Light Therapy Market Size and Forecast 2025 to 2034

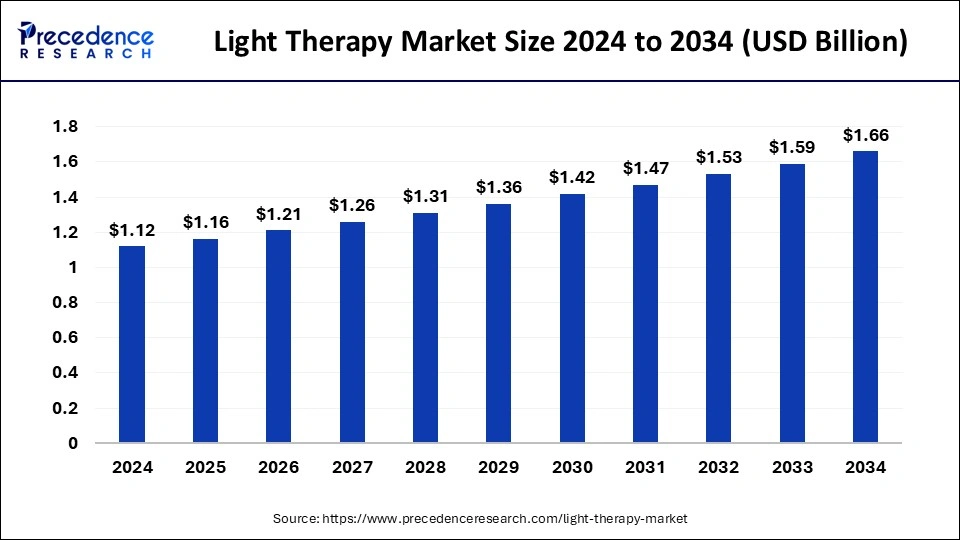

The global light therapy market size accounted for USD 1.12 billion in 2024 and is predicted to increase from USD 1.16 billion in 2025 to approximately USD 1.66 billion by 2034, expanding at a CAGR of 4.05% from 2025 to 2034. The market is driven by the increasing adoption of non-invasive treatments and the growing prevalence of skin diseases.

Light Therapy MarketKey Takeaways

- The global light therapy market was valued at USD 1.12 billion in 2024.

- It is projected to reach USD 1.66 billion by 2034.

- The light therapy market is expected to grow at a CAGR of 4.05% from 2025 to 2034.

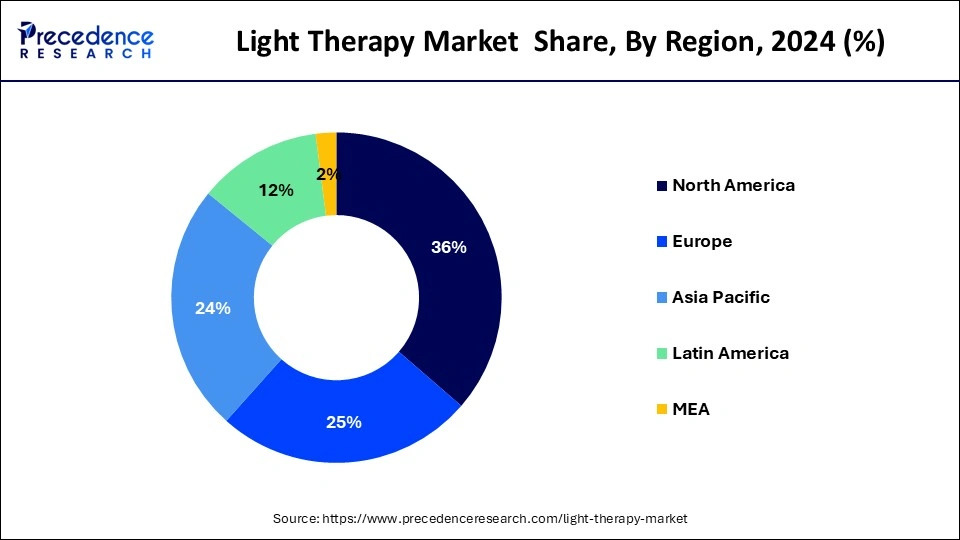

- North America has accounted highest revenue share of around 36% in 2024.

- Asia Pacific is projected to experience the fastest growth during the forecast period.

- By product, the handheld devices segment has accounted highest share in 2024.

- By-product, the light visor segment is anticipated to grow at a rate during the forecast period.

- By application, the sleeping disorder segment has captured healthy a revenue share in 2024.

- By application, the SAD/winter blues segment is projected to experience the highest growth rate during the forecast period.

- By light type, the blue light segment has held a revenue share in 2024.

- By end-use, the home healthcare segment held the largest market share in 2024.

- By end-use, the dermatology clinics segment is expected to experience a rapid growth rate during the forecast period.

U.S.Light Therapy Market Size and Growth 2025 to 2034

The U.S. light therapy market size was exhibited at USD 360 million in 2024 and is projected to be worth around USD 550 million by 2034, growing at a CAGR of 4.33% from 2025 to 2034.

North America had the largest market share of 36% in 2024 in the light therapy market due to increased seasonal affective disorder (SAD) or winter blues symptoms and psoriasis. Light therapy, conducted under medical supervision, exposes the skin to artificial ultraviolet light. UVB and UVA light, either alone or combined, alleviate inflammation, slow down the growth of skin cells, and improve symptoms. The Canadian Dermatology Association estimates that around 1 million people in the region have psoriasis, contributing to the growing demand for these devices.

The North American light therapy market is growing due to several factors. The increasing prevalence of mental health and skin disorders, along with growing research and development efforts, rising investments, frequent product launches, and key initiatives by market players, are driving this growth. The market is mainly boosted by rising skin issues like acne, psoriasis, and vitiligo, which light therapy effectively addresses. Furthermore, new light therapy products and services are launched in the region.

- Oralucent's innovative toothbrush in February 2022, designed with blue and red light for teeth whitening and common dental concerns, is expected to contribute significantly to the expansion of the light therapy market.

Asia Pacific is projected to expand at the fastest CAGR during the forecast period, primarily due to the growing awareness of the benefits of light therapy and increased investments in telemedicine. Adopting light therapy devices in hospitals, clinics, and home care settings also contributes to this expansion. The market is expected to keep growing, fueled by the rising prevalence of sleep disorders and the increasing use of light therapy devices for treating skin conditions like acne, psoriasis, and eczema.

Market Overview

Light therapy, or phototherapy, involves exposure to artificial light or equivalent light sources. It is primarily used to treat conditions such as major seasonal affective disorder, depressive disorders, and various skin conditions. This technology has shown significant results in treating skin disorders. Different light therapies include red light therapy, blue light therapy, and white light therapy. They are often used to alleviate the effects of jet lag and also help individuals adapt to shift work schedules by resetting the body's internal clock.

The treatment can also be explored as a non-invasive option for managing specific types of pain disorders. Light therapy can involve exposure to natural sunlight, full-spectrum light bulbs, or specialized lamps emitting particular wavelengths.

Light Therapy Market Growth Factors

- The increasing awareness among the general population and healthcare professionals regarding the positive effects of light therapy for conditions like seasonal affective disorder (SAD), sleep disorders, and skin conditions is a crucial factor fueling the growth of the light therapy market.

- The growing incidence of mood disorders, including depression and seasonal affective disorder, has resulted in a heightened demand for non-pharmacological and effective treatments such as light therapy.

- Continual advancements in the market, characterized by the creation of more portable and user-friendly devices, enhance accessibility and convenience for users.

- With the global population aging, there is a heightened prevalence of conditions like insomnia, depression, and other age-related disorders that can potentially be addressed or managed through light therapy.

- More accessible light therapy treatments may encourage more individuals to explore and adopt these therapies. The growing health insurance coverage plays a role in the light therapy market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.16 Billion |

| Market Size by 2034 | USD 1.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.05% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Light Type, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Advancement in healthcare technology

The light therapy market is expected to grow due to the increasing advancements in healthcare technology, skin issues, and depressive disorders like winter blues and seasonal affective disorders. Clinical depression, marked by persistent feelings of loss of interest in daily activities and sadness, is a common health issue. It also leads to physical symptoms such as fatigue, lack of focus, appetite, and sleep disorders. A combination of environmental, genetic, biological, and psychological factors influences the development of depression.

Increase in preference for non-invasive procedures

The light therapy market is growing as patients increasingly prefer non-invasive procedures like LED therapy and low-level laser therapy. These treatments are gaining popularity due to their safety, effectiveness, minimal discomfort, and downtime, making them convenient for individuals with busy schedules who seek effective options without surgery. Developed economies with established healthcare infrastructure and a focus on advanced medical treatments provide a favorable compensation scenario. This encourages the development of innovative medical technologies, especially in areas like oncology, cardiology, and neurology. Favorable reimbursement remains a crucial driver for growth and innovation in the healthcare industry.

- In February 2022, Mito Red joined forces with the Arizona Coyotes to enhance the team's recovery and overall health through red light therapy. The increasing use of red-light therapy across different industries is anticipated to drive significant growth in the market.

Restraint

Possible skin damage due to exposure to UV light

While light therapy has made notable progress in treating skin conditions and depression, it has potential drawbacks. Although generally safe, some patients may experience side effects such as irritability, headaches, eye strain, sleep disturbances, and insomnia. Clinicians express concerns about the heightened risk of UV light exposure during light therapy, leading to undesirable outcomes such as skin dryness and itching. Prolonged exposure may even increase the risk of developing skin cancers. These factors pose significant challenges to the future expansion of the light therapy market.

Opportunities

Red light prospectives

Red light therapy (RLT), also known as photobiomodulation, is a promising treatment for addressing acne, scars, wrinkles, redness, and signs of aging. This non-toxic and non-invasive therapy utilizes low-wavelength red light to enhance skin appearance and treat various medical conditions. The light therapy market is expected to experience growth due to the introduction of new RLT products and services, increased adoption, substantial investments, strategic initiatives by major players, and ongoing research and development studies. Notably, collaborations, partnerships, acquisitions, and other critical strategies by major players, such as the UFC Performance Institute and GameDay Ready Recovery Zone, are anticipated to boost the segment.

- In February 2022, the UFC Performance Institute and GameDay Ready Recovery Zone joined forces to offer red light therapy to all UFC athletes. This collaboration aims to improve athletes' performance by leveraging red light to enhance cellular-level functions. The treatment increases adenosine triphosphate (ATP) production and reduces oxidative stress, which is particularly beneficial after demanding workouts.

Surging insomnia cases

As sedentary lifestyles become more common, the prevalence of sleep disorders is on the rise. Insomnia has severe consequences, including depression, impaired work performance, accidents, and diminished quality of life. Fortunately, various treatment options are available to prevent and address this condition. The light therapy market uses methods that aim to regulate an individual's circadian rhythm, a crucial aspect of the body's internal clock that dictates alertness during the day and sleepiness at night. When applied appropriately, light therapy can reset the circadian rhythm, improving sleep outcomes. Several companies, including Re-Timer, have taken the lead in providing light therapy solutions designed to address insomnia, catering to individuals struggling with sleep issues and those working night shifts.

- The American Sleep Association estimated that 50-70 million U.S. adults suffer from sleep disorders, with chronic insomnia accounting for a significant portion. Almost 37% of individuals aged 20-39 report inadequate sleep, and this percentage rises to 40% among those aged 40-59. Globally, insomnia affects 10 to 30% of the population, and in some cases, it reaches as high as 50 to 60%.

Product Insights

The light therapy market is segmented into various products, including handheld devices for skin treatment, light therapy lamps, lightboxes, dawn simulators, light visors, and floor and desk lamps. In 2024, the handheld devices segment led the market. This segment is popular due to its portable nature, efficient technology, and user-friendly features. Widely used for skin treatment, these devices employ ultrasonic waves and microcurrents to enhance skin appearance.

The light visor segment is estimated to expand at the fastest CAGR over the projected period. This growth is linked to the rise in air travel, causing conditions like eye fatigue, insomnia, and jet lag due to changes in time zones and sleep patterns. Light visors, worn on the head, are portable and user-friendly. They help regulate melatonin hormones and enhance the body's circadian rhythms. Furthermore, new product launches by market players are contributing to market growth.

- In August 2023, Immersed introduced its new Visor X.R. headset, addressing the critical challenges of the Vision Pro model. This headset aims to enhance your workspace experience while ensuring comfort during use, offering a solution to common issues users face.

Application Insights

The sleeping disorder segment held the largest market share in 2024. Various conditions related to sleep disorders, including hypersomnia, insomnia, and sleep-disordered breathing, are linked to unhealthy lifestyles, such as alcohol consumption, smoking, and excessive screen time.

The SAD/winter blues segment is projected to experience the fastest rate of expansion in the light therapy market during the forecast period. This can be linked to increased screen time and unhealthy lifestyles, including lack of physical activity, poor diet, and prolonged indoor stays during winter.

Light Type Insights

The blue light segment holds the largest market share in the global light therapy market in 2024. Blue light therapy is employed to address various concerns, including skin issues, acne, seasonal affective disorders, and clinical depression. The duration of treatment sessions varies based on the specific condition and treatment area, ranging from 15 to 90 minutes.

- According to the AAD association, 9,500 people in the U.S. are diagnosed with skin cancer every day, and about 1 million people in the U.S. have melanoma. Research indicates that blue light therapy is effective in treating melanoma, which is expected to increase the demand for blue light therapy devices.

End User Insights

The global light therapy market is divided into home healthcare and dermatology clinics. The home healthcare segment led the market in 2024 due to increased consumer awareness and technological advancements such as remote patient monitoring. The segment also experienced growth due to higher healthcare spending on various needs during the pandemic.

The dermatology clinics segment is expected to experience the most rapid growth during the forecast period. These clinics address skin conditions like acne, eczema, psoriasis, and vitiligo. According to the World Health Organization (WHO), nearly 900 million people are affected by skin diseases, contributing to the growing demand for dermatology clinics. Moreover, the rising preference for non-invasive treatments and advancements in technology, such as laser technology, is anticipated to fuel the market's growth in the coming years.

Light Therapy Market Companies

- Koninklijke Philips N.V.

- Beurer GmbH

- BioPhotas.

- Northern Light Technologies

- Lumie

- Verilux, Inc

- Zepter International

- The Daylight Company

- Zerigo Health

- Naturebright

Recent Developments

- In January 2024, LumiThera initiated a European registry study investigating light therapy for age-related macular degeneration (AMD). This study follows a set of clinical trials known as the LIGHT SIDE studies, demonstrating that the treatment was well-tolerated by patients with dry AMD.

- In February 2022, STRATA Skin Sciences, Inc. launched its new excimer laser system, XTRAC Momentum 1.0, designed for precise UVB light therapy in treating inflammatory skin conditions like psoriasis, atopic dermatitis, and vitiligo.

- In January 2022, Bilihome secured funding from Health Innovations and Oost NL to launch an innovative, wearable light therapy device for jaundice affecting 10% of newborns.

- In February 2022, UFC Performance Institute and GameDay Ready Recovery Zone joined forces to offer red light therapy to all UFC athletes. This partnership aims to improve athlete performance as red light therapy facilitates the body's recovery at a cellular level.

Segments Covered in the Report

By Product

- Light Box

- Floor and Desk Lamps

- Handheld Devices

- Light Visor

- Dawn Simulator

- Light Therapy Lamps

By Application

- Psoriasis

- Vitiligo

- Eczema

- Acne Vulgaris

- SAD/Winter Blues

- Sleeping Disorders

By Light Type

- Blue Light

- Red Light

- White Light

By End User

- Dermatology Clinics

- Home Healthcare

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting