Lipase Inhibitors Obesity Drugs Market Size and Forecast 2025 to 2034

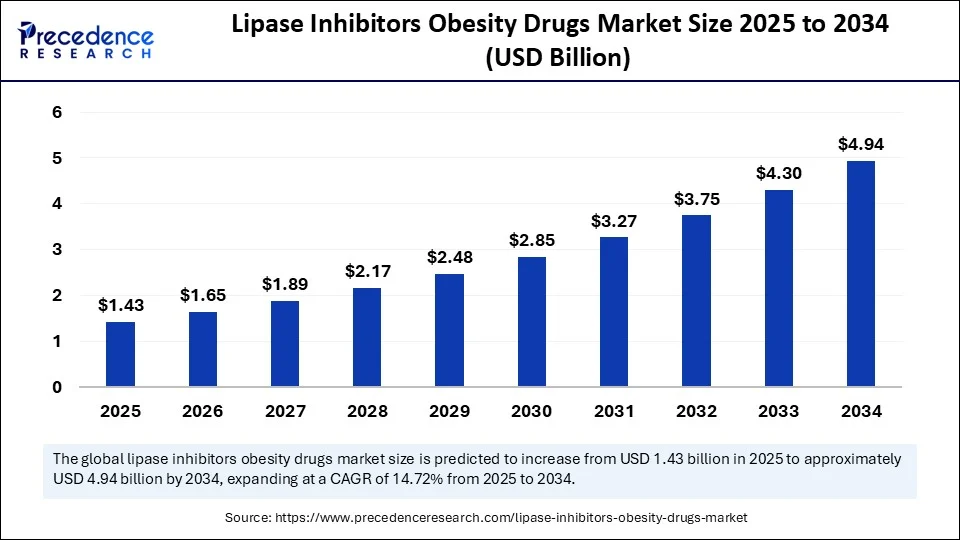

The global lipase inhibitors obesity drugs market size accounted for USD 1.25 billion in 2024 and is predicted to increase from USD 1.43 billion in 2025 to approximately USD 4.94 billion by 2034, expanding at a CAGR of 14.72% from 2025 to 2034. The lipase inhibitors obesity drugs market is growing as obesity increases, awareness for weight management is also on the rise, and people are demanding non-invasive treatment options. In addition, government health programs and new advances in drug formulation will progress the overall market.

Lipase Inhibitors Obesity Drugs Market Key Takeaways

- In terms of revenue, the global lipase inhibitors obesity drugs market was valued at USD 1.25 billion in 2024.

- It is projected to reach USD 4.94 billion by 2034.

- The market is expected to grow at a CAGR of 14.72% from 2025 to 2034.

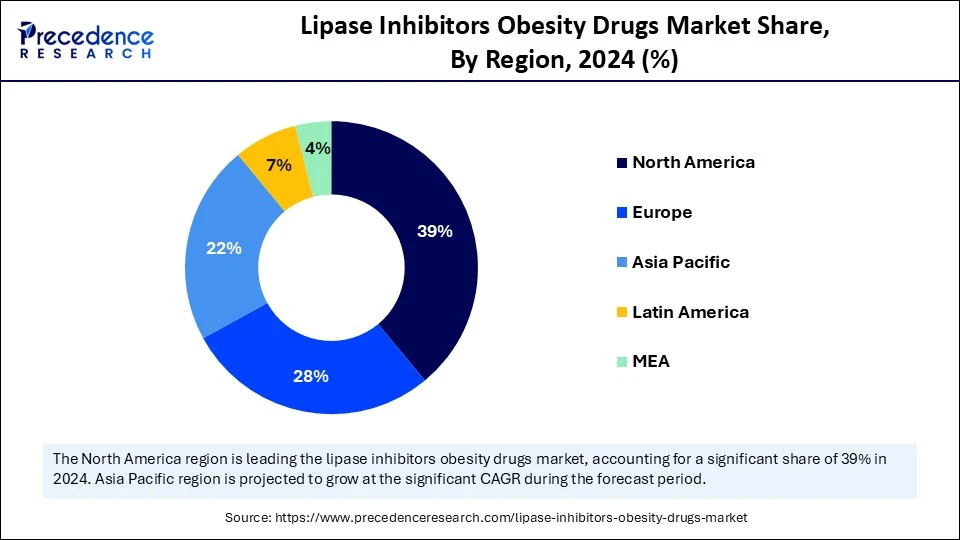

- North America dominated the lipase inhibitors obesity drugs market with the largest market share of 39% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By drug type, the Orlistat segment held the biggest market share of 81% in 2024.

- By drug type, the Cetilistat segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By formulation, the capsules segment captured the biggest market share of 68% in 2024.

- By formulation, the soft gels & oral films segment is expected to expand at a notable CAGR over the projected period.

- By route of administration, the oral segment contributed the highest market share of 98% in 2024.

- By route of administration, the transdermal segment is expected to expand at a notable CAGR over the projected period.

- By distribution channel, the retail pharmacies segment generated the major market share of 46% in 2024.

- By distribution channel, the online pharmacies segment is expected to expand at a notable CAGR over the projected period.

- By patient group, the adults segment accounted for a significant market share of 89% in 2024.

- By patient group, the pediatric/adolescent segment is expected to expand at a notable CAGR over the projected period.

How is AI Revolutionizing the Lipase Inhibitors Obesity Drugs Market?

Artificial intelligence is transforming the field of obesity drugs, particularly in the development of lipase inhibitors. Recent advances in artificial intelligence drug discovery platforms, such as those used by companies like Insilico Medicine and Recursion, are enabling the rapid discovery of lipase-inhibiting compounds. For instance, in 2024, a group of researchers at MIT were able to optimize fat absorption blockers with the least side effects using AI models.AI models are being utilized to predict the success of clinical trials and facilitate more effective patient selection. With the prevalence of obesity rising rapidly worldwide, the need for precision obesity treatment through using AI to develop better, more targeted lipase inhibitors makes sense. It marks a tremendous step toward making obesity treatment more efficient.

U.S. Lipase Inhibitors Obesity Drugs Market Size and Growth 2025 to 2034

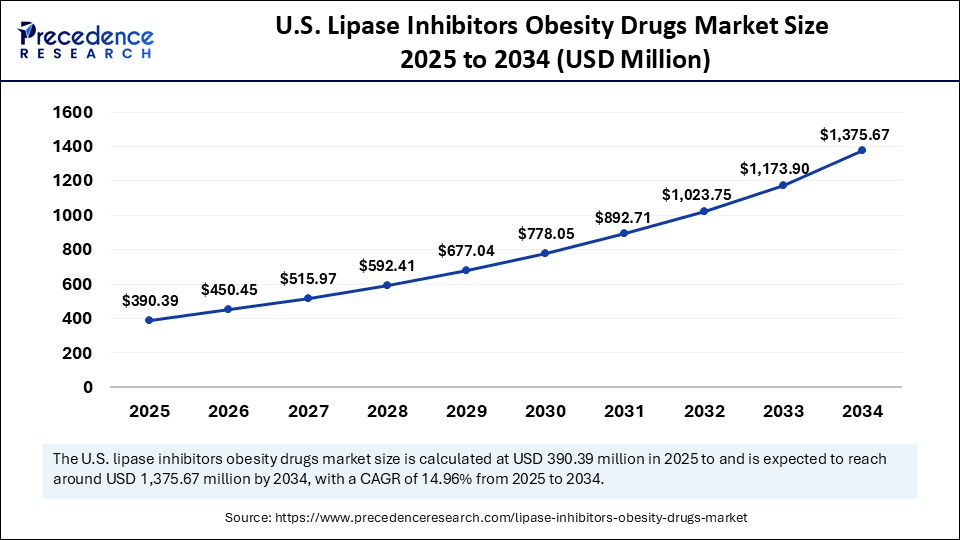

The U.S. lipase inhibitors obesity drugs market size was exhibited at USD 341.25 million in 2024 and is projected to be worth around USD 1,375.67 million by 2034, growing at a CAGR of 14.96% from 2025 to 2034.

What Factors Contribute to North America's Dominance in the Lipase Inhibitors Obesity Drugs Market in 2024?

North America dominated the global lipase inhibitors obesity drugs market, holding a significant share in 2024. This is primarily due to the region's high obesity rates and robust healthcare system. As of 2024, the Centers for Disease Control and Prevention (CDC) indicated that over 42% of the U.S. adult population was obese. This number indicated a large patient pool seeking pharmacological interventions to manage their weight. There is an increased accessibility to Lipase inhibitors, including those marketed as Orlistat (also known as Xenical and Alli), through both prescription and OTC (over-the-counter) means. The region has excellent access to anti-obesity therapies, either as prescription medications or in an OTC status.

The U.S. has established itself as the leading country in the lipase inhibitors obesity drugs market due to its complicated mix of high prevalence of obesity, regulatory systems that support the drugs, and access to the market. In addition, U.S.-based pharmaceutical companies engage in the advertising and distribution of their products through some of the larger pharmacy drug retail chains, such as Walgreens and CVS.

Asia Pacific: The Fastest-Growing Region

Asia Pacific is expected to witness the fastest growth in the market due to rising rates of obesity, heightened awareness around weight management, and increased access to healthcare. Urbanization, coupled with sedentary lifestyles and higher-calorie diets, is creating a surge in obesity rates, especially among the younger population. Various governments in the region, specifically China, India, and Japan, are focusing on addressing the obesity crisis by implementing national health strategies and forming alliances with healthcare providers to combat obesity.

India is emerging as a key growth region for the lipase inhibitor drugs market, with the number of Indians classified as obese and overweight in rapid ascent. According to the National Family Health Survey (NFHS-5), obesity increased sharply with higher incidences in Indigenous and rural populations. Orlistat is a lipase inhibitor commonly prescribed in India, often in conjunction with dietary counseling and lifestyle modifications. Indian pharmaceutical companies, such as Sun Pharma and Cipla, manufacture low-cost versions of Orlistat, which enables a cheaper, longer-term treatment plan.

Market Overview

Lipase inhibitors are a type of anti-obesity drug that works by blocking the absorption of dietary fat. They do this by blocking the function of pancreatic lipase, which is needed for dietary fat to break down triglycerides in the intestine. In this way, the drug interferes with fat digestion, thus reducing total calorie intake and assisting weight loss efforts. Lipase inhibitors are being used for the treatment of obesity and overweight conditions, typically used as an adjunct to a low-calorie diet and physical activity in a weight management plan. The most established lipase inhibitor is Orlistat, also marketed under several brand names.The lipase inhibitors obesity drugs market is experiencing rapid growth, driven by the increasing global rate of obesity and the rising awareness of managing one's body weight. Improvements in drug formulations and the increase in approvals in emerging economies are expected to drive this market further.

Lipase Inhibitors Obesity Drugs Market Growth Factors

- Rising Global Obesity Rate: Rising global obesity and overweight populations are driving efforts to develop and market pharmacological therapies, such as lipase inhibitors, for both developed and developing countries.

- Changing Lifestyle and Diet: Sedentary living, increased consumption of diets high in fat and low in activity, is accelerating obesity levels and quickly driving the acceptability of lipase inhibitors as part of a broader lifestyle and diet change process for weight management.

- Government and Health Organization Efforts: Government-supported campaigns to raise awareness about obesity as a risk factor for type 2 diabetes and other societal problems have led to endorsements from entities such as the CDC and WHO, paving the way for the adoption of medical interventions, such as lipase inhibitors.

- Research & Development:Continued research to improve efficacy and reduce side effects accelerates new products in the lipase inhibitor class, leading to greater use and acceptance by healthcare providers and patients.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.94 Billion |

| Market Size in 2025 | USD 1.43 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.72% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Formulation,Route of Administration, Distribution Channel, Patient Group, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is the Global Obesity Epidemic Increasing Demand for Lipase Inhibitor Drugs?

A major catalyst for the lipase inhibitors obesity drugs market is the significant rise in global obesity rates. The World Health Organization (WHO) states that in 2022, one in eight persons globally were affected by obesity, and over 2.5 billion adults over the age of 18 were classified as overweight. Of these 2.5 billion, over 890 million were living with obesity. This represents that 43% of adults throughout the world were overweight, regardless of sex (43% of all men; and 44% of all women). These figures mark an escalating public health crisis, as obesity is associated with numerous chronic diseases, particularly diabetes and cardiovascular diseases. In response, there is an increasing demand for effective weight management solutions, such as lipase inhibitor drugs, that will support global health efforts.

(Source: https://www.who.int)

Government Guided Initiatives

Governments globally are establishing anti-obesity programs and policies, thus drawing greater public and healthcare attention to weight management drugs. Additionally, the FDA is pushing reviews of anti-obesity drugs faster than ever before as prices for social insurance programs continue to rise. Given these circumstances, it's clear that companies examining lipase inhibitors should accommodate the increased access, formulations, and public health intentions to meet the growing demand.

Restraint

Risk of Side Effects

For lipase inhibitors, like Orlistat, a significant limiting factor is the risk of oxalate-related kidney injury in susceptible patients. Governments and regulators, including the MHRA in the UK, have published cases of oxalate nephropathy with severity ranging from kidney stones to acute renal failure triggered by fat mal-absorption enhancing oxalate absorption. For example, the ICES database in Canada found that of the 953 patients who received Orlistat, 18 experienced acute kidney injury within 12 months of initiating use, compared to 5 in the year before (p = 0.01).

Also of concern is that regulatory labels are now warning against use in patients that have pre-existing renal impairment or hyperoxaluria, requiring ongoing monitoring. This concern will likely deter prescribers from using lipase inhibitors and their patients from adhering to treatment, ultimately preventing lipase inhibitors from gaining broader acceptance.

The gastrointestinal adverse effects are one of the most significant limitations of lipase-inhibitor obesity drugs (e.g., Orlistat) is the negative impact of the side effects on user adherence. According to information provided by MedlinePlus and the U.S. FDA, gastrointestinal side effects/diarrheal events/reactions with these obesity agents include oily/profuse stools, loose stools, increased bowel movements (4 or 5 in one day), abdominal pain, and fecal incontinence.

Opportunity

Is Growing Preference Towards Non-Invasive Weight Loss Options Contributing to Demand for Lipase Inhibitors?

The rise in preference for non-invasive, low-risk, and easily accessible weight-loss treatment represents a significant opportunity for the lipase inhibitors obesity drugs market. With the relatively high cost and standard clinical procedures and training required for bariatric surgery and moderate to new injectable therapies, lipase inhibitors such as Orlistat and other lipase inhibitors are considered more convenient oral alternatives, carrying fewer procedural risks. Furthermore, with the rising acceptance of medical treatment for weight loss, particularly among the younger population, and the interest in and appeal of safe, non-invasive, over-the-counter or prescription-based solutions, as well as maintaining a desirable weight for the increasingly accepted inactive lifestyle, there is significant opportunities in the market.

Drug Type Insights

How Does the Orlistat Segment Lead the Market?

The Orlistat segment held the largest share of 81%, the lipase inhibitors obesity drugs market in 2024 because it is established clinically, has its FDA-approved for some time, and its strong brand recognition under Xenical and Alli has further ensured consumer awareness and trust. In terms of fat absorption, Orlistat has proven to be a significant intervention for adults with obesity. Orlistat's safety and efficacy history, including both prescription and OTC availability, as well as its worldwide presence through retail pharmacies, has made it the leader in the lipase inhibitor market.

The Cetilistat segment is expected to grow at the highest CAGR in the upcoming period because of increased research and development in Asia Pacific, as well as developments in parts of Europe. Cetilistat does not have the same safety profile as Orlistat, but it has a better gastrointestinal tolerance profile, drawing interest from clinicians treating obesity with improved tolerability and fewer side effects. While Cetilistat is also still in the development stages or early commercialization stages, it is gaining momentum with newer formulations being developed such as soft gels and oral films.

Formulation Insights

Why are Capsules the Most Dominant Formulation for Lipase Inhibitors?

The capsules segment dominated the market the biggest share of 68% in 2024 due to their exceptional stability, relative simplicity of manufacture, and patient compliance. Orlistat, the leading drug, is available in both prescription and over-the-counter preparations, offered as capsules. Capsules offer precise dosages and have less variance between them than many other dosage formulations, making them suitable for providers who wish to offer patients a consistent therapeutic effect. Adult patients often prefer capsules over tablets, and pharmacy personnel typically prefer capsules, which can increase variability in consistency with pharmacy adherence protocols.

The soft gels & oral films segment is expected to grow rapidly in the coming years, as they are quickly becoming alternative preference options due to their improved swallowability and faster absorption time. The patient-friendliness of these formulations offers a real alternative in new development options preferred by adolescent and pediatric patients who are unable to tolerate capsules. The increased need for patient-friendly science, particularly personalized medicine, should entice pharmaceutical and biotech companies to invest in these new types of systems.

Route of Administration Insights

Why Did the Oral Segment Dominate the Lipase Inhibitors Obesity Drugs Market in 2024?

The oral route is the dominant segment with highest market share of 98% in 2024 than any other route because it is convenient, promotes patient compliance, and theoretically provides systemic effects. Most lipase inhibitors available today are delivered as oral formulations, including Orlistat. Because the oral route is non-invasive and feasible for patients as a chronic treatment, both clinicians and patients find it acceptable.

The transdermal segment is expected to expand at the fastest rate during the projection period. Transdermal delivery allows for patient comfort and compliance in a route that is not oral, potentially mitigating any gastrointestinal side effects associated with oral drugs like Orlistat. Research institutions and biotech companies have all investigated the use of skin patches or gels as the delivery modes for lipase inhibitors.

Distribution Channel Insights

What Made Retail Pharmacies the Dominant Distribution Channel?

Retail pharmacies are the dominant distribution channel for lipase inhibitors withe due to a combination of accessibility and high consumer trust, as both prescription and FDA-approved over-the-counter versions of Orlistat are dispensed in retail pharmacies. Retail pharmacies are the primary point of contact for adults, particularly in developed markets such as the U.S. and Europe, when attempting to order medications for obesity-related indications.

The online pharmacies segment is expected to grow at the fastest CAGR during the forecast period as much of the population is looking for convenience, privacy, and greater access to medications. This trend is most prevalent in urban communities and among younger groups. Online access points facilitate a frictionless purchasing experience, with home delivery, subscription refills, and reduced prices contributing to the long-term management of obesity disorders.

Patient Group Insights

Why Did the Adult Segment Dominate the Lipase Inhibitors Obesity Drugs Market in 2024?

The adult segment accounted for the majority of the share of 89%in 2024, as adult obesity is more prevalent worldwide. The growth of sedentary lifestyles, worsening obesity rates, and unhealthy eating behaviors have caused this problem, particularly in middle-aged individuals. Orlistat has been prescribed for adults for many years now, and due to its OTC accessibility, utilization of Orlistat in adults is on the rise.

The pediatric/adolescent segment is likely to grow at a rapid pace in the upcoming period due to the rising prevalence of childhood obesity around the world. Existing treatments, such as Orlistat, are frequently poorly tolerated in younger populations. Therefore, novel interest in newer drugs, such as Cetilistat, or novel formulations, such as oral films or soft gels, is emerging. Healthcare agencies and parents are focusing much more on prevention and maximizing early intervention strategies, ultimately increasing the opportunity for age-specific lipase inhibitor treatments.

Lipase Inhibitors Obesity Drugs Market Companies

- Roche Holding AG (Xenical)

- GlaxoSmithKline plc (Alli)

- Alizyme Therapeutics (Cetilistat developer)

- Takeda Pharmaceutical Co. Ltd.

- Mylan N.V. (now Viatris)

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals

- Dr. Reddy's Laboratories

- Cipla Ltd.

- Zydus Lifesciences

- Novartis AG (through research collab)

- Merck KGaA (exploratory obesity programs)

- Pfizer Inc. (past obesity pipeline)

- Eisai Co., Ltd.

- Boehringer Ingelheim (research-based obesity targets)

- Hanmi Pharmaceutical

- LG Chem (obesity pipeline)

- Currax Pharmaceuticals (alli distribution in U.S.)

- Hisamitsu Pharmaceutical (transdermal R&D)

Recent Development

- In March 2025, Eli Lilly and Company launched its diabetes and obesity management drug Mounjaro (tirzepatide) in India. The company launched the drug in a single-dose vial following marketing authorisation from the Central Drugs Standard Control Organisation (CDSCO). This drug contains about 39 types of amino acids and is an analog of the gastric inhibitory polypeptide.

(Source: https://www.thehindu.com)

Segments Covered in the Report

By Drug Type

- Orlistat (Xenical, Alli)

- Cetilistat

- Experimental/Investigational Lipase Inhibitors

- Others (Modified-release or combination therapies)

By Formulation

- Capsules

- Tablets

- Powder

- Soft Gels

- Others (e.g., Oral disintegrating films, patches under development)

By Route of Administration

- Oral

- Transdermal (investigational)

- Others (Buccal/sublingual – exploratory)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Patient Group

- Adults

- Pediatric/Adolescent (limited approval)

- Others (High-risk/metabolic syndrome patients)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting