What is the Lipase Testing Reagents MarketSize?

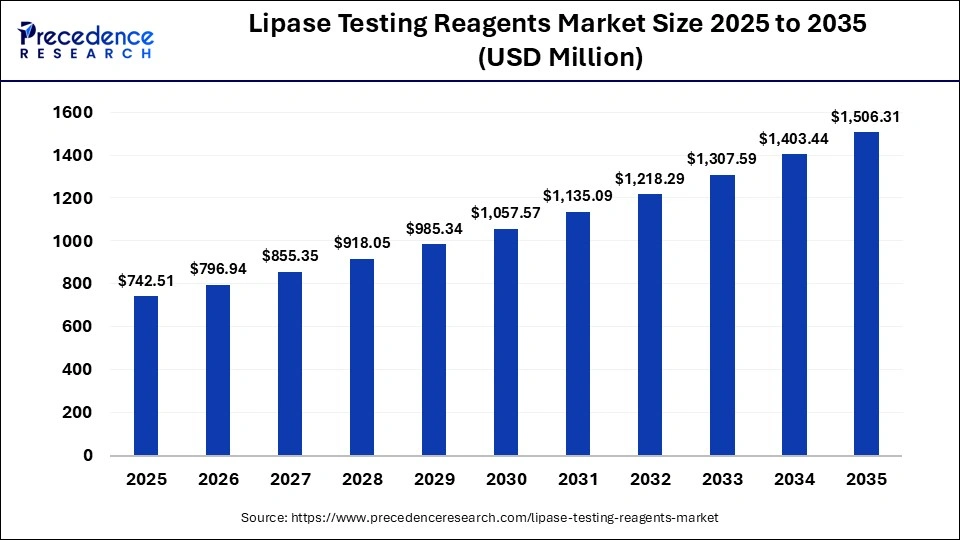

The global lipase testing reagents market size was calculated at USD 742.51 million in 2025 and is predicted to increase from USD 796.94 million in 2026 to approximately USD 1,506.31 million by 2035, expanding at a CAGR of 7.33% from 2026 to 2035. This market is growing due to the rising prevalence of pancreatic disorders and gastrointestinal diseases, coupled with increasing demand for early and accurate diagnostic testing in clinical laboratories.

Lipase Testing Reagents MarketKey Takeaways

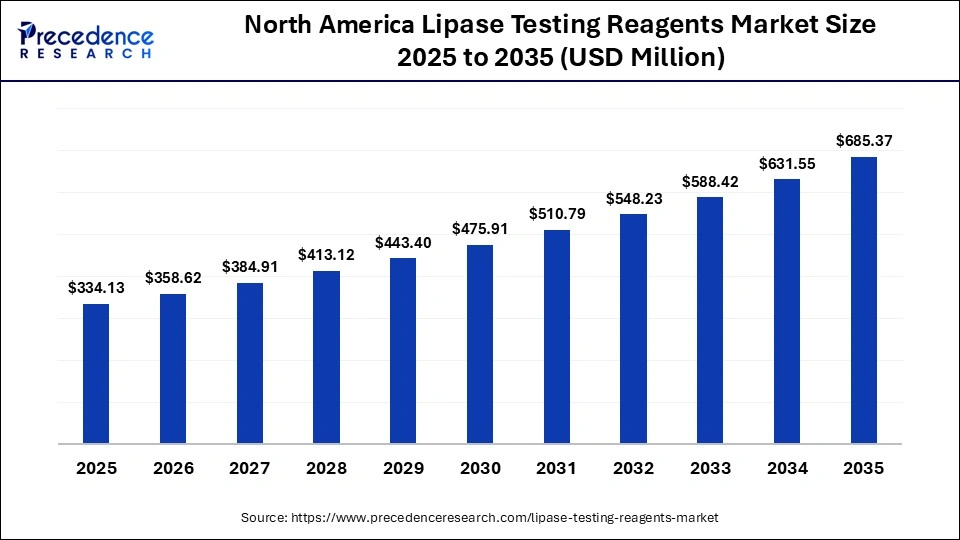

- North America dominated the global lipase testing reagents market by holding the highest market share of 45% in 2025.

- The Asia Pacific is expected to grow at a notable CAGR of 8% from 2026 to 2035.

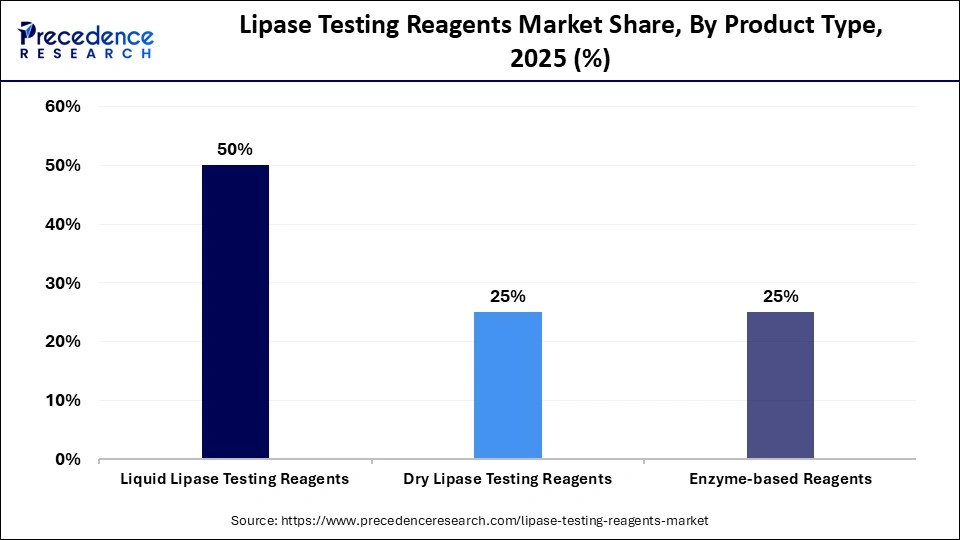

- By product type, the liquid lipase testing reagent segment dominated the market with a 50% of the market share in 2025.

- By product type, the dry lipase testing reagent segment is growing at a strong CAGR of 7.3% between 2026 and 2035.

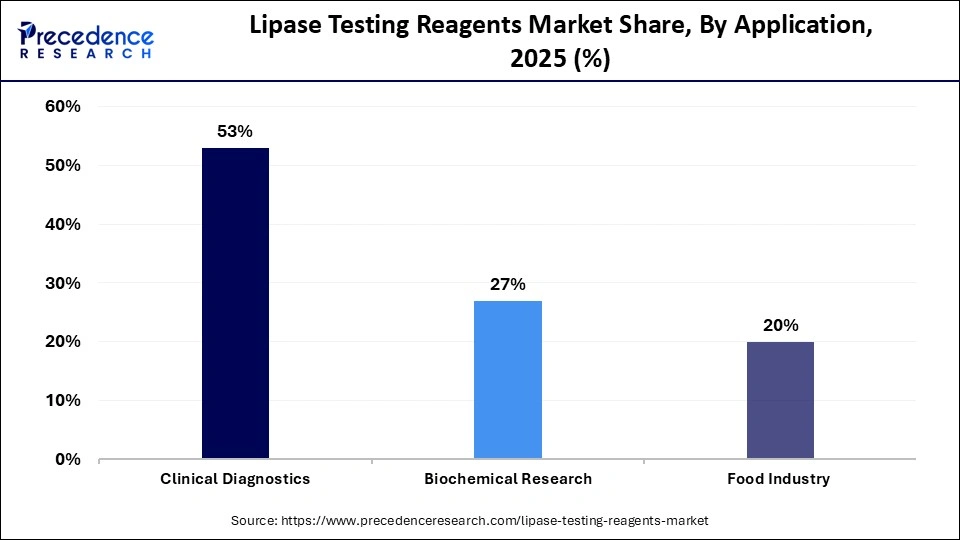

- By application, the clinical diagnostics segment led to a market share of 53% in 2025.

- By application, the biochemical research segment is poised to grow at the fastest CAGR of 7% between 2026 and 2035.

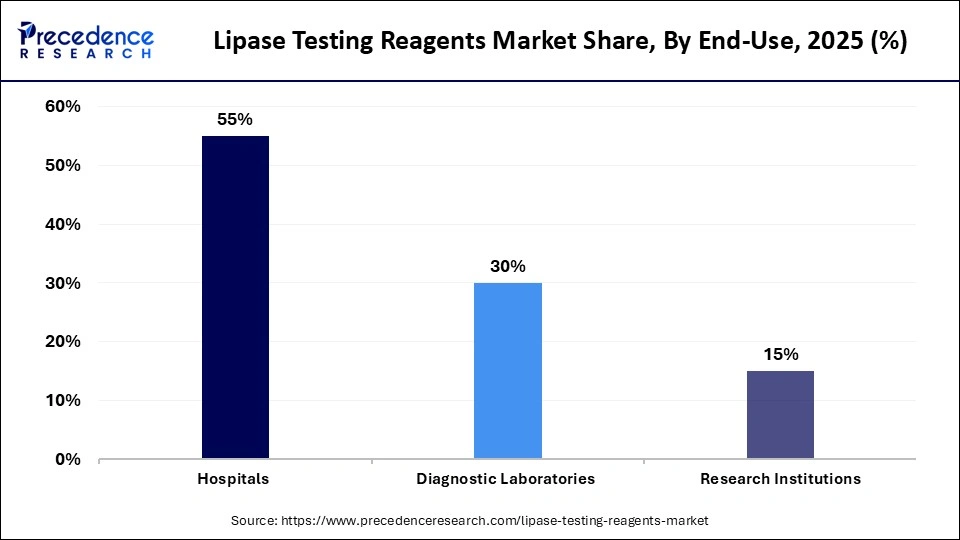

- By end-use, the hospitals segment dominated the market share of 47-55% in 2025.

- By end-use, the diagnostic laboratories segment is growing at a notable CAGR of 7.1% between 2026 and 2035.

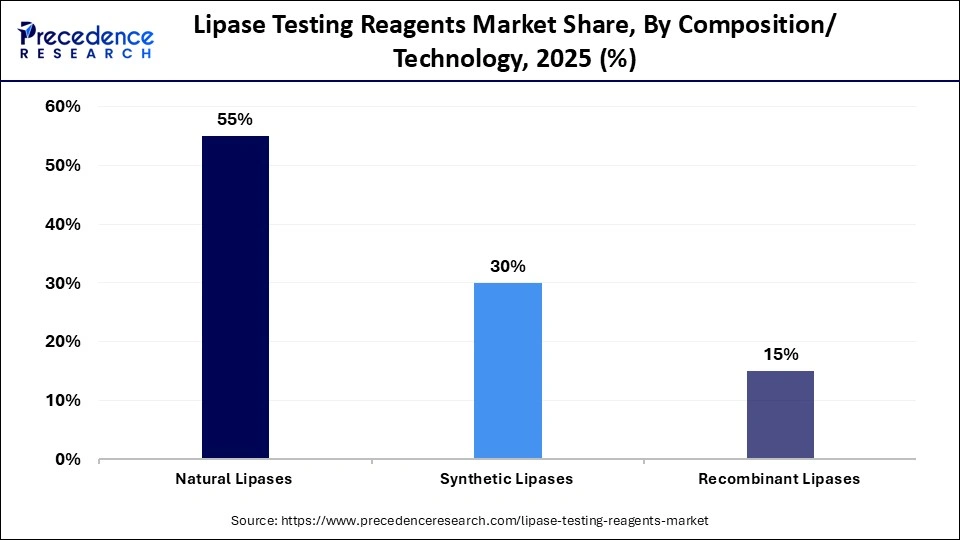

- By composition/technology, the natural lipases segment led the market share with 40% in 2024.

- By composition/technology, the synthetic lipases segment is projected to grow at the fastest rate of 7.2% between 2026 and 2035.

Why is the Lipase Testing Reagents Market Gaining Momentum?

The lipase testing reagents market is witnessing steady growth due to the rising global prevalence of gastrointestinal and pancreatic conditions. The market is expanding due to the growing reliance on laboratory diagnostics for precise and timely disease detection. Test efficiency and dependability are increasing thanks to technological developments in automated and high-sensitivity assay systems. Furthermore, increasing access to healthcare and the volume of diagnostic tests performed in developing nations are boosting market demand overall.

How Is AI Impacting the Lipase Testing Reagents Market?

By increasing diagnostic precision and expenditure result interpretation and decreasing human error, AI is boosting the market for lipase testing reagents. High-throughput testing and predictive insights for research and clinical applications are made possible by integration with automated analyzers. This technology is increasing productivity, cutting expenses, and opening up new markets around the world.

Market Trends

- Rising Adoption of Automated Diagnostic Systems: Increased use of automated analyzers in clinical labs is boosting demand for high-throughput lipase testing reagents.

- Growing Focus on Early Disease Detection: Health systems are prioritizing early diagnosis of pancreatic and gastrointestinal conditions, driving uptake of sensitive lipase assays.

- Expansion of Outpatient and Point-of-Care Testing: More lipase tests are being conducted outside traditional hospital settings, including clinics and urgent care facilities.

- Technological Advancements in Assay Platforms: The development of more accurate, rapid, and user-friendly lipase testing kits is enhancing diagnostic efficiency.

- Integration with Digital Health Records and AI Tools: Labs increasingly use data analytics and AI to interpret lipase results, improving diagnostic insights.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 742.51 Million |

| Market Size in 2026 | USD 796.94 Million |

| Market Size by 2035 | USD 1,506.31 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.33% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Voltage Rating, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Future Demand

|

Future Demand Factors |

Demand Outlook |

|

Rising diagnostic testing for pancreatic and gastrointestinal disorders |

Continued increase in routine and emergency testing volumes |

|

Growing focus on preventive and early disease detection |

Sustained long-term demand across hospitals and diagnostic labs |

|

Expansion of hospital and reference laboratory infrastructure |

Higher and more consistent reagent consumption |

|

Increasing adoption of automated and point-of-care testing systems |

Strong demand for compatible and high-performance lipase reagents |

|

Improving healthcare access in emerging markets, lipase testing in new and expanding facilities |

Accelerated uptake of lipase testing in new and expanding facilities |

Opportunities

- Expansion in Emerging Economies: Increasing healthcare infrastructure and growing awareness about digestive health in regions like the Asia Pacific, Latin America, and the Middle East present major growth opportunities for lipase testing reagents.

- Development of Point of Care Testing Solutions:There is strong potential for rapid, portable lipase testing kits that can be used in clinics, urgent care centers, and remote areas, improving access to diagnostics.

- Integration with Advanced Diagnostic Platforms:Collaborating with developers of automated analyzers, immunoassay systems, and digital health tools can help reagent manufacturers offer more comprehensive and efficient testing solutions.

- Strategic Partnerships with Healthcare Providers and CROs:Forming alliances with hospitals, diagnostic chains, and contract research organizations can expand market reach and facilitate the adoption of lipase testing in broader clinical applications.

- R&D for Enhanced Sensitivity and Specificity: Investing in research to improve the accuracy and speed of lipase assays can differentiate products and meet growing demand for precise diagnostics.

- Increasing Chronic Disease Screening Programs: Governments and health agencies launching more preventive healthcare initiatives create opportunities for wider use of lipase testing in routine checkups and disease management.

Segmental Insights

Product Type Insights

What Made the Liquid Lipase Testing Reagents Segment Dominate the Lipase Testing Reagents Market?

The liquid lipase testing reagents segment is the dominant product type, holding around 50% of the market share, with its popularity driven by its go-to status in hospitals and diagnostic labs due to its simple handling, quicker reaction times, and smooth integration with automated clinical analyzers. Liquid reagents also make it possible for test results to be more consistent and precise, which is essential for making clinical decisions. Their dominance in both developed and emerging markets is further reinforced by well-established supply chains and demonstrated effectiveness.

The dry lipase testing reagents segment is the fastest-growing product type, with a 7.3% CAGR, with its growth fueled by a longer shelf life stability during transit and appropriateness for use in isolated or resource-constrained locations, providing substantial potential in developing markets. Additionally, dry reagents minimize reagent waste and lessen reliance on cold chain logistics, making them more affordable for smaller diagnostic facilities.

Application Insights

What Made the Clinical Diagnostics Segment Dominate the Lipase Testing Reagents Market?

Clinical diagnostics segment dominates the market with a 53% share, demonstrating the vital role lipase testing plays in identifying pancreatic, gastrointestinal, and associated metabolic diseases in patients, because of this segment's proven performance and established protocols, hospitals and diagnostic labs favor it. This segment's dominance is further reinforced by rising patient awareness and the prevalence of chronic pancreatic conditions.

The biochemical research segment is the fastest-growing application area, with a 7% CAGR. Increasing reliance on lipase assays for enzyme activity studies, drug development, and research into disease mechanisms is driving the expansion of this segment. The trend toward personalized medicine and targeted therapeutics is further boosting demand for research-grade lipase reagents.

End-Use Insights

What Made Hospital Segments Dominate the Lipase Testing Reagents Market?

The hospital segment is the dominant end user, holding 47-55% of the market, with its leading position being a result of high patient volumes and the demand for quick and accurate lipase testing in routine diagnostics and emergency care. Integrated lab systems that enhance patient throughput and optimize workflow are advantageous to hospitals. Consistent test quality and continuous supply are guaranteed by solid relationships with reagent suppliers.

The diagnostic laboratories segment is the fastest-growing end user, with a 7.1% CAGR, with growth supported by the adoption of high-throughput testing systems that need a supply of reagents, the growth of standalone laboratories, and the outsourcing trend, all of which contribute to growth. Adoption in this sector is also fueled by growing laboratory accreditation programs and preventive healthcare programs.

Composition/Technology Insights

What Made the Natural Lipases Segment Dominate the Lipase Testing Reagents Market During 2025?

The natural lipases segment dominates the market with a 40% market share, as it is frequently chosen due to its dependability, biocompatibility, and demonstrated efficacy in clinical diagnostics. Additionally, it is simpler to standardize natural lipases for common assays, guaranteeing reliable and consistent results. Healthcare providers' trust is strengthened by their long-standing use in clinical procedures.

The synthetic lipases segment is growing rapidly, accounting for a 7.2% CAGR due to strong adoption being driven by developments in enzyme engineering and high specificity for specialized diagnostic and research applications. The development of next-generation diagnostic tests is supported by the customization of synthetic lipases for assay conditions. Growth in this sector is accelerated by a greater emphasis on innovation and laboratory R&D.

Regional Insights

How Big is the North America Lipase Testing Reagents Market?

The North America lipase testing reagents market size is estimated at USD 334.13 million in 2025 and is projected to reach approximately USD 685.37 million by 2035, with a 7.45% CAGR from 2026 to 2035.

What Made the North America Region Dominate the Lipase Testing Reagents Market?

North America is dominant in the lipase testing reagents market, holding a 40-45% share, supported by well-regulated diagnostic frameworks, a high adoption rate of automated testing systems, and sophisticated healthcare infrastructure. Consistent demand is also fueled by general awareness of gastrointestinal and pancreatic disorders. The existence of top reagent producers guarantees ongoing supply and innovation to satisfy clinical requirements.

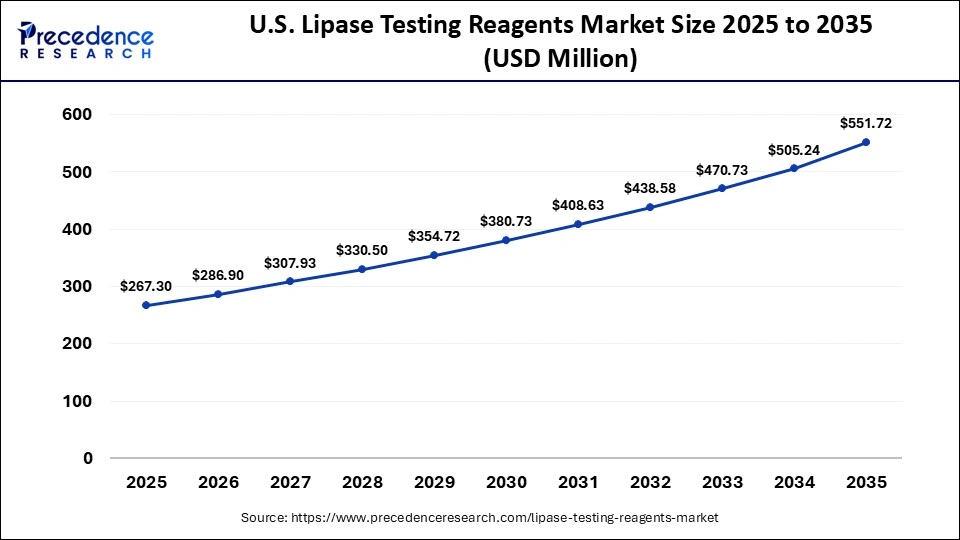

What is the Size of the U.S. Lipase Testing Reagents Market?

The U.S. lipase testing reagents market size is calculated at USD 267.30 million in 2025 and is expected to reach nearly USD 551.72 million in 2035, accelerating at a strong CAGR of 7.52% between 2026 and 2035.

U.S. Testing Reagents Market

The U.S. is dominating the lipase testing reagents market because automated clinical analyzers are widely used in hospitals and diagnostic labs. It is perfect for both routine and emergency testing due to its quick reaction times and accurate results. Liquid reagents also facilitate high-throughput processes, lower manual error rates, and are simple to integrate with electronic lab equipment. Additionally, reliable supply to the nation's major healthcare facilities is guaranteed by well-established networks.

Why Is the Asia Pacific Set to Be the Fastest-Growing in the Market for Lipase Testing Reagents in the Coming Years?

Asia Pacific is the fastest-growing region, expanding at 8% growth driven by expanding access to healthcare, growing knowledge of pancreatic diseases, and the quick growth of diagnostic labs in nations. Growing private healthcare networks and government programs to enhance healthcare diagnostics hasten market adoption. Rising investments in hospital infrastructure and specialty gastroenterology centers are increasing the volume of pancreatic function testing and related diagnostic procedures. Expansion of laboratory accreditation programs and adoption of standardized diagnostic protocols are improving test reliability and clinician confidence across both urban and semi-urban settings. In parallel, increasing focus on early disease detection and preventive screening is strengthening sustained demand for pancreatic diagnostic solutions across the Asia Pacific region.

India Lipase Testing Reagents Market

India is growing rapidly, propelled by growing research projects, biotech facilities, and academic institutions funding drug discovery and enzyme research. The use of reagents is being further increased by growing partnerships between pharmaceutical companies and academic institutions. Furthermore, the need for specialized lipase reagents is rising in India due to the increased emphasis on clinical research trials and personalized medicine.

Who are the Major Players Operating in the Lipase Testing Reagents Market?

The major players operating in the lipase testing reagents market are Abbott Laboratories, F. Hoffmann-La Roche Ltd (Roche Diagnostics), Siemens Healthineers, Danaher Corporation (including Beckman Coulter), Merck KGaA, Bio-Rad Laboratories, Inc., Randox Laboratories Ltd, DiaSys Diagnostic Systems GmbH, Thermo Fisher Scientific Inc., Sekisui Diagnostics, LLC, IDEXX Laboratories, Inc., and Biocatalysts Ltd.

Recent Developments

- In March 2025, Beckman Coulter launched the DxC 500i Integrated Chemistry and Immunoassay Analyzer, enabling enhanced automation and efficient processing of enzymatic tests, including lipase, in clinical laboratories. This development supports laboratories seeking higher throughput, reduced turnaround time, and improved workflow efficiency.

(Source: beckmancoulter.com) - In February 2025, researchers at the Acharya Prafulla Chandra College conducted a statistical insight into the exploration of medicinal wastewater as a source of thermostable lipase-producing microorganisms. The study successfully isolated 19 lipase-producing bacterial colonies from industrial wastewater, with a viable count of 30 × 10⸠CFU/mL on nutrient agar. (Source: journals.plos.org)

Segments Covered in the Report

By Product Type

- Liquid Lipase Testing Reagents

- Dry Lipase Testing Reagents

- Enzyme-based Reagents

By Application

- Clinical Diagnostics

- Biochemical Research

- Food Industry

By End-Use

- Hospitals

- Diagnostic Laboratories

- Research Institutions

By Composition/Technology

- Natural Lipases

- Synthetic Lipases

- Recombinant Lipases

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting