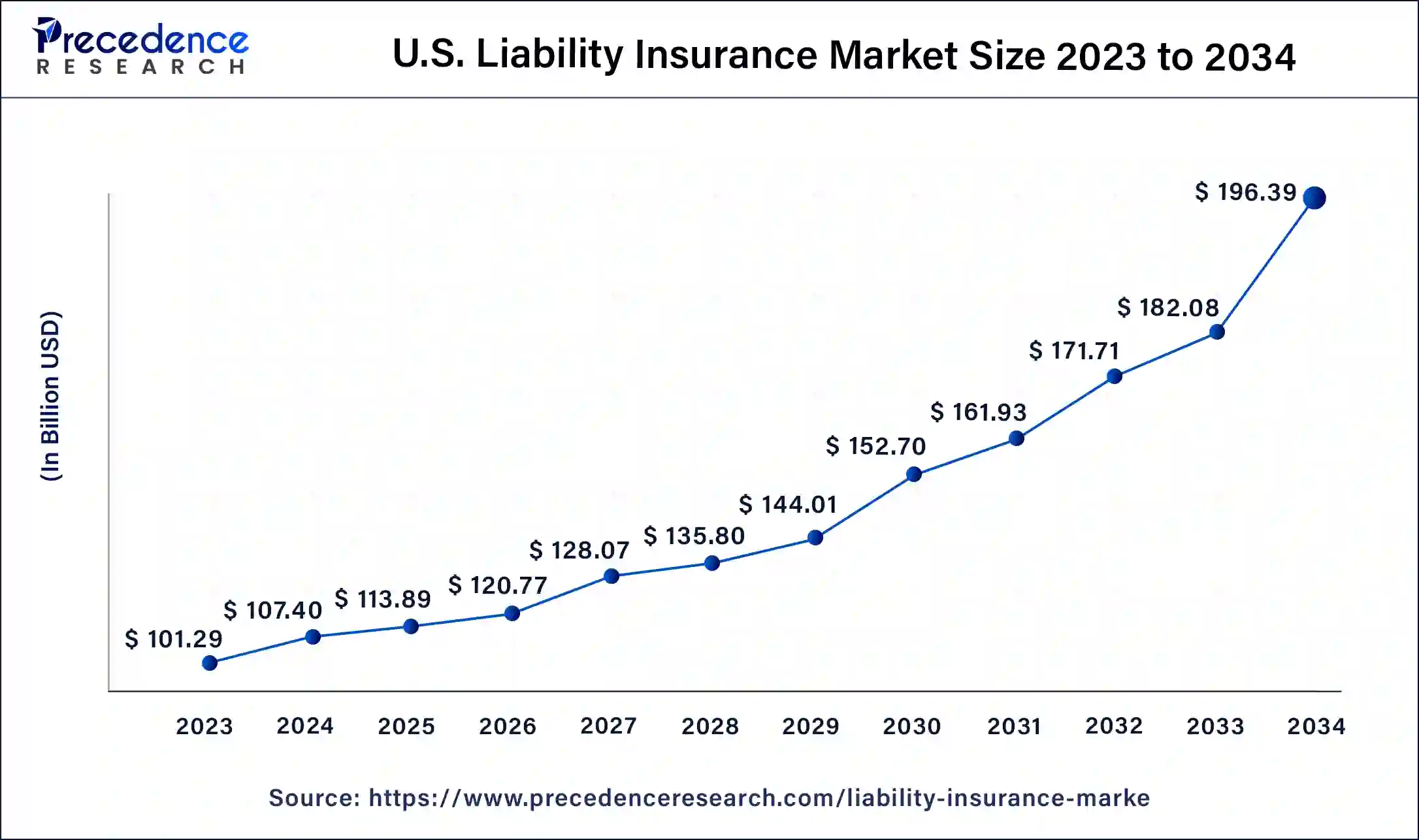

The U.S. liability insurance market size was exhibited at USD 107.40 billion in 2024 and is projected to be worth around USD 196.39 billion by 2034, poised to grow at a CAGR of 6.22% from 2025 to 2034.

North America held the largest share of the liability insurance market in 2024. The growth of the market in this region is mainly driven by the rising number of lawsuit cases by governments and organizations imposed in various companies across several countries, such as the U.S. and Canada, for various reasons, including fraudulent activities and violation of regulations. The growing developments in the corporate industry in countries such as the U.S. and Canada, along with rising government investments in developing the AI industry across this region, have helped the liability insurance industry to grow in this region.

Moreover, several local market players in liability insurance, such as American International Group Inc., Zurich American Insurance Company, Chubb, and others, are continuously engaged in providing the best insurance policies for the people and adopting strategies such as partnerships, launches, and business expansions, which in turn drives the growth of the liability insurance market in this region.

- In June 2024, the Recording Industry Association of America filed a lawsuit case against two companies named ‘Suno' and ‘Udio'. This case is filed as these companies did not take prior permission from the concerned authorities related to copyright infringement issues.

- In April 2024, the Canadian government made an announcement stating that it will invest around US$2.4 billion in developing the AI and tech industry across the country.

- In July 2024, Zurich North America launched a new liability insurance policy. This policy was launched to address the risks faced by companies in the life sciences.

Asia-Pacific is expected to be the fastest-growing region during the forecast period. The rising developments in the healthcare sector, along with superior healthcare facilities, have increased the demand for personal injury insurance policies due to growing cases of accidents across the region, boosting the market growth. Moreover, the growing demand for liability insurance policies related to agricultural business, along with new regulatory developments and digitalization, is likely to drive the market growth. The rising developments in economic activities, along with rising cases of cybercrimes in the corporate sector, have increased the demand for liability insurance policies, thereby driving market growth.

Additionally, the presence of various local companies of liability insurance, such as Liberty General Insurance Limited, IFFCO-Tokio General Insurance Company Limited, Max Life Insurance, and some others are providing several beneficial insurance policies across the Asia Pacific region, which in turn is expected to drive the growth of the liability insurance market in this region.

- According to the data of OECD, the number of road accident cases in Japan reached 281,803, and the number of accident-related deaths was 3216 in the year 2022.

- In June 2024, IFFCO-Tokio GIC announced a joint venture with Japan's Tokio Marine Group and Indian Farmers Fertilizer Co-operative (IFFCO). This joint venture is aimed at launching a new insurance policy that provides coverage for Directors and Key Management Personnel (KMPs).

Market Overview

The liability insurance market is one of the important industries in the BFSI sector. This industry mainly deals in launching and providing beneficial insurance policies to people across the world. The ongoing changes in people's mindsets, along with the availability of EMI facilities, have increased the sales of insurance policies across the world. This industry provides coverages for several entities that mainly include general liability insurance, professional liability insurance, insurance for directors & officers, and some others. It also finds applications for commercial and personal purposes. Liability insurance is provided to various enterprises, which mainly include large enterprises, medium enterprises, small enterprises, and some others. This industry is expected to grow significantly with the growth in the financial sector.

- According to the annual report of Zurich, 17 % of the total revenue (42.3 billion US$) is derived from the liability insurance segment in 2023.

Liability Insurance Market Growth Factors

- The growing developments in the BFSI sector have led to market growth significantly.

- Government initiatives to strengthen the insurance sector have increased the demand for liability insurance.

- There is an upsurge in the number of accidents in factories across the world.

- There are growing investments from public and private sector entities to develop the liability insurance industry.

- The rise in the number of small-sized enterprises in developing nations has helped the liability insurance market to grow significantly.

- The increasing awareness regarding the benefits of liability insurance across the world accelerates industrial growth.

- The advancements in technologies for developing smartphone-based insurance software.

- The insurance policies that provide coverages for professionals against claims and legal liabilities.

- The demand for medical liability insurance due to growing incidences of chronic diseases.

- The increasing number of insurance companies providing cyber liability coverages.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 524.66 Billion |

| Market Size in 2025 | USD 309.49 Billion |

| Market Size in 2024 | USD 291.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.04% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Coverage Type, Application, Enterprise Size, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for directors and officers (D&O) insurance

Companies face certain problems for several reasons, including compliance violations and other factors. Government authorities or some recognized organizations may file lawsuit cases against companies due to non-adherence to their policies. For instance, in March 2024, the U.S. government filed a lawsuit case against Apple. This case was filed because Apple was monopolizing the smartphone industry through unethical processes. In critical situations, the directors and officers of the companies might have to pay huge penalties that are being imposed by the regulatory authorities. Thus, in order to protect the director and officers in emergency situations, the demand for directors and officer insurance increases, which in turn drives the growth of the liability insurance market.

- In July 2024, Janover launched a new liability insurance policy. Through this launch, the company aims to provide coverage to directors and officers (D&O) of publicly traded companies.

Restraint

Cybersecurity-related issues and regulatory compliances

Awareness of insurance policies has gained significant traction among the people of the world due to the benefits they provide. Although there are several benefits associated with it, there are also several problems associated with it. Firstly, the financial details of the people can be collected by hackers and saved on the servers, which leads to security breaches. Secondly, there are several rules and regulations that forbid the withdrawal of insured amounts in emergency situations. Thus, cybersecurity issues, along with strict rules associated with insurance terms and conditions, are expected to restrain the growth of the liability insurance market during the forecast period.

Opportunity

AI-based insurance platforms started gaining momentum

The insurance industry has developed rapidly with the development of science and technologies associated with it. Nowadays, tech companies have started developing advanced AI-based insurance platforms that are integrated with modern features to cater to the needs of customers based on their choices and budgets. Thus, the growing proliferation of AI-enabled insurance platforms is expected to create ample growth opportunities for market players in the future.

- In June 2024, Sapiens launched an AI-enabled insurance platform. This AI-based platform uses machine learning (ML) and generative AI to provide insurers with various options along with increasing the automation of these processes.

Coverage Type Insights

The general liability insurance segment held the largest market share in 2024. The growing awareness regarding general liability insurance has driven the market growth. Also, the rising demand for third-party bodily insurance due to its coverage for medical expenses is also boosting the market growth. Moreover, the increasing application of a general liability insurance policy covering third-party property damage and reputational harm is expected to propel the growth of the liability insurance market.

- In February 2023, Hub International Limited launched a hub shopping center insurance. This insurance policy covers multi-tenant shopping centers in the U.S. and helps the tenants to provide coverage in emergency situations.

The professional liability insurance segment is expected to grow with the highest compound annual growth rate during the forecast period. The growing cases of wrong treatments by doctors across the world drive the market growth. Also, the rising demand for professional liability insurance policies by consultants, brokers, engineers, and some others boosts the market growth. Moreover, the increasing application of professional liability insurance policies to provide coverage during professional errors, judgments, and some other issues is likely to drive the growth of the liability insurance market during the forecast period.

- In May 2024, Mosaic Insurance launched a new professional liability insurance policy. This new insurance policy is launched to provide coverage to specialist engineers regarding public-relations expenses, pollution coverage, and risk mitigation services.

Application Insights

The commercial segment held a dominant share in 2024. The rising demand for insurance policies that provide coverage against property damages has driven the market growth. Also, the growing demand for commercial insurance due to liability protection and business continuity boosts the market growth. Moreover, the increasing application of commercial insurance policies as they provide financial security and help in following compliance with lender requirements is expected to drive the growth of the liability insurance market during the forecast period.

- In July 2024, Aurora launched a new commercial insurance policy. This insurance policy provides coverage to small and medium-sized enterprises.

The personal segment is expected to attain the fastest CAGR during the forecast period. The growing demand for personal insurance policies due to tax benefits and loan options has driven the market growth. Also, the rising awareness regarding life insurance policies among the people is driving the market growth. Moreover, the numerous advantages of personal insurance policies, such as hospitalization cost, wealth creation, retirement planning, risk coverage, and some others, are expected to boost the growth of the liability insurance market during the forecast period.

- In July 2024, ICICI Lombard launched Elevate. Elevate is an AI-powered health insurance policy that caters to diverse healthcare needs during emergencies.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024. The rise in the number of large enterprises across the world has increased the demand for liability insurance policies, thereby driving market growth. Also, large enterprises may face several issues regarding violating rules and damage to their assets, thereby increasing the demand for liability insurance policies, which in turn drives market growth. Moreover, the rising applications of liability insurance plans to provide coverage to large enterprises against natural disasters are also expected to propel the growth of the liability insurance market during the forecast period.

- In May 2024, Coalition launched a new cyber insurance policy for large enterprises in Canada. This insurance policy is launched to provide coverage to businesses with revenues of up to CAD 5bn against cybersecurity threats.

The medium-sized enterprises segment is estimated to grow with the highest CAGR during the forecast period. The rise in the number of medium-sized companies increases the demand for liability insurance policies, thereby driving market growth. Also, the demand for liability insurance plans by the MSME sector due to several benefits, including health benefits, coverage for workers' compensation, and other employee-related risks, boosts the market growth. Moreover, the rising benefits of MSME-based insurance policies for enhancing credit capacity and ensuring continuous business operations across the world are expected to foster the growth of the liability insurance market during the forecast period.

- In October 2023, the government of Kerala in India launched a new insurance scheme. This insurance policy has been launched to provide coverage to the MSME sector in Kerala.

Liability Insurance Market Companies

- Allianz

- American International Group Inc

- AXA SA

- IFFCO-Tokio General Insurance Company Limited

- CNA Financial Corporation

- The Travelers Indemnity Company

- The Hartford

- Chubb

- Liberty General Insurance Limited

- Zurich American Insurance Company

Recent Developments

- In June 2024, One80 launched a liability insurance policy. This policy is aimed at providing coverage of around US$30 million for restructuring companies.

- In May 2024, TATA AIG launched a satellite in-orbit third-party liability insurance policy in India. This policy was launched with the aim of safeguarding satellite operators and manufacturers that deal in the aerospace sector.

- In May 2024, HSB Canada launched an employment practices liability insurance. This insurance policy provides coverage to small businesses for responding to claims arising out of employment-related practices.

- In May 2024, RSA Insurance announced a partnership with Q Underwriting. This partnership is done to launch a comprehensive management liability product to protect directors, officers, and the company from various losses.

- In January 2024, Liberty Mutual launched ProShield. ProShield is a liability insurance policy that provides coverages to matters related to directors & officers, fiduciary, employment practices liability, and crime coverages.

- In November 2023, Hub International Limited (HUB) launched a new liability insurance policy. This insurance policy is named ‘Violent Acts Liability Insurance' to ensure safety in business operations.

- In August 2023, NEXT Insurance launched an umbrella/excess liability coverage. This insurance policy is launched for small businesses to provide coverage during emergencies.

- In May 2023, Nicholas Hill launched a liability insurance policy. This insurance policy has been launched with the aim of providing coverage for virtual races.

- In January 2023, Beazley launched a new private equity liability insurance policy. This policy was launched to provide coverage to directors and officers (D&O) working in private equity firms.

- In January 2023, ExecutivePerils launched EPL+WHIP. EPL+WHIP is a new liability insurance policy that provides coverages for employment practice liability (EPL).

- In January 2023, Coalition launched an insurance policy. This insurance policy was launched to provide coverage related to crime and fiduciary activities.

Segments Covered in the Report

By Coverage Type

- General Liability Insurance

- Professional Liability Insurance

- Insurance for Directors and Officers

By Application

- Commercial

- Personal

By Enterprise Size

- Large Enterprises

- Medium Enterprises

- Small Enterprises

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting